|

市场调查报告书

商品编码

1844700

附着力促进剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Adhesion Promoters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

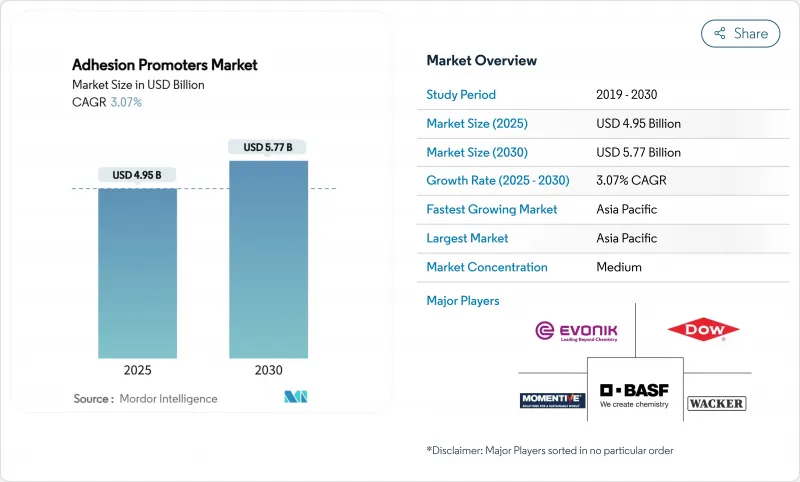

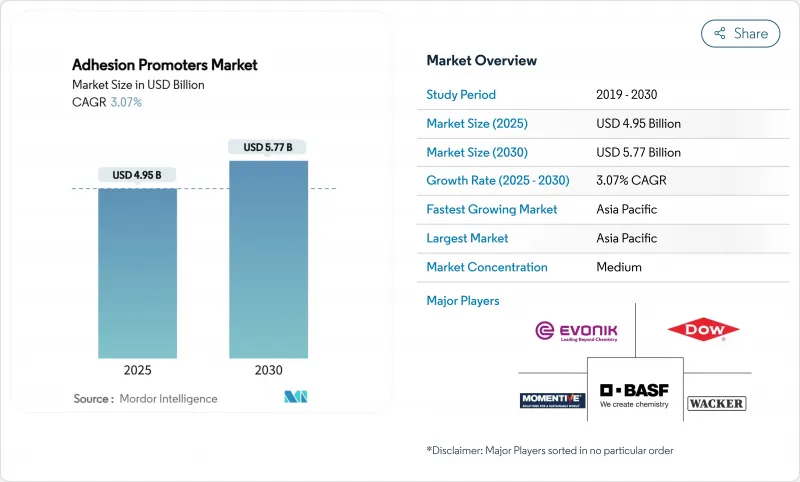

黏合促进剂市场规模预计在 2025 年为 49.5 亿美元,预计到 2030 年将达到 57.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.07%。

温和的成长反映了该行业在法规收紧和永续化学兴起的背景下从快速采用到稳定替代需求的转变。收益仍然受到亚太地区汽车轻量化、电子产品快速小型化和软质包装领域投资的驱动。拥有垂直整合硅烷生产能力的供应商能够免受原材料波动的影响,并随着电动车的普及而获得下游价值。同时,能够满足更严格的VOC基准值且不牺牲粘合强度的配方正在赢得长期合同,尤其是在建筑和消费品领域。因此,黏合促进剂市场正在为拥有分子设计专业知识和在成长地区拥有本地製造足迹的参与者带来丰厚回报。

全球附着力促进剂市场趋势与洞察

汽车对轻质塑胶和复合材料的需求不断增长

全球汽车平台正在转型为碳纤维、玻璃纤维、铝和高强度钢相结合的多材料架构。这些不同基板之间的共用键结依赖硅烷、钛酸酯和锆酸酯促进剂,这些促进剂能够承受超过150°C的热循环,同时抑制电解腐蚀。最新配方可在不影响碰撞性能的情况下将车辆重量减轻15%,直接支援电动车续航里程目标。随着原始设备製造商(OEM)对其电池组生产线进行本地化,黏合促进剂的区域采购已成为一项竞争优势,遵守通膨控制含量法规会影响供应商的选择,尤其是在北美地区。因此,黏合促进剂市场在每一年车型的推出中都日益深入地融入汽车价值链。

电子产品的小型化和电动车电池的包装需求

折迭式显示器、相机镜头堆迭和系统级构装基板需要超薄黏合剂层,这些黏合剂层能够弯曲数千次,同时保持光学透明度。采用低玻璃化转变温度单体设计的促进剂可保持透明度,抑制黄变,并实现无边框智慧型手机设计。同时,电池到电池组的电动车架构消除了传统的模组壁,采用专用促进剂将电池连接到冷却板,可承受-40°C至85°C的温度波动,并抑制热失控的蔓延。这两种压力正在加速导热和电绝缘促进剂化学的应用,从而扩大消费性电子和行动电子产品中的黏合剂促进剂市场。

硅烷和顺丁烯二酸酐原料价格波动。

2024年至2025年,由于能源相关投入和物流瓶颈对中国生产商产生连锁影响,硅烷现货价格波动了25%。顺丁烯二酸酐价格波动幅度紧接在苯和丁烷之后,迫使改质商重新协商季度合约。一级供应商加速了后向整合,而中级混合商将额外费用转嫁给下游,侵蚀了黏合剂製造商的利润。这些动态将使黏合促进剂市场的复合年增长率降低近1个百分点,直到预测期后半段新增产能稳定供应。

細項分析

到 2024 年,硅烷基产品将占据黏合促进剂市场的 39.18%,到 2030 年的复合年增长率为 5.9%,这突显了它们将继续向汽车、轮胎和电子基材领域多元化发展。可水解烷氧基确保与玻璃、金属氧化物和二氧化硅的黏合,而功能性有机基团则与环氧树脂、聚酯和胺甲酸乙酯共聚。这种双重反应性缩短了组装时间并减少了对机械预处理的需求。下一代硅烷接枝侧酰亚胺或环氧环,以提高电池组和航太零件的耐高温性。顺丁烯二酸酐接枝聚烯对于聚丙烯表面改质仍然至关重要,但只有在其成本低于氯基替代品的情况下才会成长。钛酸盐和锆酸盐促进剂虽然属于小众市场,但在 200°C 以上的引擎盖下应用和在高压釜循环中固化的复合材料中,业务正在蓬勃发展。

赢创正在将其二氧化硅和硅烷业务整合到其智慧效应部门,使上游中间体与客户定制的偶联剂同步。小型配方商正在授权这些硅烷来开发预缩合混合物,以减少使用者的混合错误。环境问题正在推动对氯化聚烯的需求转向符合PFAS法规的非卤化等级。因此,化学物质之间的动态平衡将在未来十年塑造黏合促进剂市场。

黏合促进剂市场按类型(硅烷、顺丁烯二酸酐、钛酸酯和锆酸酯等)、应用(塑胶和复合材料、油漆和涂料等)、终端用户产业(汽车和运输、电气和电子等)以及地区(亚太地区、北美、欧洲等)细分。市场预测以美元计算。

区域分析

在汽车组装丛集、电子产品出口中心和快速城市基础设施发展的推动下,亚太地区将在2024年占据黏合促进剂市场的主导地位,营收占比达47.38%。该地区的软质包装正在迅速采用电子束固化技术,而这种转变需要兼具快速表面转移和低气味的黏合促进剂。中国、印度和印尼政府对轻型电动车的激励措施进一步推动了市场发展,而国内硅烷的生产也使该地区的买家免受外汇衝击的影响。

北美是一个成熟而富有创新的地区,法规合规性正在塑造需求。加州的挥发性有机化合物(VOC)法规正在加速水性促进剂系统的采用,而《美国-墨西哥-加拿大协议》则正在促进化学品供应链更加区域化。在密西根州和德克萨斯州,电动皮卡的推出证明了能够承受极端冬季条件(包括冻融循环和高温浸泡)的促进剂的有效性,从而推动了特种有机硅改性偶联剂的合约增长。因此,附着力促进剂市场正透过规格升级而非销售成长来发展。

欧洲的环境法规依然严格,推动维修材料生产商转向非卤化和生物基促进剂。汽车绿色轮胎强制要求使硅烷製造商成为追求二氧化碳减排目标的原始设备製造商的策略合作伙伴。 「翻新浪潮」倡议下的翻新项目进一步推动了含有磷酸酯促进剂的建筑密封胶的消费,这些促进剂用于与新一代建筑幕墙覆层材料的粘合。儘管该地区的GDP成长温和,但严格的标准正在推高产品价格分布,从而扩大了黏合促进剂的市场规模(以收益为准)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 汽车对轻质塑胶和复合材料的需求不断增加

- 电子产品的小型化和电动车电池的封装需求

- 软包装加工商在亚洲扩张

- 转向硅烷基绿色轮胎化合物

- 扩大电气和电子产业的应用

- 市场限制

- 挥发性硅烷和顺丁烯二酸酐原料价格。

- VOC 和卤化 CPO 的监管压力

- 生物基加速器的性价比差距

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按类型

- 硅烷

- 顺丁烯二酸酐

- 钛酸盐和锆酸盐

- 氯化聚烯

- 非氯化聚烯

- 其他类型

- 按用途

- 塑胶和复合材料

- 油漆和涂料

- 橡皮

- 胶水

- 金属基板

- 其他用途

- 按行业

- 汽车和运输

- 电气和电子

- 包装

- 消费品

- 建造

- 其他行业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- 3M

- Arkema

- Atlanta Group(BYK-Chemie GmbH)

- BASF

- Borica Co., Ltd

- DIC Corporation

- Dow

- Eastman Chemical Company

- EMS-CHEMIE Holding AG

- Evonik Industries AG

- Huntsman International LLC

- Kemipex

- Momentive

- Nagase ChemteX Corporation

- NIPPON PAPER INDUSTRIES CO., LTD.

- Nouryon

- ROWA GROUP Holding GmbH(TRAMACO Gmbh)

- ShinEtsu Microsi

- Sika AG

- Solvay

- Toyobo Co. Ltd.

- Wacker Chemie AG

第七章 市场机会与未来展望

The Adhesion Promoters Market size is estimated at USD 4.95 billion in 2025, and is expected to reach USD 5.77 billion by 2030, at a CAGR of 3.07% during the forecast period (2025-2030).

Moderate expansion reflects a sector moving from rapid adoption to steady replacement demand as regulations tighten and sustainable chemistry gains ground. Investment in automotive lightweighting, relentless electronics miniaturization, and Asia-Pacific's flourishing flexible-packaging sector continue to anchor revenue. Suppliers with vertically integrated silane capacity are insulated from feedstock swings, positioning them to capture downstream value as electric vehicles multiply. Meanwhile, formulators that can align with stricter VOC thresholds without sacrificing bond strength are securing long-term contracts, particularly in construction and consumer goods. The adhesion promoters market therefore rewards players that pair molecular design expertise with localized production footprints in growth regions.

Global Adhesion Promoters Market Trends and Insights

Rising demand for lightweight automotive plastics and composites

Global vehicle platforms are migrating toward multi-material architectures that combine carbon fiber, glass fiber, aluminum, and high-strength steel. Covalent bonding across such dissimilar substrates hinges on silane, titanate, and zirconate promoters that tolerate thermal cycling beyond 150 °C while curbing galvanic corrosion. Latest formulations enable a 15% curb-weight reduction without compromising crash metrics, directly supporting electric-vehicle range goals. As OEMs localize battery-pack lines, regional sourcing of adhesion promoters becomes a competitive differentiator, particularly in North America where compliance with Inflation Reduction Act content rules shapes supplier selection. The adhesion promoters market therefore embeds itself deeper into the automotive value chain each model year.

Electronics miniaturization and EV battery packaging needs

Foldable displays, camera lens stacks, and system-in-package boards call for ultra-thin adhesive layers able to flex thousands of times while remaining optically clear. Promoters engineered with low glass-transition monomers preserve transparency and suppress yellowing, enabling bezel-free smartphone designs. In parallel, cell-to-pack EV architectures eliminate conventional module walls; specialized promoters now link cells to cooling plates, withstanding -40 °C to 85 °C swings and inhibiting thermal-runaway propagation. These dual pressures speed adoption of thermally conductive, electrically insulating promoter chemistries, expanding the adhesion promoters market across consumer and mobility electronics.

Volatile silane and maleic-anhydride feedstock prices

Spot silane quotes swung 25% during 2024-2025 as energy-linked inputs and logistical bottlenecks rippled through Chinese producers. Maleic anhydride followed benzene and butane volatility, forcing formulators to renegotiate quarterly contracts. While tier-one suppliers accelerate backward integration, mid-size blenders pass surcharges downstream, eroding adhesive makers' margins. These dynamics shave nearly 1 percentage point from the adhesion promoters market CAGR until fresh capacity stabilizes supply late in the forecast window.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of flexible packaging converters in Asia

- Shift to silane-based green-tire formulations

- VOC and halogenated CPO regulatory pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silane-based products captured 39.18% of the adhesion promoters market size in 2024 and their 5.9% CAGR through 2030 underscores continued diversification into automotive, tire, and electronics substrates. Hydrolyzable alkoxy groups secure bonds to glass, metal oxides, and silica, while functional organics co-polymerize with epoxies, polyesters, or urethanes. This dual reactivity shortens assembly time and reduces the need for mechanical pretreatment. Next-generation silanes graft pendant imide or epoxy rings, enhancing high-temperature tolerance for battery pack and aerospace components. Maleic-anhydride grafted polyolefins remain indispensable in polypropylene surface modification but grow only where lower cost outweighs chlorinated alternatives. Titanate and zirconate promoters, though niche, win contracts in under-hood applications exceeding 200 °C and in composites cured by autoclave cycles.

Competition now hinges on supply security; Evonik consolidated its silica and silane operations into the Smart Effects business line to synchronize upstream intermediates with customer-specific coupling agents. Smaller formulators are licensing these silanes to develop pre-condensed blends that cut user mixing errors. Environmental scrutiny is steering demand from chlorinated polyolefins toward non-halogenated grades compliant with emerging PFAS limits. As a result, dynamic rebalancing among chemistries will shape the adhesion promoters market across the decade.

The Adhesion Promotors Market Segments the Industry by Type (Silanes, Maleic Anhydride, Titanates and Zirconates, and More), Application (Plastics and Composites, Paints and Coatings, and More), End-User Industry (Automotive and Transportation, Electrical and Electronics, and More) and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated the adhesion promoters market with 47.38% revenue in 2024, propelled by automotive assembly clusters, electronics export bases, and swift urban infrastructure rollout. The region's flexible-packaging converters are racing to adopt electron-beam curing, a shift that requires promoters with rapid surface migration yet low odor Adhesives Magazine. Government incentives for light-duty EVs in China, India, and Indonesia add further pull, and domestic silane output shields regional buyers from exchange-rate shocks.

North America represents a mature but innovation-heavy arena where regulatory compliance shapes demand. California's VOC limits accelerated adoption of water-borne promoter systems, and the United States-Mexico-Canada Agreement favors localized chemical supply chains. Electric-pickup launches in Michigan and Texas validate promoters that survive winter freeze-thaw and hot-soak extremes, expanding contract volumes for specialty silicone-modified coupling agents. The adhesion promoters market therefore evolves here through specification upgrades rather than unit-growth spurts.

Europe remains tightly governed by environmental legislation, steering formulators to non-halogenated and bio-based promoters. Automotive green-tire mandates make silane suppliers strategic partners for OEMs chasing CO2 fleet targets. Retrofit programs under the Renovation Wave initiative further lift consumption in building sealants that embed phosphate-ester promoters for adhesion to new-generation facade claddings. Despite modest GDP growth, the region's rigorous standards create premium pricing corridors that lift the adhesion promoters market size in revenue terms.

- 3M

- Arkema

- Atlanta Group (BYK-Chemie GmbH)

- BASF

- Borica Co., Ltd

- DIC Corporation

- Dow

- Eastman Chemical Company

- EMS-CHEMIE Holding AG

- Evonik Industries AG

- Huntsman International LLC

- Kemipex

- Momentive

- Nagase ChemteX Corporation

- NIPPON PAPER INDUSTRIES CO., LTD.

- Nouryon

- ROWA GROUP Holding GmbH (TRAMACO Gmbh)

- ShinEtsu Microsi

- Sika AG

- Solvay

- Toyobo Co. Ltd.

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Lightweight Automotive Plastics and Composites

- 4.2.2 Electronics Miniaturisation and EV Battery Packaging Needs

- 4.2.3 Expansion of Flexible Packaging Converters in Asia

- 4.2.4 Shift to Silane-Based Green-Tire Formulations

- 4.2.5 Increasing Usage in the Electrical and Electronics Industry

- 4.3 Market Restraints

- 4.3.1 Volatile Silane and Maleic-Anhydride Feedstock Prices

- 4.3.2 VOC and Halogenated CPO Regulatory Pressure

- 4.3.3 Cost-Performance Gap of Bio-Based Promoters

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Silane

- 5.1.2 Maleic Anhydride

- 5.1.3 Titanate and Zirconate

- 5.1.4 Chlorinated Polyolefins

- 5.1.5 Non-chlorinated Polyolefins

- 5.1.6 Other Types

- 5.2 By Application

- 5.2.1 Plastics and Composites

- 5.2.2 Paints and Coatings

- 5.2.3 Rubber

- 5.2.4 Adhesives

- 5.2.5 Metal Substrates

- 5.2.6 Other Applications

- 5.3 By End-Use Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Electrical and Electronics

- 5.3.3 Packaging

- 5.3.4 Consumer Goods

- 5.3.5 Construction

- 5.3.6 Others End-Use Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Atlanta Group (BYK-Chemie GmbH)

- 6.4.4 BASF

- 6.4.5 Borica Co., Ltd

- 6.4.6 DIC Corporation

- 6.4.7 Dow

- 6.4.8 Eastman Chemical Company

- 6.4.9 EMS-CHEMIE Holding AG

- 6.4.10 Evonik Industries AG

- 6.4.11 Huntsman International LLC

- 6.4.12 Kemipex

- 6.4.13 Momentive

- 6.4.14 Nagase ChemteX Corporation

- 6.4.15 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.16 Nouryon

- 6.4.17 ROWA GROUP Holding GmbH (TRAMACO Gmbh)

- 6.4.18 ShinEtsu Microsi

- 6.4.19 Sika AG

- 6.4.20 Solvay

- 6.4.21 Toyobo Co. Ltd.

- 6.4.22 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment