|

市场调查报告书

商品编码

1844708

汽车触媒转换器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Catalytic Converter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

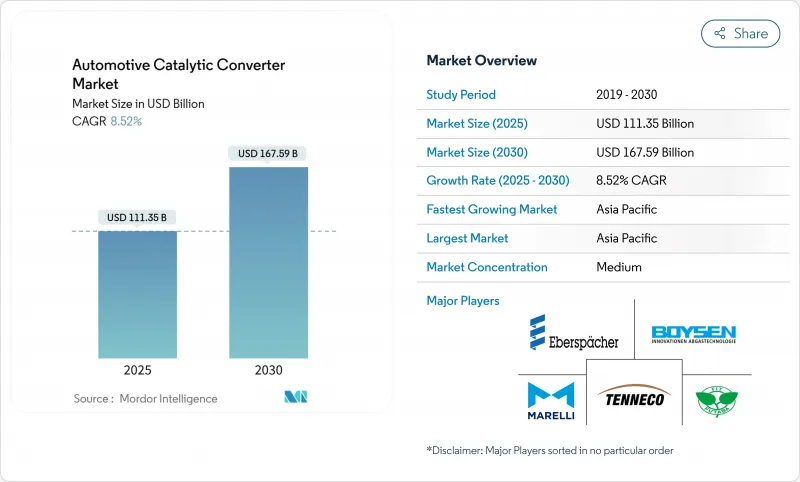

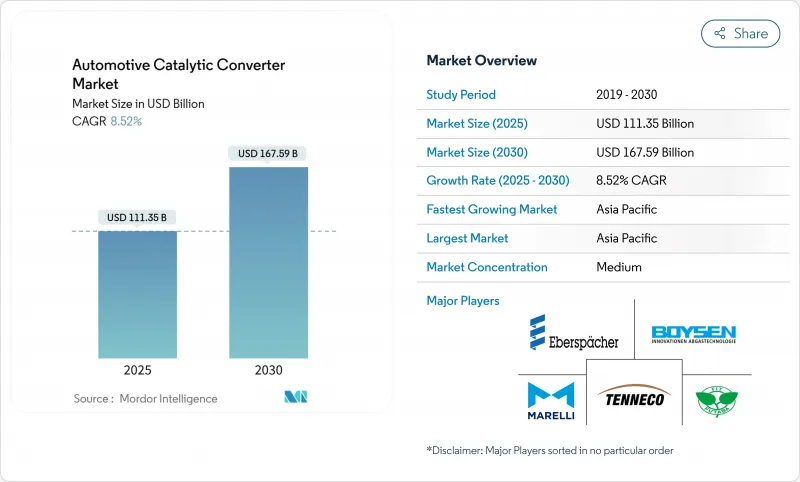

预计触媒转换器市场在 2025 年将达到 1,113.5 亿美元,到 2030 年将达到 1,675.9 亿美元,复合年增长率为 8.52%。

这反映了自2025年起持续收紧的监管措施,包括欧7、国7和更新的美国标,这些标准都要求更高的贵金属负载量和先进的涂层化学成分。全球内燃机和混合动力汽车产量的復苏、旨在降低成本和风险的贵金属替代策略,以及非道路机械车队的改造活动,将带来进一步的动力。供应链的韧性、新的氢内燃机计划以及前景看好的单一材料催化剂,正在为触媒转换器市场带来机会。

全球汽车触媒转换器市场趋势与洞察

2025年起更严格的排放法规将推动技术升级

欧盟7标准将于2025年7月起分阶段实施,将合规寿命延长至8年/16万公里,迫使汽车製造商指定更厚的贵金属层和更先进的汽油颗粒过滤器。国7标准与欧7标准一致,甚至在某些方面超越了欧7标准,强制要求各平台的粒状物计数限值和实际排放测试。在美国,针对越野车和轻型车辆的更严格法规消除了历史性的监管空白。全球统一的阈值消除了原始设备製造商先前使用的滞后缓衝,从而加快了先进三向和四向系统的设计週期。

疫情后全球内燃机汽车和混合动力汽车产量的復苏

全球轻型汽车产量在汽油、柴油和混合动力车型上均有所復苏。商用卡车产量因物流需求而成长,而亚太地区的基础设施奖励策略则使重型汽车组装保持活跃。混合动力汽车约占总产量的10%,需要更大的催化剂用量来抑制频繁启停循环中的冷启动排放。中国工业协会正在实施一项分三阶段实施的发展策略,旨在透过提高热效率和先进的排放控制系统,到2035年将二氧化碳排放减少20%。随着工厂运转率的恢復,触媒转换器市场儘管面临长期的电气化压力,但短期内出货量仍将成长。

铂族金属价格的极端波动

预计钯金价格将从2022年的每盎司3000美元以上跌至2025年初的1000美元以下,而铂金价格将在900美元至1100美元/盎司之间波动,这将使采购预算更加复杂,并鼓励替代产品。虽然供应商正在进行对冲,但规模较小的参与者难以抵消价格波动,一旦出现成本衝击,他们将面临短期利润不确定和订单延迟的风险。南非计划削减矿业资本支出,这可能导致十年后供应紧张。

細項分析

到2024年,三元催化器将占据触媒转换器市场66.78%的份额,反映出其对化学计量汽油引擎的普遍适用性。随着颗粒物和耐久性法规的日益严格,这种催化器在合规性方面发挥核心作用,同时金属负载和涂层配方也在不断发展。预计到2030年,三元触媒转换器市场规模将与汽车总产量同步成长,而混合动力化将增加冷启动事件的发生。

新一波四效转换器、稀油氮氧化物捕集器和混合选择性催化还原系统将集中在「其他类型」类别中,预计复合年增长率为11.83%。华盛顿州立大学的实验室发现,高排气热能促进奈米级二氧化铈丛集,使活性增加10倍,同时减少贵金属使用量。同时进行的自再生钙钛矿催化剂研究旨在将铂族金属(PGM)含量降低高达90%,一旦达到生产规模和耐久性基准,即可实现更广泛的应用。

受绝对产量驱动,乘用车将在2024年占据触媒转换器市场的63.60%。儘管随着电气化的发展,这一比例将略有下降,但由于车辆寿命延长、混合动力汽车推出较晚,以及柴油车小型化和汽油车战略的兴起,乘用车催化剂仍将是主导产品。

中型和重型商用车的复合年增长率最高,为 9.08%。物流扩张、基础设施投资以及重型车辆氮氧化物排放法规的日益严格,促使车队管理者寻求更大容量的催化剂和更长的保固期。开发商已开始检验氢内燃机系统是否适用于远距卡车,为三元催化剂的研发铺平了道路。三元催化剂必须能够承受高排气温度下的 100% 氢气流,同时抑制氮氧化物。非公路机械虽然市场规模较小,但得益于采用客製化加工管壳的 Stage V 改装套件,其市场正经历长期成长。

区域分析

预计到2024年,亚太地区将占触媒转换器市场收益的49.82%,到2030年,复合年增长率将达到7.85%。中国正在推动国七标准,该标准纳入了高于欧洲基准值的颗粒物计数和实际驾驶通讯协定,以支撑该地区的成长。随着印度汽车产量扩大以满足国内出行需求和出口订单,印度的产量将会成长。该地区的重型汽车产量将受益于基础设施建设,这将刺激卡车和非公路设备的销售。在新广州交易所上市的铂金和钯金期货将提高金属采购的专业化程度,并降低当地製造商的价格波动风险。

北美预计将以5.10%的复合年增长率成长。联邦法规正在更新,要求到2032年将非机动车废气(NMOG)和氮氧化物(NOx)排放量减少50%,并强制采用汽油颗粒过滤器。德克萨斯州、密西根州和安大略省仍然是轻型汽车废气转换器的主要生产地,而加州的Tier 5非公路排放法规正在推动施工机械采用先进的选择性催化还原(SCR)系统。对氢燃料内燃机测试实验室的投资显示了该地区对替代推进技术的决心,同时依靠后处理来减少氮氧化物。

欧洲的复合年增长率为4.80%,反映出其成熟的汽车群体正面临2035年起强制零排放销售的压力。欧7将引入八年的耐久性限制,并扩大工作温度范围,这将在短期内增加催化剂的需求。领先的供应商正专注于开发更緻密的涂层、电加热砖以及氮氧化物/颗粒物综合再生演算法,以满足严格的欧7法规。一旦新车需求趋于平稳,非道路车辆的改装活动将支撑售后市场的销售量。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 2025年起更严格的排放法规将推动技术升级

- 疫情后全球内燃机汽车和混合动力汽车产量的復苏

- 增加 GDI 和轻度混合动力引擎中的贵金属负载

- ESG压力推动非道路/汽车机械OEM的改造需求

- 转换器窃盗回收热潮导致供应链出现缺口

- 加大对需要三元转换器的氢动力内燃机汽车的奖励

- 市场限制

- 铂族金属(PGM)价格剧烈波动

- 由于纯电动车的加速普及,车辆需求长期下降

- 打击非法铂金属采购导致合规成本上升

- 单一材料催化剂(钒、钙钛矿)的早期商业化

- 价值/供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测(单位:美元)

- 按转换器类型

- 双向触媒转换器

- 三元触媒转换器

- 其他类型

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中大型商用车

- 越野和非道路设备

- 摩托车和强力运动

- 按燃料类型

- 汽油

- 柴油引擎

- 混合动力(MHEV、HEV、PHEV)

- 按基板

- 铂

- 钯

- 铑

- 其他(铈、钒、钙钛矿)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略性倡议(合资企业、生产能力、回收计划)

- 市占率分析

- 公司简介

- Marelli Holdings Co., Ltd.

- Tenneco Inc.(Walker Emissions Control)

- HELLA GmbH and Co. KGaA

- Eberspacher Group

- Yutaka Giken Company Limited

- Futaba Industrial Co. Ltd.

- Boysen Group

- BOSAL International

- Katcon SA de CV

- Sejong Industrial Co., Ltd.

- Hanwoo Industrial Co. Ltd.

- Sango Co. Ltd.

- Benteler International AG

第七章 市场机会与未来展望

The catalytic converters market generated USD 111.35 billion in 2025 and is forecast to reach USD 167.59 billion by 2030, advancing at an 8.52% CAGR.

The expansion reflects consistent regulatory tightening after 2025, including Euro 7, China 7, and updated United States standards, all of which mandate higher precious-metal loadings and advanced wash-coat chemistries. Further momentum comes from the rebound in global internal-combustion and hybrid vehicle production, precious-metal substitution strategies that cut cost risk, and retrofit activity in non-road machinery fleets. Supply chain resilience, new hydrogen internal-combustion projects, and promising single-material catalysts round out the opportunity set for the catalytic converters market.

Global Automotive Catalytic Converter Market Trends and Insights

Stringent Post-2025 Emission Legislation Drives Technology Upgrades

Euro 7 begins phasing in from July 2025 and extends compliance durability to eight years/160,000 km, forcing automakers to specify thicker precious-metal layers and sophisticated gasoline particulate filters. China 7 mirrors and, in several respects, exceeds Euro 7, requiring particulate-number limits and real-driving emissions testing across platforms. In the United States, tougher off-road and light-vehicle rules close historical regulatory gaps. Unified global thresholds remove the lag-time cushion OEMs once used, accelerating design cycles for advanced three- and four-way systems.

Rebound in Global ICE and Hybrid Production Volume Post-COVID

Worldwide light-vehicle output witnessed volume restoration across gasoline, diesel, and hybrid lines. Commercial trucks added volume on the back of logistics demand, while infrastructure stimulus in Asia-Pacific kept heavy-duty assembly lines active. Hybrids represented approximately 10% of production and need larger catalyst volumes to control cold-start emissions during frequent stop-start cycling. the China Association of Automobile Manufacturers is implementing a three-step development strategy targeting 20% carbon emissions reduction by 2035 through enhanced thermal efficiency and advanced emission control systems. Normalized factory utilization raises near-term unit shipments for the catalytic converters market despite longer-term electrification pressure.

Extreme Platinum-Group-Metal Price Volatility

Palladium's fall from more than USD 3,000/oz in 2022 to under USD 1,000/oz in early 2025, and platinum's swings between USD 900-1,100/oz, complicate sourcing budgets and encourage substitution. Suppliers hedge, but small participants struggle to offset price moves, reducing short-term margin visibility and delaying orders when cost shocks hit. Planned reductions in South African mine capex threaten to tighten supply later in the decade..

Other drivers and restraints analyzed in the detailed report include:

- Higher Precious-Metal Loadings in GDI and Mild Hybrid Engines

- OEM Retrofit Demand from Non-Road/Mobile Machinery ESG Pressure

- Accelerated BEV Penetration Reducing Long-Term Unit Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Three-way converters retained a 66.78% share of the catalytic converters market in 2024, reflecting their universal fit for stoichiometric gasoline engines. Tightening particulate-number and durability rules keep this format central to compliance, though metal loading and wash-coat formulations continue to evolve. The catalytic converters market size for three-way units is forecast to rise in line with overall vehicle production through 2030, underpinned by hybridization that magnifies cold-start events.

A new wave of four-way converters, lean-NOx traps, and combined selective catalytic-reduction systems clusters in the "other types" category, which is projected to grow at 11.83% CAGR. Laboratory work at Washington State University shows that nano-scale ceria clustering induced by high exhaust heat boosts activity tenfold while using less precious metal, a discovery that may reshape cost curves. Parallel research into self-regenerating perovskite catalysts aims to cut PGM content by up to 90%, setting the stage for broader adoption once production scale and durability benchmarks are met.

Passenger cars dominated the 2024 volume with 63.60% catalytic converters market share, driven by their absolute production scale. Despite the portion declining modestly as electrification grows, passenger-car catalysts remain a staple due to long fleet lives, late-cycle hybrid launches, and emerging diesel-downsize gasoline strategies.

Medium and heavy commercial vehicles provide the fastest 9.08% CAGR. Logistics expansion, infrastructure spending, and stricter heavy-duty NOx ceilings push fleet managers toward higher-capacity catalyst bricks and longer warranties. Developers are already validating hydrogen-ICE systems for long-haul trucking, opening a fresh avenue for three-way catalysts that must tolerate 100% hydrogen streams at high exhaust temperatures while still curbing NOx. Off-road machinery, though niche, prolongs growth by tapping Stage V retrofit packages with bespoke pipe-fabricated housings.

The Catalytic Converter Market Report is Segmented by Converter Type (Two-Way Catalytic Converters, Three-Way Catalytic Converters, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Fuel Type (Gasoline, Diesel, and Hybrid), Substrate Material (Platinum, Palladium, and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 49.82% of the catalytic converters market revenue in 2024 and is expected to expand at a 7.85% CAGR through 2030. China anchors regional growth on the back of China 7 standards that embed particulate-number and real-driving protocols exceeding European thresholds. India adds volume as automotive production ramps up to meet both domestic mobility demand and export orders. Regional heavy-duty output benefits from infrastructure pipelines that stimulate truck and off-road equipment sales. Futures contracts for platinum and palladium listed on a new Guangzhou exchange further professionalize metal procurement, lessening price-shock exposure for local manufacturers.

North America is forecast to grow at 5.10% CAGR. Updated federal rules demand 50% NMOG + NOx cuts by 2032 and force gasoline particulate-filter adoption. Texas, Michigan, and Ontario remain key production clusters for light-vehicle converters, while Tier 5 off-road proposals in California pull through advanced SCR systems for construction machinery. Investments in hydrogen-ICE testing labs illustrate the region's commitment to alternative propulsion while still relying on after-treatment for NOx abatement.

Europe's 4.80% CAGR reflects a mature vehicle base under pressure from mandated zero-emission sales after 2035. Near-term catalyst demand rises as Euro 7 introduces eight-year durability and extended temperature compliance windows. Leading suppliers focus on higher density wash-coats, electrically heated bricks, and combined NOx/particulate regeneration algorithms to meet the stringent Euro 7 limits. Retrofit activity in non-road fleets sustains aftermarket volumes once new-car demand flattens.

- Marelli Holdings Co., Ltd.

- Tenneco Inc. (Walker Emissions Control)

- HELLA GmbH and Co. KGaA

- Eberspacher Group

- Yutaka Giken Company Limited

- Futaba Industrial Co. Ltd.

- Boysen Group

- BOSAL International

- Katcon S.A. de C.V.

- Sejong Industrial Co., Ltd.

- Hanwoo Industrial Co. Ltd.

- Sango Co. Ltd.

- Benteler International AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Post-2025 Emission Legislation Drives Technology Upgrades

- 4.2.2 Rebound in global ICE and hybrid production volumes post-COVID

- 4.2.3 Higher precious-metal loadings in GDI and mild-hybrid engines

- 4.2.4 OEM retrofit demand from non-road/mobile machinery ESG pressure

- 4.2.5 Supply-chain gaps caused by converter-theft recycling boom

- 4.2.6 Growing incentives for hydrogen-ICE vehicles needing three-way converters

- 4.3 Market Restraints

- 4.3.1 Extreme platinum-group metal (PGM) price volatility

- 4.3.2 Accelerated BEV penetration reducing long-term unit demand

- 4.3.3 Crack-down on illicit PGM sourcing raising compliance cost

- 4.3.4 Early-stage commercialisation of single-material catalysts (vanadium, perovskite)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value in USD)

- 5.1 By Converter Type

- 5.1.1 Two-Way Catalytic Converters

- 5.1.2 Three-Way Catalytic Converters

- 5.1.3 Other Types

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Off-Road and Non-Road Equipment

- 5.2.5 Motorcycles and Powersports

- 5.3 By Fuel Type

- 5.3.1 Gasoline

- 5.3.2 Diesel

- 5.3.3 Hybrid (MHEV, HEV, and PHEV)

- 5.4 By Substrate Material

- 5.4.1 Platinum

- 5.4.2 Palladium

- 5.4.3 Rhodium

- 5.4.4 Others (Cerium, Vanadium, and Perovskites)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, JV, capacity, and recycling initiatives)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Marelli Holdings Co., Ltd.

- 6.4.2 Tenneco Inc. (Walker Emissions Control)

- 6.4.3 HELLA GmbH and Co. KGaA

- 6.4.4 Eberspacher Group

- 6.4.5 Yutaka Giken Company Limited

- 6.4.6 Futaba Industrial Co. Ltd.

- 6.4.7 Boysen Group

- 6.4.8 BOSAL International

- 6.4.9 Katcon S.A. de C.V.

- 6.4.10 Sejong Industrial Co., Ltd.

- 6.4.11 Hanwoo Industrial Co. Ltd.

- 6.4.12 Sango Co. Ltd.

- 6.4.13 Benteler International AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment