|

市场调查报告书

商品编码

1846184

热喷涂涂层:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Thermal Spray Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

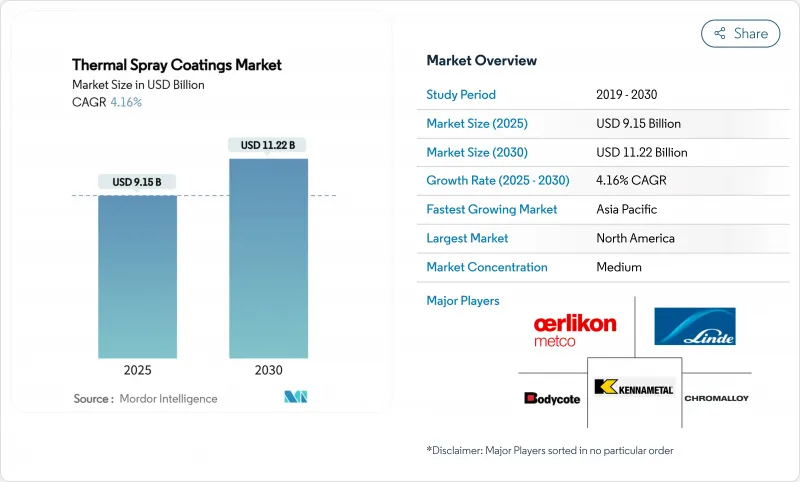

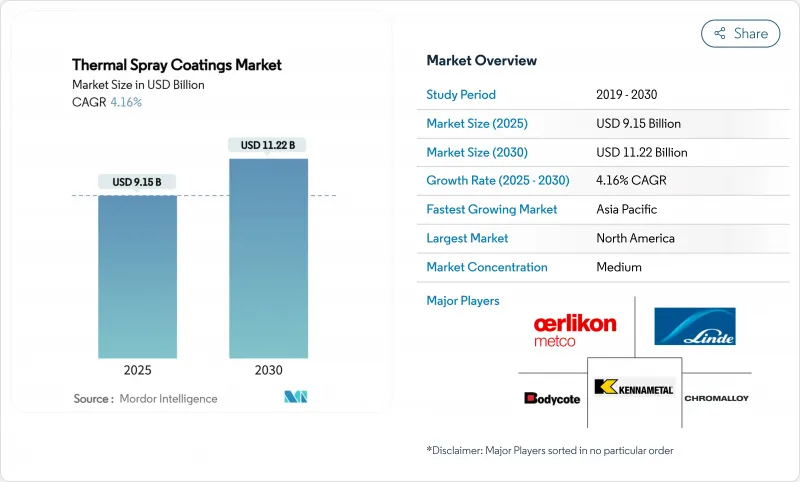

预计到 2025 年,热喷涂涂层市场规模将达到 91.5 亿美元,到 2030 年将达到 112.2 亿美元,预测期(2025-2030 年)复合年增长率为 4.16%。

推动市场需求的因素包括:可延长零件寿命的混合增材製造+喷涂修復方法;需要生物活性表面的医疗应用不断扩展;以及依赖先进隔热层来应对发动机温度上升的航太项目。数位化「智慧」喷涂单元正在增强製程控制并缩短开发週期。从区域来看,亚太地区的生产能力提升正在缩小与北美的差距,而美国更严格的VOC法规正在加速向低排放气体的电能热喷涂製程转型。

全球热喷涂涂层市场趋势与洞察

在医疗植入和义肢的应用日益广泛

医用级等离子喷涂羟基磷灰石仍然是目前唯一获得FDA批准用于大规模生产的整形外科植入物的涂层技术,而近期使用B相钛合金的研究表明,其与骨骼的模量差异较小。高功率脉衝磁控溅镀和高速火焰喷涂(HVOF)技术正被结合到层状结构中,以提供抗菌表面,同时又不影响骨整合。随着3D列印晶格植入物的规模化应用,喷涂生物陶瓷涂层使得客製化几何形状的植入物能够更快地通过认证,儘管监管机构仍在最终确定测试通讯协定。能够证明其表面粗糙度和相组成可重复性的涂层供应商正在赢得新的多年供应合约。

在航太涡轮机和机身部件中的应用日益广泛

引擎预热阶段不断提高涡轮进口温度,对智慧工厂提出了更高的要求,即每个试样的厚度范围必须更严格。欧瑞康和MTU航空发动机公司开发的数位化喷涂单元采用闭合迴路流诊断技术,可将返工率降低25%。冷喷涂已成为领先的维修技术,能够修復铝製飞行控制壳体和镁製齿轮箱盖,而不会因热效应而变形。具有抗氧化中阶延长了发动机大修时间,使航空公司能够延长窄体飞机的服役时间。

涂层品质问题的可靠性和可重复性

大型原始设备製造商 (OEM) 目前规定的统计製程窗口,小型製造工厂难以满足。颗粒尺寸变化、羽流动力学和基材预热都会影响氧化物含量和孔隙率,进而影响使用过程中的磨损。自动化视觉和线上声波感测器有助于检测超出规格的情况,但对于小批量应用而言,整合成本仍然很高。由于缺乏即时监控的全球标准,认证週期很长,尤其是在航太和医疗设备专案中。

细分市场分析

到2024年,陶瓷氧化物将占总收入的30.15%,并以5.12%的复合年增长率快速成长。这一优势源于其卓越的高温稳定性和生物相容性,使氧化物成为涡轮机、医疗和氢能基础设施计划的首选材料。碳化物混合物则适用于石油和天然气阀门以及采矿工具等极端磨损应用。镍铬钼合金等金属有助于防止海洋结构腐蚀,而聚合物基覆层则应用于介电性能至关重要的电子领域。悬浮等离子喷涂法製备的奈米结构氧化物可提高热循环寿命,为未来的推进系统架构释放。将稀土元素掺杂氧化锆与功能梯度黏结层结合的製造商,如今宣称其产品具有5万小时的耐久性保证,从而将热喷涂涂层市场从防护提升至性能。

新型粉末雾化技术也降低了碳化钨供应风险。一些亚洲钢厂已开始将硬质合金废料回收製成团聚碳化钨钴原料,从而减少了对中国原生钨的依赖。同时,混合放电等离子烧结棒材的出现拓宽了原料选择范围。这些转变透过降低原料成本波动性并为局部粉末中心的发展打开大门,从而增强了热喷涂市场。

区域分析

北美拥有成熟的航太、国防和医疗设备生态系统,预计2024年将以34.27%的收入占比领先。获得美国联邦航空管理局(FAA)认证的维修店正在使用冷喷涂技术将材料重新黏合到镁合金齿轮箱上,避免了昂贵的零件更换。儘管加州的空气品质检测对合规性造成了不确定性,但该地区在智慧喷涂单元方面的先发优势应该会使其在整个预测期内保持领先地位。

由于汽车电气化、消费性电子产品产能和燃气燃气涡轮机建设的快速扩张,亚太地区预计将以6.21%的复合年增长率实现快速成长。中国粉末回收企业已开始向当地涂料公司供应碳化物原料,以规避美国地质调查局(USGS)指出的钨矿风险。日本半导体工厂正在扩大用于5奈米以下蚀刻腔的耐等离子氧化铝涂层的生产规模,而印度铁路公司则指定在高速铁路轨道部件上使用电弧喷涂钢板。这些计划表明,热喷涂市场已渗透到该地区製造业的各个环节。

在欧洲,更严格的VOC(挥发性有机化合物)法规正推动闭环等离子喷涂室和水性黏合剂的普及,并展现出稳定的进展。北海离岸风力发电电场目前指定在单桩内部喷涂铝锌热喷涂牺牲阳极,从而将其使用寿命延长至25年或更久。欧盟委员会的「Fit-for-55」计画间接促进了对工业燃气涡轮机高效阻隔涂层的需求。儘管在中东和非洲,此类涂层仍处于小众市场,但随着炼油厂维修和海水淡化厂寻求持久的防腐蚀保护层,预计未来需求将会增加。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在医疗植入和义肢的应用日益广泛

- 在航太涡轮机和机身部件中的应用日益广泛

- 人们越来越偏好选择陶瓷氧化物阻隔涂层

- 用于电动车零件的冷喷涂电磁干扰屏蔽

- 超合金零件的增材製造修復

- 市场限制

- 涂层品质问题的可靠性和可重复性

- 更严格的VOC/粉尘排放法规

- 关键粉末(碳化钨、稀有碳化物)供应波动

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 粉末涂料

- 陶瓷氧化物

- 碳化物

- 金属

- 聚合物和其他材料

- 透过流程

- 燃烧

- 电能

- 按最终用户产业

- 航太

- 工业用燃气涡轮机

- 车

- 电子设备

- 医疗设备

- 能源和电力

- 石油和天然气

- 其他(纸浆和造纸、采矿等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Abakan Inc.

- APS Materials Inc.

- Bodycote

- Chromalloy Gas Turbine LLC

- Curtiss-Wright Corporation(FW Gartner)

- Fisher Barton

- Flame Spray Technologies BV

- Hannecard Roller Coatings, Inc-ASB Industries

- Kennametal Inc.

- Linde

- OC Oerlikon Management AG

- Steel Goode Products, LLC

- Sulzer Ltd

- Thermion

- Tocalo Co. Ltd.

- TST LLC

第七章 市场机会与未来展望

The Thermal Spray Coatings Market size is estimated at USD 9.15 billion in 2025, and is expected to reach USD 11.22 billion by 2030, at a CAGR of 4.16% during the forecast period (2025-2030).

Demand is fueled by hybrid additive-plus-spray repair methods that extend component life, widening medical applications that require bio-active surfaces, and aerospace programs that rely on advanced thermal-barrier stacks for higher engine temperatures. Growth also reflects rising adoption of cold-spray EMI shielding in e-mobility electronics, while digitalized "smart" spray cells are tightening process control and shortening development cycles. Regionally, Asia-Pacific's manufacturing build-out is closing the gap with North America, even as tightening VOC rules in the United States accelerate the shift to low-emission electric-energy spray routes.

Global Thermal Spray Coatings Market Trends and Insights

Increased Usage in Medical Implants and Prosthetics

Medical-grade plasma-sprayed hydroxyapatite continues to be the only FDA-cleared coating technology for mass-produced orthopedic implants, and recent work with B-phase Ti alloys is reducing elastic-modulus mismatch to bone. High-power impulse magnetron sputtering and HVOF overlays are now being combined in layered constructs that supply antibacterial surfaces without compromising osseointegration. As 3-D printed lattice implants scale up, spray-applied bio-ceramic finishes allow patient-specific geometries to move through qualification more quickly, though regulators are still finalizing test protocols. Coating providers able to certify repeatable roughness and phase composition are winning new multi-year supply contracts.

Growing Adoption in Aerospace Turbine & Air-Frame Parts

Engine primes are raising turbine inlet temperatures and demanding smart factories that deliver tight thickness windows on every coupon. Digitalized spray cells developed by Oerlikon and MTU Aero Engines now employ closed-loop plume diagnostics that cut rework rates by 25%. Cold-spray has become a frontline depot-repair tool, allowing aluminum flight-control housings and magnesium gearbox covers to be rebuilt without heat-affected distortion. Multilayer ceramic-oxide barrier stacks with oxidation-resistant inter-layers are extending engine overhaul intervals, enabling airlines to keep narrow-body fleets in service longer.

Reliability & Coating-Quality Repeatability Issues

Large OEMs now specify statistical process windows that smaller job shops struggle to meet. Particle size variance, plume dynamics, and substrate pre-heat all influence oxide content and porosity, which in turn dictate in-service wear. Automated vision and inline acoustic sensors are helping detect off-nominal conditions, but integration costs remain high for low-volume applications. Without global standards on real-time monitoring, qualification cycles lengthen, especially in aerospace and medical device programs.

Other drivers and restraints analyzed in the detailed report include:

- Rising Preference for Ceramic-Oxide Barrier Coatings

- Cold-Spray EMI Shielding for E-Mobility Components

- Tightening VOC / Dust-Emission Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ceramic oxides recorded 30.15% of 2024 revenue and will grow fastest at 5.12% CAGR. This dominance arises from outstanding high-temperature stability and bio-compatibility, making oxides the default for turbine, medical, and hydrogen infrastructure projects. Carbide blends follow for extreme wear tasks on oil-and-gas valves and mining tools. Metals such as Ni-Cr-Mo alloys serve corrosion defense of marine structures, while polymer-based overlays target electronics where dielectric properties matter. Nanostructured oxides fabricated via suspension plasma spray tighten thermal-cycling life and are unlocking future propulsion architectures. Manufacturers combining rare-earth-doped zirconia with functionally graded bond coats now market 50 000-hour durability guarantees, lifting the thermal spray coating market perception from protective to performance-enabling.

New powder atomization methods are also trimming tungsten carbide supply risk. Several Asian plants have begun recycling hard-metal scrap into agglomerated WC-Co feedstock, lessening exposure to Chinese primary tungsten. At the same time, hybrid spark-plasma-sintered rod stock is widening the choice of feed materials. These shifts will strengthen the thermal spray coating market by easing raw-material cost swings and opening the door to localized powder hubs.

The Thermal Spray Coating Market Report is Segmented by Powder Coating Materials (Ceramic Oxides, Carbides, Metals, Polymers & Other Materials), Process (Combustion, Electric Energy), End-User Industry (Aerospace, Industrial Gas Turbines, Automotive, Electronics, Medical Devices, and More), and Geography (Asia-Pacific, North America, Europe, South America, , and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 34.27% revenue in 2024 on the back of entrenched aerospace, defense, and medical device ecosystems. FAA-class repair shops now rely on cold-spray to redeposit material on magnesium gearboxes, avoiding costly part replacement, while the Department of Energy funds oxide-coating research for hydrogen-ready turbines. California's air-quality probes add compliance uncertainty, but the region's first-mover advantage in smart spray cells should preserve leadership during the forecast window.

Asia-Pacific is projected to grow fastest at 6.21% CAGR as automotive electrification, consumer-electronics capacity, and gas-turbine build-outs surge. Chinese powder recyclers already supply carbide feedstock to local coaters, hedging tungsten risks identified by USGS. Japanese semiconductor plants are scaling plasma-resistant alumina coatings for sub-5 nm etch chambers, while Indian railways specify arc-sprayed steel overlays on high-speed track components. These projects illustrate how the thermal spray coating market is embedding itself across the region's manufacturing spectrum.

Europe shows steady progress as tougher VOC caps push operators toward closed-loop plasma booths and water-borne binders. Offshore wind farms in the North Sea now specify Al-Zn thermally sprayed sacrificial anodes on monopile interiors, lengthening service life beyond 25 years. The European Commission's "Fit-for-55" package indirectly boosts demand for efficiency-raising barrier coatings on industrial gas turbines. Middle East and Africa remain niche today but will see higher uptake as refinery revamps and desalination plants pursue long-life corrosion shields.

- Abakan Inc.

- APS Materials Inc.

- Bodycote

- Chromalloy Gas Turbine LLC

- Curtiss-Wright Corporation (FW Gartner)

- Fisher Barton

- Flame Spray Technologies BV

- Hannecard Roller Coatings, Inc - ASB Industries

- Kennametal Inc.

- Linde

- OC Oerlikon Management AG

- Steel Goode Products, LLC

- Sulzer Ltd

- Thermion

- Tocalo Co. Ltd.

- TST LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased usage in medical implants & prosthetics

- 4.2.2 Growing adoption in aerospace turbine & air-frame parts

- 4.2.3 Rising preference for ceramic-oxide barrier coatings

- 4.2.4 Cold-spray EMI shielding for e-mobility components

- 4.2.5 Additive-manufacturing repair of super-alloy parts

- 4.3 Market Restraints

- 4.3.1 Reliability & coating-quality repeatability issues

- 4.3.2 Tightening VOC / dust-emission regulations

- 4.3.3 Critical-powder supply volatility (WC, rare carbides)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Powder Coating Materials

- 5.1.1 Ceramic Oxides

- 5.1.2 Carbides

- 5.1.3 Metals

- 5.1.4 Polymers & Other Materials

- 5.2 By Process

- 5.2.1 Combustion

- 5.2.2 Electric Energy

- 5.3 By End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Industrial Gas Turbines

- 5.3.3 Automotive

- 5.3.4 Electronics

- 5.3.5 Medical Devices

- 5.3.6 Energy and Power

- 5.3.7 Oil and Gas

- 5.3.8 Others (Pulp and Paper, Mining, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Abakan Inc.

- 6.4.2 APS Materials Inc.

- 6.4.3 Bodycote

- 6.4.4 Chromalloy Gas Turbine LLC

- 6.4.5 Curtiss-Wright Corporation (FW Gartner)

- 6.4.6 Fisher Barton

- 6.4.7 Flame Spray Technologies BV

- 6.4.8 Hannecard Roller Coatings, Inc - ASB Industries

- 6.4.9 Kennametal Inc.

- 6.4.10 Linde

- 6.4.11 OC Oerlikon Management AG

- 6.4.12 Steel Goode Products, LLC

- 6.4.13 Sulzer Ltd

- 6.4.14 Thermion

- 6.4.15 Tocalo Co. Ltd.

- 6.4.16 TST LLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment