|

市场调查报告书

商品编码

1846224

石脑油:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Naphtha - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

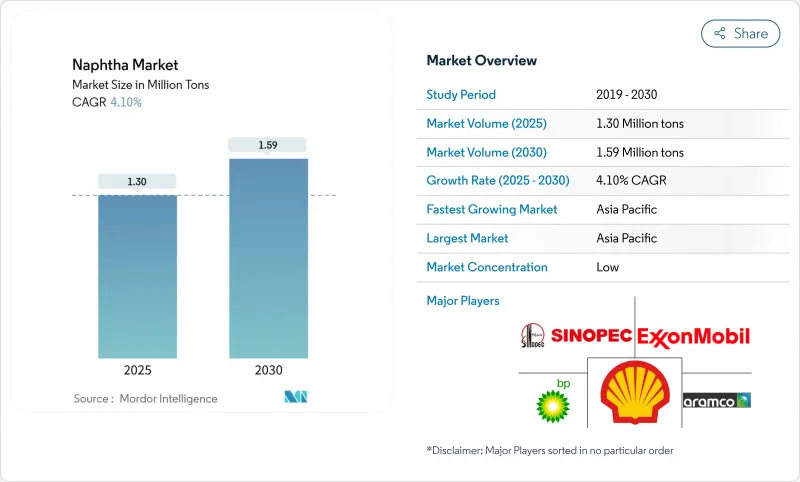

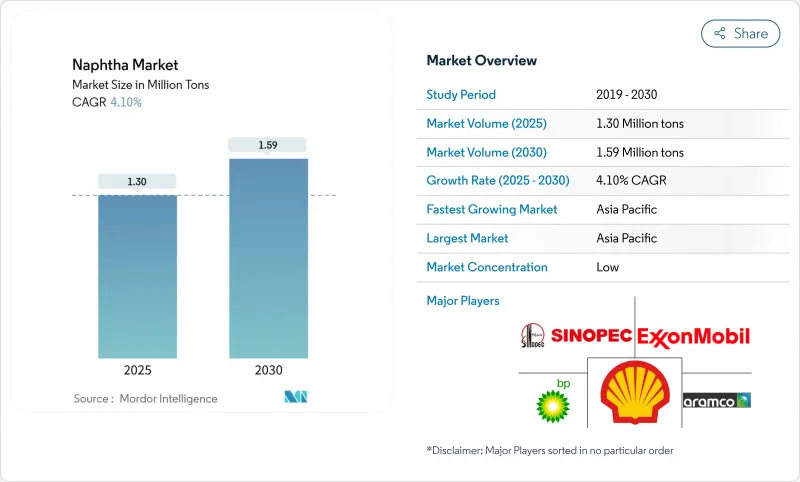

预计到 2025 年,石脑油市场规模将达到 130 万吨,预计到 2030 年将达到 159 万吨,在市场估算和预测期(2025-2030 年)内,复合年增长率为 4.10%。

石脑油作为烯烃和芳烃的石化原料,需求占主导地位,而大型蒸汽裂解装置为了提高乙烯产率而倾向于使用轻质馏分油,进一步强化了这一需求。美国墨西哥湾沿岸冷凝油裂解装置和亚洲新建炼油厂的投资正在重塑全球贸易流量,而生物石脑油产能的扩张则提供了补充性的低碳供应管道。大型炼油厂正在将上游原油供应与下游石化转化相结合,从而在整个产业链中实现价值最大化。然而,原油与石脑油价差的波动、天然气液作为替代原料日益增长的吸引力以及日益严格的碳排放法规,都为利润率稳定性和资本配置决策带来了不确定性。

全球石脑油市场趋势与洞察

亚洲蒸汽裂解装置推动烯烃和芳烃原料需求激增

在中国,为提高轻质石脑油的消耗量,大型裂解装置正陆续试运行,因为石蜡组分能够最大程度地提高乙烯产量。这些新装置到2028年的总合炼油能力将达到80万至110万桶/日,其设计均包含整合的冷凝油裂解装置,以提高石脑油的产率。恆力石化和福建石化的产能扩张将保持需求成长势头,从根本上增加冷凝油油的原油进口,并促进石脑油价格与整体市场价格的同步调整。供应安全奖励正在鼓励中东生产商与亚洲裂解装置之间签订长期承购协议,进一步巩固区域价值链。根据净收益计算,每新增一套蒸汽裂解装置,每年将使区域轻质石脑油需求增加150万吨,从而显着促进整体成长。

中东炼油厂升级改造计划与石脑油重整装置的整合

巴林石油公司(Bapco)的现代化计画和沙特阿美投资110亿美元的AMIRAL炼油厂项目,标誌着一种战略转变,即采用催化重整装置与混合原料裂解装置相结合的方式,以提高汽油辛烷值和芳烃产量。这种模式将先前用于车用燃料油池的直馏石脑油转化为利润率更高的石化产品,从而提升炼油厂的整体毛利率。此外,透过共用公用设施和灵活的原料选择,此一体化专案还提高了能源效率,并降低了利润波动。光是AMIRAL炼油厂每年就需要约500万吨石脑油,这使得该地区成为亚洲石脑油供应的重要枢纽,从而改善了区域供需平衡,并促进了石脑油市场的繁荣发展。

挥发性原油/石脑油价差侵蚀裂解利润

地缘政治事件和炼油厂产能中断会导致石脑油裂解价差剧烈波动,使炼厂生产计画复杂化,并促使炼油厂削减产能。 2024年初,亚丁湾发生成品油轮袭击事件后,亚洲石脑油裂解价差达到两年来的最高点,但随着套利货物的到来,价差迅速收窄。由于美国炼油产能仍比2019年以来的峰值低62万桶/日,全球供应缓衝仍然不足,加剧了市场波动。这种波动在不利时期可能导致炼油厂运转率下降高达8%,增加贸易商的营运资金需求,并限製石脑油市场的扩张。

细分市场分析

由于其优异的乙烯产率和高石蜡含量,轻质石脑油受到现代裂解装置的青睐,预计到2024年将占全球石脑油市场的58%。该细分市场预计到2030年将以4.80%的复合年增长率成长,成为所有馏分油中成长最快的。美国和亚洲地区冷凝油裂解装置的扩建,旨在生产符合裂解装置馏分油要求的石蜡馏分油,这进一步巩固了该细分市场在石脑油市场的领导地位。每台日处理量10万桶的裂解装置大约生产3万桶/日的轻质石脑油,这加剧了轻质石脑油与重整装置的供需平衡,并推高了汽油级原料的溢价。一体化业者透过将裂解装置产生的馏分油与重整装置产生的馏分油混合,来对冲利润週期波动并提高整体资产利用率。

由于重质石脑油芳烃含量高、乙烯转化率低,其市场成长一直落后,仅为个位数中段。儘管如此,它仍然是催化重整装置的重要原料,该装置能够提高辛烷值并生产苯、甲苯和二甲苯。对铂锡和铂铼双金属催化剂的投资提高了重整装置的耐受性,并拓宽了重质石脑油的加工窗口。随着汽油价差收窄,炼油商利用芳烃销售合约将重质石脑油收益,从而维持了其在石脑油市场中虽有所下降但仍保持增长的份额。

石脑油市场按类型(轻质石脑油、重质石脑油)、来源(炼厂来源、生物石脑油、其他来源)、终端用户产业(石油化工、农业、油漆涂料、航太、其他产业)和地区(亚太地区、北美地区、欧洲地区、南美地区、中东和非洲地区)进行细分。市场预测以吨为单位。

区域分析

亚太地区将在2024年占据石脑油市场44%的份额,预计到2030年将以4.90%的复合年增长率增长,这主要得益于石化产品和化肥行业的同步增长。中国2023年原油日加工量将达到创纪录的1480万桶,从而实现原料自给自足;而印度的聚合物需求预计到2028年将达到3500万吨。沙特阿美持有恆力石化10%的股份,其在福建省的计划将进一步扩大区域一体化,使中东的供应与东亚不断增长的需求相匹配。

由于对冷凝油裂解装置的投资以及页岩液化石油气产量的成长,北美轻质石脑油持续面临结构性供不应求。预计美国炼油产能将在2023年成长2%,到2024年初达到1,840万桶/日的运作能。然而,天然气凝液供应量的激增将转移石化产品的需求,并减缓区域石脑油市场的扩张速度。对拉丁美洲出口的增加以及偶尔对欧洲的套利交易正在平衡季节性供应过剩。

随着可再生燃料生产取代化石燃料原料,欧洲对石脑油的需求将略有下降,但剩余的重整产能将供应芳烃炼和高辛烷值汽油调和成分。炼油厂将放宽对碳捕集试点设施的投资,透过维修现有设施生产氢化植物油(HVO)和永续航空燃料油(SAF)而非新建设施,来减少传统石脑油的隐含排放。中东将利用一体化重整-裂解计划,在套利窗口开启之际,将自身定位为亚洲和欧洲的边际供应商。南美和非洲将透过尼日利亚丹格特炼油厂等计划提升影响力,炼油厂将生产高达8万桶/日的汽油和石脑油,逐步改变区域贸易格局。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲蒸汽裂解装置对烯烃和芳烃原料的需求激增

- 中东地区石脑油重整装置和炼油厂升级改造计划的整合

- 印度化肥需求不断成长

- 美国墨西哥湾沿岸地区冷凝油分离器投资增加,目标是提高轻质石脑油产量

- 可再生燃料指令推动生质能生产规模化。

- 市场限制

- 美国液态天然气需求

- 原油石脑油价差的波动会侵蚀裂解边缘。

- 对低碳替代燃料和再生材料製定更严格的法规

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 原料分析

第五章 市场规模及成长预测(数量与价值)

- 按类型

- 轻石脑油

- 重石脑油

- 按原料

- 精製基础

- 比奥纳夫塔

- 其他的

- 按最终用户产业

- 石化

- 农业

- 油漆和涂料

- 航太

- 其他行业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Alexandria Mineral Oils Company

- BP plc

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- ENEOS Holdings Inc.

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Idemitsu Kosan Co.,Ltd.

- Indian Oil Corporation Ltd.

- Kuwait Petroleum Corporation

- LG Chem

- LyondellBasell Industries Holdings BV

- MGT Petroil

- PetroChina Company Limited

- Petroleos Mexicanos

- PTT Global Chemical Public Company Limited

- QatarEnergy

- Reliance Industries Limited

- SABIC

- Sasol Limited

- Saudi Arabian Oil Co.

- Shell plc

- SK Inc.

- TotalEnergies

第七章 市场机会与未来展望

The Naphtha Market size is estimated at 1.30 million tons in 2025, and is expected to reach 1.59 million tons by 2030, at a CAGR of 4.10% during the forecast period (2025-2030).

Demand is anchored by naphtha's role as the dominant petrochemical feedstock for olefins and aromatics, a position reinforced by large-scale steam crackers that prefer light fractions for higher ethylene yields. Investments in condensate splitters along the U.S. Gulf Coast and new integrated refineries in Asia are reshaping global trade flows, while bio-naphtha capacity additions provide a complementary, low-carbon supply stream. Leading refiners integrate upstream crude supply with downstream petrochemical conversion to capture value across the chain. However, volatile crude-naphtha spreads, the growing appeal of natural gas liquids as alternative feedstocks, and increasingly stringent carbon regulations inject uncertainty into margin stability and capital-allocation decisions.

Global Naphtha Market Trends and Insights

Surging Demand for Olefins and Aromatics Feedstocks from Asian Steam Crackers

China is commissioning a wave of mega-crackers that elevate consumption of light naphtha because its paraffinic composition maximizes ethylene output. New capacity totaling 0.8-1.1 million b/d of refining throughput by 2028 is designed with integrated condensate splitters that raise naphtha yield ratios. Capacity additions at Hengli Petrochemical and Fujian Petrochemical will maintain upward demand momentum, translating into structurally higher imports of condensate-rich crudes and driving regional price alignment with the broader naphtha market. Supply security incentives are prompting long-term offtake agreements between Middle-East producers and Asian crackers, further knitting regional value chains. Net-back calculations suggest that each incremental steam cracker complex boosts regional light naphtha requirements by 1.5 million tons annually, underpinning the driver's substantial contribution to overall growth.

Integration of Naphtha Reformers with Refinery Upgrading Projects in the Middle East

Bahrain's Bapco Modernization Programme and Saudi Aramco's USD 11 billion AMIRAL complex illustrate the strategic shift toward co-locating catalytic reformers with mixed-feed crackers to enhance gasoline octane and aromatic output. The model diverts straight-run naphtha that previously entered the motor-fuel pool into higher-margin petrochemical streams, improving overall refinery gross margins. Integration delivers energy-efficiency gains through shared utilities and furnishes flexible feedstock menus that dampen margin volatility. With AMIRAL alone requiring about 5 million tons of naphtha annually, the region becomes a swing supplier to Asia, tightening inter-regional balances and supporting a more robust naphtha market.

Volatile Crude-Naphtha Spreads Undermining Crack Margins

Geopolitical incidents and refining capacity outages drive sharp swings in naphtha crack spreads, challenging refinery scheduling and prompting throughput cuts. An attack on a product tanker in the Gulf of Aden sent Asian naphtha cracks to a two-year high in early 2024, yet spreads retraced swiftly as arbitrage cargoes arrived. With post-2019 U.S. refinery capacity still 620,000 b/d below the peak, global supply buffers remain thin, magnifying volatility. This instability dampens refinery utilization rates by up to 8% in adverse periods and raises working-capital requirements for traders, tempering naphtha market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Fertilizers in India

- Bio-Naphtha Scale-up Backed by Renewable-Fuel Mandates

- Regulatory Push for Low-Carbon Alternatives and Recycled Feedstocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Light naphtha generated 58% of the global naphtha market in 2024 as modern crackers favor its high paraffin content for superior ethylene yield. The segment is projected to grow at 4.80% CAGR to 2030, the briskest pace among cut types. Condensate splitter expansions in the United States and Asia are calibrated to produce paraffinic cuts that align with cracker slate requirements, reinforcing segment leadership in the naphtha market. Each 100,000 b/d splitter yields around 30,000 b/d of light naphtha, tightening balances and supporting premiums to gasoline-grade material. Integrated operators blend splitter streams with reformer output to hedge margin cycles and improve overall asset utilization.

Heavy naphtha lags with mid-single-digit growth owing to its higher aromatic content and lower ethylene productivity. Nonetheless, it remains an essential feedstock for catalytic reformers that upgrade octane and generate benzene, toluene, and xylenes. Investments in platinum-tin and platinum-rhenium bimetallic catalysts improve reformer severity tolerance, widening the processing window for heavier grades. Refiners leverage aromatics marketing agreements to monetize heavy cuts when gasoline spreads compress, preserving a supportive though less dynamic contribution to the naphtha market.

The Naphtha Market Report is Segmented by Type (Light Naphtha and Heavy Naphtha), Source (Refinery-Based, Bio-Naphtha, and Others), End-User Industry (Petrochemicals, Agriculture, Paints and Coatings, Aerospace, and Other Industries), and Geography (Asia Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific led the naphtha market with 44% share in 2024, and its 4.90% forecast CAGR to 2030 stems from synchronized growth in petrochemicals and fertilizers. China processed a record 14.8 million b/d of crude in 2023, underpinning self-sufficiency in feedstocks, while India's polymer demand is on track to hit 35 million tons by 2028. Aramco's 10% stake in Hengli Petrochemical and the Fujian project further expand regional integration, aligning Middle-East supply with East-Asian demand growth.

North America remains structurally long light naphtha due to condensate splitter investments and rising shale liquids output. U.S. refining capacity climbed 2% in 2023, taking operable nameplate to 18.4 million b/d at the start of 2024. Yet surging NGL availability diverts petrochemical demand, moderating the regional naphtha market expansion pace. Export growth into Latin America and occasional arbitrage to Europe balances seasonal surpluses.

Europe's naphtha demand contracts modestly as renewable fuel production displaces fossil feedstocks, but residual reformer capacity supplies aromatics chains and high-octane gasoline blendstocks. Refiners retrofit existing units for HVO and SAF rather than building greenfield assets, freeing investment for carbon-capture pilots that lower the embedded emissions of conventional naphtha. The Middle East capitalizes on integration projects that couple reformers and crackers, positioning itself as the marginal supplier into Asia and Europe when arbitrage windows open. South America and Africa gain influence through projects such as Nigeria's Dangote refinery, which will produce up to 80 kbd of gasoline and naphtha, gradually transforming regional trade balances.

- Alexandria Mineral Oils Company

- BP p.l.c.

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- CNPC

- ENEOS Holdings Inc.

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Idemitsu Kosan Co.,Ltd.

- Indian Oil Corporation Ltd.

- Kuwait Petroleum Corporation

- LG Chem

- LyondellBasell Industries Holdings B.V.

- MGT Petroil

- PetroChina Company Limited

- Petroleos Mexicanos

- PTT Global Chemical Public Company Limited

- QatarEnergy

- Reliance Industries Limited

- SABIC

- Sasol Limited

- Saudi Arabian Oil Co.

- Shell plc

- SK Inc.

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Olefins and Aromatics Feedstocks from Asian Steam Crackers

- 4.2.2 Integration of Naphtha Reformers with Refinery Upgrading Projects in the Middle East

- 4.2.3 Rising Demand for Fertilizers in India

- 4.2.4 Rising Investments in USGC Condensate Splitters Targeting Light Naphtha Output

- 4.2.5 Bio-Naphtha Scale-up Backed by Renewable-Fuel Mandates

- 4.3 Market Restraints

- 4.3.1 Natural Gas Liquid Demand in the United States

- 4.3.2 Volatile Crude-Naphtha Spreads Undermining Crack Margins

- 4.3.3 Regulatory Push for Low-Carbon Alternatives and Recycled Feedstocks

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Feedstock Analysis

5 Market Size and Growth Forecasts (Volume and Value)

- 5.1 By Type

- 5.1.1 Light Naphtha

- 5.1.2 Heavy Naphtha

- 5.2 By Source

- 5.2.1 Refinery-Based

- 5.2.2 Bio-Naphtha

- 5.2.3 Others

- 5.3 By End-user Industry

- 5.3.1 Petrochemicals

- 5.3.2 Agriculture

- 5.3.3 Paints and Coatings

- 5.3.4 Aerospace

- 5.3.5 Other Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Alexandria Mineral Oils Company

- 6.4.2 BP p.l.c.

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petrochemical Corporation

- 6.4.5 CNPC

- 6.4.6 ENEOS Holdings Inc.

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 Formosa Petrochemical Corporation

- 6.4.9 Idemitsu Kosan Co.,Ltd.

- 6.4.10 Indian Oil Corporation Ltd.

- 6.4.11 Kuwait Petroleum Corporation

- 6.4.12 LG Chem

- 6.4.13 LyondellBasell Industries Holdings B.V.

- 6.4.14 MGT Petroil

- 6.4.15 PetroChina Company Limited

- 6.4.16 Petroleos Mexicanos

- 6.4.17 PTT Global Chemical Public Company Limited

- 6.4.18 QatarEnergy

- 6.4.19 Reliance Industries Limited

- 6.4.20 SABIC

- 6.4.21 Sasol Limited

- 6.4.22 Saudi Arabian Oil Co.

- 6.4.23 Shell plc

- 6.4.24 SK Inc.

- 6.4.25 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment