|

市场调查报告书

商品编码

1846257

汽车电源模组封装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Power Module Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

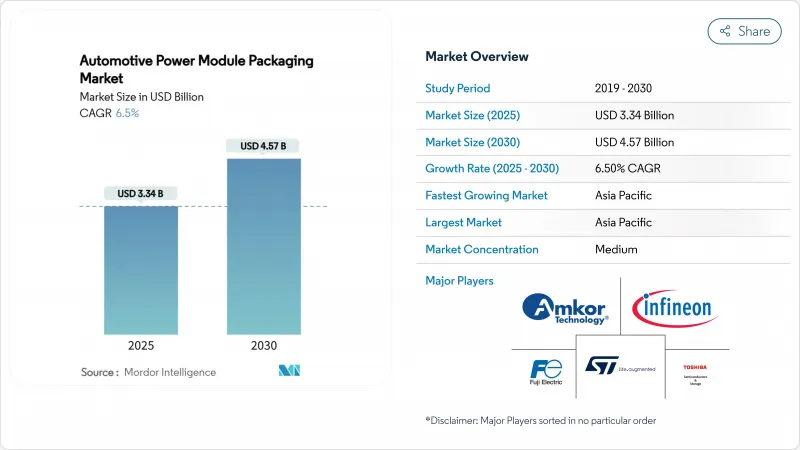

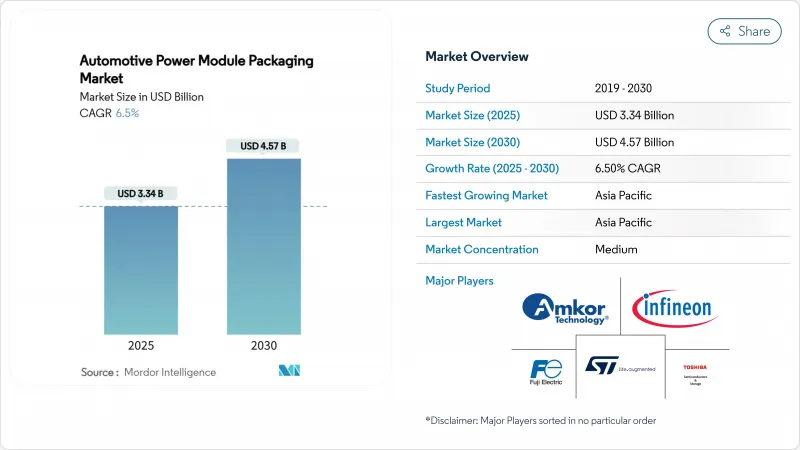

预计到 2025 年,汽车电源模组封装市场规模将达到 33.4 亿美元,到 2030 年将达到 45.7 亿美元,复合年增长率为 6.5%。

随着汽车製造商加速推进电气化进程、推动高压架构的大规模生产以及对宽能带隙带元件先进温度控管解决方案的需求,汽车功率模组封装市场正在不断扩张。对200毫米碳化硅晶圆厂投资的增加、缩短开发週期的伙伴关係以及日益严格的排放法规,都在强化市场的长期需求。专注于无打线接合合互连、双面冷却和银烧结技术的供应商在牵引逆变器、车用充电器和DC-DC转换器设计领域占有优势。同时,碳化硅基板供应的限制和分散的认证规则仍然是市场发展的阻碍。

全球汽车电源模组封装:市场趋势与洞察

电动车和混合动力汽车产量快速成长

预计到2024年,全球纯电动和混合动力汽车产量将大幅成长,汽车应用已占碳化硅需求的70%以上。特斯拉Cybertruck的电源转换器展示了800V平台如何使电压应力翻倍,并增加对温度控管的需求。包括ZF的300kW eBeam车桥在内的商用车专案进一步扩大了加固型封装的应用范围。

向SiC和GaN宽能带隙元件的转变

第四代碳化硅 (SiC) MOSFET 的结温现已超过 200°C,这增加了对铜夹、银烧结和直接晶粒冷却的需求。英飞凌预测,2025 年将是汽车级氮化镓 (GaN) 的转捩点,尤其是在车载充电器和高频直流-直流转换器方面。 SiC基板供应瓶颈主要集中在向 200 毫米晶圆的过渡以及为稳定产能而达成的多供应商协议上。

缺乏标准化的认证通讯协定

由于不同地区的原始设备製造商 (OEM) 对 AEC-Q100、AEC-Q101 和 AEC-Q200 的解读各不相同,电力电子供应商面临着反覆测试的困境,导致产品上市时间延长,一次性成本增加。国际电工委员会 (IECQ)推出了汽车认证计划 (AQP) 以统一认证流程,但该计划的实施情况并不均衡。

细分市场分析

智慧功率模组将占2024年销量的38.1%,并将继续成为入门级电动车和混合动力汽车的首选。儘管成本较高,但由于高阶和商用平台优先考虑效率,碳化硅(SiC)功率模组的复合年增长率预计仍将达到15.4%。到2030年,SiC元件的汽车功率模组封装市场预计将再成长7.5个百分点。 ROHM和Valeo的TRCDRIVE封装表明,SiC能够在不影响散热性能的前提下实现逆变器的小型化。同时,氮化镓(GaN)已渗透到车载充电器中,其高频开关特性克服了电流限制。 IGBT和FET模组继续用于中程和辅助负载,三菱马达最近推出的一款产品在提高防潮性能的同时,将开关损耗降低了15%。

随着汽车原始设备製造商 (OEM) 在成本、效率和供货能力之间寻求平衡,汽车功率模组封装市场持续多元化发展。随着 200 毫米晶圆实现量产以及垂直整合策略的日益成熟,碳化硅 (SiC) 的成本预计将会下降。因此,能够提供设计工具、闸极驱动器和热优化封装等整合解决方案的供应商,预计将赢得多年期平台合约。随着客户对承包模组化子系统的需求不断增长,集成设备製造商和组装专家之间的竞争差距可能会缩小。

到2024年,电压最高600V的系统将维持44.3%的市场份额,这主要得益于现有400V乘用车平台的普及。然而,在汽车功率模组封装市场,601-1200V电压频宽的成长速度最快,复合年增长率达6.9%,反映出市场正向800V拓朴结构转变,进而缩短快速充电时间。安波福解释了绝缘挑战和爬电距离要求如何提升了坚固型封装的价值。电压高于1200V的模组仍属于小众市场,主要面向重型车辆和基础设施应用。

更高的电压需求推动了更厚绝缘凝胶、低电感铜夹以及额定电压超过 1.5 kV 的压入式引脚的研发。英飞凌的 1200 V CoolSiC MOSFET 已被 Forvia Hella 应用于其 800 V DC-DC 转换器,这标誌着平台技术的转变。随着 OEM 厂商将下一代高压域控制器作为标准,能够确保局部放电耐久性和现场故障分析的封装供应商有望赢得规范制定权。

汽车功率模组封装市场按模组类型(IPM、SiC 功率模组、GaN 功率模组、其他)、额定功率(最高 600V、601-1200V、其他)、封装技术(打线接合、无引线打线接合合/功率覆盖、其他)、驱动类型(BEV、HEV、PHEV、FCEV-DC转换器、辅助/空调/EPS)和地区进行细分。

区域分析

预计亚太地区在2024年将维持57.2%的市场份额,并在2030年之前维持8.9%的最高复合年增长率。中国的双轨制信用政策和规模优势吸引了大量碳化硅投资,其中包括英飞凌在马来西亚投资20亿美元建设的200毫米晶圆厂,该晶圆厂提升了该地区的产能韧性。涵盖基板、金属化浆料和封装材料的本地化供应链缩短了前置作业时间并降低了成本。

Onsemi 投资 20 亿美元在捷克共和国建立了一条端到端的 SiC 生产线,确保从晶圆到组件的控制,减少对进口的依赖,而联邦製造业扣除额也鼓励了在美国进行组件组装。

在欧洲,关注的焦点是高端电动车品牌和更严格的排放法规。维特斯科科技公司投资5.76亿欧元(约6.5亿美元)扩大在奥斯特拉瓦的先进电子产品生产,体现了该公司对该地区电气化发展势头的信心。区域多元化措施正汇聚成一股力量,旨在降低单一区域的风险,并促进技术转让,从而提升全球品质标准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动车和混合动力汽车产量快速成长

- 向SiC和GaN宽能带隙元件的转变

- 车辆电气化需要更高功率密度的模组

- 严格的全球废气排放法规

- OEM采用无焊接线/顶部冷却封装

- 采用整合功率模组的电池到包装一体化架构

- 市场限制

- 缺乏标准化的认证通讯协定

- SiC/GaN基板高成本且供应受限

- 新兴800V平台的温度控管局限性

- 碳化硅供应链可能有供给能力

- 宏观经济因素的影响

- 价值链分析

- 监管状况

- 技术展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按模组类型

- 智慧型电源模组(IPM)

- SiC功率模组

- 氮化镓功率模组

- IGBT模组

- FET模组

- 额定功率

- 最高可达 600 伏

- 601~1200 V

- 1200伏特或以上

- 依封装技术

- 打线接合

- 引线键结/电源覆盖层

- 压入配合/直接压入晶粒

- PCB嵌入

- 依推进类型

- 纯电动车(BEV)

- 混合动力汽车(HEV)

- 插电式混合动力车(PHEV)

- 燃料电池电动车(FCEV)

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车辆和巴士

- 透过使用

- 牵引逆变器

- 车用充电器

- 直流-直流转换器

- 辅助/气候/EPS

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 其他南美

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Amkor Technology, Inc.

- Kulicke & Soffa Industries, Inc.

- Powertech Technology Inc.(PTI)

- Infineon Technologies AG

- STMicroelectronics NV

- Fuji Electric Co., Ltd.

- Toshiba Electronic Devices & Storage Corporation

- SEMIKRON Danfoss GmbH & Co. KG

- JCET Group Co., Ltd.

- StarPower Semiconductor Ltd.

- Mitsubishi Electric Corporation

- ROHM Co., Ltd.

- onsemi Corporation

- Nexperia BV

- Wolfspeed, Inc.

- Microchip Technology Inc.

- Littelfuse, Inc.(IXYS)

- Vitesco Technologies Group AG

- Vincotech GmbH

- CISSOID SA

- Hitachi Astemo, Ltd.

- Danfoss Silicon Power GmbH

- BYD Semiconductor Co., Ltd.

- Dynex Semiconductor Ltd.

- Shenzhen BASiC Semiconductor Ltd.

第七章 市场机会与未来展望

The automotive power module packaging market size reached USD 3.34 billion in 2025 and is forecast to climb to USD 4.57 billion by 2030, reflecting a compound annual growth rate (CAGR) of 6.5%.

The automotive power module packaging market is expanding because automakers accelerated electrification programs, pushed higher voltage architectures into volume production, and demanded advanced thermal-management solutions for wide-bandgap devices. Rising investments in 200 mm SiC wafer fabs, partnerships that compress development cycles, and tighter emission standards collectively reinforce long-term demand. Suppliers that master wire-bondless interconnects, double-sided cooling, and silver sintering are securing design wins in traction inverters, on-board chargers, and DC-DC converters. Meanwhile, supply constraints for SiC substrates and fragmented qualification rules remain headwinds.

Global Automotive Power Module Packaging Market Trends and Insights

Rapid EV and HEV production growth

Global battery-electric and hybrid output climbed sharply in 2024, and automotive applications already accounted for more than 70% of SiC demand. Tesla's Cybertruck power converter illustrated how 800 V platforms double voltage stresses and intensify thermal management needs. Tier-1 suppliers such as BorgWarner reported 47% year-on-year eProduct sales growth, signaling that established drivetrain specialists are pivoting resources toward high-density modules.Commercial vehicle programs, including ZF's 300 kW eBeam axle, further widen the addressable base for ruggedized packaging.

Shift toward SiC and GaN wide-bandgap devices

Fourth-generation SiC MOSFETs now sustain junction temperatures above 200 °C, intensifying the need for copper clips, silver sintering, and direct die cooling. Infineon forecasts 2025 as an inflection year for automotive GaN, especially in on-board chargers and high-frequency DC-DC converters. Supply bottlenecks for SiC substrates sharpened focus on 200 mm wafer transitions and on multi-source agreements that stabilize capacity.

Lack of standardized qualification protocols

Power-electronics suppliers faced repeated test loops because AEC-Q100, AEC-Q101, and AEC-Q200 were interpreted differently by regional OEMs, prolonging time-to-market and inflating non-recurring expenses. IECQ launched its Automotive Qualification Programme to harmonize procedures, yet adoption remained uneven.

Other drivers and restraints analyzed in the detailed report include:

- Vehicle electrification demands higher power-density modules

- Stringent global emission regulations

- High cost and supply constraints of SiC/GaN substrates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Intelligent Power Modules held 38.1% of 2024 revenue and remained the volume choice for entry-level EVs and hybrids. SiC Power Modules, though costlier, achieved 15.4% CAGR forecasts as premium and commercial platforms prioritized efficiency. The automotive power module packaging market size for SiC devices is projected to capture an additional 7.5 percentage-point share by 2030. ROHM and Valeo's TRCDRIVE pack showed how SiC enables inverter downsizing without thermal compromise. Meanwhile, GaN penetrated on-board chargers where high-frequency switching outweighed current limits. IGBT and FET modules continue to serve mid-range and auxiliary loads, and recent Mitsubishi Electric releases reduced switching losses by 15% while extending moisture tolerance.

Market diversification persisted across the automotive power module packaging market as OEMs balanced cost, efficiency, and availability. SiC cost declines are expected once 200 mm wafers reach scale and vertical-integration strategies mature. Hence, suppliers that bundle design tools, gate drivers, and thermally optimized housings are positioning themselves to capture multi-year platform awards. The competitive split between integrated device makers and specialized assembly firms is likely to narrow as customers demand turnkey module sub-systems.

Systems up to 600 V retained a 44.3% share in 2024, anchored by existing 400 V passenger-car platforms. However, the 601-1200 V band is the automotive power module packaging market's fastest climber at 6.9% CAGR, mirroring the shift to 800 V topologies that cut fast-charging times. Aptiv outlined insulation challenges and creepage requirements that raise the value of robust packaging. Above-1200V modules remain niche, targeting heavy-duty and infrastructure roles.

Higher voltage demands intensified the development of thicker insulation gels, copper clips with lower inductance, and press-fit pins rated beyond 1.5 kV. Infineon's 1200 V CoolSiC MOSFETs were selected by Forvia Hella for 800 V DC-DC converters, underscoring the platform shift. Packaging suppliers that guarantee partial discharge endurance and field-failure analytics will win specifications as OEMs standardize on next-generation high-voltage domain controllers.

Automotive Power Module Packaging Market is Segmented by Module Type (IPM, Sic Power Module, Gan Power Module, and More), Power Rating (Up To 600V, 601-1200V, and More), Packaging Technology (Wire-Bond, Wire-bondless/Power Overlay, and More), Propulsion Type (BEV, HEV, PHEV, and FCEV), Vehicle Type (Passenger Cars, and More), Application (Traction Inverter, On-Board Charger, DC-DC Converter, Auxiliary/Climate/EPS), and Geography.

Geography Analysis

Asia-Pacific retained a 57.2% share in 2024 and posted the highest outlook at 8.9% CAGR to 2030. China's dual-credit rules and scale advantages drew major SiC investments, including Infineon's USD 2 billion 200 mm fab in Malaysia that addressed regional capacity resilience. Local supply chains spanning substrates, metallization pastes, and molding compounds shortened lead times and trimmed costs.

North American demand accelerated as domestic OEMs unveiled new 800 V pickups and SUVs. onsemi committed USD 2 billion to build an end-to-end SiC line in the Czech Republic, ensuring wafer-to-module control and reducing import dependency. Federal manufacturing tax credits also encouraged module assembly within the United States.

Europe focused on premium EV brands and strict emissions mandates. Vitesco Technologies invested EUR 576 million (USD 650 million) to expand advanced-electronics production in Ostrava, signaling confidence in regional electrification momentum. Collectively, regional diversification initiatives are diluting single-region risk and fostering technology transfers that elevate global quality benchmarks.

- Amkor Technology, Inc.

- Kulicke & Soffa Industries, Inc.

- Powertech Technology Inc. (PTI)

- Infineon Technologies AG

- STMicroelectronics N.V.

- Fuji Electric Co., Ltd.

- Toshiba Electronic Devices & Storage Corporation

- SEMIKRON Danfoss GmbH & Co. KG

- JCET Group Co., Ltd.

- StarPower Semiconductor Ltd.

- Mitsubishi Electric Corporation

- ROHM Co., Ltd.

- onsemi Corporation

- Nexperia B.V.

- Wolfspeed, Inc.

- Microchip Technology Inc.

- Littelfuse, Inc. (IXYS)

- Vitesco Technologies Group AG

- Vincotech GmbH

- CISSOID SA

- Hitachi Astemo, Ltd.

- Danfoss Silicon Power GmbH

- BYD Semiconductor Co., Ltd.

- Dynex Semiconductor Ltd.

- Shenzhen BASiC Semiconductor Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid EV and HEV production growth

- 4.2.2 Shift toward SiC and GaN wide-bandgap devices

- 4.2.3 Vehicle electrification demanding higher power-density modules

- 4.2.4 Stringent global emission regulations

- 4.2.5 OEM adoption of wire-bondless / top-side-cooling packages

- 4.2.6 Cell-to-pack architectures integrating power modules

- 4.3 Market Restraints

- 4.3.1 Lack of standardized qualification protocols

- 4.3.2 High cost and supply constraints of SiC / GaN substrates

- 4.3.3 Thermal-management limits in emerging 800 V platforms

- 4.3.4 Potential SiC supply-chain over-capacity

- 4.4 Impact of Macroeconomic Factors

- 4.5 Value Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Buyers

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Module Type

- 5.1.1 Intelligent Power Module (IPM)

- 5.1.2 SiC Power Module

- 5.1.3 GaN Power Module

- 5.1.4 IGBT Module

- 5.1.5 FET Module

- 5.2 By Power Rating

- 5.2.1 Up to 600 V

- 5.2.2 601 - 1200 V

- 5.2.3 Above 1200 V

- 5.3 By Packaging Technology

- 5.3.1 Wire-bond

- 5.3.2 Wire-bondless / Power Overlay

- 5.3.3 Press-fit / Direct Pressed-Die

- 5.3.4 PCB-embedded

- 5.4 By Propulsion Type

- 5.4.1 Battery-Electric Vehicle (BEV)

- 5.4.2 Hybrid Electric Vehicle (HEV)

- 5.4.3 Plug-in Hybrid (PHEV)

- 5.4.4 Fuel-Cell Electric Vehicle (FCEV)

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Light Commercial Vehicles

- 5.5.3 Heavy Commercial Vehicles and Buses

- 5.6 By Application

- 5.6.1 Traction Inverter

- 5.6.2 On-board Charger

- 5.6.3 DC-DC Converter

- 5.6.4 Auxiliary / Climate / EPS

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 France

- 5.7.3.3 United Kingdom

- 5.7.3.4 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amkor Technology, Inc.

- 6.4.2 Kulicke & Soffa Industries, Inc.

- 6.4.3 Powertech Technology Inc. (PTI)

- 6.4.4 Infineon Technologies AG

- 6.4.5 STMicroelectronics N.V.

- 6.4.6 Fuji Electric Co., Ltd.

- 6.4.7 Toshiba Electronic Devices & Storage Corporation

- 6.4.8 SEMIKRON Danfoss GmbH & Co. KG

- 6.4.9 JCET Group Co., Ltd.

- 6.4.10 StarPower Semiconductor Ltd.

- 6.4.11 Mitsubishi Electric Corporation

- 6.4.12 ROHM Co., Ltd.

- 6.4.13 onsemi Corporation

- 6.4.14 Nexperia B.V.

- 6.4.15 Wolfspeed, Inc.

- 6.4.16 Microchip Technology Inc.

- 6.4.17 Littelfuse, Inc. (IXYS)

- 6.4.18 Vitesco Technologies Group AG

- 6.4.19 Vincotech GmbH

- 6.4.20 CISSOID SA

- 6.4.21 Hitachi Astemo, Ltd.

- 6.4.22 Danfoss Silicon Power GmbH

- 6.4.23 BYD Semiconductor Co., Ltd.

- 6.4.24 Dynex Semiconductor Ltd.

- 6.4.25 Shenzhen BASiC Semiconductor Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment