|

市场调查报告书

商品编码

1846271

家禽包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Poultry Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

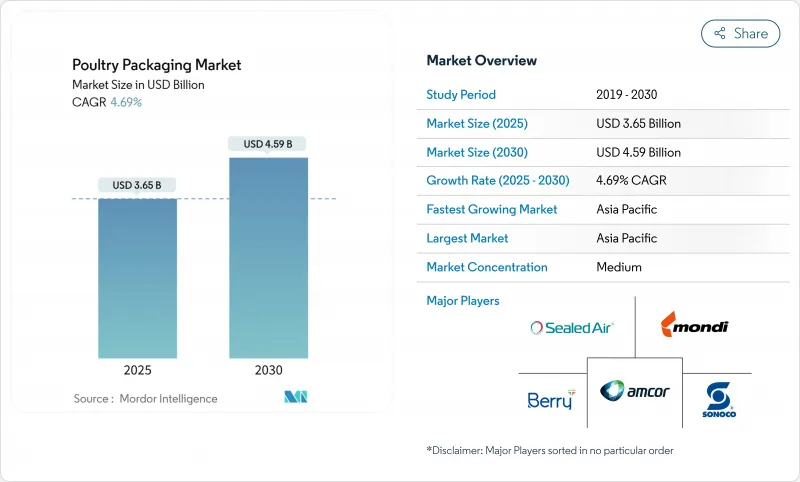

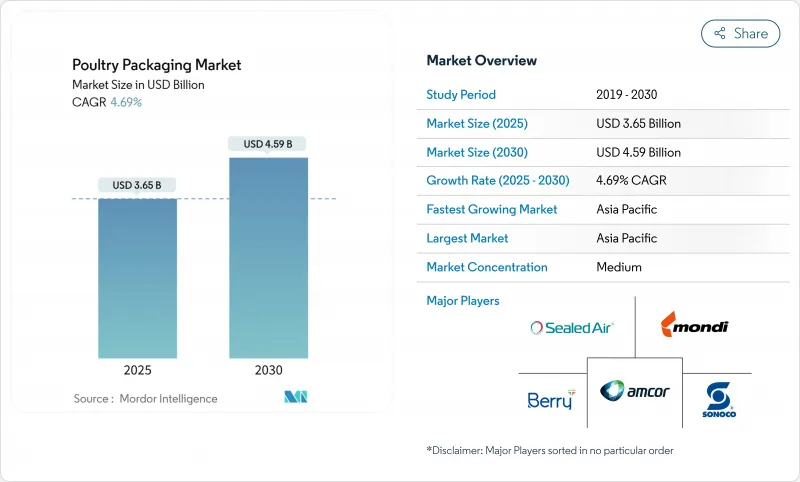

预计到 2025 年,家禽包装市场规模将达到 36.5 亿美元,到 2030 年将达到 45.9 亿美元,年复合成长率为 4.69%。

对即食鸡肉需求的成长、新型改良气调包装解决方案的出现以及永续性法规的推动,共同支撑着这个产业的稳定成长。零售商青睐可减少损耗和人工成本的即食鸡肉托盘。电商则需要能够承受多日运输的保温托盘。纸基复合材料的兴起迫使生产商在不降低产量的前提下,不断创新隔离层材料。同时,产业整合正在改变加工商和生产商之间的议价能力,而科技公司则在产业链的每个环节植入感测器,以预警温度超标的情况。

全球家禽包装市场趋势与洞察

消费者对方便快速的即食鸡肉的需求不断增长

千禧世代和Z世代消费者偏好便捷易取的鸡肉餐,尤其是采用易撕托盘或烤箱适用包装袋的鸡肉餐。因此,大型零售商纷纷采用集中式预包装方案,以减少店内人工成本并提高产品品质的一致性。托盘製造商现在会在包装内加入吸水垫片和气体冲洗阀,从而延长保质期数天。像G. Mondini这样的设备供应商提供模组化生产线,将精确分装与薄膜厚度结合,在不影响美观的前提下减少材料用量。连锁餐厅也顺应这一趋势,订购预先腌製真空密着包装,可直接从冷藏室取出放入烤架。高端食材自煮包平台也采用相同的包装来延长运输过程中的保质期,从而获得更高的利润,抵消了先进薄膜的成本。

MAP和真空皮肤技术的普及

虽然调气包装透过减缓微生物生长来延长保质期,但早期的高氧配方会促进脂质氧化和颜色变化。加工商目前正在试验一氧化碳助剂,这种助剂可以在不引起安全隐患的情况下稳定肉的色泽。像Duropac这样的公司生产的真空贴体膜因其能防止渗漏和抗穿刺,而备受带骨肉块的青睐。等离子处理的托盘可在包装内产生臭氧,无需使用化学物质即可减少90%的曲状桿菌和60%的沙门氏菌。像MULTIVAC这样的设备製造商将MAP阀与微孔盖结合,使加工商能够针对每个SKU定制气体比例。

禽流感导致的供应中断

2024-2025 年的高致病性禽流感疫情导致数百万隻禽鸟从供应链中消失,生产计画被打乱,托盘需求也因重量等级而异。美国为此支付了 18 亿美元的赔偿金,但禽舍需要 24 週才能恢復饲养,延长了生产的不稳定性。华盛顿大学研发的一种快速生物感测器可在五分钟内检测出 H5N1 病毒,从而实现早期控制和有针对性的扑杀。更短的禽群週期迫使加工商订购更灵活规格的禽鸟并调整品牌组合。

细分市场分析

由于消费者广泛接受以及去骨生产线的精简高效,鸡肉类别占据了家禽包装市场65.89%的份额。高产量使加工商能够与供应商协商薄膜成本,促使他们尝试使用易撕封口盖来减少食物废弃物。儘管鸭肉市场基数较小,但随着高端零售商在真空包装托盘中采用先进的鸡胸肉分割控制技术,鸭肉市场预计将以5.61%的复合年增长率成长。随着特色肉品逐渐进入主流冷冻库,鸭肉包装市场规模预计将稳定成长。安姆科的强化阻隔袋可防止油脂迁移,保持肉色鲜艳,并符合高阶产品展示标准。

鸭肉消费量的上升要求加工商采用防油涂层,并保持透明度以吸引零售商。鸭肉加工如今已自动化,符合重量规格,并能像鸡肉一样直接包装贩售。虽然季节性的整禽包装形式仍能维持火鸡的市场份额,但增值烤肉和切片熟食包装则支撑了全年需求。这就要求针对每种蛋白质客製化阻隔性、抗穿刺性和外形,迫使薄膜製造商在不增加SKU数量的前提下拓展产品组合。

到2024年,柔性包装结构将占据家禽包装市场62.93%的份额,这主要得益于其较低的材料强度和透过醒目的图形设计提升的货架展示效果。随着单层PET和PE复合材料实现可回收利用,这种包装形式仍将保持成长势头,年增长率达5.39%。在家禽包装市场中,硬质托盘仍将适用于高端烤箱适用产品和整禽包装,因为这些产品需要良好的堆迭稳定性。

GEA 的 PowerPak 1000 等设备使中型工厂能够在单一机架上切换真空包装、气调包装和剥离包装,从而减少换型停机时间。如今,软包装袋内建了新鲜度感测器,会随着 pH 值升高而改变颜色,使包装机成为品质监测器。这些升级既能保护对成本敏感的蛋白质产品的价格分布,又能满足零售商延长包装绳使用寿命以减少损耗的需求。

区域分析

预计到2024年,亚太地区将占全球禽肉包装市场38.71%的份额,并在2030年之前以5.24%的复合年增长率持续成长。中国和印度快速的城市化进程以及可支配收入的成长正在推动冷藏鸡肉的需求,而泰国也不断巩固其出口地位。各国循环经济法规正在促进可回收复合材料的应用,当地加工商正与全球机械製造商合作,以满足出口卫生标准。进军印尼和越南市场的跨国零售商正在推行即用型包装方案,这为区域加工商带来了新的商机。

以以金额为准计算,北美位居第二。儘管联邦法规保持稳定,但加州和奥勒冈州等州正在增加生产者责任费,并鼓励使用单一材料包装。消费者表现出强烈的意愿为不含抗生素和获得永续性认证的包装买单,这促使品牌试用可堆肥托盘。加拿大更新后的「零塑胶废弃物」议程与欧盟的目标相呼应,并进一步加速了向纸-聚合物混合材料的过渡。智慧标籤正在被早期采用,大型零售商正在测试包装上的QR码以实现可追溯性。

欧洲整体经济成长缓慢,但创新密度很高。 2025/40号法规要求在2030年实现100%可回收利用,并禁止使用PFAS,这将迫使加工商迅速寻找替代材料。零售商正与供应商合作,检验,该托盘可使鸡肉保鲜21天。在德国,智慧感测器试点计画追踪时间和温度滥用情况,提供数据以帮助动态折扣,从而减少浪费。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 市场定义与研究假设

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 方便快速且对即食鸡肉的需求不断增长

- MAP和真空皮肤技术的普及

- 转向使用生物基和可回收材料

- 电子商务与低温运输的扩张

- 智慧保鲜感光元件

- 主要市场强制要求使用再生材料

- 市场限制

- 禽流感导致的供应中断

- 高昂的食品接触合规成本

- 聚烯原料价格波动

- 高氧平均动脉压

- 价值/供应链分析

- 关键法规结构评估

- 关键相关人员影响评估

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 宏观经济因素的影响

第五章 市场规模与成长预测

- 按肉类类型

- 鸡

- 火鸡

- 鸭子

- 按包装类型

- 固定/刚性

- 柔软的

- 透过包装材料

- 塑胶

- 纸和纸板

- 金属

- 透过包装技术

- 调气包装(MAP)

- 真空紧缩包装(VSP)

- 主动式智慧包装

- 高压和其他

- 按分销管道

- 零售

- 食品服务/饭店餐饮

- 工业和设施

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Amcor plc

- Berry Global Group Inc.

- Mondi plc

- Sealed Air Corporation

- Sonoco Products Company

- ProAmpac Holdings LLC

- UFlex Limited

- Huhtamaki Oyj

- Winpak Ltd.

- Glenroy Inc.

- LINPAC SEALPAC International BV

- Coveris Holding SA

- Smurfit Kappa Group plc

- Klockner Pentaplast GmbH

- Cascades Inc.

- DS Smith plc

- Printpack Inc.

- Graphic Packaging Holding Company

- Innovia Films Ltd.

- Flexopack SA

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The poultry packaging market reached USD 3.65 billion in 2025 and is expected to achieve USD 4.59 billion by 2030, advancing at a 4.69% CAGR.

Rising demand for case-ready poultry, new modified-atmosphere solutions, and sustainability regulations underpin this steady growth. Retailers prefer shelf-stable chicken trays that reduce shrink and labor. E-commerce adds volume for insulated formats that survive multi-day transit. Material shifts toward paper-based laminates press producers to innovate barrier layers without losing throughput. Meanwhile, merger activity is altering bargaining power between converters and processors, and technology firms are embedding sensors that warn of temperature abuse at every link in the chain.

Global Poultry Packaging Market Trends and Insights

Rising Demand for Convenience and Case-Ready Poultry

Millennial and Generation Z shoppers favor quick, no-mess poultry meals that arrive in easy-peel trays or ovenable pouches. Large retailers therefore specify centralized case-ready programs that cut in-store labor and improve product consistency. Tray producers now integrate absorbent pads and gas-flush valves that extend freshness by several days. Equipment vendors such as G.Mondini supply modular lines that blend precise portioning with lower film gauge, trimming material use without sacrificing visual appeal. Foodservice chains mirror this shift by ordering pre-marinated, vacuum-skin packs that move from cooler to grill in one step. Premium meal-kit platforms exploit the same packaging to boost shelf life during shipping, capturing higher margins that offset advanced film costs.

Surge in MAP and Vacuum-Skin Technologies

Modified-atmosphere packaging improves shelf life by slowing microbial growth, yet early high-oxygen blends accelerated lipid oxidation and color shifts. Converters now trial carbon-monoxide adjuncts that stabilize bloom without raising safety concerns. Vacuum-skin films from firms like Duropac prevent purge and withstand puncture, making them attractive for bone-in cuts. Plasma-treated trays that create in-pack ozone cut Campylobacter by 90% and Salmonella by 60% without chemicals. Equipment makers such as MULTIVAC pair MAP valves with micro-perforated lids so processors can tune gas ratios to each SKU.

Avian-Influenza Supply Disruptions

The 2024-2025 HPAI wave removed millions of birds from supply chains, unsettling production schedules and altering tray demand by weight class. USDA spent USD 1.8 billion on indemnities, but barns need up to 24 weeks to repopulate, prolonging volume instability. Rapid biosensors from Washington University now detect H5N1 in five minutes, enabling earlier lockdowns and targeted culls. Shorter flock cycles force processors to order more flexible sizes and adjust brand mix, which in turn influences run-length planning for converters.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Bio-Based and Recyclable Materials

- E-Commerce Cold-Chain Expansion

- Stringent Food-Contact Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The chicken category owns 65.89% of the poultry packaging market, thanks to broad consumer acceptance and streamlined deboning lines. High throughput lets processors negotiate film cost and spur experimentation with peel-reseal lids that cut food waste. Duck, despite its modest base, grows at a 5.61% CAGR as upscale retailers introduce portion-controlled breasts in sleek vacuum-skin trays. Here, the poultry packaging market size for duck is forecast to climb steadily as exotic proteins move into mainstream freezers. Enhanced barrier bags from Amcor prevent grease migration and preserve dark-meat color, meeting premium presentation standards.

Duck's rise compels converters to integrate oil-resistant coatings while keeping clarity for retail appeal. Automation now portions duck to weight specs, enabling case-ready rollouts similar to chicken. Turkey holds share through seasonal whole-bird formats, yet value-added roasts and sliced deli packs sustain year-round demand. Each protein therefore demands tailored barrier, puncture strength, and silhouette, nudging film suppliers to broaden portfolios without inflating SKU count.

Flexible structures delivered 62.93% of the poultry packaging market in 2024, supported by lower material intensity and high graphics that elevate shelf presence. The format will remain the growth leader, advancing 5.39% each year as mono-PET and PE laminates become store-drop recyclable. Within the poultry packaging market size, rigid trays retain roles in premium oven-ready SKUs and whole-bird presentations that benefit from stacking stability.

Equipment such as GEA's PowerPak 1000 lets mid-scale plants swing between vacuum, MAP, and skin variants on a single frame, cutting change-over downtime . Flexible pouches now embed freshness sensors that change color when pH rises, turning the wrapper into a quality monitor. These upgrades defend price points in a cost-sensitive protein category and satisfy retailers that push for longer coded life to lower shrink.

The Poultry Packaging Market Report is Segmented by Meat Type (Chicken, Turkey, Duck), Packaging Format (Fixed/Rigid, Flexible), Packaging Material (Plastics, Paper and Paperboard, Metals), Packaging Technology (Modified Atmosphere Packaging, Vacuum Skin Packaging, and More), Distribution Channel (Retail, Foodservice/HORECA, Industrial and Institutional), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 38.71% of the poultry packaging market in 2024 and is projected to expand at a 5.24% CAGR to 2030. Rapid urban migration and rising disposable income in China and India lift chilled-poultry demand, while Thailand strengthens its export position. National circular-economy rules spur adoption of recyclable laminates, and local processors engage global machinery firms to meet export hygiene codes. Multinational retailers entering Indonesia and Vietnam specify case-ready programs, unlocking new business for regional converters.

North America ranks second in value. Federal regulation remains stable, but states such as California and Oregon add producer-responsibility fees that reward mono-material formats . Consumers display strong willingness to pay for antibiotic-free and sustainability-certified packs, encouraging brands to pilot compostable trays. Canada's updated Zero Plastic Waste agenda echoes EU targets, further accelerating the shift to paper-polymer hybrids. Intelligent labels see early uptake as big-box stores test on-pack QR codes for traceability.

Europe shows low headline growth yet high innovation density. Regulation 2025/40 enforces 100% recyclability by 2030 and bans PFAS, forcing converters into rapid material substitution. Retailers collaborate with suppliers to validate fully fiber trays that keep poultry fresh for 21 days, exemplified by Coveris' new BarrierFresh line. Smart-sensor pilots in Germany track time-temperature abuse, delivering data that informs dynamic discounting to curb waste.

- Amcor plc

- Berry Global Group Inc.

- Mondi plc

- Sealed Air Corporation

- Sonoco Products Company

- ProAmpac Holdings LLC

- UFlex Limited

- Huhtamaki Oyj

- Winpak Ltd.

- Glenroy Inc.

- LINPAC SEALPAC International BV

- Coveris Holding SA

- Smurfit Kappa Group plc

- Klockner Pentaplast GmbH

- Cascades Inc.

- DS Smith plc

- Printpack Inc.

- Graphic Packaging Holding Company

- Innovia Films Ltd.

- Flexopack SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for convenience and case-ready poultry

- 4.2.2 Surge in MAP and vacuum-skin technologies

- 4.2.3 Shift toward bio-based and recyclable materials

- 4.2.4 E-commerce cold-chain expansion

- 4.2.5 Adoption of intelligent freshness sensors

- 4.2.6 Recycled-content mandates in key markets

- 4.3 Market Restraints

- 4.3.1 Avian-influenza supply disruptions

- 4.3.2 Stringent food-contact compliance costs

- 4.3.3 Feedstock-price volatility for polyolefins

- 4.3.4 Consumer skepticism of high-O? MAP

- 4.4 Value / Supply-Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Meat Type

- 5.1.1 Chicken

- 5.1.2 Turkey

- 5.1.3 Duck

- 5.2 By Packaging Format

- 5.2.1 Fixed / Rigid

- 5.2.2 Flexible

- 5.3 By Packaging Material

- 5.3.1 Plastics

- 5.3.2 Paper and Paperboard

- 5.3.3 Metals

- 5.4 By Packaging Technology

- 5.4.1 Modified Atmosphere Packaging (MAP)

- 5.4.2 Vacuum Skin Packaging (VSP)

- 5.4.3 Active and Intelligent Packaging

- 5.4.4 High-Pressure and Others

- 5.5 By Distribution Channel

- 5.5.1 Retail

- 5.5.2 Foodservice / HORECA

- 5.5.3 Industrial and Institutional

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Berry Global Group Inc.

- 6.4.3 Mondi plc

- 6.4.4 Sealed Air Corporation

- 6.4.5 Sonoco Products Company

- 6.4.6 ProAmpac Holdings LLC

- 6.4.7 UFlex Limited

- 6.4.8 Huhtamaki Oyj

- 6.4.9 Winpak Ltd.

- 6.4.10 Glenroy Inc.

- 6.4.11 LINPAC SEALPAC International BV

- 6.4.12 Coveris Holding SA

- 6.4.13 Smurfit Kappa Group plc

- 6.4.14 Klockner Pentaplast GmbH

- 6.4.15 Cascades Inc.

- 6.4.16 DS Smith plc

- 6.4.17 Printpack Inc.

- 6.4.18 Graphic Packaging Holding Company

- 6.4.19 Innovia Films Ltd.

- 6.4.20 Flexopack SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment