|

市场调查报告书

商品编码

1848285

中国太阳能市场:市场份额分析、行业趋势、统计数据和成长预测(2025-2030年)China Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

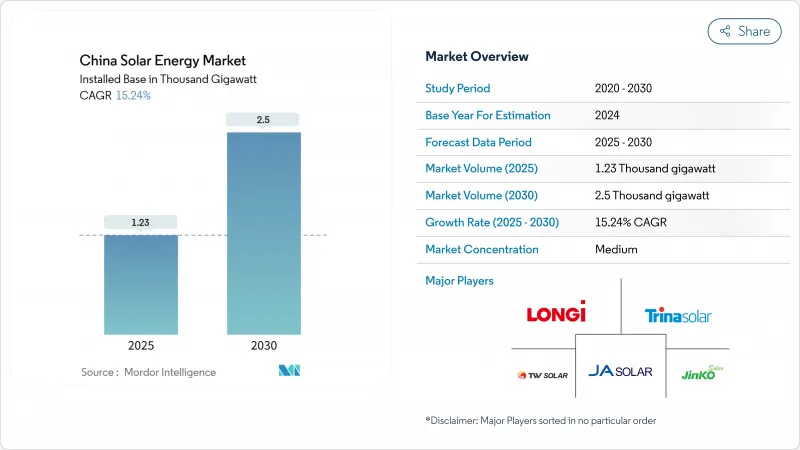

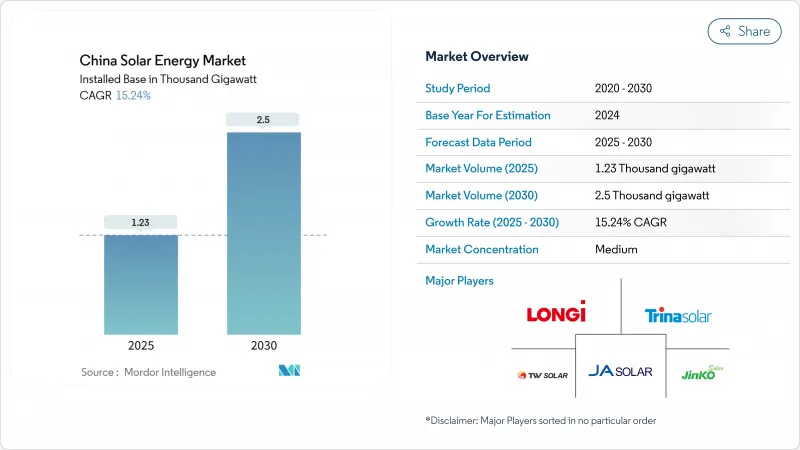

预计到 2025 年,中国太阳能装置容量将从 1230 吉瓦成长到 2030 年的 2500 吉瓦,预测期(2025-2030 年)复合年增长率为 15.24%。

受「十四五」规划加速推进、组件价格创历史新低以及企业购电协议(PPA)生态系统不断扩大的推动,中国太阳能市场成长动能将保持强劲。 N型电池效率的快速提升、超高压输电网的建设以及公共设施屋顶安装太阳能係统的政策,将带动新计划的涌现。同时,西北省份电网拥塞、市场化电价机制的引入以及全球贸易壁垒的加强,构成了一定的结构性阻力。然而,凭藉持续的技术创新和政策协调,中国太阳能市场预计在2030年之前继续保持全球最大可再生能源市场的地位。

中国太阳能市场趋势与洞察

创纪录的低组件价格提升了平准化度电成本竞争力

随着中国光电产能飙升至861吉瓦,组件价格在2024年初降至0.75元/瓦。成本领先优势使得太阳能的平准化度电成本在超过25个省份低于煤炭发电,这鼓励开发商在没有补贴的情况下加快建设吉瓦级计划。儘管产业整合不可避免,但隆基和晶科能源等主要厂商正受惠于其N型拓普康生产线,该生产线能够带来净利率。

「十四五」规划旨在加速产能扩张

该计画将优先发展库布齐等特大沙漠基地和「太阳能长城」丛集,确保其与土地、电网和资金筹措管道的对接。地方政府将把屋顶和农业太阳能光电发电及储能试点计画与国家配额挂钩,以鼓励农村家庭参与能源转型。

西北地区的电网拥塞限制了其容量利用率。

儘管全国电力短缺状况缓解,但新疆维吾尔自治区和甘肃省部分地区仍面临超过5%的电力缺口。目前正在建设中的±800千伏高压直流输电线路每年将增加36太瓦时的可再生能源供电量,但电力短缺问题要到2027年才能完全缓解。

细分市场分析

到2024年,光伏发电将占中国太阳能市场的99.5%。其中,N型TOPCon、HJT和背接触式光伏电池的转换效率将达到创纪录的25.4%,到2024年底,其出货量将占比达到70%。更高的功率密度降低了系统总成本,从而维持了价格优势。新疆维吾尔自治区的一座示范电站于2024年12月併网发电,其聚光型太阳热能发电装置容量超过1吉瓦。青海省为聚光太阳能发电企业提供0.55元/千瓦时的专项补贴,确保其获利能力,并实现发电来源多元化,以平衡光伏渗透率较高的地区的电力供应。

由于规模经济、本地化的供应链和政策确定性,光伏发电在中国太阳能市场占据主导地位。聚光太阳能发电(CSP)目前仍处于小众市场,但在日益严格的逆变器相关电网监管政策下,作为一种稳定能源,正受益于政策支持。 2027年后,钙钛矿和硅材料协同研究的进展可望重新定义这两种技术的效率阈值。

中国太阳能市场报告按技术(光伏、聚光型太阳光电)、併网类型(併网、离网)和终端用户(住宅、商业/工业和公共产业)进行细分。市场规模和预测以装置容量(GW)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 创纪录的低组件价格降低了平准化度电成本

- 「十四五」计画产能目标

- 企业购电协议/绿色能源交易蓬勃发展

- 新建公共建筑必须强制安装屋顶太阳能发电系统。

- 有利于併网的逆变器维修政策

- CSP Plus 储能补助计划

- 市场限制

- 中国西北地区电网壅塞及限电问题

- 逐步取消上网电价补助和低价竞标

- 中国製造模组面临的对外贸易壁垒

- 对新疆多晶硅供应的ESG调查

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 竞争对手之间的竞争

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 新进入者的威胁

- PESTEL 分析

第五章 市场规模与成长预测

- 透过技术

- 光伏(PV)

- 聚光型太阳光电(CSP)

- 按连线类型

- 併网

- 离网

- 最终用户

- 住宅

- 商业和工业

- 公用事业

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- LONGi Green Energy Technology Co Ltd

- Trina Solar Co Ltd

- JA Solar Technology Co Ltd

- JinkoSolar Holding Co Ltd

- Tongwei Solar Co Ltd

- Zhejiang Chint Electrics Co Ltd

- Hanwha Q CELLS Co Ltd

- Yingli Green Energy Holding Co Ltd

- Huasun Energy Co Ltd

- Drinda New Energy Technology Co Ltd

- GCL-Poly Energy Holdings Ltd

- Risen Energy Co Ltd

- Suntech Power Co Ltd

- Seraphim Solar System Co Ltd

- GoodWe Technologies Co Ltd

- Sungrow Power Supply Co Ltd

- Huawei Digital Power Technologies Co Ltd

- Tianjin Zhonghuan Semiconductor Co Ltd

- Aiko Solar Energy Co Ltd

- Shunfeng International Clean Energy Ltd

- Envision Energy Ltd

第七章 市场机会与未来展望

The China Solar Energy Market size in terms of installed base is expected to grow from 1.23 Thousand gigawatt in 2025 to 2.5 Thousand gigawatt by 2030, at a CAGR of 15.24% during the forecast period (2025-2030).

Accelerated deployment under the 14th Five-Year Plan, record-low module prices, and an expanding corporate PPA ecosystem keep growth momentum high. Rapid improvement in N-type cell efficiency, ultra-high voltage transmission build-out, and policies mandating rooftop systems on public buildings create new project pipelines. At the same time, grid congestion in northwestern provinces, the incoming market-based tariff regime, and intensifying global trade barriers pose structural headwinds. Nonetheless, continued innovation and policy coordination position the Chinese solar energy market to remain the world's largest renewable-power arena through 2030.

China Solar Energy Market Trends and Insights

Record-Low Module Prices Drive LCOE Competitiveness

Module prices fell to RMB 0.75/W in early 2024 after China's manufacturing capacity ballooned to 861 GW against global demand of 600 GW . Cost leadership pushed solar LCOE below coal in more than 25 provinces, prompting developers to accelerate gigawatt-scale projects without subsidies. Industry consolidation is inevitable, yet leading firms such as LONGi and JinkoSolar benefit from N-type TOPCon lines that preserve margins.

14th Five-Year Plan Targets Accelerate Capacity Expansion

The plan prioritizes gigantic desert bases such as Kubuqi and "Great Solar Wall" clusters, ensuring land, grid, and financing coordination. Local governments link rooftop, agro-PV, and storage pilots to national quotas, bringing rural households into the energy transition.

Grid Congestion Constrains Northwestern Capacity Utilization

Curtailment has subsided nationally but remains above 5% in parts of Xinjiang and Gansu . +-800 kV UHVDC lines now under construction will raise renewable transfer by 36 TWh a year, yet full relief comes only after 2027.

Other drivers and restraints analyzed in the detailed report include:

- Corporate PPA Market Transforms Energy Procurement

- Mandatory Rooftop PV Policies Drive Distributed Growth

- Feed-in-Tariff Phase-out Intensifies Market Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar photovoltaic retained 99.5% of the Chinese solar energy market in 2024. Within PV, N-type TOPCon, HJT, and back-contact cells reached 70% shipment share by the end of 2024 as conversion efficiency climbed to 25.4% record. Higher power density lowers balance-of-system costs, sustaining price premiums. Concentrated solar power capacity topped 1 GW after Xinjiang's demonstration plant joined the grid in December 2024, pairing 8-hour storage with Linear Fresnel heliostats to enhance peak-shaving capability. CSP's dedicated subsidy of 0.55 yuan/kWh in Qinghai secures returns and diversifies generation sources that balance high-penetration PV provinces.

The PV segment's economies of scale, localized supply chain, and policy certainty make it the Chinese solar energy market anchor. CSP remains niche but gains policy tailwinds as a stabilizing resource amid rising inverter-related grid regulations. Advancements in perovskite-silicon tandem research could arrive after 2027, potentially redefining efficiency thresholds across both technologies.

The China Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Connection Type (On-Grid and Off-Grid), and End-User (Residential, Commercial and Industrial, and Utilities). The Market Size and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- LONGi Green Energy Technology Co Ltd

- Trina Solar Co Ltd

- JA Solar Technology Co Ltd

- JinkoSolar Holding Co Ltd

- Tongwei Solar Co Ltd

- Zhejiang Chint Electrics Co Ltd

- Hanwha Q CELLS Co Ltd

- Yingli Green Energy Holding Co Ltd

- Huasun Energy Co Ltd

- Drinda New Energy Technology Co Ltd

- GCL-Poly Energy Holdings Ltd

- Risen Energy Co Ltd

- Suntech Power Co Ltd

- Seraphim Solar System Co Ltd

- GoodWe Technologies Co Ltd

- Sungrow Power Supply Co Ltd

- Huawei Digital Power Technologies Co Ltd

- Tianjin Zhonghuan Semiconductor Co Ltd

- Aiko Solar Energy Co Ltd

- Shunfeng International Clean Energy Ltd

- Envision Energy Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Record-low module prices cut LCOE

- 4.2.2 14th Five-Year Plan capacity targets

- 4.2.3 Corporate PPAs/green-power trading boom

- 4.2.4 Mandatory rooftop PV on new public buildings

- 4.2.5 Grid-friendly inverter retrofits policy

- 4.2.6 CSP-plus-storage subsidy scheme

- 4.3 Market Restraints

- 4.3.1 Grid congestion & curtailment in NW China

- 4.3.2 Feed-in-tariff phase-out & low auction prices

- 4.3.3 Overseas trade barriers to Chinese modules

- 4.3.4 ESG scrutiny of Xinjiang polysilicon supply

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Threat of New Entrants

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Connection Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial and Industrial

- 5.3.3 Utilities

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 LONGi Green Energy Technology Co Ltd

- 6.4.2 Trina Solar Co Ltd

- 6.4.3 JA Solar Technology Co Ltd

- 6.4.4 JinkoSolar Holding Co Ltd

- 6.4.5 Tongwei Solar Co Ltd

- 6.4.6 Zhejiang Chint Electrics Co Ltd

- 6.4.7 Hanwha Q CELLS Co Ltd

- 6.4.8 Yingli Green Energy Holding Co Ltd

- 6.4.9 Huasun Energy Co Ltd

- 6.4.10 Drinda New Energy Technology Co Ltd

- 6.4.11 GCL-Poly Energy Holdings Ltd

- 6.4.12 Risen Energy Co Ltd

- 6.4.13 Suntech Power Co Ltd

- 6.4.14 Seraphim Solar System Co Ltd

- 6.4.15 GoodWe Technologies Co Ltd

- 6.4.16 Sungrow Power Supply Co Ltd

- 6.4.17 Huawei Digital Power Technologies Co Ltd

- 6.4.18 Tianjin Zhonghuan Semiconductor Co Ltd

- 6.4.19 Aiko Solar Energy Co Ltd

- 6.4.20 Shunfeng International Clean Energy Ltd

- 6.4.21 Envision Energy Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment