|

市场调查报告书

商品编码

1849807

汽车资讯娱乐系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Infotainment Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

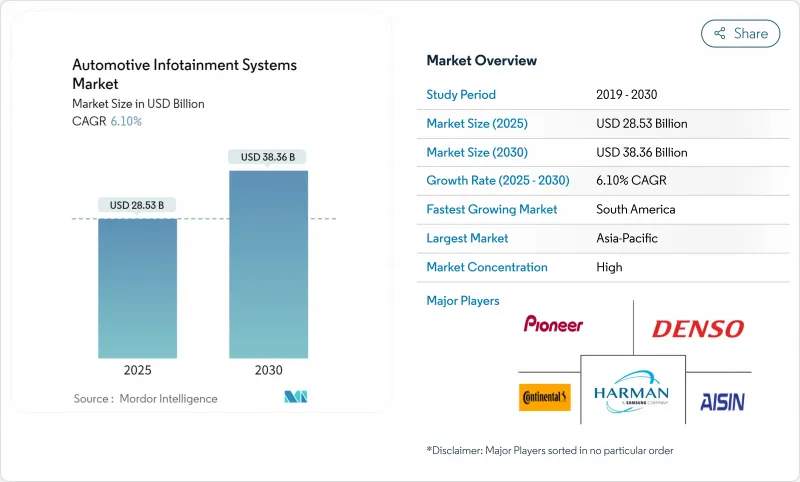

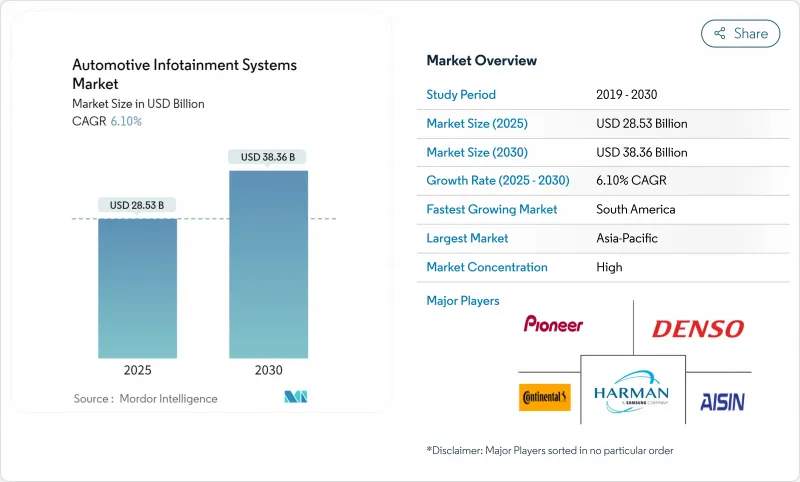

预计到 2025 年全球汽车资讯娱乐系统市场规模将达到 285.3 亿美元,到 2030 年将扩大到 383.6 亿美元,预测期内复合年增长率 (CAGR) 为 6.10%。

这一成长轨迹反映了汽车产业向软体定义汽车的根本性转变,其中资讯娱乐系统是驾驶员与日益复杂的车辆架构之间的主要介面。强制安全法规推动了市场扩张,尤其是欧盟的《通用安全法规 II》(将于 2024 年 7 月生效),该法规要求将大陆汽车等资讯娱乐平台与高级驾驶辅助系统 (ADAS) 整合。市场演变反映了更广泛的转型,即资讯娱乐系统正从以娱乐为中心的平台转向任务关键型车辆操作介面。 NITI Aayog 预测,到 2030 年,每辆汽车的半导体成本将翻一番,达到 1,200 美元,随着汽车整合人工智慧、机器学习和云端原生架构,资讯娱乐系统将占这一增长的很大一部分。

全球汽车资讯娱乐系统市场趋势与洞察

将以 ADAS 为中心的 HMI 整合到资讯娱乐主机中

ADAS(高阶驾驶辅助系统)与人机介面的整合代表着模式转移,它超越了传统的安全应用,建构了整合式车辆控制架构。大陆集团的智慧驾驶座高性能电脑支援最多三个显示器和五个摄像头,同时整合了Google云端的生成式人工智慧,可实现直觉的语音互动、对话式导航和无缝的车内控制。哈曼与HL Klemove的合作展示了ADAS整合如何为汽车製造商打造整合解决方案。这种整合降低了系统复杂性,同时使汽车製造商能够透过软体定义的体验而非硬体扩散来实现差异化。在欧盟,智能限速辅助和驾驶员疲劳警告将于2024年7月起强制执行,这将加速这一融合。博斯的驾驶座整合平台体现了这一趋势,能够在单一车辆驾驶座架构内无缝整合各种功能。

消费者对连网服务和 5G 部署的需求

汽车产业 5G 的部署正在加速,它已不再局限于简单的连接升级,而是实现了以即时数据收益和边缘运算应用为中心的全新经营模式。李尔公司预测,汽车 5G 市场规模将从 2025 年的 20 亿美元增长到 2030 年的 50 亿美元,这得益于车联网 (V2A) 能力,这些能力将把资讯通讯系统转变为综合行动平台。哈曼支援 5G 的 TBOT 技术可优化不同连接区域的数据使用,同时预测串流媒体和游戏应用的连接需求,展示了智慧软体将如何释放 5G 的全部潜力。据估计,到 2030 年,售出的汽车中将有超过 90% 配备连接功能,消费者愿意为了卓越的连接体验而放弃品牌,尤其是在纯电动车领域。 5G 与人工智慧的整合将实现预测性维护和个人化内容传送,创造订阅收益机会,每辆车每年可产生 1,600 美元的收入。通用汽车与 AT&T伙伴关係在其美国製造的汽车上推出 5G,这表明传统汽车製造商将连接性定位为核心差异化因素,而不是可选功能。

入门车型的成本敏感性

在入门级汽车领域,整合高级资讯娱乐功能的同时保持价格竞争力的压力日益增大,这在消费者期望和製造成本之间造成了根本性的矛盾。恩智浦半导体的入门级资讯娱乐产品组合,包括 i.MX6UL 处理器和 TDF8541 功率放大器,专门针对成本敏感型应用,这些应用必须以最低成本提供基本的连接和音讯功能。预计到 2030 年,每辆车的半导体成本将翻一番,达到 1,200 美元,而资讯娱乐系统占了这一增长的很大一部分,这加剧了这一挑战。印度市场动态体现了这种矛盾,高阶车型在某些细分市场中占销售额的 40%。然而,在大众市场,价格敏感度仍然至关重要,必须在基本的资讯娱乐功能和成本限制之间取得谨慎的平衡。比亚迪在智慧驾驶技术方面投资 1,000 亿元人民币,专门针对入门级车型的可及性,旨在使高级功能大众化,同时保持具有竞争力的价格。这种成本压力可能迫使原始设备製造商在功能丰富性和可负担性之间做出策略性权衡,从而限制价格敏感领域的市场渗透。

細項分析

车载资讯娱乐系统市场将以嵌入系统配置为主,2024 年占 72.32%。 BMW即将推出的全景 iDrive 将 48 吋曲面 OLED 萤幕与 3D 抬头显示器相结合,展示了中央显示器如何在没有单独按钮的情况下编配空调控制、导航和娱乐功能。特斯拉 Model Y 的单萤幕驾驶舱是硬体极简主义的另一个例子,软体选单取代了实体旋钮。同时,由于自动驾驶可以解放乘客,后座娱乐类别预计将以 11.81% 的复合年增长率成长。豪华品牌正在推出可播放 4K 串流内容的吸顶式和椅背式多显示器阵列,为订阅收入创造一个令人上瘾的平台。哈曼的 SeatSonic 透过座椅框架传输音频,在不提高车内分贝水平的情况下增强了沉浸感。日益增长的叫车车队也进一步增加了需求。乘客开始期望在通勤途中观看视讯点播,这迫使营运商甚至在中檔轿车上也安装娱乐萤幕。

以乘客为中心的互动正在重塑介面逻辑。触觉回馈、情境照明和基于摄影机的手势控制正在仪表板中融合,使其成为非娱乐车辆区域的指挥中心。后座模组现在直接连接到云端配置文件,允许所有用户在整个旅程中继续播放播放清单和视讯进度。尝试订阅套餐的汽车製造商通常会在后显示器上推出月度游戏包,以测试消费者的兴趣,然后再将功能推送到驾驶员萤幕上。新兴的关于驾驶分心的监管策略也可能使设计更倾向于平视投影而非触控萤幕。这些动态强化了市场动态,使其成为使用者体验设计和商业化战略交叉融合的游乐场。

到 2024 年,乘用车将占全球销售量的 79.34%,而买家将车辆视为其数位生活方式的延伸。电动动力传动系统将推动对续航里程优化路线和电池分析的需求,从而推动纯电动车资讯娱乐系统的普及。到 2030 年,轻型商用车的复合年增长率将达到 11.34%。长期以来,车载资讯服务占据主导地位,现在它们正在分层整合资讯娱乐应用程序,以实现疲劳监测、数位行车记录器和行程记录。例如,福特 Pro 已将其仪錶板转变为企业 SaaS 端点,记录了美国车队约 60 万个付费软体订阅。车队营运商重视执行时间和便利的无线补丁,以避免前往维修站。因此,商用车资讯娱乐系统市场预计到 2030 年将达到 64 亿美元,捕捉到先前因价格敏感度而掩盖的新收益。

共乘和最后一英里物流进一步扩大了覆盖范围。自动填入运单和送货证明照片的仪錶板减少了管理开销。整合到资讯娱乐系统中的带有摄影机的ADAS系统可透过提供碰撞侦测和降低保费来协助保险公司。同时,高级轿车透过多声道音讯、身临其境型环境灯和可直接透过萤幕预订的门房服务脱颖而出。随着软体成熟度的提高,车辆之间的差异也变得模糊。为豪华乘用车编写的程式码模组只需稍加改动即可重新包装用于轻型卡车。这种重复利用的思维模式加速了功能的采用,并提高了汽车资讯娱乐系统市场的规模经济效益。

预计到 2024 年,主机和网域控制器的收入将成长 41.33%,这得益于从倒车摄影机拼接到语音 AI 等运算密集功能的推动。作业系统和应用程式收入预计将以 15.92% 的复合年增长率增长,这证实了该行业正在从钢铁转向代码。高通的骁龙 Cockpit Gen 4 整合了 8-TOPS 晶片上 NPU,无需额外晶片即可实现座舱个人化和驾驶员状态分析。德克萨斯的 AM275x-Q1 微控制器将 DSP 吞吐量提高了 4 倍,使注重成本的 OEM 无需高端 SoC 即可添加空间音讯。显示器也在同步发展。 MicroLED 面板亮度更高、功耗更低,使车门触控萤幕更纤薄。天线模组面临从分集 4G 向大规模 MIMO 5G 阵列的转变,这将增加每辆车的组件成本。总的来说,这些转变将使软体发挥乘数作用,将汽车资讯娱乐系统市场转变为一个层堆迭,其中作业系统和应用层的价值不断增加。

供应商的策略反映了这个现实。大陆集团现在出售的基于Telechips的主机板捆绑了Android系统,旨在提供承包灵活性,而不是裸机。二线韧体厂商提供无线诊断和店面SDK,使汽车製造商能够在首次销售后很长一段时间内推出付费附加元件功能。对投资者而言,持续的软体利润比一次性硬体加价更为重要。最终,儘管硬体仍然是系统成本的主要驱动力,但纯软体供应商的市占率正在上升。

区域分析

比亚迪将投资1,000亿元人民币用于ADAS和资讯娱乐系统研发,以支持2025年实现550万辆电动车的销售量。日本汽车製造商(丰田、日产、本田)正在整合资源,用于生成式人工智慧和自主研发半导体,以确保未来驾驶座平台的供应弹性。印度高端汽车的市占率将升至40%,哈曼印度等供应商将在班加罗尔扩大语音助理和区域语言使用者体验在地化的研发规模。

北美正在拥抱「互联优先」的思维模式。 AT&T 和通用汽车在美国的合作,推动了 5G 车型的激增,缩短了更新时间,并实现了分层资料方案,从而产生了经常性收益。同时,两党共同通过的「维修权」法案可能会迫使原始设备製造商公开诊断 API,并影响资讯娱乐系统安全金钥与独立公司共用的方式。资料管治在欧洲日益重要。欧盟数据立法将于 2025 年生效,强制用户管理车载数据,并要求汽车製造商授予第三方服务存取权限。 eCall 向 4G/5G 的过渡以及 2024 年「维修权」指令也将影响驾驶座设计的可维护性和向后相容性。

南美洲目前拥有绝对市场规模最小但复合年增长率最高的市场。巴西的「Mover」计画将税收优惠与本地内容法规结合,鼓励原始设备製造商在国内采购资讯娱乐系统ECU。视听投资超过50亿美元,提供了能够满足汽车需求的显示和声音处理供应链。消费者的期望反映了智慧型手机的普及,连结、应用程式商店和非接触式支付如今被视为基本功能。然而,外汇波动和进口关税的上涨正在推动降低工程成本的需求,这通常透过SoC整合来实现。这些因素代表着灵活、以软体为中心的供应商将迎来显着的成长,同时保持汽车资讯娱乐系统市场的地理多样性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 将以 ADAS 为中心的 HMI 整合到资讯娱乐主机中

- 消费者对连网服务和 5G 部署的需求

- 向软体定义汽车和数位驾驶座的转变

- 车载电子商务/App Store收益(报告不足)

- 新兴市场的强制性 eCall 和资料登录法规(报告不足)

- 云端原生更新支援按需功能(频道不足)

- 市场限制

- 入门车型的成本敏感度

- 网路安全与责任风险

- 汽车SoC供应链中未被充分通报的波动

- 修復权和资料所有权法律(报告不足)

- 价值/供应链分析

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模与成长预测(价值(美元))

- 按安装类型

- 嵌入系统资讯娱乐系统

- 后座资讯娱乐系统

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和重型商用车

- 按组件

- 显示/触控萤幕模组

- 主机/网域控制器

- 作业系统软体和应用程式

- 连线IC和天线模组

- 依推进类型

- 内燃机汽车

- 油电混合车

- 纯电动车

- 连结世代

- 4G LTE

- 5G

- 传统 2G/3G

- 按作业系统

- 基于 Linux(AAOS、AGL 等)

- QNX

- Android Automotive OS

- 其他(专有规范、RTOS)

- 按销售管道

- OEM安装

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 埃及

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Harman International Industries Inc.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Visteon Corporation

- Panasonic Corporation(Automotive)

- Aptiv plc

- Mitsubishi Electric Corporation

- Alpine Electronics Inc.

- JVCKenwood Corporation

- Pioneer Corporation

- Faurecia SE(Clarion Electronics)

- Qualcomm Technologies Inc.

- Nvidia Corporation

- NXP Semiconductors NV

第七章 市场机会与未来展望

The global automotive infotainment systems market reached USD 28.53 billion in 2025 and is projected to expand to USD 38.36 billion by 2030, registering a compound annual CAGR of 6.10% during the forecast period.

This growth trajectory reflects the automotive industry's fundamental shift toward software-defined vehicles, where infotainment systems serve as the primary interface between drivers and increasingly complex vehicle architectures. The market's expansion is underpinned by mandatory safety regulations, particularly the EU's General Safety Regulation II, effective July 2024, which requires advanced driver assistance systems integration with infotainment platforms, such as Continental Automotive. The market's evolution reflects a broader transformation where infotainment systems transition from entertainment-centric platforms to mission-critical vehicle operating interfaces. NITI Aayog projects semiconductor costs per vehicle will double to USD 1,200 by 2030, with infotainment systems accounting for a substantial portion of this increase as vehicles integrate artificial intelligence, machine learning, and cloud-native architectures.

Global Automotive Infotainment Systems Market Trends and Insights

Integration of ADAS-Centric HMI into Infotainment Head Units

The convergence of Advanced Driver Assistance Systems with human-machine interfaces represents a paradigm shift that extends beyond traditional safety applications to create unified vehicle control architectures. Continental's Smart Cockpit High-Performance Computer supports up to 3 displays and five cameras while integrating Google Cloud's generative AI for intuitive voice interaction, enabling conversational navigation and seamless in-car control. HARMAN's collaboration with HL Klemove demonstrates how ADAS integration creates unified solutions for automakers, where driver monitoring systems and collision avoidance features share processing resources with entertainment functions. This integration reduces system complexity while enabling automakers to differentiate through software-defined experiences rather than hardware proliferation. The EU's mandatory implementation of intelligent speed assistance and driver drowsiness warnings from July 2024 accelerates this convergence. OEMs seek cost-effective solutions that combine regulatory compliance with enhanced user experiences.Bosch's cockpit integration platform exemplifies this trend by enabling seamless integration of various functionalities within a single vehicle cockpit architecture.

Consumer Demand for Connected Services & 5G Roll-out

The automotive industry's 5G deployment accelerates beyond mere connectivity upgrades to enable fundamentally new business models centered on real-time data monetization and edge computing applications. Lear Corporation estimates the automotive 5G market will grow from USD 2 billion in 2025 to USD 5 billion by 2030, driven by vehicle-to-everything communication capabilities that transform infotainment systems into comprehensive mobility platforms. HARMAN's 5G-enabled TBOT technology anticipates connectivity needs for streaming and gaming applications while optimizing data usage across varying connectivity zones, demonstrating how intelligent software can maximize 5G's potential. It has been estimated that over 90% of vehicles sold by 2030 will feature connectivity capabilities, with consumers willing to switch brands for superior connected experiences, particularly in battery-electric vehicle segments. The convergence of 5G with artificial intelligence enables predictive maintenance and personalized content delivery, creating subscription revenue opportunities that could generate USD 1,600 per vehicle annually. General Motors' partnership with AT&T for 5G deployment across U.S.-built vehicles exemplifies how traditional automakers position connectivity as a core differentiator rather than an optional feature.

Cost Sensitivity in Entry-Level Models

Entry-level vehicle segments face mounting pressure to integrate advanced infotainment capabilities while maintaining price competitiveness, creating a fundamental tension between consumer expectations and manufacturing economics. NXP Semiconductors' entry infotainment portfolio, including i.MX6UL processors and TDF8541 power amplifiers, specifically targets cost-conscious applications where basic connectivity and audio functionality must be delivered at minimal expense. The challenge intensifies as semiconductor costs per vehicle are projected to double to USD 1,200 by 2030, with infotainment systems representing a significant portion of this increase. Indian market dynamics illustrate this tension, where premium variants account for 40% of sales in certain segments. Yet, price sensitivity remains paramount for volume segments where basic infotainment features must be carefully balanced against cost constraints. BYD's CNY 100 billion investments in smart driving technology specifically target entry-level model accessibility, aiming to democratize advanced features while maintaining competitive pricing. This cost pressure forces OEMs to make strategic trade-offs between feature richness and affordability, potentially limiting market penetration in price-sensitive segments.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward Software-Defined Vehicles & Digital Cockpits

- In-Car E-commerce / App-Store Monetization

- Cyber-security & Liability Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In-dash configurations held 72.32% of 2024 shipments, illustrating their grip on the automotive infotainment systems market. BMW's forthcoming Panoramic iDrive melds a 48-inch curved OLED with 3D head-up overlays, demonstrating how central displays now orchestrate HVAC, navigation, and entertainment without discrete buttons. Tesla's single-screen Model Y cockpit offers another illustration of hardware minimalism where software menus replace physical knobs. The rear-seat entertainment category, meanwhile, is projected to register an 11.81% CAGR as autonomous features free passengers from active driving. Luxury brands deploy multi-display ceiling mounts and seat-back arrays that stream 4K content, creating a captive platform for subscription revenue. HARMAN's SeatSonic transduces audio through seat frames, enhancing immersion without raising cabin decibel levels. Growing ride-hailing fleets add further demand: passengers increasingly expect video-on-demand during commutes, pushing operators to retrofit entertainment screens even in mid-tier sedans.

Passenger-centric interactions are reshaping interface logic. Haptic feedback, contextual lighting, and camera-based gesture control converge on the in-dash stack, turning it into a command center for vehicle domains beyond entertainment. Rear-seat modules now link directly to cloud profiles so every user can resume playlists or video progress across trips. Automakers experimenting with subscription tiers often debut pay-per-month gaming bundles on rear displays to test consumer appetite before pushing features to the driver's screen. Emerging regulatory talk on driver distraction could also tilt design, favoring heads-up projection over touchscreens. These dynamics reinforce the automotive infotainment systems market as a playground where UX design and monetization strategy intersect.

Passenger cars owned 79.34% of global revenue in 2024 as buyers consider the cabin an extension of their digital lifestyle. Electric powertrains intensify the need for range-optimized routing and battery analytics, driving BEV infotainment installations. Light commercial vehicle is expanding at 11.34% CAGR by 2030, long dominated by telematics, now layer infotainment apps for fatigue monitoring, digital tachographs, and haul documentation. Ford Pro, for instance, logs around 600,000 paid software subscriptions across its U.S. fleet, turning dashboards into enterprise SaaS endpoints. Fleet operators prize uptime and simple over-the-air patches that avoid depot visits. Consequently, the market size of commercial vehicles' automotive infotainment systems is projected to reach USD 6.4 billion by 2030, capturing fresh revenue otherwise shielded by price sensitivity.

Ride-sharing and last-mile logistics further widen the addressable scope. Dashboards that auto-populate waybills or proof-of-delivery photos cut administrative overhead. Camera-enabled ADAS integrated into infotainment helps insurers by providing crash forensics and lowering premiums. Meanwhile, premium sedans are differentiated through multichannel audio, immersive ambient lighting, and concierge services that are bookable straight from the screen. As software maturity grows, vehicle type distinctions blur: code modules written for premium passenger cars get repackaged for light trucks with minimal change. That reuse philosophy accelerates feature spread and enhances economies of scale for the automotive infotainment systems market.

Head units and domain controllers secured 41.33% revenue in 2024 because every feature-from rear-view camera stitching to voice AI-relies on computational horsepower. Yet the software tier is scaling faster: operating-system and app revenue is slated for a 15.92% CAGR, underscoring the industry pivot from steel to code. Qualcomm's Snapdragon Cockpit Gen 4 integrates an on-die NPU capable of 8 TOPS, allowing cabin personalization and driver-state analytics without extra chips. Texas Instruments' AM275x-Q1 microcontrollers quadruple DSP throughput so cost-conscious OEMs can add spatial audio without high-end SoCs. Displays are simultaneously evolving-micro-LED panels deliver better luminance with lower power draw, enabling slim door-mounted touchscreens. Antenna modules face a switch from diversity 4G to massive-MIMO 5G arrays, lifting the bill-of-materials value per vehicle. Altogether, these shifts reinforce software as the multiplier, transforming the automotive infotainment systems market into a layered stack where value accretes at the OS and application tier.

Supplier strategies mirror that reality. Continental now ships Telechips-based boards bundled with Android distribution, selling turnkey flexibility rather than bare metal. Tier-2 firmware houses offer over-the-air diagnostics and storefront SDKs, enabling carmakers to launch paid feature add-ons long after the initial sale. For investors, recurring software margin beats once-off hardware markup, a critical pivot as raw-material prices stay volatile. Ultimately, the automotive infotainment systems market share of pure-play software vendors is rising, even though hardware still anchors system cost.

The Automotive Infotainment Systems Market Report is Segmented by Installation Type (In-Dash Infotainment and More), Vehicle Type (Passenger Cars, Lcvs, and More), Component (Display Modules, and More), Propulsion Type (ICE, Hevs, and More), Connectivity (4G LTE, 5G, and More), Operating System (Linux-Based, and More), Sales Channel (OEM and Aftermarket) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 39% foothold owes much to China's aggressive smart-cockpit race, with BYD earmarking CNY 100 billion for ADAS and infotainment R&D to support 5.5 million EV sales by 2025. Japanese automakers-Toyota, Nissan, Honda-are pooling resources for generative AI and in-house semiconductors, ensuring supply resilience for future cockpit platforms. India's share of premium trims has climbed to 40%, pushing suppliers like HARMAN India to expand Bengaluru R&D for localization of voice assistants and regional language UX.

North America adopts a "connected-first" mindset. The U.S. surge of 5 G-equipped models, spurred by AT&T-GM collaboration, cuts update time and unlocks tiered data plans that generate recurring revenue. Meanwhile, bipartisan Right-to-Repair bills could compel OEMs to publish diagnostic APIs, influencing how infotainment security keys are shared with independents. Europe focuses on data governance: the EU Data Act in 2025 mandates user control of in-vehicle data and obliges carmakers to allow third-party service access. eCall migration to 4G/5G and the 2024 Right-to-Repair Directive also shape cockpit design for maintainability and backward compatibility.

South America currently represents a smaller absolute market but the highest CAGR. Brazil's 'Mover' program links tax incentives to local-content rules, pushing OEMs to source infotainment ECUs domestically. Audiovisual investment exceeding USD 5 billion provides display and sound-processing supply chains that can serve automotive demand. Consumer expectations mirror smartphone penetration: connectivity, app stores, and contactless payments are now considered base-level features. However, currency volatility and high import duties require cost-down engineering, often achieved through SoC consolidation. These forces collectively maintain geographic diversity in the automotive infotainment systems market while signaling strong upside for flexible, software-centric suppliers.

- Harman International Industries Inc.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Visteon Corporation

- Panasonic Corporation (Automotive)

- Aptiv plc

- Mitsubishi Electric Corporation

- Alpine Electronics Inc.

- JVCKenwood Corporation

- Pioneer Corporation

- Faurecia SE (Clarion Electronics)

- Qualcomm Technologies Inc.

- Nvidia Corporation

- NXP Semiconductors N.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of ADAS-Centric HMI into Infotainment Head Units

- 4.2.2 Consumer Demand for Connected Services & 5G Roll-out

- 4.2.3 Shift toward Software-Defined Vehicles & Digital Cockpits

- 4.2.4 In-Car E-commerce / App-Store Monetisation (Under-reported)

- 4.2.5 Mandatory eCall & Data-Logging Regulations in Emerging Markets (Under-reported)

- 4.2.6 Cloud-Native Updates Enabling Feature-on-Demand (Under-reported)

- 4.3 Market Restraints

- 4.3.1 Cost Sensitivity in Entry-Level Models

- 4.3.2 Cyber-security & Liability Risks

- 4.3.3 Automotive SoC Supply-Chain Volatility (Under-reported)

- 4.3.4 Right-to-Repair & Data-Ownership Legislation (Under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Installation Type

- 5.1.1 In-dash Infotainment

- 5.1.2 Rear-seat Infotainment

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.3 By Component

- 5.3.1 Display / Touch-screen Module

- 5.3.2 Head Unit / Domain Controller

- 5.3.3 Operating-System Software & Apps

- 5.3.4 Connectivity ICs & Antenna Modules

- 5.4 By Propulsion Type

- 5.4.1 Internal-Combustion Engine Vehicles

- 5.4.2 Hybrid Electric Vehicles

- 5.4.3 Battery Electric Vehicles

- 5.5 By Connectivity Generation

- 5.5.1 4G LTE

- 5.5.2 5G

- 5.5.3 Legacy 2G/3G

- 5.6 By Operating System

- 5.6.1 Linux-Based (AAOS, AGL, etc.)

- 5.6.2 QNX

- 5.6.3 Android Automotive OS

- 5.6.4 Others (Proprietary, RTOS)

- 5.7 By Sales Channel

- 5.7.1 OEM-Installed

- 5.7.2 Aftermarket

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Rest of North America

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Russia

- 5.8.3.7 Rest of Europe

- 5.8.4 Asia-Pacific

- 5.8.4.1 China

- 5.8.4.2 Japan

- 5.8.4.3 India

- 5.8.4.4 South Korea

- 5.8.4.5 Australia

- 5.8.4.6 Rest of Asia-Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 United Arab Emirates

- 5.8.5.2 Saudi Arabia

- 5.8.5.3 Turkey

- 5.8.5.4 Egypt

- 5.8.5.5 South Africa

- 5.8.5.6 Rest of Middle East and Africa

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Harman International Industries Inc.

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Continental AG

- 6.4.4 Denso Corporation

- 6.4.5 Visteon Corporation

- 6.4.6 Panasonic Corporation (Automotive)

- 6.4.7 Aptiv plc

- 6.4.8 Mitsubishi Electric Corporation

- 6.4.9 Alpine Electronics Inc.

- 6.4.10 JVCKenwood Corporation

- 6.4.11 Pioneer Corporation

- 6.4.12 Faurecia SE (Clarion Electronics)

- 6.4.13 Qualcomm Technologies Inc.

- 6.4.14 Nvidia Corporation

- 6.4.15 NXP Semiconductors N.V.

7 Market Opportunities & Future Outlook

- 7.1 Augmented-Reality Head-up Displays Integrated with IVI

- 7.2 Affordable Android-based Aftermarket Units in Emerging Economies

- 7.3 Subscription-based Feature Monetisation & Pay-as-you-Drive Services

- 7.4 Partnerships with Streaming & Cloud-Gaming Providers

- 7.5 Edge-AI Personalisation for Driver Behaviour & Wellness