|

市场调查报告书

商品编码

1849869

汽车塑胶:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

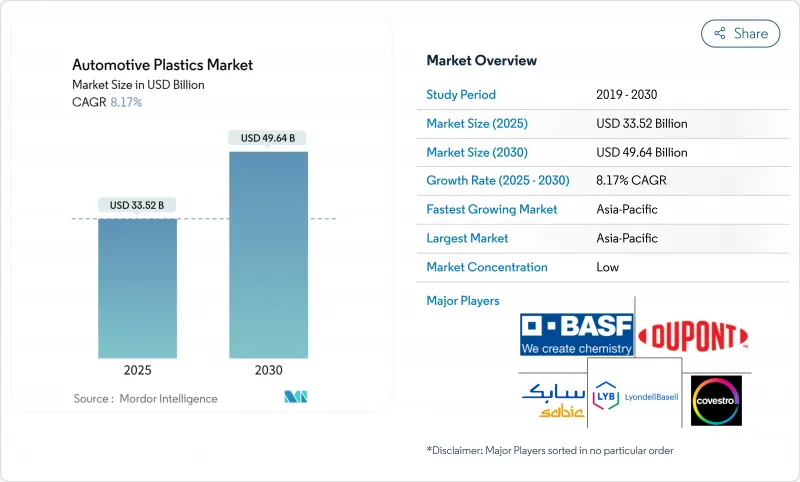

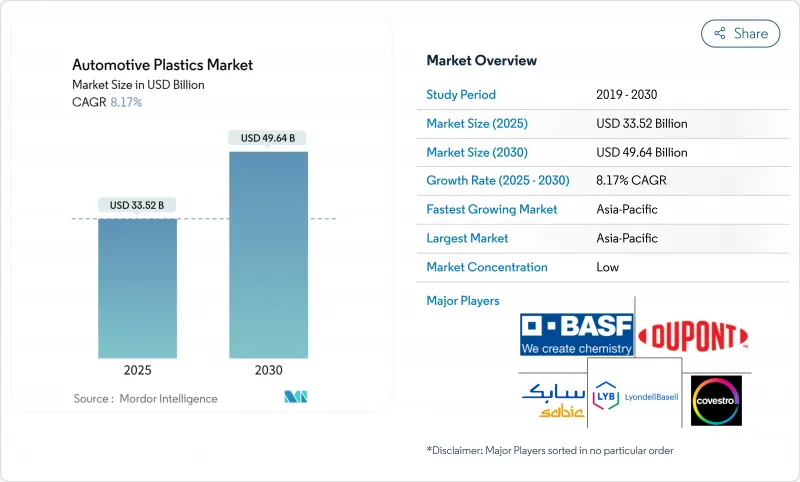

据估计,2025 年汽车塑胶市场价值为 335.2 亿美元,预计到 2030 年将达到 496.4 亿美元,预测期(2025-2030 年)复合年增长率为 8.17%。

这一稳步增长反映了汽车製造商为平衡严格的排放气体法规和性能目标而转向轻量化材料。先进聚合物解决方案的加速应用,尤其是在电动车 (EV) 平台上的应用,正推动汽车塑胶市场以远超过以往的速度成长。亚太地区占全球需求的近一半,也是复合材料市场成长最快的地区。同时,聚丙烯 (PP) 在关键汽车系统中继续保持着性价比的标竿地位。

全球汽车塑胶市场趋势与洞察

电动车对轻量材料的需求日益增长

续航焦虑和电池组成本使得轻量化成为电动车工程的核心。如今,电动车中聚丙烯(PP)复合材料的使用量远高于同类内燃机汽车,这主要是因为减轻重量可以直接提高续航里程,而无需改变电池尺寸。除了仪錶面板和装饰件外,高介电常数聚丙烯和先进的聚酰胺材料也越来越多地用于结构外壳和高压汇流排。电动车专用平台使设计师摆脱了传统金属连接点的束缚,从而能够将更多塑胶零件整合到车身结构和温度控管通道中。

碳排放法规加速聚丙烯保险桿的采用

欧洲和北美的车队平均排放气体法规对二氧化碳排放超标处以重罚。因此,汽车製造商正寻求「快速见效」的措施,例如将金属加固保险桿更换为全聚丙烯(PP)保险槓,这样既能显着减轻重量,又能降低系统成本。产业生命週期评估始终表明,考虑到使用过程中的燃油节省,PP保险桿的碳足迹比钢或铝製保险桿更小。

气味和易燃性会延缓生物基聚酰胺的OEM认证。

生物基聚酰胺有望实现从原料生产到最终交付的全过程减排,但残留气味和不稳定的燃烧性能使其难以获得驾驶室和引擎室的认证。针对纤维素纤维增强生物基聚酰胺的学术研究发现,由于纤维分散性问题,其机械性质有较大差异。产业组织正在向监管机构请愿,希望延长检验週期,以便材料供应商能够对其配方进行微调。

细分市场分析

由于聚丙烯在成本、加工性能和物理性能方面具有良好的平衡性,预计到2024年,其在汽车塑胶市场将占据34.18%的份额。聚丙烯的主要应用领域包括内部装潢建材、车门饰板和中央控制台,而玻璃纤维增强型聚丙烯也用于半结构性座椅支架和后挡板。

到2030年,随着高温电动动力传动系统对隔热和绝缘性能要求的提高,聚酰胺的年复合成长率将达到8.87%。 PA66和部分芳香族PA6/6T共混物正在取代电池冷板组件、逆变器外壳和涡轮增压器风道中的金属支架。生物基聚酰胺目前尚未成为主流,但一旦克服了气味和阻燃方面的障碍,它们将吸引那些寻求范围3碳减排的原始设备製造商(OEM)。

到2024年,内装塑胶将占汽车塑胶市场规模的32.97%,这主要得益于对触感柔软的仪表板、环境灯门板以及一体成型显示器的需求。触感涂层和雷射蚀刻图案则依赖特殊的丛集 、ABS和PC/PMMA共混物,进一步强化了塑胶在体验式设计中的重要作用。

虽然引擎室内零件的绝对体积较小,但其年增长率高达 8.98%。随着电气化架构整合更多电子元件并需要更复杂的冷却通道,耐热的 PA、PPS 和 PBT 材料正在取代晶粒铝,用于製造电子马达冷却套和高压汇流排罩。

区域分析

到2024年,亚太地区将占据全球汽车塑胶市场48.25%的份额,并在2030年之前保持9.82%的最高复合年增长率。中国大规模推广电动车,得益于与电池製造商的合作以及政府的激励措施,正推动PP、PA和PBT价值链上聚合物产能的扩张。印度乘用车产量预计将实现两位数成长,这将促使当地投资建造复合材料生产中心,以降低对进口的依赖。韩国和日本正在改进用于抗衝击外饰板的超高分子量聚合物,进一步巩固了创新和产能成长的良性循环。

北美呈现出成熟又充满创新活力的市场格局。为了满足日益严格的企业平均燃油经济性(CAFE)标准,汽车製造商(OEM)正在推广多材料架构,以最大限度地利用塑胶材料製造尾门、电池组和高级驾驶辅助感测器外壳。美国也在树脂供应商和一级模塑商之间率先建立闭合迴路回收伙伴关係,支持该地区的循环经济目标。

在高端市场和严格的法律规范的推动下,欧洲市场对再生塑胶的需求依然强劲。建议的乘用车25%再生材料含量标准将促进相容剂添加剂和除臭系统的研究与开发,从而提升消费后再生树脂的性能。德国在纤维增强聚酰胺(PA)横樑技术的推广应用方面处于领先地位,而法国和英国则透过公共资金资助生物聚合物试点生产线。然而,由于能源成本波动,该地区面临利润压力,因此提高材料效率已成为一项战略要务。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动车对轻量化材料的需求日益增长

- 碳排放罚款加速聚丙烯保险桿的普及

- 转向采用射出成型成型混合材料的模组化前端载体(MEC)

- 汽车产业对灵活且经济高效的工程材料的需求不断增长

- 全球汽车产业稳定扩张

- 市场限制

- 气味和易燃性会延缓生物基聚酰胺的OEM认证。

- 高昂的材料和加工成本

- 汽车产业替代材料的竞争日益加剧

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 材料

- 聚丙烯(PP)

- 聚氨酯(PU)

- 聚氯乙烯(PVC)

- 聚乙烯(PE)

- 丙烯腈丁二烯苯乙烯(ABS)

- 聚酰胺(PA)

- 聚碳酸酯(PC)

- 其他成分

- 透过使用

- 外部的

- 内部的

- 引擎盖下

- 其他用途

- 按车辆类型

- 传统车辆

- 电动车

- 按原料

- 原生塑胶

- 回收塑胶

- 生物基塑料

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Arkema

- Asahi Kasei Advance Corporation

- BASF SE

- Borealis AG

- Braskem

- Celanese Corporation

- Covestro AG

- Daicel Corporation

- Dow

- dsm-firmenich

- DuPont

- Evonik Industries AG

- Exxon Mobil Corporation

- INEOS

- LANXESS

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals Inc.

- SABIC

- TEIJIN LIMITED

第七章 市场机会与未来展望

The Automotive Plastics Market size is estimated at USD 33.52 billion in 2025, and is expected to reach USD 49.64 billion by 2030, at a CAGR of 8.17% during the forecast period (2025-2030).

The steady uptick reflects automakers' pivot toward lighter materials to reconcile strict emission rules with performance targets. Accelerated adoption of advanced polymer solutions, especially in electric-vehicle (EV) platforms, is pushing the automotive plastics market well ahead of its historical pace. Asia-Pacific commands almost half of global demand and is compounding at the fastest regional rate, while polypropylene (PP) continues to set the benchmark for cost-to-performance across major vehicle systems.

Global Automotive Plastics Market Trends and Insights

Increasing demand for lightweight materials in electric vehicles

Range anxiety and battery-pack cost keep lightweighting at the center of EV engineering. PP compounds now appear in larger volumes per EV than in comparable internal-combustion cars, largely because lower mass converts directly into added driving range without resizing the battery. Beyond instrument panels and trims, high-dielectric PP and advanced polyamide grades are entering structural housings and high-voltage busbars. Dedicated EV platforms free designers from legacy metal hard-points, allowing more plastic integration into body structures and thermal-management channels.

Carbon-emission penalties accelerating polypropylene bumper adoption

Fleet-average emissions standards in Europe and North America impose significant financial penalties for excess CO2. Automakers therefore target "quick wins" such as switching from metal-reinforced to fully PP bumpers, achieving meaningful mass savings at lower system cost. Industry life-cycle assessments consistently show PP bumpers delivering a smaller carbon footprint than steel or aluminum alternatives once use-phase fuel savings are incorporated.

OEM qualification delays for Bio-PA due to odor & flammability

Bio-sourced polyamides promise lower cradle-to-gate emissions, yet residual odor and inconsistent ignition behavior complicate cabin and under-hood approvals. Academic work on cellulosic-fiber-reinforced Bio-PA confirms wide variability in mechanical properties stemming from fiber dispersion challenges. Industry groups have petitioned regulators to allow longer validation cycles so material suppliers can fine-tune formulations.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Modular Front-End Carriers (MECs) via injection-molded hybrids

- Growing demand for flexible and cost-efficient design materials

- High materials and processing cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polypropylene held a commanding 34.18% automotive plastics market share in 2024 on the back of balanced cost, processability and property retention. Interior fascia, door trims and center consoles dominate PP usage, but glass-fiber-reinforced grades now extend into semi-structural seat carriers and tailgates.

Polyamides are climbing an 8.87% CAGR trajectory through 2030 as high-temperature electrified powertrains demand better thermal and dielectric insulation. PA66 and partially aromatic PA6/6T blends displace metal brackets in battery-cold-plate assemblies, inverter housings and turbo-air ducts. Bio-based PA grades, while not yet mainstream, attract OEMs seeking Scope-3 carbon reductions once odor and flame-spread hurdles are cleared.

Interior accounted for 32.97% of the automotive plastics market size in 2024, buoyed by demand for soft-touch dashboards, ambient-lit door panels, and integrating display clusters into single multi-shot molded units. Haptic coatings and laser-etch graphics depend on specialty PP, ABS, and PC/PMMA blends, reinforcing plastics' role in experiential design.

Under-bonnet components, though smaller in absolute volume, are growing at 8.98% per year. Electrified architectures pack more electronics and require intricate cooling channels; thus, heat-stabilized PA, PPS, and PBT replace die-cast aluminum for e-motor cooling jackets and high-voltage busbar covers.

The Automotive Plastics Market Report Segments the Industry by Material (Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), and More), Application (Exterior, Interior, and More), Vehicle Type (Conventional/Traditional Vehicles, and Electric Vehicles), Source (Virgin Plastic, Recycled Plastic, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific dominated the automotive plastics market with a 48.25% stake in 2024 and mirrors the highest regional CAGR at 9.82% to 2030. China's large-scale EV rollout, supported by battery-maker alliances and state incentives, is spurring polymer capacity expansions across PP, PA and PBT value chains. India records double-digit growth in passenger-car output, triggering investments in local compounding hubs to curb import reliance. South Korea and Japan refine ultra-high-molecular-weight grades for impact-resistant exterior panels, further embedding a virtuous innovation-capacity loop.

North America presents a mature yet inventive landscape. Compliance with tightening Corporate Average Fuel Economy standards pushes OEMs toward multi-material architectures that maximize plastics in liftgates, battery packs and advanced driver-assistance sensor housings. The United States also hosts pioneering work in closed-loop recycling partnerships between resin suppliers and tier-one molders, supporting local circular-economy targets.

Europe maintains sizeable demand anchored by premium vehicle segments and aggressive regulatory frameworks. The proposed 25% recycled-content threshold in passenger cars catalyzes R&D around compatibilizer additives and de-odorizing systems that elevate post-consumer resin performance. Germany leads technology deployments in fiber-reinforced PA cross-members, while France and the United Kingdom channel public funding toward biopolymer pilot lines. The region nevertheless faces margin pressures from energy-cost volatility, making material efficiency a strategic imperative.

- Arkema

- Asahi Kasei Advance Corporation

- BASF SE

- Borealis AG

- Braskem

- Celanese Corporation

- Covestro AG

- Daicel Corporation

- Dow

- dsm-firmenich

- DuPont

- Evonik Industries AG

- Exxon Mobil Corporation

- INEOS

- LANXESS

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals Inc.

- SABIC

- TEIJIN LIMITED

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Lighweight Materials in Electric Vehicles

- 4.2.2 Carbon Emission Penalties Accelerating Polypropylene Bumper Adoption

- 4.2.3 Shift to Modular Front-End Carriers (MECs) via Injection-Molded Hybrids

- 4.2.4 Growing Demand for Flexible and Cost Efficient Design Materials in Automotive

- 4.2.5 Consistent Expansion of the Global Automotive Sector

- 4.3 Market Restraints

- 4.3.1 OEM Qualification Delays for Bio-PA due to Odor and Flammability

- 4.3.2 High Materials and Processing Cost

- 4.3.3 Incraesing Competion from Alternative Materials in Automotive

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyurethane (PU)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Polyethylene (PE)

- 5.1.5 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.6 Polyamides (PA)

- 5.1.7 Polycarbonate (PC)

- 5.1.8 Other Materials

- 5.2 By Application

- 5.2.1 Exterior

- 5.2.2 Interior

- 5.2.3 Under Bonnet

- 5.2.4 Other Applications

- 5.3 Vehicle Type

- 5.3.1 Conventional/Traditional Vehicles

- 5.3.2 Electic Vehicles

- 5.4 Source

- 5.4.1 Virgin Plastic

- 5.4.2 Recycled Plastic

- 5.4.3 Bio-based Plastic

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Arkema

- 6.4.2 Asahi Kasei Advance Corporation

- 6.4.3 BASF SE

- 6.4.4 Borealis AG

- 6.4.5 Braskem

- 6.4.6 Celanese Corporation

- 6.4.7 Covestro AG

- 6.4.8 Daicel Corporation

- 6.4.9 Dow

- 6.4.10 dsm-firmenich

- 6.4.11 DuPont

- 6.4.12 Evonik Industries AG

- 6.4.13 Exxon Mobil Corporation

- 6.4.14 INEOS

- 6.4.15 LANXESS

- 6.4.16 LG Chem

- 6.4.17 LyondellBasell Industries Holdings B.V.

- 6.4.18 Mitsui Chemicals Inc.

- 6.4.19 SABIC

- 6.4.20 TEIJIN LIMITED

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Technological Developments in Electric Vehicles