|

市场调查报告书

商品编码

1849900

学习管理系统 (LMS):市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Learning Management System (LMS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

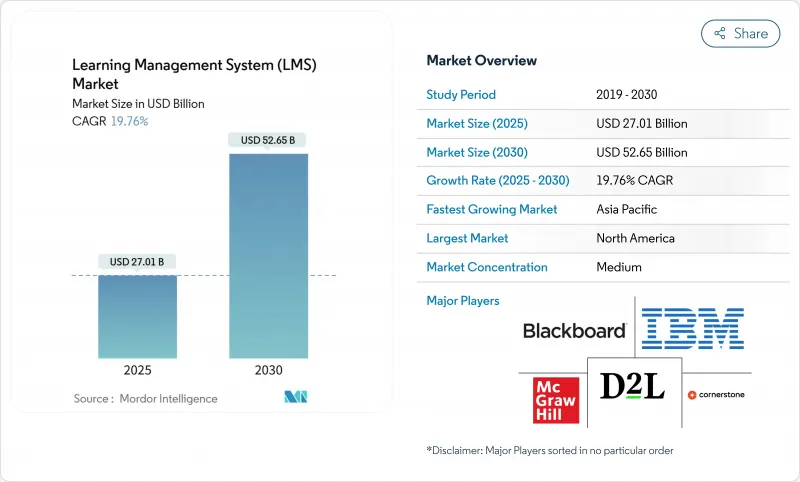

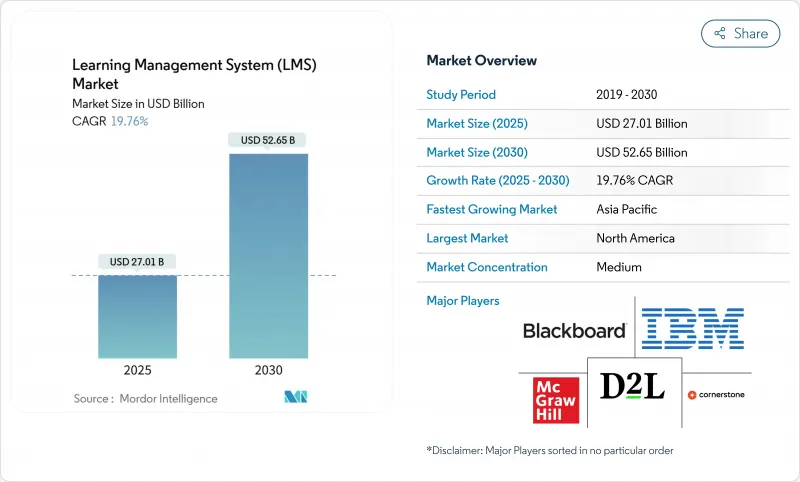

学习管理系统市场预计到 2025 年将达到 270.1 亿美元,到 2030 年预计将成长到 526.5 亿美元,复合年增长率为 19.76%。

各行各业的公司都在投资人工智慧驱动的个人化、微认证和行动学习,以保持员工技能与时俱进,同时满足日益复杂的合规义务。北美医疗保健和金融服务公司仍是早期采用者,而亚太地区的製造地正透过将数位化学习与可衡量的生产力提升相结合,推动需求成长。技术供应商正透过预测分析、精细技能检验和低程式码整合等技术,将培训嵌入到日常工作流程中。与此同时,不断上涨的 SaaS 授权费用和「最后一哩路」连接的缺口正在阻碍预算敏感型细分市场的发展,迫使供应商改进定价并优化内容传送。

全球学习管理系统 (LMS) 市场趋势与洞察

人工智慧主导的自适应学习演算法改变了课程完成的动态

人工智慧自我调整系统即时调整难度、节奏和回馈,在北美一所大学的试点计画中将课程完成率提高了 40%。透过分析任务完成时间、评估分数和点选流数据,演算法可以预测学习者的学习脱离情况,并提供有针对性的干预措施,帮助学习者重回正轨。许多公司正在效仿这种做法,透过将学习目标与关键绩效指标直接挂钩,减少入门时间并提高认证通过率。采用可解释人工智慧的供应商正在赢得相关人员的信任,他们必须在认证审核期间捍卫演算法决策。随着功能集的成熟,客户将期待即插即用的建议引擎,而不是客製化的资料科学计划,从而简化中端市场买家的采用。

微证推动以技能为基础的招募革命

随着亚太地区製造业面临快速的自动化週期,製造业更青睐能够证明其在机器人技术、品管、供应链分析等领域能力的小型证书。调查显示,86% 的雇主认为微证书在评估求职者时非常有用,而员工则会逐步累积这些证书,以创建动态技能组合。区块链检验可确保记录不可窜改,招募经理可以立即验证,从而缩短招募週期。随着影响力证据的不断扩大,北美专业协会将开始将证书与继续教育学分挂钩,并将证书模型扩展到受监管的职业。

不断上涨的 SaaS 授权成本给教育预算带来压力

随着疫情救助金的减少,每位学习者的经常性成本飙升,迫使K-12机构重新评估多年的学习管理系统(LMS)合约。一个拥有2万名学生的学区报告称,2025年的年度续约增加了14%,超过了停滞不前的营运预算。一些机构正在转向开放原始码替代方案,却发现自架和维护存在隐性成本,这凸显了自付费用和管理负担之间的权衡。供应商采取了与有效用户指标挂钩的分级定价策略,但透明度的不一致导致采购週期过长。

細項分析

到2024年,解决方案将占据学习管理系统市场67%的收益份额,凸显了平台授权的重要性。然而,服务细分市场正以21.3%的复合年增长率成长。已经实施核心平台的机构正在寻求教学设计支援、系统整合和分析优化。案例研究表明,一家供应链公司将内容映射外包给专业机构后,课程开发速度加快了30%。随着人工智慧功能的普及,内部团队需要指导来调整演算法,这为专业服务提供者开闢了新的收益来源。学习管理系统服务市场预计将从2025年的81.1亿美元扩大到2030年的212亿美元。

解决方案领域基本上保持稳定。供应商正在逐步增加低程式码工作流程建构器、API 市场和原生影片製作套件,以避免商品化。大型买家会协商企业范围的协议,将多个模组(创作、凭证、进阶分析)捆绑到可预测的订阅中。小型供应商则透过提供垂直模板来实现差异化,这些模板附带医疗保健和製造业的合规库。因此,采购团队现在会评估五年期的总拥有成本,而不是关键的授权费用,这种转变有利于能够展示强大生态系统蓝图的供应商。

到2024年,云端架构将占学习管理系统市场总收益的70%,并将继续以22.8%的复合年增长率成长。买家认为自动安全修补程式、弹性扩充和降低IT开销是决定性因素。跨国公司也重视针对特定区域的资料居住选项,这些选项可以简化欧洲和亚洲的隐私合规性。预计云端部署的学习管理系统市场规模将从2025年的189亿美元成长到2030年的434亿美元,证实了向本地部署系统的加速转变。

在国防、能源和公共部门领域,本地部署仍然强劲,因为机密环境可以降低间谍活动的风险。即使是这些组织也越来越多地尝试私有云端前导测试的同时,将敏感的评估资料保存在本机伺服器上。即便如此,市场发展势头仍然青睐纯粹的云端颠覆者,他们每月都会发布新功能,并且升级速度超过了传统套件通常的年度升级週期。

区域分析

由于先进的互联互通、强大的SaaS应对力以及医疗和金融领域严格的合规框架,北美预计将在2024年占据全球收入的36%。大型企业目前更专注于人工智慧主导的最佳化,而非初始实施,这刺激了对预测性劳动力分析附加元件的需求。联邦和州政府针对劳动力再培训的津贴,进一步推动了社区大学和退伍军人培训计画对平台的采用。然而,在资金筹措模式稳定下来之前,K-12学区的预算审查正在抑制短期成长。

预计到2030年,亚太地区的复合年增长率将达到24.5%,这得益于印度的「数位印度」计画和中国的「中国製造2025」政策。这两项政策都将工业现代化与劳动力技能提升结合。跨国製造商正在其区域工厂强制执行统一的培训标准,并创建跨境学习管理系统(LMS)部署,以奖励拥有在地化专业知识的供应商。东协市场的银行数位化进一步推动了合规培训许可的发放。然而,语言和资料隐私法律法规的多样性使得模组化实施策略成为必要。

欧洲正稳步成长,因为GDPR合规性和CPD规则推动了对具有精细审核追踪的平台的需求。各国政府正在资助依赖学习管理系统(LMS)的数位学徒计划,企业也将学习套件与人才管理系统结合,以解决人口技能短缺的问题。在中东,海湾合作委员会(GCC)经济体正经历高于平均的成长,这些国家的国家转型议程将数位技能放在优先位置。在非洲,云端学习管理系统(LMS)在都市区的采用率正在快速成长,但由于网路连线的挑战,农村地区的采用率成长较慢。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 人工智慧驱动的自适应学习演算法的整合提高了北美高等教育的课程完成率

- 雇主对技能检验微证书的需求推动亚太地区製造地采用 LMS

- 欧盟医疗保健CPD授权推广专业LMS模组

- 去中心化零售连锁店的 BYOD 员工流动性加速了中东地区行动优先云 LMS 的采用

- 市场限制

- 每位学生的 SaaS 许可证价格上涨给 K-12 学区预算带来压力

- 在非洲和南亚的农村地区,5G/宽频覆盖不稳定,限制了身临其境型内容的传输。

- 资料标准碎片化阻碍了拥有众多旧有系统的欧洲公司实现 HRIS 和 LMS 的整合

- 勒索软体攻击后网路保险成本上升阻碍小型医疗保健组织迁移到云端 LMS

- 价值链分析

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方议价能力/学习者

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济趋势的市场评估

第五章市场规模与成长预测(价值)

- 按组件

- 解决方案

- 服务

- 依部署方式

- 云

- 本地部署

- 按配送方式

- 远距学习

- 讲师指导的培训

- 按最终用户

- BFSI

- 医疗保健和製药

- 製造业

- 零售和消费品

- 教育机构

- 政府机构

- 其他最终用户领域

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 墨西哥

- 南美洲其他地区

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- McGraw-Hill Companies

- Blackboard Inc.

- D2L Corporation

- Cornerstone OnDemand Inc.

- IBM Corporation

- Oracle Corporation

- Instructure Inc.

- SAP SE

- Docebo SpA

- Saba Software

- Moodle Pty Ltd

- Adobe Inc.

- Absorb Software Inc.

- TalentLMS(Epignosis LLC)

- Infor(Infor LMS)

- Skillsoft Corporation

- Edmodo

- Schoology(PowerSchool)

- Tovuti LMS

- PowerSchool Holdings Inc.

- 360Learning SA

- Thought Industries Inc.

- Meridian Knowledge Solutions

第七章 市场机会与未来展望

The learning management system market is valued at USD 27.01 billion in 2025 and is forecast to climb to USD 52.65 billion by 2030, advancing at a 19.76% CAGR.

Enterprises across sectors are investing in AI-powered personalization, micro-credentialing, and mobile learning to keep workforce skills current while meeting increasingly complex compliance mandates. North American healthcare and financial-services organizations remain early adopters, yet Asia-Pacific manufacturing hubs now drive incremental demand by linking digital learning to measurable productivity gains. Technology vendors are responding with predictive analytics, granular skills verification, and low-code integration to embed training into daily workflows. At the same time, rising SaaS licensing fees and last-mile connectivity gaps restrain budget-sensitive segments, forcing vendors to refine pricing tiers and content-delivery optimization.

Global Learning Management System (LMS) Market Trends and Insights

AI-Driven Adaptive Learning Algorithms Transform Course Completion Dynamics

AI-powered adaptive systems now tailor difficulty, pacing, and feedback in real time, delivering 40% higher course-completion rates for pilot programs in North American universities. Algorithms analyse time-on-task, assessment scores, and click-stream data to forecast disengagement and trigger targeted interventions that keep learners on track. Enterprises mirror this practice to reduce onboarding time and raise certification pass rates, tying learning objectives directly to key-performance indicators. Vendors that embed explainable AI build credibility with educators who must defend algorithmic decisions during accreditation audits. As feature sets mature, customers expect plug-and-play recommendation engines rather than bespoke data-science projects, simplifying adoption for mid-market buyers.

Micro-Credentials Drive Skills-Based Hiring Revolution

Asia-Pacific manufacturers face rapid automation cycles and therefore favour bite-sized certifications that prove competence in robotics, quality control, and supply-chain analytics. Surveys show 86% of employers rate micro-credentials as beneficial when evaluating applicants; workers progressively stack these badges to create dynamic skill portfolios. Blockchain verification ensures tamper-proof records that hiring managers can authenticate instantly, shortening recruitment cycles. As evidence of impact spreads, professional associations in North America begin mapping badges to continuing-education credits, extending the credentialing model into regulated professions.

SaaS Licensing Cost Inflation Pressures Educational Budgets

Recurring per-learner fees escalate as pandemic relief subsidies taper, forcing K-12 districts to reassess multi-year LMS contracts. Districts with 20,000 students report annual renewals rising 14% in 2025, outpacing stagnant operating budgets. Some pivot to open-source alternatives yet discover hidden costs in self-hosting and maintenance, highlighting a trade-off between cash outlay and administrative burden. Vendors respond with tiered pricing tied to active user metrics, but transparency remains inconsistent, prolonging procurement cycles.

Other drivers and restraints analyzed in the detailed report include:

- European Healthcare CPD Regulations Mandate Specialized Training Modules

- BYOD Workforce Mobility Accelerates Mobile-First LMS Architecture

- Infrastructure Limitations Constrain Immersive Learning Delivery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated a dominant 67% revenue share in 2024, underscoring the centrality of platform licences in the learning management system market. The Services segment, however, is racing ahead at a 21.3% CAGR. Organisations that have already deployed a core platform now seek instructional-design support, system integration, and analytics optimisation. Case studies show that supply-chain firms achieved 30% faster course development after outsourcing content mapping to specialist agencies. As AI features proliferate, in-house teams require guidance to calibrate algorithms, opening new revenue pools for professional-services providers. The learning management system market size for Services is projected to rise from USD 8.11 billion in 2025 to USD 21.2 billion by 2030.

The Solutions segment is hardly static. Vendors are layering low-code workflow builders, API marketplaces, and native video-production suites to stave off commoditisation. Larger buyers negotiate enterprise-wide contracts that bundle multiple modules-authoring, credentialing, and advanced analytics-into predictable subscription envelopes. Smaller vendors differentiate through vertical templates that ship with compliance libraries for health and manufacturing domains. Consequently, procurement teams now evaluate total cost of ownership over five-year horizons rather than headline licence fees, a shift that benefits suppliers able to present robust ecosystem roadmaps.

Cloud architectures held 70% share of total learning management system market revenue in 2024 and continue to expand at 22.8% CAGR. Buyers cite automatic security patches, elastic scaling, and reduced IT overhead as decisive factors. Multinational firms further value region-specific data-residency options that simplify privacy compliance in Europe and Asia. The learning management system market size for cloud deployments is poised to climb from USD 18.9 billion in 2025 to USD 43.4 billion by 2030, underscoring an accelerating on-premise migration wave.

On-premise implementations persist in defence, energy, and public-sector accounts where air-gapped environments mitigate espionage risks. Even these organisations increasingly test private-cloud pilots to modernise user experience and analytics. Vendors thus support hybrid architectures that synchronise content repositories while retaining sensitive assessment data on local servers. Marketplace momentum nevertheless favours pure-cloud disruptors that release new features monthly, outpacing annual upgrade cycles typical of legacy suites.

The Learning Management System Market is Segmented by Component (Solutions, Services), Deployment Mode (Cloud, On-Premise), Delivery Mode (Distance Learning, Instructor-Led Training), End-User Vertical (BFSI, Healthcare and Pharmaceuticals, Manufacturing, Retail and Consumer Goods, Educational Institutions, Government Agencies, Other End-User Verticals), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 36% of global revenue in 2024, supported by advanced connectivity, high SaaS readiness, and stringent compliance frameworks across healthcare and finance. Large enterprises now focus on AI-driven optimisation rather than first-time deployment, spurring demand for predictive talent analytics add-ons. Federal and state grants targeting workforce reskilling further buoy platform adoption in community colleges and veteran-training programmes. Nevertheless, budget scrutiny in K-12 districts tempers short-term growth until funding models stabilise.

Asia-Pacific is projected to grow at 24.5% CAGR through 2030, propelled by India's Digital India programme and China's Made in China 2025 policy, both of which tie industrial modernisation to workforce upskilling. Multinational manufacturers mandate uniform training standards across regional plants, creating cross-border LMS rollouts that reward vendors with localisation expertise. Banking digitalisation across ASEAN markets further drives compliance-training licences. Still, linguistic diversity and varied data-privacy statutes necessitate modular deployment strategies.

Europe exhibits stable expansion as GDPR compliance and CPD rules fuel demand for platforms with granular audit trails. Governments fund digital apprenticeships that rely on LMS scaffolding, while corporations integrate learning suites with talent-management systems to address demographic skill shortages. The Middle East experiences above-average growth in GCC economies where national-transformation agendas prioritise digital skills. Africa shows uneven progress; urban centres adopt cloud LMS rapidly whereas rural districts lag due to connectivity challenges.

- McGraw-Hill Companies

- Blackboard Inc.

- D2L Corporation

- Cornerstone OnDemand Inc.

- IBM Corporation

- Oracle Corporation

- Instructure Inc.

- SAP SE

- Docebo SpA

- Saba Software

- Moodle Pty Ltd

- Adobe Inc.

- Absorb Software Inc.

- TalentLMS (Epignosis LLC)

- Infor (Infor LMS)

- Skillsoft Corporation

- Edmodo

- Schoology (PowerSchool)

- Tovuti LMS

- PowerSchool Holdings Inc.

- 360Learning SA

- Thought Industries Inc.

- Meridian Knowledge Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of AI-driven adaptive learning algorithms boosting course-completion rates in North American higher-education

- 4.2.2 Employer demand for skills-verification micro-credentials fueling LMS uptake across APAC manufacturing hubs

- 4.2.3 Mandatory CPD regulations in EU healthcare catalyzing specialised LMS modules

- 4.2.4 BYOD workforce mobility in distributed retail chains accelerating mobile-first cloud LMS adoption in Middle East

- 4.3 Market Restraints

- 4.3.1 Rising per-learner SaaS-licensing inflation squeezing budgets of K-12 districts

- 4.3.2 Patchy 5G / broadband coverage limiting immersive-content delivery in rural Africa and South Asia

- 4.3.3 Fragmented data standards hindering HRIS-LMS integrations in legacy-heavy European corporates

- 4.3.4 Escalating cyber-insurance premiums post-ransomware attacks deterring small healthcare providers from cloud LMS migration

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers / Learners

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Delivery Mode

- 5.3.1 Distance Learning

- 5.3.2 Instructor-led Training

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 Healthcare and Pharmaceuticals

- 5.4.3 Manufacturing

- 5.4.4 Retail and Consumer Goods

- 5.4.5 Educational Institutions

- 5.4.6 Government Agencies

- 5.4.7 Other End-user Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 McGraw-Hill Companies

- 6.4.2 Blackboard Inc.

- 6.4.3 D2L Corporation

- 6.4.4 Cornerstone OnDemand Inc.

- 6.4.5 IBM Corporation

- 6.4.6 Oracle Corporation

- 6.4.7 Instructure Inc.

- 6.4.8 SAP SE

- 6.4.9 Docebo SpA

- 6.4.10 Saba Software

- 6.4.11 Moodle Pty Ltd

- 6.4.12 Adobe Inc.

- 6.4.13 Absorb Software Inc.

- 6.4.14 TalentLMS (Epignosis LLC)

- 6.4.15 Infor (Infor LMS)

- 6.4.16 Skillsoft Corporation

- 6.4.17 Edmodo

- 6.4.18 Schoology (PowerSchool)

- 6.4.19 Tovuti LMS

- 6.4.20 PowerSchool Holdings Inc.

- 6.4.21 360Learning SA

- 6.4.22 Thought Industries Inc.

- 6.4.23 Meridian Knowledge Solutions

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment