|

市场调查报告书

商品编码

1849913

软性显示器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Flexible Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

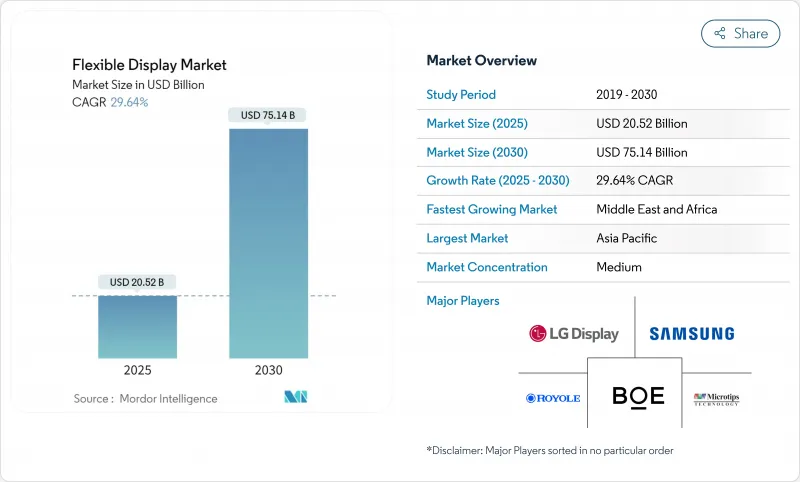

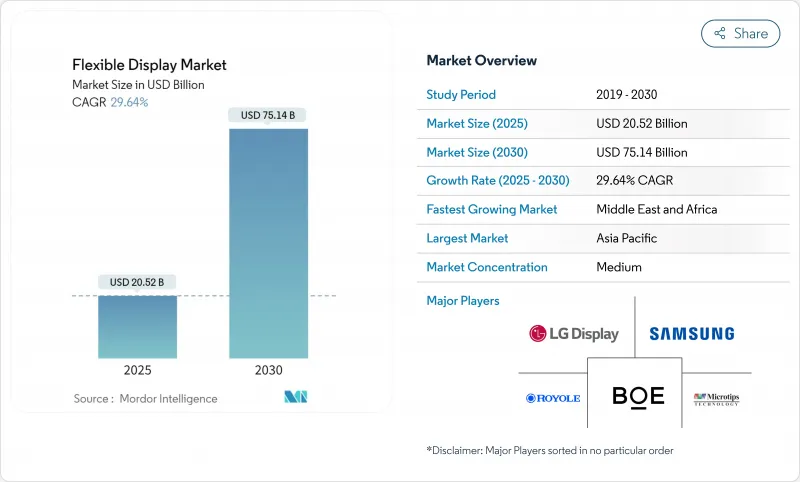

预计到 2025 年,软性显示器市场规模将达到 205.2 亿美元,到 2030 年将达到 751.4 亿美元,复合年增长率高达 29.64%。

估值飙升标誌着一个转捩点,规模经济、材料突破和产品设计自由的结合,正推动柔性面板从利基概念走向消费性电子、移动出行和工业领域的主流介面。对第八代半OLED晶圆厂的生产投资、旋转性的快速创新以及microLED向穿戴装置的转型,都在扩大其潜在市场。随着中国製造商产能扩张速度超过韩国现有企业,竞争日益激烈,这挑战了既有的成本结构,并加速了价格下降。同时,拥有成熟的聚酰亚胺、封装和铰链的一体化企业则能够免受供应衝击和诉讼风险的影响。

全球软性显示器市场趋势与洞察

旋转性和可折迭智慧型手机在中国和韩国的发布量活性化

预计到2024年,柔性OLED智慧型手机面板的出货量将成长26%,达到7.84亿片,显示创新的外型设计能够刺激更换需求。计画于2025年底推出的新型三折迭设计,将实现360度旋转,并采用摺痕更少的超薄玻璃,从而增强品牌差异化。透过满足铰链耐久性目标并缩短设计到上市的周期,中国参与企业将迅速扩大规模,并在价格和技术创新速度方面对现有厂商构成压力。与铰链、耐热聚酰亚胺和透明盖膜相关的组件生态系统将直接受益。这一成长也将波及配件和维修市场,带来更多服务收入。

欧洲将全面采用高阶电动车曲面OLED驾驶座

豪华电动车正透过宽敞的曲面仪錶板提升车内体验,例如EQS SUV的Hyper-screen,它将多个显示器融合在一块连续的玻璃面板下。汽车製造商青睐柔性OLED,因为它具有超薄、亮度均匀和设计自由度高等优点,从而推动了单车显示面积的快速增长。一级供应商正与面板製造商深化合作,共同开发驾驶座平台,而软体定义车辆策略则要求显示器支援持续的空中升级。随着自动驾驶技术的成熟,多模态互动和可拉伸的跨柱萤幕将进一步增加单车的消费量。

第八代及以后聚酰亚胺的产量比率降低会导致废料成本增加。

将生产规模扩大到更大的母玻璃基板会增加柔性聚酰亚胺(PI)基板中的热应力,导致缺陷造成良率产量比率并增加单位成本。对气凝胶增强PI纤维的研究表明,其在提高热稳定性方面具有潜力,但工业应用仍处于起步阶段,工厂在推出将面临昂贵的废料损失。

细分市场分析

到2024年,OLED将占据软性显示器市场85%的份额,它利用自发光像素实现无需背光的超薄曲面模组。由于中国晶圆厂成本的降低和蒸发器产能的提升,OLED仍然是智慧型手机、手錶和曲面资讯娱乐丛集的首选面板。同时,随着量子点颜色转换器、大量传输精度和修復产量比率的提高,microLED的出货量正从试生产阶段逐步扩大到初步量产阶段,预计复合年增长率将达到36%。天马科技的8吋原型机表明,microLED的亮度可达10000尼特,即使在高热负荷下也能保持较长的使用寿命,这首先使汽车抬头显示器和坚固耐用的可穿戴设备受益。电子纸在低功耗指示牌和物流标籤领域占据着一定的市场份额,而量子点-LCD混合显示器则在中阶设备中不断缩小价格和色域方面的差距。

OLED的统治地位正面临三大挑战。首先,无机微型LED材料更长的使用寿命正在削弱OLED的老化风险。其次,第八代半OLED的成本优势正在缩小刚性OLED和柔性OLED之间的平均售价差距,推动价格更亲民的OLED朝向柔性外形规格发展。第三,片上量子点技术正逐渐与卷对卷塑胶基板相容,这为OLED在超大透明窗口领域创造了一个潜在的竞争对手。儘管如此,随着生态系的日趋成熟、设备折旧免税额以及充足的供应,OLED在中期内仍可能保持主导。

到2024年,折迭式设备将占据软性显示器市场71%的份额,并将继续引领市场成长,智慧型手机厂商竞相改善双折、三折和袖口式设计。与铰链形状和UTG层压相关的专利障碍巩固了先行者的领先优势,但这并不妨碍竞争对手透过授权或创新开发替代的运动学堆迭结构。预计年复合成长率将达到39%的旋转性萤幕,由于其紧凑的机壳设计,能够有效节省空间,并满足消费者对口袋大小大萤幕的需求。早期应用于笔记型电脑和平板电脑的旋转性萤幕,透过电动捲和拉伸受限的层压技术,已展现出超过3万次的重复捲曲性能。

由于其机械负荷较为简单,可弯曲且可贴合的显示器仍是曲面行动电话、健身环和汽车雷达等设备的主要组成部分。新兴的「无固定外形规格」显示屏,得益于可拉伸基板网格和蛇形电路图案,目前正被积极研究用于皮肤贴片和软性机器人。关于可拉伸显示器的学术论文数量将从2014年的17篇激增至2023年的197篇,反映出研发投入的活性化。儘管商业化进程缓慢,但这项进展为十年后无处不在的环境显示器的普及奠定了基础。

区域分析

亚太地区将占2024年营收的57%,这主要得益于韩国、中国和台湾地区从聚酰亚胺树脂合成到模组组装的密集製造业生态系统。到2028年,中国的柔性OLED产能将成长8%,而韩国仅成长2%,这将使中国在全球面板产量中的份额从68%提升至74%。区域政策激励措施为本土製造商在土地、税收和电力方面提供了优惠条件,使国内智慧型手机OEM厂商能够迅速满足市场需求。这种良性循环增强了供应链的自给自足能力,并缩短了新生产线的生产週期。

北美凭藉其在扩增实境/虚拟实境、高效能运算和高阶笔记型电脑领域的主导,在科技领域拥有强大的竞争力。美国品牌正在采购用于2026年MacBook等级的OLED面板,这迫使供应商对氧化物TFT和迭层结构进行认证,以确保其在静态使用者介面负载下拥有更长的使用寿命。铰链专利带来的法律风险仍然令人担忧,但企业通常会透过和解或交叉授权来保障产品上市日期。政府对微电子产业回流的津贴可能会推动部分产业链向美国转移,尤其是在背板和无玻璃封装工具领域。

欧洲正透过生态设计法规和即将推出的数位产品护照施加监管影响,推动产业朝可回收结构和材料完全公开的方向发展。德国、瑞典和英国的汽车产业丛集正在迅速采用曲面OLED丛集,促进了本地整合、黏合和测试合作伙伴的发展。欧洲力争2030年实现24%的材料回收利用率,推动了低溶剂聚合物、可生物降解黏合剂和易于分离的机械紧固件的研发。

儘管中东和非洲地区面积相对较小,但其数位数位电子看板在交通枢纽、体育场馆和休閒场所的普及应用推动了该地区数位看板市场的成长,实现了32%的复合年增长率。可贴合玻璃建筑幕墙的柔性LED薄膜萤幕体现了建筑师对新型外形规格的需求。政府支持的智慧城市计划和高照度环境使得高亮度微型LED成为极具吸引力的选择。在南美洲,智慧型手机的普及率正在上升,汽车组装厂也开始为出口车型指定使用柔性丛集。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 中国和韩国的捲轴式和折迭式智慧型手机发布速度加快

- 在欧洲,高阶电动车采用曲面OLED驾驶座的比例正在增加。

- 北美对轻薄型AR/VR微型OLED面板的需求激增

- 中国8.6代柔性OLED工厂成本降低

- 符合欧盟循环经济倡议的无玻璃组件

- 日本和韩国柔性医疗穿戴设备的成长

- 市场限制

- 第八代及以后聚酰亚胺的良率下降产量比率了废料成本。

- 封装供应紧张

- 以美国为中心的关于折迭式铰链的专利诉讼

- 塑胶液晶指示牌在寒冷天气下的可靠性问题

- 产业生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按显示类型

- 有机发光二极体

- 液晶

- 电子纸显示器(EPD)

- 微型LED

- 量子点和其他新兴类型

- 按外形规格

- 折迭式

- 旋转性

- 可弯曲的

- 可贴合(弧形/环绕式)

- 按基板

- 玻璃

- 塑胶 - 聚酰亚胺 (PI)

- 塑胶 - PET/PEN

- 金属箔

- 其他(聚碳酸酯、超薄玻璃)

- 透过使用

- 智慧型手机和平板电脑

- 智慧型穿戴装置(手錶、贴片)

- 电视数位电子看板

- 桌上型电脑和笔记型电脑

- 汽车驾驶座和资讯娱乐系统

- AR/VR头戴式显示器

- 工业和公共交通展览

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 亚太其他地区

- 南美洲

- 巴西

- 其他南美洲

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- ROYOLE Corporation

- E Ink Holdings Inc.

- AU Optronics Corp.

- Sharp Corporation

- Innolux Corporation

- TCL CSOT

- Visionox Co., Ltd.

- Tianma Micro-electronics Co., Ltd.

- Truly International Holdings

- Japan Display Inc.

- Microtips Technology

- FlexEnable Technology Ltd.

- Plastic Logic Germany

- Chunghwa Picture Tubes Ltd.

- Shenzhen China Star Optoelectronics Technology

- Huawei Technologies Co., Ltd.(Panel R&D)

- Guangzhou OED Technologies Co., Ltd.

- Universal Display Corporation

第七章 市场机会与未来展望

The flexible display market size stands at USD 20.52 billion in 2025 and is forecast to reach USD 75.14 billion by 2030, translating into a powerful 29.64% CAGR over the period.

The valuation leap signals a turning point in which scale economies, material breakthroughs and product design freedom converge to shift flexible panels from niche concepts into mainstream interfaces across consumer electronics, mobility and industrial environments. Production investments in Gen-8.6 OLED fabs, rapid rollable innovation and the migration of micro-LED into wearables are widening the addressable base, while regulatory pushes for glass-free modules spur fresh applications in Europe. Competitive intensity is rising as Chinese manufacturers expand capacity faster than Korean incumbents, challenging established cost structures and accelerating price declines. Simultaneously, integrated players that secure polyimide, encapsulation and hinge know-how are insulating themselves from supply shocks and litigation risk.

Global Flexible Display Market Trends and Insights

Rollable and foldable smartphone launch momentum in China and Korea

Shipments of flexible OLED smartphone panels climbed 26% in 2024 to 784 million units, underscoring how fresh form factors stimulate replacement demand.New tri-fold designs slated for late 2025 bring 360-degree rotation and ultra-thin glass that lowers crease visibility, intensifying brand differentiation. Chinese entrants scale quickly by matching hinge durability targets and shortening design-to-launch cycles, pressuring incumbents on price and innovation tempo. Component ecosystems around hinges, temperature-resistant polyimide and transparent cover films benefit directly. The upturn also spills into accessory and repair markets, creating incremental service revenue streams.

Premium-EV curved OLED cockpit adoption across Europe

Luxury electric vehicles elevate interior experience through expansive curved dashboards such as the EQS SUV Hyper-screen, which merges multiple displays under a continuous glass cover.Automotive OEMs prefer flexible OLED for its thin profile, uniform luminance and design latitude, leading to a surge in display-area per vehicle. Tier-1 suppliers deepen partnerships with panel makers to co-develop cockpit platforms, while software-defined vehicle strategies demand displays that support continuous over-the-air upgrades. As autonomous functionality matures, multi-modal interaction and stretchable pillar-to-pillar screens are set to multiply display square-meter consumption per car.

Gen-8+ polyimide yield losses elevating scrap costs

Scaling to larger mother-glass intensifies thermal stress on flexible PI substrates, driving defect-induced yield drops that inflate per-unit cost. Research on aerogel-reinforced PI fibers shows promise in lifting thermal stability yet industrial adoption remains nascent, leaving fabs exposed to expensive scrap during ramp-up.Yield recovery programmes now focus on real-time in-line metrology and AI-based predictive maintenance to shave defect density before mass output begins.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight AR/VR micro-OLED demand in North America

- Cost reduction from Gen-8.6 flexible OLED fabs in China

- Encapsulation material supply crunch

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OLED held an 85% share of the flexible display market in 2024, leveraging emissive pixels that enable thinner, curve-friendly modules without backlights. Cost erosion from Chinese fabs and evaporator throughput gains have kept OLED the panel of choice for smartphones, watches and curved infotainment clusters. At the same time, micro-LED shipments are scaling from pilot to early mass production, posting a 36% forecast CAGR as quantum-dot colour converters, mass-transfer accuracy and repair yields improve. Automotive head-up displays and rugged wearables benefit first because micro-LED pushes brightness to 10,000 nits and delivers long lifetimes even under high thermal load, as evidenced by Tianma's 8-inch prototype. E-paper holds a niche in low-power signage and logistics tags, while quantum-dot LCD hybrids continue bridging price and colour-gamut gaps for mid-range devices.

OLED dominance faces three pressure points. First, inorganic micro-LED material longevity dilutes OLED's burn-in risk narrative. Second, Gen-8.6 cost advantages narrow the ASP gap between rigid and flexible OLED, nudging budget segments toward flexible form factors. Third, quantum-dot on-chip approaches are now compatible with roll-to-roll plastic substrates, seeding future competition in ultra-large transparent windows. Even so, ecosystem maturity, equipment depreciation and abundant supply keep OLED firmly in charge through the mid-term.

Foldable devices captured 71% of the flexible display market in 2024 and remain the volume engine as smartphone vendors race to iterate bi-fold, tri-fold and wrap-around formats. Patent barricades on hinge geometry and UTG lamination reinforce the lead of first movers yet do not preclude rivals that licence or innovate alternative kinematic stacks. Rollable screens, forecast to expand at a 39% CAGR, unlock spatial efficiency by retracting into compact housings, aligning with consumer demand for pocket-friendly yet expansive displays. Early notebook and tablet rollables demonstrate that motorised spools and stretch-limiting lamination can achieve repeatability over 30,000 actuations.

Bendable and conformable displays remain staples in curved edge phones, fitness bands and automotive radars thanks to their simpler mechanical loads. A nascent "form-factor free" class, enabled by stretchable substrate meshes and serpentine circuit patterns, is under active exploration for skin-adhesive health patches and soft robots. Academic output on stretchable displays jumped from 17 papers in 2014 to 197 in 2023, mirroring heightened R&D investment. While commercialisation lags, the progress sets the stage for ubiquitous ambient display surfaces later in the decade.

The Flexible Display Market Report is Segmented by Display Type (OLED, -Paper Display, and More), Form Factor (Foldable, Rollable, Bendable, Micro-LED, and More), Substrate Material (Glass, Plastic - Polyimide (PI), Plastic - PET/PEN, Metal Foil, and More), Application (Smartphones and Tablets, Smart Wearables, Televisions and Digital Signage, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific dominated with 57% revenue in 2024, propelled by dense manufacturing ecosystems in Korea, China and Taiwan that span PI resin synthesis to module assembly. China alone is adding 8% annual flexible OLED capacity through 2028 against Korea's 2% run-rate, lifting its share of global panel output from 68% to 74%. Regional policy incentives grant favourable land, tax and power terms to local champions, while domestic smartphone OEMs provide ready demand. This virtuous cycle cements supply-chain self-sufficiency and accelerates time-to-yield for new lines.

North America commands technology pull on account of its leadership in AR/VR, high-performance computing and premium notebook segments. US brands source OLED MacBook-class panels for 2026, compelling suppliers to qualify oxide TFT and tandem stack architectures that lengthen lifetime under static UI loads. Legal exposure arising from hinge patents remains a watch-item; however, players often settle or cross-licence to safeguard launch windows. Government grants for microelectronic reshoring may redirect portions of the ecosystem stateside, particularly in backplane and glass-free encapsulation tooling.

Europe exerts regulatory influence through the Ecodesign Regulation and the upcoming Digital Product Passport, pushing the industry toward recyclable structures and full material disclosure. Automotive clusters in Germany, Sweden and the United Kingdom adopt curved OLED clusters at a brisk pace, stimulating local integration, bonding and test partners. The continent's circular material use target of 24% by 2030 drives R&D into solvent-reduced PI, biodegradable adhesives and mechanical fasteners that enable easy separation.

The Middle East and Africa, while comparatively small, records the fastest growth at a 32% CAGR off expanding digital signage in transport hubs, sports arenas and leisure venues. Flexible LED film screens that conform to glass facades exemplify the architectural appetite for novel form factors. Government-backed smart-city projects and high ambient-light conditions make high-brightness micro-LED an attractive option. South America follows with rising smartphone penetration and automotive assembly plants beginning to specify flexible clusters for export models.

- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- ROYOLE Corporation

- E Ink Holdings Inc.

- AU Optronics Corp.

- Sharp Corporation

- Innolux Corporation

- TCL CSOT

- Visionox Co., Ltd.

- Tianma Micro-electronics Co., Ltd.

- Truly International Holdings

- Japan Display Inc.

- Microtips Technology

- FlexEnable Technology Ltd.

- Plastic Logic Germany

- Chunghwa Picture Tubes Ltd.

- Shenzhen China Star Optoelectronics Technology

- Huawei Technologies Co., Ltd. (Panel R&D)

- Guangzhou OED Technologies Co., Ltd.

- Universal Display Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rollable and Foldable Smartphone Launch Momentum in China and Korea

- 4.2.2 Premium-EV Curved OLED Cockpit Adoption Across Europe

- 4.2.3 Demand Spike for Lightweight AR/VR Micro-OLED Panels in North America

- 4.2.4 Cost Reduction from Gen-8.6 Flexible OLED Fabs in China

- 4.2.5 EU Circular-Economy Push for Glass-Free Modules

- 4.2.6 Growth in Flexible Medical Wearables in Japan and South Korea

- 4.3 Market Restraints

- 4.3.1 Gen-8+ Polyimide Yield Losses Elevating Scrap Costs

- 4.3.2 Encapsulation Material Supply Crunch

- 4.3.3 US-Centric Patent Litigation on Foldable Hinges

- 4.3.4 Cold-Climate Reliability Issues of Plastic-LCD Signage

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Display Type

- 5.1.1 OLED

- 5.1.2 LCD

- 5.1.3 E-Paper Display (EPD)

- 5.1.4 Micro-LED

- 5.1.5 Quantum-Dot and Other Emerging Types

- 5.2 By Form Factor

- 5.2.1 Foldable

- 5.2.2 Rollable

- 5.2.3 Bendable

- 5.2.4 Conformable (Curved/Wrap-around)

- 5.3 By Substrate Material

- 5.3.1 Glass

- 5.3.2 Plastic - Polyimide (PI)

- 5.3.3 Plastic - PET/PEN

- 5.3.4 Metal Foil

- 5.3.5 Others (Polycarbonate, Ultra-thin Glass)

- 5.4 By Application

- 5.4.1 Smartphones and Tablets

- 5.4.2 Smart Wearables (Watches, Patches)

- 5.4.3 Televisions and Digital Signage

- 5.4.4 Personal Computers and Laptops

- 5.4.5 Automotive Cockpit and Infotainment

- 5.4.6 AR/VR Head-Mounted Displays

- 5.4.7 Industrial and Public Transport Displays

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 South East Asia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Display Co., Ltd.

- 6.4.2 LG Display Co., Ltd.

- 6.4.3 BOE Technology Group Co., Ltd.

- 6.4.4 ROYOLE Corporation

- 6.4.5 E Ink Holdings Inc.

- 6.4.6 AU Optronics Corp.

- 6.4.7 Sharp Corporation

- 6.4.8 Innolux Corporation

- 6.4.9 TCL CSOT

- 6.4.10 Visionox Co., Ltd.

- 6.4.11 Tianma Micro-electronics Co., Ltd.

- 6.4.12 Truly International Holdings

- 6.4.13 Japan Display Inc.

- 6.4.14 Microtips Technology

- 6.4.15 FlexEnable Technology Ltd.

- 6.4.16 Plastic Logic Germany

- 6.4.17 Chunghwa Picture Tubes Ltd.

- 6.4.18 Shenzhen China Star Optoelectronics Technology

- 6.4.19 Huawei Technologies Co., Ltd. (Panel R&D)

- 6.4.20 Guangzhou OED Technologies Co., Ltd.

- 6.4.21 Universal Display Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment