|

市场调查报告书

商品编码

1849950

棉花:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Cotton - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

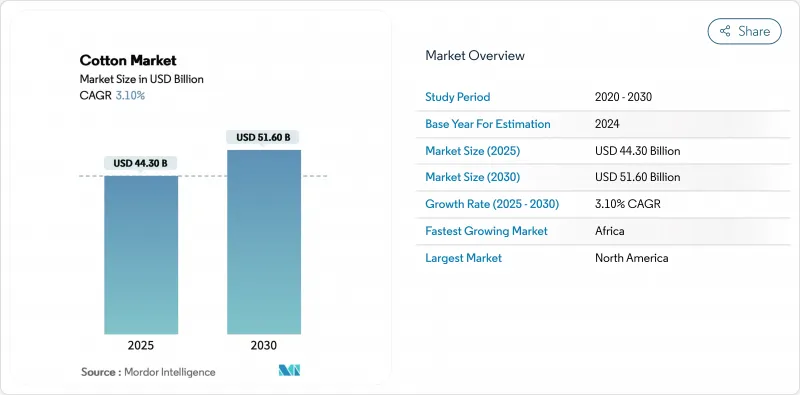

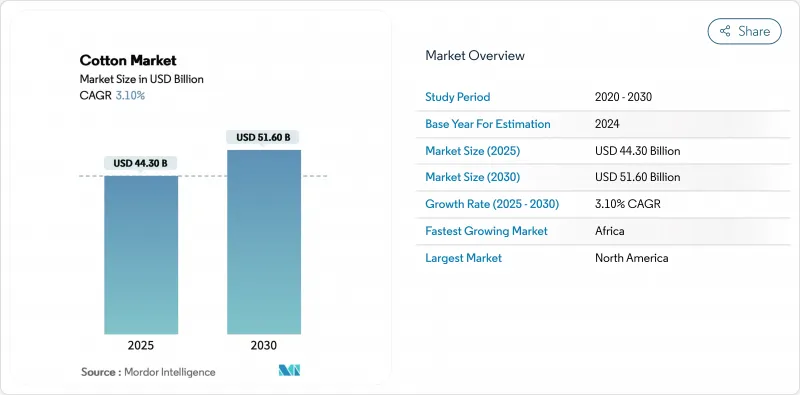

根据估计和预测,2025 年棉花市场规模为 443 亿美元,预计到 2030 年将达到 516 亿美元,预测期内复合年增长率为 3.1%。

持续的永续性要求正鼓励生产者采用精密农业工具,从卫星引导的播种到感测器驱动的灌溉计划,在保障盈利的同时减少资源消耗。可追溯性法规(尤其是《维吾尔族强迫劳动预防法》)的兴起正在重塑全球采购格局,并推动商家实现端到端的数位可视性。同时,BCI认证正成为大众服装零售商的预设采购要求,使符合认证标准的生产者拥有了更大的议价能力。儘管来自纤维素纤维的竞争压力仍然是结构性阻力,但气候智慧型灌溉技术的改进和人工智慧驱动的产量预测系统正在提升新兴经济体生产者的利润韧性。

全球棉花市场趋势与洞察

主要纺织品进口中心对优质棉绒的需求持续旺盛

孟加拉预计在2025年成为全球最大的棉绒进口国,预计进口量将达到800万包。亚洲少数几个製造群的需求集中,使得能够提供棉包级数据证明纤维特性的生产商能够获得稳定的溢价。儘管关税存在不确定性,但越南仍然是孟加拉的主要出口目的地,凭藉其具有竞争力的人事费用和成熟的港口物流,有效抵消了政策风险。西非棉绒目前在孟加拉的消费份额不断增长,预计到2022-2023年将达到39%。这主要归功于西非棉绒的高马克隆值以及非洲贸易商能够保证源头农药残留符合标准。这种采购模式有助于全球贸易流向多元化,摆脱以往从美国到东亚的传统路线,并降低工厂和贸易商的运输风险。

商业棉花倡议组织(BCI)加速了更优质采购方式的转变。

目前,22个国家的超过213万名农民依照BCI通讯协定进行生产,使该计画成为规模最大的经独立检验的农业永续性计画。在最新的报告週期中,全球零售商采购的BCI标准棉绒增加了40%,使这项最初为自愿性质的倡议转变为供应商合约中不可协商的条款。除了减少水资源和农药的使用外,该标准还纳入了性别平等指标等社会保障措施,从而为印度和巴基斯坦的小农户提供了更多发展资金。品质平衡产销监管链模式允许混合认证棉和传统棉,同时降低交易成本,加速了零售商的采用。 H&M、Target和Inditex已宣布,到2030年,他们将100%采购来自经认证的永续项目的棉花,这为认证生产商和贸易商带来了可观的市场需求。

将粉红甲虫的抗性扩展到基因改造性状

研发工作已证实,印度粉红巨型蚧壳虫族群已对双毒素Bt基因改造品种产生多基因抗性,导致田间药效降低,杀虫剂用量增加。在中国,Cry1Ac抗性等位基因的频率正在上升,促使监管机构强制要求建立结构化避难所和进行基因替换。实验室检测表明,逆转录转座子会诱导几丁质合成酶途径发生突变,导致某些品系对Vip3Aa毒素的抗性超过5000倍。为了减缓选择压力,科学家提倡使用含有25%非Bt种子的混合种子,目前正在古吉拉突邦进行公私合作推广计画的试点工作。生技公司正在试验RNA干扰构建体和基于CRISPR的基因编辑技术来抑制害虫肠道酵素的合成,但商业性化应用至少还需要五个种植季,这意味着在此期间,种植者将依赖综合虫害管理通讯协定。

细分市场分析

棉花市场报告按地区划分(北美、欧洲、亚太、南美以及中东和非洲)。报告内容包括产量分析(数量)、消费量分析(价值和数量)、出口量分析(价值和数量)、进口量分析(价值和数量)以及价格趋势分析。市场预测以价值(美元)和数量(公吨)为单位。

区域分析

到2024年,北美将占全球棉花产值的38.9%,成为最大的区域份额。该地区的优势在于精准的种植设备,这缩短了从棉花收穫到出口装船的前置作业时间;此外,还有感测器驱动的灌溉系统和全数数位化的分级机构。技术的进步保证了纤维品质的稳定性,使工厂能够最大限度地减少停机时间,并满足更严格的公差要求。诸如永久性棉包标誌等先进的可追溯性方案提高了对强迫劳动法规的遵守程度,使北美棉绒成为面临日益严格审查的品牌的低风险选择。

非洲预计5.60%的复合年增长率反映了非洲大陆农业现代化进程的宏大图景。政府对种子、化肥和农药等投入品的补贴,加上优惠利率的巨额融资,鼓励小农户扩大种植面积,不再局限于主粮作物。国际货币基金组织的实地报告指出,贝南的经济特区促进了当地纱线纺织计画的发展。埃及继续优先发展长纤维出口,但水资源短缺迫使政策制定者在粮食作物需求和农业生产之间寻求平衡,鼓励采用高效滴灌系统和耐盐品种以保障产量潜力。随着西非棉绒在孟加拉的销售成长,贸易商正在实现销售组合多元化,降低单一买家集中带来的风险。

亚太地区在全球纺织品生产中仍占据重要份额,但结构性障碍限制了其成长速度。在印度,病虫害抗药性週期的加剧促使研究机构推广性状关联种子和强制性避难区规定;而在巴基斯坦,气候智慧型试验田透过米级灌溉计画和综合养分管理,获得了更高的收益。在澳大利亚,儘管水资源分配日益紧张,物联网赋能的亏损灌溉策略仍维持了棉绒产量,从而保障了对东亚市场的出口稳定性。中国的大部分纺织品用于国内消费,政策制定者透过实施进口配额来维持纺织品产业的价格稳定。相较之下,孟加拉已从生产国转变为主要进口国,凸显了其市场向垂直专业化经济的重组。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 主要纺织品进口中心对优质纺织纱线的需求持续强劲。

- 加速向良好棉花发展协会 (BCI) 采购的过渡

- 全球服装巨头迅速采用再生棉混纺布料

- 已开发国家的气候适应型灌溉投资

- 利用人工智慧驱动的收入预测工具降低商家风险

- 新兴製造业丛集的进口需求不断成长

- 市场限制

- 西部花芽虫对基因改造性状的抗药性不断增强

- 加强可追溯性和打击强迫劳动法规

- 波动的海运运费会影响商家利润。

- 在快时尚领域与纤维素纤维的竞争

- 价值/供应链分析

- 监管环境

- 技术展望

- PESTEL 分析

第五章 市场规模与成长预测

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 法国

- 俄罗斯

- 希腊

- 义大利

- 亚太地区

- 中国

- 印度

- 巴基斯坦

- 孟加拉

- 澳洲

- 中东

- 土耳其

- 伊朗

- 以色列

- 非洲

- 埃及

- 南非

- 贝南

- 北美洲

第六章 竞争情势

- 相关利益者名单

第七章 市场机会与未来展望

The Cotton Market size is estimated at USD 44.30 billion in 2025 and is projected to reach USD 51.60 billion by 2030, at a CAGR of 3.1% during the forecast period.

Ongoing sustainability mandates are encouraging growers to adopt precision agriculture tools, from satellite-guided seed placement to sensor-driven irrigation scheduling, to protect profitability while lowering resource footprints. The rise of traceability regulations, especially the Uyghur Forced Labor Prevention Act, is reshaping global sourcing maps and pushing merchants toward end-to-end digital visibility. Simultaneously, Better Cotton Initiative (BCI) certification is becoming a default procurement requirement among mass-market apparel retailers, shifting bargaining power toward compliant producers. Competitive pressure from cellulosic fibers remains a structural headwind, yet climate-smart irrigation upgrades and AI-enabled yield-forecasting systems are improving margin resilience for growers in developed economies.

Global Cotton Market Trends and Insights

Persistent Demand from Major Textile-Importing Hubs for High-Grade Lint

Bangladesh is poised to become the world's largest lint importer by 2025, with inbound volumes projected to touch 8 million bales as vertically integrated mills seek uniform fiber length and strength to meet premium yarn contracts. This concentration of demand in a handful of Asian manufacturing clusters supports stable price premiums for growers able to certify fiber characteristics with bale-level data. Vietnam remains a top destination despite tariff uncertainties, leveraging competitive labor costs and mature port logistics to offset policy risks. West African lint now satisfies a growing share of Bangladeshi consumption, 39% in fiscal 2022-23, driven by its high micronaire values and the ability of African merchants to guarantee pesticide-residue compliance at origin. These purchasing patterns help diversify global trade flows away from historical US-to-East-Asia corridors, reducing freight risk for mills and merchants alike.

Accelerating Shift to Better Cotton Initiative (BCI) Sourcing

More than 2.13 million farmers across 22 countries now operate under BCI protocols, making the program agriculture's largest independently verified sustainability scheme. Global retailers increased purchases of BCI-equivalent lint by 40% over the latest reporting cycle, turning what began as a voluntary commitment into a non-negotiable line item in supplier contracts. Beyond lower water and pesticide footprints, the standard embeds social safeguards such as gender-inclusion metrics, unlocking incremental development funding for smallholders in India and Pakistan. The mass-balance chain-of-custody model lets traders blend certified and conventional cotton while keeping transaction costs low, a feature that accelerates retailer adoption. Corporate announcements from H&M, Target, and Inditex to source 100% of cotton from verified sustainable programs by 2030 ensure durable forward-demand visibility for compliant ginners and merchants.

Escalating Pink-Bollworm Resistance to GM Traits

Research confirms that pink bollworm populations in India have developed multigenic resistance to dual-toxin Bt varieties, reducing field-level efficacy and driving up insecticide use. In China, resistance allele frequencies to Cry1Ac are rising, prompting regulators to mandate structured refuges and alternative gene stacking. Laboratory assays show retrotransposon-induced mutations in chitin synthase pathways, producing more than 5,000-fold resistance to Vip3Aa toxins in some strains. Scientists advocate seed mixtures containing 25% non-Bt seed to slow selection pressure, a practice now piloted across Gujarat under public-private extension programs. Biotechnology firms are experimenting with RNA-interference constructs and CRISPR-enabled edits that silence pest gut-enzyme synthesis, but commercial deployment remains at least five seasons away, leaving growers dependent on integrated pest-management protocols in the interim.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Recycled-Cotton Blend Adoption by Global Apparel Majors

- Climate-Smart Irrigation Investments in Developed Countries

- Tightening Traceability and Forced-Labor Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Cotton Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America accounts for 38.9% of global cotton value in 2024, the largest regional share worldwide. The region's dominance rests on precision-planting equipment, sensor-driven irrigation, and fully digitized classing offices that compress lead times from harvest to export vessel. Technology depth supports consistent fiber quality, enabling mills to minimize downtime and meet tighter tolerance specifications. Advanced traceability schemes such as permanent bale IDs improve compliance with forced-labor regulations, positioning North American lint as a low-risk choice for brands facing heightened scrutiny.

Africa's 5.60% CAGR projection embodies the continent's broader agricultural modernization narrative. Government subsidy programs covering seed, fertilizer, and insect-control inputs are paired with concessional-rate ginner financing, encouraging smallholders to expand acreage beyond staple grains. IMF field reports credit Benin's Special Economic Zone with catalyzing local yarn-spinning projects, a shift that captures more value domestically and hedges growers against raw-lint-price swings. Egypt continues to prioritize long-staple exports, but water constraints force policymakers to balance cotton with food-crop imperatives, prompting the adoption of high-efficiency drip networks and salt-tolerant cultivars to safeguard yield potential. As West African lint secures higher offtake in Bangladesh, merchants diversify sales portfolios, reducing exposure to single-buyer concentration risks.

Asia-Pacific still accounts for a substantial share of global output, yet structural hurdles temper its growth velocity. India's escalating pest-resistance cycle pushes research institutes toward stacked-trait seeds and mandatory refuge compliance, while Pakistan's climate-smart pilot plots record better returns driven by meter-level irrigation scheduling and integrated nutrient management. Australia's adoption of IoT-enabled deficit-irrigation strategies maintains lint yields despite tightening water allocations, sustaining export reliability into East-Asian markets. China remains a unique case: domestic consumption absorbs most of its harvest, and policymakers apply import-quota levers to manage price stability inside the textile sector. In contrast, Bangladesh's role as a top importer rather than a producer underscores the cotton market's realignment toward vertically specialized economies.

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Key Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Persistent demand from major textile-importing hubs for high-grade lint.

- 4.2.2 Accelerating shift to Better Cotton Initiative (BCI) sourcing

- 4.2.3 Surge in recycled-cotton blend adoption by global apparel majors

- 4.2.4 Climate-smart irrigation investments in the developed countries

- 4.2.5 AI-enabled yield-forecasting tools lowering merchant risk

- 4.2.6 Rising import demand from emerging manufacturing clusters

- 4.3 Market Restraints

- 4.3.1 Escalating pink-bollworm resistance to GM traits

- 4.3.2 Tightening traceability and forced-labor regulations

- 4.3.3 Volatile ocean-freight rates impacting merchant margins

- 4.3.4 Competition from cellulosic fibers in fast fashion

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.1.3 Mexico

- 5.1.2 South America

- 5.1.2.1 Brazil

- 5.1.2.2 Argentina

- 5.1.3 Europe

- 5.1.3.1 Germany

- 5.1.3.2 France

- 5.1.3.3 Russia

- 5.1.3.4 Greece

- 5.1.3.5 Italy

- 5.1.4 Asia-Pacific

- 5.1.4.1 China

- 5.1.4.2 India

- 5.1.4.3 Pakistan

- 5.1.4.4 Bangladesh

- 5.1.4.5 Australia

- 5.1.5 Middle East

- 5.1.5.1 Turkey

- 5.1.5.2 Iran

- 5.1.5.3 Israel

- 5.1.6 Africa

- 5.1.6.1 Egypt

- 5.1.6.2 South Africa

- 5.1.6.3 Benin

- 5.1.1 North America

6 Competitive Landscape

- 6.1 List of Key Stakeholders