|

市场调查报告书

商品编码

1850029

管理资讯服务:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Managed Information Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

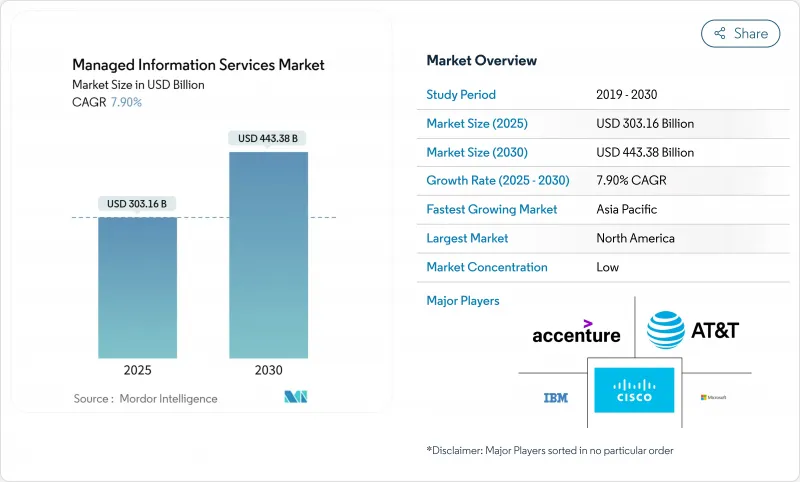

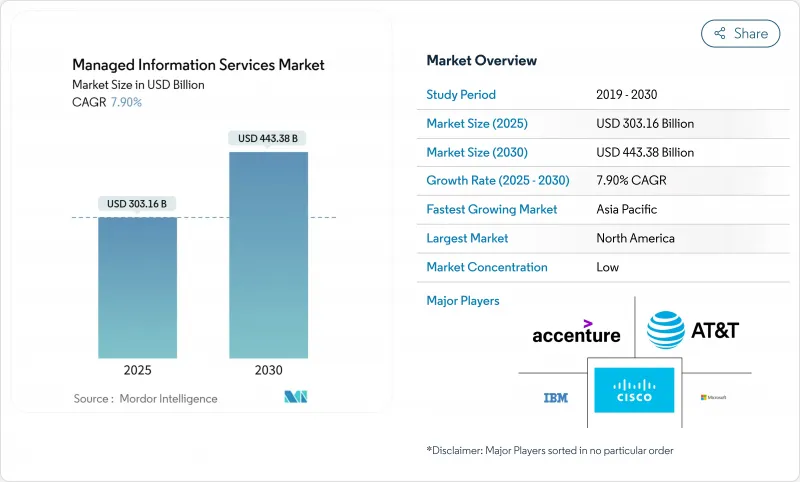

託管资讯服务市场预计将在 2025 年达到 3,031.6 亿美元,以 7.9% 的复合年增长率成长,到 2030 年达到 4,433.8 亿美元。

随着企业从所有权模式向消费模式转型,加速其云端优先蓝图,并透过将自动化和人工智慧融入日常营运的专业合作伙伴来弥补关键人才缺口,託管资讯服务市场持续保持强劲成长势头。此外,网路风险上升、监管压力加大以及对持续运作的需求也使託管资讯服务市场受益,而大多数内部IT团队无法提供资金或大规模配备人员。北美仍然是全球支出中心,但亚太地区的快速数位化正在缩小这一差距。竞争优势正在转向能够提供基于成果的合约、混合架构的整合管理以及持续保全行动以满足不断变化的合规性需求的供应商。

全球管理资讯服务市场趋势与洞察

转向混合/多重云端架构

混合云和多重云端已成为董事会层面的当务之急,而非工具偏好,预计到 2027 年将有 90% 的公司采用这种方法。工作负载可携性、资料驻留规则和供应商多样性正在增加营运复杂性,并促使公司从第三方专家购买整合管理。思科报告称,53% 的企业每週都会在本地端和云端环境之间迁移工作负载,这使得对编配平台和跨域管治服务的需求持续成长。能够提供一致的策略执行、整合的可观察性和跨不同平台的自动化工作负载分配的提供者现在拥有更高的价格。在必须同时满足合规性和创新目标的严格监管行业中,采用混合云和多云最为明显,这强化了能够将本地控制与云端敏捷性相结合的託管服务的提案主张。

成本优化和 OPEX 偏好

经济不确定性和技术的快速更替正推动财务主管转向可预测的订阅支出。託管服务将资本支出转化为营运支出,同时将硬体淘汰、许可证管理和人才招募的风险转移给供应商。中小企业最快地接受了这种模式,因为它们无需大量的前期投资即可获得企业级安全和分析功能。供应商也承担合规性报告和事件回应的责任,使内部团队能够将稀缺的技能转向面向客户的创新。因此,营运成本主导的合约通常包含不仅与基础设施可用性相关的结果保证,还与服务水准、使用者体验和业务指标相关。

遗留整合和监管复杂性

许多公司的核心应用程式运作在数十年历史的系统上,这些系统难以轻鬆与现代託管平台对接。银行、公共产业和公共机构面临严格的审核要求,需要客製化控制、专用适配器和延长检验週期。客製化整合会增加计划成本,并削弱规模经济效应,而规模经济正是託管服务的吸引力。 《萨班斯-奥克斯利法案》(SOX) 和《一般资料保护规范》(GDPR) 等合规框架通常要求本地审核记录和资料隔离,迫使提供者部署专用环境,从而增加交付工作量。这些因素会延长销售週期并延迟价值实现时间,尤其对于承担多种监管义务的跨国公司而言。

細項分析

至2024年,本地环境将占据託管资讯服务市场份额的54.1%。对私人资料中心和延迟敏感型工作负载的巨额投资进一步推动了这一趋势。然而,云端基础的託管服务预计将以13.8%的复合年增长率成长,凸显了重视敏捷性和弹性消费的产业工作负载迁移的加速。混合环境现已成为主流,要求服务供应商在两种环境中提供单一管理平台的可视性、自动化配置漂移修復和统一的安全管理。

云端加速也反映出人们对超大规模平台日益增长的信任,这些平台目前提供特定产业的合规蓝图、主权云端区域和精细加密选项。此外,企业意识到云端现代化与应用程式转型密不可分,这推动了对重构、DevSecOps 流程和持续合规监控的需求。拥有经过认证的云端专业知识、专有迁移加速器和强大财务优化工具的託管服务合作伙伴正在赢得更大的合约范围。相反,由于客户采用云端原生设计模式并期望获得工作负载布局经济性的主动指导,那些局限于资料中心外包的供应商可能会面临合约流失的风险。

至2024年,託管安全服务将占总收入的28.5%,复合年增长率为14.7%。高级服务结合了威胁情报、行为分析和透过整合平台执行的自动回应,从而减少了人工分类的工作量。

对零信任网路存取、云端工作负载保护和供应链风险评估的需求也在不断增长。同时,託管资料中心和网路服务继续提供可预测的收入来源,但由于基础设施自动化压缩了传统的工单量,成长的驱动力在于安全性。因此,服务组合正向安全的多云功能方向整合,供应商整合身分管治、预防资料外泄和合规性仪表板。 Canalys 强调,与独立提案相比,安全与云端优化服务的组合可产生 1.6 倍的交叉销售收益。因此,投资于多重云端平台、安全分析和专业事件回应团队的供应商正在获得差异化的利润。

託管资讯服务市场按配置(云端 vs. 本地部署)、服务类型(託管资料中心、託管安全、託管通讯(统一通讯 vs. VoIP)等)、最终用户公司规模(中小企业 vs. 大型企业)、最终用户垂直领域(IT 和电信、金融服务、保险、医疗保健等)和区域细分。市场预测以美元计算。

区域分析

2024年,北美将维持35.4%的收入成长,这得益于早期云端运算应用、先进的网路安全法规以及丰富的一级供应商生态系统。美国企业通常需要预测分析、人工智慧辅助营运以及将费用与业务KPI挂钩的基于成果的合约。加拿大正凭藉联邦政府的「数位政府」计画和依赖安全多重云端弹性的现代银行倡议获得发展势头。许多供应商正在部署区域交付中心和主权云端区,以遵守不断发展的州级隐私法,同时维持低延迟的服务水准。

亚太地区是成长最快的地区,复合年增长率达12.9%,正在缩小与其他地区的差距。中国正在透过智慧城市投资和製造业升级政策来扩展託管资讯服务,这些政策需要边缘编配和安全连接。东南亚国家正在透过采用云端託管应用程式和行动优先商务来摆脱传统基础设施,这需要合作伙伴在网路优化和法规遵循方面提供支援。建立合资企业、多语言服务台和区域性垂直解决方案的供应商将占据有利地位,抢占市场份额。

在《一般资料保护规范》(GDPR)、数位化营运韧性法律和永续性报告义务的推动下,欧洲的需求正日趋成熟且具韧性。德国和英国仍然是支出最高的国家,但随着欧盟復苏基金对数位化计划的支持,南欧的支出正在加速成长。供应商透过提供可衡量的碳减排倡议、欧盟专属的资料驻留以及可审核的合规交付成果来脱颖而出。随着时间的推移,环境法规的加强将使采购标准转向那些在可再生能源采购和循环经济硬体实践方面取得检验进展的合作伙伴。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 转向混合/多重云端架构

- 成本优化和营运支出优先级

- 网路威胁和日益增长的合规压力

- 需要本地 MSP 节点的边缘运算部署

- 绿色管理服务的永续性要求

- 人工智慧驱动的自主运作 (AIOps) 成熟度

- 市场限制

- 遗留整合和监管复杂性

- 资料主权/隐私问题

- 技能人才短缺推高了 MSP 成本

- 无伺服器/无操作架构缩小了 MSP 范围

- 价值链分析

- 监管格局

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章市场规模及成长预测

- 按部署

- 本地部署

- 云

- 按服务类型

- 託管资料中心

- 託管安全

- 託管通讯(UC 和 VoIP)

- 託管网路(LAN/WAN/SASE)

- 託管基础设施(伺服器/储存)

- 管理行动性和设备

- 託管应用程式和 DevOps

- 按最终用户公司规模

- 小型企业

- 大公司

- 按最终用户

- BFSI

- 资讯科技和通讯

- 卫生保健

- 媒体和娱乐

- 零售与电子商务

- 製造业

- 政府和公共部门

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 西班牙

- 瑞士

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 新加坡

- 越南

- 印尼

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 奈及利亚

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM Corporation

- Accenture plc

- Cisco Systems Inc.

- Microsoft Corporation

- AT&T Inc.

- Fujitsu Ltd

- Hewlett Packard Enterprise(HPE)

- Dell Technologies Inc.

- Verizon Communications Inc.

- Rackspace Technology

- Deutsche Telekom AG(T-Systems)

- Nokia Solutions and Networks

- Telefonaktiebolaget LM Ericsson

- Tata Consultancy Services(TCS)

- Wipro Ltd

- HCL Technologies Ltd

- Cognizant Technology Solutions

- NTT DATA Corporation

- Capgemini SE

- Kyndryl Holdings Inc.

- Orange Business Services

第七章 市场机会与未来展望

The managed information services market reached USD 303.16 billion in 2025 and is forecast to expand at a 7.9% CAGR, delivering a managed information services market size of USD 443.38 billion by 2030.

Robust demand persists because enterprises are shifting from ownership to consumption models, accelerating cloud-first roadmaps, and closing critical talent gaps through specialist partners that embed automation and artificial intelligence into day-to-day operations. The managed information services market also benefits from cyber-risk escalation, mounting regulatory pressure, and the need for always-on resilience that most internal IT teams cannot fund or staff at scale. North America continues to anchor global spending, although rapid digitalization across Asia-Pacific is narrowing the gap. Competitive advantage now flows to providers capable of outcome-based contracts, unified management across hybrid architectures, and continuous security operations that align with evolving compliance mandates.

Global Managed Information Services Market Trends and Insights

Shift to Hybrid / Multi-Cloud Architectures

Hybrid and multi-cloud have become a board-level imperative rather than a tooling preference, with 90% of enterprises projected to adopt the approach by 2027. Workload portability, data residency rules, and vendor diversification multiply operational complexity, prompting organisations to source unified management from third-party specialists. Cisco reports that 53% of firms move workloads between on-premise and cloud environments each week, creating sustained demand for orchestration platforms and cross-domain governance services. Providers that supply consistent policy enforcement, integrated observability, and automated workload placement across dissimilar platforms currently command premium pricing. Adoption is most visible in highly regulated sectors that must simultaneously satisfy compliance and innovation goals, reinforcing the value proposition of managed services that can blend local control with cloud agility.

Cost-Optimization and OPEX Preference

Economic uncertainty and rapid technology churn are driving finance leaders toward predictable subscription spending. Managed services convert capital outlays into operating expenses while transferring hardware obsolescence, licence management, and talent retention risks to the vendor. Small and medium enterprises are embracing the model fastest because it unlocks enterprise-grade security and analytics without heavy up-front investment. Providers also assume compliance reporting and incident response responsibilities, allowing internal teams to redirect scarce skills toward customer-facing innovation. As a result, OPEX-driven contracts increasingly include outcome guarantees tied to service levels, user experience, and business metrics rather than infrastructure availability alone.

Legacy Integration and Regulatory Complexity

Many enterprises run core applications on decades-old systems that cannot easily interface with modern managed platforms. Banking, utilities, and public-sector agencies face stringent audit requirements that demand bespoke controls, specialised adapters, and extended validation cycles. Custom integration inflates project costs and erodes the economies of scale that make managed services attractive. Compliance frameworks such as SOX and GDPR often mandate on-premise audit logging and data segregation, forcing providers to deploy dedicated environments that increase delivery effort. These factors lengthen sales cycles and delay time-to-value, especially for global organisations with diverse regulatory obligations.

Other drivers and restraints analyzed in the detailed report include:

- Escalating Cyber-Threat and Compliance Pressure

- Edge-Computing Roll-Outs Requiring Local MSP Nodes

- Serverless / No-Ops Architectures Reducing MSP Scope

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise environments retained 54.1% of managed information services market share in 2024 because many highly regulated firms continue to demand direct infrastructure custody. Heavy investments in private data centres and latency-sensitive workloads further anchor this preference. Yet cloud-based managed services are on track for a 13.8% CAGR, underscoring that workload migration is gathering pace across industries that prize agility and elastic consumption. Hybrid estates now prevail, compelling service providers to offer single-pane visibility, automated configuration drift remediation, and uniform security controls across both venues.

Cloud acceleration also reflects growing trust in hyperscale platforms that now provide sector-specific compliance blueprints, sovereign cloud zones, and granular encryption options. Enterprises moreover recognise that cloud modernisation is inseparable from application transformation, driving demand for refactoring, DevSecOps pipelines, and continuous compliance monitoring. Managed services partners that demonstrate certified cloud expertise, proprietary migration accelerators, and robust financial optimisation tooling are winning larger contract scopes. Conversely, providers limited to data-centre outsourcing risk contract attrition as clients adopt cloud-native design patterns and expect proactive guidance on workload placement economics.

Managed security services controlled 28.5% of the total revenue pool in 2024 and are expanding at 14.7% CAGR, reflecting cyber risk's elevation to an enterprise-wide priority. Advanced services now blend threat intelligence, behaviour analytics, and automated response executed through unified platforms, reducing manual triage workloads.

Demand also rises for zero-trust network access, cloud workload protection, and supply-chain risk assessments. In parallel, managed data-centre and network services continue to deliver predictable annuity streams, but their growth trails security because infrastructure automation compresses traditional ticket volumes. Service portfolios are therefore converging around secure multi-cloud enablement, with providers integrating identity governance, data loss prevention, and compliance dashboards. Canalys highlights that combined security and cloud optimisation offerings generate 1.6 times higher cross-sell revenue relative to siloed propositions. Vendors investing in MDR platforms, security analytics, and specialist incident-response teams consequently command differentiated margins.

Managed Information Services Market is Segmented by Deployment (Cloud and On-Premise), Service Type (Managed Data Centre, Managed Security, Managed Communications (UC and VoIP) and More), End-User Enterprise Size (Small and Medium-Sized Enterprises and Large Enterprises), End-User Vertical (IT and Telecom, BFSI, Healthcare, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 35.4% of 2024 revenue due to early cloud adoption, sophisticated cybersecurity regulations, and a deep ecosystem of tier-one providers. Enterprises in the United States routinely demand predictive analytics, AI-assisted operations, and outcome-based contracts that tie fees to business KPIs. Canada adds momentum through federal digital-government programmes and modern banking initiatives that depend on secure multi-cloud elasticity. Many providers deploy regional delivery hubs and sovereign cloud zones to comply with evolving state-level privacy laws while sustaining low-latency service levels.

Asia-Pacific is the fastest-growing theatre at 12.9% CAGR and is closing the gap on incumbent regions. China scales managed information services through smart-city investments and manufacturing upgrade policies that require edge orchestration and secure connectivity. Southeast Asian nations are leapfrogging legacy infrastructure by adopting cloud-hosted applications and mobile-first commerce, necessitating partner support for network optimisation and regulatory compliance. Providers that establish joint ventures, multilingual service desks, and region-specific vertical solutions are well positioned to capture wallet share.

Europe shows mature yet resilient demand anchored in GDPR, the Digital Operational Resilience Act, and sustainability reporting obligations. Germany and the United Kingdom remain top spenders, but southern Europe is accelerating as EU recovery funds support digitisation projects. Providers differentiate by offering measurable carbon-reduction initiatives, EU-only data residency, and audit-ready compliance artefacts. Over time, tighter environmental rules will shift procurement criteria toward partners that demonstrate verifiable progress on renewable energy sourcing and circular-economy hardware practices

- IBM Corporation

- Accenture plc

- Cisco Systems Inc.

- Microsoft Corporation

- AT&T Inc.

- Fujitsu Ltd

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- Verizon Communications Inc.

- Rackspace Technology

- Deutsche Telekom AG (T-Systems)

- Nokia Solutions and Networks

- Telefonaktiebolaget LM Ericsson

- Tata Consultancy Services (TCS)

- Wipro Ltd

- HCL Technologies Ltd

- Cognizant Technology Solutions

- NTT DATA Corporation

- Capgemini SE

- Kyndryl Holdings Inc.

- Orange Business Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to hybrid / multi-cloud architectures

- 4.2.2 Cost-optimisation and OPEX preference

- 4.2.3 Escalating cyber-threat and compliance pressure

- 4.2.4 Edge-computing roll-outs needing local MSP nodes

- 4.2.5 Sustainability mandates for green managed services

- 4.2.6 AI-driven autonomous operations (AIOps) maturity

- 4.3 Market Restraints

- 4.3.1 Legacy integration and regulatory complexity

- 4.3.2 Data-sovereignty / privacy concerns

- 4.3.3 Skilled-talent crunch inflating MSP costs

- 4.3.4 Serverless / No-Ops architectures reducing MSP scope

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Service Type

- 5.2.1 Managed Data Centre

- 5.2.2 Managed Security

- 5.2.3 Managed Communications (UC and VoIP)

- 5.2.4 Managed Network (LAN/WAN/SASE)

- 5.2.5 Managed Infrastructure (Server / Storage)

- 5.2.6 Managed Mobility and Device

- 5.2.7 Managed Application and DevOps

- 5.3 By End-user Enterprise Size

- 5.3.1 Small and Medium Enterprises (SME)

- 5.3.2 Large Enterprises

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare

- 5.4.4 Media and Entertainment

- 5.4.5 Retail and E-commerce

- 5.4.6 Manufacturing

- 5.4.7 Government and Public Sector

- 5.4.8 Other Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Spain

- 5.5.3.7 Switzerland

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Malaysia

- 5.5.4.6 Singapore

- 5.5.4.7 Vietnam

- 5.5.4.8 Indonesia

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Accenture plc

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Microsoft Corporation

- 6.4.5 AT&T Inc.

- 6.4.6 Fujitsu Ltd

- 6.4.7 Hewlett Packard Enterprise (HPE)

- 6.4.8 Dell Technologies Inc.

- 6.4.9 Verizon Communications Inc.

- 6.4.10 Rackspace Technology

- 6.4.11 Deutsche Telekom AG (T-Systems)

- 6.4.12 Nokia Solutions and Networks

- 6.4.13 Telefonaktiebolaget LM Ericsson

- 6.4.14 Tata Consultancy Services (TCS)

- 6.4.15 Wipro Ltd

- 6.4.16 HCL Technologies Ltd

- 6.4.17 Cognizant Technology Solutions

- 6.4.18 NTT DATA Corporation

- 6.4.19 Capgemini SE

- 6.4.20 Kyndryl Holdings Inc.

- 6.4.21 Orange Business Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment