|

市场调查报告书

商品编码

1850042

北美绿色资料中心:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)North America Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

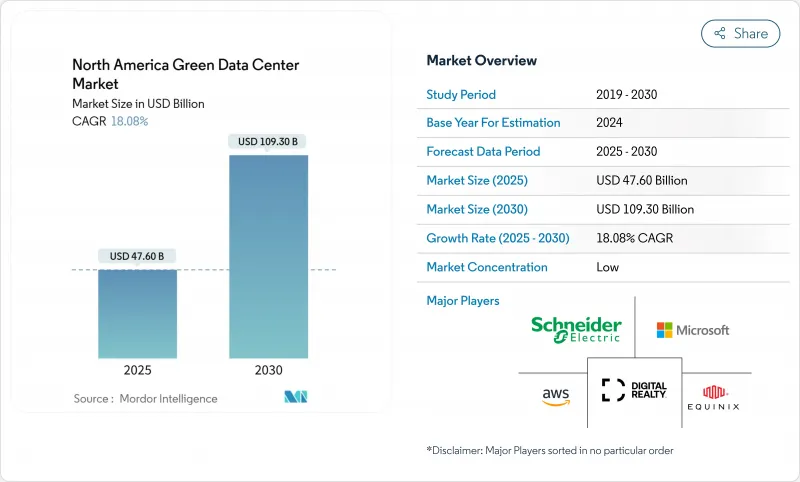

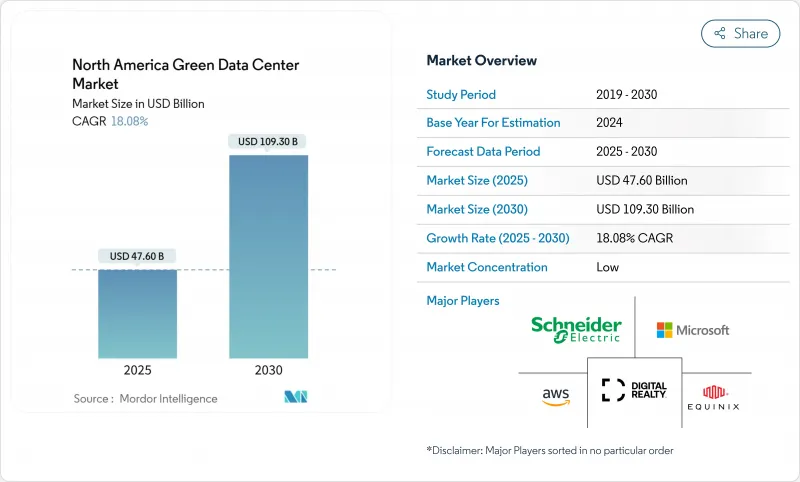

预计到 2025 年,北美绿色资料中心市场规模将达到 476 亿美元,到 2030 年将达到 1,093 亿美元,年复合成长率为 18.08%。

人工智慧工作负载的不断增长(预计到2023年将消耗176太瓦时电力)、可再生能源购电协议(PPA)的扩展以及积极的超大规模投资计划,都为美国能源部(Energy.gov)的这项倡议提供了支持。超大规模云端平台持续建造数吉瓦级园区,推动了对高密度液冷和现场清洁能源发电的需求。託管服务提供者正竞相满足企业净零排放的要求,并将永续性指标纳入服务水准协议。儘管电网互联的延迟和技术纯熟劳工短缺仍然是阻碍因素,但高层政策的支持,加上人工智慧驱动的气流优化技术突破,将使市场在未来十年保持成长势头。

北美绿色资料中心市场趋势与洞察

北美超大规模建筑项目激增

超大规模营运商正斥巨资兴建千兆瓦级园区,这些园区整合了现场太阳能发电、天然气尖峰电厂和核能资源。苹果在德克萨斯州、加州和北卡罗来纳州投资5,000亿美元兴建人工智慧设施,与微软在北美800亿美元的扩张计画遥相呼应。 Meta公司在路易斯安那州投资100亿美元建造一个综合设施,该设施将拥有高达4吉瓦的基本负载核能发电容量。基础设施建设公司Mason预测,一个能够容纳10吉瓦丛集的清洁能源园区将使该地区成为全球永续超大规模发展的标竿。这场「军备竞赛」推动北美绿色资料中心市场超大规模容量以24.4%的复合年增长率成长。

企业净零排放指令再形成託管服务招标书

在选择託管合作伙伴时,企业越来越重视可再生能源的使用,而不是延迟和价格。 Iron Mountain 自 2017 年以来一直使用再生能源为其资料中心供电,并建造了北美首个获得 BREEAM 认证的资料中心,从而树立了新的采购标竿。微软的「2030 年碳负排放承诺」和「2025 年 100%可再生能源要求」贯穿整个供应链,鼓励供应商采用与永续性挂钩的贷款和科学碳目标。能够证明其减碳检验的供应商将获得优先竞标权,使环境绩效成为决定性的竞争优势。

永续材料的前期投资溢价

低碳混凝土、散装木材和电弧炉炼钢的更高的价格仍高达两位数。微软昆西试点计画将碳排放量减少了50%,但需要客製化混合料,而这些混合料只有少数供应商能够提供。亚马逊已公开宣布,即使考虑到批量折扣,其43个新建中心仍将额外投入资金用于低碳钢。虽然从长远来看,能源和品牌效益可以抵消这些成本,但在高价格分布的大都会圈,如果没有绿色债券资金筹措或税收优惠,开发商很难使计划获利。

细分市场分析

解决方案将继续主导北美绿色资料中心市场,预计2024年将占总收入的63.1%,因为营运商正在投资高效电力、液冷和人工智慧管理平台。这种优势带来了规模经济效益,但随着采购转向标准化、利润率较低的硬件,成长速度将会放缓。相较之下,服务预计将以22.1%的复合年增长率成长,因为净零排放蓝图需要持续优化、碳计量和合规性审核。託管式永续发展服务将即时能源仪錶板与咨询支援相结合,以帮助设施符合科学碳目标。

营运商为系统整合支付高额费用,期望从风冷机房无缝切换到晶片直冷迴路,且无需停机。这种复杂的维修依赖于能够设计流体网路、处理洩漏检测数据并最大限度减少体积排放的专业公司。因此,即使设备价格面临通货紧缩压力,每千瓦的业务收益仍在成长,从而支撑了绿色资料中心市场长期稳健的构成比。

受人工智慧工作负载强度和垂直整合的清洁能源采购模式的驱动,超大规模资料中心营运商将在2024年占据北美绿色资料中心市场36.1%的份额,并在2030年之前以24.4%的复合年增长率成长。这主要得益于他们签订的大量前期风能、太阳能、小型核能和天然气合同,而规模较小的竞争对手难以匹敌。这些公司正越来越多地采用预製电气室和液冷歧管等方式,以缩短建设週期,从而支援人工智慧产品的推出。

为了应对超大规模资料中心的激增,託管服务提供者正在对其园区进行改造。新型託管服务供应商提供配备无水冷却系统的 100MW 资料中心模组,并包含与永续性相关的租赁条款,以及直连主流云端平台的光纤通道。边缘和企业级资料中心规模较小,但专注于对延迟敏感的工作负载,例如远端医疗和游戏。对可再生微电网的投资表明,分散式资料中心可以超越企业平均碳排放目标,从而扩大北美绿色资料中心市场的潜在用户群。

北美绿色资料中心市场报告将产业细分为服务(系统整合、监控服务、专业服务、其他服务)、解决方案(电力、伺服器、管理软体、其他)、使用者(託管服务供应商、云端服务供应商、企业)和最终用户产业(医疗保健、金融服务、政府、其他)。市场预测以美元计价。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美超大规模建筑项目激增

- 企业净零排放目标重塑了资料中心託管招标书

- 公共产业层面可再生能源购电协议价格下降

- 人工智慧驱动的气流优化可降低营运成本

- 模组化液冷改装的兴起

- 数据资产碳信用货币化试点项目

- 市场限制

- 永续材料的初始投资溢价

- 区域电网拥塞和互联队列积压

- 低碳混凝土和钢材供应有限

- 高密度部署中技术纯熟劳工短缺

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 按组件

- 透过服务

- 系统整合

- 监控服务

- 专业服务

- 其他服务

- 透过解决方案

- 电力

- 冷却

- 伺服器

- 网路装置

- 管理软体

- 其他解决方案

- 透过服务

- 依资料中心类型

- 託管服务提供者

- 超大规模资料中心业者/云端服务供应商

- 企业和边缘运算

- 依层级类型

- 一级和二级

- 三级

- 第四级

- 按行业

- 卫生保健

- 金融服务

- 政府

- 通讯/IT

- 製造业

- 媒体与娱乐

- 其他行业

- 按国家/地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Schneider Electric SE

- Vertiv Holdings Co

- Eaton Corporation plc

- Cisco Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise

- Fujitsu Ltd

- IBM Corp.

- Hitachi Ltd

- Equinix Inc.

- Digital Realty Trust Inc.

- QTS Realty Trust LLC

- CyrusOne Inc.

- Switch Inc.

- Iron Mountain Data Centers

- Amazon Web Services

- Microsoft Corp.

- Google LLC

- Meta Platforms Inc.

- Rittal GmbH and Co. KG

第七章 市场机会与未来展望

The North America green data center market size reached USD 47.6 billion in 2025 and is on track to hit USD 109.3 billion by 2030, expanding at an 18.08% CAGR.

Escalating AI workloads that consumed 176 TWh of electricity in 2023, wide-scale renewable power purchase agreements (PPAs), and aggressive hyperscale investment plans underpin this advance energy.gov. Hyperscale cloud platforms continue to build multi-gigawatt campuses, pulling forward demand for high-density liquid cooling and on-site clean energy generation. Colocation operators are racing to satisfy corporate net-zero mandates, weaving sustainability metrics into service-level agreements that now influence the majority of North American requests for proposal. Grid interconnection delays and skilled-labor gaps remain headwinds, yet executive-level policy support combined with technology breakthroughs in AI-driven airflow optimisation sustain the market's momentum through the decade.

North America Green Data Center Market Trends and Insights

Soaring hyperscale build-outs across North America

Hyperscale operators are pouring capital into gigawatt-scale campuses that integrate on-site solar, natural-gas peaker plants, and nuclear energy allocations. Apple committed USD 500 billion for AI-ready facilities across Texas, California, and North Carolina, echoing Microsoft's USD 80 billion North American expansion plan. Meta is channeling USD 10 billion into a Louisiana complex supported by up to 4 GW of baseload nuclear capacity. Infrastructure Masons forecasts clean-energy parks capable of hosting 10 GW clusters, positioning the region as the global benchmark for sustainable hyperscale development. This arms race underwrites the 24.4% CAGR for hyperscale capacity within the North America green data center market.

Corporate net-zero mandates reshaping colocation RFPs

Enterprises now rank renewable-energy alignment ahead of latency or price when choosing colocation partners. Iron Mountain has matched 100% of its data-center load with renewables since 2017 and built North America's first BREEAM-certified site, driving new procurement benchmarks. Microsoft's 2030 carbon-negative pledge and 2025 100% renewable coverage requirement cascade through supply chains, pushing vendors to adopt sustainability-linked loans and science-based targets. Providers demonstrating verifiable carbon reductions gain preferred-bidder status, elevating environmental performance to a decisive competitive lever.

Up-front capex premium of sustainable materials

Low-carbon concrete, mass timber, and electric-arc-furnace steel still price at double-digit premiums. Microsoft's pilot in Quincy cut embodied carbon by 50% but required bespoke mixes available from only a handful of suppliers. Amazon disclosed extra capex for lower-carbon steel across 43 new centres, even after accounting for volume discounts. While long-run energy and brand benefits offset these costs, developers in high-priced metros struggle to make projects pencil without green-bond proceeds or tax incentives.

Other drivers and restraints analyzed in the detailed report include:

- Utility-level renewable PPA price declines

- AI-driven airflow optimisation cutting OpEx

- Regional grid congestion and interconnection backlog

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions continued to dominate the North America green data center market, holding 63.1% revenue in 2024 as operators invested in efficient power, liquid cooling, and AI-enabled management platforms. This dominance delivers scale economies, but growth moderates as procurement shifts toward standardised, lower-margin hardware. Services, by contrast, are forecast to expand at 22.1% CAGR because net-zero roadmaps require continuous optimisation, carbon accounting, and compliance audits. Managed sustainability offerings now bundle real-time energy dashboards with advisory support that aligns facilities with Science-Based Targets.

Operators paying premium rates for system integration expect seamless cut-over from air-cooled halls to direct-to-chip loops without downtime. These complex retrofits rely on specialist firms that can design fluid networks, process leak detection data, and minimise embodied emissions. As a result, services revenue per kilowatt is rising even as equipment pricing faces deflationary pressure, underpinning a resilient long-term mix within the North America green data center market.

Hyperscalers captured 36.1% of the North America green data center market size in 2024, thanks to AI workload intensity and vertically integrated clean-energy procurement. Their 24.4% CAGR to 2030 draws on massive forward contracts for wind, solar, small-modular nuclear, and gas-peaking assets that smaller peers cannot match. These players increasingly pre-fabricate electrical rooms and liquid-cooling manifolds, shrinking construction cycles to meet AI product-launch windows.

Colocation providers are retooling campuses to win hyperscale spill-over deals. New builds feature 100 MW blocks with waterless cooling, sustainability-linked lease clauses, and direct fibre to major cloud on-ramps. Edge and enterprise sites, while smaller, focus on latency-sensitive workloads such as telemedicine and gaming. Their investment in renewable micro-grids illustrates how decentralised sites can still exceed corporate-average carbon goals, broadening the addressable pool for the North America green data center market.

North America Green Data Center Market Report Segments the Industry Into Service (System Integration, Monitoring Services, Professional Services, Other Services), Solution (Power, Servers, Management Software, and More), User (Colocation Providers, Cloud Service Providers, Enterprises), and End-User Industry (Healthcare, Financial Services, Government, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Vertiv Holdings Co

- Eaton Corporation plc

- Cisco Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise

- Fujitsu Ltd

- IBM Corp.

- Hitachi Ltd

- Equinix Inc.

- Digital Realty Trust Inc.

- QTS Realty Trust LLC

- CyrusOne Inc.

- Switch Inc.

- Iron Mountain Data Centers

- Amazon Web Services

- Microsoft Corp.

- Google LLC

- Meta Platforms Inc.

- Rittal GmbH and Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Soaring hyperscale build-outs across North America

- 4.2.2 Corporate net-zero mandates reshaping colocation RFPs

- 4.2.3 Utility-level renewable PPA price declines

- 4.2.4 AI-driven airflow optimisation cutting OpEx

- 4.2.5 Rise of modular liquid-cooling retrofits

- 4.2.6 Carbon-credit monetisation pilots in data estates

- 4.3 Market Restraints

- 4.3.1 Up-front capex premium of sustainable materials

- 4.3.2 Regional grid-congestion and interconnection queue backlog

- 4.3.3 Limited availability of low-carbon concrete and steel

- 4.3.4 Skilled-labour shortage for high-density deployments

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of the impact of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 By Service

- 5.1.1.1 System Integration

- 5.1.1.2 Monitoring Services

- 5.1.1.3 Professional Services

- 5.1.1.4 Other Services

- 5.1.2 By Solution

- 5.1.2.1 Power

- 5.1.2.2 Cooling

- 5.1.2.3 Servers

- 5.1.2.4 Networking Equipment

- 5.1.2.5 Management Software

- 5.1.2.6 Other Solutions

- 5.1.1 By Service

- 5.2 By Data Center Type

- 5.2.1 Colocation Providers

- 5.2.2 Hyperscalers/Cloud Service Providers

- 5.2.3 Enterprise and Edge

- 5.3 By Tier Type

- 5.3.1 Tier 1 and 2

- 5.3.2 Tier 3

- 5.3.3 Tier 4

- 5.4 By Industry Vertical

- 5.4.1 Healthcare

- 5.4.2 Financial Services

- 5.4.3 Government

- 5.4.4 Telecom and IT

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Other Verticals

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Vertiv Holdings Co

- 6.4.3 Eaton Corporation plc

- 6.4.4 Cisco Systems Inc.

- 6.4.5 Dell Technologies Inc.

- 6.4.6 Hewlett Packard Enterprise

- 6.4.7 Fujitsu Ltd

- 6.4.8 IBM Corp.

- 6.4.9 Hitachi Ltd

- 6.4.10 Equinix Inc.

- 6.4.11 Digital Realty Trust Inc.

- 6.4.12 QTS Realty Trust LLC

- 6.4.13 CyrusOne Inc.

- 6.4.14 Switch Inc.

- 6.4.15 Iron Mountain Data Centers

- 6.4.16 Amazon Web Services

- 6.4.17 Microsoft Corp.

- 6.4.18 Google LLC

- 6.4.19 Meta Platforms Inc.

- 6.4.20 Rittal GmbH and Co. KG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment