|

市场调查报告书

商品编码

1850065

3D列印资料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)3D Printing Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

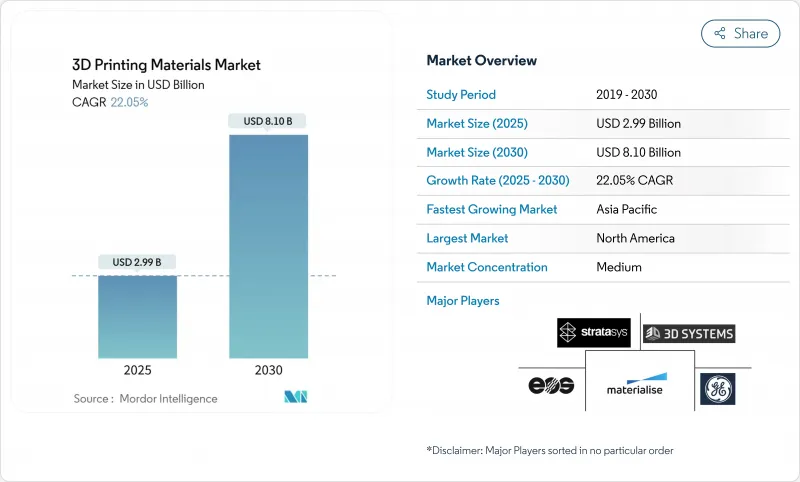

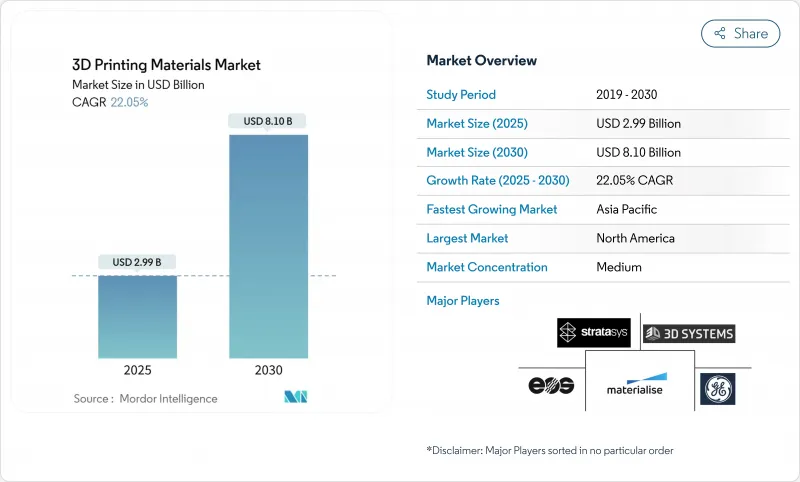

预计2025年3D列印材料市场规模将达29.9亿美元,2030年将扩大到81亿美元,复合年增长率为22.05%。

这一扩张反映了积层製造在航太、汽车和医疗保健供应链中从原型製作资源转向检验的生产工具的转变。航太主要企业持续获得钛、镍和铝粉末的连续生产资质,而医疗设备製造商则获得患者专用聚合物和金属的监管许可。汽车原始设备製造商加速采用轻量化电动车零件并提高模具效率。快速的材料创新缩短了週期时间,提高了零件性能,并为化学公司和印表机供应商开闢了新的收益来源。硬体、软体和耗材的紧密整合,以确保经常性材料收入,是竞争策略的核心。

全球3D列印材料市场趋势与洞察

金属粉末在航太和医疗製造中的应用迅速增加

航太原始设备製造商 (OEM) 正在从示范计划迈向认证钛、镍和铝合金用于飞行关键部件,其中 Ti-6Al-4V 因其较高的强度重量比和耐腐蚀性而在航太航天粉末消费中占据主导地位。生物相容性的钛和钴铬粉末可支撑颅骨板、脊柱笼和人工关节,其内部晶格目前无法透过减材製造方法实现。Honeywell2025 年对 6K 增材镍 718 的认证展示了再生材料如何满足严格的涡轮发动机要求,同时减少原材料废弃物。长达两年的认证过程设定了较高的进入门槛,保护现有粉末製造商免受价格波动的影响,并加强了 3D 列印材料市场的整合。

高性能聚合物的快速进步

聚醚醚酮 (PEEK)、聚醚酮酮 (PEKK) 和碳纤维增强共混物正在取代卫星支架、整形外科创伤板以及油气流量限制器中的铝材。 Stratasys 于 2025 年推出了 VICTREX AM 200,能够在 150°C 的工作温度下一次性生产数百个零件,同时保持尺寸精度。双喷嘴熔融沈积系统采用连续碳粗纱,将面内热导率提高至 4.54 W/(m*K),拓展了散热器和 EMI 屏蔽的用途。这些进步将生产前置作业时间缩短至 36 小时以内,并将后处理时间减少了 50%,刺激了整个 3D 列印材料市场对可重复聚合物的需求。

设备和材料成本高

工业金属印表机的成本在10万美元到100万美元之间,其中特种粉末和耗材占零件总成本的30%到40%,这限制了中小型製造商的采用。镍和稀土价格波动增加了服务机构的预算风险。大型整合商正在透过签署多年期原料合约和开发内部回收技术来应对这项挑战,但资本密集是3D列印材料全面进入市场的一个障碍。

細項分析

到2024年,塑胶将以47.25%的市占率引领3D列印材料市场。此细分市场包括ABS和PLA等通用级材料,以及耐灭菌和高温的工程聚合物。随着桌上型印表机出货量和商用熔丝安装量的增加,塑胶需求也将随之成长。塑胶产业受益于色彩保真度、阻燃性和机械性能的持续提升,不仅吸引了桌面用户,还凭藉着经过验证的数据集满足了工业用户的需求。

儘管基数较小,但金属是成长最快的3D列印材料市场,到2030年,其复合年增长率将达到23.24%。经过认证的钛、铝和镍高温合金粉末可用于製造对重量要求严格的飞机引擎支架、整形外科植入和赛车煞车卡钳。陶瓷和蜡则占据着熔模铸造壳体和高温电子产品等特殊领域。

区域分析

北美将保持领先地位,到2024年将占据3D列印材料市场的39.46%。该市场得益于强大的航太供应链、外科医生主导的植入创新以及「美国製造」联盟等联邦资助管道。材料供应商正利用其与一级飞机製造商和医疗设备丛集的接近性,合作开发特定应用的粉末和聚合物。该地区还拥有多家粉末回收商,这些回收商收集金属碎片并将其转化为合格的添加剂原料,从而减少了对原始进口的依赖。

亚太地区的复合年增长率最高,达26.25%,预计到2030年仍将是成长引擎。中国在入门级印表机出口领域占据主导地位,这赋予了生物基聚合物成本优势。欧洲拥有强大的研发能力,但同时也拥有全球最严格的环境法规。欧盟的《循环经济指令》鼓励采用再生材料,这将加速生物基PLA和PA11的产量成长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 航太和医疗设备批量生产中金属粉末的使用量快速成长

- 高性能聚合物的快速进步

- 汽车应用需求快速成长

- 大规模客製化在医疗保健和消费品领域发展势头强劲

- 生物基/可生物降解材料的采用日益增多

- 市场限制

- 设备和材料成本上升

- 严格的航太和医疗级认证

- 材料供应有限

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依材料类型

- 塑胶

- 丙烯腈丁二烯苯乙烯(ABS)

- 聚乳酸(PLA)

- 尼龙

- 聚酰胺

- 聚碳酸酯

- 其他塑胶(复合材料、可生物降解聚合物等)

- 金属

- 陶瓷

- 其他材料(气体、蜡)

- 塑胶

- 按形式

- 粉末

- 灯丝

- 液体/树脂

- 按最终用户产业

- 航太和国防

- 车

- 药品

- 家电

- 其他(能源/电力、工业机械等)

- 按地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 新加坡

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3D Systems, Inc.

- Arkema

- BASF

- CRP TECHNOLOGY Srl

- Custom Resin Solutions

- EnvisionTEC US LLC

- EOS GmbH

- Evonik Industries AG

- General Electric Company

- Henkel AG & Co. KGaA

- Hoganas AB

- HP Development Company, LP

- Materialise

- Renishaw plc

- Sandvik AB

- Solvay

- Stratasys

- voxeljet AG

第七章 市场机会与未来展望

The 3D printing materials market reached USD 2.99 billion in 2025 and is forecast to rise to USD 8.10 billion by 2030, advancing at a 22.05% CAGR.

This expansion reflects the migration of additive manufacturing from a prototyping resource to a validated production tool across aerospace, automotive, and healthcare supply chains. Aerospace primes continue to qualify titanium, nickel, and aluminum powders for serial production, while medical device makers secure regulatory clearances for patient-specific polymers and metals. Automotive OEMs accelerate adoption of lightweight electric-vehicle components and tooling efficiencies. Rapid material innovation lowers cycle times, improves part performance, and opens new revenue streams for chemical companies and printer vendors. Competitive strategies now center on tight integrating hardware, software, and consumables to lock in repeat material revenue.

Global 3D Printing Materials Market Trends and Insights

Surge in Metal Powder Usage for Serial Aerospace and Medical Production

Aerospace OEMs have moved beyond demonstration projects to certify titanium, nickel, and aluminum alloys for flight-critical components, with Ti-6Al-4V representing the major portion of the aerospace powder consumption thanks to its high strength-to-weight ratio and corrosion resistance. Medical device firms mirror this shift; biocompatible titanium and cobalt-chrome powders now support cranial plates, spinal cages, and joint replacements with internal lattices unachievable through subtractive routes. Honeywell's 2025 qualification of 6K Additive Nickel 718 illustrates how recycled feedstock can meet stringent turbine-engine requirements while reducing raw-material waste. Lengthy two-year qualification regimes create high entry barriers and shield incumbent powder suppliers from price-based disruption, reinforcing consolidation trends inside the 3D printing materials market.

Rapid Advances in High-Performance Polymers

Polyetheretherketone (PEEK), polyetherketoneketone (PEKK), and carbon-fiber-reinforced blends are replacing aluminum in satellite brackets, orthopedic trauma plates, and oil-and-gas flow restrictors. Stratasys introduced VICTREX AM 200 in 2025, enabling hundreds of parts per build and maintaining dimensional accuracy at 150 °C service temperatures. Dual-nozzle fused deposition systems now embed continuous carbon rovings that lift in-plane thermal conductivity to 4.54 W/(m*K), expanding use cases in heat sinks and EMI shielding. These advances compress production lead times below 36 hours and reduce post-machining by 50%, stimulating recurring polymer demand across the 3D printing materials market.

High Equipment and Material Cost

Industrial metal printers list between USD 100,000 and USD 1 million, while specialty powders and filaments account for 30-40% of total part cost, limiting penetration in small and medium manufacturers. Volatile nickel and rare-earth pricing add budgeting risk for service bureaus. Large integrators counter by signing multi-year feedstock contracts and developing in-house recycling, but capital intensity remains a gating factor for broader adoption across the 3D printing materials market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Demand from Automotive Applications

- Increase in the Adoption of Bio-Based/Biodegradable Feedstocks

- Stringent Certification for Aerospace and Medical Grades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics led the 3D printing materials market with a 47.25% share in 2024, reflecting their cost advantage and compatibility with both consumer and industrial printers. The segment covers commodity grades such as ABS and PLA as well as engineering polymers capable of withstanding sterilization or high-temperature service. Demand scales in tandem with desktop printer shipments and professional fused-filament installations. The plastics segment benefits from continued improvements in color fidelity, flame retardancy, and mechanical performance, which keep desktop users engaged and industrial users satisfied with validated data sets.

Although holding a smaller base, metals are on track for a 23.24% CAGR to 2030, the fastest in the 3D printing materials market. Certified titanium, aluminum, and nickel super-alloy powders enable weight-critical aero-engine brackets, orthopaedic implants, and racing-car brake calipers. Ceramics and waxes occupy specialized niches such as investment casting shells and high-temperature electronics.

The 3D Printing Materials Market Report Segments the Industry by Material Type (Plastics, Metals, Ceramics, and Other Materials), Form (Powder, Filament, and Liquid/Resin), End-User Industry (Aerospace and Defense, Automotive, Medical, Consumer Electronics, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained leadership with 39.46% of the 3D printing materials market in 2024, supported by a robust aerospace supply chain, surgeon-led implant innovation, and federal funding channels such as the America Makes consortium. Material vendors leverage proximity to Tier-1 airframers and medical device clusters to co-develop application-specific powders and polymers. The region also hosts several powder recyclers that capture metal swarf and convert it into qualified additive feedstock, reducing dependence on virgin imports.

Asia-Pacific delivered the highest 26.25% CAGR and is projected to remain the growth engine through 2030. China dominates entry-level printer exports, providing cost advantages for bio-based polymers. Europe balances strong research and development capability with some of the strictest environmental regulations worldwide. The EU's circular-economy directives encourage recycled feedstock adoption, positioning bio-derived PLA and PA11 for accelerated volume gains.

- 3D Systems, Inc.

- Arkema

- BASF

- CRP TECHNOLOGY S.r.l.

- Custom Resin Solutions

- EnvisionTEC US LLC

- EOS GmbH

- Evonik Industries AG

- General Electric Company

- Henkel AG & Co. KGaA

- Hoganas AB

- HP Development Company, L.P.

- Materialise

- Renishaw plc

- Sandvik AB

- Solvay

- Stratasys

- voxeljet AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Metal Powder Usage for Serial Aerospace and Medical Production

- 4.2.2 Rapid Advances in High-performance Polymers

- 4.2.3 Surge in Demand from Automotive Application

- 4.2.4 Mass-customization Momentum in Healthcare and Consumer Goods

- 4.2.5 Increase in the Adoption of Bio-based/Biodegradable Feedstocks

- 4.3 Market Restraints

- 4.3.1 High Equipment and Material Cost

- 4.3.2 Stringent Certification for Aerospace and Medical Grades

- 4.3.3 Availability of Limited Types of Materials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Plastics

- 5.1.1.1 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.1.2 Polylactic Acid (PLA)

- 5.1.1.3 Nylon

- 5.1.1.4 Polyamide

- 5.1.1.5 Polycarbonate

- 5.1.1.6 Other Plastics (Composites, Biodegradable Polymers, etc.)

- 5.1.2 Metals

- 5.1.3 Ceramics

- 5.1.4 Other Materials (Gases, Waxes)

- 5.1.1 Plastics

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Filament

- 5.2.3 Liquid/Resin

- 5.3 By End-user Industry

- 5.3.1 Aerospace and Defense

- 5.3.2 Automotive

- 5.3.3 Medical

- 5.3.4 Consumer Electronics

- 5.3.5 Others (Energy and Power, Industrial Machinery, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 South Korea

- 5.4.1.4 India

- 5.4.1.5 Singapore

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3D Systems, Inc.

- 6.4.2 Arkema

- 6.4.3 BASF

- 6.4.4 CRP TECHNOLOGY S.r.l.

- 6.4.5 Custom Resin Solutions

- 6.4.6 EnvisionTEC US LLC

- 6.4.7 EOS GmbH

- 6.4.8 Evonik Industries AG

- 6.4.9 General Electric Company

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 Hoganas AB

- 6.4.12 HP Development Company, L.P.

- 6.4.13 Materialise

- 6.4.14 Renishaw plc

- 6.4.15 Sandvik AB

- 6.4.16 Solvay

- 6.4.17 Stratasys

- 6.4.18 voxeljet AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Introduction of New Materials, like Graphene Opens Up New Applications

- 7.3 Adoption of 3D Printing Technology in Home Printing