|

市场调查报告书

商品编码

1850070

控制阀:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Control Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

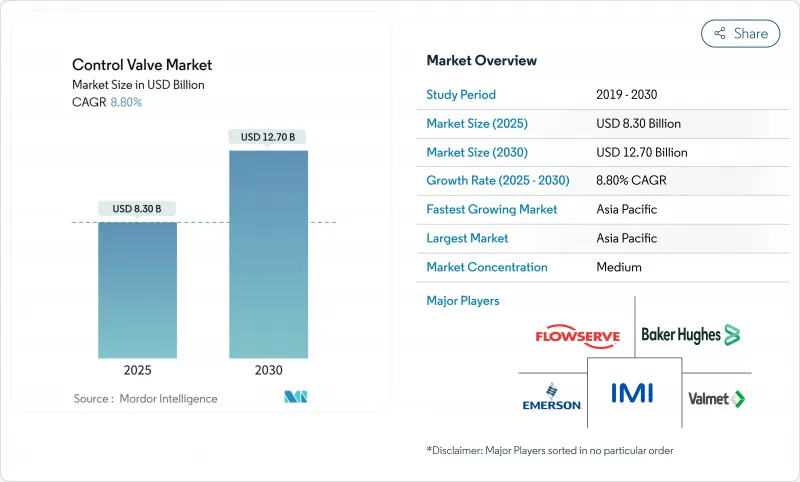

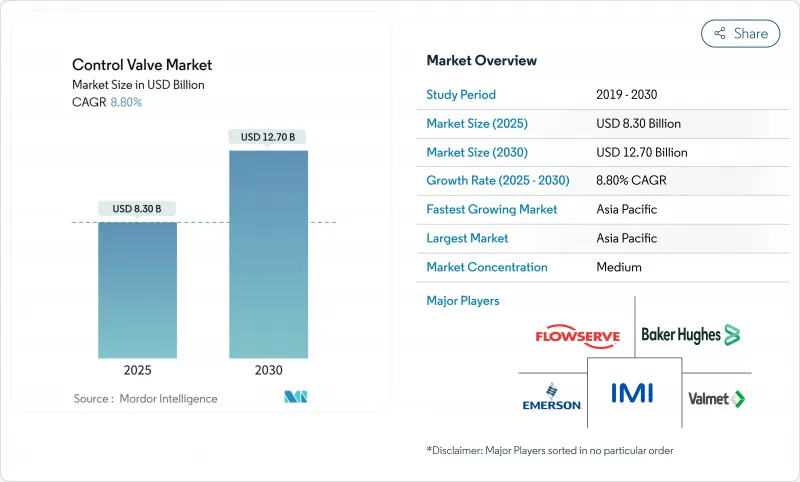

控制阀市场预计将以 8.80% 的复合年增长率成长,到 2025 年达到 83 亿美元,到 2030 年达到 127 亿美元。

对石油和天然气、电力和水利基础设施的稳定资本投资将支持这一增长,而氢能经济数位化资产管理的扩张将创造新的应用领域。预计到 2035 年,石油和天然气基础设施投资将达到 1.6 兆至 1.34 兆美元,从而确保长期需求底线。光是洛杉矶水电局就在实施一项 63 亿美元的五年资本计划,优先升级输电干线和处理厂阀门。美国环保署每吨 900 美元的甲烷排放费增加了逸散排放的合规成本,监管势头正在加速从气动到电动致动器的转变。亚太地区占 2024 年销售额的 38.2%,将在全球销量中占据主导地位,而北美和欧洲则在数位化维修和严格的服务规范方面处于领先地位。

全球控制阀市场趋势与洞察

增加对用水和污水基础设施的投资

市政公共产业正在优先考虑资产更新,以满足日益严格的品质要求和气候适应性目标。田纳西州将在2024年为102个计划提供2.32亿美元的拨款,这体现了其替换计划的广度,其中电动阀门提供了运营商目前所需的远端监控功能。加州最大的水务局正在进行为期多年的智慧蝶阀和旋塞阀采购週期,以减少未计费水量水损失。这些承诺支持电动执行器的成长轨迹,同时刺激与诊断软体结合的售后服务。

老化发电厂和加工厂的现代化改造

火力发电、核能和石化发电领域的脱碳蓝图将缩短传统流量控制资产的更换週期。美国能源局的核能发电厂现代化策略将控制阀升级列为安全的基础投资,并为适用于核能发电厂的数位定位器分配了研究资金。水电寿命延长计画正在拨款近10亿美元,用于为监控网路配备整合网路安全保障措施的现代化电子阀门。这些计划正在将阀门规格转向精密球体设计和耐腐蚀合金,巩固高价位市场。

原油价格波动抑製油气资本支出

大宗商品价格波动抑制了勘探需求,导致严重依赖高价值阀门的待开发区管道和液化天然气计划延迟。澳洲能源生产商指出,过去五年,该国仅吸引了全球1.2%的勘探支出,凸显其保守的投资环境。马来西亚国家石油公司(PETRONAS)的2025-2027年展望也体现了这种谨慎态度,强调棕地优化而非产能扩张。虽然基准维护将维持产能基础的稳健,但在价格前景改善之前,短期可自由支配的支出仍面临风险。

細項分析

截止阀凭藉其在炼油厂、化学反应器和高压蒸气迴路中的精细流动能力,在2024年占据了控制阀市场份额的32%。受惠于OEM备件的强劲售后市场,截止阀的安装量成长增强了控制阀市场的韧性。球阀因其紧密的关闭性能而备受青睐,占据了控制阀市场规模的第二大份额,支撑了管道迴路隔离作业的需求。蝶阀的复合年增长率最高,达到8.9%,这得益于其紧凑的结构、较低的单位直径成本和增强的密封性能,使其在中等关键应用领域的应用不断扩展。整合在球阀和蝶阀阀体中的数位定位器体现了机械设计与电子技术日益融合的趋势。塞阀和隔膜阀分别在浆料和卫生应用中占据重要的地位,并由哈氏合金和USP级含氟聚合物等特定应用材料製成。

生命週期经济学倾向于采用硬面阀内件的重型球阀设计,其平均维护间隔比通用装置长三倍。同时,水务公司正在选择弹性阀座蝶阀来优化资本预算,从而继续将控制阀市场拓展到製程工业以外的领域。供应商正在透过积层製造的阀内件实现差异化,以解决气蚀和闪蒸问题,从而扩大其在海水淡化和地热发电厂中的应用。随着能源转型计划整合氢能和碳捕集工艺,符合 API 6A 标准的金属阀座球阀正成为关键的成长点。

气压气压维护相对简单,并支援强大的备件生态系统,从而抑制了向电动式的过渡。然而,到2030年,受零排放运作、更高的扭力额定值以及可直接嵌入工厂乙太网路架构的整合诊断功能的推动,预计电动驱动器的市场规模将成长9.8%。这种动态正在将收益从压缩机和空气干燥器转移到软体支援的状态监控模组,再形成驱动控制阀市场的规模。

在海底和重型采矿领域,液压驱动装置虽然地位有限,但具有战略意义,因为这些领域缺乏故障安全弹簧组件和电池供电。手排变速箱通常以低占空比运行,但越来越多地与位置反馈感测器配对,以满足网路安全主导的资产可视性要求。随着云端原生历史资料库改进异常检测,具有嵌入式处理器的电力驱动器可以执行本地边缘分析,改善迴路调节,并缩短平均修復时间。提供涵盖电动、气动和液压管路的通用控制板的供应商可以提高供应链经济效益,同时简化使用者培训。

控制阀市场细分:按类型(截止阀、球阀、蝶阀等)、按最终用户行业(石油天然气、化工、石化、化肥等)、按驱动技术(气动、液压等)、按材质(钢、铸铁等)以及按地区划分。市场预测以价值(美元)提供。

区域分析

亚太地区占2024年销售额的38.2%,到2030年,其销售量将达到前所未有的水平,复合年增长率也将达到7.9%,成为全球最快的地区。中国东部沿海的大型石化企业和印度24亿美元的国家氢能计画将直接推动高压截止阀和球阀的采购。东南亚液化天然气的扩张将增强基准需求,印尼和越南的国有公共正在利用多边融资来实现水处理现代化,并维持阀门产品组合的平衡。

北美仍然是创新中心,更严格的排放法规、数位化维修以及SMR试点计画推动了高级产品的普及。美国石油协会预计,到2035年,石油和天然气基础设施投资将达到1.6兆至1.34兆美元,以支持管道阀门的生产。像洛杉矶为期五年、耗资63亿美元的水务项目这样的基础设施更新计划,将为智慧蝶阀和塞阀带来稳定的售后市场收益。

在欧洲,环保合规是重中之重,这加速了向电动驱动的转变,并有利于低洩漏阀桿密封系统。在法国和英国,核能发电厂寿命延长计划正在推动对严苛工况阀门的需求,而德国的绿色氢能走廊则指定使用带有氢渗透屏障的不銹钢阀门。在中东和非洲,企业正在利用碳氢化合物现金流为海水淡化和太阳能供水计划提供资金,并采用耐腐蚀的两相蝶阀。在拉丁美洲,企业在一定程度上受益于智利和秘鲁的铜矿开采资本支出,高压浆料阀抵消了石油收入的週期性变化。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 增加对水和污水处理基础设施的投资

- 老化发电厂和加工厂的现代化改造

- 有关排放的严格环境法规

- 扩大氢经济需要高压阀门

- 使用数位双胞胎进行预测性阀门诊断

- 越来越多的 SMR 需要能够承受严苛工况的阀门

- 市场限制

- 原油价格波动抑制了石油和天然气的资本投资

- 来自低成本亚洲供应商的价格压力

- 合金供应链中断

- 智慧定位器的网路安全风险

- 价值/供应链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章市场规模及成长预测

- 按阀门类型

- 手套

- 球

- 蝴蝶

- 插头

- 隔膜

- 其他阀门类型

- 驱动技术

- 气压

- 油压

- 电

- 手动的

- 按最终用户产业

- 石油和天然气

- 化工、石化、化肥

- 能源和电力

- 水和污水处理

- 金属和采矿

- 食品/饮料

- 製药

- 纸浆和造纸

- 其他行业

- 按材质

- 钢

- 铸铁

- 合金基体

- 塑胶(PVC、PP、PVDF)

- 其他成分

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Emerson Electric Co.

- Flowserve Corporation

- Baker Hughes Co.(Cameron)

- Valmet(Metso)

- IMI plc

- CIRCOR International Inc.

- Christian Brkert GmbH

- Crane Co. Nuclear Division

- Neway Valve(Suzhou)Co. Ltd

- ABB Ltd

- Alfa Laval AB

- Rotork plc

- AUMA Riester GmbH

- Crane Co.

- SAMSON AG

- KSB SE and Co. KGaA

- AVK Holding A/S

- Cla-Val Co.

- Velan Inc

- Spirax-Sarco Engineering plc

第七章 市场机会与未来展望

The control valve market size stands at USD 8.30 billion in 2025 and is projected to reach USD 12.70 billion by 2030, advancing at an 8.80% CAGR.

Steady capital spending in oil, gas, power, and water infrastructure underpins this growth while the scale-up of the hydrogen economy and digitalized asset management create fresh application pockets. Nearly USD 1.06 trillion to USD 1.34 trillion in oil and gas infrastructure investment forecast through 2035 secures a long-range demand floor. Municipal water authorities add structural tailwinds; Los Angeles Department of Water and Power alone is executing a USD 6.3 billion, five-year capital program that prioritizes valve upgrades in transmission mains and treatment plants. Regulatory momentum accelerates the transition from pneumatic to electric actuation as the U.S. Environmental Protection Agency's methane charge of USD 900 per metric ton raises the cost of fugitive emissions compliance. APAC, with 38.2% of 2024 revenue, anchors global volume while North America and Europe lead in digital retrofits and severe-service specifications.

Global Control Valve Market Trends and Insights

Rising investments in water & wastewater infrastructure

Municipal utilities are prioritizing asset renewal to meet tightening quality mandates and climate resilience targets. Tennessee's 2024 grants of USD 232 million for 102 projects illustrate the breadth of replacement programs where electronically actuated valves deliver the remote-monitoring functionality operators now require. Parallel spending in California's largest water district underpins a multi-year procurement cycle for smart butterfly and plug valves that reduce non-revenue water losses. These commitments underpin the electric actuation growth trajectory while stimulating aftermarket services tied to diagnostics software.

Modernisation of aging power & process plants

Decarbonization roadmaps at thermal, nuclear, and petrochemical sites compress replacement cycles for legacy flow-control assets. The U.S. Department of Energy's Nuclear Power Plant Modernization Strategy identifies control valve upgrades as a foundational safety investment and allocates research funding to digital positioners qualified for nuclear service. Hydropower life-extension programs channel nearly USD 1 billion toward modern electronic valves that integrate cybersecurity safeguards for supervisory control networks energy.gov. These projects shift specification toward high-accuracy globe designs and corrosion-resistant alloys, reinforcing premium pricing niches.

Oil-price volatility curbing O&G CAPEX

Commodity swings dampen exploration appetite, deferring greenfield pipeline and LNG projects that rely heavily on high-value valves. Australian Energy Producers note that the country attracted only 1.2% of global exploration spending over five years, underscoring a conservative investment climate . PETRONAS' 2025-2027 outlook echoes this caution, emphasizing brownfield optimization over capacity expansion. While baseline maintenance keeps the installed base active, short-cycle discretionary spending remains at risk until pricing visibility improves.

Other drivers and restraints analyzed in the detailed report include:

- Stringent environmental regulations on emissions

- Hydrogen economy scale-up requiring high-pressure valves

- Pricing pressure from low-cost Asian suppliers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Globe valves held a 32% control valve market share in 2024, reflecting their fine throttling capability in refineries, chemical reactors, and high-pressure steam loops. Their installed base drives a substantial aftermarket that favors OEM spare parts, reinforcing stickiness in the control valve market. Ball valves, preferred for tight shut-off, represent the second-largest slice of the control valve market size and sustain demand from pipeline loop-isolation duties. Butterfly valves register the fastest 8.9% CAGR thanks to compact build, lower cost per diameter, and enhanced sealing profiles that extend their use into moderately critical service. Digital positioners embedded on globe and butterfly bodies illustrate the growing convergence of mechanical design with electronics. Plug and diaphragm valves retain niche relevance in slurry and sanitary duties respectively, supported by application-specific materials such as Hastelloy or USP-grade fluoroplastics.

Lifecycle economics tilt in favor of severe-service globe designs with hard-faced trims that triple mean-time-between-maintenance versus commodity units. Concurrently, water utilities choose resilient-seated butterfly valves to optimize capital budgets, continuing to stretch the control valve market beyond process industries. Suppliers differentiate via additive-manufactured trims that handle cavitation and flashing, extending penetration in desalination and geothermal plants. As energy transition projects integrate hydrogen and carbon-capture processes, metal-seated ball valves qualified to API 6A emerge as a vital growth pocket.

Pneumatic units retained a 48% control valve market share in 2024 because intrinsic safety and torque density remain essential in hydrocarbon processing. Their relatively simple maintenance profile underpins a robust spares ecosystem that tempers migration to electrics. However, electric drives are forecast to compound at 9.8% through 2030, supported by zero-emission operation, expanding torque ratings, and the appeal of integrated diagnostics that slot directly into plant Ethernet architectures. This dynamic is reshaping the control valve market size for drives, shifting revenue from compressors and air dryers toward software-enabled condition monitoring modules.

Hydraulic actuation sustains a limited but strategic footprint in subsea and heavy mining where fail-safe spring packages or battery-backed electrics fall short. Manual gearboxes persist in low-duty cycles but are increasingly paired with position feedback sensors to satisfy cybersecurity-driven asset-visibility mandates. As cloud-native historians refine anomaly detection, electric drives with embedded processors can execute local edge analytics, improving loop tuning and lowering mean time to repair. Vendors offering common control boards across electric, pneumatic, and hydraulic lines gain supply-chain economies while simplifying user training.

Control Valve Market Segmented by Type (Globe, Ball, Butterfly and More), End-User Industry (Oil and Gas, Chemical, Petrochemical, and Fertilizer, and More), Actuation Technology (Pneumatic, Hydraulic and More), Material (Steel, Cast Iron and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC, representing 38.2% of 2024 sales, combines unmatched volume with the fastest 7.9% CAGR through 2030. Large-scale petrochemical complexes on China's eastern seaboard and India's USD 2.4 billion national hydrogen mission translate directly into high-pressure globe and ball valve procurement. Southeast Asian LNG expansion reinforces baseline demand, while state-owned utilities in Indonesia and Vietnam capitalize on multilateral financing to modernize water treatment, sustaining a balanced valve mix.

North America remains an innovation nucleus where stringent emission rules, digital retrofits, and SMR pilots drive premium product adoption. The American Petroleum Institute expects USD 1.06 trillion to USD 1.34 trillion in oil and gas infrastructure investment through 2035, anchoring pipeline valve volumes. Infrastructure renewal programs such as Los Angeles' five-year USD 6.3 billion water initiative feed consistent aftermarket revenue for smart butterfly and plug valves.

Europe positions environmental compliance at the forefront, accelerating electrification of actuation and favoring low-leakage stem-seal systems. Nuclear life-extension projects in France and the United Kingdom contribute to severe-service valve demand, while Germany's green hydrogen corridors specify stainless valves with hydrogen permeation barriers. The Middle East and Africa leverage hydrocarbon cash flows to fund desalination and solar-powered water projects, adopting corrosion-resistant duplex butterfly valves. Latin America, though smaller, benefits from copper mining CAPEX in Chile and Peru where high-pressure slurry valves offset cyclical volatility in oil revenues.

- Emerson Electric Co.

- Flowserve Corporation

- Baker Hughes Co. (Cameron)

- Valmet (Metso)

- IMI plc

- CIRCOR International Inc.

- Christian Brkert GmbH

- Crane Co. Nuclear Division

- Neway Valve (Suzhou) Co. Ltd

- ABB Ltd

- Alfa Laval AB

- Rotork plc

- AUMA Riester GmbH

- Crane Co.

- SAMSON AG

- KSB SE and Co. KGaA

- AVK Holding A/S

- Cla-Val Co.

- Velan Inc

- Spirax-Sarco Engineering plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising investments in water and waste-water infrastructure

- 4.2.2 Modernisation of aging power and process plants

- 4.2.3 Stringent environmental regulations on emissions

- 4.2.4 Hydrogen economy scale-up requiring high-pressure valves

- 4.2.5 Digital-twin enabled predictive valve diagnostics

- 4.2.6 Growth of SMRs demanding severe-service valves

- 4.3 Market Restraints

- 4.3.1 Oil-price volatility curbing Oil and Gas CAPEX

- 4.3.2 Pricing pressure from low-cost Asian suppliers

- 4.3.3 Alloy supply-chain disruptions

- 4.3.4 Cyber-security risks in smart positioners

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Valve Type

- 5.1.1 Globe

- 5.1.2 Ball

- 5.1.3 Butterfly

- 5.1.4 Plug

- 5.1.5 Diaphragm

- 5.1.6 Other Valve Types

- 5.2 By Actuation Technology

- 5.2.1 Pneumatic

- 5.2.2 Hydraulic

- 5.2.3 Electric

- 5.2.4 Manual

- 5.3 By End-user Industry

- 5.3.1 Oil and Gas

- 5.3.2 Chemical, Petrochemical and Fertilizer

- 5.3.3 Energy and Power

- 5.3.4 Water and Waste-water Treatment

- 5.3.5 Metal and Mining

- 5.3.6 Food and Beverage

- 5.3.7 Pharmaceutical

- 5.3.8 Pulp and Paper

- 5.3.9 Other Industries

- 5.4 By Material

- 5.4.1 Steel

- 5.4.2 Cast Iron

- 5.4.3 Alloy-based

- 5.4.4 Plastic (PVC, PP, PVDF)

- 5.4.5 Other Materials

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Emerson Electric Co.

- 6.4.2 Flowserve Corporation

- 6.4.3 Baker Hughes Co. (Cameron)

- 6.4.4 Valmet (Metso)

- 6.4.5 IMI plc

- 6.4.6 CIRCOR International Inc.

- 6.4.7 Christian Brkert GmbH

- 6.4.8 Crane Co. Nuclear Division

- 6.4.9 Neway Valve (Suzhou) Co. Ltd

- 6.4.10 ABB Ltd

- 6.4.11 Alfa Laval AB

- 6.4.12 Rotork plc

- 6.4.13 AUMA Riester GmbH

- 6.4.14 Crane Co.

- 6.4.15 SAMSON AG

- 6.4.16 KSB SE and Co. KGaA

- 6.4.17 AVK Holding A/S

- 6.4.18 Cla-Val Co.

- 6.4.19 Velan Inc

- 6.4.20 Spirax-Sarco Engineering plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment