|

市场调查报告书

商品编码

1850157

甘油:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Glycerin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

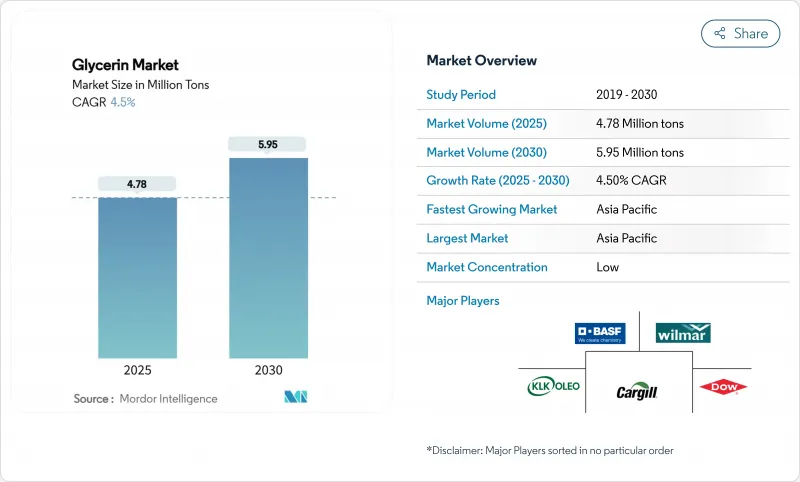

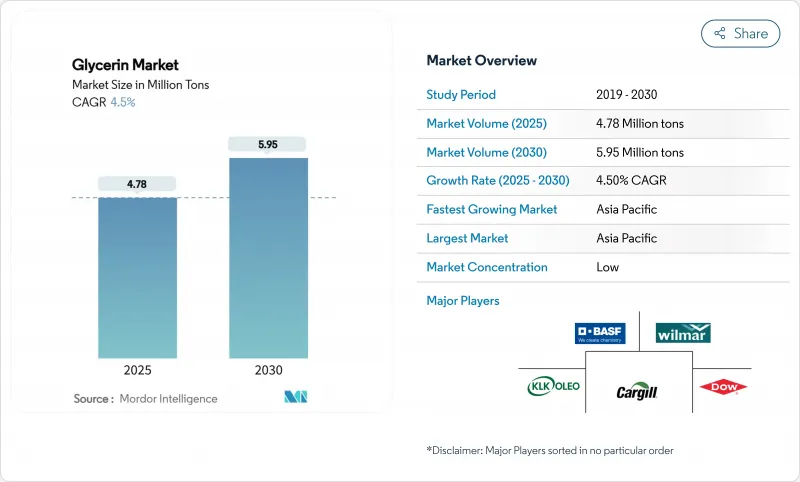

预计到 2025 年甘油市场规模为 478 万吨,到 2030 年将达到 595 万吨,预测期(2025-2030 年)复合年增长率为 4.5%。

医药级产品的应用、个人护理配方研发的蓬勃发展以及欧洲日益严格的生物基化学品法规,都在推动市场需求。生质柴油生产商与大型油脂化学公司之间的垂直整合有助于稳定原料供应,而炼油技术的进步则使规模较小的公司能够将原油提纯至精炼规格。亚太地区凭藉其庞大的製造业基础保持着定价权,而美国对生物柴油的持续投资正在形成区域性盈余,并流入出口管道。然而,甘油市场极易受到粗甘油价格波动的影响,而粗甘油价格又与生质柴油原料成本密切相关,迫使炼油商签订长期承购协议以保障利润。

全球甘油市场趋势与洞察

製药业对USP级甘油的需求迅速成长

监管机构日益严格的品质法规推动了对纯度为99.5%或更高的USP级甘油的需求。美国FDA现要求生产商确保二伸乙甘醇和乙二醇含量低于0.10%,迫使买家优先考虑完全可追溯的供应链。欧洲和亚洲的製药公司正与能够提供批次级认证的综合精炼厂签订多年供应协议,从而在这个高端市场获得更高的利润。生产线正在升级,采用先进的气相层析法系统来确保污染物控制,巩固了精製甘油作为重要辅料的地位。对于甘油市场而言,製药业的成长为其提供了一个稳固的需求支柱,该支柱在很大程度上不受生物柴油价格波动的影响。

在个人护理和化妆品行业中的使用日益增多

配方师正利用甘油的保湿功效,为洁净标示产品提供持久的肌肤保湿效果。除了简单的保湿作用外,越来越多的研究人员将甘油与神经酰胺和烟碱酰胺结合,打造出深受消费者喜爱的屏障修復系统。虽然这一趋势在亚洲最为显着,但全球品牌也在升级其传统产品线,提高天然成分的含量,使其平均含量达到3%或更高(以重量计)。精製甘油气味成分低,能够与以香氛为主的化妆品完美融合。来自美容领域的稳定需求有望抵消工业终端应用领域的周期性放缓,并增强甘油整体市场的销售稳定性。

粗甘油价格波动与生质柴油原料价格波动有关。

粗甘油价格随大豆、菜籽和废油成本波动,为炼油商的利润率带来不确定性,并使预算预测变得复杂。转向使用动物油脂会导致杂质含量升高,并迫使炼油商增加额外的精炼步骤,从而损害盈利。为了应对这种风险,主要买家正在转向与指数挂钩的合同,并采用精炼塔来适应原料品质的波动。儘管市场波动预计还将持续,但签订多年承购协议并实现原料来源多元化的公司将能够保护自身利益,并对甘油市场的长期成长保持信心。

细分市场分析

到2024年,精製甘油将占甘油市场68%的份额,预计到2030年将以每年4.9%的速度成长。这一增长反映了监管机构对污染物控制日益重视,以及个人护理和药品上市产品对符合美国药典(USP)标准的辅料的需求激增。精製甘油是精华液、乳液和注射剂必备的原料,因为其高纯度能确保产品感官特性的一致性。

同时,粗甘油作为沼气基材和藻类培养的碳源,正日益受到关注,从而实现下游收入多元化。随着薄膜过滤和离子交换技术的成熟,精炼成本逐渐降低,不同等级甘油之间的价格差距也随之缩小。

区域分析

预计亚太地区将在2024年占据甘油市场48%的份额,并保持最快增速,到2030年将以5%的复合年增长率成长。中国凭藉其大规模的生物柴油生产和庞大的个人护理用品製造地,为该地区的供需提供了有力支撑。印度在油脂化学品领域的投资以及马来西亚棕榈油生物柴油的生产能力,也增强了该地区的自给自足能力。

北美是生物燃料的主要贡献者,这得益于其成熟的生质燃料政策框架和发达的製药业。美国计划在2035年将生质燃料产量提高到130万桶/日,并且拥有丰富的原油供应。

欧洲致力于引领永续性,德国、英国、义大利和法国等国在製药、被覆剂和包装领域广泛使用精炼甘油。欧盟限制挥发性有机化合物(VOC)排放的法规正在推动以甘油基醇酸树脂取代石油树脂,而体积积层製造的实验也正在扩大小众市场的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲和欧盟製药业对USP级甘油的需求激增

- 在个人护理和化妆品行业中的应用日益广泛

- 扩大生物柴油生产

- 对低挥发性有机化合物醇酸树脂更严格的监管将增加甘油的使用(欧盟)

- 在中东、北非和东协地区,植物来源甘油在清真食品和纯素食品中的应用日益广泛。

- 市场限制

- 甘油的价格与原油价格和生质柴油原料价格的波动有关。

- 替代产品的供应情况

- 严格的药品专论限制了工业级药品的应用

- 价值链分析

- 原料分析

- 价格分析(历史数据和预测)

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按年级

- 粗甘油

- 精製甘油

- 按原料

- 生质柴油

- 脂肪酸

- 脂醇类

- 其他成分

- 透过使用

- 个人护理和化妆品

- 製药

- 食品/饮料

- 聚醚多元醇

- 醇酸树脂和表面涂料

- 烟草保湿剂

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 加勒比海岛屿

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、合资、伙伴关係)

- 市占率(%)/排名分析

- 公司简介

- ADM

- Aemetis, Inc.

- BASF

- Biodex-SA

- Cargill, Incorporated

- Dow

- Emery Oleochemicals

- Godrej Industries Group

- IOI Corporation Berhad

- Kao Corporation

- KLK OLEO

- Louis Dreyfus Company

- Munzer Bioindustrie GmbH

- Musim Mas Group

- Oleon NV

- Procter & Gamble

- Renewable Biofuels

- Thai Glycerine Co.

- Vance Group Ltd.

- Vantage Specialty Chemicals, Inc.

- Wilmar International Ltd.

第七章 市场机会与未来展望

The Glycerin Market size is estimated at 4.78 Million tons in 2025, and is expected to reach 5.95 Million tons by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

Demand is lifted by pharmaceutical grade adoption, robust personal-care formulation pipelines, and tighter European rules that encourage bio-based chemistries. Vertical integration among biodiesel producers and oleochemical majors is helping stabilize feedstock availability, while advances in purification technology enable smaller firms to upgrade crude streams to refined specifications. Asia-Pacific retains pricing power thanks to its sizable manufacturing base, and sustained biodiesel investments in the United States create regional surpluses that flow into export channels. However, the Glycerin market remains vulnerable to sharp swings in crude glycerin prices that track biodiesel feedstock costs, compelling refiners to sign long-term offtake contracts that protect margins.

Global Glycerin Market Trends and Insights

Surging Demand for USP-grade Glycerin in Pharmaceutical Industry

Tightening quality rules from regulators are boosting demand for USP-grade glycerin that consistently tests above 99.5% purity. The United States FDA now requires manufacturers to verify diethylene glycol and ethylene glycol levels below 0.10%, forcing buyers to prioritize fully traceable supply chains. European and Asian drug makers are locking in multi-year supply deals with integrated refiners that can furnish batch-level certificates, and this premium segment is capturing higher margins. Production lines are being upgraded with advanced gas chromatography systems to guarantee contaminant control, cementing refined glycerin's position as an indispensable excipient. For the Glycerin market, pharmaceutical uptake is adding a defensible demand pillar that is largely insulated from biodiesel price noise.

Increasing Use in the Personal Care and Cosmetics Industries

Formulators are leveraging glycerin's humectant capability to deliver durable skin hydration in clean-label products. Beyond simple moisturization, research laboratories are pairing glycerin with ceramides and niacinamide to build barrier-repair systems that heighten consumer appeal. The trend is strongest in Asia, but global brands are reformulating legacy lines to raise natural-origin content, lifting average inclusion rates above 3% by weight. Because refined grades carry fewer odor compounds, they integrate seamlessly into fragrance-forward cosmetics. This steady pull from beauty applications is expected to offset any cyclical slowdown in industrial end-uses, reinforcing volume stability for the overall Glycerin market.

Volatile Crude Glycerin Prices Linked to Biodiesel Feedstock Swings

Crude glycerin prices fluctuate with soybean, canola, and waste-oil costs, destabilizing refiner margins and complicating budget forecasts. Feedstock shifts toward animal fats introduce higher impurity loads, forcing additional purification steps that erode profitability. To manage the risk, large buyers are migrating to index-linked contracts and installing polishing columns that flex with variable input quality. While volatility is expected to persist, firms that lock in multi-year offtake deals and diversify feedstock sourcing can shield themselves, preserving confidence in long-term Glycerin market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Biodiesel Production

- Regulatory Push for Low-VOC Alkyd Resins

- Availability of Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Refined grades commanded 68% of the Glycerin market in 2024, and segment volume is forecast to grow 4.9% annually to 2030. The upswing reflects regulatory emphasis on contaminant control and the surge in personal-care and pharmaceutical launches that require USP-compliant excipients. Higher purity enables consistent sensory profiles, making refined glycerin indispensable in serum, lotion, and injectable formulations.

At the same time, crude glycerin is attracting interest as a biogas substrate and as a carbon feed in algae cultivation, diversifying downstream revenue. Purification costs are gradually falling as membrane filtration and ion-exchange technologies mature, narrowing the price gap between grades and inviting mid-tier producers to enter the refined arena.

The Glycerin Market Report Segments the Industry by Grade (Crude Glycerin and Refined Glycerin), Source (Biodiesel, Fatty Acids, Fatty Alcohols, and Other Sources), Application (Personal Care and Cosmetics, Pharmaceuticals, Food and Beverage, Polyether Polyols, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific led the Glycerin market with a 48% share in 2024 and is projected to register the fastest 5% CAGR to 2030. Thanks to extensive biodiesel build-outs and its sizable personal-care manufacturing hub, China anchors supply and demand. India's oleochemical investments and Malaysia's palm-based biodiesel capacity reinforce regional self-sufficiency.

North America contributes significantly, backed by its mature biofuel policy framework and sophisticated pharmaceutical sector. The United States plans to boost biofuel output to 1.3 million boepd by 2035, ensuring abundant crude glycerin flow.

Europe emphasizes sustainability leadership, with Germany, the United Kingdom, Italy, and France consuming refined glycerin in pharmaceuticals, coatings, and packaging. EU legislation limiting VOC emissions is spurring substitution of petro-resins by glycerin-based alkyds, and trials in volumetric additive manufacturing are expanding niche demand.

- ADM

- Aemetis, Inc.

- BASF

- Biodex-SA

- Cargill, Incorporated

- Dow

- Emery Oleochemicals

- Godrej Industries Group

- IOI Corporation Berhad

- Kao Corporation

- KLK OLEO

- Louis Dreyfus Company

- Munzer Bioindustrie GmbH

- Musim Mas Group

- Oleon NV

- Procter & Gamble

- Renewable Biofuels

- Thai Glycerine Co.

- Vance Group Ltd.

- Vantage Specialty Chemicals, Inc.

- Wilmar International Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for USP-grade Glycerin in Pharmaceutical industry in Asia and EU

- 4.2.2 Increasing Use in the Personal Care and Cosmetics Industries

- 4.2.3 Expansion of Biodiesel Production

- 4.2.4 Regulatory Push for Low-VOC Alkyd Resins Boosting Glycerin Usage (EU)

- 4.2.5 Rising Adoption of Vegetable-sourced Glycerin in Halal and Vegan Foods in MENA, ASEAN Region

- 4.3 Market Restraints

- 4.3.1 Volatile Crude Glycerin Prices Linked to Biodiesel Feedstock Swings

- 4.3.2 Availability Of substitutes

- 4.3.3 Stringent Pharmaceutical Monographs Limiting Technical-grade Uptake

- 4.4 Value Chain Analysis

- 4.5 Feedstock Analysis

- 4.6 Pricing Analysis (Historical and Forecast)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 Crude Glycerin

- 5.1.2 Refined Glycerin

- 5.2 By Source

- 5.2.1 Biodiesel

- 5.2.2 Fatty Acids

- 5.2.3 Fatty Alcohols

- 5.2.4 Other Sources

- 5.3 By Application

- 5.3.1 Personal Care and Cosmetics

- 5.3.2 Pharmaceuticals

- 5.3.3 Food and Beverage

- 5.3.4 Polyether Polyols

- 5.3.5 Alkyd Resins and Surface Coatings

- 5.3.6 Tobacco Humectants

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Caribbeans

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Turkey

- 5.4.5.4 South Africa

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Partnerships)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core segments, Financials, Strategic info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ADM

- 6.4.2 Aemetis, Inc.

- 6.4.3 BASF

- 6.4.4 Biodex-SA

- 6.4.5 Cargill, Incorporated

- 6.4.6 Dow

- 6.4.7 Emery Oleochemicals

- 6.4.8 Godrej Industries Group

- 6.4.9 IOI Corporation Berhad

- 6.4.10 Kao Corporation

- 6.4.11 KLK OLEO

- 6.4.12 Louis Dreyfus Company

- 6.4.13 Munzer Bioindustrie GmbH

- 6.4.14 Musim Mas Group

- 6.4.15 Oleon NV

- 6.4.16 Procter & Gamble

- 6.4.17 Renewable Biofuels

- 6.4.18 Thai Glycerine Co.

- 6.4.19 Vance Group Ltd.

- 6.4.20 Vantage Specialty Chemicals, Inc.

- 6.4.21 Wilmar International Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Rapid Uptake of Glycerin in E-cigarette Liquids in Asia and Middle-East