|

市场调查报告书

商品编码

1850169

生物润滑剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Bio-Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

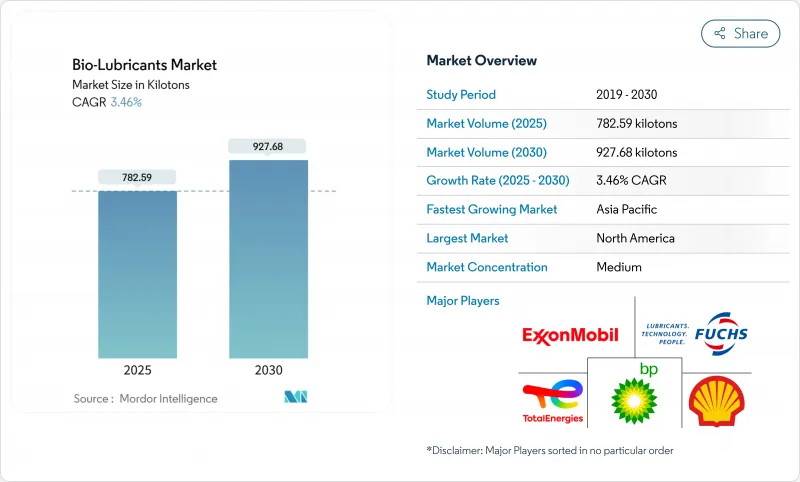

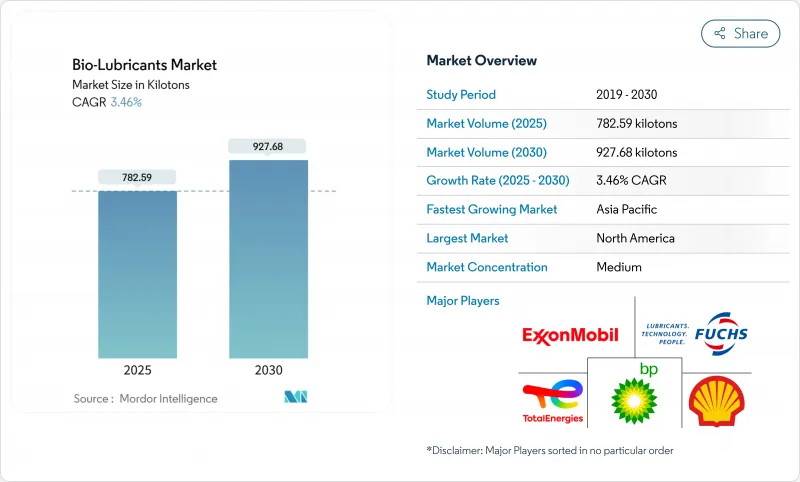

预计到 2025 年,生物润滑剂市场规模将达到 782.59 千吨,到 2030 年将达到 927.68 千吨,在预测期(2025-2030 年)内复合年增长率为 3.46%。

稳定成长反映了日益严格的环境法规、不断强化的企业永续性目标以及对高性能植物来源配方日益增长的依赖。在润滑油洩漏可能污染土壤和水源的地区,需求成长最为迅速;根据产业估计,历史上用于此类应用的石油产品中约有50%最终流入环境。目标商标产品製造商 (OEM) 正在其维修手册中正式纳入可生物降解润滑油,而离岸风力发电、林业和海洋营运商正在修订其采购政策,以避免因洩漏而受到处罚。同时,添加剂化学领域的进步,例如金属氧化物奈米颗粒包,正在提高产品的抗氧化性和热稳定性,并缩小与矿物油之间长久以来的性能差距。竞争的焦点在于规模化生产的经济效益、专有酯类化学以及能够为快速可再生的可再生能源资产提供长期供应的合作伙伴关係。

全球生物润滑剂市场趋势与洞察

严格的环境法规和强制性生态标籤

美国润滑油生态标章已发展成为永续性认证的标桿,对水生毒性、生物累积性和有害成分设定了限制,并要求其功能与矿物油等效。在美国,环保署的船舶通用许可证要求船舶在油海界面使用环境可接受润滑油(EAL),为船东开闢了一条合规性主导的采购途径。与先前的单一参数生物降解性测试不同,最新标准纳入了全生命週期生态毒性分析,加速了产品改进。监管机构已发出进一步加强监管的信号,一些亚洲司法管辖区正在製定与欧盟标准接轨的生态标籤。随着执法力度的加大,拥有第三方认证产品线的供应商在公共竞标和大型基础设施计划中获得了优先考虑,生物润滑油市场需求也被纳入长期资本预算。

可生物降解液压油的OEM规格

例如,采埃孚(ZF Friedrichshafen)推出了03H等级,专门用于符合公认环保标准的润滑油。林业收割机、建筑挖掘机和港口起重机等设备在出厂时越来越多地使用可生物降解的液压油,如果操作人员改用矿物油,则可能导致保固失效。由于每台设备都要消耗数百公升液压油,因此原始设备製造商(OEM)的采用会透过全球服务网路逐步推广,从而在设备的整个生命週期内产生持续的需求。此类规范的结构性特征稳定了消费模式,并保护生物润滑油市场免受短期商品价格波动的影响。

生物润滑剂的成本高于传统润滑剂。

酯类液压油的平均售价仍是II类矿物油基液压油的1.5至2.5倍,反映出其原料成本高、生产批量小以及添加剂配方特殊等问题。学术界一再指出,在规模经济效益改善之前,成本仍然是监管细分市场之外的关键障碍。利润率较低的终端用户,例如小型渔船队和独立经营的金属加工厂,通常会推迟采用酯类液压油,除非法律或客户合约强制要求使用可生物降解的等级。虽然随着产量增加和废油酯化技术的成熟,成本差异有望缩小,但价格仍可能对生物润滑油市场的中期复合年增长率构成压力。

细分市场分析

2024年,变速箱油和液压油占生物润滑油市场31.19%的份额,预计到2030年将以3.58%的复合年增长率成长。这一增长是生物润滑油产品类型中最大的市场份额,反映了林业收割机、港口起重机和河道疏浚船等行业严格的溢油预防法规。由于这些系统一旦发生故障就可能排放数十公升润滑油,因此营运商愿意为高生物降解性润滑油支付更高的价格,以减少清理工作量并保护敏感的湿地。添加剂的突破性进展(例如无锌抗磨化学配方)使得即使在负载变化的情况下,也能实现5000小时的换油週期,这促使原始设备製造商(OEM)将其原厂灌装润滑油更换为生物基润滑油。

润滑脂、机油和金属加工液共同构成了一个快速且多元化的丛集。润滑脂尤其受惠于离岸风力发电,因为轴承座通常位于水面以上数公尺处,洩漏路径难以监测。金属加工液在精密加工中心越来越受欢迎,其毒性较低的雾化液有助于提高工人的安全。在每个产品类别中,供应商越来越多地销售针对特定应用的配方,而不是通用的「绿色」替代品,这种策略提高了产品转换率,并巩固了长期的客户合约。

区域分析

预计到2024年,北美将以36.19%的市占率引领生物润滑油市场。美国海洋通用许可证的实施,以及加拿大先进的林业实践,确保了水道和林区内符合环保空气法(EAL)标准的设备的稳定安装。矿业公司正在矿山復垦协议中引入可生物降解的液压油,这一趋势在《北美矿业》杂誌上得到了重点报告。较高的技术水准和密集的经销商网路也进一步促进了这一转变。

亚太地区是成长最快的地区,复合年增长率达4.45%,但各国趋势不尽相同。中国正投资国内酯类生产能力和添加剂研发,以减少对进口配方的依赖。朗盛报告称,中国和东南亚的机械加工丛集对环保金属加工添加剂的需求激增。日本正将生物润滑剂的研发重心转向高精度机器人领域,而印度的农业部门则受益于可生物降解的拖拉机液压油,这种油能够防止田间污染,从而推动了农业生产的成长。中国东岸和台湾海峡沿岸的离岸风力发电电场正在采用优质生物润滑脂,以最大限度地降低其25年使用週期内的环境风险。

在欧盟生态标章计画的支持下,欧洲仍然是一个成熟且充满创新精神的市场。德国和北欧国家正在推动林业收割机和水力发电厂采用生物降解润滑剂。 2025 年在莱比锡举行的国际摩擦学与永续润滑大会重点介绍了符合循环经济目标的下一代生物降解化学品。南美洲和整个中东/非洲地区是生物降解润滑剂的早期应用区域。在巴西的风电场和墨西哥湾的海水淡化厂等跨国基础设施计划中,外国投资者正在强制执行环境、社会和治理 (ESG) 条款,要求使用生物降解润滑剂。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 严格的环境法规和生态标章要求

- 可生物降解液压油的OEM规格

- 企业净零排放与ESG采购目标

- 离岸风力发电齿轮箱对长效生物润滑脂的需求

- 来自海洋产业的需求不断成长

- 市场限制

- 生物润滑剂的成本高于传统润滑剂。

- 氧化和热稳定性限制

- 生物润滑剂有效期限

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 机油

- 传动和液压油

- 金属加工油

- 通用工业油

- 齿轮油

- 润滑脂

- 加工油

- 其他产品类型

- 按最终用户行业划分

- 发电

- 汽车和其他交通工具

- 重型机械

- 食品/饮料

- 冶金与金属加工

- 化学製造

- 其他终端用户产业

- 依基油类型

- 植物油

- 动物脂肪

- 合成酯

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Axel Christiernsson

- BP plc

- Cargill, Incorporated.

- Carl Bechem Lubricants

- Chevron Corporation

- Cortec Corporation

- Croda International plc

- Emery Oleochemicals

- Environmental Lubricants Manufacturing, Inc.

- Exxon Mobil Corporation

- FUCHS

- KCM Petro Chemicals

- Lubrication Engineers

- Novvi LLC

- Quaker Chemical Corporation

- Renewable Lubricants Inc.

- Saudi Arabian Oil Co.

- Shell plc

- TotalEnergies SE

第七章 市场机会与未来展望

The Bio-Lubricants Market size is estimated at 782.59 kilotons in 2025, and is expected to reach 927.68 kilotons by 2030, at a CAGR of 3.46% during the forecast period (2025-2030).

Steady growth reflects tightening environmental rules, stronger corporate sustainability targets, and rising confidence in high-performance, plant-derived formulations. Demand is expanding fastest where lubricant losses can contaminate soil or water, and industry estimates indicate that roughly 50% of the petroleum oil historically used in such applications eventually escapes into the environment. Original equipment manufacturers (OEMs) are formally listing biodegradable fluids in service manuals, while offshore wind, forestry, and marine operators are rewriting procurement policies to avoid penalties linked to spills. Parallel progress in additive chemistry, such as metal-oxide nanoparticle packages, has lifted oxidative and thermal stability, narrowing the historic performance gap with mineral oils. Competitive dynamics now center on scale-up economics, intellectual-property-protected ester chemistries, and partnerships that lock in long-term supply to high-growth renewable-energy assets.

Global Bio-Lubricants Market Trends and Insights

Stringent Environmental Regulations & Eco-labeling Mandates

The EU Ecolabel for lubricants has evolved into the benchmark sustainability certification, setting limits on aquatic toxicity, bioaccumulation, and hazardous components while demanding functional parity with mineral oils. In the United States, the EPA's Vessel General Permit obliges vessels to use Environmentally Acceptable Lubricants (EALs) across oil-to-sea interfaces, creating a compliance-driven purchasing lane for shipowners. Unlike earlier single-parameter biodegradability tests, modern standards incorporate full life-cycle eco-toxicity analysis, accelerating product reformulation. Regulators have signaled additional tightening, and several Asian jurisdictions are working on EU-aligned eco-label drafts. As enforcement widens, suppliers with third-party certified lines enjoy preferred status in public tenders and major infrastructure projects, embedding bio-lubricants market demand into long-term capital budgets.

OEM Specifications for Biodegradable Hydraulic Fluids

Major machinery brands now codify bio-hydraulic fluid classes inside their technical manuals; ZF Friedrichshafen, for example, introduced class 03H exclusively for lubricants certified under recognized environmental standards. Forestry harvesters, construction excavators, and port cranes increasingly ship with factory fills of biodegradable fluids, and warranty coverage can be voided if operators revert to mineral oils. Because each piece of equipment can consume several hundred liters of fluid, OEM adoption cascades through global service networks and drives repeat demand over the equipment life cycle. The structural nature of these specifications stabilizes consumption patterns and insulates the bio-lubricants market from short-term commodity price swings.

High Price of Bio-lubricants in Comparison to Conventional Lubricants

Average selling prices for ester-based hydraulic oils remain 1.5-2.5 times those of Group II mineral equivalents, reflecting higher feedstock costs, smaller batch runs, and specialized additive packages. Academic reviews reiterate that until economies of scale improve, cost remains a decisive barrier outside regulated niches. End-users with thin operating margins, such as small fishing fleets or independent metalworking shops, often delay adoption unless legislation or client contracts mandate biodegradable grades. While the cost delta is projected to narrow as production volumes climb and waste-oil-to-ester technologies mature, pricing will weigh on the bio-lubricants market CAGR over the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Net-zero & ESG Procurement Targets

- Offshore-Wind Gearbox Demand for Long-life Bio-greases

- Oxidative & Thermal Stability Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transmission and hydraulic fluids commanded 31.19% of the bio-lubricants market in 2024 and are forecast to grow at 3.58% CAGR to 2030. This advance equates to the largest slice of bio-lubricants market size among product categories and mirrors strict leakage-prevention rules in forestry harvesters, harbor cranes, and river dredgers. Because these systems can discharge dozens of liters per failure, operators willingly pay premiums for readily biodegradable grades that reduce cleanup obligations and protect sensitive wetlands. Additive breakthroughs-such as tailored zinc-free antiwear chemistries-now support 5,000-hour change intervals even under fluctuating loads, convincing OEMs to switch factory fill fluids to bio-based lines.

Greases, engine oils, and metalworking fluids together form a fast-diversifying cluster. Greases in particular benefit from offshore-wind deployments because bearing housings often sit meters above water and leak paths are hard to monitor. Metalworking fluids gain traction inside precision machining centers, where low mist toxicity enhances worker safety. Across categories, suppliers increasingly sell application-specific formulations rather than generic "green" substitutes, a strategy that bolsters switching rates and cements long-term customer contracts.

The Bio-Lubricants Market Report Segments the Industry by Product Type (Engine Oil, Transmission and Hydraulic Fluid, Metalworking Fluid, and More), End-User Industry (Power Generation, Automotive and Other Transportation, Heavy Equipment, and More), Base Oil Type (Vegetable Oils, Animal Fats and Synthetic Esters), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

North America led the bio-lubricants market with 36.19% share in 2024. Enforcement of the U.S. Vessel General Permit, combined with progressive forestry practices in Canada, ensures a stable installed base of EAL-compliant equipment across waterways and timberlands. Mining companies are retrofitting haul trucks and drills with biodegradable hydraulic fluids as part of mine-reclamation agreements, a trend profiled by North American Mining magazine. High technical literacy and dense distributor networks further ease conversions.

Asia-Pacific, the fastest-growing region at a 4.45% CAGR, shows divergent national dynamics. China invests in domestic ester capacity and additive research to reduce reliance on imported formulations. Lanxess reports surging demand for environmentally-optimized metalworking additives across Chinese and Southeast Asian machining clusters. Japan channels bio-lubricant R&D into high-precision robotics, whereas India's agriculture sector seeds volume growth via biodegradable tractor hydraulic oils that prevent field contamination. Offshore wind farms along China's eastern seaboard and Taiwan Strait are adopting premium bio-greases to minimize environmental risk during 25-year service cycles.

Europe maintains a mature but innovative market underpinned by the EU Ecolabel scheme. Germany and the Nordic nations drive uptake in forestry harvesters and hydro-electric plants. The 2025 International Conference on Tribology and Sustainable Lubrication in Leipzig spotlighted next-generation biodegradable chemistries tailored for circular-economy targets. South America and the Middle East & Africa collectively form an early-stage adoption bloc. Uptake often aligns with multinational infrastructure projects-such as Brazilian wind farms or Gulf desalination plants-where foreign investors impose ESG clauses mandating biodegradable lubricants.

- Axel Christiernsson

- BP p.l.c.

- Cargill, Incorporated.

- Carl Bechem Lubricants

- Chevron Corporation

- Cortec Corporation

- Croda International plc

- Emery Oleochemicals

- Environmental Lubricants Manufacturing, Inc.

- Exxon Mobil Corporation

- FUCHS

- KCM Petro Chemicals

- Lubrication Engineers

- Novvi LLC

- Quaker Chemical Corporation

- Renewable Lubricants Inc.

- Saudi Arabian Oil Co.

- Shell plc

- TotalEnergies SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Environmental Regulations and Eco-labeling Mandates

- 4.2.2 OEM Specifications for Biodegradable Hydraulic Fluids

- 4.2.3 Corporate Net-zero and ESG Procurement Targets

- 4.2.4 Offshore-wind Gearbox Demand for Long-life Bio-Greases

- 4.2.5 Increasing Demand from Marine Industry

- 4.3 Market Restraints

- 4.3.1 High Price of Bio lubricants in Comparison to Conventional Lubricants

- 4.3.2 Oxidative and Thermal Stability Limitations

- 4.3.3 Limited Shelf Life of Bio-Lubricants

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Hydraulic Fluid

- 5.1.3 Metalworking Fluid

- 5.1.4 General Industrial Oil

- 5.1.5 Gear Oil

- 5.1.6 Grease

- 5.1.7 Process Oil

- 5.1.8 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Power Generation

- 5.2.2 Automotive and Other Transportation

- 5.2.3 Heavy Equipment

- 5.2.4 Food and Beverage

- 5.2.5 Metallurgy and Metalworking

- 5.2.6 Chemical Manufacturing

- 5.2.7 Other End-user Industries

- 5.3 By Base Oil Type

- 5.3.1 Vegetable Oils

- 5.3.2 Animal Fats

- 5.3.3 Synthetic Esters

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Axel Christiernsson

- 6.4.2 BP p.l.c.

- 6.4.3 Cargill, Incorporated.

- 6.4.4 Carl Bechem Lubricants

- 6.4.5 Chevron Corporation

- 6.4.6 Cortec Corporation

- 6.4.7 Croda International plc

- 6.4.8 Emery Oleochemicals

- 6.4.9 Environmental Lubricants Manufacturing, Inc.

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 FUCHS

- 6.4.12 KCM Petro Chemicals

- 6.4.13 Lubrication Engineers

- 6.4.14 Novvi LLC

- 6.4.15 Quaker Chemical Corporation

- 6.4.16 Renewable Lubricants Inc.

- 6.4.17 Saudi Arabian Oil Co.

- 6.4.18 Shell plc

- 6.4.19 TotalEnergies SE

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Advancements in Technological Developments