|

市场调查报告书

商品编码

1850174

云端广告:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cloud Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

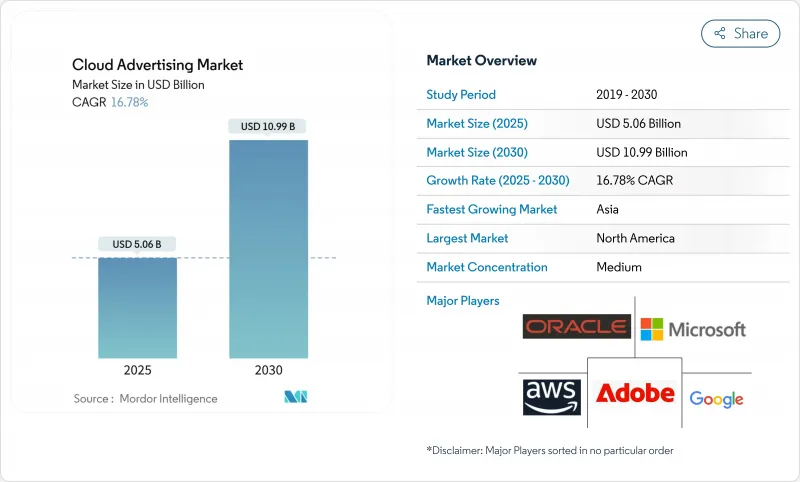

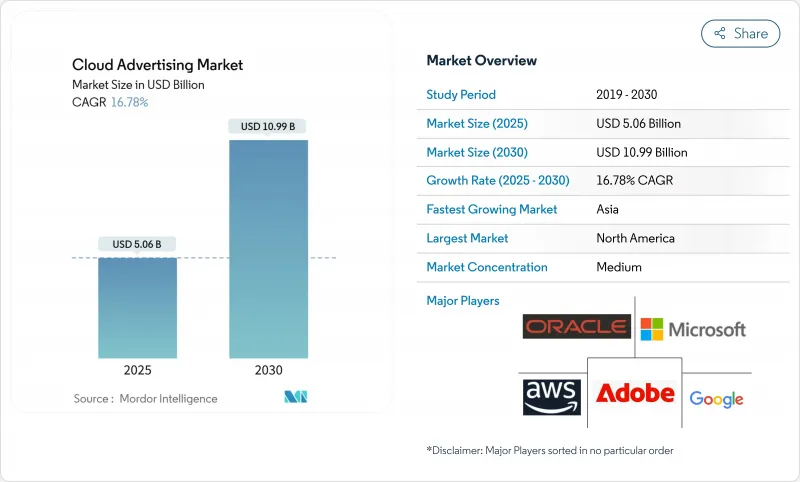

据估计,到 2025 年,云端广告市场价值将达到 50.6 亿美元,预计到 2030 年将达到 109.9 亿美元,复合年增长率为 16.8%。

随着广告商用弹性云端服务取代本地部署架构,实现毫秒竞标、即时分析和整合隐私控制,市场需求正在加速成长。每新增十亿美元流入云端工作负载,用于可观测性、加密和GPU密集型执行个体的支出也在增加,基础设施已成为直接的收入来源。管理身分图谱、创新产生和宣传活动衡量的工作负载越来越多地运行在独立或逻辑隔离的区域,促使超大规模云端服务供应商将洁净室范本和客户管理的金钥打包到预留实例服务中。如今,采购流程中行销、法务和IT部门的参与度更高,因为宣传活动的敏捷性和合规性需要在一次谈判中达成一致。

全球云端广告市场趋势与洞察

利用公共云端加速零售和媒体产业发展

一家经营大型电商平台的零售商于 2024 年将广告投放代码迁移到了公共云端。一家电商平台报告称,迁移到无伺服器 GPU 池后,Flash宣传活动的启动时间缩短了 43%,离峰时段的成本降低了两位数,从而释放了预算用于身临其境型视讯格式。按小时推送的库存感知促销活动取代了每週一次的更新週期,这表明云端运算经济正在重塑商品行销策略。

以隐私为中心的第一方资料洁净室

欧洲的 GDPR 法规持续影响架构决策。 2025 年春季,一家跨国广播公司将其受众匹配功能迁移到了一个加密的 BigQuery 资料净室,使广告商无需访问原始资料表即可衡量效果提升。如今,各大广告代理商纷纷要求为新的竞标提供类似的蓝图,这显示资料净室正逐渐成为一项预设要求,而非进阶附加元件。

云端出口费用上涨推高了整体拥有成本。

广告主发现,当广告曝光率日誌跨越多个云端平台时,资料出口费用可能会在2024年损害投资报酬率。一家欧洲游戏发行商透过将流量回传至拥有专用光纤的託管资料中心,节省了七位数的成本,且未造成任何延迟损失。如今,财务团队已将网路拓扑结构视为预算中的核心变数。

细分市场分析

混合云端广告市场预计到2030年将以24%的复合年增长率成长,凸显了品牌在不放弃敏感身分图谱的情况下对弹性运算的需求。一家全球航空公司运作了一个边缘Kubernetes集群来处理乘客名单,同时将预测任务扩展到公共区域,以实现符合GDPR的重定向和即时收益管理。由于串流媒体服务透过使用预留的GPU区块进行AV1编码,将渲染成本降低了一半,到2024年,公有云广告将维持64%的云端广告市场份额。私有云端在金融和医疗保健领域仍然非常重要,一家欧洲保险公司在将其细分模型迁移到私有OpenShift丛集后,减少了20%的监管工作量。

云端广告市场按部署类型(公共云端广告、私有云端广告、混合云端广告)、服务模式(软体即服务 (SaaS) 广告平台、广告投放的基础设施即服务 (IaaS) 及其他)、最终用户产业(零售和电子商务、媒体和娱乐及其他)以及地区进行细分。市场预测以美元计价。

区域分析

2024年,北美将占总收入的38%,这主要得益于密集的云间连接,其平均竞价竞标往返时间不到120毫秒。 2025年各州推出的隐私权法将刺激对策略即程式码工具的需求,从而使那些将合规性抽象化为声明式范本的供应商受益。

预计亚太地区将以20%的复合年增长率从2025年到2030年实现最快成长。政府对资料中心建设的激励措施、广东省的可再生能源计划以及印尼离岛的低轨道连接,将使行动广告覆盖到以前无法触及的受众群体。

欧洲面临一些最严格的隐私保护制度。一家泛欧连锁超市于2025年透过主权云端平台联合了其加密的会员ID,以少量延迟为代价换取了合规性的确定性。该地区的广告商也越来越接受这种表现的权衡,以降低监管风险。

拉丁美洲继续呈现物流投资和广告收入的良性循环:巴西履约专家将当日送达服务扩展到 55% 的都市区消费者,提高了赞助清单的点击率,并使广告收入超过了商品交易总额的增长。

中东和非洲将受惠于新建的陆地光纤线路和自主云端建设。一家海湾航空公司于2025年在其阿布达比资料中心发起了一项阿拉伯语重定向行销宣传活动,该活动显着提升了先前数位消费占比较低的市场的预订量。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 零售媒体网路采用公共云端

- 欧洲以隐私为中心的第一方资料无尘室

- 程序化影片广告的蓬勃发展刺激了亚洲对云端DSP的需求。

- 边缘AI竞标引擎需要富含GPU的IaaS。

- 生成式人工智慧创新套件推动了SaaS的普及

- 拉丁美洲中小企业电子商务发展

- 市场限制

- 云端出口费用上涨推高了整体拥有成本。

- 区域资料主权义务

- 对广告诈骗侦测延迟的担忧

- Kubernetes/DevOps人才短缺

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场规模与成长预测

- 依部署类型

- 公共云端广告

- 私有云端广告

- 混合云端广告

- 按服务模式

- 软体即服务 (SaaS) 广告平台

- 需求端平台(DSP)

- 供应端平台(SSP)

- 广告交易平台

- 广告投放的基础设施即服务 (IaaS)

- 计算最佳化实例

- GPU加速执行个体

- 边缘/内容传递网路

- 平台即服务 (PaaS) 行销中介软体

- 数据无尘室

- API管理与微服务

- AI/ML模型训练平台

- 软体即服务 (SaaS) 广告平台

- 按最终用户行业划分

- 零售与电子商务

- 媒体与娱乐

- 资讯科技与通讯

- 银行、金融服务和保险(BFSI)

- 政府和公共部门

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 策略发展

- 供应商定位分析

- 公司简介

- Adobe Inc.

- Amazon Web Services Inc.

- Google LLC

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- Salesforce Inc.

- Sprinklr Inc.

- SAP SE

- Meta Platforms Inc.

- Microsoft Advertising(Xandr)

- The Trade Desk Inc.

- InMobi Pte Ltd

- AppLovin Corporation

- PubMatic Inc.

- Criteo SA

- Magnite Inc.

- Zeta Global Holdings Corp.

- Yahoo Advertising

- Alibaba Cloud

第七章 市场机会与未来展望

The cloud advertising market size is estimated at USD 5.06 billion in 2025 and is forecast to reach USD 10.99 billion by 2030, reflecting a 16.8% CAGR.

Demand accelerates as advertisers trade on-premises stacks for elastic, AI-enabled cloud services that deliver millisecond bidding, real-time analytics, and integrated privacy controls. Each new billion flowing into cloud workloads lifts spending on observability, encryption, and GPU-rich instances, making infrastructure a direct revenue lever. Workloads that manage identity graphs, creative generation, and campaign measurement increasingly run in sovereign or logically isolated regions, pushing hyperscalers to bundle clean-room templates and customer-managed keys into reserved-instance offers. Procurement cycles now involve marketing, legal, and IT in equal measure because campaign agility and regulatory alignment have converged into one negotiation.

Global Cloud Advertising Market Trends and Insights

Public-Cloud Retail-Media Acceleration

Retailers operating large e-commerce storefronts shifted ad-serving code to public clouds in 2024. One marketplace cut flash-campaign launch times by 43% after moving to serverless GPU pools and reported double-digit off-peak cost savings, freeing budget for immersive video formats. Hourly inventory-aware promotions have replaced weekly refresh cycles, demonstrating how cloud economics reshape merchandising strategy.

Privacy-Centric First-Party Data Clean Rooms

Europe's GDPR continues to steer architecture decisions. In spring 2025, a multinational broadcaster migrated audience-matching to an encrypted BigQuery clean room, enabling advertisers to measure lift without accessing raw tables . Agencies now request similar blueprints in new tenders, indicating that clean rooms are becoming a default requirement rather than a premium add-on.

Rising Cloud Egress Fees Elevating TCO

Advertisers discovered in 2024 that data-out charges can erode ROI when impression logs traverse multiple clouds. A European gaming publisher cut seven-figure costs by repatriating traffic to a colocation facility with private fiber, without latency penalties. Finance teams now treat network topology as a core budget variable.

Other drivers and restraints analyzed in the detailed report include:

- Programmatic Video Expansion in Asia

- Edge-AI Bidding Engines

- Regional Data-Sovereignty Mandates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid-cloud advertising market size is projected to grow at a 24% CAGR through 2030, underscoring brands' need for elastic compute without relinquishing sensitive identity graphs. A global airline ran edge Kubernetes clusters for passenger-list processing while bursting forecasting tasks to public zones, enabling GDPR-compliant retargeting and real-time yield management. Public-cloud advertising retained 64% cloud advertising market share in 2024 as a streaming service halved rendering costs by using reserved GPU blocks for AV1 encoding. Private-cloud deployments remain critical in finance and healthcare, with a European insurer cutting regulatory man-hours by 20% after migrating segmentation models to a private OpenShift cluster.

Cloud Advertising Market is Segmented by Deployment Type (Public Cloud Advertising, Private Cloud Advertising, Hybrid Cloud Advertising), Service Model (Software As A Service (SaaS) Advertising Platforms, Infrastructure As A Service (IaaS) for Ad Delivery, and More), End-User Industry (Retail and ECommerce, Media and Entertainment, and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38% of 2024 revenue, supported by dense inter-cloud connectivity that keeps median bid-request round-trip below 120 ms. State-level privacy laws introduced in 2025 spurred demand for policy-as-code tooling, rewarding vendors that abstract compliance into declarative templates.

Asia-Pacific is expected to record the fastest regional growth at 20% CAGR from 2025-2030. Government incentives for data-center construction, renewable energy projects in Guangdong, and low-earth-orbit connectivity across remote Indonesian islands together extend mobile-ad reach to previously unreachable audiences.

Europe faces the strictest privacy regime. A pan-European grocery chain federated encrypted loyalty IDs through sovereign clouds in 2025, trading minor latency overhead for compliance certainty. Advertisers across the region increasingly accept such performance tradeoffs to mitigate regulatory risk.

Latin America's virtuous cycle of logistics investment and advertising revenue continues. A Brazilian fulfilment specialist extended same-day delivery to 55% of urban consumers, boosting click-through rates on sponsored listings and enabling ad revenue to outpace GMV growth.

Middle East and Africa benefit from new terrestrial fiber routes and sovereign-cloud builds. A Gulf airline's Arabic-language retargeting campaign launched from an Abu Dhabi stack in 2025 generated incremental bookings in markets that previously under-indexed on digital spend.

- Adobe Inc.

- Amazon Web Services Inc.

- Google LLC

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- Salesforce Inc.

- Sprinklr Inc.

- SAP SE

- Meta Platforms Inc.

- Microsoft Advertising (Xandr)

- The Trade Desk Inc.

- InMobi Pte Ltd

- AppLovin Corporation

- PubMatic Inc.

- Criteo SA

- Magnite Inc.

- Zeta Global Holdings Corp.

- Yahoo Advertising

- Alibaba Cloud

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Public Cloud Adoption by Retail-Media Networks

- 4.2.2 Privacy-Centric First-Party Data Clean Rooms in Europe

- 4.2.3 Programmatic Video Boom Fueling Cloud DSP Demand in Asia

- 4.2.4 Edge-AI Bidding Engines Requiring GPU-Rich IaaS

- 4.2.5 Generative-AI Creative Suites Driving SaaS Uptake

- 4.2.6 SMB eCommerce Expansion in Latin America

- 4.3 Market Restraints

- 4.3.1 Rising Cloud Egress Fees Elevating TCO

- 4.3.2 Regional Data-Sovereignty Mandates

- 4.3.3 Ad-Fraud Detection Latency Concerns

- 4.3.4 Kubernetes / DevOps Talent Shortage

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Intensity of Competitive Rivalry

- 4.6.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Type

- 5.1.1 Public Cloud Advertising

- 5.1.2 Private Cloud Advertising

- 5.1.3 Hybrid Cloud Advertising

- 5.2 By Service Model

- 5.2.1 Software as a Service (SaaS) Advertising Platforms

- 5.2.1.1 Demand-Side Platforms (DSP)

- 5.2.1.2 Supply-Side Platforms (SSP)

- 5.2.1.3 Ad Exchanges

- 5.2.2 Infrastructure as a Service (IaaS) for Ad Delivery

- 5.2.2.1 Compute-Optimized Instances

- 5.2.2.2 GPU-Accelerated Instances

- 5.2.2.3 Edge / Content Delivery Networks

- 5.2.3 Platform as a Service (PaaS) Marketing Middleware

- 5.2.3.1 Data Clean Rooms

- 5.2.3.2 API Management and Micro-services

- 5.2.3.3 AI / ML Model-Training Platforms

- 5.2.1 Software as a Service (SaaS) Advertising Platforms

- 5.3 By End-User Industry

- 5.3.1 Retail and eCommerce

- 5.3.2 Media and Entertainment

- 5.3.3 Information Technology and Telecom

- 5.3.4 Banking, Financial Services and Insurance (BFSI)

- 5.3.5 Government and Public Sector

- 5.3.6 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 South Korea

- 5.4.4.4 India

- 5.4.4.5 Australia

- 5.4.4.6 New Zealand

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Adobe Inc.

- 6.3.2 Amazon Web Services Inc.

- 6.3.3 Google LLC

- 6.3.4 Microsoft Corporation

- 6.3.5 Oracle Corporation

- 6.3.6 IBM Corporation

- 6.3.7 Salesforce Inc.

- 6.3.8 Sprinklr Inc.

- 6.3.9 SAP SE

- 6.3.10 Meta Platforms Inc.

- 6.3.11 Microsoft Advertising (Xandr)

- 6.3.12 The Trade Desk Inc.

- 6.3.13 InMobi Pte Ltd

- 6.3.14 AppLovin Corporation

- 6.3.15 PubMatic Inc.

- 6.3.16 Criteo SA

- 6.3.17 Magnite Inc.

- 6.3.18 Zeta Global Holdings Corp.

- 6.3.19 Yahoo Advertising

- 6.3.20 Alibaba Cloud

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment