|

市场调查报告书

商品编码

1850213

紫外线稳定剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)UV Stabilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

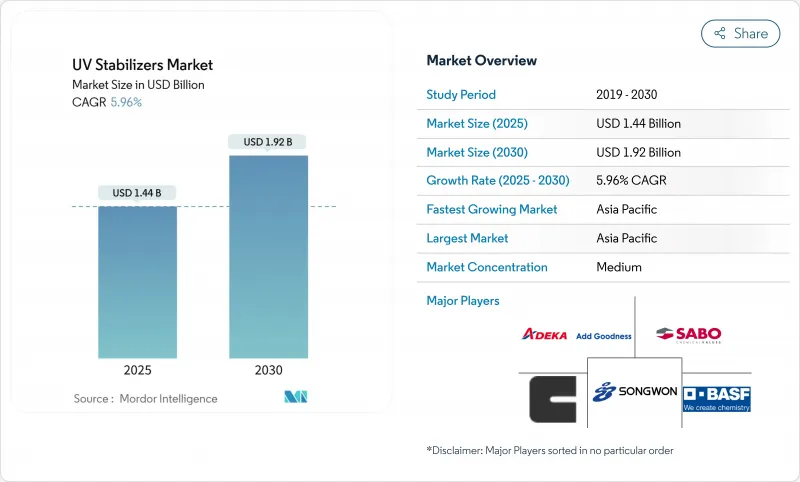

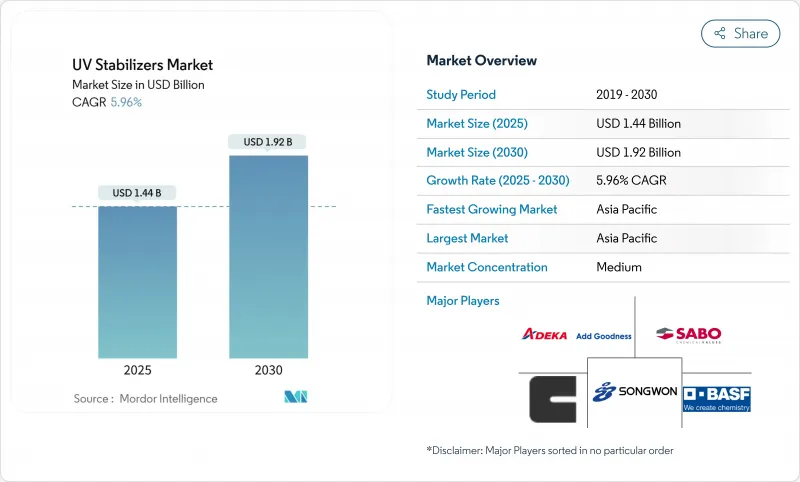

预计 2025 年紫外线稳定剂市场规模将达到 14.4 亿美元,预计到 2030 年将达到 19.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.96%。

这一增长反映出,汽车、包装和建筑应用领域对即使在阳光照射下也能保持外观和机械完整性的塑胶的需求日益增长。耐久性标准日益严格、亚太地区工业化进程迅速推进以及对永续性不断提升,这些因素促使生产商寻求生物基或生物质平衡的添加剂产品线,从而推动了塑胶市场的成长。监管方面的发展,包括2024年将UV-328列入《斯德哥尔摩公约》,正在加速塑胶再製造进程,而近期美国对特种化学品征收的关税则鼓励区域供应本地化。同时,珠状和颗粒状稳定剂以及先进的受阻胺光稳定剂(HALS)系统等快速成长的领域正在提高加工安全性、分散性和长期性能。

全球紫外线稳定剂市场趋势与洞察

抗紫外线聚烯薄膜在亚洲工业包装的快速应用

中国和印度的工业运输商正在用防紫外线聚烯薄膜取代传统的塑胶包装。受阻胺光稳定剂 (HALS) 是一种整合抗氧化剂的单粒先进包装材料,即使在高产量挤出製程中也能保持稳定的性能,因此在电子产品物流领域得到广泛应用。

欧洲转向低VOC水性木器涂料

更严格的VOC法规正促使欧洲生产商转向水性体系,这需要与水性介质相容的稳定剂。封装的紫外线吸收剂在成膜后被激活,保护户外结构免受褪色和木质素降解的影响。

原物料价格波动

地缘政治事件和石化产业重组推高了受阻胺光稳定剂(HALS)生产中关键二胺和受阻酚的成本。製造商正在寻求后向整合和提高催化製程效率,以稳定成本并保障净利率。亚洲领先的製造商纷纷宣布新增专用前驱产能,以抵销成本波动。

細項分析

受阻胺光稳定剂预计到2024年将占销售额的65%,这反映了其再生自由基清除机制,可维持聚烯在长期户外使用中的耐久性。竞争焦点正转向低色度受阻胺光稳定剂等级,例如圣莱科特国际集团的LOWILITE系列,该系列产品在保持透明度的同时,也满足严格的食品接触标准。

由于三嗪类化合物与受阻胺光稳定剂 (HALS) 具有协同作用,紫外线吸收剂细分市场发展势头强劲,尤其是在需要光学透明度的聚碳酸酯和丙烯酸树脂中。猝灭剂和抗氧化剂则瞄准了需要热稳定性和光稳定性的狭窄细分市场,例如用于照明透镜的透明苯乙烯类材料。

到 2024 年,聚烯将占销售额的 52%。更有效率的受阻胺光稳定剂 (HALS) 已将吹塑薄膜中的典型添加量从 0.25% 降低至 0.15%,且不会影响伸长率或光泽保持率。

聚氨酯的复合年增长率最高,达到 6.44%,因为其在透明涂层、密封剂和暴露于阳光下的软质发泡体中的应用日益增多。聚氯乙烯、工程塑胶和弹性体需要多种添加剂来抵抗光氧化以及热应力和化学应力。

区域分析

预计到2024年,亚太地区将占全球收益的54%,到2030年,复合年增长率将达到6.59%。三棵树与索尔维合作生产的TPO BIPV膜,经验证具有25年的耐候性,彰显了该地区的材料创新。在中国和印度,政府的激励措施进一步支持了温室气体薄膜和工业包装的生产,而日本电子产品製造商则正在指定兼顾耐用性和可回收性的下一代稳定剂。

北美排名第二,其特点是交通运输、航太和积层製造等领域的高价值应用。普渡大学的研究表明,产研合作开发了一种防紫外线喷雾,可在精密表面形成耐用涂层,延长复合材料零件的使用寿命。该地区在电动车TPO面板的应用方面也处于领先地位。

欧洲严格的化学品和永续性法规正在推动对低VOC、可回收配方的需求。 Cradle-ALP蓝图强调添加剂的循环性,挑战配方师在不牺牲产品终身耐候性的前提下,提供生物基替代品。

南美洲温室和灌溉产品市场呈现温和成长态势,主要集中在巴西和阿根廷。在中东和非洲,对保护性农膜的需求以及大型基础设施计划推动了高于平均的成长。沙乌地阿拉伯的大型温室计画为优质的多季受阻胺光稳定剂 (HALS) 包装带来了商机。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 抗紫外线聚烯薄膜在亚洲工业包装的快速应用

- 欧洲向低VOC水性木器涂料的过渡

- 北美地区耐候性3D列印塑胶的采用率不断提高

- 中东地区对紫外线稳定温室薄膜的需求激增

- 原始设备製造商对长寿命汽车外部塑胶的义务

- 市场限制

- 原物料价格波动

- HALS中间体供应链中断

- 高阻隔单层薄膜减少了对稳定剂的需求

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按类型

- 受阻胺光稳定剂(HALS)

- 紫外线吸收剂

- 猝灭剂

- 抗氧化剂

- 按最终用途行业

- 包裹

- 车

- 农业

- 建筑/施工

- 黏合剂和密封剂

- 其他最终用户产业(电气、电子等)

- 按聚合物类型

- 聚烯(PE、PP)

- PVC

- 聚氨酯

- 工程塑胶(PC、PA、PET)

- 其他(苯乙烯树脂、橡胶和弹性体)

- 按形式

- 液体

- 粉末

- 珠子/颗粒

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚洲其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- 3V Sigma SpA

- ADEKA Corporation

- Altana AG

- BASF SE

- Chitec Technology Co., Ltd.

- Clariant

- Eastman Chemical Company

- Everlight Chemical Industrial Co.

- Evonik Industries AG

- Kaneka Corporation

- Lycus Ltd. LLC

- Mayzo Inc.

- Rianlon Corporation

- SABO SpA

- SI Group Inc.

- Solvay

- Songwon

- SUQIAN UNITECH CORP..LTD

- Tianjin Baofeng Chemical Co., Ltd.

- Wanhua

第七章 市场机会与未来展望

The UV Stabilizers Market size is estimated at USD 1.44 billion in 2025, and is expected to reach USD 1.92 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

The expansion reflects rising demand for plastics that retain appearance and mechanical integrity when exposed to sunlight in automotive, packaging, and construction settings. Growth is reinforced by stricter durability standards, rapid industrialization in Asia-Pacific, and mounting sustainability expectations that push producers toward bio-based or biomass-balanced additive lines. Regulatory momentum - including the 2024 listing of UV-328 under the Stockholm Convention - is accelerating reformulation, while recent US tariffs on specialty chemicals are prompting regional supply localization. Concurrently, fast-growing segments such as bead- or granule-form stabilizers and advanced HALS systems are improving processing safety, dispersion, and long-term performance.

Global UV Stabilizers Market Trends and Insights

Rapid Penetration of UV-Stable Polyolefin Films in Asia's Industrial Packaging

Industrial shippers in China and India are replacing conventional wraps with UV-protected polyolefin films that cut material use by up to 15% while extending shelf life. Advanced HALS packages integrated with antioxidants in single-pellet form ensure consistent performance during high-throughput extrusion, leading to broader adoption in electronics logistics.

Shift Toward Low-VOC, Water-Borne Wood Coatings in Europe

Stringent VOC rules are moving European producers toward waterborne systems that need stabilizers compatible with aqueous media. Encapsulated UV absorbers activate after film formation, preventing colour fade and lignin breakdown in outdoor structures, a technology highlighted in recent launches for exterior decking.

Volatility in Feedstock Prices

Geopolitical events and petrochemical realignments have lifted the cost of key diamines and hindered phenols used in HALS production. Manufacturers are pursuing backward integration and catalytic process efficiencies to stabilize costs and protect margins, with one leading Asian producer announcing new on-purpose precursor capacity to offset volatility.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Weather-Resistant 3D-Printed Plastics in North America

- Surge in UV-Stabilized Greenhouse Films Across the Middle East

- Supply-Chain Disruptions of HALS Intermediates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hindered amine light stabilizers account for 65% of 2024 revenue, reflecting their regenerative radical-scavenging mechanism that sustains polyolefin durability over extended outdoor service. Competitive focus has shifted to low-colour HALS grades that maintain clarity while meeting stringent food-contact norms, typified by SI Group's LOWILITE series.

The UV absorbers sub-segment is accelerating as triazine chemistries pair synergistically with HALS, particularly in polycarbonate and acrylic systems that demand optical clarity. Quenchers and antioxidants target narrower niches where thermal-light stability is required simultaneously, such as clear styrenics for lighting lenses.

Polyolefins secured 52% of revenue in 2024. Higher-efficiency HALS has reduced typical loading from 0.25% to 0.15% in blown film without compromising retention of elongation or gloss.

Polyurethanes post the highest CAGR at 6.44% on rising use in clear coats, sealants, and flexible foams exposed to sunlight. PVC, engineering plastics, and elastomers round out the demand profile, each requiring tailored multi-additive packages that address photo-oxidation alongside thermal or chemical stresses.

The UV Stabilizers Market Report Segments the Industry by Type (Hindered Amine Light Stabilizers (HALS), UV Absorbers, Quenchers, and More), End-User Industry (Packaging, Automotive, Agriculture, and More), Polymer Type (Polyolefins, PVC, Polyurethane, and More), Form (Liquid, Powder, and Bead/Granule), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific controlled 54% of 2024 revenue and is forecast for a 6.59% CAGR to 2030, propelled by accelerating automotive builds, infrastructure expansion, and photovoltaic roofing adoption. A collaboration between 3TREES and Solvay produced a TPO BIPV membrane demonstrating 25-year weathering, highlighting regional material innovation. Government incentives in China and India further underpin greenhouse film and industrial packaging volumes, while Japanese electronics majors specify next-generation stabilizers that balance durability with recycling compatibility.

North America ranks second, characterised by high-value applications in transportation, aerospace and additive manufacturing. Research at Purdue University produced a UV-protectant spray that forms a durable film on sensitive surfaces, illustrating academic-industry collaboration to extend service life for composite parts. The region also leads in electric-vehicle TPO fascia adoption.

Europe's stringent chemical and sustainability legislation steers demand toward low-VOC, recyclable formulations. The Cradle-ALP roadmap underscores additive circularity, pressuring formulators to deliver bio-based alternatives without sacrificing lifetime weatherability.

South America shows moderate expansion concentrated in Brazilian and Argentine greenhouse and irrigation products. In the Middle East and Africa, protected-agriculture film demand and big-ticket infrastructure projects fuel above-average growth; Saudi Arabia's large-scale greenhouse initiatives typify the opportunity for premium multi-season HALS packages.

- 3V Sigma S.p.A.

- ADEKA Corporation

- Altana AG

- BASF SE

- Chitec Technology Co., Ltd.

- Clariant

- Eastman Chemical Company

- Everlight Chemical Industrial Co.

- Evonik Industries AG

- Kaneka Corporation

- Lycus Ltd. LLC

- Mayzo Inc.

- Rianlon Corporation

- SABO S.p.A.

- SI Group Inc.

- Solvay

- Songwon

- SUQIAN UNITECH CORP..LTD

- Tianjin Baofeng Chemical Co., Ltd.

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Penetration of UV-Stable Polyolefin Films in Asia's Industrial Packaging

- 4.2.2 Shift Toward Low-VOC, Water-Borne Wood Coatings in Europe

- 4.2.3 Growing Adoption of Weather-Resistant 3D-Printed Plastics in North America

- 4.2.4 Surge in UV-Stabilized Greenhouse Films Across the Middle East

- 4.2.5 OEM Mandates for Long-Life Exterior Automotive Plastics

- 4.3 Market Restraints

- 4.3.1 Volatility in Feedstock Prices

- 4.3.2 Supply-Chain Disruptions of HALS Intermediates

- 4.3.3 Adoption of High-Barrier Monolayer Films Reducing Need for Stabilizers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Hindered Amine Light Stabilizers (HALS)

- 5.1.2 UV Absorbers

- 5.1.3 Quenchers

- 5.1.4 Antioxidants

- 5.2 By End-Use Industry

- 5.2.1 Packaging

- 5.2.2 Automotive

- 5.2.3 Agriculture

- 5.2.4 Building and Construction

- 5.2.5 Adhesives and Sealants

- 5.2.6 Other End-user Industries (Electrical and Electronics, etc.)

- 5.3 By Polymer Type

- 5.3.1 Polyolefins (PE, PP)

- 5.3.2 PVC

- 5.3.3 Polyurethane

- 5.3.4 Engineering Plastics (PC, PA, PET)

- 5.3.5 Others (Styrenics and Rubber and Elastomers)

- 5.4 By Form

- 5.4.1 Liquid

- 5.4.2 Powder

- 5.4.3 Bead / Granule

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3V Sigma S.p.A.

- 6.4.2 ADEKA Corporation

- 6.4.3 Altana AG

- 6.4.4 BASF SE

- 6.4.5 Chitec Technology Co., Ltd.

- 6.4.6 Clariant

- 6.4.7 Eastman Chemical Company

- 6.4.8 Everlight Chemical Industrial Co.

- 6.4.9 Evonik Industries AG

- 6.4.10 Kaneka Corporation

- 6.4.11 Lycus Ltd. LLC

- 6.4.12 Mayzo Inc.

- 6.4.13 Rianlon Corporation

- 6.4.14 SABO S.p.A.

- 6.4.15 SI Group Inc.

- 6.4.16 Solvay

- 6.4.17 Songwon

- 6.4.18 SUQIAN UNITECH CORP..LTD

- 6.4.19 Tianjin Baofeng Chemical Co., Ltd.

- 6.4.20 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Nano-composites in UV Stabilizers