|

市场调查报告书

商品编码

1850214

汽车煞车系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Brake System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

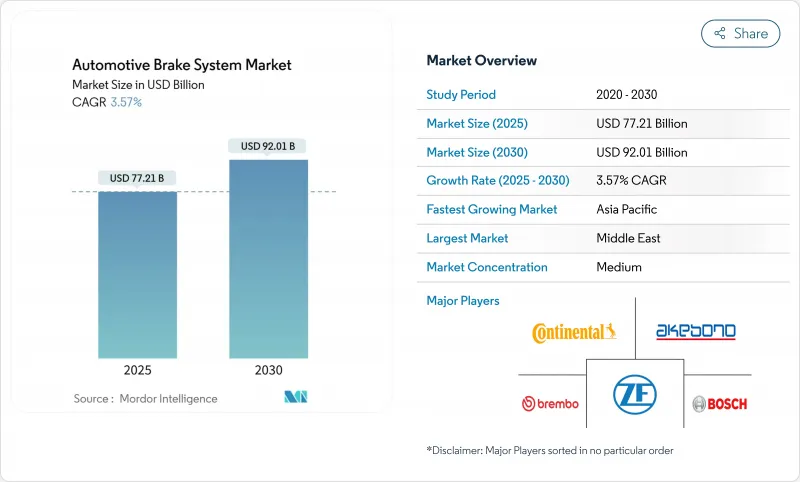

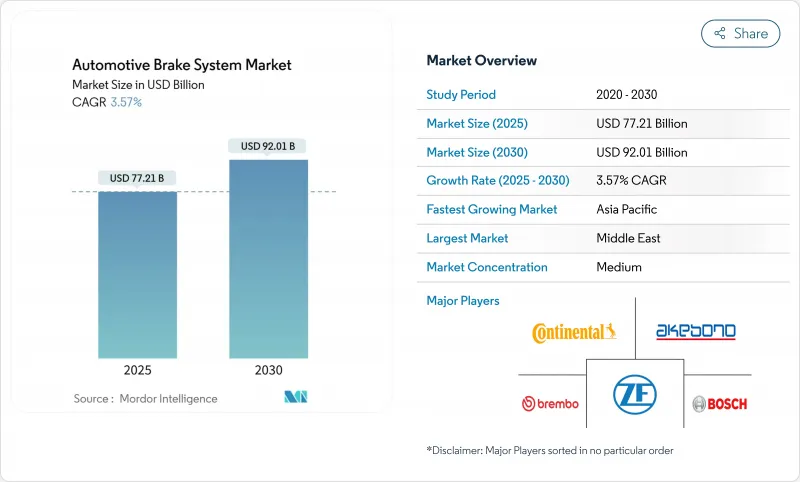

预计到 2025 年,汽车煞车系统市场规模将达到 772.1 亿美元,到 2030 年将达到 920.1 亿美元,年复合成长率为 3.57%。

市场成长反映了从纯液压系统向电子控制架构的稳定转变,这种架构能够协调软体定义车辆中的防锁死、稳定性控制和能量回收功能。亚太地区透过大规模电动车生产和电子煞车组件外包来支撑需求,而中东地区则在车辆现代化政策和基础设施投资的共同作用下实现了最快速的成长。轻型商用车业者也透过预测性维护计画来减少非计画性停机时间,从而促进售后市场销售。

全球汽车煞车系统市场趋势与洞察

快速电气化推动了再生煞车硬体的发展

由于电动车的布局会将更大的煞车扭力施加在牵引马达上,因此摩擦系统必须与软体控制的能量回收系统无缝同步。由Tevva和ZF共同开发的这套能量回收套件,其能量回收量是标准空气煞车的四倍,可将7.5吨卡车的续航里程延长至140英里。在梅赛德斯-奔驰的原型车中,煞车单元嵌入在电力驱动装置外壳内,从而避免了易生锈的硬件,并减少了颗粒物排放。爱信的协调能量回收系统进一步优化了液压煞车和马达煞车之间的平衡,确保车辆在各种负载条件下都能保持稳定性。

ADAS技术的日益普及推动了对线控刹车的需求。

2+级援助和计画中的4级自动驾驶需要毫秒级的反应速度,而液压连桿无法保证这一点。博世即将推出的液压线控刹车平台取消了机械踏板路径,同时保留了双油路以实现冗余。采埃孚的机电煞车技术已获得近500万辆汽车的预订,该技术将整合式煞车控制与软体定义的底盘模组相结合。半导体层也正在效仿:瑞萨电子的R-Car X5H晶片系统采用硬体隔离来保护安全关键的煞车区域。

稀土价格波动推高了电子煞车致动器的成本。

美国能源局已将钕、镨、镝和铽列为关键材料,这些材料的加工高度集中于中国,使得线控刹车致动器面临价格波动的风险。儘管供应商正在努力实现磁性材料化学成分的多元化,并探索非磁性马达的替代方案,但汽车煞车系统市场短期内仍将面临成本压力。

细分市场分析

到2024年,碟式煞车将占汽车煞车系统销量的63.10%,凭藉其热稳定性,将成为乘用车和轻型卡车的首选。预计到2030年,电动驻煞车系统的汽车煞车系统市场规模将成长5.22%,这主要得益于节省空间和电子整合以完善高级驾驶辅助系统(ADAS)。 Brake India将于2024年率先与全球汽车製造商合作推出电动驻车煞车,这标誌着新兴市场将以成本优化的方式采用该技术。鼓式煞车将继续用于对成本较为敏感的后轴,而能量回收模组将在纯电动车中占据更大的份额。

这款源自NASA的轻量化煞车碟盘,现已授权给Orbis Brakes公司使用,可将簧下品质降低42%,并透过扇形通风口提升散热性能。这款创新链正助力汽车煞车系统市场在不牺牲现有产品销售的前提下,采用新一代材料。

到2024年,防锁死系统(ABS)将占据45.10%的市场份额,成为安全系统的核心。然而,电子稳定控制系统(ESC)正以8.65%的复合年增长率增长,并且在许多地区已成为强制性配置,这使其能够迅速缩小与ABS的差距。大陆集团计划在2024年在印度生产超过100万套电子煞车系统(EBD),展现出其可扩展的经济效益。牵引力控制系统(TCS)和电子煞车力道分配系统(EBD)相辅相成,分别优化牵引力和负载平衡。

Brembo 的人工智慧控制器将于 2024 年底推出,它能在车轮锁死前预测抓地力丧失,证实了软体在曾经的硬体竞争中已成为决定性因素。因此,汽车煞车系统市场正持续从零件供应转向演算法主导的性能提升。

到2024年,液压驱动系统将占总收入的66.25%,这主要得益于其稳固的供应链和服务基础设施。然而,预计年复合成长率将达到9.50%的线控刹车解决方案,能够满足自动驾驶车辆对延迟的要求。博斯的液压线控刹车混合动力系统无需机械踏板,同时保留了冗余的液压迴路,为谨慎的原始设备製造商(OEM)提供了一个可行且先进的解决方案。气动系统已广泛应用于重型卡车,而机械电缆系统则仍处于成本限制的细分市场。

采埃孚轻型商用车的订单量证实了纯电子机械煞车系统的商业性可行性。汽车煞车系统市场的两条发展路径——渐进式混合动力和革命性的线传——允许在不影响现有生产布局的情况下进行逐步投资。

区域分析

2024年,亚太地区将占总销售额的58.55%,这主要得益于中国电动车的推广和印度电子组装规模的扩大。光是大陆集团一家,2024年就在印度生产了超过100万套电子煞车系统。诸如Brakes India-ADVICS等本地合资企业也提升了印度的本土技术能力。

欧洲正在推动市场对电动车的需求日益成熟且有利,这得益于粒状物排放上限和电子稳定维修。欧盟7排放基准值(7毫克/公里)将于2025年中期生效,这将加速无铜材料和低阻力卡钳的普及。北欧国家也将迎来强劲成长,年复合成长率将达到5%,因为电动车的普及推动了能源回收系统的发展。

到2030年,中东地区将以8.90%的复合年增长率引领区域成长,这主要得益于沙乌地阿拉伯的「2030愿景」基础设施规划和阿联酋的交通运输多元化发展。非洲紧随其后,年复合成长率将达到6.90%,这主要得益于南非和埃及不断壮大的组装中心。北美市场正以4.5%的速度成长,老旧的液压系统正被现代技术取代。光是在马科姆县,到2024年,煞车相关产品的销售额就可能达到1.003亿美元。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速电气化推动再生煞车硬体的转型

- ADAS技术的日益普及将推动对线控刹车架构的需求。

- 严格的美国FMVSS 126和UNECE R140法规推动了ABS/ESC的安装

- 新冠疫情后电子商务激增,扩大了轻型商用车煞车售后市场。

- 加速全球纯电动车生产需要低粉尘、无铜摩擦材料。

- 延长原厂保固期推动了长寿命陶瓷垫片配方的应用

- 市场限制

- 稀土元素价格波动推高电子煞车致动器成本

- 欧盟高等级钢转子供应链出现瓶颈

- 减少再生煞车磨损可降低售后垫片销量

- 柴油商用车产量下降导致对气动煞车的需求减少

- 价值链分析

- 监理展望

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争的激烈程度

第五章 市场规模与成长预测

- 依产品类型

- 碟煞

- 鼓式煞车

- 电动驻煞车系统

- 再生煞车模组

- 透过技术

- 防锁死煞车系统(ABS)

- 电子稳定控制系统(ESC)

- 牵引力控制系统(TCS)

- 电子煞车力道分配(EBD)

- 透过操作机制

- 油压

- 气压

- 电磁式/线控刹车

- 机械式(电缆式)

- 按组件

- 煞车皮和煞车蹄

- 卡尺

- 转子和滚筒

- 煞车增压器和主缸

- 电控系统和致动器

- 按垫片材质

- 有机(不含石棉)

- 类金属

- 金属

- 陶瓷製品

- 按销售管道

- 原始设备製造商 (OEM)

- 售后市场

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 重型商用车辆和巴士

- 透过推广

- 内燃机(ICE)车辆

- 混合动力电动车(HEV/PHEV)

- 电池电动车(BEV)

- 燃料电池电动车(FCEV)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、合资、产品发布)

- 市占率分析

- 公司简介

- Continental AG

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Brembo SpA

- Akebono Brake Industry Co. Ltd

- Aisin Corporation

- ADVICS Co. Ltd

- Knorr-Bremse AG

- Hyundai Mobis Co. Ltd

- Mando Corporation

- Federal-Mogul Motorparts(Tenneco)

- Hitachi Astemo, Ltd.

- WABCO(ZF CVS)

- Meritor Inc.

- Nissin Kogyo Co. Ltd

- Bendix Commercial Vehicle Systems

- Aptiv PLC

- Haldex AB

- Hella Pagid GmbH

- Carlisle Brake & Friction

第七章 市场机会与未来展望

The automotive brake system market stood at USD 77.21 billion in 2025 and is forecast to reach USD 92.01 billion by 2030, advancing at a 3.57% CAGR.

The market's growth reflects a steady migration from purely hydraulic setups toward electronically governed architectures that coordinate anti-lock, stability, and regenerative functions in software-defined vehicles. Asia Pacific anchors demand through large-scale electric-vehicle (EV) production and outsourcing of electronic brake assemblies, while the Middle East records the quickest expansion as fleet-modernization policies intersect with infrastructure spending. Technology vendors concentrate on brake-by-wire and low-dust friction materials to comply with UNECE R140 and Euro 7 particulate limits, and light commercial vehicle (LCV) operators lift aftermarket volumes via predictive maintenance programs that cut unplanned downtime.

Global Automotive Brake System Market Trends and Insights

Rapid Electrification Driving Regenerative-Compatible Brake Hardware

Electric-vehicle layouts place more braking torque on traction motors, so friction systems must synchronize seamlessly with software-managed energy recovery. A regenerative kit co-developed by Tevva and ZF captures up to four times more energy than standard air brakes, extending a 7.5-ton truck's range to 140 miles. Mercedes-Benz prototypes embed the brake unit inside the e-drive housing, eliminating rust-prone hardware and reducing particulate emissions. Aisin's cooperative regenerative system further balances hydraulic and motor braking to maintain vehicle stability under all load states.

Heightened ADAS Penetration Raising Demand for Brake-by-Wire

Level-2+ assistance and planned Level-4 autonomy require millisecond actuation that hydraulic linkages cannot guarantee. Bosch's upcoming hydraulic brake-by-wire platform removes mechanical pedal paths yet retains dual fluid circuits for redundancy. ZF has already booked almost 5 million vehicles for its electro-mechanical brake technology that combines integrated brake control and software-defined chassis modules. The semiconductor layer follows suit: Renesas' R-Car X5H system-on-chip uses hardware isolation to protect safety-critical braking domains.

Volatility in Rare-Earth Prices Inflating Electronic Brake Actuator Costs

The U.S. Department of Energy lists neodymium, praseodymium, dysprosium, and terbium as critical materials with concentrated processing in China, exposing brake-by-wire actuators to price swings. Suppliers are diversifying magnet chemistries and seeking non-magnetic motor alternatives, yet near-term cost pressures persist across the automotive brake system market.

Other drivers and restraints analyzed in the detailed report include:

- Stricter FMVSS 126 & UNECE R140 Mandates Boosting ABS/ESC Installations

- Post-COVID E-commerce Surge Increasing LCV Brake Aftermarket

- Reduced Wear in Regenerative Braking Curtailing Aftermarket Pad Revenues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disc brakes accounted for 63.10% of 2024 revenue, their thermal stability keeping them the default choice in passenger cars and light trucks. The automotive brake system market size for electric parking brakes is projected to expand 5.22% by 2030, driven by space savings and electronic integration that complements ADAS. Brakes India introduced its first electric park brake with a global OEM in 2024, signaling cost-optimized uptake in emerging markets. Drum brakes continue on rear axles where cost is king, while regenerative modules carve a share in battery electric vehicles.

NASA-derived lightweight rotors, now licensed to Orbis Brakes, lower unsprung mass by 42% and improve cooling via wave-shaped vents, an innovation likely to debut in high-performance EVs where every kilogram matters. This cascade of innovations helps the automotive brake system market embrace next-generation materials without sacrificing legacy volumes.

Anti-lock systems held 45.10% market share in 2024, anchoring the safety stack. Electronic stability control, however, is growing at 8.65% CAGR and is already mandated in many regions, positioning it to narrow the gap swiftly. Continental produced more than 1 million electronic brake systems in India during 2024, illustrating scalable economics. TCS and EBD remain complementary, optimizing traction and load balance respectively.

Artificial-intelligence layers are now enhancing classical ABS; Brembo's AI-enabled controller launched in late 2024 anticipates grip losses before wheel lock, confirming that software will differentiate what once was a hardware race. As a result, the automotive brake system market continues to pivot from component supply toward algorithm-driven performance gains.

Hydraulic actuation generated 66.25% of 2024 revenue as its supply chain and service base remain entrenched. Yet brake-by-wire solutions, forecast at a 9.50% CAGR, address autonomous-vehicle latency standards. Bosch's hydraulic brake-by-wire hybrid keeps fluid pathways for redundancy while removing mechanical pedals, offering an evolutionary step for cautious OEMs. Pneumatic systems hold in heavy trucks, and mechanical cables survive in cost-constrained niches.

ZF's bookings for light vehicles confirm the commercial viability of pure electro-mechanical brakes. For the automotive brake system market, this dual track, evolutionary hybrids and revolutionary by-wire, permits staged investment without disrupting existing manufacturing footprints.

The Automotive Brake System Market Report is Segmented by Vehicle Type (Passenger Cars and More), Product Type (Disc Brakes and More), Technology (Anti-Lock Braking System (ABS) and More), Actuation Mechanism (Hydraulic and More), Component (Brake Pads & Shoes and More), Pad Material (Organic and More), Sales Channel, Propulsion, and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific held 58.55% of 2024 revenue, fueled by China's EV rollout and India's electronics assembly scale. Continental alone produced more than 1 million electronic brake systems in India during 2024. Local joint ventures, such as Brakes India-ADVICS, reinforce indigenous technology capability.

Europe contributes mature yet lucrative demand stemming from mandated particulate caps and rapid ESC retrofits. Euro 7's 7 mg/km brake-dust threshold, effective mid-2025, accelerates copper-free material adoption and low-drag calipers. Nordic nations also post a robust 5% CAGR as EV penetration fosters regenerative-ready systems.

The Middle East leads regional growth at an 8.90% CAGR through 2030, powered by Vision 2030 infrastructure programs in Saudi Arabia and transport diversification in the UAE. Africa follows at 6.90% due to growing assembly hubs in South Africa and Egypt. North America advances at 4.5% as technology refresh cycles replace legacy hydraulic setups; Macomb County alone tallied USD 100.3 million in brake-specific sales in 2024

- Continental AG

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Brembo S.p.A

- Akebono Brake Industry Co. Ltd

- Aisin Corporation

- ADVICS Co. Ltd

- Knorr-Bremse AG

- Hyundai Mobis Co. Ltd

- Mando Corporation

- Federal-Mogul Motorparts (Tenneco)

- Hitachi Astemo, Ltd.

- WABCO (ZF CVS)

- Meritor Inc.

- Nissin Kogyo Co. Ltd

- Bendix Commercial Vehicle Systems

- Aptiv PLC

- Haldex AB

- Hella Pagid GmbH

- Carlisle Brake & Friction

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Electrification Driving Shift to Regenerative-Compatible Brake Hardware

- 4.2.2 Heightened ADAS Penetration Raising Demand for Brake-by-Wire Architectures

- 4.2.3 Stricter U.S. FMVSS 126 & UNECE R140 Mandates Boosting ABS/ESC Installations

- 4.2.4 Post-COVID E-commerce Surge Increasing LCV Brake Aftermarket

- 4.2.5 Accelerating Global BEV Production Necessitating Low-Dust, Copper-Free Friction Materials

- 4.2.6 OEM Warranty Extensions Driving Adoption of Long-Life Ceramic Pad Formulations

- 4.3 Market Restraints

- 4.3.1 Volatility in Rare-earth Prices Inflating Electronic Brake Actuator Costs

- 4.3.2 Supply-chain Bottlenecks for High-grade Steel Rotors in EU

- 4.3.3 Reduced Wear in Regenerative Braking Curtailing Aftermarket Pad Revenues

- 4.3.4 Declining Diesel CV Production Dampening Pneumatic Brake Demand

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Product Type

- 5.1.1 Disc Brakes

- 5.1.2 Drum Brakes

- 5.1.3 Electric Parking Brakes

- 5.1.4 Regenerative Braking Modules

- 5.2 By Technology

- 5.2.1 Anti-lock Braking System (ABS)

- 5.2.2 Electronic Stability Control (ESC)

- 5.2.3 Traction Control System (TCS)

- 5.2.4 Electronic Brake-force Distribution (EBD)

- 5.3 By Actuation Mechanism

- 5.3.1 Hydraulic

- 5.3.2 Pneumatic

- 5.3.3 Electromagnetic / Brake-by-Wire

- 5.3.4 Mechanical (Cable)

- 5.4 By Component

- 5.4.1 Brake Pads & Shoes

- 5.4.2 Calipers

- 5.4.3 Rotors & Drums

- 5.4.4 Brake Boosters & Master Cylinders

- 5.4.5 Electronic Control Units & Actuators

- 5.5 By Pad Material

- 5.5.1 Organic (Non-Asbestos)

- 5.5.2 Semi-Metallic

- 5.5.3 Metallic

- 5.5.4 Ceramic

- 5.6 By Sales Channel

- 5.6.1 Original Equipment Manufacturers (OEM)

- 5.6.2 Aftermarket

- 5.7 By Vehicle Type

- 5.7.1 Passenger Cars

- 5.7.2 Light Commercial Vehicles

- 5.7.3 Heavy Commercial Vehicles & Buses

- 5.8 By Propulsion

- 5.8.1 Internal Combustion Engine (ICE) Vehicles

- 5.8.2 Hybrid Electric Vehicles (HEV/PHEV)

- 5.8.3 Battery Electric Vehicles (BEV)

- 5.8.4 Fuel-Cell Electric Vehicles (FCEV)

- 5.9 By Geography

- 5.9.1 North America

- 5.9.1.1 United States

- 5.9.1.2 Canada

- 5.9.1.3 Rest of North America

- 5.9.2 South America

- 5.9.2.1 Brazil

- 5.9.2.2 Argentina

- 5.9.2.3 Rest of South America

- 5.9.3 Europe

- 5.9.3.1 Germany

- 5.9.3.2 United Kingdom

- 5.9.3.3 France

- 5.9.3.4 Italy

- 5.9.3.5 Spain

- 5.9.3.6 Rest of Europe

- 5.9.4 Asia Pacific

- 5.9.4.1 China

- 5.9.4.2 India

- 5.9.4.3 Japan

- 5.9.4.4 South Korea

- 5.9.4.5 Rest of Asia Pacific

- 5.9.5 Middle East and Africa

- 5.9.5.1 Saudi Arabia

- 5.9.5.2 United Arab Emirates

- 5.9.5.3 Turkey

- 5.9.5.4 South Africa

- 5.9.5.5 Egypt

- 5.9.5.6 Rest of Middle East and Africa

- 5.9.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JV, Product Launches)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Continental AG

- 6.4.2 Robert Bosch GmbH

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Brembo S.p.A

- 6.4.5 Akebono Brake Industry Co. Ltd

- 6.4.6 Aisin Corporation

- 6.4.7 ADVICS Co. Ltd

- 6.4.8 Knorr-Bremse AG

- 6.4.9 Hyundai Mobis Co. Ltd

- 6.4.10 Mando Corporation

- 6.4.11 Federal-Mogul Motorparts (Tenneco)

- 6.4.12 Hitachi Astemo, Ltd.

- 6.4.13 WABCO (ZF CVS)

- 6.4.14 Meritor Inc.

- 6.4.15 Nissin Kogyo Co. Ltd

- 6.4.16 Bendix Commercial Vehicle Systems

- 6.4.17 Aptiv PLC

- 6.4.18 Haldex AB

- 6.4.19 Hella Pagid GmbH

- 6.4.20 Carlisle Brake & Friction

7 Market Opportunities & Future Outlook

- 7.1 Integration of IoT & Predictive Maintenance Platforms

- 7.2 Next-Gen Solid-state Brake-by-Wire for Level-4 Autonomy

- 7.3 Copper-free Pad Mandates Creating Material Innovation Space

- 7.4 Lightweight Carbon-Ceramic Discs for High-Performance EVs