|

市场调查报告书

商品编码

1850237

微波装置:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Microwave Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

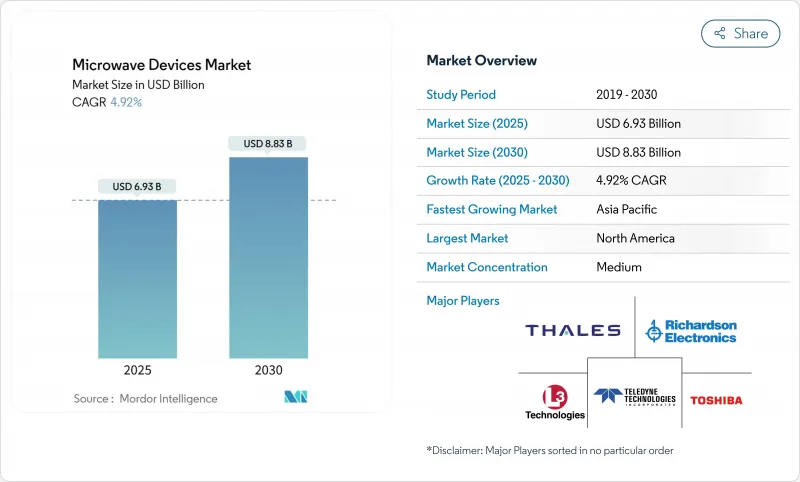

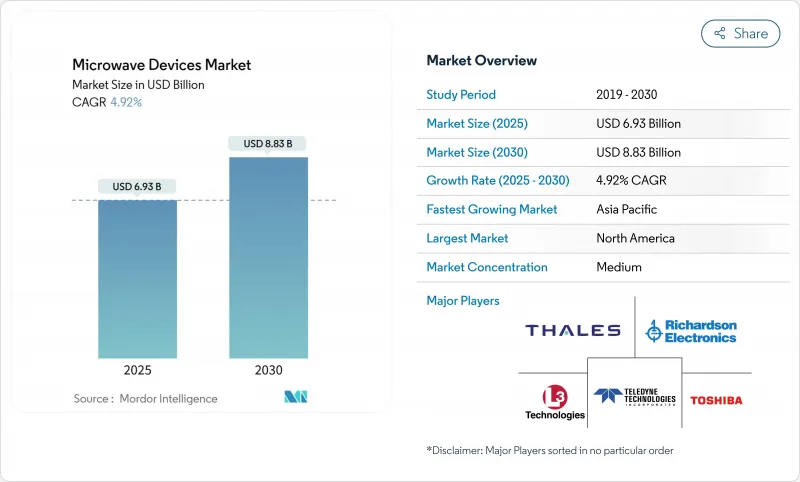

预计到 2025 年,微波设备市场规模将达到 69.3 亿美元,到 2030 年将达到 88.3 亿美元,复合年增长率为 4.92%。

这一成长反映了日趋成熟且持续的需求,涵盖国防、卫星通讯、5G回程传输以及新兴医疗领域。氮化镓(GaN)功率元件正日益取代传统的砷化镓解决方案,在提高功率密度和效率的同时,也能缩小系统尺寸并降低冷却负荷。正在进行的国防现代化项目,例如目前与美国国防部签订合约的定向能量武器原型,为高功率订单提供了坚实的基准。即使行动装置的销售量有所放缓,E频段和V频段5G固定无线存取的并行部署也将维持商业性发展动能。医用微波消融平台完善了多元化的需求结构,与射频消融相比,它能为医院提供更快捷的手术和更深的病灶穿透深度。

全球微波装置市场趋势与洞察

对安全军用卫星通讯的需求激增

现代军事网路需要抗干扰链路和多频段通用性。美国近期部署模组化VSAT终端,并与L3Harris公司签订了一份价值6000万美元的合同,这表明军事系统正朝着兼具高数据速率和快速部署能力的紧凑型系统发展。氮化镓(GaN)放大器能够实现目前规定的传输等级和频宽,加速了真空管的淘汰。同时,中国对吉瓦级高功率微波(HPM)武器的大力投资,推动了一场技术竞赛,并加速了国防采购进程。

E频段和V频段的5G和FWA回程传输部署

在光纤成本居高不下的地区,固定无线回程传输可提供Gigabit级吞吐量。美国联邦通讯委员会 (FCC) 设立的 90 亿美元「农村地区 5G 基金」旨在满足近期对 E 波段和 V 波段链路的需求。 SpaceX 公司价值 1,970 万美元的 E 波段固体功率放大器订单,验证了高频微波有效载荷的商业性规模应用。

宽能带隙装置的研发成本很高

GaN 和 SiC 外延反应器的成本高达数千万美元,这造成了很高的准入门槛:领先的供应商将 15-20% 的收入用于製程优化,这为新参与企业设定了较低的门槛。

细分市场分析

至2024年,主动元件将占微波元件市场62%的份额,并在2030年之前以7.57%的复合年增长率晶粒。尺寸、重量和可靠性方面的优势正在加速从真空电子元件向氮化镓(GaN)固体功率放大器的过渡。有源微波装置市场预计在2030年达到53亿美元。整合趋势是将波束成形和增益控制逻辑整合到放大器晶片中,从而实现软体定义无线电平台。真空管产品仍用于高功率雷达,但随着国防项目逐步采用固态模组,其市占率正在下降。

第二层影响也延伸至被动元件领域,随着更多功能整合到晶片上,分离滤波器和耦合器面临价格压力。医疗消融平台倾向于采用毫秒功率调製的主动解决方案,这巩固了该领域的长期成长势头。产品平臺对24V和28V氮化镓元件的需求不断增长,以支援新兴的5G宏无线电架构。

微波装置市场报告按装置类型(主动[固体、真空电子]、被动[滤波器、耦合器等])、频段(L 和 S、C 和 X、其他)、应用(空间和通讯、国防[雷达、电子战、定向能战]、医疗[消融、成像]、其他)和地区进行细分。

区域分析

北美地区预计到2024年将维持38%的市场份额,这主要得益于联邦政府90亿美元的5G补贴以及强劲的美国国防预算。微波装置市场将继续受益于定向能量武器计画和农村宽频建设。出口授权合规性会带来成本方面的摩擦,但现有主要供应商仍坚持在地采购策略以降低供应中断的影响。

到2030年,亚太地区的复合年增长率将达到7.24%,位居全球之首。中国控制98%的镓矿资源,赋予了国内晶圆厂成本优势,同时也使海外整合商面临价格波动的风险。区域各国政府正在资助兴建300毫米功率半导体晶圆厂,而印度新成立的设计工作室将为射频前端创新提供人才。韩国和日本将提供先进的测试和封装能力,从而强化自足式的价值链。

欧洲在满足国家国防需求的同时,也积极拓展商业通讯。欧盟的政策奖励旨在实现氮化镓(GaN)外延和封装产能的在地化。跨大西洋伙伴关係将欧洲的射频设计送往北美工厂进行试运作,然后将生产线迁回国内,降低地缘政治风险。永续性要求进一步引导网路营运商在新一代5G和未来的6G节点中采用节能的GaN平台。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对安全军用卫星通讯的需求激增

- E频段和V频段的5G和FWA回程传输部署

- 医用微波消融术简介

- 基于氮化镓的固体功率放大器的成本正在下降

- 农村宽频监管奖励

- 高功率定向能武器系统的需求

- 市场限制

- 宽能带隙装置的研发成本很高

- 关键射频元件的出口管制

- 超过 100 GHz 后,温度控管将达到极限。

- X 洞中与光子链的竞争

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依设备类型

- 活性(固体,真空电子)

- 被动元件(滤波器、耦合器等)

- 按频宽

- L 和 S

- C 和 X

- Ku 和 Ka

- V 和 E(毫米波)

- 透过使用

- 空间与通讯

- 防御(雷达、电子战、定向能武器)

- 医疗(消融术、影像学)

- 商业和工业供暖

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Communications and Power Industries(CPI)

- Teledyne Technologies

- Thales Group

- L3Harris Technologies

- Toshiba Corporation

- Qorvo Inc.

- Analog Devices Inc.

- Keysight Technologies

- TMD Technologies Ltd.

- Richardson Electronics Ltd.

- Northrop Grumman

- Raytheon Technologies

- MACOM Technology

- Microchip Technology

- Cobham Advanced Electronic Solutions

- NXP Semiconductors

- API Technologies(AEA Investors LP)

- Smiths Interconnect

- Ampleon

- MicroWave Technology Inc.

第七章 市场机会与未来展望

The microwave devices market reached a value of USD 6.93 billion in 2025 and is forecast to climb to USD 8.83 billion by 2030, reflecting a 4.92% CAGR.

Gains track a mature yet durable demand profile spanning defense, satellite communications, 5G back-haul, and emerging medical therapies. Gallium nitride (GaN) power devices continue to displace legacy gallium arsenide solutions, improving power density and efficiency while trimming system footprint and cooling loads. Ongoing defense modernization programs, highlighted by directed-energy weapon prototypes now on contract with the U.S. Department of Defense, underpin a robust baseline of high-power orders. Parallel roll-outs of 5G fixed-wireless access in the E- and V-bands sustain commercial momentum even as mass-tier handset volumes soften. Medical microwave ablation platforms round out a diversified demand stack, offering hospitals faster procedures and deeper lesion penetration than radiofrequency alternatives.

Global Microwave Devices Market Trends and Insights

Surge in Secure Military SATCOM Demand

Modern armed-forces networks require jam-resilient links and multi-band versatility. Recent U.S. Army fielding of modular VSAT terminals, backed by a USD 60 million contract with L3Harris, illustrates the shift toward compact systems that merge high data rates with quick deployment. GaN amplifiers enable the power levels and bandwidth now specified, speeding the retirement of vacuum tubes. Parallel Chinese investment in gigawatt-class high-power microwave (HPM) weapons fuels a technology race that keeps defense procurement pipelines active.

5G and FWA Backhaul Deployment in E- and V-Bands

Fixed-wireless backhaul offers gigabit-class throughput where fiber costs remain prohibitive. The FCC's USD 9 billion 5G Fund for Rural America anchors near-term demand for E- and V-band links. Satellites add another pull: a USD 19.7 million order from SpaceX for E-band solid-state power amplifiers affirms commercial scale for high-frequency microwave payloads.

High R&D Cost of Wide-Bandgap Devices

Epitaxial reactors for GaN and SiC run into the tens of millions of dollars, creating high entry barriers. Leading suppliers devote 15-20% of turnover to process optimization, a hurdle few new entrants can clear.

Other drivers and restraints analyzed in the detailed report include:

- Medical Microwave Ablation Adoption

- GaN-Based Solid-State PA Cost Declines

- Export Controls on Critical RF Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Active devices accounted for 62% of the microwave devices market in 2024 and advanced at a 7.57% CAGR to 2030. Size, weight, and reliability advantages are accelerating the swap from vacuum electron devices to GaN solid-state power amplifiers. The Microwave devices market size for active devices is on track to reach USD 5.3 billion by 2030. Integration trends fold beam-forming and gain-control logic into the amplifier die, enabling software-defined radio platforms. Vacuum tube products still serve ultra-high-power radar, but cede volume share as defense programs standardize on solid-state modules.

Second-level effects cascade into the passive segment, where discrete filters and couplers face pricing pressure as functions move on-chip. Medical ablation platforms prefer active solutions for millisecond-scale power modulation, reinforcing the segment's long-term growth trajectory. Product pipelines show rising demand for 24 V and 28 V GaN devices that align with emerging 5G macro radio architectures.

The Microwave Devices Market Report is Segmented by Device Type (Active [Solid-State, Vacuum Electron] and Passive [Filters, Couplers, Etc. ]), Frequency Band (L and S, C and X, and More), Application (Space and Communication, Defense [Radar, EW, DEW], , Medical [Ablation, Imaging] and More), and Geography.

Geography Analysis

North America retained a 38% stake in 2024, anchored by USD 9 billion in federal 5G subsidies and strong U.S. defense budgets. The microwave devices market continues to benefit from directed-energy weapon programs and rural broadband build-outs. Export-license compliance introduces cost friction, but established primes sustain local sourcing strategies that cushion supply disruptions.

Asia Pacific delivers the highest 7.24% CAGR to 2030. China controls 98% of mined gallium, giving domestic fabs cost leverage while exposing foreign integrators to price volatility. Regional governments fund 300 mm power-semiconductor fabs, and India's newly opened design houses add talent depth for RF front-end innovation. South Korea and Japan supply advanced test and packaging capacity, reinforcing a self-contained value chain.

Europe balances sovereign defense needs with commercial telecom expansion. EU policy incentives aim to localize GaN epitaxy and packaging capacity. Cross-Atlantic partnerships send European RF designs to North American fabs for pilot runs, then bring volume back to domestic lines, mitigating geopolitical risk. Sustainability directives further nudge network operators toward energy-efficient GaN platforms in new 5G and future 6G nodes.

- Communications and Power Industries (CPI)

- Teledyne Technologies

- Thales Group

- L3Harris Technologies

- Toshiba Corporation

- Qorvo Inc.

- Analog Devices Inc.

- Keysight Technologies

- TMD Technologies Ltd.

- Richardson Electronics Ltd.

- Northrop Grumman

- Raytheon Technologies

- MACOM Technology

- Microchip Technology

- Cobham Advanced Electronic Solutions

- NXP Semiconductors

- API Technologies (AEA Investors LP)

- Smiths Interconnect

- Ampleon

- MicroWave Technology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in secure military SATCOM demand

- 4.2.2 5G and FWA backhaul deployment in E- and V-bands

- 4.2.3 Medical microwave ablation adoption

- 4.2.4 GaN-based solid-state PA cost declines

- 4.2.5 Regulatory incentives for rural broadband

- 4.2.6 Demand for high-power DEW systems

- 4.3 Market Restraints

- 4.3.1 High RandD cost of wide-bandgap devices

- 4.3.2 Export controls on critical RF components

- 4.3.3 Thermal management limits at >100 GHz

- 4.3.4 Competition from photonic links in X-haul

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Type

- 5.1.1 Active (Solid-state, Vacuum Electron)

- 5.1.2 Passive (Filters, Couplers, etc.)

- 5.2 By Frequency Band

- 5.2.1 L and S

- 5.2.2 C and X

- 5.2.3 Ku and Ka

- 5.2.4 V and E (mmWave)

- 5.3 By Application

- 5.3.1 Space and Communication

- 5.3.2 Defense (Radar, EW, DEW)

- 5.3.3 Medical (Ablation, Imaging)

- 5.3.4 Commercial and Industrial Heating

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 France

- 5.4.3.3 Germany

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Communications and Power Industries (CPI)

- 6.4.2 Teledyne Technologies

- 6.4.3 Thales Group

- 6.4.4 L3Harris Technologies

- 6.4.5 Toshiba Corporation

- 6.4.6 Qorvo Inc.

- 6.4.7 Analog Devices Inc.

- 6.4.8 Keysight Technologies

- 6.4.9 TMD Technologies Ltd.

- 6.4.10 Richardson Electronics Ltd.

- 6.4.11 Northrop Grumman

- 6.4.12 Raytheon Technologies

- 6.4.13 MACOM Technology

- 6.4.14 Microchip Technology

- 6.4.15 Cobham Advanced Electronic Solutions

- 6.4.16 NXP Semiconductors

- 6.4.17 API Technologies (AEA Investors LP)

- 6.4.18 Smiths Interconnect

- 6.4.19 Ampleon

- 6.4.20 MicroWave Technology Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment