|

市场调查报告书

商品编码

1850254

OLED 微显示器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)OLED Microdisplay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

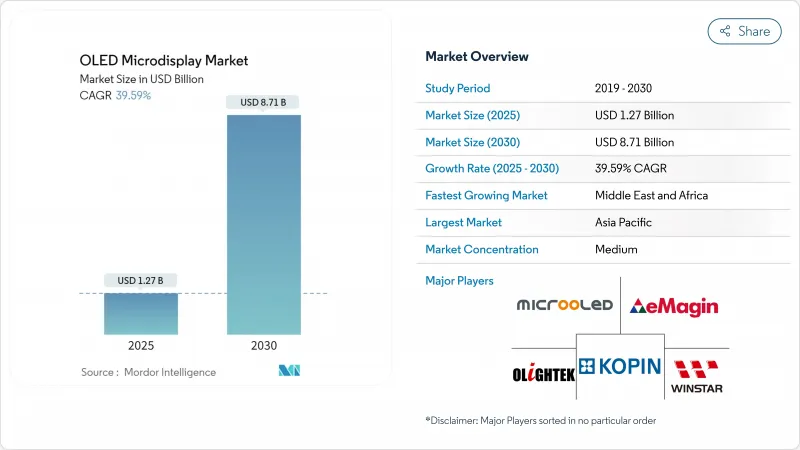

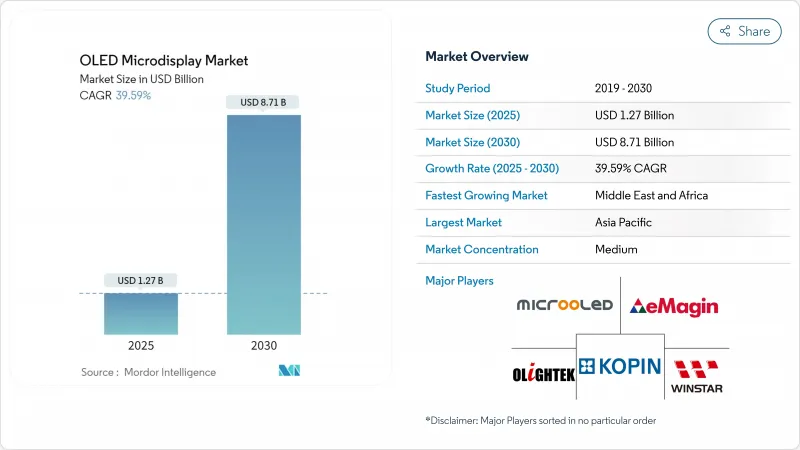

预计 OLED 微显示器市场将在 2025 年达到 12.7 亿美元,到 2030 年达到 87.1 亿美元,年复合成长率为 39.59%。

扩增实境和虚拟实境头戴装置、军用头盔系统以及高阶汽车抬头显示器对小型高解析度近眼面板的强劲需求,正推动着OLED市场销售的成长。直接图形化和迭层结构技术将亮度上限提升至60,000尼特,同时降低了功耗,增强了OLED技术对抗新兴MicroLED的优势。同时,中国硅基OLED代工厂也正在同步提升产能,降低单位成本并缩短前置作业时间。策略性收购,尤其是三星显示器在2024年收购eMagin,正将先进的製程技术应用于大规模生产线,进一步拉大与后起之秀的效能差距。

全球OLED微显示器市场趋势及洞察

中国晶圆代工厂扩大硅基OLED产能

京东方、世亚光电和爱瑞集团正在扩大产能,为OLED微显示器市场引进大量、高产量比率的供应。代工厂正将更高像素密度的前板与新建的硅背板生产线结合,以提高产能并加强製程控制。爱瑞集团对背板的专案投资标誌着其正朝着垂直整合的方向发展,减少外包环节,增强成本竞争力。这些倡议将亚太地区从区域供应基地转变为全球供应基地,在规模和技术领先地位方面对日本和韩国的现有厂商构成挑战。产能扩张也有助于稳定价格,鼓励消费性电子设备OEM厂商下达OLED微显示器的长期订单。

军用头盔显示器正被广泛采用

北美国防专案正迅速从AMLCD(积层製造液晶显示器)过渡到OLED(有机发光二极体)微型显示器,用于飞行员、地面部队和夜视光学设备。 Kopin公司于2025年4月授予的价值750万美元的合约凸显了市场对坚固耐用、近眼模组日益增长的需求,这类模组具有更高的对比度、无运动模糊的影像以及更轻的重量。在F-35平台上的检验检验了其关键任务可靠性,这促使其他项目也采用类似的显示架构。市场多角化发展至武器瞄准镜和指挥控制眼镜产品领域,分散了采购风险,使军方需求成为OLED微型显示器市场稳定的基石。

OLEDoS的湿气侵入封装挑战

水分侵入这项持续存在的挑战仍然是OLED微型显示器广泛应用的一大技术障碍,尤其是在汽车和军事等严苛环境下。与传统显示器不同,微型显示器的超小型外形规格限制了传统封装方法的应用空间,这带来了根本性的工程挑战,影响着生产产量比率和长期可靠性。韩国一所大学近期的一项创新将多功能封装技术引入基于纺织品的可穿戴OLED中,预计将为更可靠的解决方案铺平道路。然而,这项挑战的技术复杂性也体现在封装方案既要提供气密性又要保持光学透明度。这项限制对预期使用寿命较长的应用,例如需要10年或更长使用寿命的汽车显示器,影响尤为显着,也为能够开发独特封装技术的公司创造了竞争机会。

细分市场分析

预计到2025年,近眼设备市场规模将达到8.1亿美元,占总营收的64%。混合现实头显、训练眼镜和智慧头盔的持续出货将支撑市场需求。平台所有者对生态系统的投资将支持分辨率和亮度的年度升级,从而提高平均售价和毛利率。

儘管电子观景器在2025年的市占率较小,但预计到2030年其复合年增长率将达到41.2%,这意味着其成长空间巨大。SONY、尼康和Canon厂商的专业级无反光镜单眼正在将OLED电子取景器作为标配,以实现无延迟的构图和HDR预览。随着相机厂商精简产品週期,面板产量可望在三年内翻一番,使电子观景窗成为对抗OLED微显示器市场的策略性避险工具。

到2024年,高清720p等级将占据OLED微显示器市场36%的份额,在确保主流AR用户可接受的清晰度的同时,兼顾了严格的功耗控制。然而,真正的成长动力将来自像素密度超过3000 ppi的超高清等级。三星显示器公司在2025年初推出的样品将达到5000 ppi和20000尼特的峰值亮度,使其有望应用于企业级VR和军用侦察眼镜等领域。

预计到2030年,超高清(FHD)显示器的出货量将以42.3%的复合年增长率成长,占据OLED微显示器市场的大部分成长份额。这些面板通常配备高频宽介面和低延迟驱动器,从而带动相关晶片的需求,最终惠及整合供应商。

区域分析

亚太地区聚集了大量的背板製造厂、发送器供应商和消费性电子设备组装商,预计到2024年将占全球销售额的57%。三星显示器和中国领先的晶圆代工厂持续扩大产能,确保了供应的稳定性,而跨境合资企业则促进了技术转移。韩国和中国政府的激励措施进一步降低了生产成本,帮助它们保持了区域领先地位。

北美市场对国防和企业级XR部署的高规格需求,尤其是那些需要坚固耐用、高亮度模组的应用,正在满足。在硅谷和波士顿,创业投资正支持开发光学元件和驱动IC的新兴企业,促成了原型显示器的在地采购。以F-35头盔升级等项目为代表的国防采购,正持续为北美OLED微显示器市场注入购买力。

欧洲市场主要由汽车应用和高利润的医疗视觉化技术主导。德国和法国的第一线供应商正与面板製造商合作,共同设计用于汽车抬头显示器的低延迟介面。中东和非洲地区虽然基数较小,但正以42%的复合年增长率快速成长,这主要得益于国防现代化预算和包括先进AR抬头显示器在内的豪华汽车进口。南美洲市场主要由消费驱动,当地相机生产和蓬勃发展的游戏社群正逐步带来新的机会。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 透过中国代工厂扩大硅基OLED(OLEDoS)产能

- 北美军用头盔显示器加速采用微型OLED

- 欧洲汽车OEM厂商采用微型OLED面板整合AR抬头显示器

- 在日本和韩国,高阶无反光镜相机的电子观景窗(EVF)市场正在迅速成长。

- 在美国和以色列,专注于OLED微显示器的AR/VRStart-Ups获得的风险投资正在增加。

- 在小于 0.7 英吋和超过 3000 ppi 的范围内,与 Micro LED 相比具有成本绩效优势

- 市场限制

- OLEDoS中的防潮封装挑战

- 亮度低于 1,000 cd/m² 的天花板和微型 LED

- 日本和中国之间供应链的集中会带来地缘政治风险。

- 产品快速过时会增加原始设备製造商的库存风险。

- 产业生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- Near-to-Eye (NTE)

- 投影

- 电子观景器(EVF)

- 通过决议

- SVGA 或更小解析度(800 x 600 或更小)

- XGA(1024 x 768)

- 高清 (720p)

- 全高清 (1080p)

- 全高清或更高解析度(2K-4K 或更高解析度)

- 透过技术

- 硅基RGB OLED

- 白色 OLED + 彩色滤光片

- 玻璃上的AMOLED

- 顶部发光OLED

- 面板尺寸(对角线)

- 小于0.5英寸

- 0.5 至 1.0 英寸

- 1.0 英吋或以上

- 按最终用户行业划分

- 消费性电子产品

- AR/ VR头戴装置

- 数位相机和摄影机

- 智慧型穿戴装置

- 车

- AR抬头显示器

- 侧视镜更换显示器

- 卫生保健

- 外科和诊断可穿戴设备

- 医疗影像设备

- 产业和企业

- 智慧眼镜

- 机器视觉系统

- 航太与国防

- 头盔显示器

- 武器和热感成像瞄准器

- 执法与安保

- 夜视镜

- 执法记录仪

- 其他(研究和教育)

- 消费性电子产品

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 其他南美洲

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Sony Semiconductor Solutions Corp.

- Seiko Epson Corporation

- Kopin Corporation

- eMagin Corporation

- Yunnan Olightek Opto-Electronic Technology

- Microoled SA

- WiseChip Semiconductor Inc.

- Fraunhofer FEP

- Sunlike Display Technology

- BOE Technology Group Co., Ltd.

- Raysolve Technology

- SeeYA Technology

- AUO Corporation

- Dresden Microdisplay GmbH

- Jasper Display Corp.

- Himax Technologies, Inc.

- United Microdisplay Partners

- HC SemiTek Corporation

- Plessey Semiconductors

- OLiGHTEK Optoelectronics Kunming Co.

- Truly Semiconductors Ltd.

第七章 市场机会与未来展望

The oled microdisplay market is valued at USD 1.27 billion in 2025 and is forecast to reach USD 8.71 billion by 2030, advancing at a 39.59% CAGR.

Robust demand for compact, high-resolution near-eye panels in augmented and virtual reality headsets, military helmet systems and premium automotive head-up displays is accelerating volume growth. Direct patterning and tandem-stack architectures are lifting brightness ceilings toward 60,000 nits while cutting power draw, strengthening the technology's position against emerging MicroLED. Parallel capacity expansions at Chinese OLED-on-Silicon foundries are lowering unit costs and shortening lead times, which encourages broader consumer-electronics adoption. Strategic acquisitions-most notably Samsung Display's 2024 purchase of eMagin-are pushing advanced process know-how into high-volume manufacturing lines, widening the performance gap with late-entry competitors

Global OLED Microdisplay Market Trends and Insights

Expansion of OLED-on-Silicon Capacity by Chinese Foundries

Production ramp-ups at BOE, SeeYA and IRay Group are injecting high-volume, high-yield supply into the oled microdisplay market. Foundries are pairing pixel-dense front-planes with newly built silicon backplane lines to raise throughput and tighten process control. IRay's dedicated backplane investment illustrates a vertical-integration push that reduces outsourcing steps, enhancing cost competitiveness.These moves reposition Asia Pacific from a regional to a global supply anchor, challenging Japanese and Korean incumbents on both scale and technology leadership. Wider capacity also stabilizes pricing, encouraging consumer device OEMs to commit to long-term oled microdisplay market orders.

Accelerated Adoption in Military Helmet-Mounted Displays

North American defense programs are rapidly shifting from AMLCD to OLED microdisplays for pilot, ground-troop and night-vision optics. Kopin's USD 7.5 million award in April 2025 underscores rising demand for ruggedized near-eye modules with superior contrast, zero-motion blur and reduced weight.Validation within the F-35 platform demonstrates mission-critical reliability, prompting other programs to specify similar display architectures. Diversification into weapon sights and command-control eyewear spreads procurement risk, making military demand a stable cornerstone of the oled microdisplay market.

Moisture-Ingress Encapsulation Challenges for OLEDoS

The persistent challenge of moisture ingress represents a significant technical barrier to widespread OLED microdisplay adoption, particularly in harsh operating environments like automotive and military applications. Unlike conventional displays, the ultra-compact form factor of microdisplays leaves minimal space for traditional encapsulation methods, creating a fundamental engineering challenge that impacts both manufacturing yield and long-term reliability. Recent innovations from Korean universities have introduced multi-functional encapsulation for fiber-based wearable OLEDs, potentially offering pathways to more robust solutions. The technical complexity of this challenge is compounded by the need for encapsulation solutions that maintain optical clarity while providing hermetic sealing-a balance that becomes increasingly difficult as pixel densities exceed 3,000 ppi. This constraint particularly impacts applications where extended operational lifetimes are expected, such as automotive displays with 10+ year service requirements, creating a competitive opportunity for companies that can develop proprietary encapsulation technologies.

Other drivers and restraints analyzed in the detailed report include:

- Automotive OEM Integration of AR Head-Up Displays

- Surge in High-End Mirrorless Camera EVFs

- Sub-1,000 cd/m2 Brightness Ceiling versus MicroLED

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The oled microdisplay market size for Near-to-Eye devices stood at USD 0.81 billion in 2025, equal to 64% of total revenue. Sustained shipments to mixed-reality headsets, training goggles and smart helmets anchor demand. Ecosystem investment from platform owners supports annual resolution and brightness upgrades, which in turn lift average selling prices and gross margins.

Electronic Viewfinders contributed a smaller base in 2025, yet their 41.2% CAGR prospect through 2030 signals ample headroom. Professional mirrorless bodies from Sony, Nikon and Canon are standardizing OLED EVFs to deliver lag-free framing and HDR previews. As camera makers streamline model cycles, panel volumes could double within three years, establishing EVFs as a strategic hedge within the oled microdisplay market.

The HD 720p tier held 36% of oled microdisplay market share in 2024, balancing acceptable clarity with tight power budgets for mainstream AR viewers. Growth momentum, however, lies in the Above-FHD tier where pixel densities exceed 3,000 ppi. Early 2025 samples from Samsung Display achieve 5,000 ppi and 20,000 nits peak luminance, positioning these panels for enterprise VR and military recon goggles.

A 42.3% CAGR forecast to 2030 for Above-FHD shipments will absorb much of the incremental oled microdisplay market size expansion. Higher bandwidth interfaces and low-latency drivers accompany these panels, creating ancillary silicon demand that benefits integrated suppliers.

The OLED Microdisplay Market Report is Segmented by Type (Near-To-Eye, Projections, and More), Resolution (SVGA and Below (<=800 X 600), XGA (1, 024 X 768), and More), Technology (RGB OLED-On-Silicon, and More), Panel Size (Diagonal) ( Less Than 0. 5 Inch, 0. 5-1. 0 Inch, and More), End-User Industry (Automotive, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific commanded 57% of global revenue in 2024, reflecting the region's dense network of backplane fabs, emitter suppliers and consumer-device assemblers. Ongoing capacity expansions by Samsung Display and leading Chinese foundries ensure supply continuity, while cross-border joint ventures smooth technology transfer. Government incentives in South Korea and China further lower production costs, sustaining regional leadership.

North America anchors high-specification demand, especially for defense and enterprise-XR deployments that demand ruggedized, high-brightness modules. Venture-capital funding in Silicon Valley and Boston fuels start-ups developing optics and driver ICs, which in turn elevates local sourcing of prototype displays. Defense procurement, led by programs such as the F-35 helmet upgrade, adds a stable layer to North American oled microdisplay market purchases.

Europe focuses on automotive rollouts and high-margin medical visualization. German and French tier-one suppliers work with panel makers to co-design low-latency interfaces for automotive head-up implementations. The Middle East & Africa region, although starting from a small base, is pacing at a 42% CAGR due to defense-modernization budgets and luxury-vehicle imports that include advanced AR-HUDs. South America remains largely consumer-oriented, with gradual opportunities arising from local camera production and burgeoning gaming communities.

- Sony Semiconductor Solutions Corp.

- Seiko Epson Corporation

- Kopin Corporation

- eMagin Corporation

- Yunnan Olightek Opto-Electronic Technology

- Microoled SA

- WiseChip Semiconductor Inc.

- Fraunhofer FEP

- Sunlike Display Technology

- BOE Technology Group Co., Ltd.

- Raysolve Technology

- SeeYA Technology

- AUO Corporation

- Dresden Microdisplay GmbH

- Jasper Display Corp.

- Himax Technologies, Inc.

- United Microdisplay Partners

- HC SemiTek Corporation

- Plessey Semiconductors

- OLiGHTEK Optoelectronics Kunming Co.

- Truly Semiconductors Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of OLED-on-Silicon (OLEDoS) capacity by Chinese Foundries

- 4.2.2 Accelerated Adoption of MicroOLED in Military Helmet-Mounted Displays across North America

- 4.2.3 Automotive OEM Integration of AR Head-Up Displays Using MicroOLED Panels in Europe

- 4.2.4 Surge in High-End Mirrorless Camera EVFs in Japan and South Korea

- 4.2.5 Growing VC Funding for AR/VR Start-ups Focused on OLED Microdisplays in the United States and Israel

- 4.2.6 Cost-Performance Advantage over MicroLED in <0.7-inch, >3,000 ppi Range

- 4.3 Market Restraints

- 4.3.1 Moisture-Ingress Encapsulation Challenges for OLEDoS

- 4.3.2 Sub-1,000 cd/m2 Brightness Ceiling versus MicroLED

- 4.3.3 Supply-Chain Concentration in Japan-China Creating Geopolitical Risk

- 4.3.4 Rapid Product Obsolescence Increasing OEM Inventory Risk

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Near-to-Eye (NTE)

- 5.1.2 Projection

- 5.1.3 Electronic Viewfinder (EVF)

- 5.2 By Resolution

- 5.2.1 SVGA and Below (<=800 X 600)

- 5.2.2 XGA (1,024 X 768)

- 5.2.3 HD (720p)

- 5.2.4 Full HD (1080p)

- 5.2.5 Above FHD (2K-4K-Plus)

- 5.3 By Technology

- 5.3.1 RGB OLED-on-Silicon

- 5.3.2 White OLED + Color Filter

- 5.3.3 AMOLED on Glass

- 5.3.4 Top-Emitting OLED

- 5.4 By Panel Size (Diagonal)

- 5.4.1 <0.5 inch

- 5.4.2 0.5-1.0 inch

- 5.4.3 >1.0 inch

- 5.5 By End-User Industry

- 5.5.1 Consumer Electronics

- 5.5.1.1 AR/VR Headsets

- 5.5.1.2 Digital Cameras and Camcorders

- 5.5.1.3 Smart Wearables

- 5.5.2 Automotive

- 5.5.2.1 AR Head-Up Displays

- 5.5.2.2 Side-Mirror Replacement Displays

- 5.5.3 Healthcare

- 5.5.3.1 Surgical and Diagnostic Wearables

- 5.5.3.2 Medical Imaging Devices

- 5.5.4 Industrial and Enterprise

- 5.5.4.1 Smart Glasses

- 5.5.4.2 Machine Vision Systems

- 5.5.5 Aerospace and Defense

- 5.5.5.1 Helmet-Mounted Displays

- 5.5.5.2 Weapon and Thermal Sights

- 5.5.6 Law Enforcement and Security

- 5.5.6.1 Night-Vision Goggles

- 5.5.6.2 Body-Worn Cameras

- 5.5.7 Others (Research and Education)

- 5.5.1 Consumer Electronics

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 South East Asia

- 5.6.3.6 Australia

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sony Semiconductor Solutions Corp.

- 6.4.2 Seiko Epson Corporation

- 6.4.3 Kopin Corporation

- 6.4.4 eMagin Corporation

- 6.4.5 Yunnan Olightek Opto-Electronic Technology

- 6.4.6 Microoled SA

- 6.4.7 WiseChip Semiconductor Inc.

- 6.4.8 Fraunhofer FEP

- 6.4.9 Sunlike Display Technology

- 6.4.10 BOE Technology Group Co., Ltd.

- 6.4.11 Raysolve Technology

- 6.4.12 SeeYA Technology

- 6.4.13 AUO Corporation

- 6.4.14 Dresden Microdisplay GmbH

- 6.4.15 Jasper Display Corp.

- 6.4.16 Himax Technologies, Inc.

- 6.4.17 United Microdisplay Partners

- 6.4.18 HC SemiTek Corporation

- 6.4.19 Plessey Semiconductors

- 6.4.20 OLiGHTEK Optoelectronics Kunming Co.

- 6.4.21 Truly Semiconductors Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment