|

市场调查报告书

商品编码

1850263

除生物剂:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Biocides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

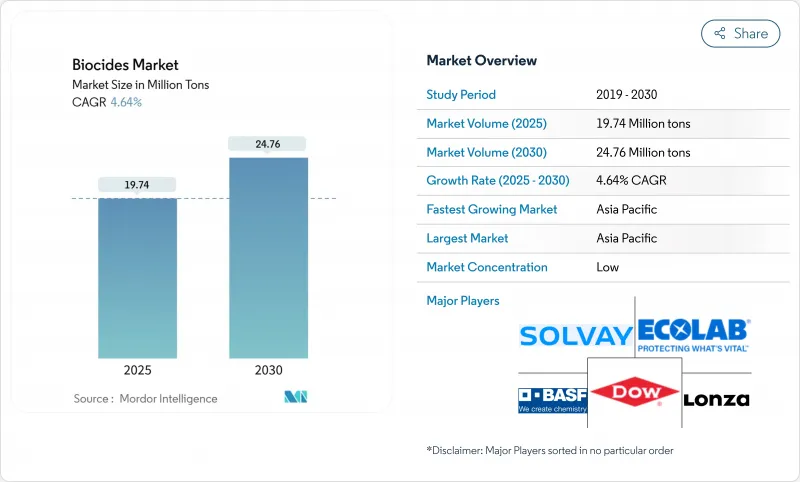

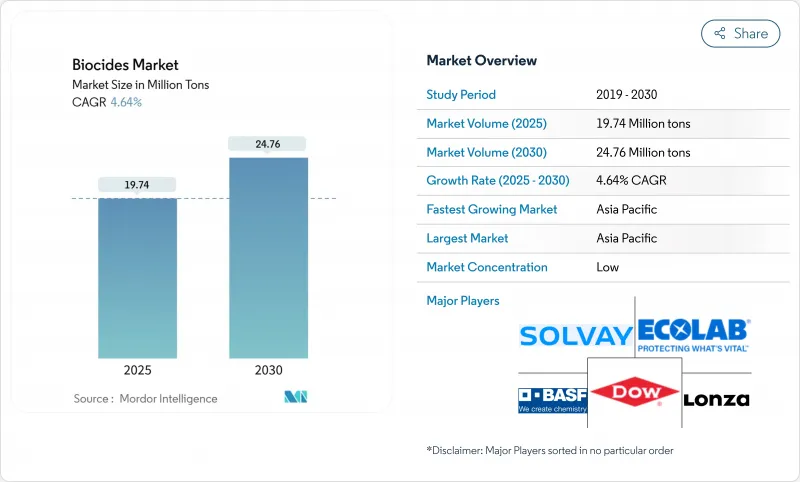

预计到 2025 年,除生物剂市场规模将达到 1,974 万吨,到 2030 年将达到 2,476 万吨,2025 年至 2030 年的复合年增长率为 4.64%。

即使终端用户面临日益严格的环境法规,水处理、食品安全、医疗保健和建筑领域对抗菌解决方案的强劲需求仍支撑着市场销售的成长。工业水回用计划的稳定成长正在拓宽抗菌解决方案的应用范围,并因此推高其消费量,这表明剂量优化技术将直接转化为产能的提升。同时,永续性的要求促使製造商将其产品组合多元化,转向氧化剂和生物基配方,这表明整个行业的扩张伴随着技术的质的提升。产量成长与环保化学品的并存表明,规模效益正在提高,合规性也在改善。主要供应商的投资计画表明,该行业正在提升产能以满足预期需求曲线,而不是盲目追求投机性成长。

全球除生物剂市场趋势与洞察

全球对水处理的需求不断增长

水资源短缺和日益提高的再利用目标正促使市政当局和工业运营商采用在较低活性成分用量下仍能维持残留功效的除生物剂配方。公共产业正在采用整合感测器和云端分析的剂量控制平台,推动除生物剂市场转向基于性能的采购模式。美国监管机构近期核准用于地下水修復的过氧乙酸和稳定溴表明,氧化能力与快速降解相结合被认为是符合法规要求的最佳方案。这意味着,将数据主导的剂量指导融入产品中的供应商更有可能抵御商品化压力,从而保住其市场地位。

食品和饮料行业的需求不断增长

食品加工商正在重新思考其卫生消毒通讯协定,以最大限度地减少交叉污染,且不留下任何可检测的残留物,这导致对羟基自由基消毒系统的需求增加,该系统不仅作用于表面,还能作用于周围空气。包装厂目前正在试用含有除生物剂的奈米复合物,以抑制腐败微生物并延长保存期限。空气、表面和包装消毒的整合表明,整合式卫生解决方案可以跨多个预算范围挖掘交叉销售机会。这种趋势预示着传统的湿式化学消毒剂正逐渐被持续作用技术所取代。

与除生物剂相关的环境与健康问题

监管机构正在逐步淘汰持久性或致癌性活性物质。欧盟执委会逐步淘汰环氧乙烷的倡议,凸显了配方师面临的监管不确定性。研究表明,在船舶清洗过程中,每10,000平方米船体表面会释放高达4.3公斤的微塑胶涂料颗粒,这凸显了某些涂料对环境的影响。这些发现正在推动可生物降解活性成分的需求,进而促进生物基原料的研发。另一个讯号可能是,保险公司和港口当局将开始对依赖传统被覆剂的业者处以罚款,间接鼓励采用环境优化型除生物剂。

细分市场分析

预计到2024年,卤素化合物将占据28%的除生物剂市场份额,并在2030年之前以5.8%的复合年增长率增长。溴基溶液因其持久的生物静电效应(即使在氯消毒困难的情况下)仍然是高温冷却系统的首选,这凸显了该细分市场成长背后的营运逻辑。目前,采用封装式方法测量溴排放量,可延长维护週期,减少整体化学物质排放,并符合日益严格的污水法规。这意味着,透过逐步调整工艺,而不是激进的转换,可以兼顾性能和合规性。

随着供应商对环保产品的需求日益增长,卤素产业的竞争日益激烈,这主要得益于产品生物降解性能的提升。雅宝公司优化萃取工艺,降低了单位溴的能耗,这表明上游永续性的提高将带动下游需求的成长。同时,研发部门正在探索配备即时监控功能的二氧化氯发生器,这表明数位化能力正与化学技术一样,成为企业脱颖而出的关键因素。综上所述,这些倡议显示卤素供应商正将重点从产品销售商转向解决方案合作伙伴。

区域分析

亚太地区预计到2024年将占全球除生物剂市场份额的35%,并在2030年之前保持5.15%的复合年增长率,成为成长最快的地区。中国大力提高工业水资源再利用率,正加速高性能除生物剂的应用。日本供应商正利用其专业技术向邻国出口高纯度活化剂,显示亚洲内部供应链正在不断深化。同时,东南亚国家正逐步淘汰传统的氯化消毒方式,转而采用溴基模组化系统。该地区的综合需求模式表明,产量增加将伴随着技术的快速吸收。

北美仍然是技术领域的领先者,因为美国环保署对《有毒物质控制法》(TSCA) 和《联邦杀虫剂、杀菌剂和灭鼠剂法案》(FIFRA) 的持续审查要求製剂生产商必须维护完善的毒性资料包。这种严格的监管促使人们研发出持久性更低的活性成分,这些产品正出口到其他地区。加拿大拥有悠久的林业传统,在木材防腐领域也占据重要地位,各州监管机构较低的渗滤液阈值鼓励供应商转向铜Azole类化合物。此外,石化联合企业大型冷却塔的维修也使该地区市场受益,这表明需求不仅与新建项目相关,也与维护週期相关。

欧洲拥有全球最严格的除生物剂产品认证框架,如果申请人未能提交新的环境风险数据,活性物质的批准可能会失效。近期环氧乙烷的撤回凸显了这一趋势,并强化了更安全替代方案的商业价值。虽然德国和英国占据消费量主导地位,但北欧国家往往率先推出可生物降解的解决方案,随后这些方案推广到其他国家。循环经济法规倾向于选择生命週期结束后环境影响最小的活性物质,这使得那些投资于从摇篮到坟墓评估的供应商在未来的竞标中更具优势。因此,欧洲成为了一个试验场。符合欧洲标准的合格产品通常只需稍作修改即可被其他国家接受。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球对水处理的需求不断增长

- 食品和饮料行业的需求不断增长

- 人们的健康和卫生意识增强

- 油漆和涂料行业需求不断增长

- 监理机关对更安全替代方案的支持

- 市场限制

- 与除生物剂相关的环境与健康问题

- 原物料价格波动

- 高昂的研发成本

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 卤素化合物

- 金属化合物

- 有机硫

- 有机酸

- 酚类

- 其他类型(季铵化合物)

- 透过使用

- 水处理

- 药物和个人护理

- 木材防腐

- 食品/饮料

- 油漆和涂料

- 其他应用领域(石油和天然气、农业、消毒剂和卫生用品)

- 透过作用机制

- 氧化性除生物剂

- 非氧化性除生物剂

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 印尼

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Albemarle Corporation

- Arxada

- Baker Hughes Company

- BASF SE

- Dow

- Ecolab

- IRO Group Inc.

- Italmatch AWS

- Kemipex

- Kemira

- LANXESS

- Lonza

- Merck KGaA

- Nouryon

- Solvay

- Stepan Company

- The Lubrizol Corporation

- Thor Group Ltd.

- Valtris Specialty Chemicals

- Veolia

- Vink Chemicals GmbH & Co. KG

第七章 市场机会与未来展望

The biocides market size is valued at 19.74 million tons in 2025 and is forecast to attain 24.76 million tons by 2030, reflecting a 4.64% CAGR during 2025-2030.

Robust demand for antimicrobial solutions in water treatment, food safety, healthcare, and construction continues to underpin volume growth, even as end-users confront stricter environmental regulations. A steady rise in industrial water reuse projects is widening the application base, and the resulting consumption uptick suggests that dosage-optimization technologies are translating directly into larger addressable volumes. At the same time, sustainability requirements are encouraging manufacturers to diversify portfolios toward oxidizing and biobased formulations, which implies that overall industry expansion is being accompanied by a qualitative technology upgrade. The coexistence of rising output and greener chemistries signals that scale efficiencies are improving alongside compliance readiness. Evidence from leading suppliers' investment plans further indicates that the industry is aligning capacity additions with the projected demand curve rather than chasing speculative growth.

Global Biocides Market Trends and Insights

Increasing Demand for Water Treatment Globally

Rising water scarcity and heightened reuse targets drive municipalities and industrial operators to deploy biocide formulations that maintain residual efficacy with lower active-ingredient loads. Utilities are adopting dosage-control platforms that integrate sensors with cloud analytics, which is nudging the biocides market toward performance-based procurement models. Peracetic acid and stabilized bromine, recently endorsed for groundwater remediation by United States regulators, demonstrate that oxidation strength combined with rapid decomposition is considered the sweet spot for compliance. A key inference is that suppliers who embed data-driven dosing guidance into their product offering will likely defend market positions against commoditization pressure.

Growing Demand From the Food and Beverage Industry

Food processors are revising sanitation protocols to minimize cross-contamination without leaving detectable residues, which lifts demand for hydroxyl-radical systems that work in ambient air as well as on surfaces. Packaging plants now trial biocide-embedded nanocomposites to extend shelf life by suppressing spoilage organisms, a shift that expands the functional scope of preservation beyond the product itself. This convergence of air, surface, and package sterilization suggests that integrated hygiene solutions can unlock cross-sell opportunities across multiple budget lines. The pattern indicates a gradual substitution away from legacy wet-chemistry disinfectants toward continuous-action technologies.

Environmental Issues and Health Hazards Related to Biocides

Regulators are phasing out active substances with persistence or carcinogenicity concerns; the European Commission's withdrawal of ethylene oxide illustrates the regulatory unpredictability facing formulators. Research estimating up to 4.3 kg of microplastic paint particles released per 10,000 m2 of ship hull during cleaning underscores the ecological cost of certain coatings. Such findings are intensifying demand for degradable actives, which in turn encourage research and development into biobased feedstocks. An emerging signal is that insurers and port authorities could start penalizing operators that rely on legacy coatings, indirectly boosting eco-optimized biocides adoption.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Awareness of Health and Hygiene

- Rising Demand in Paints and Coatings Industry

- Fluctuating Raw Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Halogen compounds account for 28% biocides market share in 2024 and are forecast to expand at a 5.8% CAGR to 2030, indicating that efficacy still outweighs environmental apprehensions in many end-uses. Bromine-based solutions remain the first choice for high-temperature cooling systems because their biostatic effect persists where chlorination falters, revealing an operational rationale behind the segment's growth. Encapsulation methods that meter bromine release now prolong service intervals, which reduces overall chemical discharge and aligns with tightening wastewater rules. The inference is that incremental process tweaks, rather than wholesale active-switching, can reconcile performance with compliance.

Competition within halogens intensifies as suppliers seek greener credentials by improving biodegradability profiles. Albemarle's extraction optimization lowers energy input per bromine unit, signaling that upstream sustainability gains can cascade into stronger downstream demand. Parallel research and development explores chlorine-dioxide generators with real-time monitoring, indicating that digital capabilities are becoming a differentiator alongside chemistry. Collectively, these initiatives suggest that halogen suppliers are pivoting from product sellers to solution partners.

The Biocides Market Report Segments the Industry by Type (Halogen Compounds, Metallic Compounds, and More), Application (Water Treatment, Pharmaceutical and Personal Care, Wood Preservation, and More), Mode of Action (Oxidizing Biocides and Non-Oxidizing Biocides), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific contributes 35% of the global biocides market share in 2024 and shows the fastest CAGR at 5.15% to 2030, reflecting industrial expansion accompanied by stricter public-health oversight. China's push for higher water-reuse ratios in industrial parks is accelerating the adoption of high-performing oxidizing biocides, while India's Smart Cities Mission channels budget toward municipal disinfection infrastructure. Japanese suppliers leverage specialty know-how to export high-purity actives to regional neighbors, indicating intra-Asian supply-chain deepening. Meanwhile, Southeast Asian economies are leapfrogging legacy chlorination by adopting modular bromine-based systems, highlighting how latecomers can embrace state-of-the-art chemistry from inception. Collectively, the region's demand pattern suggests that volume increases are accompanied by fast technology assimilation.

North America remains a technology trailblazer, where the United States Environmental Protection Agency's ongoing TSCA and FIFRA reviews compel formulators to maintain robust toxicology data packages. This regulatory rigour spurs innovation in less persistent actives, which in turn gets exported to other jurisdictions. Canada's forestry heritage sustains a sizable wood-preservation segment, and provincial authorities now stipulate lower leachate thresholds, pushing suppliers toward copper-azole hybrids. The regional market also benefits from large-scale cooling-tower retrofits in petrochemical complexes, implying that demand is tied not only to new-builds but also to maintenance cycles.

Europe stands out for the toughest biocide product authorization framework worldwide, where active-substance approvals can lapse if applicants fail to supply new environmental-risk data. The recent withdrawal of ethylene oxide underscores this dynamic, reinforcing the business case for safer substitutes. Germany and the United Kingdom dominate consumption, yet Nordic countries often pioneer biodegradable solutions that later scale southwards. Circular-economy legislation favors actives with minimal end-of-life footprint, so suppliers investing in cradle-to-grave assessments are better positioned for future tenders. The cumulative effect is that Europe acts as a proving ground: products succeeding under its rules can typically secure acceptance elsewhere with minor adaptations.

- Albemarle Corporation

- Arxada

- Baker Hughes Company

- BASF SE

- Dow

- Ecolab

- IRO Group Inc.

- Italmatch AWS

- Kemipex

- Kemira

- LANXESS

- Lonza

- Merck KGaA

- Nouryon

- Solvay

- Stepan Company

- The Lubrizol Corporation

- Thor Group Ltd.

- Valtris Specialty Chemicals

- Veolia

- Vink Chemicals GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Water Treatment Globally

- 4.2.2 Growing Demand From the Food and Beverage Industry

- 4.2.3 Heightened Awareness of Health and Hygiene

- 4.2.4 Rising Demand in Paints and Coatings Industry

- 4.2.5 Regulatory Support for Safer Alternatives

- 4.3 Market Restraints

- 4.3.1 Environmental Issues and Health Hazards Related to Biocides

- 4.3.2 Fluctuating Raw Material Prices

- 4.3.3 High Research and Development Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Halogen Compounds

- 5.1.2 Metallic Compounds

- 5.1.3 Organosulfurs

- 5.1.4 Organic Acids

- 5.1.5 Phenolics

- 5.1.6 Other Types (Quaternary Ammonium Compounds)

- 5.2 By Application

- 5.2.1 Water Treatment

- 5.2.2 Pharmaceutical and Personal-care

- 5.2.3 Wood Preservation

- 5.2.4 Food and Beverage

- 5.2.5 Paints and Coatings

- 5.2.6 Other Applications (Oil and Gas, Agriculture, Disinfectants and Sanitization)

- 5.3 By Mode of Action

- 5.3.1 Oxidizing Biocides

- 5.3.2 Non-oxidizing Biocides

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Malaysia

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Nordics

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Albemarle Corporation

- 6.4.2 Arxada

- 6.4.3 Baker Hughes Company

- 6.4.4 BASF SE

- 6.4.5 Dow

- 6.4.6 Ecolab

- 6.4.7 IRO Group Inc.

- 6.4.8 Italmatch AWS

- 6.4.9 Kemipex

- 6.4.10 Kemira

- 6.4.11 LANXESS

- 6.4.12 Lonza

- 6.4.13 Merck KGaA

- 6.4.14 Nouryon

- 6.4.15 Solvay

- 6.4.16 Stepan Company

- 6.4.17 The Lubrizol Corporation

- 6.4.18 Thor Group Ltd.

- 6.4.19 Valtris Specialty Chemicals

- 6.4.20 Veolia

- 6.4.21 Vink Chemicals GmbH & Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Increasing Awareness in the Agricultural Sector