|

市场调查报告书

商品编码

1850319

小型基地台网路:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Small Cell Networks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

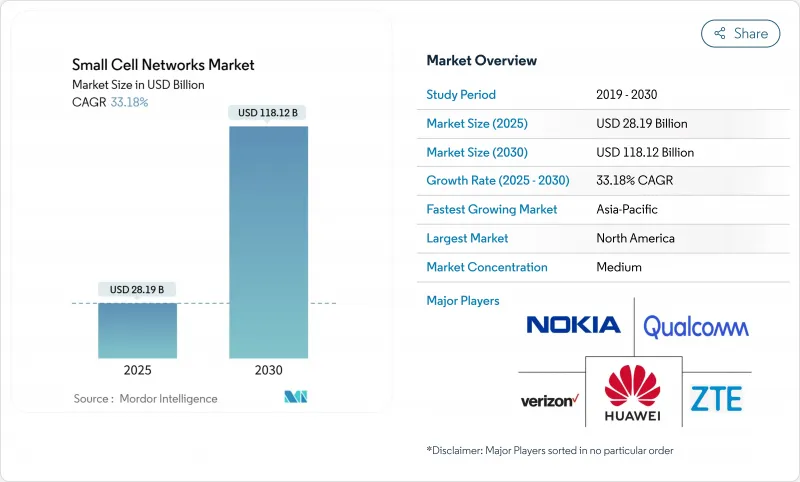

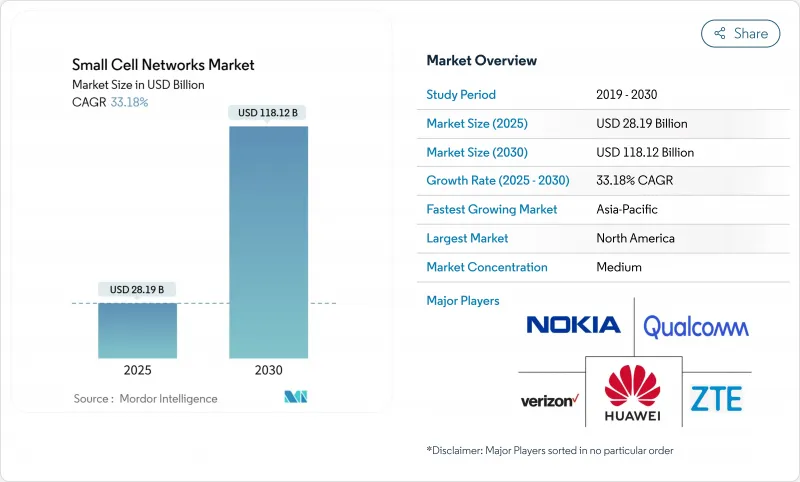

预计到 2025 年,小型基地台网路市场规模将达到 281.9 亿美元,并以 33.18% 的复合年增长率增长,到 2030 年将达到 1,181.2 亿美元。

在行动数据量成长、向更高频率的5G频段转移以及相关频谱政策的支持下,小型基地台已从小众解决方案转变为核心网路资产。毫米波和中频段讯号衰减迅速,尤其是在超过80%的流量发生在室内的情况下。共用主机和中立主机模式的早期成功降低了拥有成本,而人工智慧驱动的自优化功能与传统的分散式天线系统相比,能耗降低了高达45%。随着现有营运商在AWS-3竞标前寻求规模优势,产业整合正在加剧。 AWS-3预计于2026年6月完成,届时将竞标30亿至45亿美元的中频段频谱可供商业使用。

全球小型基地台网路市场趋势与洞察

5G频谱竞标将加速网路密集化

中频段频谱分配释放了5G所需的频谱余量。独立经济模型显示,每增加100MHz频谱,就能为GDP贡献2,640亿美元。即将进行的AWS-3销售可望进一步强化此效果。快速审批流程已将美国的频谱许可週期从数年缩短至数月,使营运商能够将网路规模从宏基站扩展到每个城市数千个街道节点。由于毫米波讯号衰减严重,持续覆盖所需的小型基地台数量是传统大型基地台的10倍,这推动了对小型无线电设备和整合天线的订单。

行动数据爆炸性成长推动了普及

根据爱立信预测,年流量成长20%,到2029年,5G将承载75%的流量。超高清影片串流、XR内容和云端游戏等热门需求给分区域宏网路带来了压力。透过部署小型基地台丛集,无需全面覆盖即可实现局部容量,使营运商能够在降低资本支出的同时,保持用户体验。产业组织预测,未来十年, 小型基地台容量将成长八倍。

监管障碍阻碍了采用

即使经过联邦层级的简化,地方法规仍有很大差异。历史街区通常会进行设计审查,导致核准长达12至24个月,并推高建设预算。目前,美国约有20个州制定了小型基地台法规,但由于解释不一致,跨州建设变得复杂。营运商已将桿顶式基地台外壳标准化,并利用街道设施租赁来缩短週期,但各种摩擦仍然阻碍户外部署。

细分市场分析

到2024年,毫微微基地台)将占总收入的37%,这反映了其价格优势,特别适合家庭和小型办公室使用。毫微微基地台可在约60英尺(约18公尺)的范围内容纳多达6个用户,使其成为室内局部网路改善的理想选择。然而,微型蜂巢(Microcell)预计将以35.30%的复合年增长率(CAGR)实现最快成长。它们能够在1000英尺(约305公尺)的范围内服务200个用户,使其成为人口密集的商业区和交通枢纽的理想选择。随着通讯业者设计也正朝着开放式无线接入网(Open RAN)标准靠拢,从而建构一个小型基地台厂商生态系统,减少厂商锁定并加速创新。

微微型基地台(覆盖中型场所750英尺范围)的兼容性升级正在催生新的企业合同,而区域基地台则正沿主要道路部署,以实现行人层面的平滑切换。室内无线点阵架构已涵盖超过120家营运商,以最少的现场设备即可提供与宏基地台相当的速度。总而言之,这些趋势表明,小型基地台网路市场正从单一设备提案转变为多层次生态系统。

小型基地台网路市场报告按蜂窝类型(毫微微基地台蜂窝、微微型基地台、微型蜂窝、区域基地台、无线点系统)、运行环境(室内和室外)、最终用户垂直行业(银行、金融服务和保险、IT和电信、医疗保健、零售、电力和能源、智慧城市和政府)以及地区进行细分。

区域分析

由于早期C频段竞标和联邦位置改革,北美地区贡献了2024年总收入的35%。光是美国就计画透过「美国农村5G基金」投资90亿美元,将网路覆盖范围扩展到城域网路核心区以外,预计到2022年将部署超过45.2万个室外节点。一项开创性的140亿美元现代化计划将以开放式架构无线电取代传统的基频设备,体现了营运商对供应商多元化的承诺。

亚太地区预计将实现38.49%的复合年增长率,成为成长最快的地区。中国已部署超过50万个5G基地台,而印度的数位通讯政策正在全国逐步放宽权利限制。预计2023年,该地区的行动生态系统将为GDP贡献8,800亿美元,凸显其经济重要性。旗舰级室内小型基地台部署案例,例如KT面向智慧办公环境的Radio Dot部署,充分展现了企业级室内覆盖的商业价值。

欧洲正优先考虑永续性,并寻求能将现场能源消耗降低高达 45% 的解决方案。各国蓝图(例如德国的 5G 战略)优先发展紧凑型小型基地台,以支援自动驾驶和工业 4.0。该地区的通讯业者正在常规地将微型无线电模组嵌入路灯中。伦敦的一个试点计画在威斯敏斯特区增设了 80 个基地台,对视觉影响极小。

中东和非洲部分地区正在将 5G 扩展到朝圣地和智慧城市走廊,沙乌地阿拉伯正在运行一个结合大型基地台和小型基地台的多供应商计画。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 5G频谱竞标和网路密集化强制措施

- 行动数据和视讯流量的爆炸性成长

- 企业对专用 5G/LTE-A 网路的需求

- 监管机构主导的频谱共用和CBRS采用

- 中立的东道主和一波共用基础设施投资

- 人工智慧驱动的自优化网路可降低营运成本

- 市场限制

- 复杂的土地征用和市政许可

- 回程传输光纤/电力可用性缺口

- 能源效率合规成本不断上升

- 射频前端晶片组出口限制与供应风险

- 价值链分析

- 监管格局

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资和资金筹措趋势分析

第五章 市场规模与成长预测

- 按细胞类型

- 毫微微基地台

- 微微型基地台

- 微蜂巢

- 区域基地台

- 无线电点系统

- 透过操作环境

- 室内的

- 户外

- 最终用户

- BFSI

- 资讯科技和通讯

- 卫生保健

- 零售

- 电力和能源

- 智慧城市与政府

- 按地区

- 北美洲

- 南美洲

- 欧洲

- 亚太地区

- 中东和非洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- ZTE Corporation

- Samsung Electronics Co. Ltd.

- Cisco Systems Inc.

- CommScope Inc.(incl. Airvana)

- American Tower Corporation

- Qualcomm Technologies Inc.

- ATandT Inc.

- Verizon Communications Inc.

- Crown Castle International Corp.

- Airspan Networks Holdings Inc.

- Qucell Inc.

- Cirrus Core Networks

- Casa Systems Inc.

- Sercomm Corporation

- Baicells Technologies

- Comba Telecom Systems Holdings Ltd.

- IP.Access Ltd.

- Boingo Wireless Inc.

- Parallel Wireless Inc.

- JMA Wireless

- Corning Inc.(SpiderCloud)

第七章 市场机会与未来展望

The small cell networks market is valued at USD 28.19 billion in 2025 and is forecast to expand at a robust 33.18% CAGR, reaching USD 118.12 billion by 2030.

Rising mobile-data volumes, the transition to higher-frequency 5G bands, and supportive spectrum policies have moved small cells from niche solutions to core network assets. Carriers now treat densification as a necessity because millimeter-wave and mid-band signals attenuate rapidly, especially indoors, where more than 80% of traffic originates. Early wins with shared and neutral-host models are lowering ownership costs, while AI-enabled self-optimizing features are cutting energy use by up to 45% relative to traditional distributed antenna systems. Consolidation is intensifying as incumbents seek scale advantages ahead of the AWS-3 auction mandated for completion by June 2026, a sale projected to redirect USD 3 billion-4.5 billion of mid-band spectrum into commercial hands.

Global Small Cell Networks Market Trends and Insights

5G spectrum auctions accelerate network densification

Mid-band allocations are unlocking the spectral headroom needed for 5G. Independent economic modelling shows that every extra 100 MHz could add USD 264 billion to GDP. The forthcoming AWS-3 sale will reinforce this effect. Faster permitting has trimmed U.S. approval cycles from several years to months, enabling operators to scale from macro sites to thousands of street-level nodes per city. Because millimeter-wave signals decay sharply, achieving contiguous coverage can demand up to 10 times more small cells than legacy macrocells, driving orders for compact radios and integrated antennas.

Mobile-data explosion drives adoption

Annual traffic is rising 20%, and 5G will carry 75% of bits by 2029, according to Ericsson. Streaming UHD video, XR content, and cloud gaming create hotspot demand profiles that strain sectorized macros. Targeted clusters of small cells deliver localized capacity without full-scale overlays, enabling operators to throttle capex while preserving user experience. Deployments have already quadrupled over the past decade; industry associations expect an eight-fold increase in the next ten years.

Regulatory hurdles impede deployment velocity

Even after federal streamlining, local rules vary widely. Historic districts often impose design reviews, stretching approvals to 12-24 months and inflating construction budgets. Roughly 20 U.S. states now have small-cell statutes, yet inconsistent interpretation complicates multi-state builds. Operators are standardizing pole-top enclosures and leveraging street furniture leases to shorten cycles, but friction remains a brake on outdoor rollout.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise private networks create new growth vectors

- Neutral-host models transform deployment economics

- Semiconductor supply constraints threaten scaling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Femtocells captured 37% of 2024 revenue, reflecting their affordability for homes and small offices. They handle up to six users within roughly 60 feet, making them the go-to for spot indoor remediation. Yet microcells are slated to grow fastest at 35.30% CAGR, benefiting from an ability to serve 200 users across 1,000 feet-ideal for dense shopping streets and transit stations. The small cell networks market size for the microcell tier is expected to expand swiftly as carriers combine these nodes with edge compute to support latency-sensitive use cases. Radio designs are also converging with Open RAN standards, enabling multi-vendor ecosystems that reduce lock-in and accelerate innovation.

Compatibility upgrades in picocells-covering 750 feet for mid-sized venues-are unlocking new enterprise contracts, while metrocells are rolling out along arterial roads to smooth hand-offs at pedestrian level. Indoor radio-dot architectures have passed 120 operators and deliver macro-parity speeds with minimal on-site equipment. Collectively, these trends underscore how the small cell networks market is becoming a multi-layered ecosystem rather than a single-device proposition.

The Small Cell Networks Market Report is Segmented by Cell Type (Femtocell, Picocell, Microcell, Metrocell, and Radio Dot Systems), Operating Environment (Indoor and Outdoor), End-User Vertical (BFSI, IT and Telecom, Healthcare, Retail, Power and Energy, and Smart City and Government), and Geography.

Geography Analysis

North America held 35% revenue in 2024, anchored by early C-band auctions and federal siting reforms. The United States alone counted more than 452,000 outdoor nodes by 2022 and is budgeted to invest USD 9 billion via the 5G Fund for Rural America to expand beyond metro cores. A landmark USD 14 billion modernization project is replacing legacy basebands with open-architecture radios, illustrating carrier commitment to vendor diversity.

Asia Pacific is projected to deliver a 38.49% CAGR, the steepest regional trajectory. China has deployed more than 500,000 5G base stations, and India's Digital Communications Policy is easing right-of-way barriers nationwide. The regional mobile ecosystem added USD 880 billion to GDP in 2023, underscoring economic stakes. Flagship indoor small-cell implementations-such as KT's Radio Dot roll-out for smart offices-demonstrate the business case for enterprise-grade indoor coverage.

Europe emphasizes sustainability, pursuing solutions that cut site energy by up to 45%. National roadmaps-Germany's 5G Strategy being an example-prioritize tight-grid small cells to support automated driving and Industry 4.0. Operators in the region routinely embed compact radios on streetlamps; one London pilot added 80 cells across Westminster with minimal visual impact.

The Middle East and parts of Africa are scaling 5G for pilgrimage sites and smart-city corridors, as seen in Saudi Arabia's multi-vendor program that combines macro and small-cell layers.

List of Companies Covered in this Report:

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- ZTE Corporation

- Samsung Electronics Co. Ltd.

- Cisco Systems Inc.

- CommScope Inc. (incl. Airvana)

- American Tower Corporation

- Qualcomm Technologies Inc.

- ATandT Inc.

- Verizon Communications Inc.

- Crown Castle International Corp.

- Airspan Networks Holdings Inc.

- Qucell Inc.

- Cirrus Core Networks

- Casa Systems Inc.

- Sercomm Corporation

- Baicells Technologies

- Comba Telecom Systems Holdings Ltd.

- IP.Access Ltd.

- Boingo Wireless Inc.

- Parallel Wireless Inc.

- JMA Wireless

- Corning Inc. (SpiderCloud)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G spectrum auctions and network densification mandates

- 4.2.2 Explosive mobile-data and video traffic growth

- 4.2.3 Enterprise demand for private 5G / LTE-A networks

- 4.2.4 Regulator-led spectrum-sharing and CBRS uptake

- 4.2.5 Neutral-host and shared-infrastructure investment wave

- 4.2.6 AI-driven self-optimising networks lowering OPEX

- 4.3 Market Restraints

- 4.3.1 Complex site-acquisition and municipal permitting

- 4.3.2 Backhaul fibre / power availability gaps

- 4.3.3 Rising energy-efficiency compliance costs

- 4.3.4 RF front-end chipset export controls and supply risk

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment and Funding Trends Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cell Type

- 5.1.1 Femtocell

- 5.1.2 Picocell

- 5.1.3 Microcell

- 5.1.4 Metrocell

- 5.1.5 Radio Dot Systems

- 5.2 By Operating Environment

- 5.2.1 Indoor

- 5.2.2 Outdoor

- 5.3 By End-user Vertical

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Healthcare

- 5.3.4 Retail

- 5.3.5 Power and Energy

- 5.3.6 Smart City and Government

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 South America

- 5.4.3 Europe

- 5.4.4 Asia-Pacific

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Huawei Technologies Co. Ltd.

- 6.4.2 Telefonaktiebolaget LM Ericsson

- 6.4.3 Nokia Corporation

- 6.4.4 ZTE Corporation

- 6.4.5 Samsung Electronics Co. Ltd.

- 6.4.6 Cisco Systems Inc.

- 6.4.7 CommScope Inc. (incl. Airvana)

- 6.4.8 American Tower Corporation

- 6.4.9 Qualcomm Technologies Inc.

- 6.4.10 ATandT Inc.

- 6.4.11 Verizon Communications Inc.

- 6.4.12 Crown Castle International Corp.

- 6.4.13 Airspan Networks Holdings Inc.

- 6.4.14 Qucell Inc.

- 6.4.15 Cirrus Core Networks

- 6.4.16 Casa Systems Inc.

- 6.4.17 Sercomm Corporation

- 6.4.18 Baicells Technologies

- 6.4.19 Comba Telecom Systems Holdings Ltd.

- 6.4.20 IP.Access Ltd.

- 6.4.21 Boingo Wireless Inc.

- 6.4.22 Parallel Wireless Inc.

- 6.4.23 JMA Wireless

- 6.4.24 Corning Inc. (SpiderCloud)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment