|

市场调查报告书

商品编码

1850367

PLM软体:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030年)PLM Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

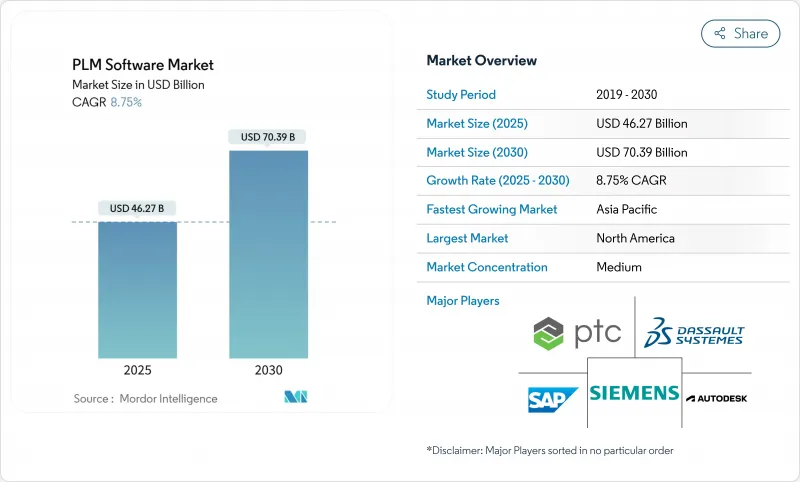

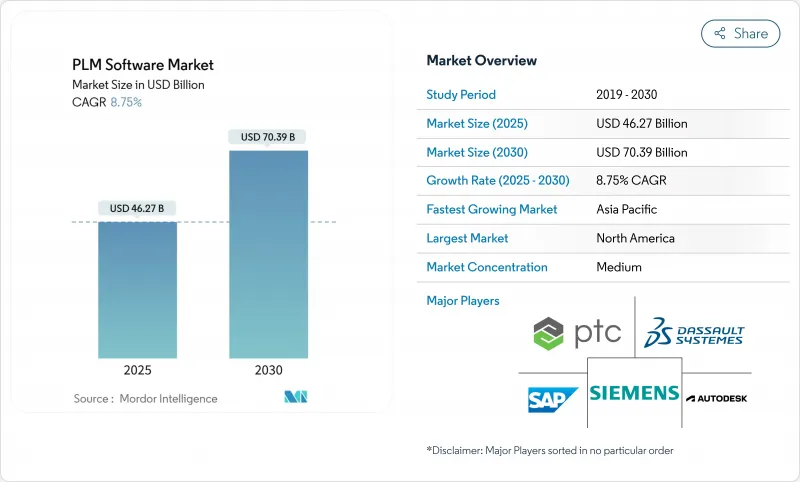

PLM 软体市场预计到 2025 年将达到 462.7 亿美元,到 2030 年将达到 703.9 亿美元,年复合成长率为 8.8%。

从本地部署到云端原生部署的持续转变、工程环境中生成式人工智慧助理的快速普及以及日益增长的可追溯性监管要求,都在推动成长前景。供应商强调,软体即服务 (SaaS) 产品生命週期管理 (PLM) 订阅能够扩展全球分散式工程团队之间的协作,并透过自动更新和弹性运算资源降低营运成本。在汽车、航太和电子设计领域持续面临技能短缺的情况下,生成式人工智慧助理能够加快工程变更单 (ECO) 的週期,并释放专业人员的资源。同时,端到端的 Digital Tread计划将设计、模拟、製造、服务和回收资料连接起来,提供了一个单一资讯来源,简化了对欧洲数位产品护照以及全球类似法规的合规性要求。大型供应商正在收购相关的模拟和资料科学资产,加剧了基于安全、多租户架构建构的综合工业平台之间的竞争。

全球PLM软体市场趋势与洞察

一级製造商拥抱云端优先

PLM软体市场正从传统的本地部署环境转型为SaaS交付模式。 Gartner预测,到2026年,一半的中大型製造商将采用SaaS PLM作为标准解决方案,而Aras报告称,其云端订阅量同比增长超过50%。像红牛和H-TEC Systems这样的成功案例表明,透过使用Aras Innovator SaaS取代本地託管工具,成本节省了35%至50%。虽然自动修补程式、内建网路安全和即时存取AI辅助分析等功能越来越受欢迎,但资料主权问题阻碍了SaaS在日本等市场的普及,这些市场的接受率仍然只有60%左右。不过,混合部署模式——利用SaaS进行协作,同时将敏感工作负载保留在企业内部——可以作为转型过程中的实用桥樑。

对端到端数位主线的需求日益增长

如今,企业将产品资料视为涵盖概念、设计、模拟、製造、服务和回收的连续体。洛克希德马丁公司正在展示如何将 Teamcenter 与下一代 MES 系统集成,以帮助飞机製造商获得完整的生命週期可视性并减少计划外返工。空中巴士的「绿色之家」倡议将 1000 多个旧有系统与 Aras Innovator 连接起来,应用通用资料模型,同时实现快速应用原型製作。随着永续性审核的增加,数位化主线提供了精细的碳足迹指标,有助于企业遵守欧盟生态设计法规,并创建能够快速应对中断和召回的弹性供应链。

传统CAD与现代PLM之间持续存在的互通性差距

将 4400 个檔案从 SOLIDWORKS 迁移到 Teamcenter 可能需要经验丰富的顾问花费一个多月的时间,这凸显了桌面 CAD 架构与企业 PLM资料库之间的脱节。 PTC 的 Onshape 迁移嚮导由 AWS 提供支援,旨在实现资料映射的自动化,但许多公司采用混合环境,这不仅增加了支援成本,也削弱了其所承诺的单一资料来源的有效性。

细分市场分析

到2024年,本地部署系统仍将占PLM软体市场68.2%的份额,这反映了对资料中心硬体和客製化整合的投资。由于疫情期间远距办公的需求,云端合约将以10.5%的复合年增长率成长。 Aras报告称,SaaS的年增长率将超过50%,并引用一项调查显示,81%的行业受访者预计SaaS将成为预设的交付模式。近期部署倾向混合设计模式,利用云端的弹性进行分析,同时将监管资料保留在本地。以目前的成长速度,预计到2030年,这种转变将推动云端部署的PLM软体市场规模超过300亿美元。德语区(德国、奥地利和瑞士)对SaaS的接受度高达91%,而日本的比例为60%,日本强调资料主权的文化减缓了这一转变的步伐。

第二代SaaS架构提供零停机升级和内建灾难復原功能。供应商在通用资料模型之上迭加AI服务,使用者无需安装修补程式即可利用自然语言搜寻和自动程式码产生功能。由于硬体信任根模组和持续渗透测试,其安全性达到甚至超过了本地部署的标准。因此,PLM软体市场正逐步将预算从伺服器等资本支出转向订阅套餐等营运支出。

协作式PDM/CPDM工具,用于管理跨多个学科的图面、规范和变更记录,占了56.1%的收入份额。然而,成长最快的细分市场是数位化製造和MES-PLM集成,其复合年增长率高达9.9%,因为工厂管理人员需要设计意图与车间执行之间实现即时回馈。洛克希德马丁公司正在将其下一代MES与Teamcenter集成,以即时更新设计并减少返工。预计到2030年,MES整合产品的PLM软体市场将翻一番,这显示工程和营运之间的界线正变得越来越模糊。

模拟、分析和ALM/SLM领域的需求一直保持稳定,尤其是在电动车和连网医疗设备等软体定义产品方面。西门子以106亿美元收购的Altair公司正在将其多物理场求解器与Teamcenter集成,从而创建一个统一的环境,工程师可以在其中迭代设计、运行虚拟测试,并将检验的参数直接推送至製造环节。随着工业4.0的加速发展,PLM软体市场将促进闭合迴路流程的构建,将设计、生产和现场性能数据整合到一个持续改进的循环中。

PLM 软体市场报告按部署类型(本地部署、云端部署)、解决方案类型(协作式 PDM/CPDM、MCAD 整合 PLM、其他)、组织规模(大型企业、中小企业)、最终用户产业(汽车和运输、航太和国防、其他)和地区进行细分。

区域分析

预计到2024年,北美地区的收益将增长36.4%,这主要得益于该地区深厚的航太和高科技产业丛集,这些集群很早就实现了数位化流程的标准化。生成式人工智慧试点计画在硅谷蓬勃发展,新兴企业正与产品生命週期管理(PLM)领域的现有企业合作,开发具有情境感知能力的助理。联邦政府强制倡议在国防合约中采用基于模型的系统工程,这将进一步提振市场需求。

亚太地区是成长最快的地区,复合年增长率达9.6%。预计到2024年,中国工业软体市场规模将从2017年的1.293兆元人民币增长一倍以上,超过3兆元。 「中国製造2025」等政府措施以及印度的生产连结奖励计画正在推动工厂数位化。海信集团报告称,实施多站点PLM主干系统后,设计效率提高了70%,平均週期时间从60天缩短至43.2天。因此,如果目前的成长动能持续下去,预计到2030年,亚太地区PLM软体市场规模将超过200亿美元。

欧洲凭藉监管主导保持关键地位。生态设计法规迫使製造商在设计过程早期就融入永续性属性,并强化了生命週期资料管理的必要性。西门子与英国航空航天系统公司(BAE Systems)签署的五年数位化创新协议,标誌着英国国防体系的持续现代化。同时,在法国和德国,主权云端策略的迫切需求正推动着符合Gaia-X框架认证的区域资料中心的采购。在公共云端基础设施消除了资本投资障碍以及提供垂直行业模板的本地合作伙伴的推动下,拉丁美洲、中东和非洲等新兴经济体正逐步进入垂直云市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 一级製造商优先采用云端技术

- 对端到端数位主线的需求日益增长

- 推动产品可追溯性和永续性报告的法规

- 生成式人工智慧副驾驶缩短工程变更单週期

- 中小企业价值链的微订阅PLM软体包

- 市场限制

- 传统CAD和现代PLM之间仍然存在互通性差距。

- 多租户SaaS中的网路安全与智慧财产权外洩问题

- 开放原始码数位双胞胎技术堆迭的兴起正在蚕食付费许可证的市场份额

- 价值链分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 依部署类型

- 本地部署

- 云

- 按解决方案类型

- 协作式 PDM/cPDM

- MCAD整合PLM

- 模拟与分析

- 数位製造和MES-PLM

- ALM/SLM

- 按公司规模

- 大公司

- 小型企业

- 按最终用户产业

- 汽车和运输

- 航太与国防

- 电子与高科技

- 工业和重型设备

- 建筑、工程和施工 (AEC)

- 生命科学和医疗设备

- 消费品/零售

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- ASEAN

- 澳洲和纽西兰

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Siemens AG

- Dassault Systemes SE

- PTC Inc.

- SAP SE

- Autodesk Inc.

- Oracle Corporation

- IBM Corporation

- ANSYS Inc.

- Aras Corporation

- Arena(SaaS by PTC)

- Infor Inc.

- Hexagon AB

- Bentley Systems Inc.

- Altair Engineering Inc.

- Propel Software

- Siemens Mendix

- Dassault SolidWorks

- IFS AB

- HCL Tech xLMCloud

- Accenture Industry X

- ABB Ability PLM

- Epicor CPQ

- OpenBOM

- Propulsion-PLM

第七章 市场机会与未来展望

The PLM software market size stood at USD 46.27 billion in 2025 and is forecast to reach USD 70.39 billion by 2030, advancing at 8.8% CAGR Aras.

Sustained migration from on-premise installations to cloud-native rollouts, the rapid infusion of generative-AI copilots into engineering environments, and rising regulatory demands for traceability collectively lift growth prospects. Vendors highlight that software-as-a-service (SaaS) PLM subscriptions expand collaboration across globally dispersed engineering teams while lowering operating expenses through automatic updates and elastic compute resources. Generative-AI assistants accelerate engineering change-order (ECO) cycles, freeing specialist capacity amid persistent skills shortages in automotive, aerospace, and electronics design. Meanwhile, end-to-end digital-thread projects that link design, simulation, manufacturing, service, and recycling data deliver a single source of truth that simplifies compliance with Europe's Digital Product Passport and similar mandates worldwide. Competitive dynamics intensify as leading providers acquire adjacent simulation and data-science assets, signalling a race to deliver comprehensive industrial platforms built on secure, multi-tenant architectures.

Global PLM Software Market Trends and Insights

Cloud-first adoption among Tier-1 manufacturers

The PLM software market is pivoting from legacy on-premise environments to SaaS delivery as industrial leaders seek real-time collaboration across global design centres. Gartner notes that half of midsize and large manufacturers will standardise on SaaS PLM by 2026, while Aras reports more than 50% year-over-year growth in cloud subscriptions. Success stories such as Red Bull and H-TEC Systems reveal 35-50% cost savings after replacing locally hosted tools with Aras Innovator SaaS. Automatic patching, built-in cyber-security, and instant access to AI-assisted analytics amplify the appeal, although data-sovereignty concerns temper adoption in markets such as Japan, where acceptance lingers at 60%. Even so, hybrid rollouts that retain sensitive workloads on site while using SaaS for collaboration act as a pragmatic bridge during migration.

Growing need for end-to-end digital thread

Enterprises now treat product data as a continuum spanning concept, design, simulation, manufacturing, service, and recycling. Lockheed Martin's integration of Teamcenter with a next-generation MES demonstrates how aircraft builders gain full lifecycle visibility and cut unplanned rework. Airbus's "Greenhouse" initiative ties more than 1,000 legacy systems into Aras Innovator, enabling rapid application prototyping while enforcing common data models. As sustainability audits rise, digital threads deliver granular carbon-footprint metrics, facilitating compliance with EU Eco-design rules and building resilient supply chains able to respond rapidly to disruption or recall events.

Persistent interoperability gaps between legacy CAD and modern PLM

Migrating 4,400 files from SOLIDWORKS to Teamcenter can still consume more than a month for skilled consultants, underscoring the disconnect between desktop CAD schemas and enterprise PLM databases. PTC's Onshape migration-wizard powered by AWS attempts to automate data mapping, yet many firms run hybrid environments that inflate support costs and dilute the promised single source of truth.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory push for product traceability and sustainability reporting

- Generative-AI copilots trimming engineering change-order cycles

- Cyber-security and IP leakage concerns in multi-tenant SaaS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise systems still house 68.2% of the PLM software market in 2024, reflecting sunk investments in data-centre hardware and bespoke integrations. Cloud subscriptions rise at 10.5% CAGR as pandemic-era remote-work imperatives uncover the collaboration limits of site-bound servers. Aras records >50% annual SaaS growth and cites surveys where 81% of industrial respondents expect SaaS to become the default delivery model. Modern rollouts favour hybrid design patterns that retain regulated data locally while exploiting cloud elasticity for analytics. This shift ensures the PLM software market size for cloud deployments is projected to eclipse USD 30 billion by 2030 at current growth rates. The DACH region features 91% SaaS acceptance, contrasting with 60% in Japan, where cultural emphasis on data sovereignty slows transition.

Second-generation SaaS architectures offer zero-downtime upgrades and built-in disaster recovery. Vendors layer AI services atop common data models, letting users tap natural-language search and automated code generation without installing patches. Security now equals or surpasses on-premise benchmarks thanks to hardware-root-of-trust modules and continual penetration testing. As a result, the PLM software market steadily reallocates budgets from capital expenditure on servers to operational expenditure on subscription bundles.

Collaborative PDM/cPDM tools capture 56.1% revenue share by managing drawings, specifications, and change records across multi-disciplinary teams. Yet the fastest-growing slot belongs to digital-manufacturing and MES-PLM integration, which expands 9.9% CAGR as plant managers seek real-time feedback loops between design intent and shop-floor execution. Lockheed Martin exemplifies gains after linking a next-generation MES to Teamcenter, shrinking rework via instant propagation of design updates. The PLM software market size for MES-linked offerings is on track to double by 2030, evidence that discrete boundaries between engineering and operations are disappearing.

Simulation, analysis, and ALM/SLM categories log steady demand, especially in software-defined products like EVs and connected medical devices. Siemens' USD 10.6 billion Altair buyout unites multiphysics solvers with Teamcenter, creating an integrated environment where engineers iterate designs, run virtual tests, and push validated parameters directly to production. As Industry 4.0 accelerates, the PLM software market will likely elevate closed-loop workflows that merge design, production, and field-performance data into a continuous improvement cycle.

The PLM Software Market Report is Segmented by Deployment Type (On-Premise and Cloud), Solution Type (Collaborative PDM / CPDM, MCAD Integration PLM, and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), End-User Industry (Automotive and Transportation, Aerospace and Defence, and More), and Geography.

Geography Analysis

North America captured 36.4% revenue in 2024, benefiting from deep aerospace and high-tech clusters that standardised early on digital-thread programmes. Generative-AI pilots proliferate in Silicon Valley, where start-ups co-innovate with PLM incumbents on context-aware assistants. Federal initiatives that stipulate model-based systems engineering in defence contracts further cement demand.

Asia-Pacific is the fastest-growing theatre with 9.6% CAGR as China's industrial software sector more than doubled from 1,293 billion yuan in 2017 to beyond 3,000 billion yuan by 2024. Government drives such as "Made in China 2025" and India's Production-Linked Incentive schemes spur factories to digitise. Hisense Group reports a 70% design-efficiency gain after rolling out a multi-site PLM backbone, trimming average cycle time from 60 days to 43.2 days. Consequently, Asia-Pacific's slice of the PLM software market size is projected to surpass USD 20 billion by 2030 if present momentum persists.

Europe remains pivotal through regulatory leadership. The Eco-design Regulation forces manufacturers to embed sustainability attributes at design inception, reinforcing the need for lifecycle data management. Siemens' partnership with BAE Systems under a five-year digital-innovation accord indicates ongoing modernisation within the UK defence complex. Meanwhile, sovereign-cloud imperatives in France and Germany steer procurement towards regional data centres certified under Gaia-X frameworks. Emerging economies in Latin America, the Middle East, and Africa are gradually entering the PLM software market, aided by public-cloud infrastructure that removes capex hurdles and local partners that deliver vertical templates.

- Siemens AG

- Dassault Systemes SE

- PTC Inc.

- SAP SE

- Autodesk Inc.

- Oracle Corporation

- IBM Corporation

- ANSYS Inc.

- Aras Corporation

- Arena (SaaS by PTC)

- Infor Inc.

- Hexagon AB

- Bentley Systems Inc.

- Altair Engineering Inc.

- Propel Software

- Siemens Mendix

- Dassault SolidWorks

- IFS AB

- HCL Tech xLMCloud

- Accenture Industry X

- ABB Ability PLM

- Epicor CPQ

- OpenBOM

- Propulsion-PLM

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first adoption among Tier-1 manufacturers

- 4.2.2 Growing need for end-to-end digital thread

- 4.2.3 Regulatory push for product traceability and sustainability reporting

- 4.2.4 Generative-AI copilots trimming engineering change-order cycles

- 4.2.5 Micro-subscription PLM bundles for SMB value chains

- 4.3 Market Restraints

- 4.3.1 Persistent interoperability gaps between legacy CAD and modern PLM

- 4.3.2 Cyber-security and IP leakage concerns in multi-tenant SaaS

- 4.3.3 Growing open-source digital twin stacks cannibalising paid licences

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Type

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By Solution Type

- 5.2.1 Collaborative PDM / cPDM

- 5.2.2 MCAD Integration PLM

- 5.2.3 Simulation and Analysis

- 5.2.4 Digital Manufacturing and MES-PLM

- 5.2.5 ALM / SLM

- 5.3 By Organisation Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Aerospace and Defence

- 5.4.3 Electronics and High-Tech

- 5.4.4 Industrial Machinery and Heavy Equipment

- 5.4.5 Architecture, Engineering and Construction (AEC)

- 5.4.6 Life Sciences and Medical Devices

- 5.4.7 Consumer Packaged Goods / Retail

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Australia and New Zealand

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Siemens AG

- 6.4.2 Dassault Systemes SE

- 6.4.3 PTC Inc.

- 6.4.4 SAP SE

- 6.4.5 Autodesk Inc.

- 6.4.6 Oracle Corporation

- 6.4.7 IBM Corporation

- 6.4.8 ANSYS Inc.

- 6.4.9 Aras Corporation

- 6.4.10 Arena (SaaS by PTC)

- 6.4.11 Infor Inc.

- 6.4.12 Hexagon AB

- 6.4.13 Bentley Systems Inc.

- 6.4.14 Altair Engineering Inc.

- 6.4.15 Propel Software

- 6.4.16 Siemens Mendix

- 6.4.17 Dassault SolidWorks

- 6.4.18 IFS AB

- 6.4.19 HCL Tech xLMCloud

- 6.4.20 Accenture Industry X

- 6.4.21 ABB Ability PLM

- 6.4.22 Epicor CPQ

- 6.4.23 OpenBOM

- 6.4.24 Propulsion-PLM

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment