|

市场调查报告书

商品编码

1850962

专业服务自动化:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Professional Services Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

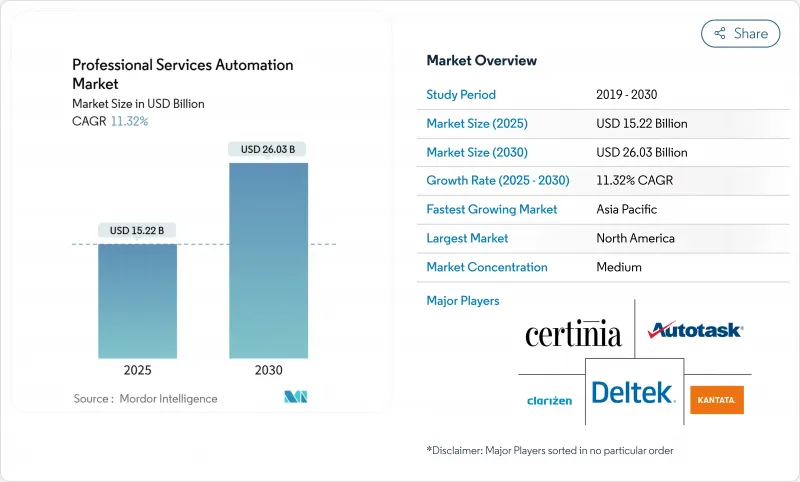

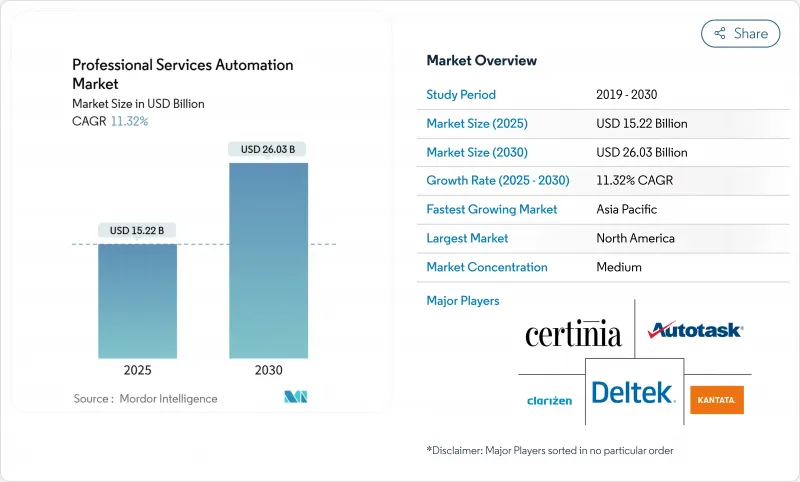

预计到 2025 年,专业服务自动化市场规模将达到 152.2 亿美元,到 2030 年将达到 260.3 亿美元,预测期(2025-2030 年)复合年增长率为 11.32%。

云端优先转型、人工智慧主导的工作流程编配以及对整合计划和现金流可视性的需求正在推动这一扩张。企业竞相采用预测分析来指南人员配置、利润管理和客户体验,而基于结果的计费模式则促进了更丰富的绩效衡量能力。 2024 年 69.3% 的云端采用率证明,可扩展的订阅式交付模式目前是大多数新部署的基础,而能够在月末结算前发现上运作风险的人工智慧模组则加快了决策週期。随着人才短缺的持续,供应商正透过低程式码配置、内建最佳实践范本以及紧密整合的 ERP/CRM 连接器来降低复杂部署的风险,从而实现差异化竞争。平台广度是竞争优势的关键。将计划管理、资源配置、计费和分析整合到单一工作空间中的套件能够吸引更多用户,并推动收入成长。

全球专业服务自动化市场趋势与洞察

中小企业采用云PSA

中小企业正引领专业服务自动化市场实现最强劲的成长,公共部门的数位化津贴和便利的SaaS上线方式消除了以往的基础设施障碍。新加坡的生产力解决方案补助金可返还高达50%的订阅费,让微企业也能获得以往只有全球顾问公司才能使用的功能。订阅定价模式也将前期投资资本支出转化为可控的营运支出,为供应商提供持续资金,从而加速功能发展。 Jana Small Finance Bank在实施UiPath自动化套件后,週转时间缩短了65-70%。这些成果表明,即使是只有10名员工的小型公司也能实现企业级流程编配,进而重塑专业服务领域的竞争格局。

提高资源和利润的即时可见性

宏观经济波动迫使企业即时发现运转率不足和利润漏洞,而非仅依赖季度审查。 BeyondTrust 采用 Certinia PSA,将精细化的技能矩阵与即时回馈机制结合,从而将资源利用率提升了 20%。仪錶板能够清楚显示工程师过度配置和专案里程碑资金不足的情况,在盈利超支侵蚀获利能力之前将其遏制。随着企划团队越来越多地跨时区协作,即时偏差警报使管理人员能够重新安排任务顺序,确保按时完成。内建的 AI 模拟器会对人才招募方案进行压力测试,以确保价格折扣或范围变更不会影响预期的毛利率。

多租户云端中的资料隐私问题

GDPR 制定了严格的居住和同意规则,增加了对处理客户记录、计划笔记和员工工时表的共用租户架构的审查力度。受监管的咨询机构目前正在协商资料处理附加条款,以规范加密金钥、区域容错移转和符合审核要求的日誌记录。虽然超大规模云端已通过 SOC2 和 ISO-27001 认证,但一些客户仍然倾向于单一租户或欧盟主权区域,这减缓了向纯云端的过渡,并在短期内对专业服务自动化的采用产生了一定影响。

细分市场分析

至2024年,云端部署将占专业服务自动化市场69.3%的份额,并在2030年之前以13.2%的复合年增长率成长。自动修补、弹性运算和订阅定价模式符合分散式办公室模式的实际情况,也满足了财务长将资本支出(CAPEX)转向营运支出(OPEX)的需求。虽然在资料必须储存在防火墙后的高监管行业,本地部署的专业服务自动化仍然占据一席之地,但混合型邻近分析或云端移动时间采集等技术正在迅速发展。平台供应商正在深化与AWS和微软的合作,以利用全球可用区和共用的AI加速器。这些倡议正在将实施週期从几季缩短到几週,并扩大专业服务自动化市场的潜在规模。

过去依赖永久许可的传统供应商如今正在开发增量迁移套件,提供资料迁移工具和双系统运行选项,以最大限度地减少停机时间。云端原生的参与企业正利用这种惯性,承诺零占用空间部署、按需收费以及适合没有专门IT支援的团队使用的产品内演示。因此,云端PSA的普及不仅取代了传统工具,也促使新兴经济体首次购买PSA,从而扩大了专业服务自动化市场。

到2024年,解决方案收入将占总收入的61.6%,而服务收入正以13.7%的复合年增长率快速增长,这反映出企业级部署的兴起,而这些部署需要流程重组、资料清理和用户赋能。每个新的AI模组或ERP连接器都需要下游配置、整合和管治框架,但客户往往缺乏频宽。因此,系统整合商正在获取高额咨询收入,包括制定蓝图、配置基于角色的仪表板以及协调分阶段切换。

由于成功实施取决于行为改变,变革管理专家将主导沟通、角色扮演和KPI仪表板,以在实施后保持动力。像Thirdera这样的供应商迅速行动,为ServiceNow客户提供工作流程资料架构加速器。服务改进能够提高平均合约价值,支援持续成长的订单,并巩固专业服务自动化市场中供应商与客户之间的长期关係。

专业服务自动化市场按部署类型(云端部署与本地部署)、组件(解决方案与服务)、公司规模(大型企业与中小企业)、最终用户行业垂直领域(IT与通讯、金融服务和保险、其他)、功能模组(计划与资源管理、发票与结算、其他)以及地区进行细分。市场预测以美元(USD)计价。

区域分析

到2024年,北美将占据专业服务自动化市场规模的38.06%,这主要得益于成熟的IT咨询生态系统、萨班斯-奥克斯利法案以及早期人工智慧试点计画的预算投入。由于靠近总部,许多供应商能够利用回馈机制和与设计合作伙伴的关係来加速功能部署。早期采用者目前正从部门试点转向企业级集成,重点关注利用率优化、高级盈利建模以及人工智慧驱动的提案生成。儘管市场饱和限制了销售成长,但分析、行动端支出以及向人才市场交叉销售正在推动收入成长。

亚太地区正以14.5%的复合年增长率(CAGR)维持全球最快的成长速度,主要得益于政府补贴、薪资上涨压力以及蓬勃发展的SaaS开发者群体。预计2024年,日本的电子合约咨询量将激增157%,预示数位化浪潮的席捲全球。印度SaaS公司计划在2028年占据全球8%的市场份额,它们既是PSA(生产力解决方案)领域的买家,也是其建构者。新加坡的生产力解决方案补助金计画以及澳洲对人工智慧生产力的重视将进一步推动该地区的发展。供应商正在对税务、合规和语言包进行本地化,以开拓这些多元化的细分市场。

在欧洲,儘管对GDPR的担忧,PSA的普及仍在稳步推进。许多咨询机构正在寻求私有云端或欧盟主权云部署方案,一旦采购障碍消除,销售週期虽然会延长,但交易规模将会扩大。 Workday在英国投资5.5亿英镑,其中包括本地AWS区域和学徒计划,以缓解资料居住问题和人才短缺的困扰。强制性ESG报告也推动了PSA功能的增强,使其能够捕捉碳排放影响和多元化指标,从而将专业服务自动化市场定位为监管合规的推动者。同时,在中东和非洲,PSA也开始被用于监管大型计划,例如智慧城市建设和基础设施开发。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 中小企业采用云PSA

- 实现资源和利润的即时可见性

- ERP/CRM整合势头强劲

- 转向以结果为导向的服务模式

- 人工智慧驱动的预测性人员配置分析

- 市场限制

- 多租户云端中的资料隐私问题

- 与传统技术栈整合的复杂性

- 缺乏具备PSA技能的实施人员

- 供应商整合与锁定风险

- 产业价值链分析

- 监管环境

- 技术展望

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 影响市场的宏观经济因素

第五章 市场规模与成长预测

- 依部署类型

- 云

- 本地部署

- 按组件

- 解决方案

- 服务

- 按公司规模

- 大公司

- 小型企业

- 按最终用户行业划分

- 资讯科技和通讯

- BFSI

- 建筑、工程及施工

- 卫生保健

- 法律服务

- 咨询顾问

- 其他终端用户产业

- 按功能模组

- 计划和资源管理

- 帐单和发票

- 时间和费用跟踪

- 商业分析与报告

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 新加坡

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Autotask Corporation(Datto)

- Kantata(Mavenlink+Kimble Apps)

- Clarizen Inc.

- Deltek Inc.

- Certinia(FinancialForce.com, Inc.)

- Infor Inc.

- Oracle NetSuite OpenAir

- Upland Software(Tenrox)

- Projector PSA Inc.

- Replicon Inc.

- Unanet Technologies

- Adobe Workfront

- ConnectWise PSA

- BigTime Software

- Planview(Changepoint)

- Avaza Ltd.

- Accelo Ltd.

- Wrike(Citrix)

- Hub Planner

- BQE Software(BQE CORE)

- Smartsheet(Resource Mgt)

- ServiceNow PSA

- Unit4 PSA

- Kimble(legacy)

- Workday PSA

- SAP Professional Services Cloud

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Professional Services Automation Market size is estimated at USD 15.22 billion in 2025, and is expected to reach USD 26.03 billion by 2030, at a CAGR of 11.32% during the forecast period (2025-2030).

Cloud-first transformation, AI-driven workflow orchestration, and the need for unified project-to-cash visibility anchor this expansion. Firms race to embed predictive analytics that guide staffing, margin management, and client outcomes, while outcome-based billing models spur richer performance measurement capabilities. A 69.3% cloud deployment footprint in 2024 proves that scalable, subscription-based delivery now underpins most new implementations, and AI modules that surface utilization risks before month-end close accelerate decision cycles. As talent shortages persist, vendors differentiate through low-code configuration, embedded best-practice templates, and tight ERP/CRM connectors that de-risk complex rollouts. Competitive advantage hinges on platform breadth: suites that combine project management, resourcing, billing, and analytics in one workspace capture larger seat counts and drive expansion revenue.

Global Professional Services Automation Market Trends and Insights

Cloud PSA Adoption Among SMEs

Small and medium enterprises propel the most dynamic growth in the professional services automation market as public-sector digitization grants and easy SaaS onboarding dismantle historical infrastructure hurdles. Singapore's Productivity Solutions Grant reimburses up to 50% of subscription fees, letting micro-firms access capabilities once reserved for global consultancies. A referral flywheel forms as early wins showcase productivity boosts, and subscription pricing converts upfront CAPEX into manageable OPEX, giving vendors recurring cash flows that fund feature velocity. Jana Small Finance Bank cut turnaround time by 65-70% after deploying UiPath's automation suite. Such results validate the thesis that even a 10-seat firm can wield enterprise-grade orchestration, reshaping competitive parity across professional services segments.

Drive for Real-Time Resource and Margin Visibility

Macroeconomic volatility forces firms to expose utilization gaps and margin leaks in real time rather than at quarterly review. BeyondTrust lifted resource utilization 20% after adopting Certinia PSA, pairing granular skills matrices with live feedback loops. Dashboards that surface over-allocated engineers or under-funded milestones curb cost overruns before they erode profitability. As more project teams work across time zones, instantaneous variance alerts allow managers to re-sequence tasks without breaching delivery windows. Embedded AI simulators pressure-test resourcing scenarios, ensuring that rate-card discounts or scope changes do not dilute forecasted gross margin.

Data-Privacy Concerns in Multi-Tenant Clouds

GDPR imposes strict residency and consent rules that intensify scrutiny of shared-tenant architectures handling client records, project notes, and employee timesheets. Regulated advisory practices now negotiate data-processing addendums that stipulate encryption keys, regional failover, and audit-ready logging. While hyperscale clouds boast SOC 2 and ISO-27001 attestations, some clients still prefer single-tenant or EU sovereign zones, delaying pure-cloud migrations and marginally dampening professional services automation market adoption in the short term.

Other drivers and restraints analyzed in the detailed report include:

- ERP/CRM Integration Momentum

- AI-Driven Predictive Staffing Analytics

- Integration Complexity with Legacy Stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments represented 69.3% of the professional services automation market size in 2024 and are slated to grow at 13.2% CAGR to 2030, reflecting a decisive pivot from on-premise custom builds. Automatic patching, elastic compute, and subscription pricing align with distributed workforce realities and CFO mandates to shift CAPEX to OPEX. On-premise PSA persists in highly regulated niches that mandate behind-firewall data residency, but even there, hybrid adjacency-analytics or mobile time capture in the cloud-gains traction. Platform vendors deepen alliances with AWS and Microsoft to tap global availability zones and shared AI accelerators. These moves compress implementation cycles from quarters to weeks, broadening the total addressable professional services automation market.

Traditional vendors that once relied on perpetual licenses now craft phased migration toolkits, offering data migration utilities and dual-running options that limit downtime. Emerging entrants born in the cloud exploit this inertia by promising zero-footprint deployment, consumption-based billing, and in-product walk-throughs suited to teams without dedicated IT support. As a result, cloud PSA adoption not only displaces legacy tools but can also catalyze first-time PSA buyers in emerging economies, extending the professional services automation market footprint.

While Solutions retained 61.6% revenue in 2024, the Services segment is expanding at 13.7% CAGR, mirroring the rise in enterprise-wide rollouts that demand process re-engineering, data cleanup, and user enablement. Every new AI module or ERP connector creates a downstream need for configuration, integration, and governance frameworks, and customers often lack the bandwidth to manage this layer themselves. Systems integrators, therefore, carve premium consulting revenue, shaping roadmaps, configuring role-based dashboards, and staging phased cut-overs.

Because successful adoption hinges on behavior change, change-management specialists orchestrate communications, role-play sessions, and KPI dashboards that sustain momentum post go-live. Vendors such as Thirdera became early movers, delivering Workflow Data Fabric accelerators for ServiceNow customers. The services upturn bolsters average contract value and underpins recurring expansion bookings, solidifying long-term vendor-client relationships within the professional services automation market.

Professional Services Automation Market is Segmented by Deployment Type (Cloud and On-Premise), Component (Solutions and Services), Enterprise Size (Large Enterprises and Small and Medium Enterprises), End-User Industry (IT and Telecom, BFSI, and More), Functionality Module (Project and Resource Management, Billing and Invoicing, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.06% of the professional services automation market size in 2024, anchored by mature IT consulting ecosystems, Sarbanes-Oxley controls, and early AI pilot budgets. Headquarters proximity grants many vendors live feedback loops and design-partner engagements that accelerate feature rollouts. Early adopters now progress from departmental pilots to enterprise-wide consolidations, focusing on utilization optimization, advanced profitability modeling, and AI-assisted proposal generation. Although saturation tempers volume growth, cross-selling into analytics, mobile expense, and talent marketplaces sustains revenue lift.

Asia-Pacific is on track for the fastest 14.5% CAGR, backed by government grants, rising wage pressure, and a vibrant SaaS developer base. Japan saw a 157% spike in electronic contract inquiries in 2024, signaling widespread digitization momentum. India's SaaS firms target an 8% global share by 2028, translating into dual-role participation as both buyers and builders of PSA capabilities. Singapore's Productivity Solutions Grant and Australia's focus on AI productivity further energize the regional pipeline. Vendors localize tax, compliance, and language packs to capture these diverse micro-markets.

Europe offers steady uptake tempered by GDPR anxieties. Many advisory practices pursue private-cloud or EU-sovereign deployments, elongating sales but enlarging deal size once procurement hurdles clear. Workday's GBP 550 million UK investment includes local AWS regions and apprenticeship programs, easing data-residency fears and talent shortages. ESG reporting mandates also catalyze PSA enhancements that capture carbon impact and diversity metrics, positioning the professional services automation market as an enabler of regulatory compliance. Meanwhile, the Middle East and Africa begin to deploy PSA for megaproject oversight-think smart-city builds and infrastructure rollouts-though connectivity gaps and scarce admin talent slow mass adoption.

- Autotask Corporation (Datto)

- Kantata (Mavenlink + Kimble Apps)

- Clarizen Inc.

- Deltek Inc.

- Certinia (FinancialForce.com, Inc.)

- Infor Inc.

- Oracle NetSuite OpenAir

- Upland Software (Tenrox)

- Projector PSA Inc.

- Replicon Inc.

- Unanet Technologies

- Adobe Workfront

- ConnectWise PSA

- BigTime Software

- Planview (Changepoint)

- Avaza Ltd.

- Accelo Ltd.

- Wrike (Citrix)

- Hub Planner

- BQE Software (BQE CORE)

- Smartsheet (Resource Mgt)

- ServiceNow PSA

- Unit4 PSA

- Kimble (legacy)

- Workday PSA

- SAP Professional Services Cloud

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud PSA adoption among SMEs

- 4.2.2 Drive for real-time resource and margin visibility

- 4.2.3 ERP/CRM integration momentum

- 4.2.4 Shift to outcome-based service models

- 4.2.5 AI-driven predictive staffing analytics

- 4.3 Market Restraints

- 4.3.1 Data-privacy concerns in multi-tenant clouds

- 4.3.2 Integration complexity with legacy stacks

- 4.3.3 Scarcity of PSA-skilled implementation talent

- 4.3.4 Vendor consolidation and lock-in risk

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment Type

- 5.1.1 Cloud

- 5.1.2 On-Premise

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.2 Services

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Architecture, Engineering, and Construction

- 5.4.4 Healthcare

- 5.4.5 Legal Services

- 5.4.6 Consulting and Advisory

- 5.4.7 Other End-user Industries

- 5.5 By Functionality Module

- 5.5.1 Project and Resource Management

- 5.5.2 Billing and Invoicing

- 5.5.3 Time and Expense Tracking

- 5.5.4 Business Analytics and Reporting

- 5.5.5 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Autotask Corporation (Datto)

- 6.4.2 Kantata (Mavenlink + Kimble Apps)

- 6.4.3 Clarizen Inc.

- 6.4.4 Deltek Inc.

- 6.4.5 Certinia (FinancialForce.com, Inc.)

- 6.4.6 Infor Inc.

- 6.4.7 Oracle NetSuite OpenAir

- 6.4.8 Upland Software (Tenrox)

- 6.4.9 Projector PSA Inc.

- 6.4.10 Replicon Inc.

- 6.4.11 Unanet Technologies

- 6.4.12 Adobe Workfront

- 6.4.13 ConnectWise PSA

- 6.4.14 BigTime Software

- 6.4.15 Planview (Changepoint)

- 6.4.16 Avaza Ltd.

- 6.4.17 Accelo Ltd.

- 6.4.18 Wrike (Citrix)

- 6.4.19 Hub Planner

- 6.4.20 BQE Software (BQE CORE)

- 6.4.21 Smartsheet (Resource Mgt)

- 6.4.22 ServiceNow PSA

- 6.4.23 Unit4 PSA

- 6.4.24 Kimble (legacy)

- 6.4.25 Workday PSA

- 6.4.26 SAP Professional Services Cloud

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment