|

市场调查报告书

商品编码

1851021

工业感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Industrial Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

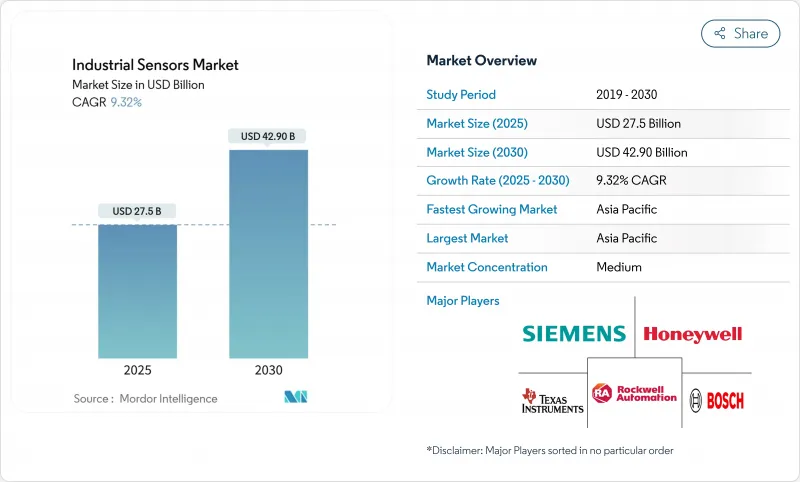

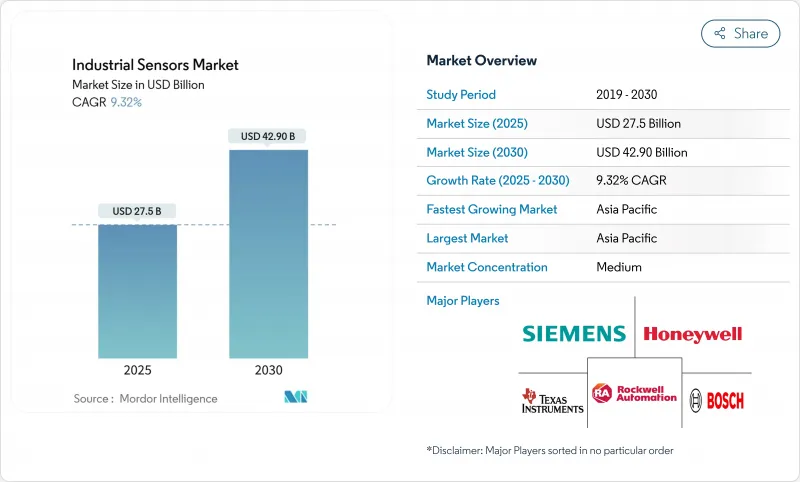

预计到 2025 年,工业感测器市场规模将达到 275 亿美元,到 2030 年将扩大到 429 亿美元,复合年增长率为 9.3%。

强劲的需求源自于工厂数位化程度的提高、边缘设备的普及以及简化系统整合的开放通讯协定的广泛应用。製造商将密集型感测器网路视为自动驾驶的“耳目”,无需将所有数据上传至云端即可实现现场快速决策。能源密集型产业正在部署精细化感测技术以满足日益严格的脱碳要求,而棕地工厂则正在加速进行IO-Link维修,以获取资产健康数据。在技术方面,感测器内建人工智慧和多重通讯协定连接正在重塑工业感测器市场,增强关键任务环境中的反应速度和韧性。

全球工业感测器市场趋势与洞察

工业4.0/工业物联网应用激增

面临数位化挑战的製造商正推动工业感测器市场蓬勃发展。密集的感测器网路是工业物联网 (IIoT) 架构的基础,能够即时撷取温度、压力和流量等数据,将以往各自独立的机械设备转变为智慧资产。随着工厂将分析环节更靠近生产流程,降低延迟并缓解对云端频宽的需求,预计边缘运算领域的支出将大幅成长。亚太地区尤其如此,中国的智慧工厂政策和日本的自动化主导正在加速感测器的应用。

对预测性维护和远端监控的需求

数据主导的维护策略正日益普及,因为及早发现故障可以减少代价高昂的停机时间。透过部署结合振动、温度和声波感测器以及边缘人工智慧模型的设备,可以在降低网路流量的同时,实现超过 90% 的预测准确率。流程工业由于其严格的安全要求而重视这些功能,但投资回报率的计算必须考虑整合工作和组织变革。

高额资本支出和复杂的整合

对于中小企业而言,如果将网路升级、中介软体和整合服务等费用纳入考量,计划总成本通常会是材料清单的三到四倍。维修原有的MES和ERP平台以适应异质感测器输出,可能会导致漫长的实施过程,并且需要专门的资源。

细分市场分析

液位感测器预计在2024年占销售额的18.4%,为化学、石油和水处理等行业的工业感测器市场提供至关重要的库存管理功能。同时,受线上机器视觉系统在自动化缺陷检测领域日益普及的推动,影像/视觉设备预计将以11.2%的复合年增长率成长。儘管有线类比感测器仍受到工厂的青睐,因为它们可靠性久经考验,但具备自我诊断功能的数位感测器也在快速发展。供应商正在根据ESG(环境、社会和治理)要求,将用于能源监测的MEMS(微机电系统)压力和流量感测器小型化。

次要趋势包括:结合光学和超音波技术的混合感测平台,旨在提高对复杂固体材料测量的精度;以及嵌入轻便型相机的边缘人工智慧技术,可在不占用过多频宽的情况下实现设备端异常检测。这些动态可能会推动工业液位测量感测器市场保持其主导地位,即便新兴成像技术正在吸引更多投资。

到2024年,离散製造将占据工业感测器市场31%的份额。在对连续设备监测的强劲需求推动下,工厂不断升级到可同时撷取振动、温度和位置资料的多功能感测器。生命科学和製药产业预计到2030年将以9.8%的复合年增长率成长,这主要得益于无菌生产环境更严格的验证通讯协定以及连续生产线的日益普及。

化学和石化企业在旨在优化产量比率的数位双胞胎框架内部署了强大的排放气体监测解决方案。矿业公司正在试验利用密集环境感测技术来导航危险区域的集群机器人系统。电力公共产业在电网现代化改造过程中,正在整合光纤和压电感测器,以改善可再生能源发电预测和资产管理,从而将工业感测器产业拓展到新的能源领域。

工业感测器市场按感测器类型(流量、压力及其他)、终端用户产业(化工及石化、矿业及冶金、电力及能源、食品及饮料及其他)、技术(有线/模拟、边缘AI/虚拟感测器及其他)、通讯协定(现场汇流排及其他)及地区进行细分。所有细分市场的市场规模和预测均以美元计价。

区域分析

亚太地区将在2024年占全球支出的44%,这反映了持续的政策奖励和强大的机器人生态系统。中国在「中国製造2025」计画的推动下,将占全球工业机器人出货量的52%,并且作为汽车和家电中心,其感测器订单量强劲。日本提供尖端的自动化技术,而韩国则在政府联合投资的推动下,加速智慧工厂的普及。

北美在多元化、小批量生产和能源基础设施升级方面仍然至关重要。工厂正在整合边缘人工智慧感测器,以推动预测性维护并提高工人安全。欧洲市场的成长与强制持续排放气体监测的脱碳法规一致,刺激了对高精度流量和气体分析感测器的需求。中东、非洲和南美洲的新兴经济体正在加速基础建设,推动采矿、金属和发电工程对相关技术的应用日益广泛。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 工业4.0/工业物联网主流应用激增

- 对预测性维护和远端监控的主流需求

- 以机器人为中心的智慧工厂发展已成为主流

- 隐蔽的边缘AI感测器节点降低云延迟

- 棕地工厂IO-Link改装浪潮

- 净零排放指令能够实现精细化的能源检测

- 市场限制

- 主流方案:资本投入高,整合难度高

- 网路感测器中的网路安全漏洞

- 幕后资料主权规则限制了跨境分析

- OT-IT技能的隐性短缺减缓了技术的采用。

- 价值/供应链分析

- 监管环境

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依感测器类型

- 流动

- 压力

- 邻近/区域

- 等级

- 温度

- 图像/视觉

- 光电

- 其他类型

- 按最终用户行业划分

- 化工/石油化工

- 采矿和金属

- 电力和能源

- 饮食

- 生命科学与製药

- 航太/国防

- 用水和污水

- 其他行业

- 透过技术

- 有线/模拟

- 有线/数字(智慧)

- 无线的

- 边缘人工智慧/虚拟感测器

- 透过通讯协定

- 现场汇流排(例如 PROFIBUS、Modbus)

- 工业乙太网(PROFINET、EtherNet/IP、EtherCAT)

- IO-Link

- 无线ICP(Wi-Sun、6LoWPAN、BLE-Mesh)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 越南

- 亚太其他地区

- 中东和非洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Siemens AG

- Honeywell International Inc.

- Texas Instruments Inc.

- Rockwell Automation Inc.

- Bosch Sensortec GmbH

- TE Connectivity Ltd.

- ABB Ltd.

- STMicroelectronics NV

- Infineon Technologies AG

- NXP Semiconductors NV

- Omron Corporation

- Sick AG

- Emerson Electric Co.

- Schneider Electric SE

- Balluff GmbH

- Pepperl+Fuchs SE

- Keyence Corporation

- IFM Electronic GmbH

- Yokogawa Electric Corp.

- Endress+Hauser AG

- Analog Devices Inc.

第七章 市场机会与未来展望

The industrial sensors market reached USD 27.5 billion in 2025 and is forecast to advance to USD 42.9 billion by 2030, delivering a 9.3% CAGR.

Strong demand stems from rising factory digitalization, deeper penetration of edge-ready devices, and wider availability of open communications protocols that simplify system integration. Manufacturers view dense sensor networks as the "eyes and ears" of automated operations, enabling faster decisions on the shop floor without routing all data to the cloud. Energy-intensive sectors now deploy granular sensing to comply with tightening decarbonization mandates, while brown-field plants accelerate IO-Link retrofits to unlock asset-health data. On the technology front, in-sensor AI and multi-protocol connectivity are redefining the industrial sensors market, enhancing responsiveness and resilience in mission-critical environments.

Global Industrial Sensors Market Trends and Insights

Industry 4.0 / IIoT Adoption Surge

Manufacturers under competitive pressure to digitize operations keep fueling an upswing in the industrial sensors market. Dense sensor grids underpin IIoT architectures that collect real-time data on temperature, pressure, and flow, transforming previously disconnected machines into intelligent assets. Edge computing spend is projected to rise steeply as plants shift analytics closer to the process, trimming latency and easing cloud bandwidth demands. The trend is pronounced in Asia-Pacific where China's smart-factory mandates and Japan's automation leadership accelerate sensor uptake.

Predictive Maintenance & Remote Monitoring Demand

Data-driven maintenance strategies are gaining traction because early fault detection curbs costly downtime. Facilities deploying vibration, thermal, and acoustic sensors coupled with edge AI models achieve prediction accuracies above 90% while lowering network traffic. Process industries value these capabilities due to stringent safety requirements, yet ROI calculations must account for integration work and organizational change.

High Capex and Integration Complexity

Small and mid-size enterprises often face total project costs three to four times higher than the bill of materials once network upgrades, middleware, and integration services are included. Retrofitting legacy MES and ERP platforms to accommodate heterogeneous sensor outputs prolongs implementation and demands specialist talent.

Other drivers and restraints analyzed in the detailed report include:

- Robot-centric Smart-factory Expansion

- Cyber-security Vulnerabilities of Networked Sensors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Level sensors accounted for 18.4% of 2024 revenue, anchoring the industrial sensors market with indispensable inventory-control functionality in chemicals, oil, and water-treatment operations. Image/vision devices, meanwhile, are forecast for an 11.2% CAGR as inline machine-vision systems proliferate for automated defect detection. Wired analog versions remain widespread because factories value proven reliability, but digital variants with self-diagnostics are advancing fast. Suppliers are miniaturizing MEMS pressure and flow sensors for energy-monitoring tasks aligned with ESG mandates.

Second-order trends point to hybrid sensing platforms that combine optical and ultrasonic techniques to boost accuracy for challenging solid-material measurements. Edge AI incorporated within compact cameras now enables on-device anomaly detection without bandwidth strain. These dynamics position the industrial sensors market size for level measurement to retain a commanding share even as emerging imaging technologies capture incremental spend.

Discrete manufacturing held 31% of the industrial sensors market share in 2024 due to persistent investments in automotive and electronics lines. Robust demand for continuous equipment monitoring keeps factories upgrading to multifunctional sensors that capture vibration, temperature, and positional data concurrently. Life sciences and pharmaceuticals are projected to achieve a 9.8% CAGR through 2030, benefitting from stricter validation protocols for sterile production environments and wider adoption of continuous-manufacturing lines.

Manufacturers in chemicals and petrochemicals deploy rugged solutions for emissions monitoring within digital-twin frameworks aimed at optimizing yield. Mining operators experiment with swarm-robotics systems that rely on dense environmental sensing to navigate hazardous zones. Utilities modernizing grids integrate fiber-optic and piezoelectric sensors to improve renewable-generation forecasting and equipment asset management, extending the industrial sensors industry into new energy verticals.

The Industrial Sensors Market is Segmented by Sensor Type (Flow, Pressure, and More), End-User Industry (Chemical & Petrochemicals, Mining & Metals, Power & Energy, Food & Beverage and More), Technology (Wired / Analog, Edge-AI / Virtual Sensors and More), Communication Protocol (Fieldbus and More), Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Segments.

Geography Analysis

Asia-Pacific captured 44% of 2024 spending, reflecting ongoing policy incentives and a strong robotics ecosystem. China dominates installations, propelled by the Made in China 2025 program and a 52% share of global industrial-robot shipments, translating into vigorous sensor orders across automotive and consumer-electronics hubs. Japan contributes cutting-edge automation technologies, while South Korea's government co-investment accelerates smart-factory penetration.

North America remains pivotal for high-mix, low-volume production and energy-infrastructure renewal. Plants integrate edge-AI sensors to advance predictive maintenance and enhance workforce safety. Europe's market growth aligns with decarbonization rules that require continuous emissions monitoring, stimulating demand for high-precision flow and gas-analysis sensors. Emerging economies in the Middle East, Africa, and South America increase uptake for mining, metals, and power-generation projects as infrastructure build-outs gather momentum.

- Siemens AG

- Honeywell International Inc.

- Texas Instruments Inc.

- Rockwell Automation Inc.

- Bosch Sensortec GmbH

- TE Connectivity Ltd.

- ABB Ltd.

- STMicroelectronics N.V.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Omron Corporation

- Sick AG

- Emerson Electric Co.

- Schneider Electric SE

- Balluff GmbH

- Pepperl+Fuchs SE

- Keyence Corporation

- IFM Electronic GmbH

- Yokogawa Electric Corp.

- Endress+Hauser AG

- Analog Devices Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Industry 4.0 / IIoT adoption surge

- 4.2.2 Mainstream Predictive maintenance & remote monitoring demand

- 4.2.3 Mainstream Robot-centric smart-factory expansion

- 4.2.4 Under-the-radar Edge-AI sensor nodes cut cloud latency

- 4.2.5 Under-the-radar IO-Link retrofit wave in brown-field plants

- 4.2.6 Under-the-radar Net-zero mandates drive granular energy sensing

- 4.3 Market Restraints

- 4.3.1 Mainstream High capex & integration complexity

- 4.3.2 Mainstream Cyber-security vulnerabilities of networked sensors

- 4.3.3 Under-the-radar Data-sovereignty rules limit cross-border analytics

- 4.3.4 Under-the-radar OT-IT skills shortage slows deployments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Flow

- 5.1.2 Pressure

- 5.1.3 Proximity / Area

- 5.1.4 Level

- 5.1.5 Temperature

- 5.1.6 Image / Vision

- 5.1.7 Photo-electric

- 5.1.8 Other Types

- 5.2 By End-user Industry

- 5.2.1 Chemical & Petrochemicals

- 5.2.2 Mining & Metals

- 5.2.3 Power & Energy

- 5.2.4 Food & Beverage

- 5.2.5 Life Sciences & Pharmaceuticals

- 5.2.6 Aerospace & Defense

- 5.2.7 Water & Waste-water

- 5.2.8 Other Industries

- 5.3 By Technology

- 5.3.1 Wired / Analog

- 5.3.2 Wired / Digital (Smart)

- 5.3.3 Wireless

- 5.3.4 Edge-AI / Virtual Sensors

- 5.4 By Communication Protocol

- 5.4.1 Fieldbus (e.g., PROFIBUS, Modbus)

- 5.4.2 Industrial Ethernet (PROFINET, EtherNet/IP, EtherCAT)

- 5.4.3 IO-Link

- 5.4.4 Wireless ICPs (Wi-Sun, 6LoWPAN, BLE-Mesh)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 Vietnam

- 5.5.4.5 Rest of APAC

- 5.5.5 Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Siemens AG

- 6.4.2 Honeywell International Inc.

- 6.4.3 Texas Instruments Inc.

- 6.4.4 Rockwell Automation Inc.

- 6.4.5 Bosch Sensortec GmbH

- 6.4.6 TE Connectivity Ltd.

- 6.4.7 ABB Ltd.

- 6.4.8 STMicroelectronics N.V.

- 6.4.9 Infineon Technologies AG

- 6.4.10 NXP Semiconductors N.V.

- 6.4.11 Omron Corporation

- 6.4.12 Sick AG

- 6.4.13 Emerson Electric Co.

- 6.4.14 Schneider Electric SE

- 6.4.15 Balluff GmbH

- 6.4.16 Pepperl+Fuchs SE

- 6.4.17 Keyence Corporation

- 6.4.18 IFM Electronic GmbH

- 6.4.19 Yokogawa Electric Corp.

- 6.4.20 Endress+Hauser AG

- 6.4.21 Analog Devices Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment