|

市场调查报告书

商品编码

1851029

无线网路安全:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Wireless Network Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

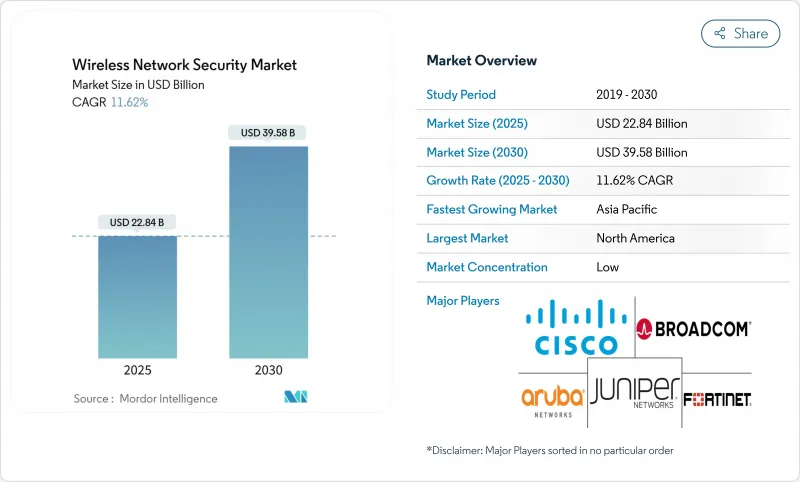

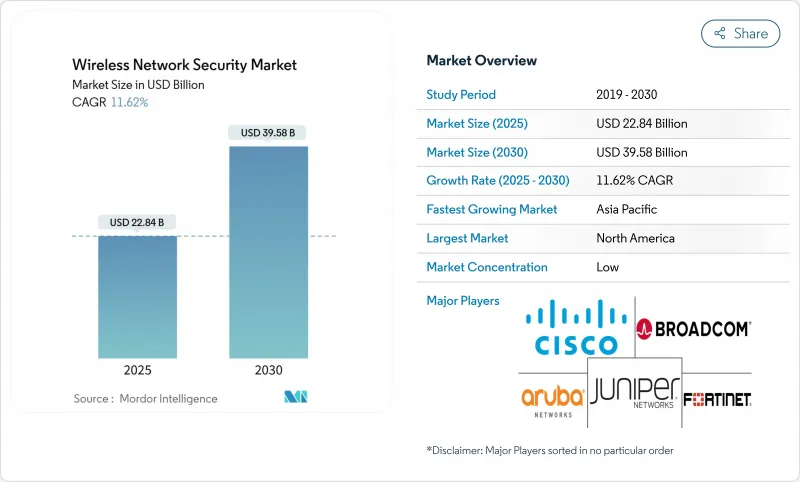

预计到 2025 年,无线网路安全市场规模将达到 228.4 亿美元,到 2030 年将达到 395.8 亿美元,预测期(2025-2030 年)的复合年增长率为 11.62%。

强劲的需求源自于Wi-Fi 6E和Wi-Fi 7的快速普及、云端优先策略以及私人5G部署,这些因素扩大了攻击面,并对下一代零信任保护提出了更高的要求。企业正在用整合安全堆迭取代以边界为中心的防御,这些堆迭能够与安全存取服务边缘框架无缝整合。此外,美国实施的多因素身份验证也加速了整合无线安全防护的普及。传统的深层封包侦测引擎无法在不增加延迟的情况下维持多Gigabit的吞吐量,迫使供应商专门针对6GHz频段重新设计晶片,导致硬体持续更新换代。北美凭藉着一项30亿美元的「拆机升级」计画引领着这一潮流,而亚太地区则实现了最快的成长,因为行动优先的经济体正在充分利用5G主导的数位化。在日益激烈的竞争中,供应商正转向人工智慧驱动的异常检测、量子安全加密和云端原生交付模式,以维持利润率和市场竞争力。

全球无线网路安全市场趋势与洞察

Wi-Fi 6E/7 后无线流量快速成长

WPA3 加密、320 MHz 频道以及 Wi-Fi 7 强制的多链路运行将使总吞吐量超过 30 Gbps,这将使传统检测设备不堪重负,迫使企业对其安全硬体进行现代化改造,以在 6 GHz 频段提供即时分析。现场试验已证实,在 40 英尺(约 12 公尺)的距离上可实现 1 Gbps 的持续传输速度,是 Wi-Fi 6E 速度的两倍,这迫使供应商整合高速 TLS 卸载和硬体加速模式匹配功能。自动频率调整增加了策略的复杂性,因为它需要在 2.4、5 和 6 GHz 频段上保持一致的威胁控制。因此,企业正在投资可扩展的云端管理防火墙,这些防火墙可以卸载运算密集型任务,同时保持一致的使用者体验。工程师需要对员工进行再培训,以适应确定性调度、多链路堆迭配置和更精细的服务品质 (QoS) 控制。

云端迁移和行动优先企业架构

随着边界防御的崩坏,企业需要将状态侦测和加密功能直接嵌入到网路基地台中,例如 HPE 的 CX 10040 交换机,它无需外部设备即可提供内联防火墙。边缘安全降低了回程传输成本和延迟,同时满足了员工随时随地存取的需求。 SD-WAN 和 WLAN 安全的整合正在推动託管服务的成长,因为跨混合云端的策略编配给内部团队带来了挑战。然而,由于管理员需要同步本地无线网路、公共 IaaS 和边缘运算节点之间的规则集,这增加了变更管理的开销,因此需要基于 AI 的配置检验。

高昂的实施和整合成本

大型无线安全计划的前期成本可能超过 1000 万美元,因为企业必须在确保合规性的同时,调整网路基地台韧体、网路存取控制 (NAC) 伺服器和 SIEM 分析系统。像研华 FWA-6183 这样拥有 192 个核心的高阶设备,清楚展现了多Gigabit侦测所需的顶级硬体。再加上专业服务、年度维护和员工技能提升等费用,总拥有成本将大幅膨胀,因此中小企业更倾向于选择基于订阅的託管服务。

细分市场分析

防火墙产品再次巩固了其作为基础控製手段的地位,预计到2024年将占据无线网路安全市场35%的份额。然而,SASE产品预计将以16.21%的复合年增长率成长,并凭藉其向整合式网关、CASB和ZTNA功能的单一途径架构的转变,重塑无线网路安全市场格局。 Fortinet的FortiGate 700G凭藉其7倍的吞吐量提升和后量子时代就绪性,清晰地展现了这一转变。统一威胁管理发展缓慢,因为其单体设计缺乏云端原生架构的弹性。儘管由于监管要求,加密套件仍然重要,但基于身份的分段在零信任计划下正获得越来越多的支持。随着SASE的普及,供应商正透过人工智慧驱动的关联引擎和端到端策略视觉化来缩短停留时间,从而实现主导竞争。

随着企业以云端交付的边缘节点取代老旧的VPN集中器,SASE平台的无线网路安全市场规模预计将快速成长。到2030年,SASE的绝对收入将与防火墙不相上下,这主要得益于服务供应商的各种解决方案,例如Palo Alto Networks的Prisma SASE 5G,它将基于SIM卡的身份资讯注入到策略树中。同时,「其他解决方案」包括量子安全加密和区块链认证等,这些方案虽然在早期阶段就能带来收益源,但可能要到预测期后期才会成熟。

至2024年,本地部署将占无线网路安全市场58%的份额。然而,在美国通讯委员会(FCC)等公共机构斥资2亿美元开展SaaS安全试验计画后,云端解决方案预计将以15.91%的复合年增长率成长。弹性容量、自动签章更新和按需付费等特性深受寻求降低资本支出的IT经理的青睐。

混合部署模式正逐渐成为复杂企业的主流设计。核心资料中心在本地维持高可靠性的侦测,而分店和行动工作人员则透过云端网关进行扩展。供应链风险正促使某些工作负载迁移回本地,但随着侦测越来越接近内容来源,整体成长趋势仍倾向云端。来自云端主机的路由遥测资料为跨供应商的机器学习模型提供动力,与孤立的设备资料相比,显着提高了侦测精度。

区域分析

受第14028号行政命令的推动,北美地区将在2024年维持全球38%的收入份额。该行政命令强制要求联邦政府体系实施多因素认证和零信任机制。随着一项耗资30亿美元的「彻底更换」计画在全国范围内移除存在漏洞的硬件,该地区的无线网路安全市场规模将继续扩大。加拿大和墨西哥也将效仿美国,围绕FIPS认证的密码技术和NIST后量子演算法实现采购标准化。

亚太地区预计将实现15.50%的最高复合年增长率,主要受行动用户数量增长和大规模私人5G製造走廊建设的推动。中国、日本和印度正在为校园安全网路提供财政奖励,而韩国已宣布将在全国推广Wi-Fi 7,以支持智慧城市分析。各地区政府正在製定符合区域资料主权规则的网路安全规范,从而推动了对跨司法管辖区合规模块的需求。

欧洲正稳步发展,这得益于GDPR和NIS2指令的实施,后者扩大了强制性资料外洩报告的范围。供应商正在打包针对特定行业法规的政策模板,例如针对金融机构的欧盟资料外洩报告法案(DORA)。同时,中东/非洲和南美洲是新兴但充满潜力的地区,通讯业者正在采用开放式无线存取网(RAN)进行现代化改造,各国政府也向关键基础设施防御注入奖励策略。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- Wi-Fi 6E/7 后无线流量快速成长

- 云端迁移和行动优先企业架构

- 物联网/工业物联网设备的激增需要微隔离

- 私有 5G 和 Wi-Fi 7 部署将加速零信任无线支出

- SASE 和边缘运算 WLAN 和安全协定栈集成

- 人工智慧驱动的自主渗透测试推动了对自适应防御的需求

- 市场限制

- 高昂的实施和整合成本

- 网路技能短缺

- 深层封包检测面临隐私法反弹

- 始终开启的运作设备的能耗

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术概览

第五章 市场规模与成长预测

- 透过解决方案

- 防火墙

- 加密

- 身分和存取管理

- 统一威胁管理

- 入侵防御/侦测系统

- 安全存取服务边际(SASE)

- 其他解决方案

- 透过部署

- 本地部署

- 云

- 按最终用户行业划分

- BFSI

- 卫生保健

- 零售

- 製造业

- 资讯科技和电讯

- 政府

- 航太与国防

- 其他终端用户产业

- 按组织规模

- 大公司

- 中小企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

- 关键绩效指标

- 潜在市场规模(TAM)

- 每个安全接入点的平均交易规模

- 平均检测时间(MTTD)

- 平均反应时间(MTTR)

- 零信任无线区域网路采用率

- 每个安全接入点的设备密度

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems, Inc.

- Aruba Networks(HPE)

- Juniper Networks, Inc.

- Fortinet, Inc.

- Motorola Solutions(Zebra Technologies)

- Sophos Ltd.

- Broadcom Inc.(Symantec)

- Aerohive Networks, Inc.

- SonicWall, Inc.

- Pwnie Express

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Huawei Technologies Co., Ltd.

- Zscaler, Inc.

- Trend Micro Incorporated

- Dell Technologies Inc.(VMware NSX)

- WatchGuard Technologies, Inc.

- Barracuda Networks, Inc.

- IBM Corporation

- Ubiquiti Inc.

第七章 市场机会与未来展望

The Wireless Network Security Market size is estimated at USD 22.84 billion in 2025, and is expected to reach USD 39.58 billion by 2030, at a CAGR of 11.62% during the forecast period (2025-2030).

Robust demand stems from rapid Wi-Fi 6E and Wi-Fi 7 adoption, cloud-first strategies and private-5G rollouts that collectively enlarge the attack surface and necessitate next-generation zero-trust protection. Enterprises are replacing perimeter-centric defenses with integrated security stacks that blend seamlessly with Secure Access Service Edge frameworks, while multifactor authentication mandates in the United States accelerate uptake of unified wireless safeguards. Hardware refresh cycles are underway because legacy deep-packet inspection engines cannot sustain multi-gigabit throughput without latency penalties, compelling vendors to redesign silicon specifically for 6 GHz operations. North America leads on the back of the USD 3 billion Rip-and-Replace program, whereas Asia-Pacific registers the fastest expansion as mobile-first economies pour capital into 5G-driven digitalization. Intensifying competitive dynamics push suppliers toward AI-enabled anomaly detection, quantum-resistant encryption and cloud-native delivery models to preserve margin and relevance.

Global Wireless Network Security Market Trends and Insights

Exponential Growth of Wireless Traffic Post-Wi-Fi 6E/7

Mandatory WPA3 encryption, 320 MHz channels and multi-link operation in Wi-Fi 7 lift aggregate throughput beyond 30 Gbps, overwhelming legacy inspection appliances and prompting enterprises to refresh security hardware capable of real-time analytics at 6 GHz. Field trials confirmed sustained 1 Gbps at 40 feet-double Wi-Fi 6E-forcing vendors to embed high-speed TLS off-load and hardware-accelerated pattern matching. Automated Frequency Coordination adds policy complexity because threat controls must remain consistent across 2.4, 5 and 6 GHz bands. Organizations therefore allocate capital toward scalable, cloud-managed firewalls that off-load compute-intensive tasks while preserving user experience. Staff retraining becomes essential as engineers adapt to deterministic scheduling, multi-link stack configuration and more granular quality-of-service enforcement.

Cloud Migration & Mobile-First Enterprise Architectures

Collapsing perimeters oblige enterprises to embed stateful inspection and encryption directly inside access points, exemplified by HPE's CX 10040 switch that furnishes inline firewalling without external appliances. Edge-based security reduces backhaul costs and latency, aligning with employee demand for location-agnostic access. The fusion of SD-WAN and WLAN security fuels managed-service growth because policy orchestration across hybrid clouds challenges internal teams. However, change-control overhead rises as administrators synchronize rulesets spanning on-premises radios, public IaaS and edge compute nodes, elevating the need for AI-driven configuration validation.

High Implementation & Integration Costs

Large-scale wireless security undertakings can exceed USD 10 million upfront because enterprises must align access-point firmware, NAC servers and SIEM analytics while maintaining compliance. High-end appliances such as Advantech's FWA-6183 wield 192 cores, underscoring the premium hardware required for multi-gigabit inspection. Total ownership balloons once professional services, annual maintenance and workforce upskilling are added, prompting SMEs to prefer subscription-based managed offerings.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of IoT/IIoT Devices Requiring Micro-Segmentation

- Private-5G & Wi-Fi 7 Rollouts Accelerating Zero-Trust Wireless Spend

- Cyber-Skills Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Firewall products captured 35% of the wireless network security market share in 2024, reaffirming their role as foundational controls. However, SASE offerings are slated to expand at a 16.21% CAGR, reshaping the wireless network security market as organizations pivot toward single-pass architectures that consolidate gateway, CASB and ZTNA features. Fortinet's FortiGate 700G underscores the shift with 7-fold throughput gains and post-quantum readiness. Unified Threat Management is slipping because monolithic designs lack the elasticity of cloud-native stacks. Encryption suites remain relevant due to regulatory mandates, whereas identity-driven segmentation gains traction under zero-trust programs. As SASE adoption accelerates, suppliers differentiate on AI-powered correlation engines and end-to-end policy visualizations that cut dwell time.

The wireless network security market size for SASE platforms is forecast to climb steeply as enterprises replace aging VPN concentrators with cloud-delivered edge nodes. By 2030, SASE is positioned to rival firewalls in absolute revenue, buoyed by service-provider variants such as Palo Alto Networks' Prisma SASE 5G that inject SIM-based identity into policy trees. Meanwhile, quantum-resistant encryption and blockchain-authenticated onboarding sit in the "Other Solutions" bucket, offering early-stage revenue streams that may mature late in the forecast horizon.

On-premises implementations represented 58% of the wireless network security market size in 2024 because financial-services and public-sector operators favour direct control over sensitive data. Yet cloud variants are pacing at a 15.91% CAGR after public agencies such as the U.S. FCC promoted SaaS security in a USD 200 million pilot program. Elastic capacity, automatic signature updates and consumption-based pricing resonate strongly with IT managers seeking lower capex.

Hybrid deployment models crystallize as the dominant design for complex enterprises: core data centers keep high-assurance inspection local, while branch sites and mobile workforces traverse cloud gateways for scale. Supply-chain risks push certain workloads back on-premises, but overall growth trajectory favours cloud as inspection moves closer to content sources. Routed telemetry from cloud consoles fuels vendor-wide machine-learning models, lifting detection fidelity compared with siloed appliance data.

Wireless Network Security Market Report is Segmented by Solution (Firewall, Encryption, and More), Deployment, End-User Industry (BFSI, Healthcare, and More), Organization Size (Large Enterprises, Smes), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained a 38% slice of global revenue in 2024, catalysed by Executive Order 14028 mandating multifactor authentication and zero-trust implementation across federal systems. The wireless network security market size in the region will keep expanding as the USD 3 billion Rip-and-Replace program removes vulnerable hardware nation-wide. Canada and Mexico piggyback on U.S. standards, standardizing procurement around FIPS-validated cryptography and NIST post-quantum algorithms.

Asia-Pacific is projected to clock a 15.50% CAGR, the highest globally, on the back of swelling mobile-subscriber counts and large-scale private-5G manufacturing corridors. China, Japan and India allocate fiscal incentives for secure campus networks, while South Korea showcases nationwide Wi-Fi 7 rollouts supporting smart-city analytics. Regional governments codify cyber norms tailored to local data-sovereignty rules, driving demand for multi-jurisdictional compliance modules.

Europe shows steady momentum anchored by GDPR enforcement and the NIS2 directive that broadens mandatory breach-reporting. Vendors package policy templates specific to sectoral rules like EU DORA for financial institutions. Meanwhile, Middle East & Africa and South America remain emerging yet promising pockets as telcos modernize with open-RAN and governments channel stimulus into critical infrastructure defense.

- Cisco Systems, Inc.

- Aruba Networks (HPE)

- Juniper Networks, Inc.

- Fortinet, Inc.

- Motorola Solutions (Zebra Technologies)

- Sophos Ltd.

- Broadcom Inc. (Symantec)

- Aerohive Networks, Inc.

- SonicWall, Inc.

- Pwnie Express

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Huawei Technologies Co., Ltd.

- Zscaler, Inc.

- Trend Micro Incorporated

- Dell Technologies Inc. (VMware NSX)

- WatchGuard Technologies, Inc.

- Barracuda Networks, Inc.

- IBM Corporation

- Ubiquiti Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential growth of wireless traffic post-Wi-Fi 6E/7

- 4.2.2 Cloud migration and mobile-first enterprise architectures

- 4.2.3 Proliferation of IoT / IIoT devices requiring micro-segmentation

- 4.2.4 Private-5G and Wi-Fi 7 roll-outs accelerating zero-trust wireless spend

- 4.2.5 SASE and edge compute forcing integrated WLAN-security stacks

- 4.2.6 AI-driven autonomous pen-testing boosting demand for adaptive defense

- 4.3 Market Restraints

- 4.3.1 High implementation and integration costs

- 4.3.2 Cyber-skills shortage

- 4.3.3 Privacy-law pushback on deep-packet inspection

- 4.3.4 Energy footprint of always-on security appliances

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Technology Snapshot

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Firewall

- 5.1.2 Encryption

- 5.1.3 Identity and Access Management

- 5.1.4 Unified Threat Management

- 5.1.5 Intrusion Prevention / Detection System

- 5.1.6 Secure Access Service Edge (SASE)

- 5.1.7 Other Solutions

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Retail

- 5.3.4 Manufacturing

- 5.3.5 IT and Telecom

- 5.3.6 Government

- 5.3.7 Aerospace and Defense

- 5.3.8 Other End-user Industries

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium-sized Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

- 5.6 Key Performance Indicators

- 5.6.1 Total Addressable Market (TAM)

- 5.6.2 Average Deal Size per Secure AP

- 5.6.3 Mean Time to Detect (MTTD)

- 5.6.4 Mean Time to Respond (MTTR)

- 5.6.5 % Zero-Trust WLAN Deployments

- 5.6.6 Device Density per Secure AP

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems, Inc.

- 6.4.2 Aruba Networks (HPE)

- 6.4.3 Juniper Networks, Inc.

- 6.4.4 Fortinet, Inc.

- 6.4.5 Motorola Solutions (Zebra Technologies)

- 6.4.6 Sophos Ltd.

- 6.4.7 Broadcom Inc. (Symantec)

- 6.4.8 Aerohive Networks, Inc.

- 6.4.9 SonicWall, Inc.

- 6.4.10 Pwnie Express

- 6.4.11 Palo Alto Networks, Inc.

- 6.4.12 Check Point Software Technologies Ltd.

- 6.4.13 Huawei Technologies Co., Ltd.

- 6.4.14 Zscaler, Inc.

- 6.4.15 Trend Micro Incorporated

- 6.4.16 Dell Technologies Inc. (VMware NSX)

- 6.4.17 WatchGuard Technologies, Inc.

- 6.4.18 Barracuda Networks, Inc.

- 6.4.19 IBM Corporation

- 6.4.20 Ubiquiti Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment