|

市场调查报告书

商品编码

1851041

云端整合软体:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cloud Integration Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

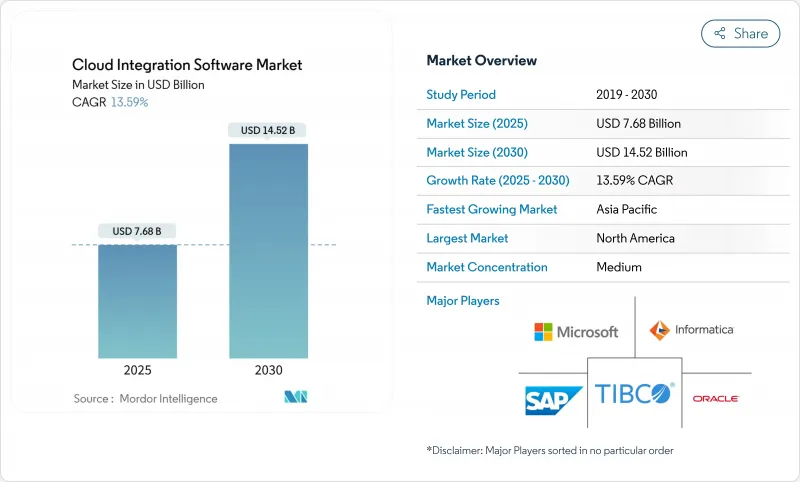

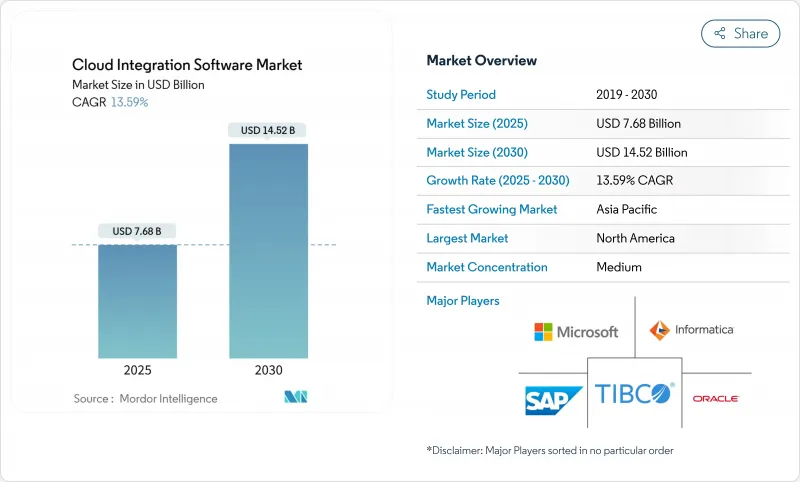

预计到 2025 年,云端整合软体市场规模将达到 76.8 亿美元,到 2030 年将达到 145.2 亿美元,复合年增长率为 13.6%。

如今,大多数企业至少会将工作负载分布在两个超大规模资料中心,从而减少供应商锁定,并根据实际用例需求量身订做运算配置。不断扩展的SaaS产品组合需要即时数据交换,事件驱动型分析引擎的日益普及,以及将边缘感测器与云端AI平台连接起来的工厂现代化计划,都将推动成长。低程式码工具能够缩短价值实现时间,同时也推动应用普及,此外,供应商整合将API管理、资料管道和管治整合到单一合约中,也扮演了重要角色。跨境资料管理和超大规模资料中心出口流量费用等不利因素,正促使服务供应商转向混合部署模式,以支援全球协作,同时在本地处理敏感记录。

全球云端整合软体市场趋势与洞察

多重云端的兴起

企业正将多重云端视为竞争优势而非保险,利用GPU密集型节点进行AI训练,同时将受监管的资料託管在主权区域。超大规模资料中心供应商正积极回应,提供跨云端资料库和网路服务,以降低延迟并消除出口流量费用,从而刺激了对能够抽象化提供者间策略执行的控制平面的需求。统一管治能够加速合作伙伴的入驻流程,因为无论工作负载位于何处,加密和日誌记录都保持一致。

大量SaaS应用程式需要集成

如今,平均每个企业运行超过 360 个 SaaS 应用,点对点连结在大规模部署下会失效,导致资料碎片化,并对合规性产生负面影响。现代整合平台即服务 (iPaaS) 捆绑了预先建置的连接器、模式映射和版本控制功能,使团队无需编写脚本即可即时同步记录。供应商也不断推出 API 市场,客户可以在这里销售自己的连接器,从而将整合从后勤部门成本转变为收入来源。

资料主权与合规性的复杂性

分散的隐私法律迫使团队按地区建立管道,虽然供应商透过主权云端区域和基于策略的路由来解决这个问题,但合规性审核会延长部署时间并增加营运成本。

细分市场分析

由于大型企业需要高度客製化服务,平台即服务 (PaaS) 预计在 2024 年仍将保持 58.3% 的市场份额。然而,由于即时扩展、内建可观测性和降低资本支出的订阅定价模式,软体即服务 (SaaS) 整合将实现 15.3% 的年增长率。供应商正在将基于人工智慧的资料映射和异常检测功能整合到 SaaS 层,使非专业开发者无需编写程式码即可建立流程,同时安全团队也能保持控制。

在监管领域,基础设施即服务 (IaaS) 整合透过将工作负载绑定到专用主机并接受严格审核来确保其有效性。此类配置通常依赖 Kubernetes Operator 来强制执行策略范本并在丛集间复製金钥。

以ERP和CRM集成为基础的应用整合将在2024年占据36.7%的收入份额。然而,随着企业实现数位资产变现并采用微服务,API管理将以14.2%的复合年增长率成长。如今,网关具备自助式开发者入口网站、配额执行和模式自省等功能,可将合作伙伴的进驻时间从数月缩短至数天。

EDI现代化也正在加速推进,製造商们正在用即时事件流取代批量平面文件交换,以提高存货周转并减少缺货情况。

云端整合软体市场报告按类型(PaaS、IaaS、SaaS)、整合类型(应用程式整合、资料整合、其他)、公司规模(大型企业、中小企业)、服务类型(专业服务、託管服务)、最终用户产业(银行、金融服务和保险、IT和电信、其他)和地区进行细分。

区域分析

到2024年,北美将占据36.4%的市场份额,这主要得益于其深厚的云端运算专业知识、宽鬆的资料流机制以及由于靠近厂商总部而能够更早地获取尖端技术。该地区的企业正积极采用人工智慧主导的统一可观测性,将API呼叫、讯息伫列和资料管道整合到一个统一的管理平台中。

预计到2030年,亚太地区将以14.5%的复合年增长率成为全球成长最快的地区。主权云端专案需要混合平台,既能确保资料驻留,又能实现全球研发工作负载的同步。中国、日本和韩国5G的快速部署和物联网的普及将产生大量遥测数据,这些数据需要在边缘进行清洗,然后再归檔到中央数据湖中。

欧洲凭藉其严格的隐私保护法规(强调审核日誌、使用者许可流程和不可篡改的资料沿袭),占据了较大的市场份额。即将出台的《数位营运弹性法案》可能会促使金融机构采用能够抵御单点故障的事件流架构。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 多重云端的兴起

- 大量SaaS应用程式需要集成

- 对即时数据分析和API主导连接的需求

- 微服务中的事件驱动架构

- 面向工业4.0的边缘到云编配

- 市场连接器(iPaaS)货币化

- 市场限制

- 资料主权与合规性的复杂性

- 传统本地整合的复杂性

- 超大规模资料中心出口费用上涨

- 云端原生整合人才短缺

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 按类型

- PaaS

- IaaS

- SaaS

- 透过整合

- 应用整合

- 数据集成

- API管理

- 流程整合与编配

- B2B/EDI集成

- 按公司规模

- 大公司

- 中小企业

- 按服务类型

- 专业服务

- 託管服务

- 按最终用户行业划分

- BFSI

- 资讯科技和电信

- 零售与电子商务

- 教育

- 医疗保健和生命科学

- 製造业

- 政府/公共部门

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Microsoft

- Salesforce(MuleSoft)

- IBM

- Boomi

- Informatica

- SAP

- Oracle

- TIBCO

- SnapLogic

- Software AG

- Workato

- Celigo

- Jitterbit

- Talend

- WSO2

- Red Hat

- Axway

- Kong Inc.

- Accenture

- Deloitte

第七章 市场机会与未来展望

The cloud integration software market size reached USD 7.68 billion in 2025 and is projected to climb to USD 14.52 billion by 2030, reflecting a 13.6% CAGR.

Most enterprises now distribute workloads across at least two hyperscalers to contain vendor lock-in while matching compute profiles to use-case needs. Growth is amplified by sprawling SaaS portfolios that must exchange data in real time, rising adoption of event-driven analytics engines, and factory modernisation initiatives that link edge sensors with cloud AI platforms. Uptake is further helped by low-code tooling that reduces time-to-value, plus vendor consolidation that bundles API management, data pipelines, and governance in a single contract. Headwinds such as cross-border data controls and hyperscaler egress fees are pushing providers toward hybrid deployment models that process sensitive records locally while still supporting global collaboration.

Global Cloud Integration Software Market Trends and Insights

Proliferation of Multi-Cloud Adoption

Enterprises treat multi-cloud as a competitive lever rather than an insurance policy, matching GPU-dense nodes to AI training while housing regulated data in sovereign regions. Hyperscalers respond with cross-cloud database and networking services that trim latency and erase egress fees, spurring demand for control planes that abstract policy enforcement across providers. Unified governance hastens partner onboarding because encryption and logging remain consistent no matter where workloads land.

SaaS Application Sprawl Requiring Unified Integration

With the average enterprise now running more than 360 SaaS apps, point-to-point links crack under scale, fragmenting data and harming compliance. Modern iPaaS bundles pre-built connectors, schema mapping, and version control so teams can sync records instantly without scripting. Vendors further add API marketplaces that let customers sell curated connectors, turning integration from back-office cost into incremental revenue.

Data-Sovereignty and Compliance Complexity

Fragmented privacy laws force teams to build region-specific pipelines that keep regulated data resident while still enabling global analytics. Vendors answer with sovereign cloud zones and policy-based routing, but compliance audits prolong rollouts and inflate operating costs.

Other drivers and restraints analyzed in the detailed report include:

- Need for Real-Time Data Analytics and API-Led Connectivity

- Event-Driven Architectures in Microservices

- Legacy On-Premises Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform-as-a-Service kept 58.3% share in 2024 because large enterprises need advanced customisation. Yet SaaS integration will grow 15.3% annually, thanks to instant scaling, built-in observability, and subscription pricing that slashes CapEx. Vendors weave AI-based data mapping and anomaly detection into their SaaS layers, letting citizen developers build flows without code while security teams remain in control.

For regulated sectors, Infrastructure-as-a-Service integration maintains relevance by anchoring workloads on dedicated hosts under strict audit. These deployments often rely on Kubernetes operators that enforce policy templates and replicate secrets across clusters.

Application Integration dominated revenue at 36.7% in 2024, underpinning ERP and CRM linkages. API Management, however, will post a 14.2% CAGR as firms monetise digital assets and adopt microservices. Gateways now ship with self-service developer portals, quota enforcement, and schema introspection, shrinking partner onboarding windows from months to days.

EDI modernisation also gains steam: manufacturers replace batch flat-file exchanges with real-time event streams that improve inventory turns and reduce stock-outs.

The Cloud Integration Software Market Report is Segmented by Type (PaaS, Iaas, and SaaS), Integration (Application Integration, Data Integration, and More), Enterprise Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Service Type (Professional Service and Managed Services), End-User Industry (BFSI, IT and Telecom, and More), and Geography.

Geography Analysis

North America held 36.4% market share in 2024, buoyed by deep cloud expertise, permissive data-flow regimes, and proximity to vendor headquarters that grants early access to bleeding-edge features. Enterprises here adopt AI-driven integration observability that correlates API calls, message queues, and data pipelines under one pane of glass.

Asia-Pacific is forecast for the fastest 14.5% CAGR through 2030. Sovereign cloud programs require hybrid platforms able to enforce data-residency while still syncing R and D workloads globally. Rapid 5G deployment and IoT proliferation in China, Japan, and South Korea generate telemetry bursts that must be cleansed at the edge before archive to central data lakes.

Europe keeps sizable share due to strict privacy mandates that emphasise audit logs, consent workflows, and immutable data lineage. The upcoming Digital Operational Resilience Act will push financial institutions to adopt event-streaming architectures that survive single-point failures.

- Microsoft

- Salesforce (MuleSoft)

- IBM

- Boomi

- Informatica

- SAP

- Oracle

- TIBCO

- SnapLogic

- Software AG

- Workato

- Celigo

- Jitterbit

- Talend

- WSO2

- Red Hat

- Axway

- Kong Inc.

- Accenture

- Deloitte

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of multi-cloud adoption

- 4.2.2 SaaS application sprawl requiring unified integration

- 4.2.3 Need for real-time data analytics and API-led connectivity

- 4.2.4 Event-driven architectures in micro-services

- 4.2.5 Edge-to-cloud orchestration for Industry 4.0

- 4.2.6 Monetisation of marketplace connectors (iPaaS)

- 4.3 Market Restraints

- 4.3.1 Data-sovereignty and compliance complexity

- 4.3.2 Legacy on-prem integration complexity

- 4.3.3 Rising hyperscaler egress charges

- 4.3.4 Scarcity of cloud-native integration talent

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 PaaS

- 5.1.2 IaaS

- 5.1.3 SaaS

- 5.2 By Integration

- 5.2.1 Application Integration

- 5.2.2 Data Integration

- 5.2.3 API Management

- 5.2.4 Process Integration and Orchestration

- 5.2.5 B2B/EDI Integration

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Service Type

- 5.4.1 Professional Services

- 5.4.2 Managed Services

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecom

- 5.5.3 Retail and E-commerce

- 5.5.4 Education

- 5.5.5 Healthcare and Life Sciences

- 5.5.6 Manufacturing

- 5.5.7 Government and Public Sector

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft

- 6.4.2 Salesforce (MuleSoft)

- 6.4.3 IBM

- 6.4.4 Boomi

- 6.4.5 Informatica

- 6.4.6 SAP

- 6.4.7 Oracle

- 6.4.8 TIBCO

- 6.4.9 SnapLogic

- 6.4.10 Software AG

- 6.4.11 Workato

- 6.4.12 Celigo

- 6.4.13 Jitterbit

- 6.4.14 Talend

- 6.4.15 WSO2

- 6.4.16 Red Hat

- 6.4.17 Axway

- 6.4.18 Kong Inc.

- 6.4.19 Accenture

- 6.4.20 Deloitte

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment