|

市场调查报告书

商品编码

1851046

进阶分析:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Advanced Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

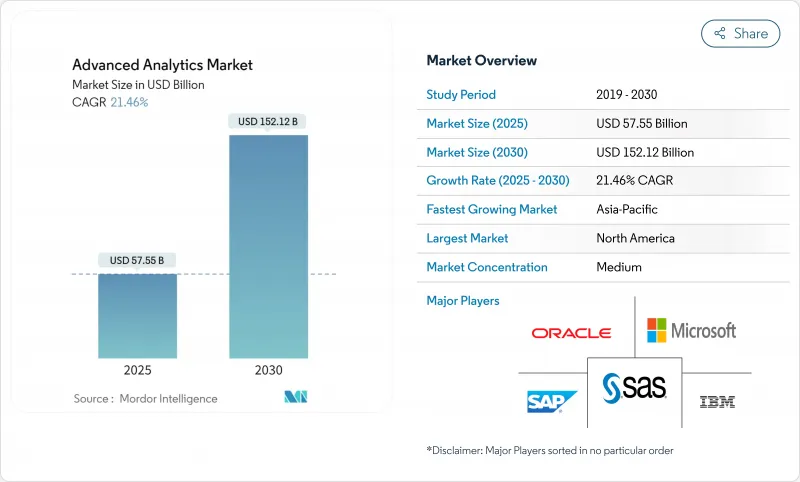

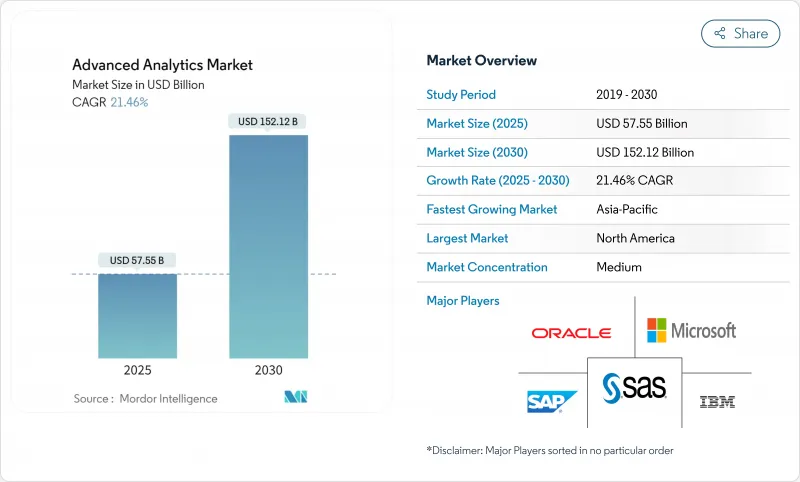

预计到 2025 年,高阶分析市场规模将达到 575.5 亿美元,到 2030 年将达到 1,522.2 亿美元,复合年增长率为 21.46%。

资料量快速成长、人工智慧基础设施成本下降以及对即时决策支援的迫切需求,持续推动各产业采用人工智慧技术。欺诈手段的日益复杂化加速了对预测分析、风险分析和图分析的需求,而平台整合则降低了客户转换成本,并推动了多功能应用。边缘处理如今对于延迟敏感型应用场景(例如自主系统和工业自动化)至关重要,其对边缘分析成长的推动作用超过了其他领域。同时,欧盟可解释人工智慧法规正引导投资流向透明且审核的模型,为合规供应商提供了先发优势。

全球高阶分析市场趋势与洞察

对诈欺侦测的需求日益增长

金融机构面临日益复杂的诈欺威胁,这些威胁已经超越了基于规则的系统所能应对的范围。美国监管机构正在鼓励使用人工智慧驱动的监控,机器学习模型已经将侦测准确率提高了40%,同时将误报率降低了一半。 IBM的一项研究发现,几乎即时分析大量交易资料可以达到95%的分类准确率。混合云边缘架构能够满足亚秒延迟的要求,为服务供应商创造了将诈欺分析、合规仪表板和模型管治整合到一个整合平台的机会。

巨量资料规模和复杂性的爆炸性成长

到2024年,企业每天将产生3.2877亿TB的数据,这将使传统商业智慧工具不堪负荷。目前,近一半的企业正在采用混合储存和资料架构方法来整合孤立的资料来源,并拓展到高阶分析市场。预计到2025年,超过50%的关键处理将在传统资料中心之外进行,这将推动对自动化资料准备和增强型分析的需求,以便为非技术业务用户提供洞察。

数据整合和连接差距

碎片化的架构常常导致资料分散在老旧的本地部署、云端和操作技术系统中。企业64%的工程时间都花在整合而非分析上,这不仅降低了投资回报,也削弱了企业对大型计划的热情。工业企业也面临专有通讯协定的困扰,这些协定使分析整合变得复杂,凸显了资料架构和无程式码整合解决方案的重要性。

细分市场分析

边缘分析预计到2030年将以28.70%的复合年增长率成长,这反映了其在对延迟要求极高的物联网场景中的重要作用。相较之下,预测分析到2024年将维持24.22%的市场份额,在预测期内占据主导地位。边缘设备执行本地推理,从而降低网路成本并确保资料主权。汽车、能源和製造业正在采用微型推理晶片来实现异常检测和自主控制迴路。供应商正透过联邦学习功能来凸显自身优势,该功能无需暴露原始资料即可训练全局模型。在非结构化资料量呈指数级增长的情况下,文字和视觉化分析将保持稳定的应用,而规范性分析和风险分析将受到最佳化和场景建模需求的驱动。

随着5G的广泛应用,边缘高级分析的市场规模预计将迅速扩大。关键基础设施所有者正从集中式云端转向分散式网状网络,将决策逻辑推送至涡轮机、变电站和车辆等设备。同时,现有的预测平台正在整合即时资料流以避免过时,这预示着市场正向混合云边缘架构转变。

到2024年,银行和公共部门机构青睐的本地部署架构将占总收入的54%。然而,随着企业寻求弹性扩展和计量型的经济模式,云端运算的采用率正以24.80%的复合年增长率成长。儘管超大规模资料中心营运商优先扩展其GPU集群,但间歇性的容量短缺为专注于分析的云端和混合型託管边缘部署创造了空间。

安全性和保密运算服务的提升正逐步降低客户的抵触情绪。可自动侦测漂移、版本控制和管治的託管模型维运套件进一步扩大了云端工作负载高阶分析的市场规模。混合方案将敏感的本地资料处理与突发式云端训练週期结合,既确保了合规性,又不阻碍创新。区域资料居住法正在影响服务提供者的架构布局,尤其是在欧盟和亚太地区,这些地区的国家区域法规旨在解决隐私问题。

区域分析

预计到2024年,北美将占高级分析市场收入的41%。创业投资投入1,091亿美元,其中339亿美元用于产生模型、拓展新兴企业生态系统以及企业实验。美国超大规模资料中心营运商正透过部署新的GPU丛集来解决先前的容量限制问题,亚马逊在宾州投资200亿美元的扩建计画就充分体现了其投资规模。监管倡议众多但仍分散,因此需要能够解读联邦和州级不同要求的管治附加元件。

亚太地区以23.10%的复合年增长率领先,主要得益于製造业自动化、5G网路部署和政府智慧城市津贴。中国人工智慧模式的强化催生了具有竞争力的国内替代方案,而印度的IT服务出口则为区域製造商提供了实施人才。日本和韩国致力于将边缘分析技术应用于工业机器人和自动驾驶领域。随着东南亚国家整合电子商务、金融科技和物流平台,整体拥有成本的下降和公共部门数位化政策的推进将推动东南亚国家高阶分析市场的发展。

在严格且不断发展的政策框架下,欧洲将保持稳定成长。欧盟人工智慧立法将加速可解释平台的普及,以满足透明度规则,尤其是在关键领域。德国汽车和机械公司正在采用预测性和规范性分析来实现工业4.0,而北欧公用事业公司则正在整合永续性分析以优化再生能源的使用。英国金融机构正在脱欧后加大对风险模型管治的投入。欧洲高级分析市场的规模正受益于跨国资料空间倡议,该倡议协调了成员国之间的共用标准,但合规工作量正在延长引进週期。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对诈欺侦测的需求日益增长

- 巨量资料规模和复杂性的爆炸性成长

- 企业数位转型浪潮

- 人工智慧/机器学习和云端运算成本迅速下降

- 用于即时决策的边缘分析

- 概述:人工智慧监管可能收紧

- 市场限制

- 数据整合和连接差距

- 资料科学人才短缺

- 计算能源永续性极限

- 供应商锁定导致超大规模云

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 统计分析

- 文字分析

- 风险分析

- 预测分析

- 指示性分析

- 视觉化分析

- 网路分析

- 地理空间分析

- 社群媒体分析

- 边缘分析

- 其他类型

- 透过部署模式

- 本地部署

- 云

- 杂交种

- 按组件

- 解决方案

- 服务

- 咨询

- 託管服务

- 按业务职能

- 销售与行销

- 金融与风险

- 营运和供应链

- 人力资源

- 客户支援

- 按最终用户行业划分

- BFSI

- 零售和消费品

- 医疗保健和生命科学

- 资讯科技/通讯

- 运输与物流

- 政府和国防部

- 製造业

- 能源与公共产业

- 媒体与娱乐

- 其他行业

- 按组织规模

- 大公司

- 中小企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- IBM Corporation

- Microsoft Corporation

- SAS Institute Inc.

- SAP SE

- Oracle Corporation

- Amazon Web Services(AWS)

- Google LLC

- Salesforce Inc.(Tableau)

- Teradata Corporation

- QlikTech International AB

- MicroStrategy Incorporated

- Alteryx Inc.

- KNIME AG

- RapidMiner Inc.

- TIBCO Software Inc.

- Altair Engineering Inc.

- Sisense Inc.

- Domo Inc.

- Fair Isaac Corporation(FICO)

- Avanade Inc.

第七章 市场机会与未来展望

The advanced analytics market stands at USD 57.55 billion in 2025 and is forecast to reach USD 152.22 billion by 2030, reflecting a 21.46% CAGR.

Surging data volumes, falling AI infrastructure costs, and urgent requirements for real-time decision support continue to expand adoption across industries. Rising fraud sophistication is accelerating demand for predictive, risk, and graph analytics, while platform consolidation is reducing customer switching costs and encouraging multi-function deployments. Edge processing is now critical for latency-sensitive use cases such as autonomous systems and industrial automation, lifting edge-analytics growth ahead of other segments. Simultaneously, explainable AI regulation in the EU is redirecting investment toward transparent, auditable models, granting compliant vendors an early-mover advantage.

Global Advanced Analytics Market Trends and Insights

Escalating Fraud-Detection Needs

Financial institutions face highly sophisticated fraud threats that outpace rule-based systems. U.S. regulators urge AI-driven monitoring, and machine-learning models already lift detection accuracy by 40% while halving false positives. IBM research shows 95% classification accuracy when large-scale transaction data is analysed in near real time. Hybrid cloud-edge architectures satisfy sub-second latency requirements and create opportunities for providers bundling fraud analytics, compliance dashboards, and model governance into unified platforms.

Big-Data Volume & Complexity Explosion

Enterprises generated 328.77 million TB daily in 2024, overwhelming traditional BI tooling. Nearly half now employ hybrid storage and data-fabric approaches to integrate siloed sources for advanced analytics market deployments. By 2025, more than 50% of critical processing is expected outside conventional data centers, reinforcing the need for automated data preparation and augmented analytics that expose insights to non-technical business users.

Data Integration & Connectivity Gaps

Fragmented architectures often trap data across aging on-premises, cloud, and operational-technology systems. Organizations allocate 64% of engineering time to integration rather than analysis, delaying returns and dampening enthusiasm for large-scale projects. Industrial firms battle proprietary protocols that complicate analytics linkages, reinforcing the premium placed on data-fabric and no-code integration solutions.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise Digital-Transformation Wave

- Regulatory Push for Explainable AI

- Shortage of Data-Science Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Edge Analytics owns a 28.70% CAGR to 2030, reflecting its role in latency-critical IoT scenarios. In contrast, Predictive Analytics retained 24.22% advanced analytics market share in 2024 as the mainstream choice for forecasting. Edge devices perform localized inference, cutting network costs and ensuring data sovereignty, which is vital for regulated verticals. Automotive, energy, and manufacturing players are embedding compact inference chips to enable anomaly detection and autonomous control loops. Vendors differentiate through federated-learning capabilities that train global models without raw-data egress. Text and Visual Analytics hold steady adoption as unstructured data volumes balloon, while Prescriptive and Risk Analytics are spurred by demand for optimization and scenario modelling.

The advanced analytics market size for Edge Analytics is poised to expand rapidly as 5G coverage broadens. Critical infrastructure owners shift from centralized clouds to distributed mesh fabrics that push decision logic to turbines, substations, and vehicles. Meanwhile, established predictive platforms are integrating real-time data streams to avoid obsolescence, illustrating the market's pivot toward hybrid cloud-edge designs

On-Premises architectures, favored by banks and public agencies, accounted for 54% revenue in 2024 largely due to data-sovereignty mandates. Still, Cloud deployment is rising at 24.80% CAGR as enterprises pursue elastic scaling and pay-as-you-go economics. Hyperscalers prioritize GPU fleet expansion, though intermittent capacity shortfalls create openings for specialized analytics clouds and colocation-edge hybrids.

Security improvements and confidential-compute services steadily erode customer objections. The advanced analytics market size for cloud workloads gains further lift from managed model-ops suites that automate drift detection, versioning, and governance. Hybrid scenarios blend sensitive on-premises data processing with burst-to-cloud training cycles, ensuring compliance without capping innovation. Regional data-residency laws now shape provider buildouts, particularly in the EU and APAC, where in-country zones address privacy statutes.

The Advanced Analytics Market is Segmented by Type (Statistical Analysis, Text Analytics, and More), Deployment Mode (On-Premises, Cloud, Hybrid), Component (Solutions and Services), Business Function (Sales & Marketing, Finance & Risk, and More), End-User Industry, Organization Size (Large Enterprises, Smes), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America continued to command 41% of advanced analytics market revenue in 2024. Venture capital channelled USD 109.1 billion into AI, including USD 33.9 billion for generative models, expanding startup ecosystems and enterprise experimentation. U.S. hyperscalers address prior capacity constraints by injecting new GPU clusters, with Amazon's USD 20 billion Pennsylvania build-out illustrating the scale of investment. Regulatory initiatives, though numerous, remain fragmented, prompting demand for governance add-ons that interpret divergent federal and state requirements.

APAC posts the highest 23.10% CAGR, propelled by manufacturing automation, 5G rollouts, and government smart-city grants. Chinese AI-model enhancements create competitive domestic alternatives, while India's IT-services exports deliver implementation talent to regional manufacturers. Japan and South Korea push deep into edge-analytics applications for industrial robotics and autonomous mobility. Lower total-cost-of-ownership and public-sector digitalization policies expand the advanced analytics market across Southeast Asian nations integrating ecommerce, fintech, and logistics platforms.

Europe grows steadily under rigorously evolving policy. The EU AI Act accelerates purchases of explainable platforms to satisfy transparency rules, especially in critical sectors. Germany's automotive and machinery firms adopt predictive and prescriptive analytics for Industry 4.0, while Nordic utilities embed sustainability analytics to optimize renewables. United Kingdom financial institutions invest in risk-model governance post-Brexit. The advanced analytics market size in Europe benefits from cross-border data-space initiatives that harmonize sharing standards among member states, yet compliance workloads elongate deployment cycles.

- IBM Corporation

- Microsoft Corporation

- SAS Institute Inc.

- SAP SE

- Oracle Corporation

- Amazon Web Services (AWS)

- Google LLC

- Salesforce Inc. (Tableau)

- Teradata Corporation

- QlikTech International AB

- MicroStrategy Incorporated

- Alteryx Inc.

- KNIME AG

- RapidMiner Inc.

- TIBCO Software Inc.

- Altair Engineering Inc.

- Sisense Inc.

- Domo Inc.

- Fair Isaac Corporation (FICO)

- Avanade Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating fraud-detection needs

- 4.2.2 Big-data volume and complexity explosion

- 4.2.3 Enterprise digital-transformation wave

- 4.2.4 Rapid AI/ML and cloud cost declines

- 4.2.5 Edge analytics for real-time decisions

- 4.2.6 Regulatory push for explainable AI

- 4.3 Market Restraints

- 4.3.1 Data integration and connectivity gaps

- 4.3.2 Shortage of data-science talent

- 4.3.3 Sustainability limits on compute energy

- 4.3.4 Vendor lock-in to hyperscale clouds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Statistical Analysis

- 5.1.2 Text Analytics

- 5.1.3 Risk Analytics

- 5.1.4 Predictive Analytics

- 5.1.5 Prescriptive Analytics

- 5.1.6 Visual Analytics

- 5.1.7 Network Analytics

- 5.1.8 Geospatial Analytics

- 5.1.9 Social Media Analytics

- 5.1.10 Edge Analytics

- 5.1.11 Other Types

- 5.2 By Deployment Mode

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Component

- 5.3.1 Solutions

- 5.3.2 Services

- 5.3.2.1 Consulting

- 5.3.2.2 Managed Services

- 5.4 By Business Function

- 5.4.1 Sales and Marketing

- 5.4.2 Finance and Risk

- 5.4.3 Operations and Supply-Chain

- 5.4.4 Human Resources

- 5.4.5 Customer Support

- 5.5 By End-User Industry

- 5.5.1 BFSI

- 5.5.2 Retail and Consumer Goods

- 5.5.3 Healthcare and Life Sciences

- 5.5.4 IT and Telecommunication

- 5.5.5 Transportation and Logistics

- 5.5.6 Government and Defense

- 5.5.7 Manufacturing

- 5.5.8 Energy and Utilities

- 5.5.9 Media and Entertainment

- 5.5.10 Other Industries

- 5.6 By Organization Size

- 5.6.1 Large Enterprises

- 5.6.2 Small and Mid-Sized Enterprises (SMEs)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 Israel

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 United Arab Emirates

- 5.7.5.4 Turkey

- 5.7.5.5 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Egypt

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 SAS Institute Inc.

- 6.4.4 SAP SE

- 6.4.5 Oracle Corporation

- 6.4.6 Amazon Web Services (AWS)

- 6.4.7 Google LLC

- 6.4.8 Salesforce Inc. (Tableau)

- 6.4.9 Teradata Corporation

- 6.4.10 QlikTech International AB

- 6.4.11 MicroStrategy Incorporated

- 6.4.12 Alteryx Inc.

- 6.4.13 KNIME AG

- 6.4.14 RapidMiner Inc.

- 6.4.15 TIBCO Software Inc.

- 6.4.16 Altair Engineering Inc.

- 6.4.17 Sisense Inc.

- 6.4.18 Domo Inc.

- 6.4.19 Fair Isaac Corporation (FICO)

- 6.4.20 Avanade Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment