|

市场调查报告书

商品编码

1851103

电讯领域API:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Telecom API - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

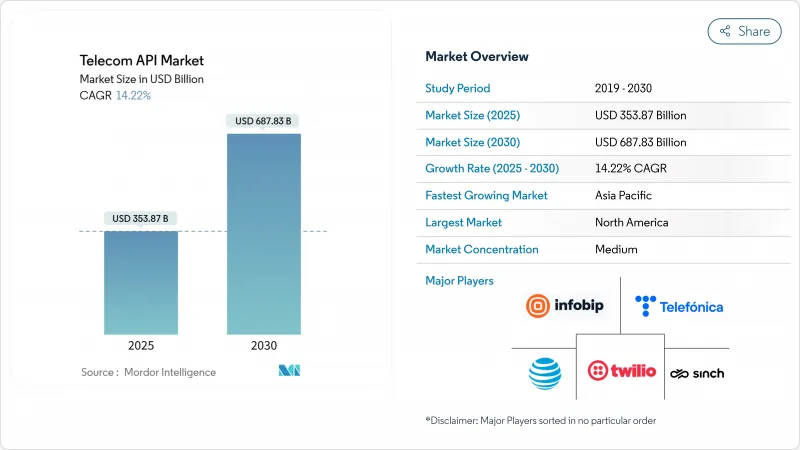

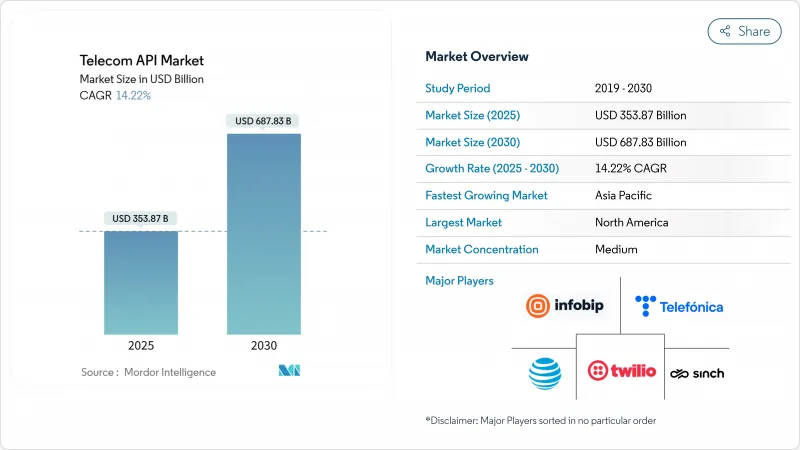

预计到 2025 年,电讯的 API 市场规模将达到 3,538.7 亿美元,到 2030 年将达到 6,878.3 亿美元,在预测期(2025-2030 年)内,复合年增长率将达到 14.22%。

这一成长反映了通讯业向可编程网路转型、5G功能货币化以及通讯平台即服务 (CPaaS) 的快速普及。 GSMA 开放网关等标准化措施、5G 网路切片按需品质 API 的广泛应用以及企业对嵌入式即时通讯的需求是推动成长的关键因素。日益激烈的竞争正在推动产业整合。设备供应商和通讯业者正在组建合资企业以共享网路 API,而 CPaaS 专家则透过收购策略扩大规模。混合云端部署也为市场带来益处,它平衡了云端的敏捷性和资料主权要求,使营运商能够快速向开发者生态系统开放网路功能。

全球电讯API市场趋势与洞察

企业中CPaaS采用率快速成长

企业正持续将全通路通讯融入客户工作流程,Twilio 2025 年第一季11.7 亿美元的营收和超过 33.5 万活跃客户便印证了这一点。通讯业者也不断提升内部效率:AT&T 以 MuleSoft 为基础的专案将新用户入职週期从一年缩短至六週,每年节省 200 万工时。 API 重用带来的经济效益进一步强化了经营团队对开发者体验和持续整合管道的关注。人工智慧驱动的生成式编码助理通讯了内部团队的入门门槛,而个人化讯息则持续推动简讯、RCS 和语音管道的流量成长。

透过开放网关和CAMARA实现网路API标准化

目前,已有 49 家营运商集团认可了 GSMA 开放网关,这表明业界已就设备检验、延迟控制和定位服务等功能的统一介面达成共识。西班牙电信的商业化应用使开发者能够在保持隐私控制的同时,将通讯功能整合到金融科技和串流媒体应用中。 T-Mobile 符合 CAMARA 标准的按需品质 API 则支援在医疗保健、物流和零售等行业实现低延迟部署。标准化降低了软体公司的整合成本,并加快了网路应用的上市速度。

API安全漏洞和诈欺性讯号传输的严重程度日益加剧

预计到2024年,API呼叫量将激增167%,这将使平檯面临更多攻击风险,导致戴尔、GitHub和TracFone等公司遭受资料洩露,其中TracFone被罚款1,600万美元。调查显示,95%的组织都曾遭遇API安全事件,23%的组织遭受资料遗失。由于用户身分和信令系统跨越多个网域,电讯仍然是高风险目标。有效的缓解策略包括零信任策略、持续运行时保护以及通讯业者和云端提供者之间的威胁情报共用。

细分市场分析

到2024年,通讯API将维持35.67%的电讯API市场份额,这主要得益于企业A2P流量的成长,该流量已达到2.2兆条讯息。随着企业优先使用简讯、彩信和进阶通讯服务进行身份验证和推广,通讯电讯API市场规模预计将稳定成长。 RCS的成长动能强劲:Infobip预测,到2029年,A2P RCS营收将达到42亿美元。同时,支付API的成长速度最快,复合年增长率(CAGR)高达17.45%,这得益于嵌入式金融模式将用户的覆盖范围与金融科技能力结合。随着企业将多模态支援整合到客户经验平台中,语音、IVR和WebRTC API仍然具有重要意义。开发人员也正在通讯业者识别和诈骗侦测API来增强行动交易的安全性。

需求模式持续转变为增值功能。生成式人工智慧聊天机器人推动情境化通讯,而基于位置的API则协助智慧城市部署中的超当地语系化行销。反垃圾邮件监管的加强促使业者对经过认证的寄件者ID收取额外费用,从而实现收入多元化。与云端客服中心供应商的深度合作,使得通讯API成为医疗保健、银行、零售等产业企业转型策略的核心。

混合部署将实现最高成长,到2024年将占据49.85%的市场份额,复合年增长率(CAGR)为15.45%。随着网路核心仍保留在本地,而收费、分析和对外服务等微服务迁移到公共云端,混合电讯部署中的API市场规模预计将会成长。营运商案例包括VIVA Bahrain的混合云端核心和PCCW Global面向批发API的多重云端策略。在亚太地区,本地资料储存的监管要求正在推动混合部署的进一步普及。

业者倾向采用与云端平台无关的容器编排管理,以避免厂商锁定,并动态调整工作负载以优化成本。边缘节点扩展了混合拓扑结构,为人工智慧推理和电脑视觉任务提供毫秒延迟。纯公共云端模式仍然适用于待开发区虚拟网路营运商 (MVNO),但整合复杂性和不可预测的出口流量费用限制了其在顶级营运商中的广泛应用。纯本地部署策略适用于对安全性要求较高的政府网络,但缺乏大规模 API 经济所需的弹性。

电讯API 市场报告按服务类型(通讯/简讯-彩信-RCS API、语音/IVR 和语音控制 API、其他)、部署类型(混合式、多重云端、其他部署模式)、最终用户(企业开发人员、内部通讯开发人员、合作伙伴开发人员、长尾开发人员)、经营模式(直接面向营运商、聚合商主导的CPS、平台进行细分服务 [PaaS、平台、PaaS]。

区域分析

北美地区将占2024年总收入的34.06%,反映出CPaaS(通讯平台即服务)的高普及率和5G网路的广泛覆盖范围。 AT&T、T-Mobile和Verizon与Aduna Ventures的合作,为金融科技和医疗保健应用提供统一的号码认证和SIM卡交换API访问,从而增强安全性。 Twilio 2024年44.6亿美元的营收凸显了企业对可程式通讯的强劲投资。政府鼓励技术沙箱的框架支持电讯API市场的持续实验。

预计到2030年,亚太地区将以17.51%的复合年增长率实现最快增长,这主要得益于其行动优先的经济模式推动了5G的普及和数位服务的广泛应用。预计到2024年第二季度,亚太地区通讯业者的总合收入将达到1,477亿美元,其中72%的营运商实现了正成长。中国的5G用户普及率预计到2028年将达到88%,而澳洲、日本和韩国在推广按需高品质API所做的努力,都预示着该地区电信市场将积极扩张。政府对智慧製造和电子政府的推动,正在驱动对低延迟和安全功能的需求,使得电讯API市场成为该地区数位化进程的支柱。

随着符合GDPR标准的各项安全措施提升了客户对API服务的信任度,欧洲市场呈现稳定成长态势。德国电信的AI手机蓝图表明,区域通讯业者对设备、人工智慧和通讯能力的融合表现出浓厚的兴趣。欧洲通讯业者与超大规模资料中心业者的合作计划加速了边缘部署和CAMARA API的标准化进程。中东、非洲和拉丁美洲等新兴市场也正经历类似的成长,这得益于网路现代化投资和云端伙伴关係策略,从而加快了数位服务上市的速度。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 企业中CPaaS采用率快速成长

- 透过开放网关和CAMARA实现网路API标准化

- 5G货币化压力推动按需服务品质API的发展

- 边缘运算工作负载需要低延迟切片 API

- 不断成长的物联网设备需要身分和收费API

- Gen-AI 支援降低准入门槛的开发工具

- 市场限制

- API安全漏洞和讯号诈骗的严重程度日益加剧

- 传统OSS/BSS升级瓶颈

- OTT CPaaS 竞赛压缩利润空间

- 与超大规模资料中心业者采用不透明的收入分成模式

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 宏观经济影响分析

- 电讯的API应用案例

第五章 市场规模与成长预测

- 按服务类型

- 通讯/简讯-彩信-RCS API

- 语音/IVR 和语音控制 API

- 支付 API

- WebRTC API

- 位置和地图 API

- 用户身分管理和 SSO API

- 其他服务

- 依部署类型

- 杂交种

- 多重云端

- 其他部署模式

- 最终用户

- 企业开发人员

- 内部通讯开发人员

- 合作伙伴开发商

- 长尾开发者

- 按经营模式

- 直接连接通讯业者

- 聚合器主导的CPaaS

- 平台即服务 (PaaS)

- API市场/交易平台

- 按地区

- 北美洲

- 南美洲

- 欧洲

- 亚太地区

- 中东和非洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 供应商能力矩阵

- 主要供应商的关键案例研究

- 公司简介

- ATandT Inc.

- Telefonica SA

- Twilio Inc.

- Infobip Ltd.

- Sinch AB

- Verizon Communications Inc.

- Orange SA

- Deutsche Telekom AG

- Ribbon Communications

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Cisco Systems Inc.

- Google LLC(Apigee)

- Vodafone Group Plc

- Nokia Corp.

- Vonage Holdings Corp.

- MessageBird BV

- Bandwidth Inc.

- Telnyx LLC

- Syniverse Technologies LLC

第七章 市场机会与未来展望

The Telecom API Market size is estimated at USD 353.87 billion in 2025, and is expected to reach USD 687.83 billion by 2030, at a CAGR of 14.22% during the forecast period (2025-2030).

Uptake reflects the telecom sector's pivot to programmable networks, monetization of 5G capabilities, and the rapid spread of Communications Platform as a Service (CPaaS). Key forces behind growth include standardization efforts such as GSMA Open Gateway, the proliferation of quality-on-demand APIs for 5G network slicing, and enterprise demand for embedded real-time communications. Competitive intensity has prompted consolidation: equipment vendors and carriers have formed joint ventures to pool network APIs, while CPaaS specialists scale through enterprise acquisition strategies. The market also benefits from hybrid cloud deployments that balance cloud agility with data-sovereignty requirements, positioning operators to quickly expose network functions to developer ecosystems.

Global Telecom API Market Trends and Insights

Surge in CPaaS adoption among enterprises

Enterprises continue embedding omnichannel communications into customer workflows, illustrated by Twilio's Q1 2025 revenue of USD 1.17 billion and an active customer base exceeding 335,000. Operators improve internal efficiency as well: AT&T's MuleSoft-centered program cut onboarding cycles from one year to six weeks and saved 2 million work hours annually. The economic payoff from API reuse reinforces management's focus on developer experience and continuous integration pipelines. Generative-AI-powered coding assistants lower entry barriers for in-house teams, and personalized messaging fuels sustained traffic on SMS, RCS, and voice channels.

Open Gateway and CAMARA standardization of network APIs

Forty-nine operator groups now back GSMA Open Gateway, signaling an industry consensus on unified interfaces for capabilities such as device verification, latency control, and location services. Telefonica's commercial launch shows developers integrating telecom features into fintech and streaming apps while retaining privacy controls. T-Mobile's CAMARA-compliant Quality-on-Demand APIs enable low-latency deployments in healthcare, logistics, and retail. Standardization lowers integration costs for software firms and accelerates time-to-market for network-aware applications.

Escalating API-security breaches and signaling fraud

API call volumes leapt 167% in 2024, exposing platforms to attack vectors that resulted in breaches at Dell, GitHub, and TracFone, the latter paying USD 16 million in penalties. Research shows 95% of organizations faced API security incidents, with 23% suffering data loss. Telecom players remain high-value targets because subscriber identity and signaling systems traverse multiple domains. Effective mitigations include zero-trust policies, continuous runtime protection, and threat-intelligence sharing between carriers and cloud providers.

Other drivers and restraints analyzed in the detailed report include:

- Monetization pressure on 5G driving QoS-on-demand APIs

- Edge-computing workloads need low-latency slicing APIs

- Legacy OSS/BSS upgrade bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Messaging APIs retained 35.67% Telecom API market share in 2024, anchored by enterprise A2P traffic that reached 2.2 trillion messages. The Telecom API market size for messaging is forecast to expand steadily as businesses prioritize SMS, MMS, and Rich Communication Services for authentication and promotions. RCS growth is striking: Infobip projects A2P RCS revenue climbing to USD 4.2 billion by 2029. Meanwhile, Payment APIs are scaling fastest at 17.45% CAGR because embedded finance models blend telecom reach with fintech capabilities. Voice, IVR, and WebRTC APIs retain relevance as enterprises integrate multi-modal support into customer-experience platforms. Developers also leverage subscriber-identity and fraud-detection APIs to boost security for mobile transactions.

Demand patterns continue shifting toward value-added functionality. Generative-AI chatbots drive contextual messaging, and location-based APIs enable hyperlocal marketing in smart-city rollouts. As regulation tightens against spam, operators charge premiums for verified sender IDs, reinforcing revenue diversification. Close collaboration with cloud contact-center vendors keeps messaging APIs central to enterprise transformation agendas across healthcare, banking, and retail.

Hybrid environments captured 49.85% market share in 2024 and delivered the highest growth trajectory at 15.45% CAGR, underscoring operator priorities around sovereignty and latency. Telecom API market size for hybrid deployments is projected to expand as network cores stay on-premises while microservices for billing, analytics, and exposure layers move to public cloud. Operator examples include VIVA Bahrain's hybrid cloud core and PCCW Global's multi-cloud strategy for wholesale APIs. Regulatory mandates for local data storage in APAC further sustain hybrid uptake.

Operators favor cloud-agnostic container orchestration to avoid vendor lock-in and to dynamically shift workloads for cost optimization. Edge nodes extend hybrid topologies, offering developers single-digit-millisecond latency for AI inference and computer-vision tasks. Pure public-cloud models remain suitable for greenfield MVNOs, but integration complexity and unpredictable egress fees limit broad adoption for tier-one operators. On-premises-only strategies persist for security-sensitive government networks yet lack the elasticity required for large-scale API economies.

The Telecom API Market Report is Segmented by Service Type (Messaging/SMS-MMS-RCS API, Voice/IVR & Voice Control API, and More), Deployment Type (Hybrid, Multi-Cloud, and Other Deployment Modes), End-User (Enterprise Developer, Internal Telecom Developer, Partner Developer, and Long-Tail Developer), Business Model (Direct Carrier Exposure, Aggregator-Led CPaaS, Platform-As-A-Service [PaaS], and More), and Geography.

Geography Analysis

North America accounted for 34.06% of 2024 revenue, reflecting high CPaaS penetration and extensive 5G coverage. Collaboration among AT&T, T-Mobile, and Verizon in the Aduna venture allows unified access to Number Verification and SIM Swap APIs that raise security for fintech and healthcare applications. Twilio's USD 4.46 billion 2024 revenue underscores robust enterprise spending on programmable communications, while developer-first cultures spur quick uptake of new network features. Government frameworks that encourage technology sandboxes support continuous experimentation in the Telecom API market.

Asia-Pacific is forecast to register the fastest 17.51% CAGR through 2030 as mobile-first economies escalate 5G rollouts and digital-services adoption. Combined regional telco revenue hit USD 147.7 billion in Q2 2024, with 72% of operators reporting positive growth. China's projected 88% 5G subscription rate by 2028 and initiatives in Australia, Japan, and South Korea to expose quality-on-demand APIs illustrate aggressive expansion. Government mandates for smart manufacturing and e-governance increase demand for low-latency and security features, making the Telecom API market the backbone of regional digital agendas.

Europe shows steady growth because GDPR-aligned security practices elevate customer trust in API services. Deutsche Telekom's AI-phone roadmap demonstrates regional operator interest in converging devices, AI, and telecom capabilities. Collaborative projects among European carriers and hyperscalers accelerate edge deployments and standardized CAMARA APIs. Emerging markets in the Middle East, Africa, and Latin America ride similar trajectories, backed by network-modernization investments and cloud-partnership strategies that lower time-to-market for digital-service launches.

- ATandT Inc.

- Telefonica SA

- Twilio Inc.

- Infobip Ltd.

- Sinch AB

- Verizon Communications Inc.

- Orange SA

- Deutsche Telekom AG

- Ribbon Communications

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Cisco Systems Inc.

- Google LLC (Apigee)

- Vodafone Group Plc

- Nokia Corp.

- Vonage Holdings Corp.

- MessageBird B.V.

- Bandwidth Inc.

- Telnyx LLC

- Syniverse Technologies LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in CPaaS adoption among enterprises

- 4.2.2 Open Gateway and CAMARA standardisation of network APIs

- 4.2.3 Monetisation pressure on 5G driving QoS-on-demand APIs

- 4.2.4 Edge-computing workloads need low-latency slicing APIs

- 4.2.5 IoT fleet expansion demanding ID and billing APIs

- 4.2.6 Gen-AI-assisted dev-tools lowering entry barriers

- 4.3 Market Restraints

- 4.3.1 Escalating API-security breaches and signalling fraud

- 4.3.2 Legacy OSS/BSS upgrade bottlenecks

- 4.3.3 Margin compression from OTT CPaaS competitors

- 4.3.4 Unclear revenue-share models with hyperscalers

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Macroeconomic Impact Analysis

- 4.9 API Use Cases in Telecom Industry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Messaging/SMS-MMS-RCS API

- 5.1.2 Voice/IVR and Voice Control API

- 5.1.3 Payment API

- 5.1.4 WebRTC API

- 5.1.5 Location and Mapping API

- 5.1.6 Subscriber ID Mgmt and SSO API

- 5.1.7 Other Services

- 5.2 By Deployment Type

- 5.2.1 Hybrid

- 5.2.2 Multi-cloud

- 5.2.3 Other Deployment Modes

- 5.3 By End-User

- 5.3.1 Enterprise Developer

- 5.3.2 Internal Telecom Developer

- 5.3.3 Partner Developer

- 5.3.4 Long-tail Developer

- 5.4 By Business Model

- 5.4.1 Direct Carrier Exposure

- 5.4.2 Aggregator-led CPaaS

- 5.4.3 Platform-as-a-Service (PaaS)

- 5.4.4 API Marketplace/Exchange

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 South America

- 5.5.3 Europe

- 5.5.4 Asia Pacific

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Vendor Capability Matrix

- 6.5 Key Case Studies of Major Vendors

- 6.6 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.6.1 ATandT Inc.

- 6.6.2 Telefonica SA

- 6.6.3 Twilio Inc.

- 6.6.4 Infobip Ltd.

- 6.6.5 Sinch AB

- 6.6.6 Verizon Communications Inc.

- 6.6.7 Orange SA

- 6.6.8 Deutsche Telekom AG

- 6.6.9 Ribbon Communications

- 6.6.10 Huawei Technologies Co. Ltd.

- 6.6.11 Telefonaktiebolaget LM Ericsson

- 6.6.12 Cisco Systems Inc.

- 6.6.13 Google LLC (Apigee)

- 6.6.14 Vodafone Group Plc

- 6.6.15 Nokia Corp.

- 6.6.16 Vonage Holdings Corp.

- 6.6.17 MessageBird B.V.

- 6.6.18 Bandwidth Inc.

- 6.6.19 Telnyx LLC

- 6.6.20 Syniverse Technologies LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment