|

市场调查报告书

商品编码

1851110

图形处理器(GPU):市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Graphics Processing Unit (GPU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

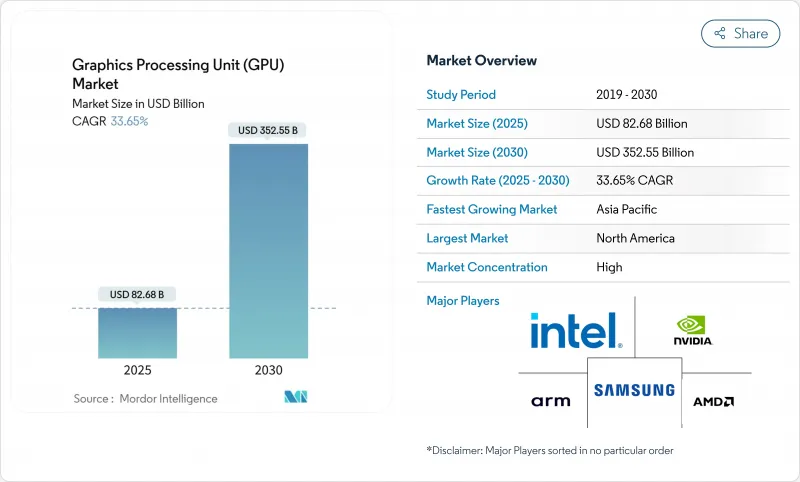

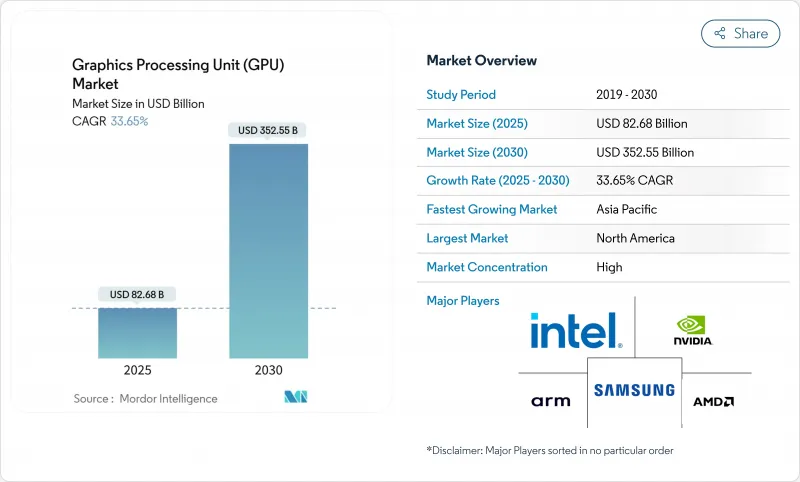

预计到 2025 年,图形处理器市场规模将达到 826.8 亿美元,到 2030 年将达到 3,525.5 亿美元,年复合成长率为 33.65%。

这一激增反映了产业从纯图形工作负载向以人工智慧为中心的运算的转变,GPU 成为驱动生成式人工智慧训练、超大规模推理、云端游戏和异质边缘系统的核心力量。自主人工智慧倡议的加速推进、企业对特定领域模型的投资以及 8K 和光线追踪游戏技术的快速成熟,持续推动对高频宽设备的需求。先进节点产能紧张,加上复杂的出口管制,促使订单转向多代工厂供应策略。同时,基于晶片组的设计和开放指令集正在引入新的竞争因素,但并未打破该行业目前的集中度。

全球图形处理器 (GPU) 市场趋势与洞察

利用GPU密集型训练生成式AI模型

大参数变换模型通常超过 1000 亿个参数,迫使企业在长达数月的训练运行中并行运行数万个 GPU,从而将张量吞吐量推至超越传统图形指标的水平。高频宽记忆体、无损互连和液冷机架已成为标准的采购标准。医疗保健、金融和製造企业现在效仿超大规模资料中心营运商,部署专用于领域模型的丛集,这种模式正在扩大图形处理器市场的终端用户群。随着工作流程编配异质 GPU 池以处理特定上下文的分片,专用混合架构进一步加剧了需求。传统资料中心的功率密度限制进一步加速了向专用 AI 群集的迁移。

建构「主权人工智慧」资料中心

世界各国政府将国内人工智慧运算视为战略资产,如同能源或通讯骨干网路。加拿大已拨款20亿美元用于其国家人工智慧运算策略,专注于发展GPU驱动的超级电脑。印度的「印度人工智慧计画」(IndiaAI Mission)计画购置超过1万块GPU用于本土语言模式。韩国也储备了类似数量的GPU,以确保研究水准的平等。这些计划将公共预算转化为多年采购计划,从而稳定了整个图形处理器市场的基准需求。从欧盟的工业自动化到墨西哥湾沿岸的能源分析,区域模型训练将架构需求从资料中心SKU扩展到强大的边缘加速器。

对7奈米以下GPU销售的出口管制限制

英伟累计了45亿美元的费用,用于支付受限的H2O加速器相关费用,这显示其收入对授权变化十分敏感。中国企业则加速了国内GPU计划的研发,可能会削弱未来对美国智慧财产权的需求。供应链中断迫使供应商维护多种晶片版本,这增加了营运成本,并使整个图形处理器市场的库存规划变得更加复杂。

细分市场分析

到2024年,独立显示卡将占据图形处理器(GPU)市场62.7%的份额,成为当年GPU市场规模最大的组成部分。市场需求集中在高频宽记忆体、专用张量核心和可扩展互连技术上,这些特性尤其适用于人工智慧丛集。企业倾向于采用模组化设计,这种设计允许在不更换主机板的情况下逐步升级机架。由于整合GPU无法支援射线追踪和8K素材,游戏领域对高阶GPU的需求持续检验。

晶片组的采用降低了单位性能成本,并透过拼接更小的晶粒提高了产量比率。 AMD 的多晶片组布局和 NVIDIA 的 NVLink Fusion 都扩大了独立显示卡在半客製化伺服器设计的应用范围。同时,整合式显示卡对于行动装置和入门级桌上型电脑仍然至关重要,因为散热预算决定了其选择。因此,图形处理器产业的细分不再仅仅基于成本,而是沿着移动性和吞吐量之间的频谱展开。

伺服器和资料中心加速器预计到2030年将以37.6%的复合年增长率快速成长,从而推动图形处理器市场的扩张。超大规模营运商正在提供完整的AI工厂,其中包含数万块通过光纤NVLink或PCIe 6.0互连的电路板。来自云端服务提供者、公共研究联盟和製药公司持续签订的采购合同,支撑着未来多年的市场需求。

游戏系统仍然是装置量最大的单一类别,但其成长速度慢于云端运算和企业级人工智慧。汽车、工业机器人和医疗影像处理虽然规模较小,但由于对功能安全性和长期支援的要求较高,因此利润率很高。这些边缘产品类别共同作用,使图形处理器产业的收入摆脱了对週期性消费的依赖。

图形处理器 (GPU) 市场按 GPU 类型(独立 GPU、整合 GPU 及其他)、装置应用(行动装置和平板电脑、PC 和工作站及其他)、部署模式(本地部署和云端部署)、指令集架构(x86-64、Arm 及其他)和地区进行细分。市场预测以美元计价。

区域分析

到2024年,北美将占据43.7%的图形处理器(GPU)市场份额,这主要得益于硅谷的晶片设计、超大规模云园区以及丰富的创业投资资金。该地区受益于半导体智慧财产权所有者与人工智慧软体新兴企业之间的紧密合作,从而加速了下一代电路板的量产。出口管制制度虽然增加了合规成本,但也促使国内补贴转向先进节点製造和封装生产线。

亚太地区是成长最快的地区,预计到2030年将以37.4%的复合年增长率成长。中国正根据其技术主权指令加速推动自主GPU计划,印度的「印度人工智慧计划」(IndiaAI Mission)正在资助建造国家级GPU设施和全邦语言模型。韩国拥有1万个GPU的国家运算中心和日本的人工智慧灾害应变计画将推动该地区对超级运算的需求从商业云端运算转向公共部门超级运算。

在欧洲,严格的人工智慧管治正在平衡工业现代化目标。德国正与英伟达合作建造一个面向车辆和机械数位孪生的工业人工智慧云端平台。法国、义大利和英国优先发展多语言学习模型和金融科技风险分析,并推广部署在高效率、区域性冷却资料中心的区域专属GPU丛集。以沙乌地阿拉伯和阿联酋为首的中东地区正大力投资人工智慧工厂,以实现经济多元化,进一步扩大全部区域图形处理器的市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- AAA 游戏画面真实感的演变

- 对扩增实境/虚拟实境和人工智慧主导的异质运算的需求

- 云端游戏服务开发

- 用于训练生成式人工智慧模型的GPU强度

- 主权人工智慧资料中心建设

- 基于晶片组的客製化GPU SKU

- 市场限制

- 前期投资和零件成本较高

- 先进节点长期供应受限

- 对7nm及以上GPU的销售实施出口管制限制

- 超大规模资料中心的冷却和功率密度限制

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按GPU类型

- 独立显示卡

- 整合显示卡

- 其他的

- 按设备使用状况

- 行动装置和平板电脑

- 个人电脑和工作站

- 伺服器和资料中心加速器

- 游戏主机和掌上型游戏机

- 汽车/ADAS

- 其他嵌入式和边缘设备

- 按部署模式

- 本地部署

- 云

- 依指令集架构

- x86-64

- Arm

- RISC-V 和 OpenGPU

- 其他(功耗、MIPS)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- NVIDIA Corporation

- Advanced Micro Devices Inc.

- Intel Corporation

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Qualcomm Technologies Inc.

- Arm Ltd.

- Imagination Technologies Group

- EVGA Corp.

- Sapphire Technology Ltd.

- ASUStek Computer Inc.

- Micro-Star International(MSI)

- Gigabyte Technology Co. Ltd.

- Zotac Technology Ltd.

- Palit Microsystems Ltd.

- Leadtek Research Inc.

- Colorful Technology Co. Ltd.

- Amazon Web Services(Elastic GPUs)

- Google LLC(Cloud TPU/GPU)

- Huawei HiSilicon

- Graphcore Ltd.

第七章 市场机会与未来展望

The graphics processing unit market size stands at USD 82.68 billion in 2025 and is forecast to reach USD 352.55 billion by 2030, delivering a 33.65% CAGR.

The surge reflects an industry pivot from graphics-only workloads to AI-centric compute, where GPUs function as the workhorses behind generative AI training, hyperscale inference, cloud gaming, and heterogeneous edge systems. Accelerated sovereign AI initiatives, corporate investment in domain-specific models, and the rapid maturation of 8K, ray-traced gaming continue to deepen demand for high-bandwidth devices. Tight advanced-node capacity, coupled with export-control complexity, is funneling orders toward multi-foundry supply strategies. Meanwhile, chiplet-based designs and open instruction sets are introducing new competitive vectors without dislodging the field's current concentration.

Global Graphics Processing Unit (GPU) Market Trends and Insights

Generative-AI Model Training GPU Intensity

Large-parameter transformer models routinely exceed 100 billion parameters, forcing enterprises to operate tens of thousands of GPUs in parallel for months-long training runs, elevating tensor throughput above traditional graphics metrics. High-bandwidth memory, lossless interconnects, and liquid-cooling racks have become standard purchase criteria. Healthcare, finance, and manufacturing firms now mirror hyperscalers by provisioning dedicated super-clusters for domain models, a pattern that broadens the graphics processing unit market's end-user base. Mixture-of-experts architectures amplify the demand, as workflows orchestrate heterogeneous GPU pools to handle context-specific shards. Power-density constraints inside legacy data halls further accelerate migration to purpose-built AI pods.

Sovereign-AI" Datacenter Build-outs

Governments view domestic AI compute as a strategic asset akin to energy or telecom backbone. Canada allocated USD 2 billion for a national AI compute strategy focused on GPU-powered supercomputers.India's IndiaAI Mission plans 10,000+ GPUs for indigenous language models. South Korea is stockpiling similar volumes to secure research parity. Such projects convert public budgets into multi-year purchase schedules, stabilizing baseline demand across the graphics processing unit market. Region-specific model training-ranging from industrial automation in the EU to energy analytics in the Gulf-expands architectural requirements beyond datacenter SKUs into ruggedized edge accelerators.

Export-Control Limits on <= 7 nm GPU Sales

The United States introduced tiered licensing for advanced computing ICs, effectively curbing shipments of state-of-the-art GPUs to China.NVIDIA booked a USD 4.5 billion charge tied to restricted H20 accelerators, illustrating revenue sensitivity to licensing shifts. Chinese firms responded by fast-tracking domestic GPU projects, potentially diluting future demand for U.S. IP. The bifurcated supply chain forces vendors to maintain multiple silicon variants, lifting operating costs and complicating inventory planning throughout the graphics processing unit market.

Other drivers and restraints analyzed in the detailed report include:

- AR/VR and AI-Led Heterogeneous Computing Demand

- Cloud-Gaming Service Roll-outs

- Chronic Advanced-Node Supply Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Discrete boards controlled 62.7% of the graphics processing unit market share in 2024, translating to the largest slice of the graphics processing unit market size for that year. Demand concentrates on high-bandwidth memory, dedicated tensor cores, and scalable interconnects suited for AI clusters. Enterprises favor modularity, enabling phased rack upgrades without motherboard swaps. Gaming continues to validate high-end variants by adopting ray tracing and 8K assets that integrated GPUs cannot sustain.

Chiplet adoption is lowering the cost per performance tier and improving yields by stitching smaller dies. AMD's multi-chiplet layout and NVIDIA's NVLink Fusion both extend discrete relevance into semi-custom server designs. Meanwhile, integrated GPUs remain indispensable for mobile and entry desktops where thermal budgets dominate. The graphics processing unit industry thus segments along a mobility-versus-throughput spectrum rather than a pure cost axis.

Servers and data-center accelerators are projected to register the fastest 37.6% CAGR through 2030, underpinning the swelling graphics processing unit market. Hyperscale operators provision entire AI factories holding tens of thousands of boards interconnected via optical NVLink or PCIe 6.0 fabrics. Sustained procurement contracts from cloud providers, public research consortia, and pharmaceutical pipelines jointly anchor demand at multi-year horizons.

Gaming systems remain the single largest installed-base category, but their growth curve is modest next to cloud and enterprise AI. Automotive, industrial robotics, and medical imaging represent smaller yet high-margin verticals thanks to functional-safety and long-life support requirements. Collectively, these edge cohorts diversify the graphics processing unit industry's revenue away from cyclical consumer cycles.

Graphics Processing Unit (GPU) Market is Segmented by GPU Type (Discrete GPU, Integrated GPU, and Others), Device Application (Mobile Devices and Tablets, Pcs and Workstations, and More), Deployment Model (On-Premises and Cloud), Instruction-Set Architecture (x86-64, Arm, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 43.7% graphics processing unit market share in 2024, anchored by Silicon Valley chip design, hyperscale cloud campuses, and deep venture funding pipelines. The region benefits from tight integration between semiconductor IP owners and AI software start-ups, accelerating time-to-volume for next-gen boards. Export-control regimes do introduce compliance overhead yet simultaneously channel domestic subsidies into advanced-node fabrication and packaging lines.

Asia-Pacific is the fastest-growing territory, expected to post a 37.4% CAGR to 2030. China accelerates indigenous GPU programs under technology-sovereignty mandates, while India's IndiaAI Mission finances national GPU facilities and statewide language models. South Korea's 10,000-GPU state compute hub and Japan's AI disaster-response initiatives extend regional demand beyond commercial clouds into public-sector supercomputing.

Europe balances stringent AI governance with industrial modernization goals. Germany partners with NVIDIA to build an industrial AI cloud targeting automotive and machinery digital twins. France, Italy, and the UK prioritize multilingual LLMs and fintech risk analytics, prompting localized GPU clusters housed in high-efficiency, district-cooled data centers. The Middle East, led by Saudi Arabia and the UAE, is investing heavily in AI factories to diversify economies, further broadening the graphics processing unit market footprint across emerging geographies.

- NVIDIA Corporation

- Advanced Micro Devices Inc.

- Intel Corporation

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Qualcomm Technologies Inc.

- Arm Ltd.

- Imagination Technologies Group

- EVGA Corp.

- Sapphire Technology Ltd.

- ASUStek Computer Inc.

- Micro-Star International (MSI)

- Gigabyte Technology Co. Ltd.

- Zotac Technology Ltd.

- Palit Microsystems Ltd.

- Leadtek Research Inc.

- Colorful Technology Co. Ltd.

- Amazon Web Services (Elastic GPUs)

- Google LLC (Cloud TPU/GPU)

- Huawei HiSilicon

- Graphcore Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Evolving graphics realism in AAA gaming

- 4.2.2 AR/VR and AI-led heterogeneous computing demand

- 4.2.3 Cloud-gaming service roll-outs

- 4.2.4 Generative-AI model training GPU intensity

- 4.2.5 Sovereign-AI" datacenter build-outs"

- 4.2.6 Chiplet-based custom GPU SKUs

- 4.3 Market Restraints

- 4.3.1 High upfront capex and BOM costs

- 4.3.2 Chronic advanced-node supply constraints

- 4.3.3 Export-control limits on greater than or equal to 7 nm GPU sales

- 4.3.4 Cooling/power-density limits in hyperscale DCs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By GPU Type

- 5.1.1 Discrete GPU

- 5.1.2 Integrated GPU

- 5.1.3 Others

- 5.2 By Device Application

- 5.2.1 Mobile Devices and Tablets

- 5.2.2 PCs and Workstations

- 5.2.3 Servers and Data-center Accelerators

- 5.2.4 Gaming Consoles and Handhelds

- 5.2.5 Automotive / ADAS

- 5.2.6 Other Embedded and Edge Devices

- 5.3 By Deployment Model

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By Instruction-Set Architecture

- 5.4.1 x86-64

- 5.4.2 Arm

- 5.4.3 RISC-V and OpenGPU

- 5.4.4 Others (Power, MIPS)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NVIDIA Corporation

- 6.4.2 Advanced Micro Devices Inc.

- 6.4.3 Intel Corporation

- 6.4.4 Apple Inc.

- 6.4.5 Samsung Electronics Co. Ltd.

- 6.4.6 Qualcomm Technologies Inc.

- 6.4.7 Arm Ltd.

- 6.4.8 Imagination Technologies Group

- 6.4.9 EVGA Corp.

- 6.4.10 Sapphire Technology Ltd.

- 6.4.11 ASUStek Computer Inc.

- 6.4.12 Micro-Star International (MSI)

- 6.4.13 Gigabyte Technology Co. Ltd.

- 6.4.14 Zotac Technology Ltd.

- 6.4.15 Palit Microsystems Ltd.

- 6.4.16 Leadtek Research Inc.

- 6.4.17 Colorful Technology Co. Ltd.

- 6.4.18 Amazon Web Services (Elastic GPUs)

- 6.4.19 Google LLC (Cloud TPU/GPU)

- 6.4.20 Huawei HiSilicon

- 6.4.21 Graphcore Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment