|

市场调查报告书

商品编码

1851119

电子竞技:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)E-Sports - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

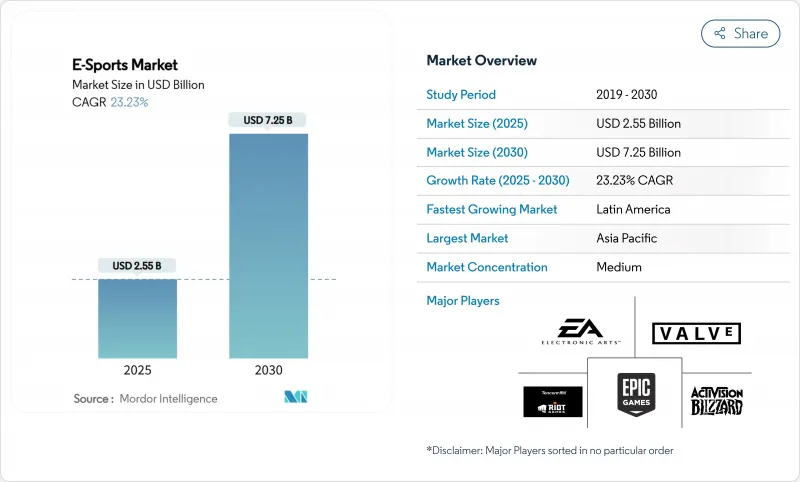

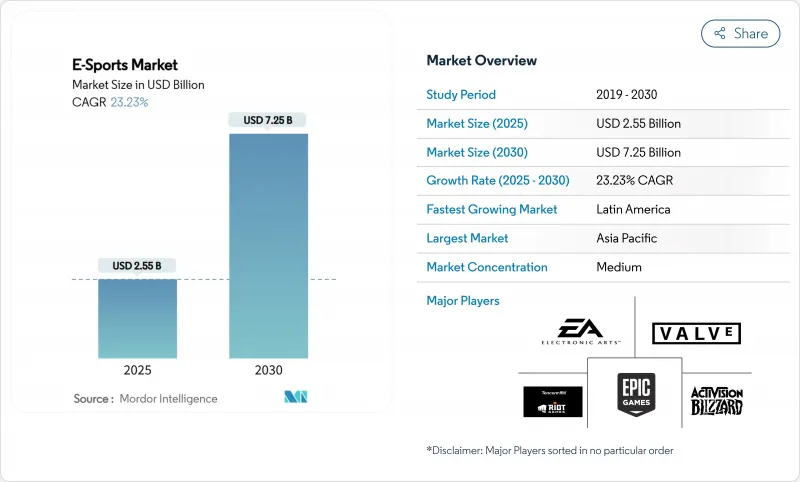

根据估计和预测,电子竞技市场规模将在 2025 年达到 25.5 亿美元,在 2030 年达到 72.5 亿美元,年复合成长率为 23.23%。

亚太地区强大的数位基础设施、日趋成熟的发行商经营的特许经营联赛以及不断增长的游戏内货币化正在推动营收成长。独家串流媒体版权协议正稳步将观众规模转化为可预测的媒体版权收入,同时对赞助的依赖也开始降低。行动端的普及、区块链赋能的资产所有权以及政府的资助计划正在扩大参与度并实现收入多元化,而游戏类型的创新,尤其是大逃杀模式,持续吸引主流玩家。随着独立赛事营运商要求更公平的智慧财产权条款并对行销人员主导的联赛结构施加压力,竞争动态正在改变。

全球电竞市场趋势与洞察

5G和光纤部署协助亚洲行动电竞商业化

5G的广泛部署有望显着提升连线速度并降低延迟,使行动游戏能够提供媲美锦标赛级别的竞技体验。 Airtel等通讯业者报告称,平均吞吐量显着提高,从而改善了观众的视讯品质和游戏内的响应速度。行动网路普及率的不断提高正推动以往服务不足的区域和二线城市参与到有组织的电竞活动中,使电竞市场远远超出传统都市区中心的范围。区域通讯集团正透过游戏积分的直接营运商收费、数据流量包赞助和联合品牌赛事等方式获取增量价值。由此形成了一个良性循环:更高的服务品质提升了用户参与度,用户参与度提升了游戏内消费,而消费的增加又吸引了发行商和赞助商的注意。因此,行动生态系统的规模经济正成为电竞市场成长的关键支柱。

基于区块链的数位资产所有权提升了出版商的收入

透过验证与电竞精彩瞬间、皮肤和成就相关的非同质化代币(NFT) 的所有权,玩家可以安心交易,而发行商则可以透过次市场交易获得持续的版税收入。一些主流游戏正在试验计画计画中将可收集物品直接整合到直播中,从而强化观看和消费的循环。各大开发人员正在探讨的互通性标准可望使资产跨越多个游戏,加深用户投入并延长产品生命週期。早期市场已呈现流动性增强的趋势,显示市场对稀有、具有声望的数位物品的需求日益增长。对于赛事主办单位而言,区块链基础设施可自动分配奖金池和出场费,从而降低营运成本和纠纷。随着技术的成熟,区块链有望开闢新的收入来源,这些收入来源在结构上对广告週期的依赖程度较低。

欧洲数位广告成长放缓,赞助支出随之减少。

随着数位广告成长放缓,欧洲品牌负责人正在收紧预算。 2024年,赞助收入将占总收入的60.27%,因此,战队和赛事主办单位对行销支出的变化高度敏感。投资回报率正受到越来越多的关注,尤其是在快餐、酒类和博彩等行业,这些行业监管的加强使得宣传活动更加复杂。因此,版权所有者正透过媒体版权竞标和游戏内物品销售等方式实现收入多元化,以降低波动性。然而,获取其他收入来源需要更强大的数据分析来证明受众价值,这给规模较小的营业单位带来了压力。因此,在赞助比例重新平衡之前,欧洲电竞市场的短期成长可能低于全球平均。

细分市场分析

到2024年,电竞市场60.27%的收入将来自赞助,但随着平台为独家内容支付溢价,媒体版权的扩张正在加速。预计到2030年,媒体版权带来的电竞市场规模将以19.8%的复合年增长率成长,逐渐缩小与赞助收入的差距。赛事组织者受益于多年转播协议,这些协议能够稳定现金流并降低赛事预算风险。同时,发行商正在将直播视窗整合到游戏用户端中,并启用将观看与微交易关联的即时购买提示。与发行商签订收入分成协议的战队可以获得这些收入,从而减少对外部品牌合约的依赖。同时,观众收益代币和即时投注迭加层等实验性收入来源也正在获得认可。收入来源的多元化表明,电子竞技市场正朝着成熟运动赛事典型的平衡结构发展。

媒体版权的崛起也对製作品质提出了更高的要求。高清画面、多语种说明和即时资料迭加提高了观看体验,并促使主办单位加大对摄影棚和虚拟实境舞台的投入。此类投资增强了主办单位在未来版权週期中的议价能力。对于规模较小的组织者而言,联合製作中心和特许经营赛事体系提供了成本分摊的途径,以保持竞争力。总而言之,这些变化可能会在预测期结束时重塑电竞市场的收入结构。

到2024年,Twitch将占据电竞市场74.89%的观看时间份额,这主要得益于其先行推出的社群工具以及与创作者的深度合作关係。然而,YouTube Gaming将凭藉其与搜寻和精彩片段重播功能的紧密整合,在观看时长方面缩小与Twitch的差距,预计到2030年将以24.38%的复合年增长率增长。虎牙和斗鱼等区域性服务在中国吸引了大量用户,而Nimo TV则在东南亚地区获得了发展势头,其本地化的语言支援显着提升了观看时长。平台间的竞争主要集中在降低延迟、简化影片剪辑製作流程以及提高创作者的变现率等方面。与顶级体育赛事类似,大型赛事的独家转播协议能够有效推动用户成长。随着内容版权在各平台间日益分散,观众越来越依赖社群媒体上的精彩片段和汇总的赛事结果,这使得流量预测变得更加复杂。

从商业性角度来看,各大平台正采用混合模式来吸引前 1% 以外的网红。他们透过整合原生电商Widgets来拓展收入来源,使用户能够在直播期间购买週边商品和门票。随着亚马逊和米高梅影业等传统媒体公司加入战局,製作大型纪录片系列,各大平台也增加了获取主流赞助商的管道。因此,多平台环境为赛事组织者提供了谈判的灵活性,但也需要完善的版权管理来防止内容蚕食。总而言之,这些动态强化了平台多样性作为电竞市场结构性特征的重要性。

电子竞技市场按收入模式(例如媒体版权、广告和赞助)、直播平台(例如 Twitch、YouTube Gaming)、设备类型(PC、行动/掌机、主机)、游戏类型(例如 MOBA、FPS)和地区进行细分。市场预测以美元计价。

区域分析

亚太地区预计2024年将贡献57.3%的电竞收入,成为电竞市场的核心。通讯业者主导的5G投资、政府对场馆建设的补贴以及游戏作为主流娱乐方式在文化上的普及,都巩固了亚太地区的主导。韩国等国家已将大学电竞联赛制度化,确保了人才的稳定输送;而中国的地方政府津贴则鼓励企业在专门的数位运动园区内聚集。该地区以行动端为主的消费群体推动了休閒游戏向电子竞技观看的转变,并透过数位道具销售和赛事门票销售增强了生态系统的自给自足资金筹措。这些结构性优势正在推动人均参与度的持续成长,使亚太地区成为发行商全球内容策略中不可或缺的一部分。

北美拥有电竞市场中最成熟的特许经营联赛体系。高额的特许经营费确保了球队的长期发展和收入分成,吸引了来自NBA和NFL的财团进驻。虽然这种模式促进了强大的商品行销和赞助,但某些联赛高达4亿美元的递延费用负债却让人对低阶球队的偿付能力产生担忧。儘管发行商的收入多元化降低了媒体曝光率,但对奖金分配机制的监管却增加了复杂性。虽然主客场赛制等营运创新尚处于试验阶段,且依赖本地粉丝群体,但成本控制对于球队保持获利至关重要。

预计到2030年,拉丁美洲将成为主要地区中成长最快的地区,年复合成长率将达到19.2%,这主要得益于宽频普及率的提高以及年轻且以行动装置为中心的用户群。巴西在该地区奖金池和观众人数方面占据主导地位,这得益于品牌对葡萄牙语转播的投资以及本地赞助商的强大阵容。经济和外汇波动导致用户平均消费下降,促使全球发行商调整其价格敏感的微交易套餐和灵活的订阅等级。此类调整将在不降低单位利润率的情况下扩大用户转换管道,从而保持整个拉丁美洲电竞市场的成长势头。

欧洲监理格局正在塑造一条独特的发展轨迹。儘管法国等国家政府为赛事举办提供津贴和奖励,但各国在广告和博彩方面的法律差异却阻碍了跨国赛事的协调统一。威尔斯的发展计画概述了一项旨在透过电子竞技创新中心实现经济多元化的国家策略。强制性最低工资和医疗保险等选手福利标准正日益受到关注,并对成本结构产生影响。欧洲观众使用多种语言,因此对于寻求市场渗透的广播公司而言,本地化投资势在必行。从长远来看,结构性的欧洲方案可能会略微减缓商业性试验的步伐,但有望加强对运动员的保护,并提升广播的专业化水平。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 5G和光纤部署协助亚洲行动电竞货币化

- 基于区块链的数位资产所有权提升出版商收入

- 特许经营联盟模式吸引了传统运动投资者

- 欧洲和中国政府对电子竞技的认可和资助

- 市场限制

- 欧洲数位广告成长放缓,赞助支出随之减少。

- 知识产权所有权分散阻碍了联赛结构的标准化。

- 监理展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按收入模式

- 赞助

- 媒体版权

- 广告

- 发行商费用和游戏内收费

- 门票和商品

- 其他的

- 透过串流媒体平台

- 抽搐

- YouTube Games

- Facebook游戏

- 富亚

- DouYu

- 其他平台

- 依设备类型

- PC

- 移动/手持设备

- 主机

- 按游戏类型

- MOBA

- 第一人称射击游戏(FPS)

- 生存游戏

- 运动与赛车

- 斗争

- 战略及其他

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- Strategic Developments

- Vendor Positioning Analysis

- 公司简介

- Tencent Holdings Ltd(Riot Games)

- Activision Blizzard Inc

- Electronic Arts Inc

- Epic Games Inc

- Valve Corporation

- Modern Times Group(ESL FACEIT Group)

- Gfinity PLC

- Capcom Co Ltd

- Ubisoft Entertainment SA

- Take-Two Interactive Software Inc

- Krafton Inc

- Garena Online(Sea Ltd)

- Nintendo Co Ltd

- Bandai Namco Holdings Inc

- NetEase Inc

- Sony Interactive Entertainment LLC

- Cloud9 Esports Inc

- Team Liquid Enterprises BV

- 100 Thieves LLC

- Fnatic Ltd

- OG Esports A/S

第七章 市场机会与未来展望

The E-Sports market size is estimated at USD 2.55 billion in 2025 and is forecast to reach USD 7.25 billion by 2030, expanding at a 23.23% CAGR.

Robust digital infrastructure in Asia-Pacific, the maturation of publisher-run franchise leagues, and rising in-game monetization are accelerating top-line growth. Exclusive streaming-rights deals are steadily converting audience scale into predictable media-rights income, even as sponsorship dependence begins to ease. Mobile accessibility, blockchain-enabled asset ownership, and government funding initiatives are widening participation and revenue diversity, while genre innovation, especially battle-royale formats, continues to draw mainstream viewers. Competitive dynamics are shifting as independent tournament operators demand fairer intellectual-property terms, placing pressure on publisher-controlled league structures.

Global E-Sports Market Trends and Insights

5G & Fiber Roll-outs Enabling Mobile Esports Monetization in Asia

Widespread 5G deployment is materially raising connection speeds and lowering latency, allowing mobile titles to deliver tournament-grade competitive experiences. Large operators such as Airtel report meaningful uplifts in average throughput, which improves spectator video quality and in-game responsiveness . As handset penetration climbs, previously under-served rural and tier-two cities gain entry to organized play, expanding the esports market well beyond traditional urban hubs. Regional telecommunications groups are capturing incremental value through direct-carrier billing for game credits, data-bundle sponsorship, and co-branded tournaments. The result is a virtuous cycle: higher service-quality drives engagement, engagement boosts in-game spend, and elevated spend draws more publisher and sponsor attention. The mobile ecosystem's scale advantage is therefore becoming a decisive growth pillar for the esports market.

Blockchain-based Digital Asset Ownership Boosting Publisher Revenues

Verifiable ownership of non-fungible tokens (NFTs) tied to esports moments, skins, and achievements gives players the confidence to trade securely while rewarding publishers with perpetual royalties on secondary-market transactions. Pilot programs inside major titles now embed collectible drops directly into live broadcasts, tightening the loop between viewing and spending. Interoperability standards under discussion among leading developers could allow assets to traverse multiple games, deepening user investment and extending product life cycles. Early-stage marketplaces already show robust liquidity, signaling pent-up demand for scarce, prestige-oriented digital items. For tournament organizers, blockchain infrastructure automates distribution of prize pools and appearance fees, cutting operational overhead and reducing disputes. As the technology matures, blockchain promises to anchor an additional revenue stream that is structurally less exposed to advertising cycles.

Sponsorship Spend Compression Amid Digital-Ad Slow-down in Europe

European brand marketers are tightening budgets as broader digital advertising growth decelerates. Because sponsorship still represents 60.27% of 2024 revenue, teams and tournament operators remain highly sensitive to shifts in marketing outlay. Return-on-investment scrutiny is rising, especially in categories such as fast food, alcohol, and gambling where tightening regulations complicate activation campaigns. Rights holders are therefore diversifying income through media-rights auctions and in-game item sales to buffer volatility. However, capturing alternative sources requires stronger data analytics to demonstrate audience value, pressuring smaller entities that lack scale. Near-term growth of the esports market in Europe may therefore trail global averages until sponsorship ratios rebalance.

Other drivers and restraints analyzed in the detailed report include:

- Franchise League Models Attracting Traditional Sports Investors

- Government Recognition & Funding of Esports in Europe & China

- Fragmented IP Ownership Restricting Standardized League Structures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The esports market generated 60.27% of its 2024 revenue from sponsorship, but the media-rights line is scaling faster as platforms pay premiums for exclusive content. The esports market size attributable to media rights is forecast to expand at a 19.8% CAGR through 2030, gradually narrowing the gap with sponsorship. Tournament organizers benefit from multi-year broadcast deals that stabilize cash flow and de-risk event budgeting. Meanwhile publishers integrate live-stream windows within game clients, enabling instant purchase prompts that link viewing to micro-transactions. Teams aligned with publishers through revenue-share agreements gain exposure to these sales, easing dependence on external brand deals. At the same time, experimental revenue formats, such as view-and-earn tokens or live-betting overlays, are under evaluation. The growing diversity of income sources signals an esports market migrating toward the balanced mixes typical of mature sports properties.

Media-rights growth also exerts upward pressure on production quality. High-definition feeds, multi-language commentary, and real-time statistics overlays elevate viewing standards, prompting capital expenditure on studios and virtual-reality stages. These investments strengthen negotiation leverage in future rights cycles. For smaller organizers, pooled production hubs and franchised event circuits offer a cost-sharing route to remain competitive. Collectively, these shifts are likely to recalibrate the revenue hierarchy within the esports market by the end of the forecast window.

Twitch dominated 2024 with a 74.89% slice of the esports market share in viewing hours, underpinned by first-mover community tools and deep creator relationships. Yet YouTube Gaming's tighter integration with search and highlight-repeat functions positions it for a 24.38% CAGR through 2030, closing the volume gap. Region-specific services such as Huya and DouYu aggregate large domestic audiences in China, while Nimo TV gains traction in Southeast Asia where localized language support wins incremental watch-time. Platform competition centers on latency reduction, clip-creation ease, and monetization rates for creators. Exclusive deals for marquee tournaments swing subscriber sign-ups, echoing competition in premium sports. As content rights fragment across services, viewers increasingly rely on social snippets and aggregated results dashboards, complicating traffic forecasts.

From a commercial standpoint, platforms are adopting hybrid ad-share and tip-economy models to attract influencers outside the top 1% percentile. Implementation of native e-commerce widgets, allowing merchandise or ticket purchase during streams, broadens revenue capture. Traditional media firms entering the fray illustrated by Amazon MGM Studios' production of documentary series around majors-inject additional distribution lanes that can unlock mainstream sponsors. The resulting multi-platform environment provides organizers with negotiation flexibility but demands sophisticated rights-management to prevent cannibalization. Overall, these dynamics reinforce platform diversity as a structural feature of the esports market.

E-Sports Market is Segmented by Revenue Model (Media Rights, Advertising and Sponsorship, and More), Streaming Platform (Twitch, Youtube Gaming, and More), by Device Type (PC, Mobile/Handheld, Console), Game Genre (MOBA, First-Person Shooter (FPS) and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 57.3% of 2024 revenue, positioning it as the cornerstone of the esports market. Carrier-led 5G investment, government subsidies for arena construction, and cultural acceptance of gaming as mainstream entertainment sustain this leadership. Countries such as South Korea institutionalize scholastic esports leagues, ensuring a steady talent pipeline, while China's municipal grants encourage corporate clustering around dedicated digital-sports parks. The region's mobile-first demographics underpin above-average conversion from casual play to esports viewership, reinforcing ecosystem self-finance through digital item sales and tournament ticketing. These structural advantages support persistently high per-capita engagement, making the region indispensable for publishers' global content strategies.

North America showcases the most mature franchise-league infrastructure inside the esports market. High franchise fees buy permanency and revenue-share participation, drawing ownership groups from NBA and NFL backgrounds. While this configuration fosters robust merchandising and sponsorship packages, deferred fee obligations estimated at USD 400 million across certain circuits raise solvency questions for lower-ranked teams. Regulatory oversight around loot-box mechanics adds complexity, though diversified publisher revenue mitigates headline exposure. Operational innovations such as home-and-away formats are experimenting with localized fan bases, but cost-control remains pivotal to returning teams to profitability.

Latin America is projected to deliver a 19.2% CAGR through 2030, the fastest among major regions, buoyed by improving broadband coverage and a youthful, mobile-centric audience. Brazil dominates regional prize pools and viewership, validating brand investment in Portuguese-language broadcasts and locally-sponsored rosters. Economic volatility and currency swings temper average spend per user, yet global publishers increasingly tailor price-sensitive micro-transaction bundles and flexible subscription tiers. These adaptations widen funnel reach without compromising per-unit margins, sustaining momentum for the esports market across the continent.

Europe's regulatory mosaic shapes a distinct trajectory. National governments such as France allocate grants and event-hosting incentives, but cross-border tournament harmonization lags due to divergent advertising and gambling laws. The Welsh development plan illustrates sub-national strategies aimed at economic diversification through esports innovation hubs. Player-welfare standards, including minimum-salary mandates and health coverage, gain prominence, influencing cost structures. Because European audiences consume multiple languages, localization investment is non-negotiable for broadcasters seeking market penetration. Over time, Europe's structured approach is likely to strengthen athlete protections and broadcasting professionalism, though it may marginally slow commercial experimentation.

- Tencent Holdings Ltd (Riot Games)

- Activision Blizzard Inc

- Electronic Arts Inc

- Epic Games Inc

- Valve Corporation

- Modern Times Group (ESL FACEIT Group)

- Gfinity PLC

- Capcom Co Ltd

- Ubisoft Entertainment SA

- Take-Two Interactive Software Inc

- Krafton Inc

- Garena Online (Sea Ltd)

- Nintendo Co Ltd

- Bandai Namco Holdings Inc

- NetEase Inc

- Sony Interactive Entertainment LLC

- Cloud9 Esports Inc

- Team Liquid Enterprises BV

- 100 Thieves LLC

- Fnatic Ltd

- OG Esports A/S

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G and Fiber Roll-outs Enabling Mobile Esports Monetization in Asia

- 4.2.2 Blockchain-based Digital Asset Ownership Boosting Publisher Revenues

- 4.2.3 Franchise League Models Attracting Traditional Sports Investors

- 4.2.4 Government Recognition and Funding of Esports in Europe and China

- 4.3 Market Restraints

- 4.3.1 Sponsorship Spend Compression Amid Digital-Ad Slow-down in Europe

- 4.3.2 Fragmented IP Ownership Restricting Standardized League Structures

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Revenue Model

- 5.1.1 Sponsorship

- 5.1.2 Media Rights

- 5.1.3 Advertising

- 5.1.4 Publisher Fees and In-Game Purchases

- 5.1.5 Tickets and Merchandise

- 5.1.6 Others

- 5.2 By Streaming Platform

- 5.2.1 Twitch

- 5.2.2 YouTube Gaming

- 5.2.3 Facebook Gaming

- 5.2.4 Huya

- 5.2.5 DouYu

- 5.2.6 Other Platforms

- 5.3 By Device Type

- 5.3.1 PC

- 5.3.2 Mobile/Handheld

- 5.3.3 Console

- 5.4 By Game Genre

- 5.4.1 MOBA

- 5.4.2 First-Person Shooter (FPS)

- 5.4.3 Battle-Royale

- 5.4.4 Sports and Racing

- 5.4.5 Fighting

- 5.4.6 Strategy and Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Tencent Holdings Ltd (Riot Games)

- 6.3.2 Activision Blizzard Inc

- 6.3.3 Electronic Arts Inc

- 6.3.4 Epic Games Inc

- 6.3.5 Valve Corporation

- 6.3.6 Modern Times Group (ESL FACEIT Group)

- 6.3.7 Gfinity PLC

- 6.3.8 Capcom Co Ltd

- 6.3.9 Ubisoft Entertainment SA

- 6.3.10 Take-Two Interactive Software Inc

- 6.3.11 Krafton Inc

- 6.3.12 Garena Online (Sea Ltd)

- 6.3.13 Nintendo Co Ltd

- 6.3.14 Bandai Namco Holdings Inc

- 6.3.15 NetEase Inc

- 6.3.16 Sony Interactive Entertainment LLC

- 6.3.17 Cloud9 Esports Inc

- 6.3.18 Team Liquid Enterprises BV

- 6.3.19 100 Thieves LLC

- 6.3.20 Fnatic Ltd

- 6.3.21 OG Esports A/S

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment