|

市场调查报告书

商品编码

1851158

热感列印:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Thermal Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

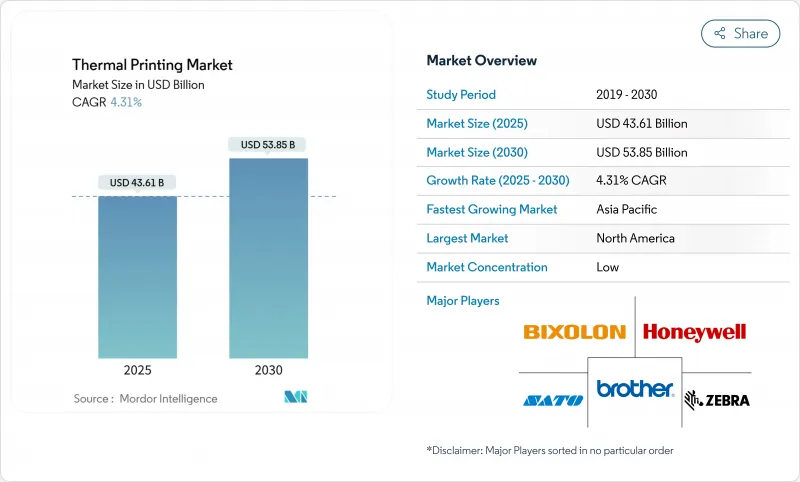

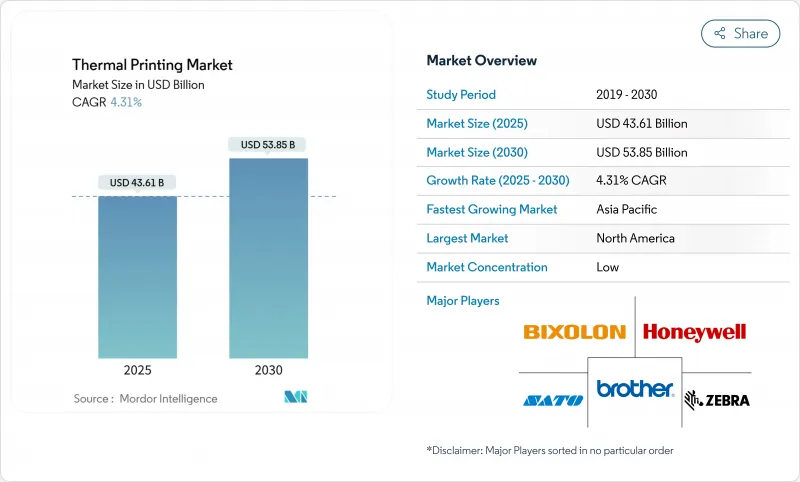

预计到 2025 年,热感列印市场规模将达到 436.1 亿美元,到 2030 年将达到 538.5 亿美元,在此期间的复合年增长率为 4.31%。

医疗保健序列化法规、电子商务小包裹量以及依赖按需标籤的工业自动化专案共同推动了热敏标籤技术的持续发展。禁止使用双酚A和其他酚类物质的监管措施加速了配方转变,但由于相容介质的选择不断增加,整体列印量并未下降。物联网列印头、远端车队管理软体以及嵌入式RFID标籤工作流程的进步,正在增强该技术在互联供应链中的重要性。同时,喷墨和雷射系统的高能耗和耗材成本使得热感列印对每年需要运输、储存和追踪数百万件商品的大批量企业更具吸引力。主要供应商在亚太地区工厂的投资,标誌着全球产能正向该地区发生决定性转移,因为跨国客户正在寻求更具韧性的供应链网路。

全球热感列印市场趋势与洞察

AIDC(自动辨识与资料撷取)的普及与电子商务物流的蓬勃发展

小包裹业者在2027年GS1标准实施截止日期前,正积极迁移至二维条码,并更新其设备以支援更高分辨率的二维码输出,从而在推行无标籤退货计划的同时,维持硬体销售。承运商的试验表明,在订单量激增的旺季,热感标籤的使用量也随之飙升,订单量增长高达200%,而实时生成标籤则避免了人工操作造成的瓶颈。零售商还在门市等光线昏暗的场所部署云端连接行动印表机,批量列印拣货标籤,从而弥合线上订购系统与末端宅配业者之间的资料鸿沟。这些市场发展趋势已将热感列印市场牢牢融入全通路物流工作流程。最后,物流中心正在将列印伺服器与仓库执行软体集成,以实现基于订单路线的自动印表机分配,从而降低停机风险。

无线和行动式热敏印表机的扩展

新款支援 Wi-Fi 6 的机型可将资料吞吐量提高一倍,并减少漫游断线,使拣货员在数千平方公尺的仓库中穿梭时也能不间断地存取标籤。持续运作的电池现在可以支援整个双班次,无需像以前那样在中午充电,从而避免了出库码头的停机。无衬纸功能可减少 50% 的介质浪费,这不仅令永续性审核满意,还提高了可用捲筒容量。远端系统管理仪表板(例如 SATO 的行动管理系统)可提醒 IT 团队介质不足和头部温度异常,从而减少现场巡检的频率。车队数据还可用于预测分析模型,可在故障发生前安排更换,从而提高物流中心的整体设备效率指标。

高昂的维修和头部更换成本

热感印表机头仍是最昂贵的耗材,其售价通常占新机价格的30%。复杂的智慧印表机整合了安全元件和物联网模组,需要经过工厂培训的技术人员进行维护,推高了人事费用。小型零售商往往等到故障发生才进行维护,迫使他们紧急采购,导致更新周期延长。供应商正在透过硬涂层和快速更换卡盒来应对这一问题,使操作人员无需工具即可更换印表头,从而将停机时间缩短至几分钟。设备韧体中内建的预测服务演算法还可以在条码颜色低于扫描器阈值之前预测故障,但此类升级会增加领先购置成本,可能会减缓预算紧张地区的采用速度。

细分市场分析

由于零售商、製造商和物流中心依赖标准化的一维和二维条码在自动化工作流程中运输货物,条码列印将继续保持其最大地位,到 2024 年将占热感列印市场份额的 40.21%。 GS1 全球一致性、监管序列化要求和低廉的耗材成本保障了该细分市场的规模,即使数位转型将部分交易转移到线上,也能保持条码更新需求的稳定性。

在整个热感列印市场规模中,行动手持列印预计将从 2025 年到 2030 年以 7.34% 的复合年增长率成长。 Wi-Fi 6 连线、长寿命电池和无底纸媒体选项正在鼓励企业用腰带式设备取代固定式自助服务终端,从而减少停机时间和浪费,缩短行程,并提高员工生产力。

到2024年,直接热感将占据47.54%的市场份额,巩固其在有效期不足12个月的短期运输标籤领域的领先地位。染料扩散热转印目前仍处于小众市场,但随着医疗器材和高端包装对清晰色彩渐层和照片级影像的需求日益增长,预计到2030年,其复合年增长率将达到5.54%。

直接热感热感采用无色带设计,活动部件较少,购置和维护成本低,且能在极少人工干预下维持高列印量。然而,由于影像在紫外线照射下可能会变暗,在冷冻库中可能会褪色,因此其在户外和零下环境中的应用受到限制。热转印列印将蜡、蜡树脂或树脂墨水涂覆到薄膜状的基材上,从而提供钢製仓库、电子标籤和高压釜小瓶等管瓶所需的耐刮擦性和耐化学性。新型混合设备提供软体可切换模式,使仓库能够使用经济实惠的直接热敏热感列印出小包裹,并使用耐用的树脂色带列印五年期资产标籤。经机器学习辅助的墨水涂覆调整技术,其准确率检验R²=0.9916,可减少列印错误并延长列印头寿命。同时,对无酚面涂层的研究促进了介质製造商和印表机原始设备製造商之间的合作,以校准热曲线,防止印字头过早磨损。这些技术创新使得热感列印市场得以保持广阔,其应用范围涵盖从快速消费品到关键工业领域。

热感列印市场报告按应用(条码、标籤、POS/收据、其他)、列印技术(直接热感、热转印、染料扩散热转印)、格式类型(工业、其他)、最终用途行业(零售/电子商务、运输/物流、製造/仓储、其他)和地区(北美、欧洲、亚太、南美、中东/非洲)进行细分。

区域分析

北美地区占2024年销售额的35.65%,这主要得益于严格的医疗保健法规、广泛的仓储自动化以及数据丰富的二维码和RFID标籤的广泛应用。联邦政府的可追溯性要求促使医院和製药公司随着标准的演变更新印表机,而连锁零售商则采用企业级管理套件来优化覆盖数百家门市的设备。自疫情爆发以来,电子商务交易量持续成长。

受生态设计法规和消费者对酚类物质抵制情绪的推动,欧洲正在大力投资无双酚介质的研发,并占据了相当大的市场份额。该地区倾向于采用无底纸列印技术,以满足减少废弃物和碳足迹的目标。德国和北欧国家的製造商正在利用 OPC-UA 网关将印表机整合到工业 4.0 系统中,将标籤资料直接传输到数位双胞胎,并创建批次系谱。对印字头健康状况的即时监控与该地区智慧工厂普遍采用的预测性维护策略相契合。

这是因为中国、印度和东协的物流业者正在建立密集的末端物流网络,需要即时产生标籤。例如,Epson将其秋田列印头工厂的产能扩大三倍,这表明日本正在整合上游零件以满足不断增长的区域需求。日本本土印表机品牌正利用较低的人事费用吸引对价格敏感的中小型企业,而跨国第三方物流公司则正在进口企业级设备以满足全球客户的服务等级协定 (SLA)。印度的统一物流介面平台 (ULIP) 等政府计划正在推动港口和铁路的条码标准化,进一步扩大了潜在用户群。中东/非洲和南美洲在规模上相对落后,但随着零售业现代化和公共机构资产追踪数位化,这些地区的市场正在稳步增长。然而,外汇波动正在减缓续约速度,促使供应商提供订阅模式,将资本支出分摊到多年合约中。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- AIDC(自动辨识与资料撷取)应用与电子商务物流蓬勃发展

- 无线和行动式热敏印表机热敏印表机的兴起

- 与喷墨/雷射印表机相比,大批量标籤列印具有成本优势。

- 医疗保健合规标籤需求日益增长

- 采用无衬纸和无BPAA的介质,促进永续性

- 低温运输物联网整合实现即时追踪

- 市场限制

- 高昂的维修和头部更换成本

- 来自RFID和数位收据普及的竞争

- 双酚A/苯酚法规增加媒体成本

- 纸浆价格波动扰乱纸张供应

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 透过使用

- 条码

- POS/收据

- 标籤

- 卡片

- RFID

- 自助售票机和门票

- 行动装置(手持装置)

- 透过印刷技术

- 直接热感(DT)

- 热传递(TT)

- 染料扩散热转移(D2T2)

- 按格式

- 产业

- 桌面

- 移动的

- 按最终用途行业划分

- 零售与电子商务

- 运输与物流

- 製造和仓储

- 医疗保健和製药

- 政府/公共

- 饭店及娱乐

- 银行和金融服务

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- ASEAN

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Zebra Technologies

- SATO Holdings

- Toshiba TEC

- Honeywell International

- Brother Industries

- Star Micronics

- Seiko Instruments

- Citizen Systems

- Fujitsu Frontech

- Epson

- BIXOLON

- TSC Auto ID

- Printronix Auto ID

- Avery Dennison

- Evolis

- Axiohm

- CognitiveTPG

- Dymo(Newell)

- Posiflex Technology

- Xiamen Rongta Technology

第七章 市场机会与未来展望

The thermal printing market size is valued at USD 43.61 billion in 2025 and is projected to reach USD 53.85 billion by 2030, translating into a 4.31% CAGR across the period.

Sustained momentum comes from healthcare serialization rules, e-commerce parcel volumes, and industrial automation programs that rely on on-demand labels. Regulatory moves banning bisphenol-A and other phenols have triggered accelerated formulation shifts but have not diminished overall print volumes because compliant media options continue to expand. Advancements in IoT-ready printheads, remote fleet management software, and RFID-embedded label workflows strengthen the technology's relevance inside connected supply chains. Meanwhile, the higher cost of energy and consumables for inkjet or laser systems keeps thermal output attractive for high-volume businesses that ship, stock, or track millions of items annually. Investments by leading vendors in Asia-Pacific factories underline a decisive tilt of global capacity toward the region as multinational customers search for resilient supply networks.

Global Thermal Printing Market Trends and Insights

Adoption of AIDC and E-commerce Logistics Boom

Parcel operators shifting to two-dimensional barcodes ahead of the 2027 GS1 deadline are refreshing fleets to support higher-resolution QR output, sustaining hardware sales even as label-free returns programs roll out. Carrier trials show that thermal label volumes spike during peak seasons when order counts climb by 200% and real-time label generation prevents manual bottlenecks. Retailers also deploy cloud-linked mobile printers inside dark stores to print batch pick labels, closing data gaps between online order systems and last-mile couriers. These developments keep the thermal printing market firmly embedded in omnichannel logistics workflows. Finally, logistics hubs integrate print servers with warehouse execution software, allowing automatic printer allocation based on order routes and mitigating downtime risk.

Expansion of Wireless and Mobile Thermal Printers

New Wi-Fi 6-enabled models double data-throughput and reduce roaming drops, giving pickers uninterrupted label access while traveling across yards that span thousands of square meters. Continuous-run batteries now support an entire double shift, cutting mid-day recharge breaks that once halted outbound docks. Linerless capability trims media waste by 50%, pleasing sustainability auditors and raising effective roll capacity. Remote-management dashboards, such as SATO's Mobile Management System, alert IT teams to low media levels and head temperature anomalies, lowering field visit frequency. Fleet data also feeds predictive analytics models that schedule swap-outs before failures occur, raising overall equipment effectiveness metrics inside distribution centers.

High Repair and Head-replacement Costs

Thermal heads remain the most expensive consumable, often priced at 30% of a new unit, and intensive industrial users still swap them yearly. Complex smart printers embed secure elements and IoT modules that require factory-trained technicians, inflating labor bills. Smaller retailers defer maintenance until failures force emergency purchases, dampening refresh schedules. Vendors answer with harder coatings and quick-swap cassettes that let operators change heads without tools, reducing downtime to minutes. Predictive service algorithms embedded in device firmware also forecast failures before barcode darkness falls below scanner thresholds, though such upgrades increase upfront acquisition prices and may slow adoption in budget-constrained sectors.

Other drivers and restraints analyzed in the detailed report include:

- Cost-advantage Over Inkjet/Laser for High-volume Labels

- Growing Healthcare Compliance Labelling Needs

- Competition from RFID and Digital Receipt Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Barcode printing retained the largest position, accounting for 40.21% of thermal printing market share in 2024 as retailers, manufacturers, and logistics hubs relied on standardized one- and two-dimensional codes to move goods through automated workflows. The segment's scale is protected by global GS1 alignment, regulatory serialization mandates, and the low cost of consumables, keeping refresh demand stable even as digital transformation shifts some transactions online.

Within the overall thermal printing market size, mobile hand-held printing is projected to expand at a 7.34% CAGR from 2025 to 2030 because warehouse pickers, field technicians, and curbside grocery runners need real-time labels at the item level. Wi-Fi 6 connectivity, longer-life batteries, and linerless media options reduce downtime and waste, encouraging enterprises to replace fixed kiosks with belt-worn units that shorten travel paths and boost task productivity.

Direct thermal claimed 47.54% share in 2024, reinforcing its central place in short-life shipping labels where scannability under 12 months is acceptable. Dye-diffusion thermal transfer, although niche today, posts a 5.54% CAGR through 2030 as healthcare devices and luxury packaging require crisp color gradients and photo-quality graphics.

Direct thermal's simplicity-no ribbon, fewer moving parts-keeps acquisition and maintenance costs low, supporting high print cycles with minimal oversight. However, images can darken under UV exposure or fade in freezers, limiting usage in outdoor or sub-zero settings. Thermal transfer applies wax, wax-resin, or resin ink to filmic facestocks, achieving scratch and chemical resistance needed in steel stockrooms, electrical labeling, and laboratory vials that undergo autoclave sterilization. Emerging hybrid devices switch between modes via software, allowing warehouses to use economical direct thermal for outbound parcels and rugged resin ribbons for asset tags with 5-year life mandates. Machine-learning-assisted ink laydown tuning, verified by an R2 = 0.9916 accuracy score, reduces misprints and extends head life. Meanwhile, research into phenol-free top-coats spurs collaboration between media mills and printer OEMs to calibrate heat profiles that prevent premature head wear. These innovations ensure the thermal printing market maintains breadth across fast-moving consumer goods and mission-critical industrial contexts alike.

The Thermal Printing Market Report is Segmented by Application (Barcode, Label, POS / Receipt, and More ), Printing Technology (Direct Thermal, Thermal Transfer, Dye Diffusion Thermal Transfer), Format Type (Industrial, and More), End-Use Industry (Retail and E-Commerce, Transportation and Logistics, Manufacturing and Warehouse and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle-East and Africa).

Geography Analysis

North America accounted for 35.65% of revenue in 2024 thanks to strict healthcare regulations, extensive warehouse automation, and high adoption of data-rich QR and RFID labelling. Federal traceability mandates ensure hospitals and pharmaceutical firms refresh printers as soon as standards evolve, and multi-site retailers standardize on enterprise-class management suites that optimize fleets across hundreds of stores. E-commerce volumes remain elevated post-pandemic, keeping parcel hubs focussed on rugged high-throughput units.

Europe follows with a sizable share, underpinned by eco-design regulations and consumer pushback against phenols, propelling R&D investments in bisphenol-free media. The region champions linerless adoption to satisfy waste-reduction directives and carbon-footprint goals. Manufacturers in Germany and the Nordic countries integrate printers with Industry 4.0 stacks, using OPC-UA gateways to feed label data directly into digital twins for batch genealogy. Real-time monitoring of printhead health aligns with predictive maintenance strategies prevalent in the region's smart factories.

Asia-Pacific is the fastest-growing slice, forecast at a 6.25% CAGR, as Chinese, Indian, and ASEAN logistics carriers build dense last-mile networks that require on-the-spot label generation. Investments like Epson's Akita printhead plant, tripling capacity, indicate upstream component consolidation in Japan serving rising regional demand. Domestic printer brands leverage lower labor costs to capture price-sensitive SMEs, while multinational 3PLs import enterprise-grade devices to satisfy global customer SLAs. Government projects such as India's Unified Logistics Interface Platform (ULIP) encourage barcode standardization across ports and railroads, further widening the addressable base. Middle East and Africa and South America trail in scale but register steady expansion as retail modernizes and public safety digitizes asset tracking; currency volatility, however, slows refresh cadence, prompting vendors to offer subscription models that spread capex over multi-year contracts.

List of Companies Covered in this Report:

- Zebra Technologies

- SATO Holdings

- Toshiba TEC

- Honeywell International

- Brother Industries

- Star Micronics

- Seiko Instruments

- Citizen Systems

- Fujitsu Frontech

- Epson

- BIXOLON

- TSC Auto ID

- Printronix Auto ID

- Avery Dennison

- Evolis

- Axiohm

- CognitiveTPG

- Dymo (Newell)

- Posiflex Technology

- Xiamen Rongta Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of AIDC and e-commerce logistics boom

- 4.2.2 Expansion of wireless and mobile thermal printers

- 4.2.3 Cost-advantage over inkjet/laser for high-volume labels

- 4.2.4 Growing healthcare compliance labelling needs

- 4.2.5 Sustainability push for liner-less and BPA-free media

- 4.2.6 Cold-chain IoT integration for real-time tracking

- 4.3 Market Restraints

- 4.3.1 High repair and head-replacement costs

- 4.3.2 Competition from RFID and digital receipt adoption

- 4.3.3 BPA/phenol regulations raising media costs

- 4.3.4 Pulp-price volatility disrupting paper supply

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Barcode

- 5.1.2 POS / Receipt

- 5.1.3 Label

- 5.1.4 Card

- 5.1.5 RFID

- 5.1.6 Kiosk and Ticket

- 5.1.7 Mobile (hand-held)

- 5.2 By Printing Technology

- 5.2.1 Direct Thermal (DT)

- 5.2.2 Thermal Transfer (TT)

- 5.2.3 Dye Diffusion Thermal Transfer (D2T2)

- 5.3 By Format Type

- 5.3.1 Industrial

- 5.3.2 Desktop

- 5.3.3 Mobile

- 5.4 By End-Use Industry

- 5.4.1 Retail and E-commerce

- 5.4.2 Transportation and Logistics

- 5.4.3 Manufacturing and Warehouse

- 5.4.4 Healthcare and Pharma

- 5.4.5 Government and Public Safety

- 5.4.6 Hospitality and Entertainment

- 5.4.7 Banking and Financial Services

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Zebra Technologies

- 6.4.2 SATO Holdings

- 6.4.3 Toshiba TEC

- 6.4.4 Honeywell International

- 6.4.5 Brother Industries

- 6.4.6 Star Micronics

- 6.4.7 Seiko Instruments

- 6.4.8 Citizen Systems

- 6.4.9 Fujitsu Frontech

- 6.4.10 Epson

- 6.4.11 BIXOLON

- 6.4.12 TSC Auto ID

- 6.4.13 Printronix Auto ID

- 6.4.14 Avery Dennison

- 6.4.15 Evolis

- 6.4.16 Axiohm

- 6.4.17 CognitiveTPG

- 6.4.18 Dymo (Newell)

- 6.4.19 Posiflex Technology

- 6.4.20 Xiamen Rongta Technology

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment