|

市场调查报告书

商品编码

1851243

防护包装:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Protective Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

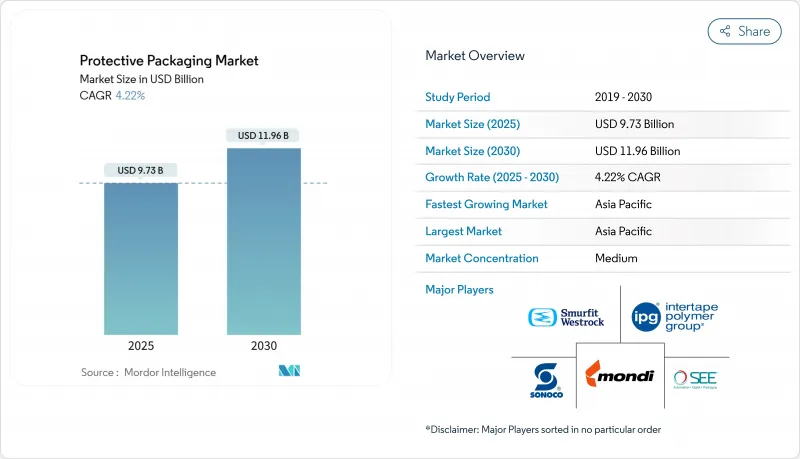

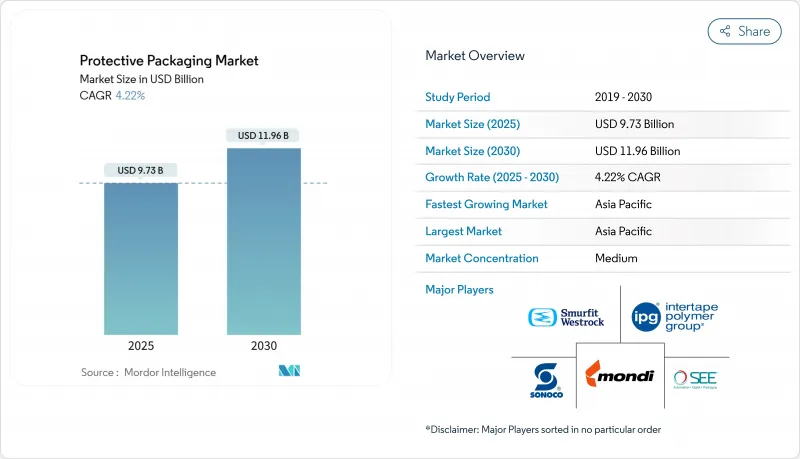

预计到 2025 年,防护包装市场规模将达到 97.3 亿美元,到 2030 年将达到 119.6 亿美元,年复合成长率为 4.22%。

电子商务交易量的成长、日益严格的永续性法规以及消费者对优质开箱体验的追求,正在重塑包装解决方案,使其从后端成本转变为提升品牌价值的关键因素。如今,市场需求青睐轻质材料,以减少体积重量费用;监管环境的确定性也推动了纸质和纤维替代品的快速发展,这些替代品必须具备可回收性。加速整合旨在释放永续技术的规模经济效益,而自动化平台则有助于加工商控制人事费用和废弃物成本。亚太地区仍是重要的策略支柱,既拥有高密度的製造业,也具备全球最快的电子商务成长速度;而欧洲则在塑造全球投资蓝图方面拥有举足轻重的监管影响力。

全球防护包装市场趋势与洞察

电子商务出货量快速成长

小包裹的指数级增长正在重塑防护包装市场的物流,迫使各大品牌缩小包装体积,并转向符合承运商尺寸重量阈值的纤维包装形式。惠普重新设计了其一体机电脑的包装,减少了98%的发泡聚乙烯,体积减少了高达67%,并提高了其27吋机型的托盘密度,从而降低了运输成本和碳排放。罗技计画在2025年完成全线产品包装的纸质化,每年可减少660吨塑胶和6,000吨二氧化碳排放。因此,各大品牌不再仅仅将防护包装市场视为成本支出,而是视为维持其线上线下经济的关键槓桿。

促进产品安全和减少伤害法规

除了可回收性之外,新法规还将包装视为保障消费者安全的关键要素。欧洲的《通用产品安全条例》(GPSS) 要求製造商检验包装的完整性,确保其能防止污染和窜改。赛默飞世尔科技的防篡改纸盒耐低温达-80°C,无需胶水,且可称重,适用于任何尺寸的管瓶。在美国,序列化法规将追踪码与缓衝层关联起来,从而推动了对智慧标籤的需求。合规时间表允许生产商在法规强制执行前数年确认其防护包装已做好市场应对力。

对塑胶和EPS(聚苯乙烯泡沫塑胶)有严格的环境法规。

欧洲已强制规定到2040年可回收率达15%,并正在禁用某些全氟烷基和多氟烷基物质(PFAS)。英国将于2025年10月实施生产者责任延伸制度(EPR),将全部处置成本转嫁给品牌商;而加州将限制使用回收标誌,除非能够证明车辆旁回收服务可以接受回收。这些措施将推高合规成本,延长发泡体包装的投资回收期,并减缓防护包装市场的成长速度。

细分市场分析

到2024年,柔性包装将占防护包装市场收入的65.34%,这反映出其能够以最小的体积容纳大件小包裹,并降低运费。发泡体包装虽然规模较小,但由于电子产品和生技药品对客製化模具的静电释放产量比率要求较高,预计到2030年将以6.75%的复合年增长率快速成长。随着低温运输的扩展,泡棉防护包装市场规模预计将同步成长,这将使泡棉製造商能够凭藉更高的阻隔性能获得更高的溢价。

Sealed Air 的 KORRVU 悬挂式包装展示了纸张和纸板如何模拟发泡体的回弹力,同时兼具路边回收和扁平运输的优点,从而降低入境运费。另一方面,硬纸板则适用于大型白色家电和机械设备,这些产品对堆迭强度要求较高。产品组合分为柔性包装和技术泡沫包装。柔性包装满足电子商务的成本节约需求,而技术泡棉包装则因其精准的缓衝和隔热材料性能而价格更高。

到2024年,塑胶仍将占总吨位的58.23%,但发泡聚合物将以7.34%的复合年增长率成为成长最快的材料,这主要得益于高价值电子产品和生命科学领域的成长。大麦基生质塑胶和再生聚乙烯薄膜正在扩大试点生产线,证明了其大规模应用的潜力。随着食品和製药行业的买家寻求可堆肥或生物基密封件,生物复合材料保护性包装的市场份额也在稳步增长。

纸张和纸板加工商正在升级阻隔涂层,以帮助纤维包装材料更好地防水防油。维吉尼亚理工大学的低压纤维素处理技术在增强纸张强度的同时,也能维持纸张的透明度,进而提升生鲜食品的货架吸引力。生产商正将这些先进技术与碳足迹揭露相结合,并将材料创新与保护性包装市场的采购优势相结合。

这份防护包装市场报告按产品类型(硬质、软质、发泡)、材料(纸、塑胶、发泡聚合物、可生物降解材料)、功能(缓衝、填充、包装、其他)、终端用户产业(食品饮料、电子、医药、电子商务)和地区(北美、欧洲、亚太、中东和非洲、南美)进行细分。市场预测以美元计价。

区域分析

预计到2024年,亚太地区将占全球收入的40.23%,年复合成长率达7.76%,这主要得益于高密度製造业、行动通讯的快速普及以及既支持又具有约束力的政策。中国塑胶产量占全球一半,为加工商提供了利润丰厚且在地化的树脂供应管道;而日本正在探索发泡纸的应用,以满足高端电子产品出口商的需求。各国正试行推行政府补贴,以支持自动化包装生产线,确保包装市场能满足跨境电商激增的需求。

北美地区的优质化仍在持续。惠普和亚马逊等美国品牌正在进行零塑胶试点项目,这些项目随后将推广至全球,使该地区成为这一趋势的先驱。以加州SB 343法案为开端,各州将推出生产者延伸责任制法规,要求企业在2026年前提交可回收性声明,并对保护性包装市场的早期采用者给予奖励。加拿大正在推广闭合迴路纸张回收,而墨西哥则利用近岸外包扩大消费性电子产品和家用电器的出口,增加了对工厂缓衝材料的需求。

欧洲在製定相关规则方面处于领先地位。 《包装废弃物法规》将锁定可回收性和再利用配额,为全球采购政策树立标竿。德国的押金制度和英国的塑胶税将加速纤维材料的普及应用。由于市场新进业者必须应对因聚合物种类而异的复杂环境调整费用,跨国公司正将研发中心集中于该地区,以开发前瞻性配方。因此,在整个防护包装市场,合规意识是一项商业性优势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务出货量快速成长

- 加强产品安全和减少危害方面的法规

- 家用电器需求不断成长

- 偏好轻便灵活的保护形式

- 采用按需包装自动化

- 扩大生技药品和疫苗的低温运输

- 市场限制

- 对塑胶和EPS(聚苯乙烯泡沫塑胶)有严格的环境法规。

- 原物料价格波动

- 都市区最后一公里配送中心的空间限制

- 重新设计产品,以最大限度地减少对保护性包装的需求

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 难的

- 纸板保护套

- 模塑纸浆

- 保温运输容器

- 其他硬核类型

- 灵活的

- 保护性邮件袋

- 气泡膜

- 空气枕/气囊

- 纸张填充

- 其他柔性包装类型(铝箔袋、拉伸膜、收缩膜)

- 形式

- 发泡成型

- 原位成型(FIP)

- 散装填充物

- 发泡捲/片

- 其他类型的泡沫材料(角块等)

- 难的

- 材料

- 纸和纸板

- 塑胶

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚对苯二甲酸乙二醇酯(PET)

- 发泡聚合物

- 发泡聚苯乙烯(EPS)

- 发泡聚乙烯(EPE)

- 发泡聚丙烯(EPP)

- 可生物降解和可堆肥

- 模塑纤维

- 淀粉类

- 聚乳酸(PLA)

- 其他材料

- 按功能

- 缓衝材料

- 阻挡和支撑

- 空隙填充

- 隔热和温度控制

- 包装

- 垫材和其他

- 按最终用户行业划分

- 饮食

- 工业产品

- 製药和生命科学

- 家用电器

- 美容及居家护理

- 汽车和航太

- 电子商务与零售履约

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Sealed Air Corporation

- Pregis LLC

- Intertape Polymer Group Inc.

- Sonoco Products Company

- Smurfit Westrock

- Mondi Group

- International Paper Company

- Storopack Hans Reichenecker GmbH

- Ranpak Holdings Corp.

- Huhtamaki Oyj

- Signode Industrial Group LLC

- Crown Holdings Inc.

- Amcor plc

- Pro-Pac Packaging Ltd.

- ProAmpac Holdings Inc.

- Reflex Packaging LLC

- Pactiv Evergreen Inc.

- AirPack Systems Ltd.

- Polyair Inter Pack Inc.

第七章 市场机会与未来展望

The protective packaging market size reached USD 9.73 billion in 2025 and is projected to advance at a 4.22% CAGR, touching USD 11.96 billion by 2030.

Rising e-commerce volumes, intensifying sustainability regulations, and the search for premium unboxing experiences are recasting protective solutions from a back-end expense into a brand value lever. Demand patterns now reward lightweight materials that curb dimensional-weight fees, and regulatory certainty is prompting rapid shifts toward paper and fiber alternatives that can demonstrate recyclability. Accelerating mergers aim to unlock scale economies in sustainable technology, while automation platforms help converters contain labor and waste costs. Asia-Pacific remains the strategic fulcrum, supplying both manufacturing density and the world's fastest e-commerce growth, yet Europe wields outsized regulatory influence that shapes global investment roadmaps.

Global Protective Packaging Market Trends and Insights

Surging E-commerce Shipping Volumes

Exponential parcel growth is redefining protective packaging market logistics, compelling brands to shrink cube sizes and pivot toward fiber formats that meet carrier dimensional weight thresholds. HP's redesign of its All-in-One PC packaging eliminated 98% of expanded polyethylene, reduced volume by up to 67%, and raised pallet density for the 27-inch model, trimming freight spend and carbon load. Logitech completed a portfolio-wide switch to paper in 2025, removing 660 tons of plastic and 6,000 tons of CO2 each year, while 61% of surveyed buyers favored recyclable packs . Brands thus regard the protective packaging market not only as a cost line but as a retention lever in a doorstep economy.

Regulatory Push for Product Safety and Damage Reduction

New statutes go beyond recyclability to treat packaging as intrinsic to consumer safety. Europe's General Product Safety Regulation obliges manufacturers to validate that pack integrity prevents contamination or tampering.Thermo Fisher's carton with built-in tamper evidence withstands -80 °C, discards glue, and scales across vial sizes. In the United States, serialization laws link tracking codes with cushioning layers, catalyzing smart-label demand. Compliance timetables push producers to confirm protective packaging market readiness years ahead of enforcement.

Stringent Environmental Rules on Plastics and EPS

Europe mandates reusable targets climbing to 15% by 2040 and bans certain PFAS, triggering immediate material substitutions and extended-producer fees that squeeze converters' margins. The United Kingdom's October 2025 EPR rollout shifts full disposal costs onto brands, while California restricts the recycling symbol unless curbside acceptance is documented. These moves inflate compliance costs and lengthen payback periods for foam installations, dragging on the protective packaging market growth curve.

Other drivers and restraints analyzed in the detailed report include:

- Growing Consumer Electronics Demand

- Preference for Lightweight Flexible Protective Formats

- Raw-material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible formats generated 65.34% of 2024 sales within the protective packaging market, reflecting their ability to serve high-volume parcels with minimal cube and lower freight spend. Foam categories, though smaller, are accelerating at 6.75% CAGR toward 2030 as electronics and biologics rely on custom molds with electrostatic discharge yields. The protective packaging market size for foam is projected to widen in tandem with cold-chain expansion, positioning foam makers for premium pricing aligned with higher barrier performance.

Sealed Air's KORRVU suspension format illustrates how paper and corrugate can mimic foam resilience, offering curbside recyclability and shipping flat to cut inbound freight. Rigid corrugated, meanwhile, remains relevant for large white-goods and machinery where stacking strength matters. The product mix signals a divide: flexibles satisfy cost-down mandates in e-commerce, whereas technical foams win where precision cushioning and thermal insulation command a price premium.

Plastics still supplied 58.23% of 2024 tonnage, yet foam polymers log the quickest 7.34% CAGR, tracking growth in high-value electronics and life sciences. Barley-based bioplastics and recycled polyethylene films are scaling pilot lines, proving viability for mass adoption. Protective packaging market share for biocomposites remains modest but expands as food and pharma buyers seek compostable or bio-based seals.

Paper and board converters upgrade barrier coatings so that fiber wraps repel moisture and grease. Virginia Tech's low-pressure cellulose treatment strengthens paper while preserving transparency, unlocking shelf-ready appeal for perishables. Producers bundle such advances with carbon footprint disclosures, translating material innovation into procurement gains within the protective packaging market.

The Protective Packaging Market Report is Segmented by Product Type (Rigid, Flexible, Foam), Materials (Paper, Plastics, Foam Polymers, Biodegradable), Function (Cushioning, Void Fill, Wrapping, Others), End-User Industry (Food & Beverage, Electronics, Pharmaceuticals, E-Commerce), and Geography (North America, Europe, Asia-Pacific, MEA, South America). Market Forecasts are in Value (USD).

Geography Analysis

Asia-Pacific controlled 40.23% revenue in 2024 and is set for 7.76% CAGR, underpinned by dense manufacturing, rapid mobile penetration, and supportive yet tightening policy. China funnels half of global plastic output, offering localized resin access that favors converters, while Japan advances foamed paper research that can satisfy premium electronics exporters. Countries pilot government subsidies for automated packing lines, ensuring the protective packaging market keeps pace with cross-border e-commerce surges.

North America follows through premiumization. United States brands like HP and Amazon test zero-plastic pilots that later migrate worldwide, positioning the region as a trend bellwether. State-level Extended Producer Responsibility rules, beginning with California SB 343, compel recyclability declarations by 2026, rewarding early adopters in the protective packaging market. Canada promotes closed-loop paper recycling, whereas Mexico leverages near-shoring to grow appliance and electronics exports, widening demand for in-plant cushioning.

Europe leads rulemaking. The Packaging and Packaging Waste Regulation locks in recyclability and reuse quotas that benchmark global sourcing policies. Germany's deposit systems and the UK's plastic tax accelerate fiber uptake. Market entrants must navigate complex eco-modulation fees that vary by polymer, so multinationals cluster R&D hubs in the region to future-proof formulations. Compliance mastery therefore becomes a commercial edge across the protective packaging market.

- Sealed Air Corporation

- Pregis LLC

- Intertape Polymer Group Inc.

- Sonoco Products Company

- Smurfit Westrock

- Mondi Group

- International Paper Company

- Storopack Hans Reichenecker GmbH

- Ranpak Holdings Corp.

- Huhtamaki Oyj

- Signode Industrial Group LLC

- Crown Holdings Inc.

- Amcor plc

- Pro-Pac Packaging Ltd.

- ProAmpac Holdings Inc.

- Reflex Packaging LLC

- Pactiv Evergreen Inc.

- AirPack Systems Ltd.

- Polyair Inter Pack Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging e-commerce shipping volumes

- 4.2.2 Regulatory push for product safety and damage reduction

- 4.2.3 Growing consumer electronics demand

- 4.2.4 Preference for lightweight flexible protective formats

- 4.2.5 Adoption of on-demand packaging automation

- 4.2.6 Expansion of cold-chain biologics and vaccines

- 4.3 Market Restraints

- 4.3.1 Stringent environmental rules on plastics and EPS

- 4.3.2 Raw-material price volatility

- 4.3.3 Space constraints at urban last-mile hubs

- 4.3.4 Product redesign minimising protective-packaging need

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Rigid

- 5.1.1.1 Corrugated Paperboard Protectors

- 5.1.1.2 Molded Pulp

- 5.1.1.3 Insulated Shipping Containers

- 5.1.1.4 Other Rigid Types

- 5.1.2 Flexible

- 5.1.2.1 Protective Mailers

- 5.1.2.2 Bubble Wrap

- 5.1.2.3 Air Pillows / Air Bags

- 5.1.2.4 Paper Fill

- 5.1.2.5 Other Flexible Types (Foil Pouches, Stretch and Shrink Films)

- 5.1.3 Foam

- 5.1.3.1 Molded Foam

- 5.1.3.2 Foam-in-Place (FIP)

- 5.1.3.3 Loose Fill

- 5.1.3.4 Foam Rolls / Sheets

- 5.1.3.5 Other Foam Types (Corner Blocks etc.)

- 5.1.1 Rigid

- 5.2 By Materials

- 5.2.1 Paper and Paperboard

- 5.2.2 Plastics

- 5.2.2.1 Polyethylene (PE)

- 5.2.2.2 Polypropylene (PP)

- 5.2.2.3 Polyethylene Terephthalate (PET)

- 5.2.3 Foam Polymers

- 5.2.3.1 Expanded Polystyrene (EPS)

- 5.2.3.2 Expanded Polyethylene (EPE)

- 5.2.3.3 Expanded Polypropylene (EPP)

- 5.2.4 Biodegradable and Compostable

- 5.2.4.1 Molded Fiber

- 5.2.4.2 Starch-based

- 5.2.4.3 Polylactic Acid (PLA)

- 5.2.5 Other Materials

- 5.3 By Function

- 5.3.1 Cushioning

- 5.3.2 Blocking and Bracing

- 5.3.3 Void Fill

- 5.3.4 Insulation and Temperature Control

- 5.3.5 Wrapping

- 5.3.6 Dunnage and Others

- 5.4 By End-user Industry

- 5.4.1 Food and Beverage

- 5.4.2 Industrial Goods

- 5.4.3 Pharmaceuticals and Life Sciences

- 5.4.4 Consumer Electronics

- 5.4.5 Beauty and Home Care

- 5.4.6 Automotive and Aerospace

- 5.4.7 E-commerce and Retail Fulfilment

- 5.4.8 Other End-user Industry

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Chile

- 5.5.5.4 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sealed Air Corporation

- 6.4.2 Pregis LLC

- 6.4.3 Intertape Polymer Group Inc.

- 6.4.4 Sonoco Products Company

- 6.4.5 Smurfit Westrock

- 6.4.6 Mondi Group

- 6.4.7 International Paper Company

- 6.4.8 Storopack Hans Reichenecker GmbH

- 6.4.9 Ranpak Holdings Corp.

- 6.4.10 Huhtamaki Oyj

- 6.4.11 Signode Industrial Group LLC

- 6.4.12 Crown Holdings Inc.

- 6.4.13 Amcor plc

- 6.4.14 Pro-Pac Packaging Ltd.

- 6.4.15 ProAmpac Holdings Inc.

- 6.4.16 Reflex Packaging LLC

- 6.4.17 Pactiv Evergreen Inc.

- 6.4.18 AirPack Systems Ltd.

- 6.4.19 Polyair Inter Pack Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment