|

市场调查报告书

商品编码

1851248

温度感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

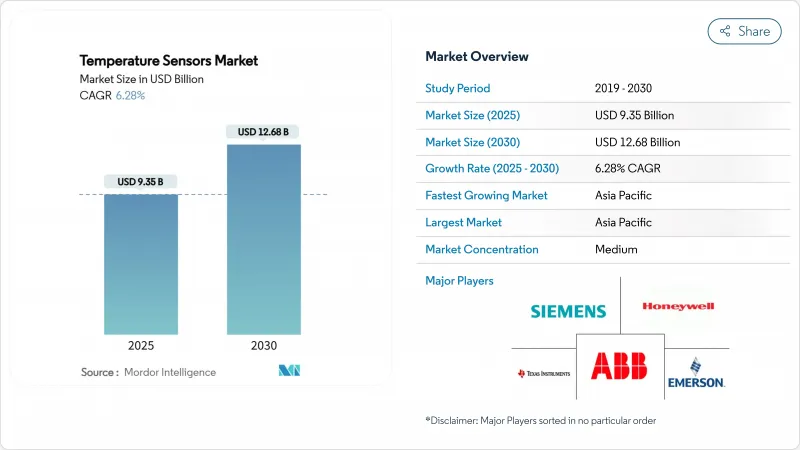

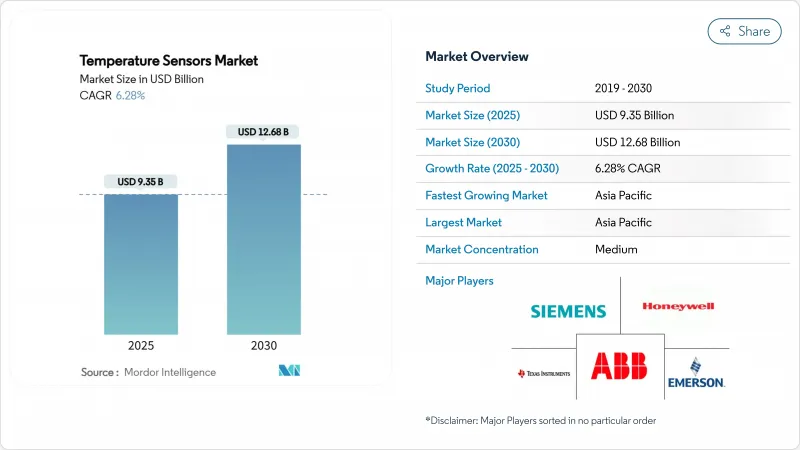

预计到 2025 年,温度感测器市场规模将达到 93.5 亿美元,到 2030 年将达到 126.8 亿美元,复合年增长率为 6.28%。

随着工业设施数位化、电动车的普及以及生命科学供应链对即时热溯源的要求日益严格,市场对感测器的需求正在增长。生技药品的低温运输法规、超大规模资料中心建设对光纤分散式感测技术的青睐,以及工业物联网在欧洲加工厂的广泛应用,共同推动了感测器市场规模的成长。 GaN/SiC功率电子元件的普及将进一步增强市场成长,因为其对精密冷却的要求更高;此外,5G基地台的部署也需要板载温度监控以确保运作。在供应方面,垂直整合的现有企业将透过专注于高精度产品和无线改造解决方案来降低总资本成本,从而应对来自亚洲低成本供应商的价格压力。

全球温度感测器市场趋势与洞察

在欧洲製程工业扩展智慧工业物联网温度网络

欧洲製造商正将无线温度节点整合到现有的控制架构中,以实现工业5.0在能源效率和工人安全方面的目标。这种免维护的感测器设计降低了生命週期成本,并简化了化纤工厂和暖通空调升级改造中极具改装的部署方案。人工智慧控制迴路利用更丰富的资料流来稳定气压和温度条件,从而提高产品产量比率并减少停机时间。一项在美国小型工厂进行的投资回报率研究表明,营运成本的节省超过了初始工业物联网硬体支出,检验了类似资本预算的可行性。因此,即使在可靠性要求极高的应用中,无线节点也越来越受欢迎,加速了温度感测器市场转型为互联架构。

GaN/SiC功率电子技术的应用推动了对精密冷却感知器的需求。

氮化镓和碳化硅元件在高功率密度下运行,会产生局部高温区域,因此需要亚摄氏度级的监测精度。半导体供应商预测,氮化镓将在快速充电器、人工智慧伺服器和电动车转换器等领域达到商业性化临界点。汽车製造商指定使用即使在强电磁场下也能保持校准的感测器,而资料中心营运商则采用多点热感映射来降低热点风险。对氮化铝薄膜感测器的研究表明,它们可以在高达 900 度C 的温度下可靠运行,从而扩展了其在极端电力电子环境中的应用。能够以具有竞争力的价格提供高精度和抗电磁干扰性能的供应商,将更有可能在温度感测器市场占据份额。

来自低成本中国供应商的降低平均售价压力

国家支持的规模经济使中国供应商能够在通用热电偶和基础型热电阻(RTD)领域以低于全球同行的价格销售产品,从而挤压了整个温度感测器市场的利润空间。欧洲公司则透过推出高性价比、高精度的产品来应对这项挑战,例如Sensirion的STS4L,产品功耗仅为微瓦级,却能保持±0.4 ℃的精度,使它们能够在不直接参与价格竞争的情况下维持市场份额。

细分市场分析

到2024年,有线感测器将占总收入的84.7%,为必须承受电磁干扰和延迟风险的关键生产迴路提供支援。随着工厂对传统生产线维修,以及楼宇管理公司引入无需布线即可安装的电池供电发射器,无线节点将填补这一空白,到2030年将以11.8%的复合年增长率增长。随着每次无线维修增加冗余通道,温度感测器市场的销售和业务收益都将增加。应用场景涵盖化学反应器、暖通空调平衡和远端油井口监测,这些都需要安全的通讯协定堆迭和多年的电池寿命。

快速成熟的通讯协定降低了无线传输相对于铜缆的可靠性Delta,使多节点部署的平均计划投资回收期缩短至两年以内。Honeywell符合 ISA100 标准的 SmartLine 发射器证明,其加密网状架构能够以亚秒级的速度更新数据,同时将封包遗失控制在 0.01% 以下 [honeywell.com]。营运商也在评估无线韧体升级,该升级允许在不中断线路的情况下部署网路安全补丁,这项韧体目前已成为温度感测器市场的标配。因此,整个温度感测器产业普遍认为无线传输是现有设施棕地专案的长期预设方案,而非小众技术。

到2024年,模拟元件的收入将维持71.2%的成长,因为4-20 mA迴路仍然是炼油厂和钢铁厂分散式控制系统(DCS)输入的主要供电介质。然而,随着工业乙太网、I2C和1-Wire汇流排在边缘到云端架构中日益普及,数位感测器市场到2030年将以9.4%的复合年增长率成长。由于数位节点嵌入了基于EEPROM的校准功能,安装人员不再需要在工厂进行微调,从而降低了试运行成本和停机时间。受此加速转变的影响,预计2030年,数位温度感测器市场规模将达到51亿美元。

德克萨斯(TI) 的 TMP117(精度为 ±0.08 度C)展示了其内建的 CRC 保护暂存器如何提升製药厂的可追溯性,这些製药厂必须储存校准资料以备 FDA审核[ti.com]。资料丰富的套件还支援资产性能管理演算法,该演算法能够预测故障的发生,从而延长泵浦和马达的使用寿命并降低责任风险。供应商正在将分析仪表板作为增值订阅服务捆绑销售,从而平滑温度感测器市场的收入週期。

温度感测器市场报告按类型(有线、无线)、输出(类比、数位)、技术(接触式热电偶、其他)、终端用户产业(化学及石化、石油天然气、其他)和地区进行细分。市场预测以美元计价。

区域分析

亚太地区将占2024年总收入的44.9%,年复合成长率达7.2%,这主要得益于中国5G大型基地台的部署和印度符合GMP标准的疫苗工厂的建设。政府对电动车电池生产线的补贴将提高单车感测器密度,而国内半导体工厂将采用对温度控制要求为±0.2°C的无尘室迴路。日本和韩国将进一步增强对精密製造的需求,特别是对需要在1400 度C高温下运作的碳化硅晶圆炉的需求。

在北美,紧随其后的是医药低温运输支援和超大规模云园区,这些园区通常每个站点部署超过150公里的光纤分散式传输系统(DTS)。美国食品药物管理局(FDA)对某些临床体温计的2025年豁免正在加速设备认证週期,而美国能源部(DOE)资助的能源效率目标正推动资料中心营运商将进气温度控制在1摄氏度以下。汽车一级供应商(Tier-1)的设计週期正在延长,但新型电动车平台仍在扩展热感节点,温度感测器市场与底特律的电气化进程保持一致。

欧洲正优先推动工业5.0维修,欧盟层级提供补贴,用于升级整合无线感测器数位双胞胎的智慧工厂。电动车的普及也将增加每辆车所需的电池温度控管单元数量。该地区的能源转型将刺激对氢电解和离岸风力发电机组耐腐蚀探头的需求。总体而言,欧洲温度感测器产业的特点是平均售价高昂,且测量标准严格,以保护净利率免受全球价格竞争的影响。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在欧洲製程工业扩展智慧工业物联网温度网络

- GaN/SiC功率电子技术的应用将推动对精密冷却感知器的需求(亚洲)

- 强制要求生技药品和mRNA疫苗低温运输可追溯性(北美)

- 亚洲地区5G基地台部署需要机载热监测

- 欧洲电动车温度控管模组的采用情况

- 超大规模资料中心建置推动光纤分散式感测(全球)

- 市场限制

- 来自低成本中国供应商的降低平均售价压力

- 用于热电阻的高纯度铂丝的供应风险

- 製药生产中的校准漂移责任索赔(美国/欧盟)

- 汽车一级供应商的长期设计冻结週期

- 价值/供应链分析

- 监管和技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场规模与成长预测

- 按类型

- 有线

- 无线的

- 透过输出

- 模拟

- 数位的

- 透过技术

- 接触式热电偶

- 电阻温度检测器(RTD)

- 热敏电阻器(NTC/PTC)

- 温度积体电路

- 非接触式红外线

- 光纤

- 终端用户产业

- 化工/石油化工

- 石油和天然气

- 金属和采矿

- 发电

- 饮食

- 汽车和电动交通

- 医疗保健

- 航太/国防

- 消费性电子产品和穿戴式装置

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Honeywell International Inc.

- Siemens AG

- Texas Instruments Inc.

- STMicroelectronics NV

- TE Connectivity Ltd.

- Panasonic Corporation

- ABB Ltd

- Emerson Electric Co.

- Analog Devices Inc.

- Denso Corporation

- Microchip Technology Inc.

- Amphenol Advanced Sensors

- Sensirion AG

- Endress+Hauser AG

- Robert Bosch GmbH

- Fluke Process Instruments

- FLIR Systems(Teledyne)

- Gnther GmbH Temperaturmesstechnik

- Kongsberg Gruppen

- Maxim Integrated Products

- Thermometris

第七章 市场机会与未来展望

The temperature sensor market size has reached USD 9.35 billion in 2025 and is forecast to climb to USD 12.68 billion by 2030, registering a 6.28% CAGR.

Demand is rising as industrial facilities digitize, electric vehicles proliferate, and life-science supply chains enforce real-time thermal traceability. Regulatory cold-chain mandates for biologics, hyperscale data-center buildouts that favor fiber-optic distributed sensing, and widespread IIoT adoption across European process plants jointly elevate sensor volumes. Growth is further strengthened by GaN/SiC power-electronics adoption, which raises precision-cooling requirements, and by 5G base-station deployments that need on-board thermal monitoring to protect uptime. On the supply side, vertically integrated incumbents counter price pressure from low-cost Asian suppliers by focusing on high-accuracy products and wireless retrofit solutions that reduce total installed cost.

Global Temperature Sensors Market Trends and Insights

Expansion of Smart IIoT Temperature Networks in European Process Industries

European manufacturers are integrating wireless temperature nodes into existing control architectures to meet Industry 5.0 goals for energy efficiency and worker safety. Maintenance-free sensor designs lower lifecycle cost and simplify retrofit deployment, which is attractive in chemical-fiber plants and HVAC upgrades. AI-enabled control loops use the richer data stream to stabilize air-pressure and thermal conditions, improving product yield and reducing downtime. Return-on-investment studies in small US factories show operating savings that outweigh initial IIoT hardware spend, validating capital budgets for similar. As a result, wireless nodes gain momentum even in reliability-critical applications, accelerating the temperature sensor market toward connected architectures.

GaN/SiC Power Electronics Adoption Elevating Precision-Cooling Sensor Demand

Gallium-nitride and silicon-carbide devices operate at higher power densities, creating localized heat zones that require sub-degree monitoring accuracy. Semiconductor suppliers forecast GaN reaching commercial tipping points in fast chargers, AI servers, and electric-vehicle converters. Automotive OEMs specify sensors that maintain calibration under strong electromagnetic fields, while data-center operators adopt multi-point thermal maps to contain hotspot risk. Research into aluminum-nitride thin-film sensors shows reliable operation up to 900 °C, extending sensor use into extreme power-electronics environments . Suppliers that deliver precision and EMI immunity at competitive cost are well-positioned to gain share in the temperature sensor market.

Downward ASP Pressure from Chinese Low-Cost Suppliers

State-supported economies of scale allow Chinese vendors to undercut global peers on commodity thermocouples and basic RTDs, eroding margins across the temperature sensor market. European firms are countering by releasing cost-efficient yet accurate models such as Sensirion's STS4L, which draws micro-watts of power while holding +-0.4 °C accuracy, thereby defending share without direct price wars

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Cold-Chain Traceability for Biologics & mRNA Vaccines

- 5G Base-Station Roll-outs Requiring On-Board Thermal Monitoring

- Supply Risk of High-Purity Platinum Wire for RTDs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wired sensors continued to dominate with 84.7 % revenue in 2024, anchoring production-critical loops that must resist electromagnetic interference and latency risks. Wireless nodes are closing the gap, expanding at 11.8 % CAGR to 2030 as factories retrofit legacy lines and building-management firms deploy battery-powered transmitters that install without conduit work. The temperature sensor market benefits because every wireless retrofit typically adds extra redundancy channels, lifting unit volumes and service revenues. Use cases span chemical reactors, HVAC balancing and remote well-head monitoring, each demanding secure protocol stacks and multi-year battery life.

Rapid protocol maturation is reducing the reliability delta versus copper cabling and bringing average project payback below two years for multi-node deployments. Honeywell's ISA100-compliant SmartLine transmitter illustrates how encrypted mesh architectures keep packet loss below 0.01 % while reporting sub-second updates [honeywell.com]. Operators also value firmware-over-the-air upgrades that let them roll out cyber-security patches without line shutdowns, a feature now common across the temperature sensor market. The overall temperature sensor industry therefore sees wireless not as a niche but as the long-term default for brown-field sites.

Analog devices retained 71.2 % revenue in 2024 because 4-20 mA loops still anchor distributed-control-system (DCS) inputs in refineries and steel mills. Digital sensors, however, are expanding 9.4 % CAGR to 2030 as industrial Ethernet, I2C and 1-Wire buses proliferate in edge-to-cloud architectures. When digital nodes embed EEPROM-based calibration, installers no longer need plant-floor trim, cutting commissioning cost and shortening downtime. The temperature sensor market size for digital devices is projected to reach USD 5.1 billion by 2030, reflecting this accelerating conversion.

Texas Instruments' +-0.08 °C TMP117 exemplifies how embedded CRC-protected registers improve traceability in pharmaceutical plants that must archive calibration data for FDA audits [ti.com]. Data-rich packets also enable asset-performance-management algorithms that predict failure before excursions occur, extending pump and motor life and lowering indemnity exposure. Vendors consequently bundle analytics dashboards as value-added subscriptions that smooth revenue cyclicality across the temperature sensor market.

The Temperature Sensors Market Report is Segmented Into Type (Wired, Wireless), Output (Analog, Digital), Technology (Contact Thermocouple, and More), End-User Industry (Chemical and Petrochemical, Oil and Gas and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 44.9 % of 2024 revenue and is advancing at a 7.2 % CAGR, supported by China's 5G macro-cell rollout and India's build-out of GMP-compliant vaccine plants. Government subsidies for EV battery lines amplify sensor density per vehicle, while domestic semiconductor fabs adopt clean-room loops that demand +-0.2 °C RTDs. Japan and South Korea add precision-manufacturing pull, especially for SiC wafer furnaces requiring 1,400 °C sensors.

North America follows with pharmaceutical cold-chain compliance and hyperscale cloud campuses that often deploy >150 km of fiber DTS per site. The FDA's 2025 waiver on certain clinical thermometers accelerates device qualification cycles, while DOE-funded efficiency targets push data-center operators to sub-1 °C inlet-air control. Automotive Tier-1 design cycles are longer, yet every new EV platform still expands thermal nodes, tying the temperature sensor market to Detroit's electrification timetable.

Europe prioritizes Industry 5.0 retrofits, leveraging EU-level grants for smart-factory upgrades that merge wireless sensor networks with digital twins. EV adoption likewise lifts battery thermal-management units per vehicle. The region's energy transition stimulates demand for corrosion-resistant probes in hydrogen electrolyzers and offshore wind converters. Overall the temperature sensor industry in Europe is characterised by premium ASPs and stringent metrology standards that shield margins against global price competition.

- Honeywell International Inc.

- Siemens AG

- Texas Instruments Inc.

- STMicroelectronics N.V.

- TE Connectivity Ltd.

- Panasonic Corporation

- ABB Ltd

- Emerson Electric Co.

- Analog Devices Inc.

- Denso Corporation

- Microchip Technology Inc.

- Amphenol Advanced Sensors

- Sensirion AG

- Endress+Hauser AG

- Robert Bosch GmbH

- Fluke Process Instruments

- FLIR Systems (Teledyne)

- Gnther GmbH Temperaturmesstechnik

- Kongsberg Gruppen

- Maxim Integrated Products

- Thermometris

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Smart IIoT Temperature Networks in European Process Industries

- 4.2.2 GaN/SiC Power Electronics Adoption Elevating Precision-Cooling Sensor Demand (Asia)

- 4.2.3 Mandatory Cold-Chain Traceability for Biologics and mRNA Vaccines (North America)

- 4.2.4 5G Base-Station Roll-outs Requiring On-Board Thermal Monitoring (Asia)

- 4.2.5 Electrified-Mobility Thermal-Management Modules Adoption (Europe)

- 4.2.6 Hyperscale Data-Center Build-out Driving Fiber-Optic Distributed Sensing (Global)

- 4.3 Market Restraints

- 4.3.1 Downward ASP Pressure from Chinese Low-Cost Suppliers

- 4.3.2 Supply Risk of High-Purity Platinum Wire for RTDs

- 4.3.3 Calibration-Drift Liability Claims in Pharma Manufacturing (US/EU)

- 4.3.4 Long Design-in Freeze Cycles in Automotive Tier-1s

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Intensity of Competitive Rivalry

- 4.6.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 Output

- 5.2.1 Analog

- 5.2.2 Digital

- 5.3 Technology

- 5.3.1 Contact Thermocouple

- 5.3.2 Resistance Temperature Detector (RTD)

- 5.3.3 Thermistor (NTC/PTC)

- 5.3.4 Temperature IC

- 5.3.5 Non-Contact Infrared

- 5.3.6 Fiber-Optic

- 5.4 End-User Industry

- 5.4.1 Chemical and Petrochemical

- 5.4.2 Oil and Gas

- 5.4.3 Metals and Mining

- 5.4.4 Power Generation

- 5.4.5 Food and Beverage

- 5.4.6 Automotive and E-Mobility

- 5.4.7 Medical and Healthcare

- 5.4.8 Aerospace and Defense

- 5.4.9 Consumer Electronics and Wearables

- 5.4.10 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Siemens AG

- 6.4.3 Texas Instruments Inc.

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 TE Connectivity Ltd.

- 6.4.6 Panasonic Corporation

- 6.4.7 ABB Ltd

- 6.4.8 Emerson Electric Co.

- 6.4.9 Analog Devices Inc.

- 6.4.10 Denso Corporation

- 6.4.11 Microchip Technology Inc.

- 6.4.12 Amphenol Advanced Sensors

- 6.4.13 Sensirion AG

- 6.4.14 Endress+Hauser AG

- 6.4.15 Robert Bosch GmbH

- 6.4.16 Fluke Process Instruments

- 6.4.17 FLIR Systems (Teledyne)

- 6.4.18 Gnther GmbH Temperaturmesstechnik

- 6.4.19 Kongsberg Gruppen

- 6.4.20 Maxim Integrated Products

- 6.4.21 Thermometris

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment