|

市场调查报告书

商品编码

1851283

压力感测器产业:市场份额分析、产业趋势、统计和成长预测(2025-2030 年)Pressure Sensors Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

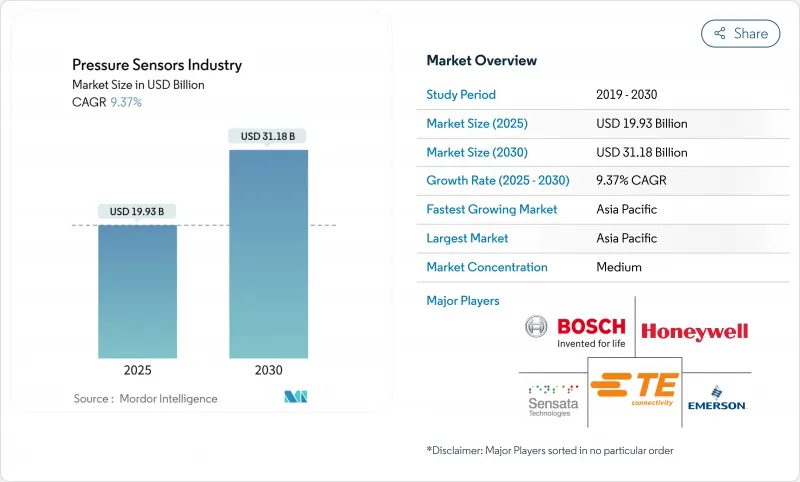

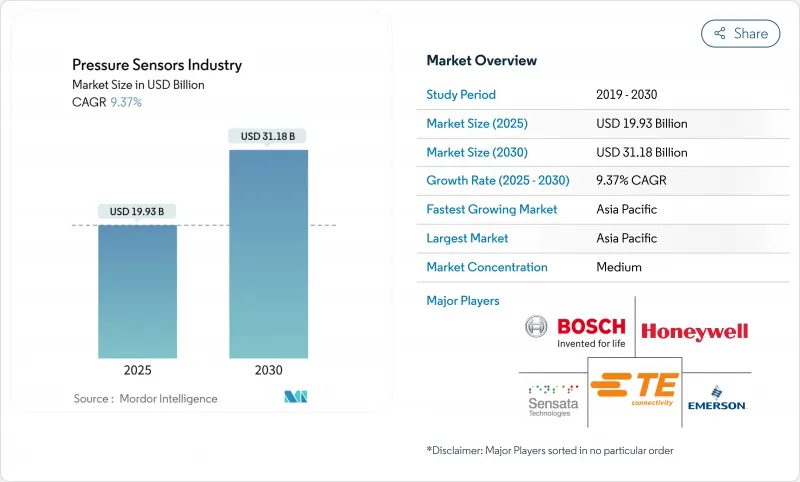

预计到 2025 年,压力感测器市场规模将达到 199.3 亿美元,到 2030 年将达到 311.8 亿美元,年复合成长率为 9.37%。

强劲的需求主要来自电动动力传动系统控制、智慧工厂维修以及需要精确压力监测以确保安全性和效率的一次性医疗设备。亚太地区的电气化政策正在加速xEV电池热感系统中高精度气压感测器的应用,而欧洲和北美地区的工业4.0升级则倾向于采用无线节点以降低安装成本。医疗设备的小型化,尤其是在心血管导管领域,为符合灭菌标准的一次性MEMS设计创造了巨大的商机。同时,在LNG运输船队等严苛环境下的探勘,也推动了能够承受超过175°C製程温度的碳化硅和光学技术的需求。竞争日益激烈:现有企业正在边缘嵌入人工智慧引擎以确保利润,而中国的白牌MEMS代工厂则在扩大生产规模并降低平均售价。

全球压力感测器产业市场趋势与洞察

xEV动力传动系统控制系统的快速电气化推动了高精度气压感测技术的发展

电动车使用高精度气压感知器来检测电池膨胀并进行散热,以避免热失控,热失控可能导致汽车製造商每辆车损失高达 3000 美元。随着碳化硅牵引逆变器预计在 2027 年达到 50% 的市场渗透率,感测器供应商正在加紧设计可在 175°C 以上温度下运作的产品。中国、日本和韩国的汽车需求最为强劲,这些国家凭藉超级工厂的产能和政府补贴,正在加速碳化硅技术的应用。

智慧工厂维修的扩展将推动对无线感测器节点的需求。

欧洲和北美的製造商正在传统设备上迭加 LoRaWAN 和 NB-IoT 压力节点,以实现预测性维护。预计到 2030 年,低功耗广域连线的数量将超过 35 亿。像 WIKA 的压力表组装线这样的组装线,目前在一个自动化单元中整合了超过 10,000 种不同的感测器。维修计划优先考虑使用电池供电的节点,以避免昂贵的导线管安装,这也是无线技术应用年复合成长率 (CAGR) 达到 12.8% 的关键因素。

由于中国白牌MEMS代工厂导致平均售价下降

像MEMSensing这样的公司在2024年实现了28.8%至36.85%的营收成长,但仍处于亏损,这凸显了激进的定价策略正在挤压全球现有企业的利润空间。西方供应商正透过转向高温碳化硅和人工智慧封装来应对这一局面。

细分市场分析

由于在引擎控制单元和手术室等高耗电环境中能够实现确定性资料传输,有线设备预计在2024年仍将维持72%的收入成长。然而,随着工厂向工业4.0维修,无线节点将以12.8%的复合年增长率超越有线节点。智慧控制改造套件能够预测压力容器的停机时间,同时降低40%的安装成本。乙太网路供电(PoE)升级透过在单一线路上復用电源和数据,确保有线感测器持续运作。无线节点利用能量采集和边缘运算技术,使其能够安装在以前被认为无法触及的旋转轴和密封腔室中。

到2024年,绝对压力式感测器将占据46%的市场份额,因为歧管压力、气象记录和无人机高度测量都需要真空参考测量。差压式感测器的复合年增长率将达到10.4%,主要受暖通维修和无尘室过滤监测的推动。近期湿式蚀刻硅製造製程的进步,使得其灵敏度达到5.07mV/V/MPa,线性度达0.67%FS。压力表仍将是油压设备中常用的装置,但其成长率预计仅为个位数中段。

区域分析

亚太地区36%的成长主要得益于中国MEMS工厂和印度强制实施的胎压监测系统(TPMS)。国家高速公路的扩建和5293个电动车充电站的建设,使得每辆车的感测器数量不断增加。国内製造商正在缩小技术差距;主要企业指出,国内供应商正在将人工智慧整合到其汽车感知系统中。欧洲充分利用其工业自动化的传统优势;英飞凌投资50亿欧元的德勒斯登智慧功率製造厂凸显了其在半导体领域的战略自主性。北美在航太和医疗领域表现卓越,DARPA资助的研究正在推动感测技术的前沿发展。中东和非洲地区将迎来12.22%的年复合成长率,成为液化天然气(LNG)计划(需要海底仪器)成长最快的地区,同时智慧城市基础设施的建设也将促进无线部署。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- xEV动力传动系统控制系统的快速电气化推动了高精度气压感测技术的发展(亚洲)

- 智慧工厂维修的扩展将推动对无线感测器节点的需求(欧洲和北美)。

- 在印度和东协,摩托车必须安装胎压监测系统。

- 加速部署 5G 毫米波无线网路需要精确的热机械压力控制。

- 门诊循环系统诊所采用一次性MEMS压力导管(美国)

- 不断扩大的液化天然气船队加强了恶劣环境下的海底压力仪器(中东)

- 市场限制

- 由于中国白牌MEMS代工厂导致平均售价下降

- 无线通讯协定碎片化导致整合成本上升

- 超过 175°C 製程温度的光压晶片的可靠性问题

- 供应链面临压阻式晶圆短缺风险

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 影响市场的宏观趋势

- 投资分析

第五章 市场规模与成长预测

- 依感测器类型

- 有线

- 无线的

- 依产品类型

- 绝对

- 微分

- 测量

- 透过技术

- 压阻器

- 电磁

- 电容式

- 共振固体

- 光学

- 其他压力感测器

- 透过使用

- 车

- 医疗的

- 消费性电子产品

- 产业

- 航太/国防

- 饮食

- 空调

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd

- All Sensors Corporation

- Bosch Sensortec GmbH

- Endress+Hauser AG

- TE Connectivity

- Honeywell International Inc.

- Schneider Electric SE

- Kistler Group

- Rockwell Automation Inc.

- Emerson Electric Co.

- Sensata Technologies Inc.

- Siemens AG

- Yokogawa Electric Corp.

- Infineon Technologies AG

- STMicroelectronics NV

- Sensirion AG

- NXP Semiconductors NV

- Texas Instruments Inc.

- Omron Corporation

- Murata Manufacturing Co., Ltd.

- Amphenol(SSI Technologies)

- BD Sensors GmbH

- Keller AG fur Druckmesstechnik

第七章 市场机会与未来展望

The pressure sensors market size is valued at USD 19.93 billion in 2025 and is forecast to reach USD 31.18 billion by 2030, advancing at a 9.37% CAGR.

Strong demand stems from electrified power-train control, smart-factory retrofits, and disposable medical devices that require precise pressure monitoring for safety and efficiency. Electrification mandates in Asia-Pacific are accelerating adoption of high-accuracy barometric sensors in xEV battery-thermal systems, while Industry 4.0 upgrades across Europe and North America favor wireless nodes that cut installation cost. Medical device miniaturization, especially in cardiovascular catheters, is opening a sizeable opportunity for single-use MEMS designs that meet sterilization standards. At the same time, harsh-environment exploration-such as LNG carrier fleets-creates premium demand for silicon-carbide and optical technologies capable of surviving >175 °C process lines. Competitive intensity is rising: incumbents embed AI engines at the edge to defend margins, whereas Chinese white-label MEMS foundries scale volume and depress average selling prices.

Global Pressure Sensors Industry Market Trends and Insights

Rapid electrification of xEV power-train control systems driving high-accuracy barometric sensing

Electric vehicles use precision barometric sensors to detect cell swelling and manage heat, avoiding thermal runaway events that can cost OEMs up to USD 3,000 per vehicle. Sensor suppliers are hardening designs for >175 °C operation because silicon-carbide traction inverters will reach 50% penetration by 2027. Automotive demand is strongest in China, Japan, and South Korea where gigafactory capacity and government subsidies intersect to accelerate adoption.

Expansion of smart-factory retrofits boosting wireless sensor node demand

European and North American manufacturers are layering LoRaWAN and NB-IoT pressure nodes onto legacy equipment to enable predictive maintenance; low-power wide-area connections are forecast to exceed 3.5 billion by 2030. Assembly lines such as WIKA's gauge facility now incorporate more than 10,000 sensor variants in a single automated cell. Retrofit projects prioritize battery-powered nodes to avoid expensive conduit runs, a key factor behind the 12.8% CAGR in wireless uptake.

ASP erosion from Chinese white-label MEMS foundries

Firms such as MEMSensing posted 28.8%-36.85% revenue growth in 2024 while still running at a loss, underscoring aggressive pricing tactics that compress margins for global incumbents. Western vendors answer by pivoting toward high-temperature silicon-carbide and AI-enabled packages.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory tyre-pressure monitoring adoption waves in India & ASEAN two-wheelers

- Accelerated rollout of 5G mmWave radios requiring precision thermo-mechanical pressure control

- Fragmented wireless protocol landscape inflating integration cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wired devices retained 72% revenue in 2024 due to deterministic data delivery in power-rich settings such as engine control units and surgical theaters. However, wireless nodes will outpace with a 12.8% CAGR as factories retrofit to Industry 4.0. Smart Control retrofit kits cut installation expense by 40% while enabling predictive shutdowns for pressure vessels. Power-over-Ethernet upgrades are keeping wired sensors relevant by multiplexing power and data on a single line. Wireless nodes leverage energy harvesting and edge compute, allowing placement on rotating shafts or sealed chambers once considered unreachable.

Absolute designs held 46% share in 2024 because manifold pressure, weather logging, and drone altimetry require vacuum-referenced readings. Differential units will see a 10.4% CAGR thanks to HVAC retrofits and filtration monitoring in cleanrooms. Recent wet-etch silicon fabrication pushed sensitivity to 5.07 mV/V/MPa with 0.67% FS linearity. Gauge units remain staple devices in hydraulics but exhibit only mid-single-digit growth.

The Pressure Sensors Market Report is Segmented by Type of Sensor (Wired, Wireless), Product Type (Absolute, Differential, Gauge), Technology (Piezoresistive, Electromagnetic, Optical, Capacitive, Resonant Solid-State, and More), Application (Automotive, Medical, Industrial, Aerospace and Defense, HVAC, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 36% leadership stems from China's MEMS fabs and India's TPMS mandates. The National Highways expansion and 5,293 EV charging stations catalyze sensor content per vehicle. Local producers are closing the technology gap; Major players notes domestic suppliers are integrating AI into automotive perception stacks. Europe leverages its industrial automation heritage; Infineon's EUR 5 billion Dresden Smart Power Fab underscores strategic semiconductor self-reliance. North America excels in aerospace and medical segments, with DARPA-funded research pushing sensing frontiers. The Middle East & Africa posts the fastest 12.22% CAGR on LNG projects needing subsea instrumentation, complemented by smart-city infrastructure that seeds wireless deployments.

- ABB Ltd

- All Sensors Corporation

- Bosch Sensortec GmbH

- Endress+Hauser AG

- TE Connectivity

- Honeywell International Inc.

- Schneider Electric SE

- Kistler Group

- Rockwell Automation Inc.

- Emerson Electric Co.

- Sensata Technologies Inc.

- Siemens AG

- Yokogawa Electric Corp.

- Infineon Technologies AG

- STMicroelectronics N.V.

- Sensirion AG

- NXP Semiconductors N.V.

- Texas Instruments Inc.

- Omron Corporation

- Murata Manufacturing Co., Ltd.

- Amphenol (S S I Technologies)

- BD Sensors GmbH

- Keller AG fur Druckmesstechnik

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid electrification of xEV power-train control systems driving high-accuracy barometric sensing (Asia)

- 4.2.2 Expansion of smart factory retrofits boosting wireless sensor node demand (Europe and NA)

- 4.2.3 Mandatory tyre-pressure monitoring adoption waves in India and ASEAN two-wheelers

- 4.2.4 Accelerated rollout of 5G mmWave radios requiring precision thermo-mechanical pressure control

- 4.2.5 Adoption of disposable MEMS pressure catheters in outpatient cardiovascular clinics (US)

- 4.2.6 LNG carrier fleet build-up elevating harsh-environment subsea pressure instrumentation (Middle East)

- 4.3 Market Restraints

- 4.3.1 ASP erosion from Chinese white-label MEMS foundries

- 4.3.2 Fragmented wireless protocol landscape inflating integration cost

- 4.3.3 Reliability concerns in optical pressure chips beyond 175 degree C process lines

- 4.3.4 Supply-chain exposure to bulk piezoresistive wafer shortages

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Macro Trends on the Market

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type of Sensor

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Product Type

- 5.2.1 Absolute

- 5.2.2 Differential

- 5.2.3 Gauge

- 5.3 By Technology

- 5.3.1 Piezoresistive

- 5.3.2 Electromagnetic

- 5.3.3 Capacitive

- 5.3.4 Resonant Solid-State

- 5.3.5 Optical

- 5.3.6 Other Pressure Sensors

- 5.4 By Application

- 5.4.1 Automotive

- 5.4.2 Medical

- 5.4.3 Consumer Electronics

- 5.4.4 Industrial

- 5.4.5 Aerospace and Defense

- 5.4.6 Food and Beverage

- 5.4.7 HVAC

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global- and Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 All Sensors Corporation

- 6.4.3 Bosch Sensortec GmbH

- 6.4.4 Endress+Hauser AG

- 6.4.5 TE Connectivity

- 6.4.6 Honeywell International Inc.

- 6.4.7 Schneider Electric SE

- 6.4.8 Kistler Group

- 6.4.9 Rockwell Automation Inc.

- 6.4.10 Emerson Electric Co.

- 6.4.11 Sensata Technologies Inc.

- 6.4.12 Siemens AG

- 6.4.13 Yokogawa Electric Corp.

- 6.4.14 Infineon Technologies AG

- 6.4.15 STMicroelectronics N.V.

- 6.4.16 Sensirion AG

- 6.4.17 NXP Semiconductors N.V.

- 6.4.18 Texas Instruments Inc.

- 6.4.19 Omron Corporation

- 6.4.20 Murata Manufacturing Co., Ltd.

- 6.4.21 Amphenol (S S I Technologies)

- 6.4.22 BD Sensors GmbH

- 6.4.23 Keller AG fur Druckmesstechnik

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment