|

市场调查报告书

商品编码

1851323

通报系统系统(MNS):市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)MNS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

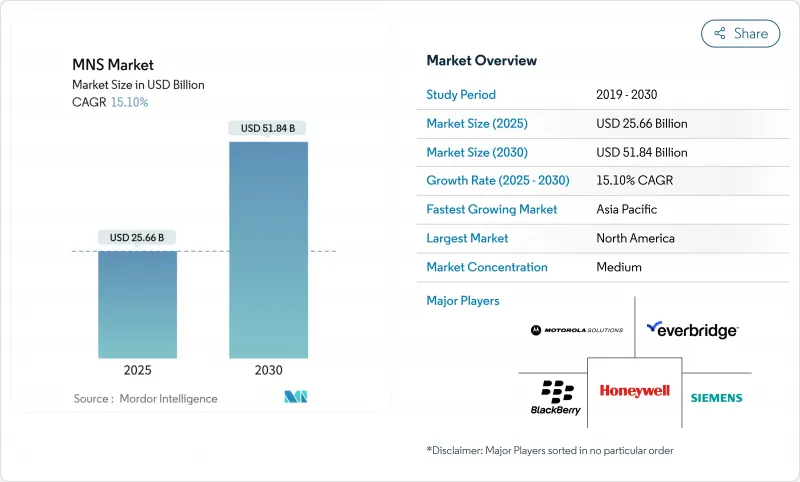

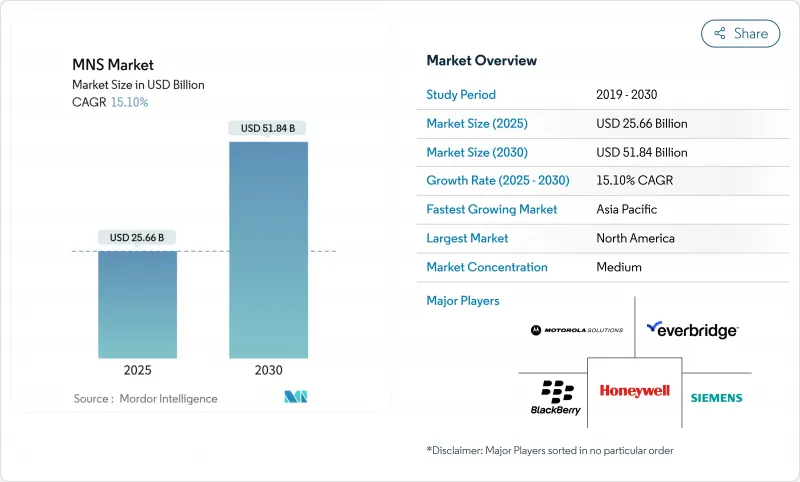

预计到 2025 年,通报系统系统 (MNS) 市场价值将达到 256.6 亿美元,到 2030 年将达到 518.4 亿美元,年复合成长率为 15.1%。

气候变迁风险加剧、安全法规日益严格、技术进步正在共同推动5G技术的应用。如今,企业期望透过单一平台,利用简讯、语音、社群媒体、桌面弹窗、公共广播和物联网感测器等多种管道触达用户,并根据用户的位置和角色自订讯息。随着企业对即时扩展和远端管理的需求日益增长,云端部署占据主导地位;但随着安全团队对本地部署控制要求的加强,混合部署模式也在迎头赶上。随着支出从政府扩展到医疗保健、教育、公共以及中小企业,拥有5G、分析和与传统基础设施整合专业知识的供应商将更有利于赢得新计画。

全球通报系统系统(MNS)市场趋势与洞察

加速部署5G技术可实现即时多媒体警报

5G 将带来Gigabit吞吐量和毫秒延迟,使平台能够推送高清视讯、楼层平面图和互动式疏散地图,而不是文字。日本、韩国和新加坡的都市区已经开始使用基于位置的警报系统,该系统会根据接收者在城市中的移动而自动调整。通讯业者报告称,在重大事件期间,5G 的连接满意度比 4G 高出 20%,这对于在拥堵网路环境下进行规划的紧急管理人员来说是一个令人安心的资料点。能够整合网路切片和边缘运算能力的供应商,正凭藉速度、冗余性和丰富的内容脱颖而出。随着频谱竞标的持续进行和设备普及率的提高,与 5G 覆盖目标相关的公共资金预计将在大规模通知系统市场占据更多份额。

欧盟《欧洲经济共同体公约》第110条促进多通路合规

该法规要求所有27个欧盟成员国必须涵盖“尽可能多的受影响人群”,并鼓励各国政府结合使用行动电话广播、基于位置的简讯和应用程式警报等多种方式。合规资金正在加速部署支援多语言内容、双向通讯和跨境互通性的混合平台。商业用户也在采用相同的架构来简化业务永续营运通讯,这使得私人投资以超出预期的速度涌入大众通知系统市场。

非洲碎片化的频谱政策阻碍了频谱的采用

区域广播依赖统一的频谱指导方针,但非洲54个国家的政策差异很大。供应商需要为每家通讯业者客製化整合方案,这延长了试验时间并推高了成本。儘管3G和4G覆盖率已超过90%,但这仍减缓了公共领域的应用。区域整合工作正在进行中,但在整合成熟之前,非洲的成长速度将低于其他新兴地区。

细分市场分析

预计到2024年,大规模通知系统解决方案市场规模将达到170亿美元,市占率高达66%,主要得益于机构和企业用指挥中心软体取代以硬体为中心的传统方案。该软体将简讯、语音、电子邮件、警报器和指示牌整合到一个统一的主机中,从而减少了培训需求和许可证重复使用的情况。在未来五年,预测收件者行为的分析模组有望促使现有客户升级,从而维持解决方案销售额两位数的成长。服务领域虽然规模较小,但由于整合、客製化和全天候监控需要专业技能,因此预计其复合年增长率将达到18.6%。

闪光灯、壁挂式扬声器和户外警报器等硬体设备在关键任务型工厂、机场和学校仍然占据一席之地。但製造商正在这些装置中内建IP连线功能,使其能够向中央平台报告状态。专业服务团队将评估、法规咨询和生命週期维护打包到多年合约中,从而为供应商创造可预测的现金流,并减少客户的意外成本。这种管理模式进一步扩大了此解决方案在群发通知系统市场的优势。

到2024年,云端将占据大规模报表系统市场71%的份额,管理者们青睐其即时扩展、计量收费和便利升级等优势。 SaaS平台也简化了大型企业跨数十个站点的多租户管理。这种模式也吸引了IT人员有限的中小型企业,使其客户净成长最为显着。然而,数据主权法规、现场部署的需求以及对供应商锁定的担忧,正促使金融服务、公共产业和医院等行业转向混合部署模式。混合部署预计将以20.4%的复合年增长率成长,成为所有部署方案中成长最快的。

本地部署规模正在缩小,但不太可能完全消失。关键基础设施拥有者通常会在加固的伺服器上运作本机实例,以确保即使外部连结发生故障,讯息也能正常传输。容器化架构现在允许营运商在公共云端和本地丛集之间迁移工作负载,从而平衡成本和控制。随着这种弹性逐渐成为主流,在群发通知系统市场中,「云端」和「本地」之间的界线可能会变得模糊,买家会选择针对特定工作负载的策略,而不是单一的、包罗万象的模式。

大众通知系统市场报告按组件(解决方案、服务、硬体)、部署方式(云端、本地部署、混合部署)、应用领域(楼宇内、广域网路、其他)、解决方案用途(业务永续营运和灾害復原、其他)、最终用户(政府和国防、其他)以及地区对产业进行细分。市场规模和预测均以美元计价。

区域分析

北美地区预计到2024年将维持40%的收入份额,反映了该地区成熟的通讯基础设施、津贴以及极端天气频繁的现状。目前,各市政当局正将大规模警报系统整合到更广泛的智慧城市平台中,这些平台将交通感测器、洪水监测仪、野火摄影机等设备与自动化讯息连接起来。云端原生升级也符合该地区对网路安全保险的高要求,确保所有部署都具备资料保护功能。

亚太地区以17.5%的复合年增长率成长,是所有地区中最快的。韩国、日本和澳洲加速推进5G网路部署,使得警报能够附带影片剪辑和多语言字幕,从而提高人口密集城市中的资讯理解能力。在菲律宾等颱风频繁的国家,政府为提高抗灾能力奖励策略,正吸引新的资金流入大众通知系统市场。同时,中国的特大城市计划正在将警报系统与监视录影机和电子钱包超级应用相结合,将公共与日常数位行为融为一体。

欧洲的情况介于这两个极端之间,但其成长主要受监管合规性驱动。 《欧洲经济共同体公约》第110条的最后期限促使所有成员国将多通路警报纳入预算,而《一般资料保护规范》(GDPR)则鼓励供应商投资于使用者同意管理和资料最小化。北欧地区对多语言内容的重视虽然延缓了一些计划的进展,但最终拓宽了产品的出口能力。英国不受欧盟指令的约束,已製定了符合小区广播最佳实践的自身标准,从而确保了跨境互通性。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速5G部署将协助亚太地区实现即时多媒体警报

- 欧盟强制监管多通路公共警告(《欧洲经济共同体法》第110条)

- 北美气候灾害日益增多,促使市政当局采取相关措施。

- 快速的校园数位化将有助于高等教育机构创造安全的自带设备(BYOD)生态系统

- 公用电网现代化计划寻求融合的OT/IT警报平台

- 市场限制

- 碎片化的频谱政策阻碍了非洲行动电话广播的普及。

- 网路保险成本上升导致医疗保健产业云端行动网路的总拥有成本增加。

- 大型企业因担心警报疲劳而限制了讯息频率。

- 多语言内容库匮乏阻碍了北欧地区的普及。

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 硬体

- 火警警报器控制面板

- 公共广播及语音疏散系统

- 通知信标数位电子看板

- 解决方案

- 紧急/群发通知软体

- 事件管理和情境察觉

- 服务

- 专业(咨询、整合)

- 託管服务

- 硬体

- 透过部署模式

- 本地部署

- 云

- 杂交种

- 目的性解决方案

- 业务永续营运和灾害復原

- 综合公共警报和预警

- 可互通应急通讯

- 按组织规模

- 大公司

- 中小企业

- 透过使用

- 室内

- 广域

- 分散式接收器

- 按行业

- 政府/国防

- 能源与公共产业

- 卫生保健

- 教育

- 商业和工业

- 运输/物流

- 资讯科技/通讯

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Everbridge Inc.

- Motorola Solutions Inc.

- Honeywell International Inc.

- Siemens AG

- Blackberry AtHoc Inc.

- Eaton Corp.

- OnSolve LLC

- Singlewire Software LLC

- Alertus Technologies LLC

- xMatters

- AlertMedia Inc.

- F24 AG

- Rave Mobile Safety

- Regroup Mass Notification

- HipLink Software

- Volo(Volo Alert)

- BlackBoard Connect(Anthology)

- Preparis(Agility Recovery)

- Pocketstop RedFlag

- Vecima Networks(Engage IP)

第七章 市场机会与未来展望

The mass notification systems market is valued at USD 25.66 billion in 2025 and is on track to reach USD 51.84 billion by 2030, rising at a 15.1% CAGR.

Heightened climate risks, tougher safety regulations, and technology advances are converging to keep adoption momentum high. Organizations now expect a single platform to reach people through text, voice, social, desktop pop-ups, public address, and IoT sensors, all while tailoring messages to location and role. Cloud deployment dominates because enterprises want immediate scale and remote management, yet the hybrid model is catching up as security teams look for tighter on-premise control. Suppliers that master integration with 5G, analytics, and legacy infrastructure are best positioned to win new projects as spending spreads from government to healthcare, education, utilities, and small businesses.

Global MNS Market Trends and Insights

Accelerated 5G roll-outs enabling real-time multimedia alerting

5G brings gigabit throughput and millisecond latency, allowing platforms to push high-definition video, floor plans, and interactive evacuation maps rather than plain text. Urban centers in Japan, South Korea, and Singapore already use location-based warnings that adapt as recipients move through a city. Operators report 20% higher connectivity satisfaction during large events compared with 4G, a data point that reassures emergency managers planning for congested networks. Vendors able to embed network- slicing and edge-compute features are differentiating on speed, redundancy, and content richness. As spectrum auctions continue and device penetration rises, the mass notification systems market will capture incremental public-safety funding tied to 5G coverage targets.

EU's EECC Article 110 driving multi-channel compliance

The code obliges all 27 EU states to reach "the maximum possible affected population," pushing governments to marry cell broadcast, location-based SMS, and app alerts. Funding streams earmarked for compliance have accelerated roll-outs of hybrid platforms that support multilingual content, two-way messaging, and cross-border interoperability. Commercial users are following the same architecture to streamline business continuity communications, pulling private investment into the mass notification systems market sooner than projected.

Fragmented spectrum policies hampering African adoption

Cell broadcast relies on harmonized spectrum guidelines, yet policies vary widely across 54 African nations. Vendors face custom integrations for each carrier, prolonging pilots and inflating costs, which slows public-safety deployments even as 3G and 4G coverage climbs above 90%. Regional harmonization efforts are underway, but until they mature, growth lags other emerging regions.

Other drivers and restraints analyzed in the detailed report include:

- Escalating climate catastrophes accelerating municipal deployments

- Campus digitization transforming educational safety

- Cyber-insurance premiums elevating cloud TCO in healthcare

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The mass notification systems market size for solutions reached USD 17 billion in 2024, translating to a 66% share as agencies and enterprises replaced hardware-centric setups with command-center software. Software unifies SMS, voice, email, sirens, and signage under one console, reducing training needs and license duplication. In the second half of the decade, analytics modules that predict recipient behavior are expected to prompt upgrades among existing customers, keeping solutions revenue on a double-digit climb. Services, while a smaller slice, are advancing at an 18.6% CAGR because integration, customization, and 24/7 monitoring demand specialist skills.

Hardware retains a foothold in plants, airports, and schools where strobe beacons, wall-mounted speakers, and outdoor sirens remain mission critical. Yet manufacturers are embedding IP connectivity in these devices so they can report status back to the central platform. Professional services teams are packaging assessments, regulatory consulting, and lifecycle maintenance into multi-year contracts, creating predictable cash flow for vendors and lowering surprise costs for clients. Such managed models are further widening the solutions edge within the mass notification systems market.

Cloud captured 71% of the mass notification systems market in 2024 as administrators favored instant scale, pay-as-you-go pricing, and hassle-free upgrades. SaaS platforms also simplified multi-tenant management for large enterprises spanning dozens of sites. That model resonates with SMEs that lack IT staff, fueling the highest net-new logo count. Even so, data-sovereignty rules, the need for on-site survivability, and concerns over vendor lock-in are steering financial services, utilities, and hospitals toward hybrid approaches. Hybrid adoption is forecast to grow at 20.4% CAGR, the fastest rate in deployment choices.

On-premise deployments are shrinking but will not disappear. Critical infrastructure owners often keep a local instance running on hardened servers so messages still flow when external links fail. Containerized architectures now let operators shift workloads between public clouds and local clusters, balancing cost and control. As such flexibility becomes mainstream, the mass notification systems market will likely see blurred lines between "cloud" and "on-premise," with buyers selecting per-workload policies rather than a single blanket model.

Mass Notification Systems Market Report Segments the Industry Into Component (Solution, Services, Hardware), Deployment (Cloud, On-Premise, Hybrid), Application (In-Building, Wide-Area and More), Solution Purpose (Business Continuity and Disaster Recovery, and More), End-User Vertical (Government and Defense, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 40% of 2024 revenue, reflecting mature telecommunications infrastructure, grant funding, and a track record of extreme weather events. Municipalities now embed mass alerting into broader smart-city platforms that tie traffic sensors, flood gauges, and wildfire cameras to automatic outbound messaging. Cloud-native upgrades also coincide with the region's high cyber-insurance requirements, ensuring data protection features are woven into every deployment.

Asia-Pacific is expanding at a 17.5% CAGR, the highest among all regions. Accelerated 5G roll-outs in South Korea, Japan, and Australia let agencies attach video clips and multilingual subtitles to alerts, boosting comprehension in dense cities. Government stimulus for disaster resilience in typhoon-prone nations such as the Philippines is funneling fresh capital into the mass notification systems market. Meanwhile China's mega-city projects integrate alerts with surveillance cameras and e-wallet super-apps, blending public safety with everyday digital behavior.

Europe sits between these extremes, but its growth is dominated by regulatory compliance. The EECC Article 110 deadline drove every member state to budget for multi-channel warnings, while GDPR pushed vendors to invest in consent management and data minimization. The Nordic region's focus on multilingual content slows some projects but ultimately broadens product capability for export. The United Kingdom, operating outside EU directives, is drafting its own standards that still align with cell broadcast best practice, ensuring continued cross-border interoperability.

- Everbridge Inc.

- Motorola Solutions Inc.

- Honeywell International Inc.

- Siemens AG

- Blackberry AtHoc Inc.

- Eaton Corp.

- OnSolve LLC

- Singlewire Software LLC

- Alertus Technologies LLC

- xMatters

- AlertMedia Inc.

- F24 AG

- Rave Mobile Safety

- Regroup Mass Notification

- HipLink Software

- Volo (Volo Alert)

- BlackBoard Connect (Anthology)

- Preparis (Agility Recovery)

- Pocketstop RedFlag

- Vecima Networks (Engage IP)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated 5G roll-outs enabling real-time, multimedia alerting in APAC

- 4.2.2 Mandated multi-channel public-warning regulations in EU (EECC Article 110)

- 4.2.3 Escalating climate-induced catastrophes in North America driving municipal deployments

- 4.2.4 Rapid campus digitization creating BYOD-ready safety ecosystems in Higher-Ed

- 4.2.5 Utilities' grid-modernization projects demanding OT/IT converged alert platforms

- 4.3 Market Restraints

- 4.3.1 Fragmented spectrum policies delaying cell-broadcast adoption in Africa

- 4.3.2 Rising cyber-insurance premiums increasing TCO for cloud MNS in healthcare

- 4.3.3 Alarm fatigue concerns curbing message frequency in large enterprises

- 4.3.4 Limited multilingual content libraries slowing uptake in the Nordics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Fire Alarm Control Panels

- 5.1.1.2 Public Address and Voice Evacuation Systems

- 5.1.1.3 Notification Beacons and Digital Signage

- 5.1.2 Solutions

- 5.1.2.1 Emergency/Mass Notification Software

- 5.1.2.2 Incident Management and Situation Awareness

- 5.1.3 Services

- 5.1.3.1 Professional (Consulting, Integration)

- 5.1.3.2 Managed Services

- 5.1.1 Hardware

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Solution Purpose

- 5.3.1 Business Continuity and Disaster Recovery

- 5.3.2 Integrated Public Alert and Warning

- 5.3.3 Interoperable Emergency Communication

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Mid-size Enterprises (SMEs)

- 5.5 By Application

- 5.5.1 In-Building

- 5.5.2 Wide-Area

- 5.5.3 Distributed Recipient

- 5.6 By End-User Vertical

- 5.6.1 Government and Defense

- 5.6.2 Energy and Utilities

- 5.6.3 Healthcare

- 5.6.4 Education

- 5.6.5 Commercial and Industrial

- 5.6.6 Transportation and Logistics

- 5.6.7 IT and Telecommunications

- 5.6.8 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Rest of Europe

- 5.7.4 Middle East

- 5.7.4.1 GCC

- 5.7.4.2 Turkey

- 5.7.4.3 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Nigeria

- 5.7.5.3 Rest of Africa

- 5.7.6 Asia-Pacific

- 5.7.6.1 China

- 5.7.6.2 Japan

- 5.7.6.3 India

- 5.7.6.4 South Korea

- 5.7.6.5 Southeast Asia

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Everbridge Inc.

- 6.4.2 Motorola Solutions Inc.

- 6.4.3 Honeywell International Inc.

- 6.4.4 Siemens AG

- 6.4.5 Blackberry AtHoc Inc.

- 6.4.6 Eaton Corp.

- 6.4.7 OnSolve LLC

- 6.4.8 Singlewire Software LLC

- 6.4.9 Alertus Technologies LLC

- 6.4.10 xMatters

- 6.4.11 AlertMedia Inc.

- 6.4.12 F24 AG

- 6.4.13 Rave Mobile Safety

- 6.4.14 Regroup Mass Notification

- 6.4.15 HipLink Software

- 6.4.16 Volo (Volo Alert)

- 6.4.17 BlackBoard Connect (Anthology)

- 6.4.18 Preparis (Agility Recovery)

- 6.4.19 Pocketstop RedFlag

- 6.4.20 Vecima Networks (Engage IP)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment