|

市场调查报告书

商品编码

1851328

安全开关:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Safety Switches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

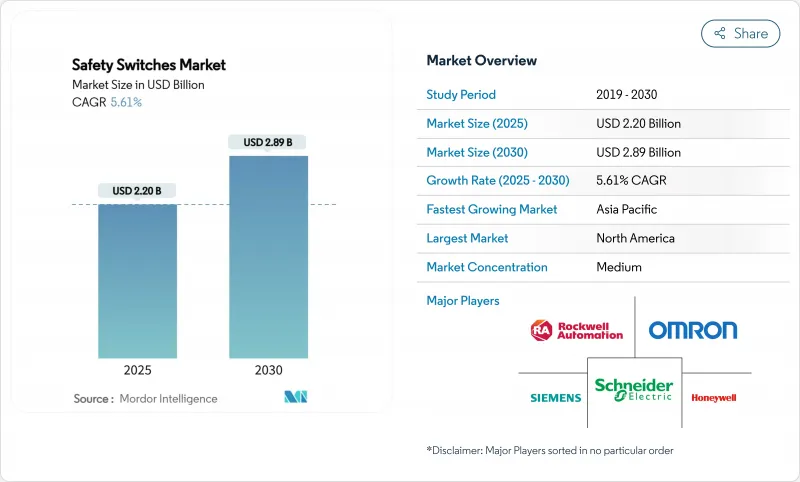

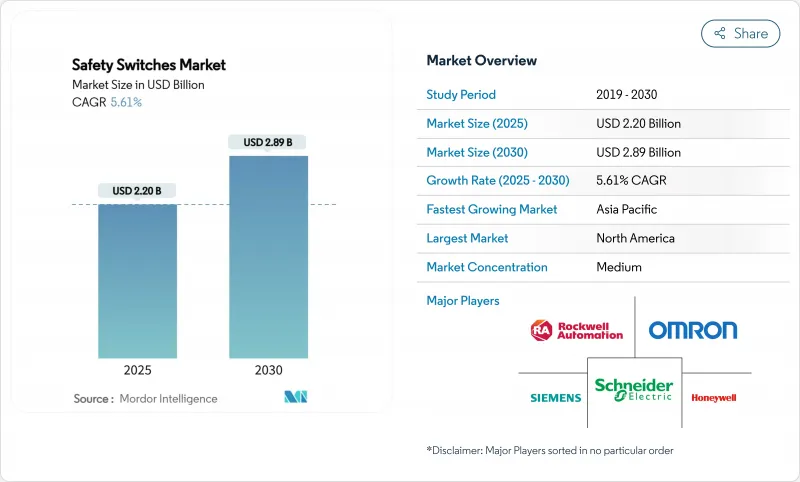

全球安全开关市场预计到 2025 年将达到 22 亿美元,到 2030 年将达到 28.9 亿美元,复合年增长率为 5.61%。

成长的驱动力来自工厂自动化领域的积极投资、日益严格的机器安全法规以及向协作机器人工作空间的快速转型。终端用户现在需要具备防篡改、自我诊断和现场汇流排连接功能的设备,而供应商则正在整合RFID编码、物联网感测器和预测性维护分析技术。亚太地区占据最大市场份额,受惠于大规模智慧工厂专案;而中东地区则有望凭藉油气产业的现代化和防爆要求实现最快成长。竞争焦点正转向以解决方案为导向的产品组合,这些组合整合了硬体、软体和服务,以实现快速合规并降低整体拥有成本。能够弥合功能安全和即时资料可见性之间差距的设备製造商有望在下一波安全开关市场浪潮中占据主导地位。

全球安全开关市场趋势与洞察

亚洲日益增长的自动化主导安全需求

随着自动化普及速度加快,亚洲製造业的安全概念正在发生根本性转变,对先进安全开关的需求也随之显着成长。中国、日本和韩国等国家正在实施更严格的职场安全法规,强制要求在自动化生产线上使用经认证的安全装置。这些法规的演变与该地区转型为智慧製造的步伐不谋而合,使得安全开关成为确保人机共存的关键组件。在人事费用不断上涨和熟练工人持续短缺的背景下,将安全开关整合到工厂自动化系统中已成为製造商寻求平衡生产效率和工人安全的重要战略考量。根据IDEC预测,从2024年起,亚洲对安全开关的需求预计将成长超过30%,其中非接触式开关在电子製造业的普及率最高。

协作机器人的兴起对整合安全解决方案提出了更高的要求。

协作机器人(cobot)在製造环境中的广泛应用,从根本上改变了安全系统的要求,并为先进的安全开关技术提供了巨大的发展机会。与在封闭环境中运作的传统工业机器人不同,协作机器人与人类协同工作,因此需要复杂的安全机制,能够根据接近程度和运作模式动态调整保护参数。 2024 年修订的 ISO 10218 工业机器人安全标准明确了协作机器人的功能安全要求,从而推动了对能够与机器人控制系统对接的安全开关的需求。儘管协作机器人本身俱有一定的安全特性,但仍需要补充防护解决方案来应对诸如夹点和程式错误等残余风险。据 PowerSafe Automation 称,正确整合安全开关可以将协作机器人相关事故减少高达 85%,同时保持运作效率,使其成为实现工业 4.0 的关键组件。

面向注重成本的中小型企业的非接触式开关,平均售价较高。

RFID感测器的成本是电子机械感测器的两到三倍,这使得预算和技术能力有限的小型维修车间难以快速更换。因此,先进设备在中小型机械製造商的普及率仍低于25%,限制了安全开关市场整体的短期应用。

细分市场分析

安全开关市场仍以电子机械开关为主导,这类开关已在多尘、振动的环境中证明了其耐用性。然而,非接触式RFID感测器发展势头最为强劲,年复合成长率高达7.8%。 2024年,电子机械设备将占46%的收入份额,而随着监管机构加强防篡改措施,RFID在製药生产线上的应用也大幅成长。预计到2030年,非接触式设备的市场规模将达到10.4亿美元,反映出它们在机器人组装单元中的应用日益广泛。

RFID感测器还支援预测性维护分析。内建记忆体记录循环次数,从而实现故障前预警。防爆外壳和不銹钢结构拓展了其在腐蚀性和危险环境中的应用,扩大了供应商的潜在收入来源。持续的微型化技术使得在紧凑型协作机器人夹爪中整合多感测器阵列成为可能,从而增强了安全开关市场的未来需求。

由于机械结构简单、单价低廉,钥匙式连锁装置应用广泛。然而,RFID编码和磁性致动器正逐渐兴起,尤其是在4类PLe应用中,它们能有效防止防护装置被窜改。这些设计可透过单一电缆连锁多达32个节点,从而缩短安装时间。製药无尘室和食品加工生产线更倾向于使用非接触式联锁装置,以消除污染物可能滞留的缝隙,这推动了安全开关市场的新成长。

基于乙太网路的功能安全技术也正在兴起。供应商将致动器和安全继电器的功能整合在同一机壳内,并将诊断资料传输到製造执行系统 (MES) 控制面板。这实现了传统硬布线链路的虚拟化,并支援灵活的单元重配置,这是工业 4.0 的核心要求。因此,致动器创新对于在安全开关市场中获取价值仍然至关重要。

工业安全开关市场按类型(电磁式、非接触式)、致动器类型(钥匙操作联锁、其他)、安装类型(面板安装、DIN导轨安装)、最终用户(工业、商业、医疗保健、石油天然气)和地区(北美、欧洲、亚太)进行细分。市场规模和预测以百万美元为单位。

区域分析

亚太地区,尤其是在中国和韩国电子产业丛集的带动下,预计到2024年将占全球销售额的38.2%。各国「智慧製造」计画下的工厂升级,特别是采用RFID连锁和IO-Link诊断技术,正推高平均售价。印度和越南政府对自动化生产线的补贴,预计将有助于它们保持其在安全开关市场的区域领先地位。

预计到2030年,中东地区的复合年增长率将达到9.1%。阿联酋和沙乌地阿拉伯的国家石油公司目前要求天然气压缩、炼油和液化天然气出口装置使用ATEX或IECEx认证的开关设备。能够提供温度等级为+度C至+55 度C且采用不銹钢外壳的供应商已获得多年期框架合同,从而推动了市场的快速扩张。

欧洲和北美市场虽然仍处于发展阶段,但蕴藏着巨大的机会。欧盟机械指令的修订迫使化学和食品加工企业在两年内对老旧的搅拌机和输送机进行改造。在美国,随着电子商务履约系统(WMS)的网路化交换机,安全开关市场持续稳定成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚洲日益增长的自动化主导安全需求

- 协作机器人的兴起以及整合安全解决方案的需求

- 欧洲流程工业中老旧机械的强制性改装

- 中东石油和天然气产业对防爆设备的需求激增

- 在具有高潜力的製药设施中采用RFID编码连锁装置(美国/欧盟)

- 电子商务仓储热潮推动输送机安全开关的使用(北美)

- 市场限制

- 面向注重成本的中小型企业的非接触式开关,平均售价较高。

- 跨多个区域的复杂身分验证流程

- 与特定产业安全现场汇流排的兼容性差距

- 假低价进口商品阻碍品牌渗透(亚太地区)

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 电子机械安全开关

- 非接触式(RFID/磁性)安全开关

- 防爆/重型安全开关

- 其他类型

- 按下致动器类型

- 钥匙操作联锁装置

- 铰链互锁

- RFID编码互锁

- 磁性致动器

- 按安装类型

- 面板安装

- DIN导轨安装

- 最终用户

- 工业生产

- 车

- 饮食

- 化学品和製药

- 航太/国防

- 金属和采矿

- 能源与电力

- 石油和天然气

- 发电业务

- 商业和机构

- 楼宇自动化

- 物流/仓储

- 卫生保健

- 其他的

- 工业生产

- 按销售管道

- 直接 OEM

- 分销商/系统整合商

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他拉丁美洲地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 中东和非洲

- 土耳其

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Schneider Electric

- Rockwell Automation

- Banner Engineering

- Eaton Corporation

- Euchner GmbH

- SICK AG

- Pilz GmbH and Co. KG

- Siemens AG

- Omron Corporation

- Honeywell International

- Phoenix Contact

- ABB Ltd.

- IDEC Corporation

- BERNSTEIN AG

- Pepperl+Fuchs

- Keyence Corporation

- Leuze electronic

- Schmersal Group

- TURCK

- Crouzet

第七章 市场机会与未来展望

The global Safety switches market size stands at USD 2.2 billion in 2025 and is forecast to reach USD 2.89 billion by 2030, registering a 5.61% CAGR.

Growth is underpinned by aggressive factory-automation investments, stricter machine-safety laws and a rapid shift toward collaborative robot workspaces. End users now demand devices that combine tamper resistance, self-diagnostics and fieldbus connectivity, pushing suppliers to embed RFID coding, IoT sensors and predictive-maintenance analytics. Asia-Pacific holds the largest regional position, benefitting from large-scale smart-factory programs, while the Middle East is set for the quickest rise on the back of oil-and-gas modernization and explosion-proof mandates. Competitive focus has moved toward solution-oriented portfolios that integrate hardware, software and services, enabling quicker compliance and reduced total cost of ownership. Device makers able to bridge functional safety and real-time data visibility are expected to capture the next wave of opportunities in the Safety switches market.

Global Safety Switches Market Trends and Insights

Expanding automation-driven safety requirements in Asia

Asia's manufacturing sector is experiencing a fundamental shift in safety paradigms as automation adoption accelerates, creating substantial demand for sophisticated safety switches. Countries like China, Japan, and South Korea are implementing stricter workplace safety regulations that mandate the use of certified safety devices in automated production lines. This regulatory evolution coincides with the region's push toward smart manufacturing, where safety switches serve as critical components in ensuring human-machine coexistence. The integration of safety switches with factory automation systems has become a strategic priority for manufacturers seeking to balance productivity with worker protection, particularly as labor costs rise and skilled worker shortages persist. According to IDEC, demand for safety switches in Asia has grown by over 30% since 2024, with non-contact varieties seeing the highest adoption rates in electronics manufacturing

Rise in collaborative robots necessitating integrated safety solutions

The proliferation of collaborative robots (cobots) across manufacturing environments is fundamentally transforming safety system requirements, creating significant opportunities for advanced safety switch technologies. Unlike traditional industrial robots that operate in caged environments, cobots work alongside humans, necessitating sophisticated safety mechanisms that can dynamically adjust protection parameters based on proximity and operation mode. The revision of ISO 10218 standard for industrial robot safety in 2024 has established clearer functional safety requirements for collaborative applications, driving demand for safety switches that can interface with robot control systems. Despite their inherent safety features, cobots still require complementary guarding solutions to address residual risks such as pinch points and programming errors. PowerSafe Automation reports that properly integrated safety switches can reduce cobot-related incidents by up to 85% while maintaining operational efficiency, making them essential components in Industry 4.0 implementations

Higher ASPs of Non-Contact Switches in Cost-Sensitive SMEs

RFID sensors cost two to three times more than electromechanical models, discouraging rapid swap-outs in small workshops where budget and technical skills are limited. Consequently, penetration of advanced units among SME machine builders remains below 25%, tempering near-term uptake across the Safety switches market .

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Retrofit of Legacy Machinery in Europe's Process Industries

- Demand Surge for Explosion-Proof Devices in Middle-East Oil & Gas

- Complex Certification Cycles Across Multi-Jurisdictional Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electromechanical models still lead the Safety switches market thanks to proven durability in dusty, high-vibration sites. Yet non-contact RFID sensors show the swiftest momentum, expanding at 7.8% CAGR as OEMs look to curb bypassing and gain live diagnostic data. In 2024, electromechanicals held a 46% revenue share, while RFID uptake in pharma lines rose sharply after regulators tightened tampering rules. The Safety switches market size for non-contact devices is projected to reach USD 1.04 billion by 2030, mirroring wider adoption in robotic assembly cells.

RFID sensors also unlock predictive-maintenance analytics; embedded memory logs cycle counts, enabling service alerts before failure. Explosion-proof housings and stainless-steel variants are broadening use in corrosive and hazardous settings, expanding supplier addressable revenue pools. Continuous miniaturization further allows multi-sensor arrays inside compact cobot grippers, reinforcing future demand within the Safety switches market.

Key-operated interlocks retain widespread use due to mechanical simplicity and low unit cost. Still, RFID-coded and magnetic actuators now set the pace, especially in Category 4, PLe applications that prohibit guard cheating. These designs cascade up to 32 nodes over a single cable, shrinking installation time. Pharmaceutical cleanrooms and food-processing lines favor non-contact formats to eliminate crevices where contaminants might lodge, spurring fresh volume in the Safety switches market.

Functional safety over Ethernet is also emerging. Vendors bundle actuator and safety-relay functions in the same housing, streaming diagnostics to MES dashboards. This virtualizes traditional hard-wired chains and supports flexible cell reconfiguration, a core Industry 4.0 requirement. Consequently, actuator innovation will remain pivotal to value capture within the Safety switches market.

Industrial Safety Switch Market is Segmented Type (Electromagnetic, Non-Contact), Actuator Type ( Key-Operated Interlock and More). Installation Configuration( Panel-Mounted, DIN-Rail Mounted ), End-User (Industrial, Commercial, Healthcare, Oil & Gas), and Geography (North America, Europe, and Asia-Pacific). The Market Sizes and Forecasts are Provided in Terms of Value (USD Million)

Geography Analysis

Asia-Pacific generated 38.2% of 2024 revenue, led by Chinese and South Korean electronics clusters. Factory upgrades under national "smart manufacturing" plans specify RFID interlocks and IO-Link diagnostics, lifting average selling prices. Government subsidies for automated lines in India and Vietnam will sustain regional leadership of the Safety switches market.

The Middle East is forecast to grow at 9.1% CAGR through 2030. National oil companies in UAE and Saudi Arabia now demand ATEX or IECEx-certified switchgear for gas compression, refining and LNG export trains. Suppliers offering -55 °C to +55 °C temperature ratings and stainless-steel enclosures have secured multiyear framework deals, catalyzing swift market expansion.

Europe and North America remain mature but opportunity rich. EU Machinery Directive revisions compel chemical and food processors to retrofit older mixers and conveyors within two years; this short-cycle demand inflates replacement volumes. In the US, e-commerce fulfillment centers adopt network-ready switches that feed safety data to cloud WMS platforms, preserving steady unit growth in the Safety switches market.

- Schneider Electric

- Rockwell Automation

- Banner Engineering

- Eaton Corporation

- Euchner GmbH

- SICK AG

- Pilz GmbH and Co. KG

- Siemens AG

- Omron Corporation

- Honeywell International

- Phoenix Contact

- ABB Ltd.

- IDEC Corporation

- BERNSTEIN AG

- Pepperl+Fuchs

- Keyence Corporation

- Leuze electronic

- Schmersal Group

- TURCK

- Crouzet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Automation-Driven Safety Requirements in Asia

- 4.2.2 Rise in Collaborative Robots Necessitating Integrated Safety Solutions

- 4.2.3 Mandatory Retrofit of Legacy Machinery in Europe's Process Industries

- 4.2.4 Demand Surge for Explosion-Proof Devices in Middle-East Oil and Gas

- 4.2.5 Adoption of RFID-Coded Interlocks in High-Potency Pharma Facilities (US/EU)

- 4.2.6 E-Commerce Warehousing Boom Boosting Conveyor Safety Switch Usage (NA)

- 4.3 Market Restraints

- 4.3.1 Higher ASPs of Non-Contact Switches in Cost-Sensitive SMEs

- 4.3.2 Complex Certification Cycles Across Multi-Jurisdictional Plants

- 4.3.3 Compatibility Gaps with Industry-Specific Safety Fieldbuses

- 4.3.4 Counterfeit Low-Cost Imports Undermining Brand Adoption (APAC)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Electromechanical Safety Switches

- 5.1.2 Non-Contact (RFID / Magnetic) Safety Switches

- 5.1.3 Explosion-Proof / Heavy-Duty Safety Switches

- 5.1.4 Other Types

- 5.2 By Actuator Type

- 5.2.1 Key-Operated Interlock

- 5.2.2 Hinge-Operated Interlock

- 5.2.3 RFID-Coded Interlock

- 5.2.4 Magnetic Actuator

- 5.3 By Installation Configuration

- 5.3.1 Panel-Mounted

- 5.3.2 DIN-Rail Mounted

- 5.4 By End-User

- 5.4.1 Industrial Manufacturing

- 5.4.1.1 Automotive

- 5.4.1.2 Food and Beverage

- 5.4.1.3 Chemicals and Pharmaceuticals

- 5.4.1.4 Aerospace and Defense

- 5.4.1.5 Metals and Mining

- 5.4.2 Energy and Power

- 5.4.2.1 Oil and Gas

- 5.4.2.2 Power Generation

- 5.4.3 Commercial and Institutional

- 5.4.3.1 Building Automation

- 5.4.3.2 Logistics and Warehousing

- 5.4.4 Healthcare

- 5.4.5 Others

- 5.4.1 Industrial Manufacturing

- 5.5 By Sales Channel

- 5.5.1 Direct OEM

- 5.5.2 Distributor / System Integrator

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of Latin America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 Turkey

- 5.6.4.2 United Arab Emirates

- 5.6.4.3 Saudi Arabia

- 5.6.4.4 South Africa

- 5.6.4.5 Rest of Middle East and Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 Japan

- 5.6.5.3 South Korea

- 5.6.5.4 India

- 5.6.5.5 Australia

- 5.6.5.6 Rest of Asia Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Schneider Electric

- 6.4.2 Rockwell Automation

- 6.4.3 Banner Engineering

- 6.4.4 Eaton Corporation

- 6.4.5 Euchner GmbH

- 6.4.6 SICK AG

- 6.4.7 Pilz GmbH and Co. KG

- 6.4.8 Siemens AG

- 6.4.9 Omron Corporation

- 6.4.10 Honeywell International

- 6.4.11 Phoenix Contact

- 6.4.12 ABB Ltd.

- 6.4.13 IDEC Corporation

- 6.4.14 BERNSTEIN AG

- 6.4.15 Pepperl+Fuchs

- 6.4.16 Keyence Corporation

- 6.4.17 Leuze electronic

- 6.4.18 Schmersal Group

- 6.4.19 TURCK

- 6.4.20 Crouzet

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis