|

市场调查报告书

商品编码

1851333

石油和天然气自动化:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Oil & Gas Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

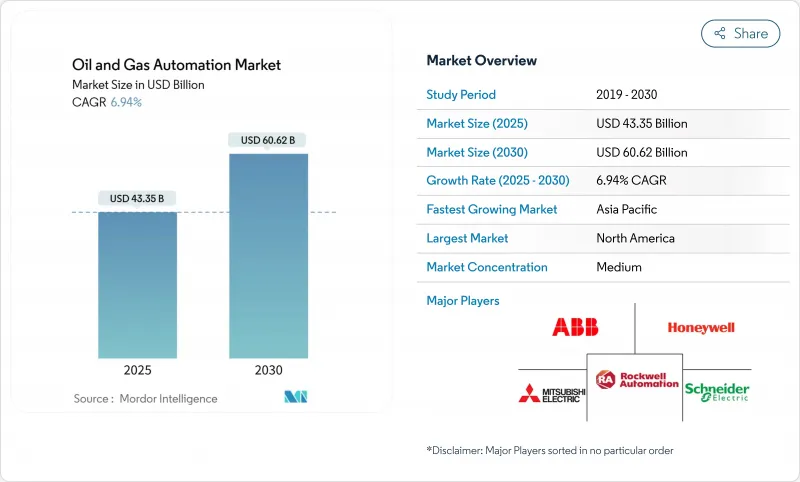

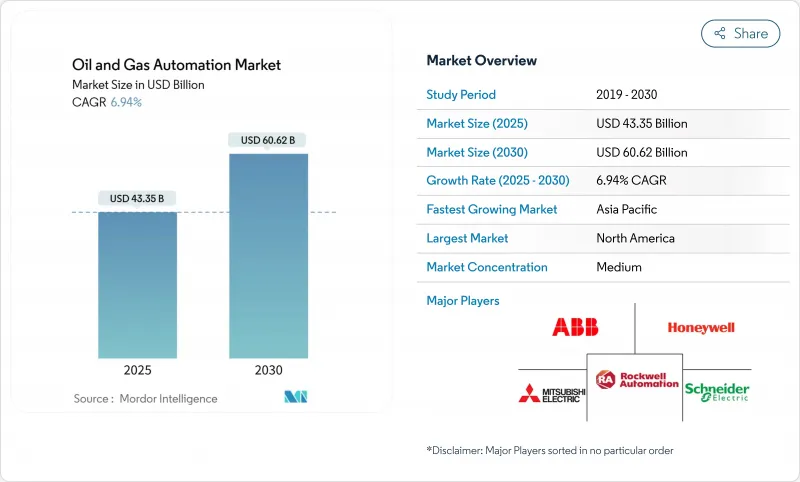

预计到 2025 年,石油和天然气自动化市场规模将达到 433.5 亿美元,到 2030 年将达到 606.2 亿美元,预测期内复合年增长率为 6.9%。

在供应链日益紧张和能源转型目标不断推进的背景下,营运商正在部署智慧现场平台、边缘人工智慧分析和自主检测工具,以减少停机时间并提高生产效率。强制性安全法规,特别是符合IEC 61511和ISA-84标准的法规,正在加速采用能够在毫秒内回应危险的安全仪器系统。亚太和非洲液化天然气基础设施的扩张,推动了对能够在高压和-160°C低温环境下运作的低温级控制系统的新需求。最后,随着营运商加强操作技术(OT)环境以抵御勒索软体和国家级攻击,网路安全预算也在增加,目前已占自动化总支出的15-20%,并正在重塑计划经济格局。

全球油气自动化市场趋势与洞察

数位油田平台应用日益普及

即时数位平台将物联网感测器、机器学习模型和云端分析技术整合到整合式仪表板中,将决策週期从几分钟缩短到几秒钟。德文能源公司在实施人工智慧驱动的钻井调整后,将油井寿命延长了25%。与即时运行资料同步的虚拟孪生模型使工程师能够在不危及实体资产的情况下测试各种方案。这种方法在井下条件不断变化的非常规储存中尤其有效。

远端监控和预测性维护的现代化资本支出

营运商正将资金转向远端监控工具,以减少现场巡检次数和安全风险。 Enbridge 基于 Azure 的管线分析技术已将威胁侦测率提高了 30%。预测演算法透过分析振动和热趋势,提前数週发现故障,从而在提高可靠性的同时,将日常检查成本降低高达 50%。

原油价格波动会影响营运支出和资本支出週期。

油价波动与支出变化之间存在六个月的滞后,这迫使小型生产商在现金流紧张时期推迟自动化升级。基于订阅的自动化服务因其收费系统与产量挂钩而日益受到青睐,因为它们可以降低领先风险,并在经济低迷时期保持流动性。

细分市场分析

到2024年,软体收入将占石油和天然气自动化市场总收入的66.7%,其分析引擎将为预测性维护和自主营运提供支援。以以金额为准,该部分在2024年将占石油和天然气自动化市场规模的289亿美元。服务虽然规模较小,但预计也将以8.5%的复合年增长率成长,因为营运商会将人工智慧配置和网路安全增强等工作外包。

软体成长将主要由边缘人工智慧软体包驱动,这些软体包将使钻井穿透率提高35%至45%。同时,包含24小时监控和基于结果的保固服务的服务合约将促使供应商从产品供应商转变为性能合作伙伴。虽然硬体对于感测器网路和强大的边缘设备仍然至关重要,但随着虚拟化控制逻辑向软体层转移,其份额预计将逐渐下降。

在上游工程中,能够校准页岩油井数千个井下参数的自主钻井和生产最佳化平台,预计到2024年将贡献59.1%的製程收入,约占油气自动化市场256亿美元的份额。中游业务虽然规模较小,但在全球LNG接收站建设和管道数位化的推动下,正以8.3%的复合年增长率成长。

上游企业如SLB在一条水平井段上展示了25次自动地质导向修正,标誌着钻机正向全自动化转型。中游企业正在使用云端SCADA系统,实现跨越数千公里的即时洩漏侦测和远端阀门操作,将事故回应时间从数小时缩短至数分钟。下游企业正在试验应用人工智慧驱动的蒸馏塔,以降低能耗并减少排放。

区域分析

北美将在2024年引领油气自动化市场,占据37.1%的营收份额,主要得益于页岩油开发商率先采用人工智慧主导的钻井和垫片优化技术。儘管钻机数量有所波动,但该地区持续的学习和适应循环使其生产力保持在高位。此外,该地区的网路安全状况也在日趋成熟,营运商正在采用联邦指导方针要求的零信任营运技术(OT)框架。

预计到2030年,亚太地区的年复合成长率将达到7.5%。中国正在对其炼油厂进行现代化改造,以生产更清洁的燃料;印度正在加速推进其深水油田的上游数位化。东南亚的大型液化天然气进口计划正依赖人工智慧驱动的低温控制系统来保障供应,并平衡电网与间歇性可再生能源之间的电力关係。各国政府正在支持数位双胞胎,并推动技术应用,以减少排放并提高安全性。

在严格的安全和环保法规下,欧洲保持稳定的支出。德国和芬兰新建的液化天然气再气化装置正在整合符合SIL-3安全等级和NIS 2.0网路安全要求的分散式控制系统(DCS)平台。中东国家石油公司在主权财富基金的支持下,正在成熟的碳酸盐岩储存中推广人工智慧主导的油井监测,例如阿布达比国家石油公司(ADNOC)投资9.2亿美元的ENERGYai计画。非洲和南美洲仍然是新兴的应用地区,它们通常利用合资伙伴进行技术转移和资金筹措。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 数位油田平台应用日益普及

- 远端监控和预测性维护的现代化资本支出

- 强制性安全系统法规

- 亚太和非洲的液化天然气和中游建设

- 在危险工作场所部署边缘人工智慧进行即时分析

- 用于海上资产的自主巡检无人机和机器人

- 市场限制

- 原油价格波动对营运支出和资本支出週期的影响

- 网路风险日益加剧,OT 安全合规成本不断攀升

- 自动化初期投资高,投资报酬率不确定性

- 旧有系统互通性

- 价值链分析

- 技术展望

- 监管环境

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体

- 服务

- 透过流程

- 上游

- 中产阶级

- 下游

- 透过技术

- 感测器和发射器

- 分散式控制系统(DCS)

- 可程式逻辑控制器(PLC)

- 监控与数据采集(SCADA)

- 安全仪器系统(SIS)

- 其他技术

- 透过使用

- 钻井及完井

- 生产和油井优化

- 管道和运输

- 炼油/石油化工

- LNG接收站及储存设施

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Rockwell Automation Inc.

- Mitsubishi Electric Corp.

- Yokogawa Electric Corp.

- Eaton Corp.

- Dassault Systemes SE

- Bosch Rexroth AG

- Texas Instruments Inc.

- Johnson Controls International plc

- Halliburton Co.

- Schlumberger NV

- Baker Hughes Co.

- Weatherford International plc

- AVEVA Group plc

- Aspen Technology Inc.

- Flowserve Corp.

第七章 市场机会与未来展望

The oil & gas automation market size reached a value of USD 43.35 billion in 2025 and is set to climb to USD 60.62 billion by 2030, registering a 6.9% CAGR during the forecast period.

Operators are embracing intelligent field platforms, edge-AI analytics, and autonomous inspection tools to curb downtime and lift productivity as supply chains tighten and energy transition goals intensify. Mandatory safety regulations, especially those aligned with IEC 61511 and ISA-84, are accelerating uptake of Safety Instrumented Systems that respond to hazards in milliseconds. LNG infrastructure expansion across Asia-Pacific and Africa is unlocking new demand for cryogenic-grade control systems that handle high-pressure, -160 °C environments. Finally, growing cybersecurity budgets-now 15-20% of total automation spend-are reshaping project economics as operators harden operational technology (OT) environments against ransomware and state-sponsored attacks.

Global Oil & Gas Automation Market Trends and Insights

Rising Adoption of Digital-Oilfield Platforms

Real-time digital platforms fuse IoT sensors, machine-learning models, and cloud analytics into unified dashboards that shorten decision cycles from minutes to seconds. Devon Energy lifted well longevity by 25% after deploying AI-guided drilling adjustments. Virtual twins synchronised with live operating data let engineers test scenarios without risking physical assets, an approach that is especially potent in unconventional reservoirs where downhole conditions vary by the hour.

Modernisation CAPEX for Remote Monitoring and Predictive Maintenance

Operators are redirecting capital toward remote surveillance tools that cut site visits and shrink safety exposure. Enbridge's Azure-based pipeline analytics improved threat detection by 30%. Predictive algorithms study vibration and thermal trends to spot failures weeks in advance, trimming routine inspection costs up to 50% while boosting reliability.

Crude-Oil Price Volatility Impacting OPEX and CAPEX Cycles

Six-month lags between crude swings and spending shifts force smaller producers to delay automation upgrades when cash flows tighten. Subscription-based automation services that align fees with production volumes are gaining favour because they lower upfront risk and preserve liquidity during downturns.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Safety-System Regulations

- LNG and Mid-Stream Build-Out in Asia-Pacific and Africa

- Escalating Cyber-Risk and OT-Security Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software captured 66.7% of 2024 revenue, anchoring the oil & gas automation market through analytics engines that power predictive maintenance and autonomous operations. In value terms, the component accounted for USD 28.9 billion of the oil & gas automation market size in 2024. Services, although smaller, are projected for an 8.5% CAGR as operators outsource AI configuration and cybersecurity hardening.

Software growth is reinforced by edge-AI packages that lift drilling rates of penetration by 35-45%. Meanwhile, service contracts that bundle 24-hour monitoring and outcome-based guarantees move providers from product suppliers to performance partners. Hardware remains essential for sensor grids and ruggedised edge devices; however, its share is expected to decline gradually as virtualised control logic migrates to software layers.

Upstream activities generated 59.1% of 2024 process revenue as autonomous drilling and production optimisation platforms calibrated thousands of downhole parameters at shale wells. This translated to roughly USD 25.6 billion of the oil & gas automation market size. Midstream operations, while holding a smaller base, are growing at 8.3% CAGR due to global LNG terminal build-outs and pipeline digitisation.

Upstream players like SLB demonstrated 25 automatic geosteering corrections on a single lateral, signalling a shift toward fully autonomous rigs. For midstream firms, cloud-linked SCADA systems enable real-time leak detection and remote valve actuation across thousands of kilometres, reducing incident response time from hours to minutes. Downstream sites are piloting AI-directed distillation columns that cut energy use and trim emissions.

The Oil & Gas Automation Market Report is Segmented by Component (Hardware, Software, and Services), Process (Upstream, Midstream, and Downstream), Technology (Sensors and Transmitters, Distributed Control Systems (DCS), and More), Application (Drilling and Completion, Production and Well Optimization, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the oil & gas automation market with 37.1% revenue share in 2024, buoyed by shale developers that pioneered AI-steered drilling and pad optimisation. Persistent learn-and-apply cycles keep regional productivity high even when rig counts fluctuate. The region's cybersecurity posture is also mature, with operators adopting zero-trust OT frameworks mandated by federal guidelines.

Asia-Pacific is poised for a 7.5% CAGR through 2030. China is modernising refineries to produce cleaner fuels, while India accelerates upstream digitisation across deep-water blocks. Massive LNG import projects in Southeast Asia rely on AI-enabled cryogenic controls to secure supply and balance power grids with intermittent renewables. Governments support digital twins to curb emissions and enhance safety, propelling technology adoption.

Europe maintains steady spending under stringent safety and environmental regulations. New LNG regasification units in Germany and Finland integrate DCS platforms that meet SIL-3 safety layers and NIS 2.0 cybersecurity mandates. Middle Eastern national oil companies, supported by sovereign funds, scale AI-driven well monitoring across mature carbonate reservoirs, exemplified by ADNOC's USD 920 million ENERGYai program. Africa and South America remain emerging adopters, often leveraging joint-venture partners for technology transfer and financing.

- ABB Ltd.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Rockwell Automation Inc.

- Mitsubishi Electric Corp.

- Yokogawa Electric Corp.

- Eaton Corp.

- Dassault Systemes SE

- Bosch Rexroth AG

- Texas Instruments Inc.

- Johnson Controls International plc

- Halliburton Co.

- Schlumberger NV

- Baker Hughes Co.

- Weatherford International plc

- AVEVA Group plc

- Aspen Technology Inc.

- Flowserve Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of digital-oilfield platforms

- 4.2.2 Modernization CAPEX for remote monitoring and predictive maintenance

- 4.2.3 Mandatory safety-system regulations

- 4.2.4 LNG and mid-stream build-out in APAC and Africa

- 4.2.5 Edge-AI deployment for real-time analytics at hazardous sites

- 4.2.6 Autonomous inspection drones and robotics for offshore assets

- 4.3 Market Restraints

- 4.3.1 Crude-oil price volatility impacting OPEX and CAPEX cycles

- 4.3.2 Escalating cyber-risk and OT-security compliance costs

- 4.3.3 High upfront automation expenditure and ROI uncertainty

- 4.3.4 Legacy-system interoperability

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Process

- 5.2.1 Upstream

- 5.2.2 Midstream

- 5.2.3 Downstream

- 5.3 By Technology

- 5.3.1 Sensors and Transmitters

- 5.3.2 Distributed Control Systems (DCS)

- 5.3.3 Programmable Logic Controllers (PLC)

- 5.3.4 Supervisory Control and Data Acquisition (SCADA)

- 5.3.5 Safety Instrumented Systems (SIS)

- 5.3.6 Other Technologies

- 5.4 By Application

- 5.4.1 Drilling and Completion

- 5.4.2 Production and Well Optimization

- 5.4.3 Pipeline and Transportation

- 5.4.4 Refining and Petrochemicals

- 5.4.5 LNG Terminals and Storage

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Honeywell International Inc.

- 6.4.3 Siemens AG

- 6.4.4 Schneider Electric SE

- 6.4.5 Emerson Electric Co.

- 6.4.6 Rockwell Automation Inc.

- 6.4.7 Mitsubishi Electric Corp.

- 6.4.8 Yokogawa Electric Corp.

- 6.4.9 Eaton Corp.

- 6.4.10 Dassault Systemes SE

- 6.4.11 Bosch Rexroth AG

- 6.4.12 Texas Instruments Inc.

- 6.4.13 Johnson Controls International plc

- 6.4.14 Halliburton Co.

- 6.4.15 Schlumberger NV

- 6.4.16 Baker Hughes Co.

- 6.4.17 Weatherford International plc

- 6.4.18 AVEVA Group plc

- 6.4.19 Aspen Technology Inc.

- 6.4.20 Flowserve Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment