|

市场调查报告书

商品编码

1851366

德国塑胶包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Germany Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

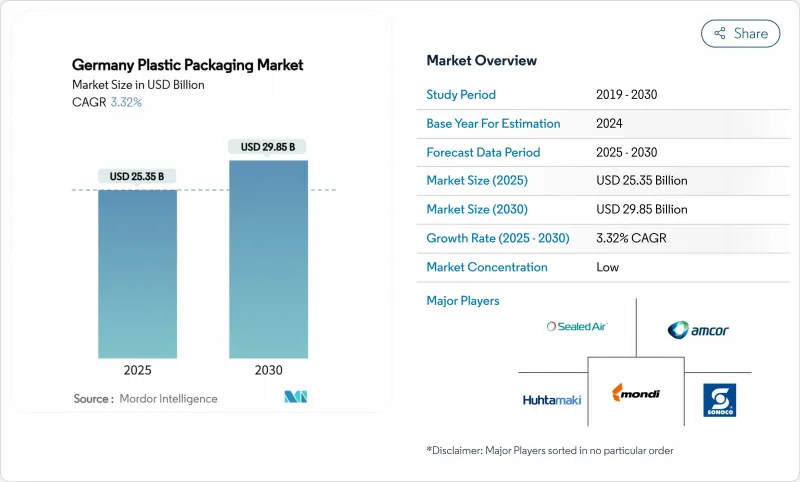

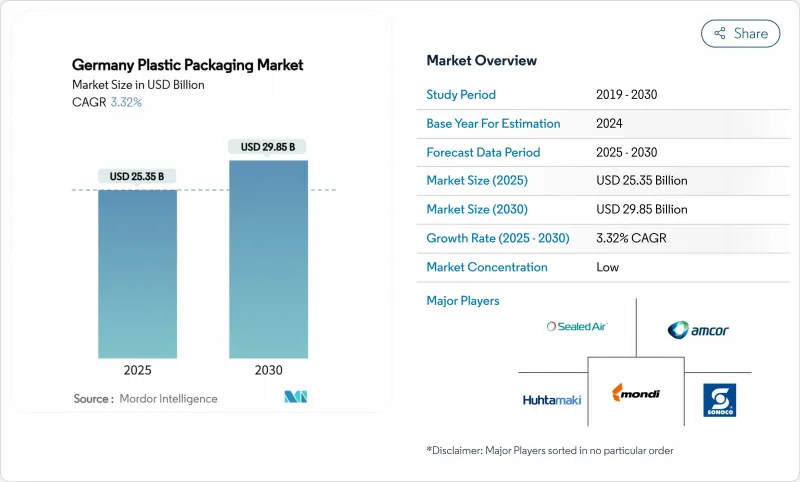

德国塑胶包装市场预计到 2025 年将达到 253.5 亿美元,到 2030 年将达到 298.5 亿美元,保持稳定,复合年增长率为 3.32%。

这一成长反映了向循环经济设计原则的持续转型,同时也应对了不断上涨的能源成本和日益严格的监管要求。食品包装仍将是销售的主要驱动力,预计2024年将占销售额的39.32%,而化妆品和个人护理用品将引领成长,到2030年复合年增长率将达到5.58%。随着电子商务、轻量化物流和单一材料应用的推进,软包装将巩固其领先地位。在硬包装方面,PET受益于德国的押金制度和高回收率,而聚丙烯化合物在汽车轻量化计画中也越来越受欢迎。儘管预计2024年德国国内加工商的销售额将下降4.3%,但由于高回收率、快速的材料创新和深度产业整合,德国塑胶包装市场仍将维持韧性。

德国塑胶包装市场趋势与洞察

生产者责任的扩大推动了对可回收、单一材料产品的需求。

德国包装方法正在收紧对可回收性的监管,鼓励品牌商放弃复杂的复合材料结构,转而采用单一聚合物结构。中央包装註册局 (ZSVR) 宣布将于 2024 年更新最低标准,对多层包装征收更高的合规费用,并鼓励投资聚乙烯和聚丙烯单一材料阻隔解决方案。 Mondi 和 Fresnap 的可回收单一材料宠物食品包装袋是监管压力如何转化为大规模商业部署的例证。这种方法还有助于采购团队在零售商的永续性评分卡上获得更高的分数,使合规性成为市场差异化优势。

德国电子商务的蓬勃发展促进了轻型柔性小包裹邮寄的发展。

儘管销量有所波动,但线上零售业持续成长,迫使小包裹业者减少包装重量。 DS Smith预测,2024年德国时尚物流将使用7.91亿个塑胶运输袋,到2030年需求量将增加42%。柔性包装袋可降低体积重量费用和碳排放,正逐渐成为服装和小型电子产品的首选。亚马逊承诺在其履约运营中逐步淘汰塑料,这鼓励了第三方经销商效仿,加速了向单一材料、可回收材料的转变。

德国提议对塑胶征收每公斤0.80欧元的税,这将推高原生树脂的价格。

《一次性塑胶基金法》于2025年1月生效,该法案对每公斤非再生塑胶包装征收0.80欧元的课税。联邦环境署估计,该法案每年的税收收入将接近14亿欧元,这对使用原生聚合物的加工商来说无疑是沉重打击。这项措施不仅强化了再生塑胶的经济优势,而且在食品级rPET和rPP供应紧张的情况下,进一步压缩了利润空间。再加上2022年起工业电费上涨265%,导致多家中型挤出企业暂停了扩张计画。

细分市场分析

2024年,聚乙烯在软包装产品收入中维持了44.54%的份额,主要得益于其成本效益、密封完整性和成熟的回收系统。预计到2025年,聚乙烯包装市场规模将达到113亿美元,并随着加工商推出不含EVOH的单层阻氧包装袋而持续成长。新兴薄膜,例如可回收的聚烯基纸触复合薄膜,正以6.87%的复合年增长率快速扩张,这表明轻质高阻隔结构方面的研发投入将持续增加,从而有助于获得生产者责任费退税。

其他硬质树脂的情况也类似。由于押金返还政策,PET占硬质材料总收入的33.36%,但聚丙烯的成长速度超过其他硬质基材,预计到2030年复合年增长率将达到5.76%。聚丙烯的尺寸稳定性和耐热性使其非常适合用于家常小菜托盘和电动车电池外壳等应用,从而增强了其在消费市场和工业市场的需求。相反,受回收相关政策的不利影响,PVC和聚苯乙烯的市占率持续下滑。

到2024年,柔性包装解决方案将占德国塑胶包装市场销售额的54.1%,巩固其在德国塑胶包装市场的中流砥柱地位。与硬质拉环包装相比,立式袋、预拉炼袋和成形充填密封一体机可节省高达70%的材料,这对于注重环保的品牌所有者而言是一项决定性优势。至2030年,柔性包装的复合年增长率将达到4.61%,高于硬质包装。这是因为弹性包装生产线所需的资本投入较少,换线速度更快,有助于加工商应对电子商务带来的订单量波动。

对于碳酸饮料、化妆品罐和需要尺寸稳定性的药品应用而言,硬质容器仍然至关重要。 PET宝特瓶的回收率高达93%,且具有很高的光学透明度,可防止食品级rPET循环中的污染。同时,肖特製药公司(SCHOTT Pharma)的纸板注射器收纳袋表明,纤维/塑胶混合材料也正在高价值医疗设备中进行测试,以满足医院废弃物分类通讯协定。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 强制性生产者延伸责任制(VerpackG)推动了对可回收单一材料的需求。

- 德国电子商务的蓬勃发展推动了轻型柔性小包裹邮寄机的发展。

- 德国汽车和工业领域从金属转向硬质塑胶以实现轻量化

- 可重复使用PET补充装分配计画加速了rPET瓶坯和瓶子的使用

- 方便食品文化推动微波炉塑胶托盘的使用

- 低温运输生技药品产品线推动对医用塑胶管瓶和泡壳包装的需求

- 市场限制

- 德国提议对塑胶征收每公斤0.80欧元的税,这将推高原生树脂的价格。

- 零售业主导的纺织品货架转型(Aldi、Reve、Lidl)和塑胶货架份额的下降

- 德国高电价促使转换器企业提高转换率。

- 食品级rPCR供应有限阻碍了回收目标的实现。

- 供应链分析

- 监理展望

- 技术展望

- 贸易情景(依相关HS编码)

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 回收与永续性展望

第五章 市场规模与成长预测

- 依材料类型

- 硬质塑胶

- 聚乙烯

- 聚丙烯(PP)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚氯乙烯(PVC)

- 聚苯乙烯(PS)和发泡聚苯乙烯(EPS)

- 其他硬质塑胶

- 软塑胶

- 聚乙烯

- 双轴延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 聚氯乙烯(PVC)

- 乙烯 - 乙烯醇(EVOH)

- 其他软塑胶

- 硬质塑胶

- 按包装类型

- 硬质塑胶包装

- 瓶子和罐子

- 托盘和泡壳

- 托盘和板条箱

- 其他硬质塑胶包装

- 软质塑胶包装

- 小袋

- 包包

- 薄膜包装

- 其他软质塑胶包装

- 硬质塑胶包装

- 按最终用途行业划分

- 食物

- 糖果甜点和零嘴零食

- 麵包和谷物

- 生鲜食品

- 乳製品

- 其他食物

- 饮料

- 瓶装水

- 果汁花蜜

- 乳类饮料

- 碳酸饮料

- 其他饮料

- 製药

- 化妆品和个人护理

- 工业的

- 宠物食品与动物护理

- 其他终端用户产业

- 食物

- 透过分销管道

- 直销通路

- 间接销售管道

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor plc

- Constantia Flexibles Group

- Alpla Werke Alwin Lehner GmbH

- Sudpack Verpackungen GmbH & Co. KG

- Gerresheimer AG

- Klockner Pentaplast GmbH

- Paccor Packaging GmbH

- Mondi Group(Germany)

- Huhtamaki Oyj(Germany)

- Schur Flexibles Holding GmbH

- Bischof+Klein SE & Co. KG

- Greiner Packaging GmbH

- Sealed Air Corporation

- Sonoco Products Company

- Coveris Holding SA

- Wipak Walsrode GmbH & Co. KG

- Tetra Laval Group

- Silgan Holdings Inc.

- Plastipak Holdings Inc.

第七章 市场机会与未来展望

The Germany plastic packaging market size stood at USD 25.35 billion in 2025 and is on course to reach USD 29.85 billion by 2030, advancing at a steady 3.32% CAGR.

The expansion reflects the sector's ongoing transition toward circular-economy design principles while absorbing higher energy costs and stringent regulatory demands. Food packaging remains the anchor for volume, accounting for 39.32% of 2024 revenues, yet cosmetics and personal care is the pace-setter with a 5.58% CAGR through 2030. Flexible formats consolidate their lead as e-commerce, lightweight logistics and mono-material adoption intensify. In rigid solutions, PET benefits from Germany's deposit system and high recycling rates, whereas polypropylene compounds gain traction in automotive light-weighting programs. Despite a 4.3% decline in domestic converter turnover during 2024, the Germany plastic packaging market continues to demonstrate resilience through high collection rates, rapid material innovation and deep industrial integration.

Germany Plastic Packaging Market Trends and Insights

Extended Producer Responsibility mandates driving recyclable mono-material demand

Germany's Packaging Act tightens recyclability rules, prompting brand owners to shift from complex laminates toward single-polymer structures. The Central Agency Packaging Register (ZSVR) released updated minimum standards in 2024 that attach higher compliance fees to multi-layer packs, channeling investment into mono-material polyethylene and polypropylene barrier solutions. Mondi and Fressnapf's recyclable mono-material pet-food pouch exemplifies how regulatory pressure is translating into large-scale commercial roll-outs. The approach also helps procurement teams score higher on retailer sustainability scorecards, turning compliance into a market differentiator.

E-commerce boom in Germany fueling lightweight flexible parcel mailers

Online retail keeps growing even as volumes fluctuate, pushing parcel operators to trim packing weight. DS Smith estimates 791 million plastic shipping bags were deployed in German fashion logistics during 2024 with unit demand projected to rise 42% to 2030. Flexible mailers reduce dimensional weight fees and carbon emissions, making them the default choice for apparel and small electronics. Amazon's pledge to phase out plastics in its own fulfillment operations pressures third-party sellers to follow, accelerating the shift toward mono-material recyclables.

Proposed EUR 0.80/kg German plastics tax inflating virgin resin prices

The Single-Use Plastics Fund Act that entered force in January 2025 levies EUR 0.80 on every kilogram of non-recycled plastic packaging. The Federal Environment Agency estimates annual collections near EUR 1.4 billion, a direct hit on converters working with virgin polymer streams umweltbundesamt.de. The measure sharpens the financial case for recycled content but also squeezes margins where food-grade rPET or rPP supply remains tight. Coupled with a 265% spike in industrial electricity tariffs since 2022, several mid-sized extruders have paused expansion plans.

Other drivers and restraints analyzed in the detailed report include:

- Automotive & industrial lightweighting shifting from metal to rigid plastics

- Mehrweg PET refill quotas accelerating rPET preform and bottle usage

- Retailer-led fiber shift shrinking plastic shelf share

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene retained 44.54% share of flexible revenues in 2024, underpinned by cost efficiency, high seal integrity and mature recycling streams. The Germany plastic packaging market size for polyethylene formats stood at USD 11.3 billion in 2025 and continues to edge upward as converters roll out mono-material pouches with EVOH-free oxygen barriers. Emerging films such as recyclable polyolefin-based paper-touch laminates are expanding at 6.87% CAGR, indicating sustained R&D investment in lightweight, high-barrier structures that unlock producer responsibility fee rebates.

Other rigid resins tell a similar story. PET captured 33.36% share of rigid revenues thanks to the deposit-return system, while polypropylene outpaces other rigid substrates with a 5.76% CAGR through 2030. Polypropylene's dimensional stability and heat resistance suit it for ready-meal trays and EV battery casings, reinforcing its demand in both consumer and industrial verticals. Conversely PVC and polystyrene continue to lose traction under recycling-related policy headwinds.

Flexible solutions held 54.1% share of 2024 revenues, validating their role as the workhorse of the Germany plastic packaging market. Stand-up pouches, pre-zipped bags and form-fill-seal webs deliver material savings of up to 70% compared with rigid tubs, a decisive advantage for brand owners paying modulated eco-fees. The segment's 4.61% CAGR through 2030 eclipses rigid formats because flexible lines require lower capital and operate at faster change-over speeds, helping converters absorb fluctuating run sizes linked to e-commerce.

Rigid containers remain indispensable for carbonated beverages, cosmetics jars and pharma applications requiring dimensional stability. PET bottles achieve 93% take-back and high optical clarity, preventing contamination of food-grade rPET loops. Meanwhile, SCHOTT Pharma's cardboard-based syringe wallet demonstrates how even high-value medical devices are testing fiber-slash-plastic hybrids to align with hospital waste-segregation protocols.

The Germany Plastic Packaging Market Report is Segmented by Material Type (Rigid Plastic, Flexible Plastic), Packaging Type (Rigid: Bottles and Jars, Trays and Clamshells, Other Rigid; Flexible: Pouches, Bags and Sacks, Films and Wraps, Other Flexible), End-Use Industry (Food, Beverage, Pharmaceutical, and More), and Distribution Channels (Direct Sales, Indirect Sales). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- Constantia Flexibles Group

- Alpla Werke Alwin Lehner GmbH

- Sudpack Verpackungen GmbH & Co. KG

- Gerresheimer AG

- Klockner Pentaplast GmbH

- Paccor Packaging GmbH

- Mondi Group (Germany)

- Huhtamaki Oyj (Germany)

- Schur Flexibles Holding GmbH

- Bischof + Klein SE & Co. KG

- Greiner Packaging GmbH

- Sealed Air Corporation

- Sonoco Products Company

- Coveris Holding SA

- Wipak Walsrode GmbH & Co. KG

- Tetra Laval Group

- Silgan Holdings Inc.

- Plastipak Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Extended Producer Responsibility (VerpackG) Mandates Driving Recyclable Mono-Material Demand

- 4.2.2 E-commerce Boom in Germany Fueling Lightweight Flexible Parcel Mailers

- 4.2.3 Lightweighting in German Automotive and Industrial Sectors Shifting from Metal to Rigid Plastics

- 4.2.4 Mehrweg PET Refill Quotas Accelerating rPET Preform and Bottle Usage

- 4.2.5 Convenience-Ready Meal Culture Boosting Microwave-Suitable Plastic Trays

- 4.2.6 Cold-Chain Biologics Pipeline Expanding Demand for Medical-Grade Plastic Vials and Blisters

- 4.3 Market Restraints

- 4.3.1 Proposed € 0.80/kg German Plastics Tax Inflating Virgin Resin Prices

- 4.3.2 Retailer Led Fiber Shift (Aldi, REWE, Lidl) Shrinking Plastic Shelf Share

- 4.3.3 High German Electricity Costs Raising Conversion Margins for Converters

- 4.3.4 Limited Food-Grade rPCR Supply Curtailing Recycled Content Targets

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Trade Scenario (Under Relevant HS Code)

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Recycling and Sustainability Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Rigid Plastic

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Polypropylene (PP)

- 5.1.1.3 Polyethylene Terephthalate (PET)

- 5.1.1.4 Polyvinyl Chloride (PVC)

- 5.1.1.5 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.6 Other Rigid Plastic

- 5.1.2 Flexible Plastic

- 5.1.2.1 Polyethylene (PE)

- 5.1.2.2 Biaxially Oriented Polypropylene (BOPP)

- 5.1.2.3 Cast Polypropylene (CPP)

- 5.1.2.4 Polyvinyl Chloride (PVC)

- 5.1.2.5 Ethylene-Vinyl Alcohol (EVOH)

- 5.1.2.6 Other Flexible Plastic

- 5.1.1 Rigid Plastic

- 5.2 By Packaging Type

- 5.2.1 Rigid Plastic Packaging

- 5.2.1.1 Bottles and Jars

- 5.2.1.2 Trays and Clamshells

- 5.2.1.3 Pallets and Crates

- 5.2.1.4 Other Rigid Plastic Packaging

- 5.2.2 Flexible Plastic Packaging

- 5.2.2.1 Pouches

- 5.2.2.2 Bags and Sacks

- 5.2.2.3 Films and Wraps

- 5.2.2.4 Other Flexible Plastic Packaging

- 5.2.1 Rigid Plastic Packaging

- 5.3 By End-use Industry

- 5.3.1 Food

- 5.3.1.1 Confectionery and Snacks

- 5.3.1.2 Breads and Cereals

- 5.3.1.3 Fresh Produce

- 5.3.1.4 Dairy based products

- 5.3.1.5 Other Food Products

- 5.3.2 Beverage

- 5.3.2.1 Bottled Water

- 5.3.2.2 Juices and Nectars

- 5.3.2.3 Dairy Based Beverages

- 5.3.2.4 Carbonated Soft Drinks

- 5.3.2.5 Other Beverages

- 5.3.3 Pharmaceutical

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Industrial

- 5.3.6 Pet Food and Animal Care

- 5.3.7 Other End-use Industry

- 5.3.1 Food

- 5.4 By Distribution Channels

- 5.4.1 Direct Sales Channels

- 5.4.2 Indirect Sales Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Constantia Flexibles Group

- 6.4.3 Alpla Werke Alwin Lehner GmbH

- 6.4.4 Sudpack Verpackungen GmbH & Co. KG

- 6.4.5 Gerresheimer AG

- 6.4.6 Klockner Pentaplast GmbH

- 6.4.7 Paccor Packaging GmbH

- 6.4.8 Mondi Group (Germany)

- 6.4.9 Huhtamaki Oyj (Germany)

- 6.4.10 Schur Flexibles Holding GmbH

- 6.4.11 Bischof + Klein SE & Co. KG

- 6.4.12 Greiner Packaging GmbH

- 6.4.13 Sealed Air Corporation

- 6.4.14 Sonoco Products Company

- 6.4.15 Coveris Holding SA

- 6.4.16 Wipak Walsrode GmbH & Co. KG

- 6.4.17 Tetra Laval Group

- 6.4.18 Silgan Holdings Inc.

- 6.4.19 Plastipak Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment