|

市场调查报告书

商品编码

1851405

智慧布料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Smart Fabrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

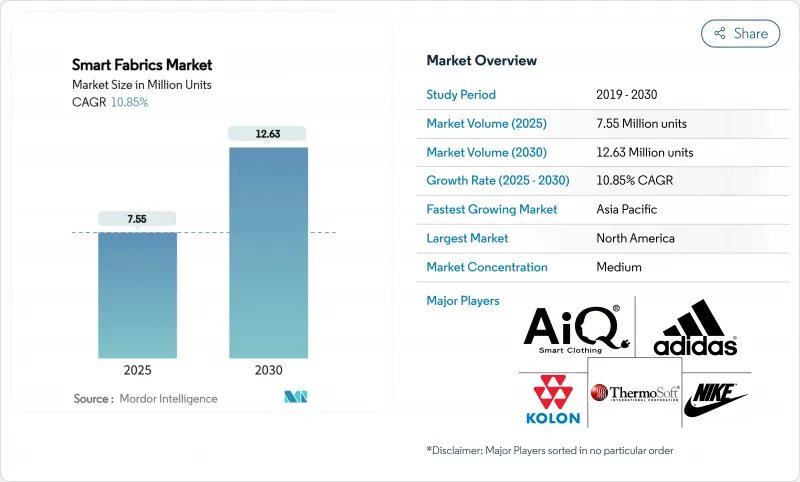

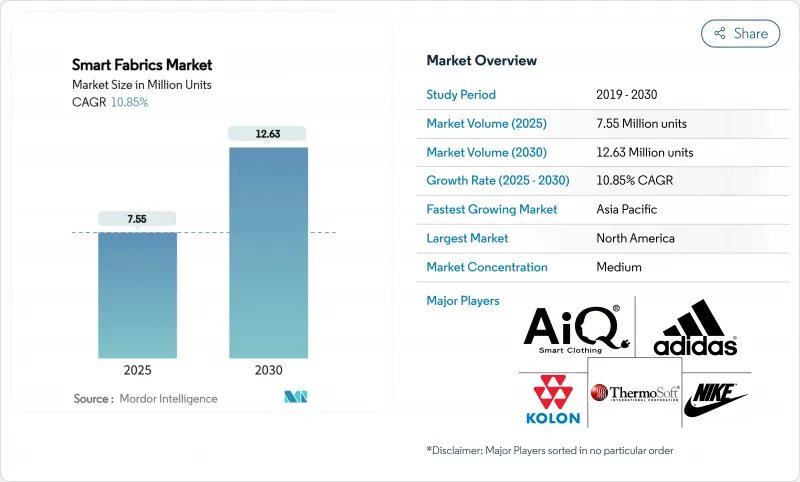

预计到 2025 年,智慧布料市场销售量将达到 775 万件,到 2030 年将达到 1,263 万件,复合年增长率为 10.85%。

国防、医疗保健和体育领域的应用日益广泛,正加速传统纺织品向智慧布料的转型,这些布料能够感知、收集能量并通讯。军方合约中对认知负荷监测服饰的指定要求、利用纺织电脑进行即时诊断的医疗保健试点项目,以及消费者对高性能服饰的需求,都在推动着市场机会。随着导电纱线和柔性积体电路专利活动的持续成长,以及纺织集团与电子供应商之间的合作扩大了生产规模,投资者信心仍然强劲。在永续性压力、元件小型化和自主电源系统协同作用的推动下,智慧布料市场正处于变革性发展阶段。

全球智慧布料市场趋势与洞察

穿戴式电子产品生态系统正在不断发展壮大

随着穿戴式装置的蓬勃发展,智慧服装的需求也随之飙升。滑铁卢大学的研究人员展示了一种能够利用太阳能和体热能的布料,无需外接电池。康乃尔大学的「Seam Fit Shirt」智慧贴合衬衫,将导电线缝入日常T恤中,能够以93.4%的准确率识别运动。加州理工学院的智慧绷带能够以专家级的准确度预测创伤治疗。 《卫报》报导了一种基于纺织材料的电子产品,它能够利用环境电磁能,将人体变成电路的一部分,为嵌入服装中的超低功耗感测器供电。这些进步正在模糊服装和电子产品之间的界限,并将智慧布料市场拓展到生活方式、医疗和工业等领域。

快速小型化和灵活的积体电路集成

整合电子技术提升了布料的舒适阈值。麻省理工学院的工程师们製造出一种可机洗的弹力纺织计算机,其内部集成了微型器件、感测器和蓝牙模组,使其成为北极任务中监测生命体征的可穿戴设备,且不会增加衣物的体积。香港大学开发的有机电化学电晶体可在布料上局部处理数据,从而降低传输负载并提升隐私性。这些突破性进展将先进的处理能力融入纺织品内部,同时保持了布料的垂坠性和柔韧性,从而提高了消费者的接受度。

高昂的製造成本和网路安全风险

生产线需要专用设备来嵌入导体、感测器和微控制器,这使得单位成本高于标准纺织品。 2024年的通膨和供应链中断进一步挤压了美国的净利率,许多纺织厂因此将资本投资从自动化升级转向其他领域。资料安全也是一个值得关注的问题,因为服饰会收集生物识别信息,而这些信息受健康数据法规的约束。加密需要额外的组件成本,而且产品生命週期内强制性的软体更新也会增加总拥有成本。小型品牌在获得合规设计所需的资金方面面临重重困难,减缓了它们进入低收入市场的步伐。

细分市场分析

随着预测分析和自动化适应技术从实验室走向大规模生产,预计到2030年,超智慧布料将以11.2%的复合年增长率领先该细分市场。由于被动式布料在基础感测任务中展现出卓越的耐用性,目前仍占据智慧布料市场45.3%的份额。能够根据刺激改变透气性等特性的主动式布料填补了这一市场空白,但必须克服性能和耐用性之间的权衡问题。

这种采用压电纱线的智慧声学布料,能够将弯曲和触摸转化为精确的电讯号,即使全天穿着也能保持透气性和温度稳定性。目前正在开发平臺的是一种整合在布料上的神经网络,它可以学习磨损模式、预测异常情况并主动发出健康警报。这些功能赋予了超智慧布料明显的价值溢价,推动了智慧布料在高性能运动服、国防和慢性病监测等领域的市场份额成长。

智慧声学技术将惠及被动式和主动式产品。巧妙的分层技术将提高讯号杂讯比,进而提升入门级平衡监控腰带和经济型姿势矫正器的效能。被动式产品製造商可以利用成熟的织布机技术,因此其规模扩张速度比超智慧的新兴企业更快。随着生产线的融合,织布机製造商和晶片供应商共用专利,导致产量比率下降,并平衡了各层级产品的成长。

到2024年,感测功能将维持智慧布料市场56.1%的份额,而能源采集功能预计将以13.5%的最高复合年增长率成长。利用相变油墨和微流体通道加热和冷却的恆温毛衣满足了特定的性能需求,而发光面料则为美观的鞋履和活动服装增添了光彩。

这款手环内建高效摩擦奈米发电机,在剧烈运动期间可提供超过 3mW/cm² 的功率,无需外部电源即可可持续发出蓝牙讯号。与这些发电机配套的耐湿超级电容可维持数天的电量,无需每日充电。这种供电系统有望实用化救援队的自主式野战服和即使在病人卧床不起的情况下也能监测生命征象的医院罩衣。

感测技术凭藉着运动T恤中普遍存在的心率和体温模组,保持着领先地位。基于纤维的感应线圈可以测量肌肉氧合情况,从而拓展了运动装备在预防运动伤害方面的作用。随着製造商将多功能纱线融入产品线,感测技术与微能量单元结合,使得这些技术类别相辅相成,而非相互排斥。

智慧布料市场按类型(被动式智慧布料、主动式智慧布料、超智慧布料)、功能(感测、温度调节、其他)、材质(棉基、聚酯纤维/尼龙、高性能)、应用(时尚娱乐、运动健身、其他)和地区进行细分。市场预测以销售量(单位)为单位。

区域分析

预计到2024年,北美将以28.5%的市场份额领先市场,这主要得益于强劲的国防预算、蓬勃发展的健康科技生态系统以及消费者对创新运动服装的热情。美国国防部正在资助纤维电脑和气候适应型製服的研发,从而确保了国内对高规格材料的需求。麻省理工学院(MIT)、滑铁卢大学和加州理工学院(Caltech)正在扶持那些授权其纺织平台的新兴企业,从而丰富了该地区的创新管道。一些工厂已将生产转移到近岸地区以缓解供应衝击,而旨在重组本地製造业的政府激励措施也已被取消。

亚太地区是经济成长的引擎,预计到2030年将以12.3%的复合年增长率成长。中国产业用纺织品产业已占纺织业总量的20%以上,在医疗、过滤和防护等领域实现了9%至13%的年增长率。北京矩阵科技的Y-Warm隔热材料具有优异的隔热和抗菌性能,为寒冷气候运动服装品牌提供了出口潜力。一家日本供应商正在改进超细导电长丝,一家韩国企业正在将可水洗的OLED纱线图案商业化,用于互动服装。印度正在扶持新兴企业,这展现了该地区广泛的应用前景。

欧洲正处于永续性需求与先进工程技术的交会点。欧盟正在推进全氟烷基和多氟烷基物质(PFAS)的监管,并研究既能保持导电性又能降低有害物质风险的替代涂层。兰精公司已收购TreeToTextile公司的少数股权,该公司正快速开发水和能源消耗更低的纤维素纤维。德国、法国和西班牙正在培育纺织品回收丛集,而消费者调查显示,消费者对永续性溢价非常敏感。一所大学正与一家汽车零件製造商合作开发能够检测驾驶员疲劳的座椅布料,这将扩大该技术在工业领域的应用,并巩固欧洲作为智慧布料市场创新中心的地位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 穿戴式电子产品的生态系统正在不断发展

- 快速小型化和灵活的积体电路集成

- 导电纱线专利申请数量快速成长(自2025年起)

- 能源采集超级电容

- 军方强制要求使用认知负荷监测设备

- 来自循环纺织品牌的可持续性溢价

- 市场限制

- 高昂的製造成本和网路安全风险

- 缺乏全球电子纺织品互通性标准

- 奈米涂层毒性新规

- 电子纺织废弃物消费后回收的复杂性

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按类型

- 被动式智慧织物

- 主动式智慧布料

- 超智慧布料

- 功能

- 感测

- 体温调节

- 能源采集

- 明亮美观

- 材料

- 棉基

- 聚酯纤维和尼龙

- 高性能材料(克维拉、Dyneema等)

- 透过使用

- 时尚与娱乐

- 运动与健身

- 医疗保健

- 交通运输-汽车和航太

- 军事/国防

- 工业与安全

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 土耳其

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Adidas AG

- NIKE Inc.

- AIQ Smart Clothing Inc.

- DuPont de Nemours Inc.

- Kolon Industries Inc.

- Sensoria Inc.

- ThermoSoft International Corp.

- Interactive Wear AG

- Ohmatex ApS

- Schoeller Textil AG

- Toray Industries Inc.

- Hexoskin/Carre Technologies Inc.

- Gentherm Inc.

- VF Corporation(The North Face)

- Under Armour Inc.

- Laird PLC(Advanced Thermal)

- Jabil Inc.(BlueSky e-textile)

- Google LLC(Jacquard by Levi's)

- Textronics Inc.

- Wearable X

- VT Garment Co.(Gravitech)

第七章 市场机会与未来展望

The smart fabrics market recorded volume sales of 7.75 million units in 2025 and is on course to reach 12.63 million units by 2030, representing a compound annual growth rate (CAGR) of 10.85%.

Rising adoption across defense, healthcare, and sports segments is accelerating the transition from conventional textiles to intelligent fabrics that sense, harvest energy, and communicate. Military contracts that specify cognitive-load monitoring garments, healthcare pilots that use fiber computers for real-time diagnostics, and consumer demand for performance apparel are broadening commercial opportunities. Investor confidence remains solid as patent activity in conductive yarns and flexible integrated circuits continues to grow, while partnerships between textile groups and electronics suppliers scale manufacturing. The interplay of sustainability pressures, miniaturized components, and autonomous power systems keeps the smart fabrics market on a transformative trajectory.

Global Smart Fabrics Market Trends and Insights

Growth in Wearable-Electronics Ecosystem

Demand for smart garments has surged in tandem with the wider wearable device boom. Researchers at the University of Waterloo demonstrated fabrics that harvest solar and body-heat energy, removing the need for external batteries. Cornell University's SeamFit shirts classified exercises with 93.4% accuracy using conductive threads stitched into everyday tees. Healthcare prototypes are progressing quickly, including smart bandages from the California Institute of Technology that predict wound-healing timelines at expert-level precision. The Guardian reported fiber-based electronics that draw ambient electromagnetic energy, turning the human body into part of the circuit and fueling ultra-low-power sensors embedded inside clothing. Collectively, these advances blur the line between attire and electronics, expanding the smart fabrics market into lifestyle, medical, and industrial realms.

Rapid Miniaturization and Flexible-IC Integration

The threshold at which integrated electronics compromise fabric comfort has shifted. MIT engineers produced elastic fiber computers containing micro-devices, sensors, and Bluetooth modules that survive machine washes, enabling Arctic mission wearables that monitor vital signs without bulk.Embroidered triboelectric nanogenerators yielded 307.5 µJ per sliding cycle, showcasing viable energy capture through regular garment motion. Organic electrochemical transistors developed at the University of Hong Kong now process data locally on the fabric, lowering transmission loads and boosting privacy. These breakthroughs place sophisticated processing power inside textiles while preserving drape and flexibility, enhancing consumer acceptance.

High Fabrication Cost and Cybersecurity Risks

Production lines require specialized equipment for embedding conductors, sensors, and microcontrollers, pushing unit costs above those of regular textiles. Inflation and supply chain disruptions in 2024 further squeezed margins for U.S. textile mills, many of which diverted capex away from automation upgrades. Data security remains a parallel concern because garments collect biometrics that fall under health-data regulations. Encryption adds component expense and mandates software updates throughout a product's life, increasing total cost of ownership. Smaller brands face hurdles securing capital for compliant design, slowing penetration in low-income markets.

Other drivers and restraints analyzed in the detailed report include:

- Textile-Embedded Energy-Harvesting Supercapacitors

- Military Mandates for Cognitive-Load Monitoring Gear

- Absence of Global E-Textile Interoperability Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ultra-smart variants are forecast to post the segment-leading 11.2% CAGR to 2030 as predictive analytics and automated adaptation move from labs into volume production. Passive formats still command 45.3% of the smart fabrics market due to proven durability across basic sensing tasks. Active fabrics, which modify properties like breathability in response to stimuli, bridge the gap but must overcome power and durability trade-offs.

Smart acoustic cloth using piezoelectric threads translates bending and touch into precise electrical signals, maintaining airflow and thermal stability for day-long wear. R&D pipelines are embedding on-textile neural networks that learn wearer patterns and predict anomalies, unlocking proactive wellness alerts. These capabilities give Ultra-smart fabrics a clear value premium, propelling their share of the smart fabrics market in high-performance sportswear, defense, and chronic-care monitoring.

Smart acoustics also benefit Passive and Active categories. Tailored layering schemes now boost signal-to-noise ratios, enhancing entry-level balance monitoring belts and low-cost posture trainers. Builders of Passive goods leverage established looms, so they scale faster than Ultra-smart newcomers. As manufacturing lines converge, patent sharing between loom makers and chip vendors will compress yields, balancing growth across tiers.

Energy Harvesting functions show the highest forecast CAGR of 13.5%, though Sensing retained a 56.1% share of the smart fabrics market in 2024. Thermoregulation sweaters that heat or cool through phase-change inks and microfluidic channels fulfill niche performance needs, while luminescent fabrics enrich aesthetic footwear and event costumes.

Efficient triboelectric nanogenerators woven into arm bands now deliver over 3 mW cm-2 during intense motion, enabling continuous Bluetooth beacons without external power arxiv.org. Moisture-enabled supercapacitors pair with those generators to retain charge for days, removing the daily charging chore. These power systems make autonomous field jackets viable for rescue crews and enable hospital gowns that track vitals even when patients lack mobility.

Sensing retains leadership through ubiquitous heart-rate and temperature modules in workout tees. Textile-based inductive coils measure muscle oxygenation, expanding the role of sports gear in injury prevention. As manufacturers integrate multi-functional yarns, product families combine sensing with micro-energy cells, making the categories mutually reinforcing rather than mutually exclusive.

Smart Fabrics Market is Segmented by Type (Passive Smart Fabrics, Active Smart Fabrics, Ultra-Smart Fabrics), Functionality (Sensing, Thermoregulation, and More), Material (Cotton-Based, Polyester and Nylon, High-Performance), Application (Fashion and Entertainment, Sports and Fitness, and More), and Geography. The Market Forecasts are Provided in Terms of Volume (Units).

Geography Analysis

North America led with 28.5% market share in 2024 on the back of strong defense budgets, vibrant health-tech ecosystems, and consumer enthusiasm for innovative sportswear. The Department of Defense funds fiber computers and climate-adaptive uniforms, ensuring domestic demand for high-spec fabrics. MIT, University of Waterloo, and Caltech spin out start-ups that license their textile platforms, keeping regional innovation pipelines full. Several mills moved to near-shore production to mitigate supply shocks, unlocking government incentives aimed at rebuilding local manufacturing.

Asia Pacific is the growth engine, projected at a 12.3% CAGR through 2030. China's technical textile segment already forms over 20% of its broader textile industry, posting 9-13% annual growth in medical, filtration, and protective categories. Beijing MatrixTech's Y-Warm insulation delivers superior thermal retention and antimicrobial properties, offering export potential to cold-weather sportswear brands. Japanese suppliers refine ultrafine conductive filaments, while Korean groups commercialize washable OLED thread patterns for interactive apparel. India nurtures start-ups that craft price-competitive smart bandages for rural clinics, demonstrating the region's wide application spread.

Europe sits at the convergence of sustainability mandates and advanced engineering. The bloc's progressive PFAS restrictions drive research into alternative coatings that cut toxic risk yet retain conductivity. Lenzing's minority stake in TreeToTextile fast-tracks cellulose fibers that lower water and energy footprints. Germany, France, and Spain foster textile recycling clusters, but consumer surveys reveal price sensitivity to sustainability premiums. Universities collaborate with automotive suppliers on seat fabrics that detect driver fatigue, broadening industrial uptake and reinforcing Europe's role as an innovation hub in the smart fabrics market.

- Adidas AG

- NIKE Inc.

- AIQ Smart Clothing Inc.

- DuPont de Nemours Inc.

- Kolon Industries Inc.

- Sensoria Inc.

- ThermoSoft International Corp.

- Interactive Wear AG

- Ohmatex ApS

- Schoeller Textil AG

- Toray Industries Inc.

- Hexoskin / Carre Technologies Inc.

- Gentherm Inc.

- VF Corporation (The North Face)

- Under Armour Inc.

- Laird PLC (Advanced Thermal)

- Jabil Inc. (BlueSky e-textile)

- Google LLC (Jacquard by Levi's)

- Textronics Inc.

- Wearable X

- VT Garment Co. (Gravitech)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in wearable-electronics ecosystem

- 4.2.2 Rapid miniaturization and flexible-IC integration

- 4.2.3 Surge in conductive-yarn patent filings (post-2025)

- 4.2.4 Textile-embedded energy-harvesting supercapacitors

- 4.2.5 Military mandates for cognitive-load monitoring gear

- 4.2.6 Sustainability premiums from circular-textile brands

- 4.3 Market Restraints

- 4.3.1 High fabrication cost and cybersecurity risks

- 4.3.2 Absence of global e-textile interoperability standards

- 4.3.3 Emerging toxicity rules on nano-coatings

- 4.3.4 End-of-life recycling complexity of e-textile waste

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Passive Smart Fabrics

- 5.1.2 Active Smart Fabrics

- 5.1.3 Ultra-smart Fabrics

- 5.2 By Functionality

- 5.2.1 Sensing

- 5.2.2 Thermoregulation

- 5.2.3 Energy Harvesting

- 5.2.4 Luminescent and Aesthetic

- 5.3 By Material

- 5.3.1 Cotton-based

- 5.3.2 Polyester and Nylon

- 5.3.3 High-performance (Kevlar, Dyneema, etc.)

- 5.4 By Application

- 5.4.1 Fashion and Entertainment

- 5.4.2 Sports and Fitness

- 5.4.3 Medical and Healthcare

- 5.4.4 Transportation - Automotive and Aerospace

- 5.4.5 Military and Defense

- 5.4.6 Industrial and Safety

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Turkey

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adidas AG

- 6.4.2 NIKE Inc.

- 6.4.3 AIQ Smart Clothing Inc.

- 6.4.4 DuPont de Nemours Inc.

- 6.4.5 Kolon Industries Inc.

- 6.4.6 Sensoria Inc.

- 6.4.7 ThermoSoft International Corp.

- 6.4.8 Interactive Wear AG

- 6.4.9 Ohmatex ApS

- 6.4.10 Schoeller Textil AG

- 6.4.11 Toray Industries Inc.

- 6.4.12 Hexoskin / Carre Technologies Inc.

- 6.4.13 Gentherm Inc.

- 6.4.14 VF Corporation (The North Face)

- 6.4.15 Under Armour Inc.

- 6.4.16 Laird PLC (Advanced Thermal)

- 6.4.17 Jabil Inc. (BlueSky e-textile)

- 6.4.18 Google LLC (Jacquard by Levi's)

- 6.4.19 Textronics Inc.

- 6.4.20 Wearable X

- 6.4.21 VT Garment Co. (Gravitech)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment