|

市场调查报告书

商品编码

1851444

石墨烯:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Graphene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

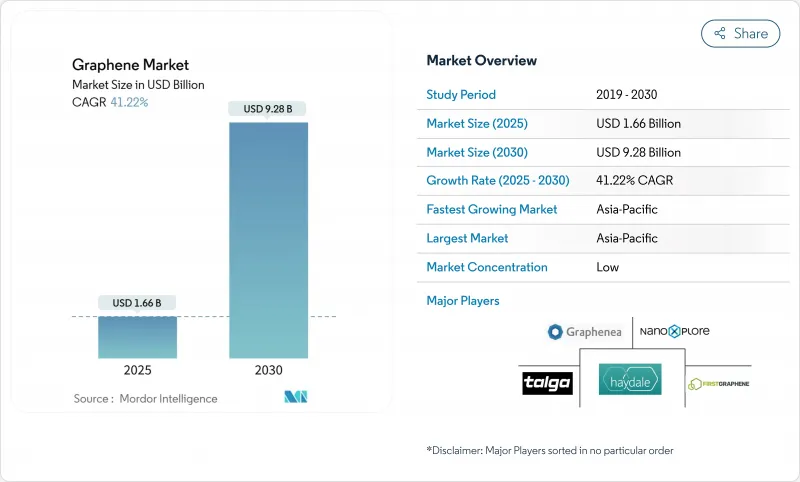

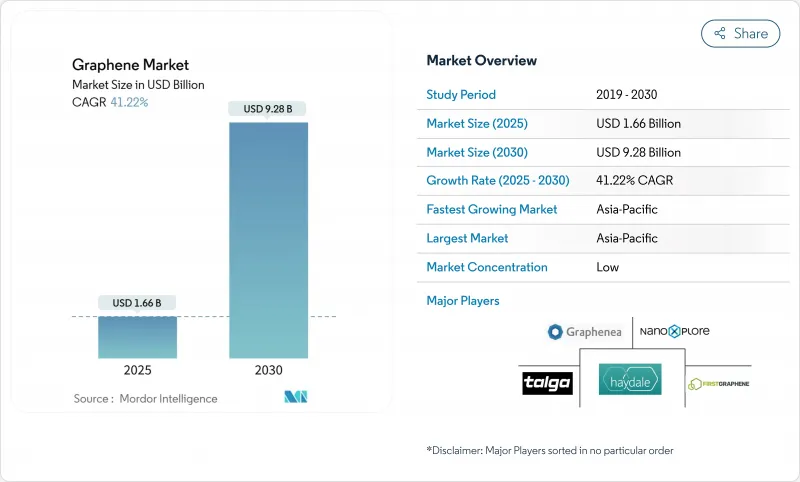

预计到 2025 年,石墨烯市场规模将达到 16.6 亿美元,到 2030 年将达到 92.8 亿美元,2025 年至 2030 年的复合年增长率为 41.22%。

这种快速成长表明,商业规模生产的障碍正在逐渐消除,而石墨烯正从实验室走向主流工业供应链。製程产量比率的提高、单位成本的下降以及与下游用户的紧密整合,支撑着电池、航太复合材料和医疗设备等高成长细分领域的持续需求。亚太地区预计到2024年将占总收入的46%,年复合成长率将达到44.69%,这得益于其密集的电子产业集群、积极的政府资助以及材料和最终产品製造商之间的密切合作。随着企业建立专注于特定应用领域的垂直定位,市场区隔程度正在加剧。例如,产业对电池化学相关智慧财产权的加强控制已成为一项至关重要的竞争优势。

全球石墨烯市场趋势与洞察

石墨烯有助于航太业的发展

与传统复合材料相比,石墨烯增强碳纤维聚合物可减轻20%至30%的质量,同时维持甚至提升机械性能。嵌入式石墨烯感测器网格可提供即时结构健康数据,从而实现预测性维护週期并减少计划外停机时间。北美和欧洲的民航机专案首先将这些多功能结构整合到辅助零件、雷达罩、整流罩和内装板中,然后再扩展到关键承重零件。随着早期服役数据的积累,监管审批流程正在缩短,从而加快了亚太地区飞机製造商的供应商资格认证。随着碳定价机制的收紧,喷射机燃料的节省可直接转化为更低的排放费,这增加了航空公司签订长期石墨烯复合材料材料供应协议的奖励,并为材料製造商提供了更清晰的需求预测。

石墨烯防腐涂层在中东海水淡化基础设施的应用

海湾合作委员会(波湾合作理事会)的公共产业运作在高盐度和高温环境下,这些环境会腐蚀钢製管道和压力容器。石墨烯涂层隔离层可有效阻止离子入侵,进而延长设备使用寿命15至20年,并降低高达30%的维修预算。同时,氧化石墨烯涂层也能将薄膜的水通量提高80%至90%,使业者能够提高单位装置容量的处理量,并抵销能源成本。预计到2030年,该地区的海水淡化能力将翻一番,因此,在新工厂建设中使用石墨烯保护膜已成为竞标规范中日益严格的要求,这促使当地製造商从现有供应商处获得该技术的许可。

高昂的生产成本

化学气相沉积 (CVD) 可提供先进电子产品所需的纯度,但其真空室和温度控制系统会增加运作成本,限制了其在价格分布应用领域的应用。材料研究人员指出,批次间的差异会使下游品管变得复杂,并令规避风险的客户望而却步。一种使用熔盐的替代电解法预计将在不牺牲晶体有序性的前提下将成本降低高达 90%,但其商业化仍处于早期测试阶段。在实现规模化效益之前,许多大众市场产品仍将继续依赖更便宜的填充材,从而限製石墨烯的供应量。

细分市场分析

预计到2024年,石墨烯奈米微片将占石墨烯市场销售额的57%,并在2030年之前以47.63%的复合年增长率增长,巩固其在石墨烯市场领先产品的地位。其薄而宽的形貌使其易于分散在聚合物、金属和沥青中,从而在低负载下提高材料的强度和阻隔性。销量的成长降低了单价,进一步推动了市场需求。 Aberdyne公司专有的超大超薄、无缺陷石墨烯奈米片製造流程预计将于2025年中期授权给一家化学合作伙伴进行生产,这将扩大供应,并为寻求可预测批次性能的航太和电池开发商提供支援。

片状材料、薄膜以及氧化石墨烯(GO)正效法奈米片,填补重要的应用空白。 GO的亲水性使其适用于生物医用水凝胶,例如能够响应血糖浓度升高而发挥作用的双交联敷料,可促进慢性伤口癒合。化学气相沉积(CVD)法製备的多层薄膜虽然成本较高,但却能展现量子输运现象,这对于高速电晶体和新一代感测器至关重要。混合发泡弹性体在微波频宽已展现约75 dB的衰减性能。

区域分析

亚太地区主导石墨烯市场,预计2024年营收将成长46%,复合年增长率高达44.69%,位居成长最快地区之首。中国在石墨原料上游和电池组装下游领域均处于主导,拥有强大的生态系统优势。国家补贴正用于支持多吨级氧化石墨烯生产线的扩建,以满足国内储能整合商的需求。韩国企业正在实现石墨供应多元化,减少对非洲的依赖,同时扩大富硅负极的产能,间接推动了石墨烯作为导电添加剂的应用。

北美正在努力提升供应链韧性:加州一家锂金属工厂将斥资 2,000 万美元维修,预计将于 2025 年底开始生产 200 兆瓦时的石墨烯增强型锂硫电池;此外,内华达州计划于 2027 年建成一座 10 吉瓦时的超级工厂。联邦采购指南优先考虑国防电子产品的国内生产,这将进一步支持晶圆级 CVD 产能的扩张。

欧洲拥有深厚的学术专长,曼彻斯特、剑桥和亚琛等地均设有研究中心,在标准磁场中实现 100% 室温磁阻等突破性成就,充分展现了该地区基础科学的实力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 石墨烯对航太产业的贡献

- 石墨烯防腐蚀涂层在中东海水淡化基础设施的应用

- 扩大储能应用

- 对电子产品和半导体的需求不断增长

- 石墨烯电磁干扰屏蔽泡棉在欧洲5G基础建设的商业化应用

- 市场限制

- 高昂的生产成本

- 可能的替代方案

- 大面积CVD石墨烯生产线需要高额资本投资。

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 石墨烯薄片和薄膜

- 石墨烯奈米微片(GNPs)

- 氧化石墨烯(GO)

- 奈米片

- 其他的

- 透过使用

- 合成的

- 储能和发电

- 印刷柔性电子

- 生物医学与医疗保健

- 画

- 其他的

- 按最终用户行业划分

- 电子与通讯

- 航太/国防

- 能源与电力

- 生物医学与医疗保健

- 其他(汽车、化工、涂料)

- 按地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- ACS Material

- Cabot Corporation

- Directa Plus SpA

- First Graphene Ltd

- G6 Materials Corp.

- Global Graphene Group

- Grafoid Inc

- Graphene Manufacturing Group Ltd

- Graphenea

- Haydale Graphene Industries plc

- NanoXplore Inc.

- Perpetuus Advanced Materials

- Talga Group

- The Sixth Element(Changzhou)Materials Technology Co.,Ltd

- Thomas Swan & Co. Ltd

- Universal Matter Inc

- Versarien plc

- Vorbeck Materials Corp.

第七章 市场机会与未来展望

The graphene market size is estimated at USD 1.66 billion in 2025 and is expected to reach USD 9.28 billion by 2030, expanding at a 41.22% CAGR between 2025-2030.

This steep ascent signals that commercial-scale production hurdles are receding, moving graphene decisively from the laboratory into mainstream industrial supply chains. Increased process yields, falling unit costs, and closer integration with downstream users now underpin sustained demand from high-growth niches such as batteries, aerospace composites, and biomedical devices. Asia-Pacific remains the centre of gravity: the region held 46% of 2024 revenue and is growing at a 44.69% CAGR thanks to dense electronics clusters, active government funding, and tight coupling between material producers and end-product manufacturers. Fragmentation is increasing as companies carve out vertical positions around specialty uses; intellectual-property control over graphene-enhanced battery chemistries, for example, is already a decisive competitive lever.

Global Graphene Market Trends and Insights

Graphene Aiding the Aerospace Industry

Lightweighting remains a core airline objective, and graphene-reinforced carbon-fiber polymers are yielding 20-30% mass reductions versus legacy composites while maintaining or improving mechanical performance. Embedded graphene sensor meshes also deliver real-time structural-health data, enabling predictive maintenance cycles and lowering unplanned downtime. Commercial aircraft programs in North America and Europe first integrate such multifunctional structures into secondary parts, radomes, fairings, and interior panels, before scaling to primary load-bearing components. Regulatory pathways are shortening as early-service data accumulate, accelerating supplier qualification for Asia-Pacific airframe builders. With jet-fuel savings translating directly into lower emissions fees under tightening carbon-pricing regimes, airlines are incentivised to secure long-term graphene composite supply agreements, reinforcing demand visibility for material producers.

Adoption of Graphene Anti-corrosion Coatings in the Middle-East Desalination Infrastructure

Gulf Cooperation Council utilities operate in extreme salinity and high-temperature environments that corrode steel piping and pressure vessels. Graphene-laden barrier layers impede ion ingress, extending asset life by 15-20 years and cutting maintenance budgets by up to 30%. Because graphene oxide coatings simultaneously raise membrane water flux 80-90%, operators gain higher throughput per installed capacity, which offsets energy expenses, crucial where desalination already accounts for a material share of national electricity demand. As regional capacity is projected to double by 2030, tender specifications increasingly mandate graphene protection for new-build plants, stimulating local formulators to license technology from established providers.

High Production Cost

Chemical-vapor-deposition (CVD) delivers the purity required for advanced electronics, yet its vacuum chambers and temperature control systems drive operating expenditure that limits adoption to premium-priced applications. Material researchers report batch-to-batch variability that complicates downstream quality control, deterring risk-averse customers. Alternative electrolysis routes in molten salts could cut costs by up to 90% without sacrificing crystalline order, though commercialisation remains in early trials. Until scale efficiencies arrive, many mass-market products will continue to rely on cheaper filler materials, capping graphene volumes.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Energy-Storage Applications

- Growing Demand in Electronics and Semiconductors

- Availability of Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Graphene nanoplatelets captured 57% of 2024 sales and are on track for a 47.63% CAGR to 2030, cementing their status as the workhorse of the graphene market. Their thin but wide morphology disperses easily in polymers, metals, and asphalt, delivering strength and barrier gains at low loadings. Volume growth is lowering unit prices, which further reinforces demand momentum. Avadain's proprietary large-thin-defect-free flake process, licensed to a chemical partner for mid-2025 production, is expected to widen supply and support aerospace and battery developers seeking predictable performance batches.

Sheets and films, and graphene oxide (GO) each trail nanoplatelets but fill essential niches. GO's hydrophilicity suits biomedical hydrogels that accelerate chronic-wound healing, as shown in double-cross-linked dressings that respond to elevated glucose levels. CVD-grown multilayer films, though costlier, unlock quantum transport phenomena valuable for high-speed transistors and next-generation sensors. Demand for three-dimensional foams is also rising where electromagnetic shielding and thermal interface performance are critical; hybrid graphene-foam elastomers have exhibited around 75 dB attenuation across microwave bands.

The Graphene Market Report Segments the Industry by Product Type (Graphene Sheets and Films, Graphene Nanoplatelets (GNP), Graphene Oxide (GO), Nanoplatelets, and Others), Application (Composites, Energy Storage and Harvesting, and More), End-User Industry (Electronics and Telecommunication, Aerospace and Defense, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific dominates the graphene market with 46% revenue in 2024 and the fastest 44.69% CAGR outlook. China's upstream leadership in graphite feedstock and downstream battery assembly grants ecosystem advantages; state grants have underwritten multi-tonne GO expansion lines that feed domestic energy-storage integrators. South Korean groups are diversifying graphite supply from Africa while scaling silicon-rich anode capacity, which indirectly elevates graphene usage for conductivity additives.

North America is pursuing supply-chain resilience. A USD 20 million retrofit of a lithium-metal facility in California will start 200 MWh of graphene-enhanced lithium-sulfur cell output in late 2025, with a 10 GWh Nevada gigafactory planned for 2027. Federal procurement guidelines prioritising domestic content for defense electronics further incentivise local wafer-scale CVD capacity builds.

Europe benefits from deep academic expertise clustered around Manchester, Cambridge and Aachen. Breakthroughs such as 100% room-temperature magnetoresistance in standard magnetic fields illustrate the region's basic-science prowess.

- ACS Material

- Cabot Corporation

- Directa Plus S.p.A.

- First Graphene Ltd

- G6 Materials Corp.

- Global Graphene Group

- Grafoid Inc

- Graphene Manufacturing Group Ltd

- Graphenea

- Haydale Graphene Industries plc

- NanoXplore Inc.

- Perpetuus Advanced Materials

- Talga Group

- The Sixth Element (Changzhou) Materials Technology Co.,Ltd

- Thomas Swan & Co. Ltd

- Universal Matter Inc

- Versarien plc

- Vorbeck Materials Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Graphene Aiding the Aerospace Industry

- 4.2.2 Adoption of Graphene Anti-corrosion Coatings in Middle-East Desalination Infrastructure

- 4.2.3 Expansion of Energy Storage Applications

- 4.2.4 Growing Demand in Electronics and Semiconductors

- 4.2.5 Commercialization of Graphene EMI-shielding Foams for European 5G Infrastructure

- 4.3 Market Restraints

- 4.3.1 High Production Cost

- 4.3.2 Avalability of Substitutes

- 4.3.3 High capex needs for large-area CVD graphene production lines

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Graphene Sheets and Films

- 5.1.2 Graphene Nanoplatelets (GNP)

- 5.1.3 Graphene Oxide (GO)

- 5.1.4 Nanoplatelets

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Composites

- 5.2.2 Energy Storage and Harvesting

- 5.2.3 Printed and Flexible Electronics

- 5.2.4 Biomedical and Healthcare

- 5.2.5 Coatings and Paints

- 5.2.6 Others

- 5.3 By End-user Industry

- 5.3.1 Electronics and Telecommunications

- 5.3.2 Aerospace and Defense

- 5.3.3 Energy and Power

- 5.3.4 Biomedical and Healthcare

- 5.3.5 Others (Automotive, Chemical, and Coatings)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 South Korea

- 5.4.1.4 India

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Turkey

- 5.4.5.4 South Africa

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ACS Material

- 6.4.2 Cabot Corporation

- 6.4.3 Directa Plus S.p.A.

- 6.4.4 First Graphene Ltd

- 6.4.5 G6 Materials Corp.

- 6.4.6 Global Graphene Group

- 6.4.7 Grafoid Inc

- 6.4.8 Graphene Manufacturing Group Ltd

- 6.4.9 Graphenea

- 6.4.10 Haydale Graphene Industries plc

- 6.4.11 NanoXplore Inc.

- 6.4.12 Perpetuus Advanced Materials

- 6.4.13 Talga Group

- 6.4.14 The Sixth Element (Changzhou) Materials Technology Co.,Ltd

- 6.4.15 Thomas Swan & Co. Ltd

- 6.4.16 Universal Matter Inc

- 6.4.17 Versarien plc

- 6.4.18 Vorbeck Materials Corp.

7 Market Opportunities and Future Outlook

- 7.1 Development of Graphene Nanodevices for DNA Sequencing

- 7.2 Adoption of Graphene into Photodetectors

- 7.3 White-space and Unmet-need Assessment