|

市场调查报告书

商品编码

1851465

商业分析:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Business Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

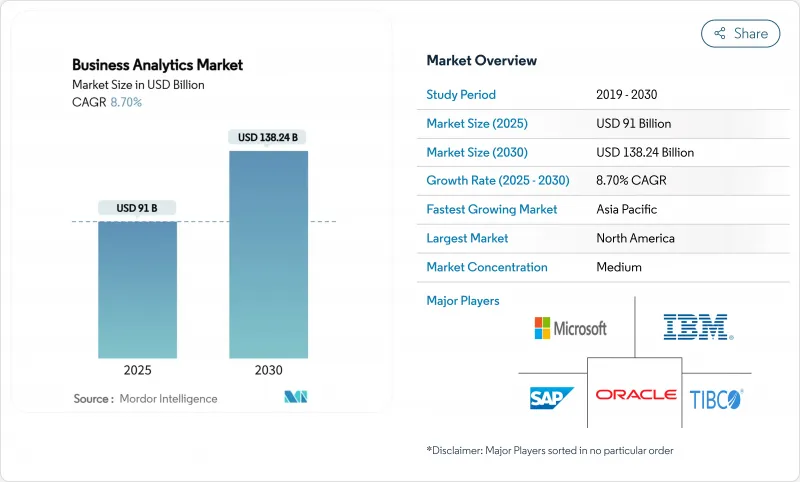

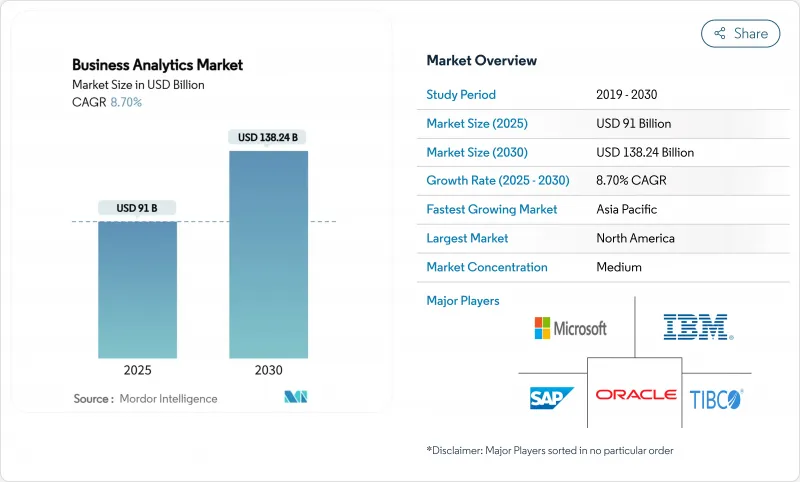

预计到 2025 年,商业分析市场规模将达到 910 亿美元,到 2030 年将达到 1,382.4 亿美元,复合年增长率为 8.70%。

云端原生平台、人工智慧驱动的自动化以及数位转型的广泛推动正在推动这一扩张。各行各业的组织机构如今都将分析融入日常工作流程,以发现低效环节、提升客户参与并缩短决策週期。人工智慧与现有分析技术的融合正将分析领域从回顾性报告转向即时预测智能,而云端运算的普及则降低了各种规模企业的准入门槛。随着现有企业软体供应商不断调整产品组合以跟上云端专家和人工智慧优先型新兴企业的步伐,竞争依然激烈,这些公司承诺提供更快的部署速度和更简单的用户体验。人才短缺、资料主权法规以及高昂的前期成本仍然限制着成长,但尚未阻止向以资料为中心的营运模式的系统性转变。

全球商业分析市场趋势与洞察

将人工智慧和机器学习整合到您的分析平台中

人工智慧正从附加功能转变为商业分析平台的核心能力。诸如 Snowflake Cortex 和 Microsoft 365 Copilot 的 Analyst 代理等新版本能够解读自然语言、自动生成 SQL 语句,并提供以往需要资料科学家才能实现的预测性洞察。采用这些功能的公司报告称,其行销、供应链和财务团队的生产力提高了 30% 到 50%。随着模型训练成本的下降,平台供应商正在整合生成式人工智慧,以扩大存取权限、自动化资料准备,并开启「代理分析」时代——在这个时代,自主代理无需人工编码编配复杂的分析流程。

巨量资料和云端运算的兴起

资料量、传输速度和资料种类都在持续成长。每週有超过 6000 家机构向 BigQuery 传输超过 275 Petabyte的资料传输,这凸显了弹性云端储存和运算正逐渐成为分析的预设基础。诸如 ClickHouse 与 AWS 签署的五年合作协议等联合创新项目,正在加速开发金融和电子商务工作负载的客製化解决方案。云端框架还支援将本地化的物联网资料处理与集中式仪表板相结合,从而使工业环境中的设备效率提高 10%,计划外停机时间减少 30%。

数据主权限制

GDPR、《云端法案》和新兴国家法律之间的衝突规则迫使跨国公司建立特定区域的资料堆迭。虽然超大规模资料中心业者和区域性云端服务供应商提供的自主云可以解决这个问题,但企业仍需要在多个供应商和控制措施之间周旋,才能在不损害分析一致性的前提下满足监管机构的要求。

细分市场分析

2024年,云端运算业务将占总营收的65.4%,年复合成长率达10.7%,到2030年,其在商业分析市场规模中的占比将进一步扩大。资本支出减少、弹性扩展以及与资料湖和人工智慧服务的快速集成,进一步增强了云端运算的吸引力。安全认证和自动化合规功能现已涵盖金融、医疗保健和政府等行业的业务,进一步削弱了本地部署支持者的最后堡垒。

儘管在面临严格的延迟要求、传统系统整合或监管义务时,本地部署仍然可行,但其市场份额近年来已逐渐萎缩。混合云方案提供了一条过渡路径,将敏感工作负载保留在防火墙后,并将突发处理迁移到云端。服务供应商正在将迁移套件、託管服务和按需付费模式捆绑在一起,以吸引犹豫不决的客户迁移到云端,从而巩固云端作为市场领导者和成长引擎的地位。

说明分析将占据商业分析市场最大份额,到2024年将占总收入的32.7%,而预测技术将以8.8%的复合年增长率超越所有其他类别。企业将从「发生了什么事」的仪錶板转向前瞻性模型,这些模型能够识别客户流失风险、优化库存,并在故障发生前安排维修人员。生成式人工智慧将透过自动产生复杂的时间序列模型并为非技术使用者展示场景模拟,来增强预测工作流程。

诊断分析充当桥樑,解释根本原因并为预测演算法提供见解。指导性工具则形成闭环,在预算和人员配置等限制条件下推荐最佳行动方案。早期成功案例,例如消费品製造商透过优化生产计划每週节省高达 20 万美元,正在推动该技术的更广泛应用。随着套件的不断完善,预测层和指导层将协同工作,将历史资料转化为跨职能部门的自动化、情境感知决策。

商业分析市场按部署模式(本地部署、云端部署)、分析类型(说明分析、诊断性分析及其他)、组织规模(大型企业、中小企业)、最终用户行业(银行、金融服务和保险、医疗保健和生命科学及其他)以及地区进行细分。市场预测以美元计价。

区域分析

北美地区预计到2024年将占全球收入的27.4%,这主要得益于其成熟的技术生态系统、丰富的人才储备以及早期对云端技术的采用。各公司正在对现有平台进行改造,整合人工智慧加速器、串流管道和自动化管治,并从现有的资料资产中提高效率。美国在云端支出方面处于领先地位,加拿大则在自然资源和金融服务领域大力应用分析技术。墨西哥正在采用云端平台来支援出口导向製造业和跨境物流。

亚太地区以10.3%的复合年增长率 (CAGR) 实现最快成长,这主要得益于政府人工智慧策略、行动应用普及以及待开发区云端平台的快速部署。中国占该地区商业分析市场37.5%的份额,这得益于其庞大的数位支付生态系统和产业升级计画。越南和菲律宾等高成长国家的年增长率超过19%,中小企业 (SME) 正积极采用SaaS分析来显着改善其旧有系统。印度、日本、韩国和泰国正将公共部门津贴用于劳动力技能提升和数据生态系统建设,这为平台供应商创造了肥沃的土壤。

在强而有力的隐私保护条例和产业数位化资金的支持下,欧洲正稳步推进。德国、法国和英国正在利用分析技术来提高製造业效率和财务合规性,而南欧国家则在旅游和零售业拓展分析技术的应用情境。主权云端框架和隐私增强技术正在满足GDPR主导的需求。中东和非洲正受益于智慧城市计划,尤其是在海湾地区;南美洲的巴西和阿根廷也在积极采用云端运算,儘管基础设施差异和货币波动正在减缓其普及速度。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 巨量资料和云端运算的兴起

- 即时决策的必要性

- 将人工智慧/机器学习引入分析平台

- 监管压力日益加大,数据主导合规性面临越来越大压力

- 面向物联网密集型产业的边缘分析

- 一个保护隐私的资料洁净室

- 市场限制

- 前期成本高,投资报酬率不确定性

- 高级分析人才短缺

- 数据主权限制

- ESG数据品质差距

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按部署模式

- 本地部署

- 云

- 按分析类型

- 说明的

- 诊断

- 预言

- 规范

- 按公司规模

- 大公司

- 中小企业

- 按最终用户行业划分

- 银行、金融服务和保险(BFSI)

- 医疗保健和生命科学

- 製造业

- 零售与电子商务

- 电讯和资讯技术

- 政府/公共部门

- 能源与公共产业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性措施与资金筹措活动

- 市占率分析

- 公司简介

- Microsoft Corp.

- SAP SE

- Oracle Corp.

- IBM Corp.

- Salesforce Inc.(Tableau)

- SAS Institute Inc.

- TIBCO Software Inc.

- Qlik Tech Intl.

- MicroStrategy Inc.

- Infor Inc.

- Google LLC(Looker)

- Amazon Web Services(QuickSight)

- Domo Inc.

- Sisense Ltd.

- ThoughtSpot Inc.

- Alteryx Inc.

- Zoho Corp.(Zoho Analytics)

- Board International

- GoodData Corp.

- Yellowfin BI

- Pyramid Analytics

- Logi Analytics(InsightSoftware)

- Teradata Corp.

- Informatica Inc.

- Palantir Technologies

- Snowflake Inc.

- Databricks Inc.

第七章 市场机会与未来展望

The business analytics market is valued at USD 91 billion in 2025 and is forecast to reach USD 138.24 billion by 2030, reflecting an 8.70% CAGR over the period.

Cloud-native platforms, AI-driven automation, and a widespread push for digital transformation underpin this expansion. Organizations across industries now embed analytics into day-to-day workflows to uncover inefficiencies, sharpen customer engagement, and shorten decision cycles. The convergence of artificial intelligence with established analytics stacks is shifting the discipline from retrospective reporting toward real-time predictive intelligence, while pervasive cloud adoption lowers entry barriers for firms of every size. Competitive intensity remains lively as incumbent enterprise software vendors revamp portfolios to match the pace set by cloud specialists and AI-first start-ups that promise faster deployment and simpler user experiences. Talent shortages, data-sovereignty rules, and high initial costs continue to temper growth yet have not derailed the structural migration toward data-centric operations.

Global Business Analytics Market Trends and Insights

AI and ML infusion into analytics platforms

Artificial intelligence has shifted from a bolt-on feature to a core capability within business analytics platforms. New releases such as Snowflake Cortex and Microsoft 365 Copilot's Analyst agent interpret natural language, auto-generate SQL, and surface predictive insights that once required a data scientist. Companies adopting these capabilities report 30-50% productivity lifts in marketing, supply-chain, and finance teams. As model training costs fall, platform vendors embed generative AI to widen access and automate data preparation, ushering in an era of "agentic analytics" where autonomous agents orchestrate complex analysis pipelines without human coding.

Proliferation of big data and cloud adoption

Volume, velocity, and variety of data keep rising. More than 6,000 organizations exchange upward of 275 petabytes each week on BigQuery, highlighting how elastic cloud storage and compute have become the default substrate for analytics. Joint innovation programs, such as the five-year agreement between ClickHouse and AWS, accelerate purpose-built solutions for finance and e-commerce workloads. Cloud frameworks also let firms pair localized IoT data processing with centralized dashboards, delivering 10% gains in equipment efficiency and 30% reductions in unplanned downtime in industrial settings.

Data-sovereignty restrictions

Conflicting rules among GDPR, the CLOUD Act, and emerging national laws force multinationals to architect region-specific data stacks. Deployments must ensure local processing, encrypted transfers, and auditable consent, adding cost and complexity.Sovereign-cloud offerings from hyperscalers and regional providers address the issue, yet organizations still juggle multiple vendors and controls to satisfy regulators without fracturing analytical coherence.

Other drivers and restraints analyzed in the detailed report include:

- Need for real-time decision-making

- Edge analytics for IoT-heavy industries

- Talent shortage in advanced analytics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The cloud segment accounts for 65.4% of 2024 revenue, and its 10.7% CAGR means it will command an even larger slice of the business analytics market size by 2030. Lower capital expenditure, elastic scaling, and rapid integration with data lakes and AI services cement its appeal. Security certifications and automated compliance features now cover finance, healthcare, and government workloads, eroding the last strongholds of on-premise advocates.

On-premise deployments persist where strict latency, legacy integration, or regulatory mandates prevail, but their share recedes every year. Hybrid blueprints, in which sensitive workloads stay behind the firewall while burst processing moves to the cloud, offer a transitional path. Providers bundle migration toolkits, managed services, and consumption-based pricing to nudge hesitant customers toward the cloud, reinforcing its position as both market leader and growth engine.

Descriptive analytics retained 32.7% of 2024 revenue, the largest slice of the business analytics market, yet predictive techniques outpace all categories with an 8.8% CAGR. Organizations evolve from "what happened" dashboards to forward-looking models that flag churn risk, optimize inventory, and route maintenance crews before breakdowns occur. Generative AI enhances predictive workflows by auto-coding complex time-series models and surfacing scenario simulations for non-technical users.

Diagnostic analytics serves as a bridge, explaining root causes and feeding features into forecasting algorithms. Prescriptive tools close the loop by recommending the best action under constraints such as budget or staffing. Early success stories like a consumer-products maker saving up to USD 200,000 weekly through optimized production schedules fuel wider adoption. As toolkits mature, predictive and prescriptive layers will jointly convert historical data into automated, context-aware decisions across functions.

Business Analytics Market is Segmented by Deployment Model (On-Premises, Cloud), Analytics Type (Descriptive, Diagnostic, and More), Organization Size (Large Enterprises, Smes), End-User Industry (BFSI, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 27.4% of 2024 revenue thanks to a mature technology ecosystem, abundant talent, and early cloud adoption. Enterprises refine existing platforms with AI accelerators, streaming pipelines, and automated governance, squeezing incremental efficiency from established data assets. The United States leads spending, and Canada leverages analytics in natural-resources and financial-services verticals. Mexico adopts cloud platforms to support export-oriented manufacturing and cross-border logistics.

Asia Pacific is the fastest-growing region at a 10.3% CAGR, fueled by government AI strategies, widespread mobile adoption, and greenfield cloud deployments. China commands 37.5% of the regional business analytics market, backed by large-scale digital payment ecosystems and industrial upgrade programs. High-growth economies such as Vietnam and the Philippines exceed 19% annual expansion as SMEs embrace SaaS analytics to leapfrog legacy systems. India, Japan, South Korea, and Thailand channel public-sector grants into workforce upskilling and data-ecosystem development, creating fertile ground for platform vendors.

Europe advances steadily underpinned by strong privacy regulations and industry digitization funding. Germany, France, and the United Kingdom deploy analytics for manufacturing efficiency and financial compliance, while southern nations expand tourism and retail analytics use cases. Sovereign-cloud frameworks and privacy-enhancing technologies address GDPR-driven demands. The Middle East and Africa benefit from smart-city agendas, especially in the Gulf states, whereas South America gains traction through cloud uptake in Brazil and Argentina, although infrastructure gaps and currency volatility temper the slope of adoption

- Microsoft Corp.

- SAP SE

- Oracle Corp.

- IBM Corp.

- Salesforce Inc. (Tableau)

- SAS Institute Inc.

- TIBCO Software Inc.

- Qlik Tech Intl.

- MicroStrategy Inc.

- Infor Inc.

- Google LLC (Looker)

- Amazon Web Services (QuickSight)

- Domo Inc.

- Sisense Ltd.

- ThoughtSpot Inc.

- Alteryx Inc.

- Zoho Corp. (Zoho Analytics)

- Board International

- GoodData Corp.

- Yellowfin BI

- Pyramid Analytics

- Logi Analytics (InsightSoftware)

- Teradata Corp.

- Informatica Inc.

- Palantir Technologies

- Snowflake Inc.

- Databricks Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of big data and cloud adoption

- 4.2.2 Need for real-time decision-making

- 4.2.3 AI/ML infusion into analytics platforms

- 4.2.4 Regulatory push for data-driven compliance

- 4.2.5 Edge analytics for IoT-heavy industries

- 4.2.6 Privacy-preserving data clean rooms

- 4.3 Market Restraints

- 4.3.1 High upfront cost and ROI uncertainty

- 4.3.2 Talent shortage in advanced analytics

- 4.3.3 Data-sovereignty restrictions

- 4.3.4 ESG-data quality gaps

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By Analytics Type

- 5.2.1 Descriptive

- 5.2.2 Diagnostic

- 5.2.3 Predictive

- 5.2.4 Prescriptive

- 5.3 By Organisation Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Mid-sized Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 Banking, Financial Services and Insurance (BFSI)

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Manufacturing

- 5.4.4 Retail and E-commerce

- 5.4.5 Telecom and IT

- 5.4.6 Government and Public Sector

- 5.4.7 Energy and Utilities

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Funding Activity

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Microsoft Corp.

- 6.4.2 SAP SE

- 6.4.3 Oracle Corp.

- 6.4.4 IBM Corp.

- 6.4.5 Salesforce Inc. (Tableau)

- 6.4.6 SAS Institute Inc.

- 6.4.7 TIBCO Software Inc.

- 6.4.8 Qlik Tech Intl.

- 6.4.9 MicroStrategy Inc.

- 6.4.10 Infor Inc.

- 6.4.11 Google LLC (Looker)

- 6.4.12 Amazon Web Services (QuickSight)

- 6.4.13 Domo Inc.

- 6.4.14 Sisense Ltd.

- 6.4.15 ThoughtSpot Inc.

- 6.4.16 Alteryx Inc.

- 6.4.17 Zoho Corp. (Zoho Analytics)

- 6.4.18 Board International

- 6.4.19 GoodData Corp.

- 6.4.20 Yellowfin BI

- 6.4.21 Pyramid Analytics

- 6.4.22 Logi Analytics (InsightSoftware)

- 6.4.23 Teradata Corp.

- 6.4.24 Informatica Inc.

- 6.4.25 Palantir Technologies

- 6.4.26 Snowflake Inc.

- 6.4.27 Databricks Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment