|

市场调查报告书

商品编码

1851468

欧洲黏合剂和密封剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Europe Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

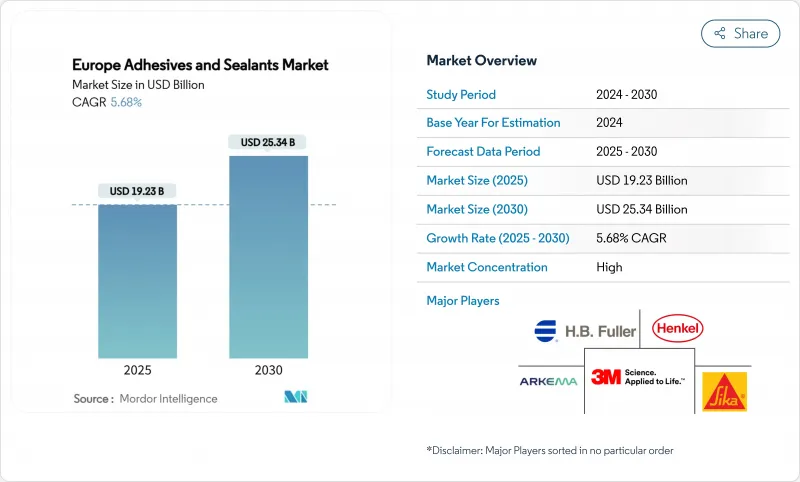

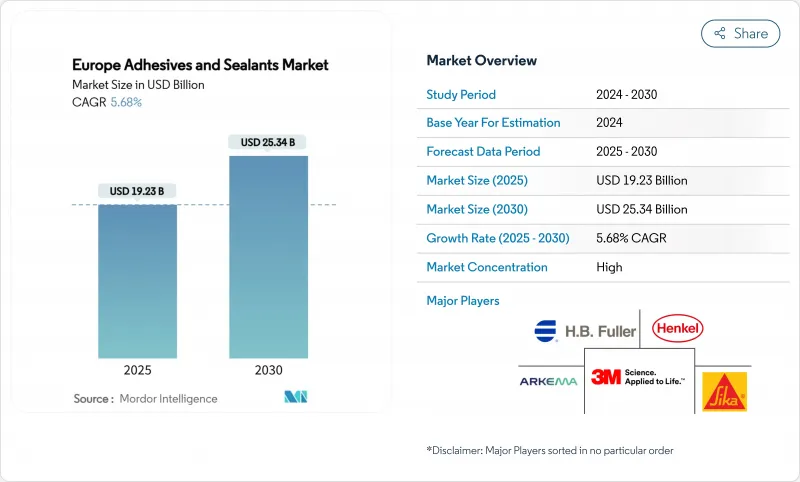

据估计,到 2025 年,欧洲黏合剂和密封剂市场规模将达到 192.3 亿美元,预计到 2030 年将达到 253.4 亿美元,在预测期(2025-2030 年)内复合年增长率为 5.68%。

这一发展轨迹反映了该产业在应对欧盟绿色协议严格法规的同时,充分利用建设业復苏、车辆轻量化强制令以及可再生能源扩张等机会的能力。随着挥发性有机化合物(VOC)法规的日益严格,水性体係正获得越来越多的关注;紫外光固化化学品则正在提升电子和汽车工厂的生产线速度。德国的绿色交易投资支撑着强劲的需求,而西班牙的可再生能源建设则是该地区结构胶合剂解决方案成长最快的买家。市场竞争依然温和,大型企业正调整其产品组合,转向生物基树脂,并透过主导扩大产能,以应对原材料价格波动和碳减排成本带来的净利率影响。

欧洲黏合剂和密封剂市场趋势及洞察

房屋翻新需求不断成长

受节能法规和后疫情时代生活方式改变的推动,欧洲的房屋翻新工程正蓬勃发展,隔热材料、地板材料和门窗维修的支出不断增加。欧盟的翻新浪潮旨在到2030年将建筑维修率翻一番,从而推动对能够消除热感桥的连续黏合系统的需求。德国每年500亿欧元(约584.5亿美元)的维修市场正日益青睐生物基产品,例如汉高的乐泰HB S ECO。北欧供应商率先研发用于预製外墙板的工厂预涂黏合剂,从而实现现场快速组装,同时满足严格的室内空气品质标准。在这一维修趋势的推动下,预计到2028年,欧洲建筑幕墙和密封剂市场将保持销售成长。

电子商务包装量快速成长

小包裹运输量的成长迫使加工商采用快速、无溶剂的黏合剂解决方案,以满足欧洲包装联合会 (FEICA) 发布的纸张回收指南。软包装黏合剂必须在黏合强度和脱墨性之间取得平衡,同时还要支援单一材料设计,从而简化欧盟塑胶战略下的回收流程。德国和荷兰的自动化生产线升级改造正在增加,这需要严格的黏度控制和快速固化。这些趋势推动了欧洲黏合剂和密封剂市场的扩张,尤其是针对高产能的热熔型和水性黏合剂。

日益增长的环境问题

REACH法规中关于二异氰酸酯的规定将于2023年8月生效,届时将要求对聚氨酯体系进行改造或对工人进行培训;而甲醛排放法规将于2026年8月生效,届时将鼓励转向超低排放等级的产品。新增的247种高度关注物质(SVHC),包括八甲基三硅氧烷,将增加监管的不确定性。对永续性投资的需求将使欧洲化工产业的年度资本支出增加70%,这将压缩净利率,但也会刺激生物基原料的长期创新。

细分市场分析

由于丙烯酸树脂用途广泛且对多种基材具有良好的黏合性,预计到2024年,其在欧洲黏合剂和密封剂市场仍将占据37.16%的份额。随着碳减排需求的日益严格,包括生物基创新产品在内的其他树脂预计将在2030年前以6.96%的复合年增长率成长。随着BASF可再生丙烯酸乙酯的上市以及Xylan热熔胶展现出30 MPa的搭接剪切强度并保持可重复使用性,欧洲生物基黏合剂和密封剂市场预计将进一步扩大。氰基丙烯酸酯在电子微型化领域获得广泛应用,而聚氨酯模塑製造商则致力于开发无需二异氰酸酯固化的湿固化系统。硅胶树脂在高温领域表现强劲,而VAE/EVA则持续保持其对成本敏感的细分市场地位。

到2024年,水性平台将占总以销售额为准的43.19%,这反映了其与现有生产线和VOC排放限制的契合度;但随着组装厂对即时粘合工艺的需求,UV固化系统到2030年将以6.54%的复合年增长率增长。 Panacol的黑色UV环氧树脂可形成较厚的固化层,消除阴影区域,目前已被指定用于电动车马达线束的应力消除接头。

反应型热熔胶兼具快速固化和牢固黏合的优点,尤其适用于高速包装生产线。航太领域对溶剂型胶合剂的需求持续成长,因为该领域对较长的开放时间要求很高;同时,高固态胶合剂有助于满足日益严格的排放法规。 LED-UV灯等设备的升级可降低能耗,进一步推动欧洲胶合剂和密封剂市场的技术转型。

欧洲黏合剂和密封剂报告按黏合剂树脂(丙烯酸、氰基丙烯酸酯、环氧树脂、其他)、黏合剂技术(热熔、反应型、溶剂型、其他)、密封剂树脂(聚氨酯、环氧树脂、丙烯酸、其他)、最终用户产业(航太、汽车、建筑、其他)和地区(德国、英国、法国、义大利、其他国家)

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 房屋翻新需求不断成长

- 电子商务包装量快速成长

- 加速欧洲汽车产业的轻量化进程

- 快速成长的风力发电机叶片黏接市场

- 预製模组化建筑的兴起

- 市场限制

- 日益增长的环境问题

- 原物料价格不稳定

- 机器人黏合剂应用劳动力技能缺口

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 通过粘合树脂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅酮

- VAE/EVA

- 其他树脂(硅烷改性聚合物(SMP)、生物基树脂等)

- 透过黏合技术

- 热熔胶

- 反应性

- 溶剂型

- 紫外线固化型

- 水溶液

- 通过密封树脂

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 硅酮

- 其他树脂(聚硫化物、SMP混合树脂等)

- 按最终用户行业划分

- 航太

- 车

- 建筑/施工

- 鞋类和皮革

- 卫生保健

- 包装

- 木工和细木工

- 其他终端用户产业(例如,可再生能源、电子产品和家电)

- 按地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3M

- Akzo Nobel NV

- Arkema

- Avery Dennison Corporation

- BASF

- Dow

- Dymax

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC.

- Jowat

- Mapei SpA

- Momentive

- Munzing

- PPG Industries, Inc.

- Sika AG

- Soudal Group

- Wacker Chemie AG

第七章 市场机会与未来展望

The Europe Adhesives And Sealants Market size is estimated at USD 19.23 billion in 2025, and is expected to reach USD 25.34 billion by 2030, at a CAGR of 5.68% during the forecast period (2025-2030).

This trajectory reflects the sector's ability to navigate stringent EU Green Deal regulations while capitalizing on construction recovery, automotive lightweighting mandates, and renewable-energy expansion. Water-borne systems gain traction as VOC limits tighten, and UV-cured chemistries accelerate line speeds in electronics and automotive plants. German infrastructure outlays underpin steady demand, while Spain's renewable build-out positions it as the region's quickest-growing buyer of structural bonding solutions. Competitive intensity remains moderate, with large incumbents refocusing portfolios on bio-based resins and acquisition-driven capability expansion to safeguard margins against feedstock price volatility and carbon-reduction costs.

Europe Adhesives And Sealants Market Trends and Insights

Rising Demand from Residential Renovation

European renovation activity is gathering momentum as energy-efficiency mandates and post-pandemic lifestyle shifts lift spending on insulation, flooring, and window upgrades. The EU Renovation Wave aims to double building refurbishment rates by 2030, bolstering demand for continuous-bonding systems that eliminate thermal bridging. Germany's EUR 50 billion (~USD 58.45 billion) annual renovation market increasingly specifies bio-based products such as Henkel's LOCTITE HB S ECO, which cuts embodied CO2 by more than 60% compared with fossil-based counterparts. Nordic suppliers pioneer factory-applied adhesives for prefabricated facade panels, allowing rapid site assembly while meeting stringent indoor-air-quality norms. This renovation push is set to sustain volume growth for the European adhesives and sealants market through 2028.

Surge in E-Commerce Packaging Volumes

Rising parcel shipments prompt converters to adopt high-speed, solvent-free bonding solutions compatible with paper-recycling guidelines published by FEICA. Flexible-packaging adhesives must balance bond strength and de-inkability while supporting mono-material designs that simplify recycling under the EU Plastics Strategy. Germany and the Netherlands are upgrading automated lines that require tight viscosity control and quick setting. These trends underpin incremental gains for the European adhesives and sealants market, especially in hot-melt and waterborne grades engineered for rapid throughput.

Rising Environmental Concerns

REACH diisocyanate restrictions effective August 2023 force reformulation of polyurethane systems or mandatory worker training, while formaldehyde emission ceilings effective August 2026 drive shifts to ultra-low-emission grades. The addition of 247 SVHCs, including octamethyltrisiloxane, extends regulatory uncertainty. Sustainability investment needs 70% higher annual capital outlays across Europe's chemical sector, compressing margins yet spurring long-run innovation in bio-based feedstocks.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Lightweighting in European Auto Industry

- Fast-Growing Wind-Turbine Blade Bonding Market

- Volatile Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylics retained 37.16% revenue share of the European adhesives and sealants market in 2024, thanks to versatility and adhesion to diverse substrates. Other resins, including bio-based innovations, are forecast to expand 6.96% CAGR to 2030 as carbon-reduction mandates intensify. Europe adhesives and sealants market size for bio-based grades is projected to widen as BASF's renewable ethyl acrylate rolls out and xylan hot-melts demonstrate 30 MPa lap-shear while remaining reusable. Cyanoacrylates gain traction in electronics miniaturization, and polyurethane formulators pursue moisture-curing systems that bypass diisocyanate training. Silicone chemistries grow in high-temperature segments, whereas VAE/EVA retains cost-driven niches.

Waterborne platforms accounted for 43.19% of the 2024 revenue base, reflecting entrenched production lines and alignment with VOC caps. UV-cured systems, however, will post a 6.54% CAGR through 2030 as assembly plants seek instant-bond processing. Panacol's black UV epoxies cure in thicker layers, eliminating shadow areas, and are now specified in EV motor wire stress-relief joints.

Reactive hot melts combine rapid set with strong final bonds, serving high-speed packaging lines. Solvent-borne demand persists in aerospace, where long open time is critical, but higher-solids versions help meet tightening emission norms. Equipment upgrades toward LED-UV lamps cut energy use and further incentivize technology switching in the European adhesives and sealants market.

The Europe Adhesives and Sealants Report is Segmented by Adhesive Resin (Acrylic, Cyanoacrylate, Epoxy, and More), Adhesive Technology (Hot-Melt, Reactive, Solvent-Borne, and More), Sealant Resin (Polyurethane, Epoxy, Acrylic, and More), End-User Industry (Aerospace, Automotive, Building and Construction, and More), and Geography (Germany, United Kingdom, France, Italy, Spain, Russia, NORDIC Countries, and Rest of Europe).

List of Companies Covered in this Report:

- 3M

- Akzo Nobel N.V.

- Arkema

- Avery Dennison Corporation

- BASF

- Dow

- Dymax

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC.

- Jowat

- Mapei S.p.A

- Momentive

- Munzing

- PPG Industries, Inc.

- Sika AG

- Soudal Group

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from Residential-Renovation

- 4.2.2 Surge in E-Commerce Packaging Volumes

- 4.2.3 Accelerating Lightweighting in European Auto Industry

- 4.2.4 Fast-Growing Wind-Turbine Blade Bonding Market

- 4.2.5 Prefab Modular Construction Uptake

- 4.3 Market Restraints

- 4.3.1 Rising Environmental Concerns

- 4.3.2 Volatile Feedstock Prices

- 4.3.3 Skill Gap in Robotic Adhesive-Dispensing Workforce

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Adhesive Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE / EVA

- 5.1.7 Other Resins (Silane-Modified Polymer (SMP), Bio-based Resins, etc.)

- 5.2 By Adhesive Technology

- 5.2.1 Hot-Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-Borne

- 5.2.4 UV-Cured

- 5.2.5 Water-Borne

- 5.3 By Sealant Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins (Polysulfide, SMP Hybrid, etc.)

- 5.4 By End-User Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-User Industries (Renewable Energy,Electronics and Appliances, etc.)

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 NORDIC Countries

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Arkema

- 6.4.4 Avery Dennison Corporation

- 6.4.5 BASF

- 6.4.6 Dow

- 6.4.7 Dymax

- 6.4.8 H.B. Fuller Company

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 Huntsman International LLC.

- 6.4.11 Jowat

- 6.4.12 Mapei S.p.A

- 6.4.13 Momentive

- 6.4.14 Munzing

- 6.4.15 PPG Industries, Inc.

- 6.4.16 Sika AG

- 6.4.17 Soudal Group

- 6.4.18 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 EU Green Deal push for low-VOC and circular materials

- 7.3 Innovation and Development of Bio-based Adhesives