|

市场调查报告书

商品编码

1851506

婴儿食品包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

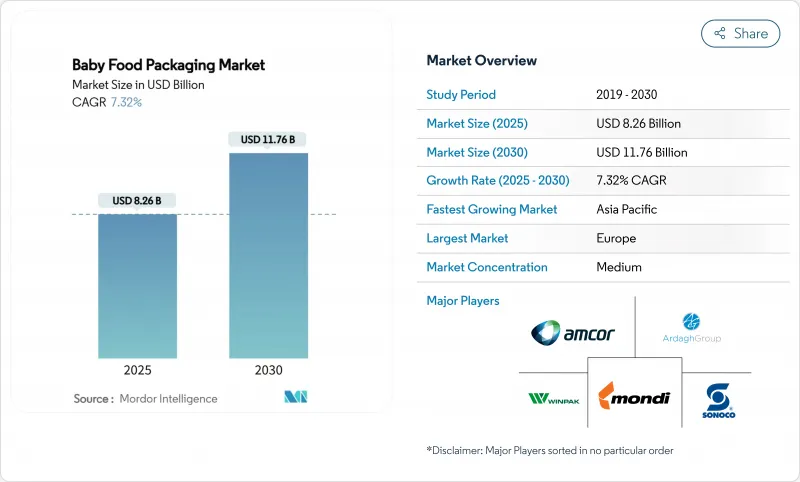

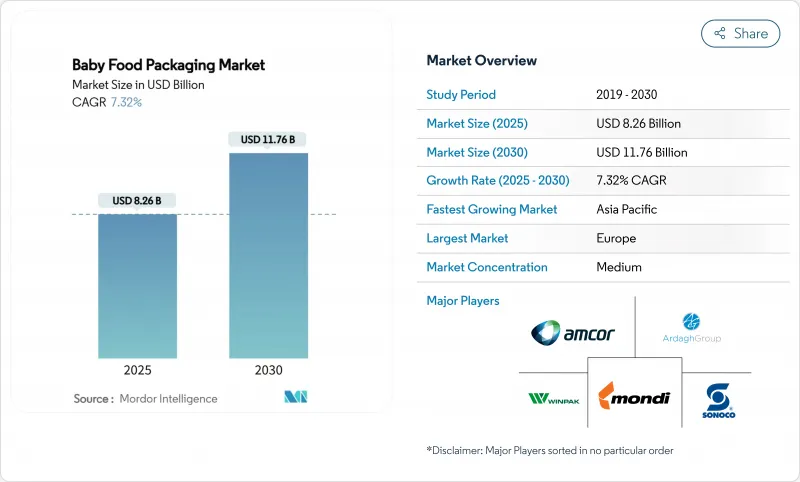

预计到 2025 年,婴儿食品包装市场规模将达到 82.6 亿美元,到 2030 年将达到 117.6 亿美元,年复合成长率为 7.32%。

随着都市区家庭对即食包装的需求不断增长,监管机构对婴幼儿食品安全制定了更为严格的规定,以及加工商采用能够延长保质期并促进消费者沟通的智能材料,婴幼儿食品包装行业的增长速度超过了整个食品包装行业。婴幼儿树脂的高价位保持稳定,使供应商能够将合规成本转嫁给消费者,而生产者延伸责任制(EPR)计划正在推动对可回收和生物基复合材料的需求。从2025年到2030年,吸嘴袋、无菌填充线和人工智慧驱动的可追溯性预计将继续引领婴幼儿食品包装市场的关键创新,从而将业绩卓越的供应商与普通商品竞争者区分开来。由于全球树脂价格波动和DIY食物泥潮流抑制了该行业的成长势头,加强医药级吸嘴和阻隔膜的供应链管理仍然至关重要。

全球婴幼儿食品包装市场趋势与洞察

婴儿食品袋装产品的受欢迎程度主要归功于其便利性。

由于轻巧、易携带且方便取用,吸嘴袋已取代玻璃瓶,占据了婴儿食品包装市场超过30%的份额。千禧世代的父母认为可重复密封和降低破损风险是至关重要的优势,这支撑了其价格溢价和重复购买率。耐热复合材料可实现热填充、蒸馏高压灭菌和高压巴氏杀菌,并确保产品无需添加防腐剂即可保持良好的货架稳定性。品牌案例研究表明,改用吸嘴袋包装后,尤其是有机食物泥,销量实现了两位数的成长。这些因素共同证实,吸嘴袋是婴儿食品包装市场中规模最大、成长最快的细分市场。

都市区双薪家庭需要节省时间的模式

在人口密集的都市,上班族父母纷纷转向即食包装,以省去准备食物和清洗的麻烦。为了满足这项需求,Once Upon a Farm 将其自动化生产线扩建至每週 120 万包,是 2020 年产能的三倍。电子商务的兴起进一步加剧了这一趋势,因为与玻璃包装相比,软包装袋和加固纸盒更能承受小包裹运输过程中的衝击。儘管价格溢价可能高达 20-30%,但市场韧性依然良好,为婴幼儿食品包装市场提供了持续的利好,因为家庭已经将包装的便利性与节省时间划上了等号。

针对塑胶永续性的强烈反对和立法

加州、缅因州、奥勒冈州和科罗拉多的生产者责任延伸制度(EPR)要求生产商为回收系统提供资金,并符合可回收的设计标准。欧盟的《包装和包装废弃物条例》进一步规定,到2030年,包装回收率必须达到30%。食品级再生聚丙烯(PP)的产能仅占再生聚合物总产量的近10%,导致供应紧张和成本上升。能够证明产品可回收性和可堆肥性的品牌赢得了消费者的信任,但传统的多层包装形式正面临加速淘汰的局面,这将挤压婴儿食品包装市场近期的净利率。

细分市场分析

预计到2024年,塑胶仍将占据26.7%的收入份额,这反映了其完善的加工基础设施。但随着监管机构和品牌商收紧碳减排目标,生质塑胶将以9.7%的复合年增长率成为成长最快的领域。 Braskem公司利用废弃食用油製成的生物循环聚丙烯可直接取代传统塑料,以便于生产线改造。 ADBioplastics公司已将一种适用于婴儿食物泥的100%可堆肥树脂商业化。生物聚合物的早期采用者正在获得生产者责任延伸(EPR)积分和市场优势,将生物聚合物定位为策略对冲工具,而传统塑胶则继续保持其规模和成本优势。

加工商正与生物聚合物供应商洽谈长期回收协议,消费品公司也重新设计标籤,以强调产品在消费前的用途。随着销售量的成长,规模经济将缩小成本差距,预计生质塑胶将在婴幼儿食品包装市场占据更有利的地位。

区域分析

2024年,欧洲在销售额方面维持25.8%的领先优势,主要得益于鼓励可回收设计、惩罚化学危害的先进法规。 2025年1月生效的BPA禁令将促使相关产业加快改进,并将业务导向拥有合格材料和合规文件的供应商。德国和法国拥有永续包装研发中心,而英国对采用整合可追溯晶片的智慧包装袋包装的高端有机食物泥的需求持续旺盛。

亚太地区到2030年将以7.8%的复合年增长率成为全球成长最快的地区。中阶收入的成长和都市区生活方式的普及将推动便利型产品(SKU)的需求,使该地区成为婴幼儿食品包装市场销售成长的最大来源。中国婴幼儿奶粉奶粉市场反弹:H&H集团2025年第一季营收成长44.3%,显示消费者在经历了先前的安全疑虑后,对品牌营养品的信任度有所回升。印度无BPA)的包装,适逢安姆科(Amcor)以2,000万美元收购凤凰软包装(Phoenix Flexibles)。日本和韩国将率先推行双重二维码溯源,反映出消费者对安全保障的需求。

北美仍然是一个高价值市场,拥有严格的FDA监管和广泛的电子商务。四个州已颁布生产者责任延伸(EPR)法,要求品牌商为回收提供资金,并推动了单一材料复合材料的快速普及。 2022年的奶粉短缺刺激了国内产能投资:Bobby's位于俄亥俄州的工厂目前在9万平方英尺的厂房内,采用严格的微生物控制措施生产罐装和奶粉。加拿大的省级EPR网路鼓励在软包装和硬包装产品中采用可回收设计,从而支持持续创新。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 方便主导婴儿食品袋

- 省时省力的格式,受到双薪都市区的青睐

- 更严格的婴儿安全法规扩大了奢侈品包装的适用范围。

- 无菌吸嘴袋填充线的兴起

- 生产者延伸责任制奖励促进可回收性

- 人工智慧驱动的个人化营养套件设计创新

- 市场限制

- 针对塑胶永续性的强烈反对和立法

- BPA/化学品合规成本压力

- 医药级喷嘴树脂供应瓶颈

- DIY婴儿食品趋势降低了包装需求

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 材料

- 塑胶

- 纸板

- 金属

- 玻璃

- 生质塑胶

- 按包装类型

- 瓶子

- 纸盒

- 瓶子

- 小袋

- 衬袋纸盒

- 副产品

- 液体配方

- 婴儿干粮

- 粉状配方

- 已烹调的婴儿辅食

- 婴儿零食

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor PLC

- Tetra Laval Group

- Mondi Group

- Berry Global Inc.(incl. former RPC)

- Silgan Holdings Inc.

- Sonoco Products Company

- Ardagh Group

- Winpak Ltd

- DS Smith PLC

- SIG Combibloc Group

- Cheer Pack North America

- Gualapack Group

- Scholle IPN

- UFlex Ltd

- ProAmpac LLC

- Huhtamaki Oyj

- AptarGroup Inc.

- Plastipak Packaging Inc.

- Crown Holdings Inc.

- Sealed Air Corp.

第七章 市场机会与未来展望

The baby food packaging market size stands at USD 8.26 billion in 2025 and is forecast to reach USD 11.76 billion by 2030, advancing at a 7.32% CAGR.

This growth rate exceeds the broader food-packaging category as urban families seek ready-to-serve formats, regulators impose strict infant-safety rules, and converters deploy smart materials that lengthen shelf life while enabling consumer interaction. Steady premium-price tolerance for infant-grade resins allows suppliers to pass through compliance costs, while extended-producer-responsibility (EPR) programs propel demand for recyclable or bio-based laminates. During 2025-2030, spouted pouches, aseptic filling lines, and AI-enabled traceability are expected to remain the pivotal innovation fronts that separate high-performing vendors from commodity competitors in the baby food packaging market. Heightened supply-chain discipline around pharmaceutical-grade spouts and barrier films will remain essential as global resin volatility and DIY puree trends periodically temper category momentum.

Global Baby Food Packaging Market Trends and Insights

Convenience-Driven Adoption of Baby Food Pouches

Spouted pouches have secured more than 30% share of the baby food packaging market by displacing glass jars through lighter weight, portability, and mess-free dispensing. Millennial parents view resealability and reduced breakage risk as decisive benefits, supporting price premiums and repeat purchases. Heat-resistant laminates enable hot-fill, retort, and high-pressure pasteurization, delivering preservative-free shelf stability. Brand case studies show double-digit sales lifts after switching to pouch formats, particularly in organic purees. Together, these factors underpin the segment's dual status as both largest and fastest growth engine of the baby food packaging market.

Urban Dual-Income Households Demanding Time-Saving Formats

In dense metros, working parents trade up to ready-to-consume packages that cut prep time and washing. Once Upon a Farm scaled automated lines to 1.2 million packs per week triple 2020 throughput-to meet this demand.Asia Pacific megacities show the sharpest volume increases as extended-family childcare support wanes. E-commerce penetration amplifies the trend because pouches and reinforced cartons tolerate parcel-handling shocks better than glass. Despite 20-30% price premiums, elasticity remains favorable as households equate packaging convenience with intangible time savings, providing sustained tailwinds for the baby food packaging market.

Plastics Sustainability Backlash & Legislation

EPR statutes in California, Maine, Oregon, and Colorado obligate producers to bankroll recycling systems and meet design-for-recovery criteria.The EU's Packaging and Packaging Waste Regulation further mandates 30% recycled content by 2030. Food-grade recycled PP capacity sits near 10% of total recycled polymer output, tightening supply and inflating costs. Brands able to validate recyclability or compostability gain consumer trust, whereas legacy multilayer formats face accelerating obsolescence, weighing on near-term margins across the baby food packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Infant-Safety Regulations Expanding Premium Packaging

- Aseptic Spouted-Pouch Filling Lines Gaining Ground

- Supply Bottlenecks of Pharma-Grade Spout Resins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic maintained 26.7% revenue share in 2024, reflecting extensive processing infrastructure, but bioplastics now post the quickest 9.7% CAGR as regulators and brands escalate carbon-reduction targets. Braskem's bio-circular polypropylene derived from used cooking oil offers a drop-in alternative that eases line changeovers. ADBioplastics commercialized a 100% compostable resin tailored for wet baby purees. Early adopters secure EPR credits and marketing lift, positioning biopolymers as a strategic hedge even while traditional plastics keep scale and cost advantages.

The material shift galvanizes supply-chain reengineering: converters negotiate long-term offtake with bio-polymer suppliers, and CPGs redesign labels to highlight end-of-life credentials. As volumes rise, economies of scale are expected to narrow the cost delta, further embedding bioplastics within the baby food packaging market.

Baby Food Packaging Market Report is Segmented by Material (Plastic, Paperboard, Metal, Glass, Bioplastics), Package Type (Bottles, Cartons, Jars, Pouches, Bag-In-Box), Product (Liquid Milk Formula, Dried Baby Food, Powder Milk Formula, Prepared Baby Food, Baby Snacks), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintained a 25.8% revenue lead in 2024, propelled by progressive regulation that rewards recyclable designs and punishes chemical hazards. The January 2025 BPA prohibition forces immediate reformulations, channeling business toward suppliers with qualifying materials and compliance documentation. Germany and France house active clusters of sustainable-packaging R&D, while the UK displays sustained demand for premium organic purees sold in smart pouches that embed traceability chips.

Asia Pacific shows the fastest 7.8% CAGR through 2030. Rising middle-class incomes and urban lifestyles accelerate convenience-focused SKUs, positioning the region as the largest incremental volume source for the baby food packaging market. China's infant-formula rebound H&H Group recorded 44.3% Q1 2025 revenue growth signals renewed confidence in branded nutrition after earlier safety scares. India's BPA-free mandate aligns with Amcor's USD 20 million purchase of Phoenix Flexibles, which boosts local flexible-film capacity in Gujarat. Japan and South Korea pioneer dual-QR traceability, reflecting consumer penchant for safety verification.

North America remains a high-value arena given stringent FDA rules and wide e-commerce penetration. EPR laws in four states obligate brands to finance recycling, pushing quick adoption of mono-material laminates. The 2022 formula shortage catalyzed domestic capacity investments: Bobbie's 90,000 sq ft Ohio plant now produces canned and powdered formula under strict microbiological controls. Canada's harmonized provincial EPR network incentivizes design-for-recycling across flexible and rigid formats alike, sustaining steady innovation.

- Amcor PLC

- Tetra Laval Group

- Mondi Group

- Berry Global Inc. (incl. former RPC)

- Silgan Holdings Inc.

- Sonoco Products Company

- Ardagh Group

- Winpak Ltd

- DS Smith PLC

- SIG Combibloc Group

- Cheer Pack North America

- Gualapack Group

- Scholle IPN

- UFlex Ltd

- ProAmpac LLC

- Huhtamaki Oyj

- AptarGroup Inc.

- Plastipak Packaging Inc.

- Crown Holdings Inc.

- Sealed Air Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience-driven adoption of baby food pouches

- 4.2.2 Urban dual-income households demanding time-saving formats

- 4.2.3 Stricter infant-safety regulations expanding premium packaging

- 4.2.4 Aseptic spouted-pouch filling lines gaining ground

- 4.2.5 Extended-producer-responsibility incentives for recyclability

- 4.2.6 AI-led personalised-nutrition pack design innovations

- 4.3 Market Restraints

- 4.3.1 Plastics sustainability backlash and legislation

- 4.3.2 BPA/chemicals compliance cost pressures

- 4.3.3 Supply bottlenecks of pharma-grade spout resins

- 4.3.4 DIY baby-food trend reducing packaged demand

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Bioplastics

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Cartons

- 5.2.3 Jars

- 5.2.4 Pouches

- 5.2.5 Bag-in-Box

- 5.3 By Product

- 5.3.1 Liquid Milk Formula

- 5.3.2 Dried Baby Food

- 5.3.3 Powder Milk Formula

- 5.3.4 Prepared Baby Food

- 5.3.5 Baby Snacks

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Southeast Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.5.2.3 Egypt

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Tetra Laval Group

- 6.4.3 Mondi Group

- 6.4.4 Berry Global Inc. (incl. former RPC)

- 6.4.5 Silgan Holdings Inc.

- 6.4.6 Sonoco Products Company

- 6.4.7 Ardagh Group

- 6.4.8 Winpak Ltd

- 6.4.9 DS Smith PLC

- 6.4.10 SIG Combibloc Group

- 6.4.11 Cheer Pack North America

- 6.4.12 Gualapack Group

- 6.4.13 Scholle IPN

- 6.4.14 UFlex Ltd

- 6.4.15 ProAmpac LLC

- 6.4.16 Huhtamaki Oyj

- 6.4.17 AptarGroup Inc.

- 6.4.18 Plastipak Packaging Inc.

- 6.4.19 Crown Holdings Inc.

- 6.4.20 Sealed Air Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment