|

市场调查报告书

商品编码

1851507

亚太地区婴幼儿食品包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)APAC Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

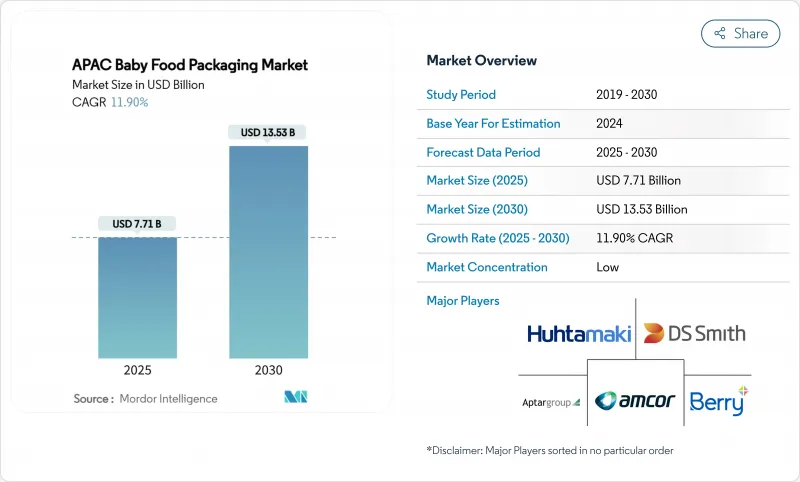

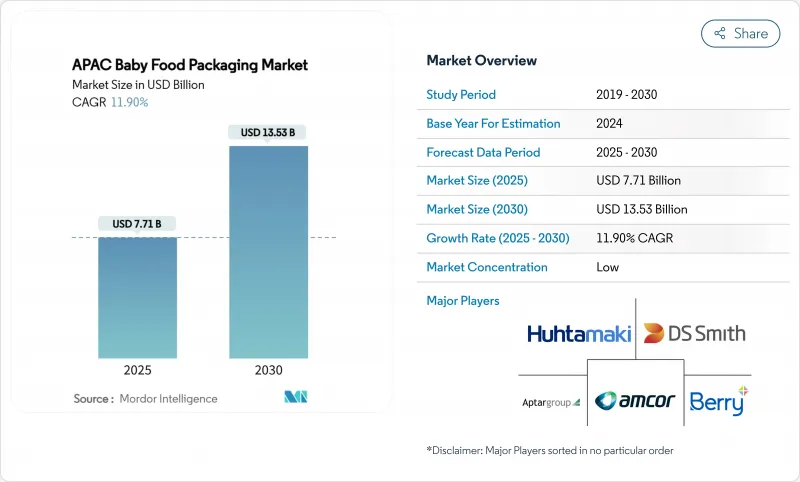

亚太地区婴儿食品包装市场规模预计在 2025 年达到 77.1 亿美元,预计到 2030 年将达到 135.3 亿美元,预测期(2025-2030 年)复合年增长率为 11.90%。

这一增长反映了该地区的人口增长势头、强劲的都市化以及消费者对高端婴幼儿营养品日益增长的偏好。受中国龙年出生登记数量增加的推动,超高端婴幼儿配方奶粉的销售量增加了44.3%,使H&H集团在该价格分布占了15.6%的市场份额。材料创新也是推动成长的因素之一。预计到2024年,塑胶将维持46.7%的市场份额,其中生质塑胶的成长速度最快,年复合成长率达18.4%,这主要得益于NatureWorks公司位于泰国、投资6亿美元的Ingeo PLA综合体计画(计画于2025年投产)。便捷包装袋目前已占据33%的市场份额,并以15.9%的年复合成长率持续成长。地理集中度依然显着,中国占35%的市场份额,而印度预计到2030年将以14%的复合年增长率实现最快成长。婴儿食品包装的电子商务销售额将以19.4%的复合年增长率加速成长,这将促使包装形式转向轻便、易于运输,从而最大限度地减少破损和体积重量。

亚太地区婴幼儿食品包装市场趋势及洞察

包装婴儿食品和婴儿配方奶粉的需求不断增长

2024年,中国婴幼儿奶粉市场维持韧性,外资品牌销售额成长8%,超高端市场占37%的份额。亚太地区的都市区父母更倾向于选择安全、保质期长、营养丰富的产品,这推动了对多层阻隔膜和高端包装的需求。代际财富转移提升了千禧世代的购买力,他们更注重便利性和品质,而非自製替代品。儘管城乡差距依然存在,但主要城市中心正成为人口密集的消费中心。

都市区双薪家庭数量增加

双薪家庭重视能满足他们忙碌生活需求的包装。吸嘴袋方便外出餵食,易于重新密封,减少洒漏,符合父母的期望。韩国和新加坡的富裕程度推动了高端定量包装的普及,而随着女性劳动参与率的提高,越南和印尼也开始出现这一趋势。因此,品牌商们更加重视符合人体工学的形状、柔软的贴合加工以及单手快速开启的设计。

严格禁止使用一次性塑胶製品

印度将在2025年前强制规定许多关键类别的产品中再生材料含量达到30%,这将迫使研发和认证週期加快。生产商将面临更高的认证消费后再生树脂成本,以及对迁移物和气味更严格的要求。新加坡和印尼的类似措施将使跨国供应链更加复杂,因为它们需要应对不同的合规期限。

细分市场分析

至2024年,塑胶将占亚太地区婴幼儿食品包装市场收入的46.7%。然而,在泰国投资促进政策和跨国品牌承诺实现碳中和的推动下,生质塑胶预计到2030年将以18.4%的复合年增长率成长。随着NatureWorks和SKC等公司的产能缩小与石油基聚合物的成本差距,生质塑胶有望成为亚太地区婴幼儿食品包装市场规模成长最快的组成部分。泰国和越南的政府补贴降低了资本门槛,而生物基PLA和PBAT薄膜的加工性能得到提升,其耐热性和密封性能可与传统软塑胶媲美。

在一些新兴国家,价格敏感度仍然限制了可堆肥包装的普及,但高端品牌和有机婴幼儿食品品牌正将可堆肥包装作为其品牌故事的一部分。玻璃罐常用于高端礼品包装,但其重量和易碎性使其在电商领域竞争力下降。金属罐的需求正逐渐被更轻的阻隔复合材料所取代。纸板,通常与生物阻隔涂层结合使用,在高端二次包装领域仍占有一席之地。

预计到2024年,袋装产品将占亚太地区婴幼儿食品包装市场的33%,复合年增长率将达到15.9%,主要得益于吸嘴式设计能够帮助婴儿自主进食。因此,在亚太地区婴幼儿食品包装领域,袋装产品的成长速度超过了硬质包装。虽然宝特瓶仍然是即饮配方奶粉的重要包装选择,但SIG和利乐等品牌的包装系统如今面临着来自碳足迹更低的单一材料软包装容器的竞争。由于重量问题,金属罐的货架吸引力正在下降,而仓储式超市也越来越多地用具有类似阻隔性能的立式袋来替代金属罐。

製造商看重包装袋的物流优势。零售商可以提高货架陈列密度,提升销售率,因为消费者更喜欢轻便的包装形式。在印尼和菲律宾,小袋包装仍然是一种经济实惠的选择,因为永续性的考虑。玻璃罐仍然是高端有机食物泥的理想包装,但越来越多地采用轻质PET材料而非玻璃。

亚太地区婴儿食品包装市场报告按材料(塑胶、纸板、金属、玻璃、生质塑胶)、包装类型(瓶子、金属罐、纸盒、其他)、产品类型(干婴儿食品、液态奶、奶粉、其他)、年龄层(0-6 个月、6-12 个月、1-2 岁、2-3 岁)、分销通路(0-6 个月、6-12 个月、1-2 岁、2-3 岁)、分销通路(超级市场/大卖场)、其他地区进行市场细分市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 包装婴儿食品和婴儿奶粉的需求不断增长

- 都市区双薪家庭数量增加

- 有组织的零售和电子商务的扩张

- 转向以品牌主导的便利商店小袋包装形式

- 政府对生物基包装生产线的补贴

- 投资于内部柔性加工能力的原始设备製造商

- 市场限制

- 严格禁止使用一次性塑胶製品

- 食品级树脂价格波动

- 不同文化对自製婴儿食品的偏好

- 东南亚新兴经济体的回收基础设施缺口

- 永续发展趋势

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 材料

- 塑胶

- 纸板

- 金属

- 玻璃

- 生质塑胶

- 按包装类型

- 瓶子

- 金属罐

- 纸盒

- 瓶子

- 其他的

- 副产品

- 婴儿干粮

- 液体配方

- 粉状配方

- 零食和手指食品

- 其他的

- 按年龄组

- 0-6个月

- 6-12个月

- 1-2岁

- 2-3岁

- 透过分销管道

- 超级市场/大卖场

- 便利商店

- 药房和药品商店

- 线上零售

- 其他的

- 按国家/地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 泰国

- 马来西亚

- 亚太其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor PLC

- Huhtamaki Oyj

- Berry Global Inc.

- Aptar Group Inc.

- Winpak Ltd.

- Tetra Laval

- Constantia Flexibles

- Uflex Ltd.

- DS Smith Plc

- Ball Corporation

- Mondi Group

- SIG Combibloc

- Sealed Air Corp.

- Toyo Seikan Group

- Sonoco Products Co.

- Gualapack SpA

- ProAmpac LLC

- Takigawa Corporation

- Visy Industries

- Nihon Yamamura Glass Co.

- Shenzhen Beauty Star Co.

第七章 市场机会与未来展望

The APAC Baby Food Packaging Market size is estimated at USD 7.71 billion in 2025, and is expected to reach USD 13.53 billion by 2030, at a CAGR of 11.90% during the forecast period (2025-2030).

This expansion reflects the region's demographic momentum, strong urbanization and the growing preference for premium infant nutrition. Rising birth registrations during China's Year of the Dragon lifted super-premium infant formula sales by 44.3%, while H&H Group captured 15.6% share of that price tier. Material innovation is another growth catalyst. Plastic retained 46.7% revenue share in 2024, yet bioplastics are climbing fastest at 18.4% CAGR, supported by NatureWorks' USD 600 million Ingeo PLA complex in Thailand scheduled for 2025. Convenience-led pouches already hold 33% share and are growing at 15.9% CAGR, reshaping packaging line investments and retail shelf layouts. Geographic concentration remains evident as China commands 35% share, while India is registering the quickest 14% CAGR through 2030. E-commerce sales of baby food packaging accelerate at 19.4% CAGR, forcing a pivot toward shipping-robust, lighter formats that minimize breakage and dimensional weight.

APAC Baby Food Packaging Market Trends and Insights

Growing demand for packaged baby food and infant formula

China's infant formula segment stayed resilient in 2024 as foreign brands logged 8% sales growth, with the super-premium tier securing 37% share. Parents in urban APAC favor products that guarantee safety, extended shelf life and superior nutrition, prompting demand for multi-layer barrier films and premium finishes. Generational wealth transfer brings millennial purchasing power that privileges convenience and perceived quality over homemade alternatives. Urban-rural divides remain, yet metropolitan centers have become high-density demand clusters.

Rising dual-income urban households

Households with two earners value packaging that supports hectic routines. Spouted pouches enable on-the-go feeding, easy resealability and reduced mess, aligning with parental expectations. Affluence in South Korea and Singapore accelerates adoption of premium, portion-controlled packs, while Vietnam and Indonesia are beginning to mirror the trend as female labor participation rises. Brands are therefore prioritizing ergonomic shapes, soft-touch laminates and quick-open closures suitable for one-hand use.

Stringent bans on single-use plastics

India mandates 30% recycled content by 2025 in many rigid categories, forcing accelerated R&D and qualification cycles. Producers face added costs for certified PCR resin and tighter specifications on migration and odor. Parallel measures in Singapore and Indonesia add complexity for multinational supply chains that must juggle differing compliance deadlines.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of organised retail and e-commerce

- Brand-led shift toward convenience pouch formats

- Volatility in food-grade resin pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic dominated the APAC baby food packaging market in 2024 with 46.7% revenue share. Bioplastics, however, are charting an 18.4% CAGR to 2030, supported by Thailand's pro-investment regime and multinational brand pledges on carbon neutrality. The APAC baby food packaging market size for bioplastics is expected to grow the fastest as capacity from NatureWorks and SKC reduces cost differentials with petro-based polymers. Government subsidies in Thailand and Vietnam lower capital thresholds, while improved processability allows bio-based PLA and PBAT films to match heat resistance and sealing integrity of conventional flexibles.

Price sensitivity still limits uptake in several emerging economies, yet premium and organic baby food brands are using compostable packs as a brand story. Glass maintains relevance in luxury gifting, yet its weight and fragility reduce competitiveness in e-commerce. Metal can demand is retreating in favor of lighter barrier laminates. Paperboard, often coupled with bio-barrier coatings, retains a niche for premium secondary packs.

Pouches held 33% share of the APAC baby food packaging market in 2024. They are forecast to expand at 15.9% CAGR, propelled by spouted designs that support independent toddler feeding. The APAC baby food packaging market size for pouches is therefore widening more quickly than rigid formats. Bottles stay important for ready-to-drink formula, but SIG and Tetra systems now compete with mono-material flexibles that claim lower carbon footprints. Metal cans are losing shelf appeal due to weight penalties and are being displaced in club stores by stand-up pouches with fitments that offer similar barrier levels.

Manufacturers appreciate the logistics benefits of pouches, which reduce inbound freight volumes and warehouse space. Retailers gain faced-up shelf density and improved sell-through as consumers embrace the lighter format. Sachets remain a cost-effective option in Indonesia and the Philippines, where single-use affordability trumps sustainability concerns. Jars persist for premium organic purees but are trending toward lightweight PET rather than glass.

APAC Baby Food Packaging Market Report is Segmented by Material (Plastic, Paperboard, Metal, Glass, Bioplastics), Package Type (Bottles, Metal Cans, Cartons, and More), Product (Dried Baby Food, Liquid Milk Formula, Powder Milk Formula and More), Age Group (0-6 Months, 6-12 Months, 1-2 Years, 2-3 Years), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores and More), and Geography.

List of Companies Covered in this Report:

- Amcor PLC

- Huhtamaki Oyj

- Berry Global Inc.

- Aptar Group Inc.

- Winpak Ltd.

- Tetra Laval

- Constantia Flexibles

- Uflex Ltd.

- DS Smith Plc

- Ball Corporation

- Mondi Group

- SIG Combibloc

- Sealed Air Corp.

- Toyo Seikan Group

- Sonoco Products Co.

- Gualapack SpA

- ProAmpac LLC

- Takigawa Corporation

- Visy Industries

- Nihon Yamamura Glass Co.

- Shenzhen Beauty Star Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for packaged baby food and infant formula

- 4.2.2 Rising dual-income urban households

- 4.2.3 Expansion of organised retail and e-commerce

- 4.2.4 Brand-led shift toward convenience pouch formats

- 4.2.5 Government subsidies for bio-based packaging lines

- 4.2.6 OEM investment in in-house flexible converting capacity

- 4.3 Market Restraints

- 4.3.1 Stringent bans on single-use plastics

- 4.3.2 Volatility in food-grade resin pricing

- 4.3.3 Cultural preference for home-cooked baby food

- 4.3.4 Recycling-infrastructure gaps across emerging SE-Asian economies

- 4.4 Sustainability Trends

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Bioplastics

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Others

- 5.3 By Product

- 5.3.1 Dried Baby Food

- 5.3.2 Liquid Milk Formula

- 5.3.3 Powder Milk Formula

- 5.3.4 Snacks and Finger Foods

- 5.3.5 Others

- 5.4 By Age Group

- 5.4.1 0-6 Months

- 5.4.2 6-12 Months

- 5.4.3 1-2 Years

- 5.4.4 2-3 Years

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets / Hypermarkets

- 5.5.2 Convenience Stores

- 5.5.3 Pharmacies and Drugstores

- 5.5.4 Online Retail

- 5.5.5 Others

- 5.6 By Country

- 5.6.1 China

- 5.6.2 India

- 5.6.3 Japan

- 5.6.4 South Korea

- 5.6.5 Indonesia

- 5.6.6 Thailand

- 5.6.7 Malaysia

- 5.6.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Huhtamaki Oyj

- 6.4.3 Berry Global Inc.

- 6.4.4 Aptar Group Inc.

- 6.4.5 Winpak Ltd.

- 6.4.6 Tetra Laval

- 6.4.7 Constantia Flexibles

- 6.4.8 Uflex Ltd.

- 6.4.9 DS Smith Plc

- 6.4.10 Ball Corporation

- 6.4.11 Mondi Group

- 6.4.12 SIG Combibloc

- 6.4.13 Sealed Air Corp.

- 6.4.14 Toyo Seikan Group

- 6.4.15 Sonoco Products Co.

- 6.4.16 Gualapack SpA

- 6.4.17 ProAmpac LLC

- 6.4.18 Takigawa Corporation

- 6.4.19 Visy Industries

- 6.4.20 Nihon Yamamura Glass Co.

- 6.4.21 Shenzhen Beauty Star Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment