|

市场调查报告书

商品编码

1851508

美国饮料包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)US Beverage Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

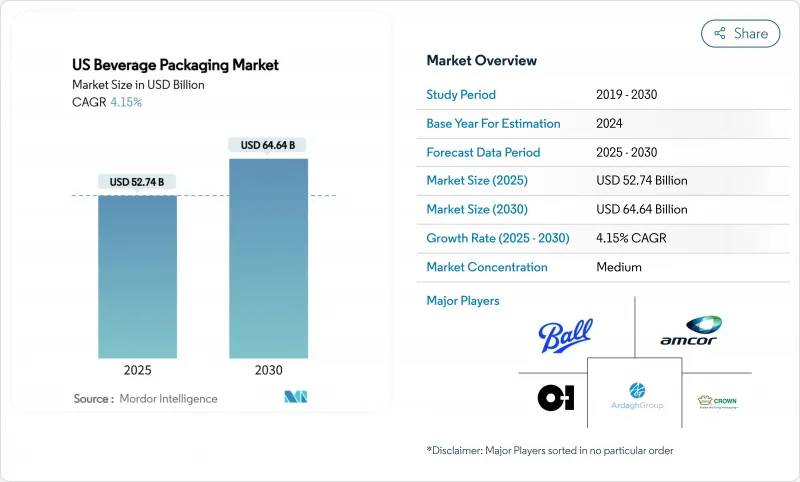

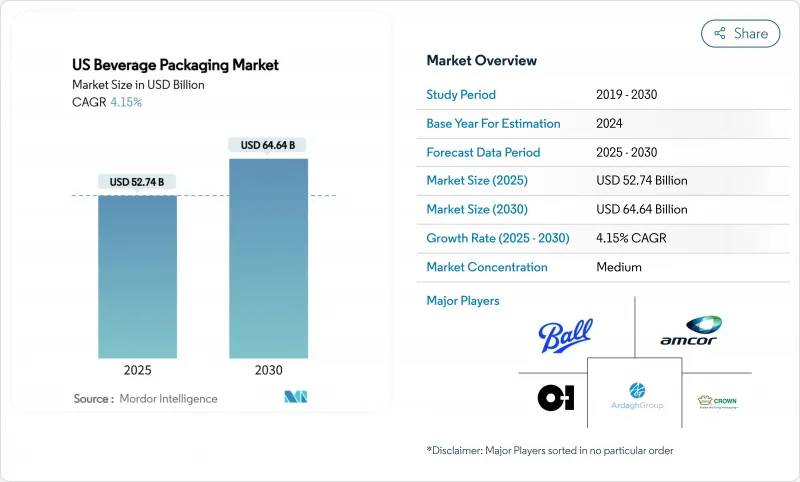

美国饮料包装市场预计到 2025 年将达到 527.4 亿美元,到 2030 年将扩大到 646.4 亿美元,复合年增长率为 4.15%。

铝製品价值的稳定成长得益于以铝为中心的策略,这些策略与日益严格的永续性法规、再生材料含量要求以及消费者对易于回收包装形式的偏好契合。品牌所有者越来越将包装视为实现碳减排目标的一种经济有效的手段,从而推动了对轻质金属容器和阻隔性柔性薄膜的需求。供应商的价格策略和最低订购量的提高,例如Ball公司自2025年1月起对12盎司罐装啤酒加收附加费,持续改变着精酿啤酒生产商的成本曲线,并扩大了大型饮料製造商和小型饮料製造商之间的差距。即额外费用咖啡、机能饮料和机能饮料的同步扩张,正在加速从多层塑胶瓶转向铝罐和带有精美图案的纤细瓶的转变。最后,电子商务的成长正在推动「自有货柜运输」包装形式的设计,这种包装形式无需二次纸板,减少了破损,并为新的优质化铺平了道路。

美国饮料包装市场趋势与洞察

永续性主导的轻量化和rPET强制令

加州AB793法案规定,2022年PET饮料容器的再生材料含量必须达到15%,2030年达到50%,这一标准正受到纽约州、新泽西州和马萨诸塞州立法者的积极关注。再生PET的成本比原生树脂高出15%至25%,迫使品牌商投资轻量化措施,以减少每个容器8%至12%的聚合物用量。百事公司透过在部分饮用水产品线中改用100%再生PET,在维持产品货架完整性的同时,减少了31%的碳排放。合规主导的生产线维修会增加每单位0.03至0.08美元的物流和加工成本,但品牌商可以透过推广其低碳包装来获得5%至8%的价格上涨。

即饮咖啡和能量饮料上市激增

即饮能量饮料占便利商店即饮饮料销售额的37%,高于2020年的28%,几乎所有主要新品都采用铝罐包装。 Monster Beverage公司97%的全球销售量来自铝罐,使其能够透过溢价抵消大宗商品通膨的影响,并预计到2025年实现71亿美元的净销售额。铝的阻光和阻氧特性有助于保持咖啡香气和功能性成分的稳定性,延长保质期而无需冷藏,并将低温运输成本降低高达30%。 2018年至2023年间,新的即饮咖啡库存单位(SKU)将成长73%,其中60%将采用罐装,因为罐装具有良好的风味保持性和装饰灵活性。

原生树脂价格不稳定

单体价格波动,尤其是乙烯和对二甲苯的价格(在墨西哥湾沿岸现货市场,这两种单体的价格经常达到每磅25-30美分),正在破坏瓶装水和碳酸饮料(CSD)生产商的PET成本结构。由于远期避险有限,小型瓶装商的利润率正逐季度受到挤压。

细分市场分析

到2024年,塑胶仍将以45.3%的市场份额占据最大份额,而金属包装预计将以6.2%的复合年增长率成为所有包装材料中成长最快的。预计到2030年,美国金属饮料包装市场规模将超过270亿美元,反映出消费者对高回收性包装形式的偏好,以及监管机构对更高比例消费后回收材料(PCR)的信任。铝的阻隔性能可防止能量饮料和即饮咖啡的口味变化,从而占据高端货架空间,抵消单价上涨的影响。

Ball公司的目标是到2030年实现90%和85%的再生材料含量,打造一个闭合迴路,这与寻求减少范围3排放的零售商的理念不谋而合。儘管玻璃因熔炉关闭和高能耗熔炼工艺而面临挑战,但纸板盒正蓬勃发展,其采用97%可再生製成的Elopak Pure-Pak结构,在大批量生产的情况下成本已与PET持平。儘管大力推进轻量化,将聚合物含量降低高达15%,但再生PET的短缺仍阻碍塑胶的广泛应用。

到2024年,瓶装饮料将占美国饮料包装市场27.8%的份额,而罐装饮料的复合年增长率将达到7.1%,这主要得益于其便携性、冷藏效率和可定製印刷等优势。与玻璃瓶相比,罐装饮料的可堆迭特性可节省20-25%的运输成本,这促使精酿啤酒、风味碳酸饮料和维生素强化水生产商纷纷转向罐装。

根据罐头製造商协会的数据,到2025年,超过70%的饮料将罐装。数位印刷技术将把前置作业时间从数週缩短至数天,加速产品种类的普及。轻量填充用的PET和玻璃瓶是瓶装创新的核心,而软包装和纸盒则更受儿童饮料和无菌乳製品替代品等小众市场的青睐。

美国饮料包装市场按材料(塑胶、金属、玻璃、纸板)、产品类型(瓶装、罐装、袋装、纸盒、啤酒桶)、应用领域(酒精饮料、牛奶及乳製品替代品、能量饮料及机能饮料、碳酸饮料及水、其他饮料)及包装类型(硬包装、软包装)进行细分。市场预测以美元计价。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 永续性主导的轻量化和rPET强制令

- 即饮咖啡/能量饮料销售快速成长

- 精酿啤酒改用铝罐

- 电子商务采用「自有货柜出货」模式。

- 繫绳帽法规(CFR 第 21 篇更新)马刺队重新设计

- 由于铝的可回收性,其占据了首要地位。

- 市场限制

- 原生树脂价格不稳定

- 玻璃熔炉产能合理化

- 扩大存款返还范围会增加合规成本

- 再生PET原料短缺

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 材料

- 塑胶

- 金属

- 玻璃

- 纸板

- 依产品类型

- 瓶子

- 能

- 小袋

- 纸盒

- 啤酒桶

- 透过使用

- 酒精饮料

- 牛奶和乳製品替代饮料

- 能量饮料和机能饮料

- 碳酸饮料和水

- 其他饮料

- 按包装类型

- 难的

- 柔软的

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Ball Corporation

- Crown Holdings Inc.

- Owens-Illinois Inc.

- Ardagh Group

- Amcor plc

- Berry Global Inc.

- Silgan Holdings Inc.

- WestRock Co.

- Berlin Packaging

- Sonoco Products Co.

- CCL Containers Inc.

- Graphic Packaging Holding

- Tetra Pak Inc.

- SIG Combibloc

- Canpack SA

- Plastipak Holdings Inc.

- Novolex

- Printpack Inc.

- ProAmpac LLC

- American Canning

第七章 市场机会与未来展望

The US beverage packaging market reached USD 52.74 billion in 2025 and is forecast to expand to USD 64.64 billion in 2030, registering a 4.15% compound annual growth rate (CAGR).

Steady value growth is underpinned by aluminum-centric strategies that align with tightening sustainability regulations, rising recycled-content mandates, and consumer preference for easily recyclable formats. Brand owners increasingly treat packaging as a cost-effective lever for carbon-reduction targets, fostering demand for lightweight metal containers and high-barrier flexible films. Supplier price actions-such as Ball Corporation's January 2025 surcharge on 12-ounce cans-and minimum-order hikes continue to reshape cost curves for craft producers, widening the gap between large and small beverage companies. Parallel expansion of ready-to-drink (RTD) coffee, energy, and functional beverages is accelerating the migration from multilayer plastic bottles toward aluminum cans and slim bottles with premium graphics. Finally, e-commerce growth is nudging the design of "ship-in-own-container" formats that eliminate secondary corrugate, reduce breakage, and create new premiumization avenues.

US Beverage Packaging Market Trends and Insights

Sustainability-driven lightweighting and rPET mandates

California's AB 793 set a 15% recycled-content floor for PET beverage containers in 2022 that rises to 50% by 2030, providing a blueprint that New York, New Jersey, and Massachusetts lawmakers are actively considering. Recycled PET carries 15-25% cost premiums over virgin resin, compelling brands to invest in lightweighting that reduces polymer usage by 8-12% per container. PepsiCo's 100% rPET shift on select water lines trimmed carbon emissions by 31% while retaining shelf integrity. Compliance-driven line retrofits add USD 0.03-0.08 per unit in logistics and processing overhead, yet brands are capturing 5-8% price lifts by marketing lower-carbon packaging.

Surge in RTD coffee and energy drink launches

RTD energy beverages now account for 37% of convenience-store RTD sales, up from 28% in 2020, and nearly every major launch uses aluminum formats. Monster Beverage derives 97% of its global volume from aluminum containers, enabling USD 7.1 billion in 2025 net sales while offsetting commodity inflation through premium pricing. Aluminum's light- and oxygen-barrier attributes help maintain coffee aromatics and functional ingredient stability, extending shelf life without chilled distribution and lowering cold-chain costs by up to 30%. New RTD coffee stock-keeping units (SKUs) rose 73% from 2018-2023, and 60% of those used cans because of flavor preservation and decoration versatility.

Volatile virgin resin prices

Monomer price swings-particularly ethylene and paraxylene-regularly reach 25-30 c/lb in Gulf Coast spot markets, destabilizing PET cost structures for bottled water and carbonated soft drink (CSD) producers. Forward hedging is limited, causing quarterly margin compression for small bottlers.

Other drivers and restraints analyzed in the detailed report include:

- Craft beer's switch to aluminum cans

- E-commerce-tailored "ship-in-own-container" formats

- Glass furnace capacity rationalization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic kept the largest share at 45.3% in 2024, yet metal packaging is projected to post a 6.2% CAGR, the fastest among all materials. The US beverage packaging market size for metal containers is forecast to exceed USD 27 billion by 2030, reflecting consumer preference for infinitely recyclable formats and regulatory credit for higher post-consumer recycled (PCR) content. Aluminum's barrier properties guard flavor volatility in energy drinks and RTD coffee, supporting premium shelf pricing that offsets higher unit costs.

Ball Corporation targets 90% recycling rates and 85% recycled content by 2030, creating a closed-loop narrative that resonates with retailers pursuing Scope 3 emission cuts. Glass faces headwinds from furnace closures and energy-intensive melting, while paperboard cartons gain momentum through 97% renewable Elopak Pure-Pak structures that reach cost parity with PET at high volume. Recycled PET shortages still restrain plastic penetration despite aggressive lightweighting that cuts polymer content by up to 15%.

Bottles commanded 27.8% of the US beverage packaging market in 2024; however, cans are pacing at a 7.1% CAGR, driven by portability, refrigeration efficiency, and customizable printing. Cans' stackable geometry yields 20-25% freight savings over glass bottles, encouraging conversion among craft beer, flavored seltzer, and vitamin-enriched water producers.

Over 70% of 2025 beverage launches are in cans compared with 45% five years earlier, according to Can Manufacturers Institute data. Digital-print technology accelerates SKU proliferation by shrinking lead times from weeks to days, vital for limited edition RTD coffee collaborations. Bottle innovation centers on lightweight refillable PET and glass, while pouches and cartons appeal to niche use cases such as children's beverages or aseptic dairy alternatives.

US Beverage Packaging Market is Segmented by Material (Plastic, Metal, Glass, Paperboard), Product Type (Bottles, Cans, Pouches, Cartons, Beer Kegs), Application (Alcoholic Beverages, Milk and Dairy Alternatives, Energy and Functional Drinks, Carbonated Soft Drinks and Water, Other Beverages), Packaging Format (Rigid, Flexible). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ball Corporation

- Crown Holdings Inc.

- Owens-Illinois Inc.

- Ardagh Group

- Amcor plc

- Berry Global Inc.

- Silgan Holdings Inc.

- WestRock Co.

- Berlin Packaging

- Sonoco Products Co.

- CCL Containers Inc.

- Graphic Packaging Holding

- Tetra Pak Inc.

- SIG Combibloc

- Canpack S.A.

- Plastipak Holdings Inc.

- Novolex

- Printpack Inc.

- ProAmpac LLC

- American Canning

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustainability-driven lightweighting and rPET mandates

- 4.2.2 Surge in RTD coffee/energy drink launches

- 4.2.3 Craft beer's switch to aluminum cans

- 4.2.4 E-commerce-tailored "ship-in-own-container" formats

- 4.2.5 Tethered-cap rule (CFR Title 21 update) spurring redesigns

- 4.2.6 Premiumpositioning through aluminum's recyclability credentials

- 4.3 Market Restraints

- 4.3.1 Volatile virgin resin prices

- 4.3.2 Glass furnace capacity rationalization

- 4.3.3 Deposit-return expansions raising compliance costs

- 4.3.4 Recycled PET feedstock shortages

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Metal

- 5.1.3 Glass

- 5.1.4 Paperboard

- 5.2 By Product Type

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Pouches

- 5.2.4 Cartons

- 5.2.5 Beer Kegs

- 5.3 By Application

- 5.3.1 Alcoholic Beverages

- 5.3.2 Milk and Dairy Alternatives

- 5.3.3 Energy and Functional Drinks

- 5.3.4 Carbonated Soft Drinks and Water

- 5.3.5 Other Beverages

- 5.4 By Packaging Format

- 5.4.1 Rigid

- 5.4.2 Flexible

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ball Corporation

- 6.4.2 Crown Holdings Inc.

- 6.4.3 Owens-Illinois Inc.

- 6.4.4 Ardagh Group

- 6.4.5 Amcor plc

- 6.4.6 Berry Global Inc.

- 6.4.7 Silgan Holdings Inc.

- 6.4.8 WestRock Co.

- 6.4.9 Berlin Packaging

- 6.4.10 Sonoco Products Co.

- 6.4.11 CCL Containers Inc.

- 6.4.12 Graphic Packaging Holding

- 6.4.13 Tetra Pak Inc.

- 6.4.14 SIG Combibloc

- 6.4.15 Canpack S.A.

- 6.4.16 Plastipak Holdings Inc.

- 6.4.17 Novolex

- 6.4.18 Printpack Inc.

- 6.4.19 ProAmpac LLC

- 6.4.20 American Canning

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment