|

市场调查报告书

商品编码

1851509

欧洲软包装:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Europe Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

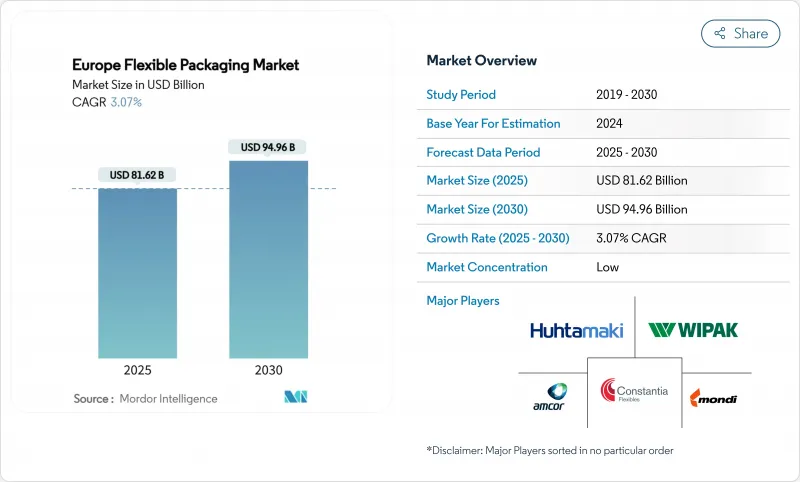

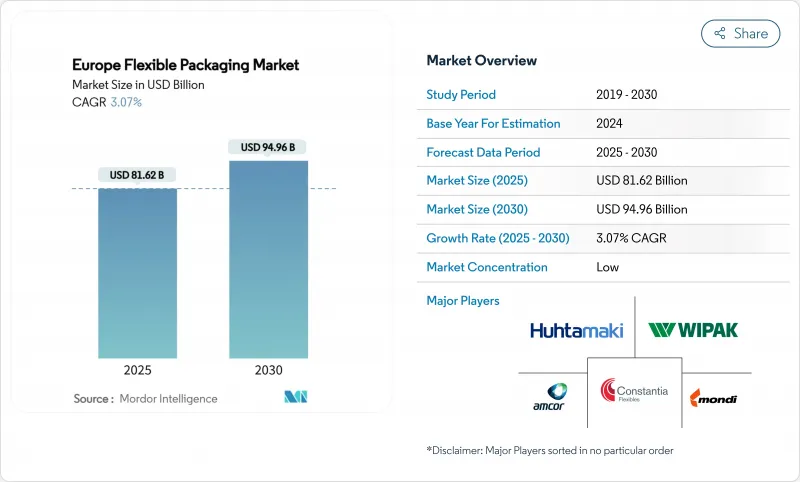

欧洲软包装市场预计到 2025 年将达到 816.2 亿美元,到 2030 年将达到 949.6 亿美元。

这一发展趋势主要受欧盟日益严格的回收政策、不断增长的电子商务小包裹量以及对需要延长保质期的方便食品需求加速增长的推动。随着《包装和包装废弃物法规》(PPWR) 推动2030年实现30%的再生塑胶含量,单一材料薄膜的创新正在加速推进。品牌所有者继续转向轻便的包装袋以降低物流成本,但由于薄膜和包装纸在食品和工业领域的广泛应用,它们仍然占据市场主导地位。市场竞争较为温和,七家主要供应商仅占约四分之一的市场份额,这为本地专业企业在阻隔技术和数位印刷等领域抓住细分市场机会留下了空间。

欧洲软包装市场趋势与洞察

欧盟循环经济目标推动了对可回收单一材料薄膜的需求激增。

PPWR(聚丙烯杀菌袋的碳足迹减少了60%,而Cycaflex计划在2025年推出一个完全可回收的产品组合,其中包含消费后回收材料。回收材料配额的豁免促进了纸基替代品的发展,例如科勒纸业的NexPlus Barrier系列。为了弥补多层结构性能的损失,供应商正在测试ORMOCER和其他无机涂层,这些涂层可将氧气透过率降低95%。生产者责任延伸费将对不可回收材料进行处罚,并加快可回收材料的推广应用。

电子商务的加速成长推动了对柔性邮寄包装和保护性包装的需求。

在许多欧盟市场,线上零售持续以两位数的速度成长,推动了轻质邮寄包装和保护膜的普及,从而降低了每个小包裹的运输成本。像HP Indigo 200K这样的数位印刷机可以製作个人化的外部图案,用于季节性或区域性促销活动,同时与履约印刷相比,还能减少设定浪费。 Uteco的SapphireAQUA混合平台采用符合食品接触法规的低迁移水性油墨,以1200 x 1200 dpi的解析度和150公尺/分钟的速度进行列印。规模较小的电商企业越来越多地将物流配送外包,并透过间接经销商更倾向于使用与自动化包装线相容的柔性包装形式。

欧盟严格的塑胶和包装废弃物法规增加了合规成本。

中小型加工商面临着巨大的投资压力,包括可回收性认证、再生树脂的整合以及为适应统一标籤而进行的图形重新设计。不合规包装的生产者责任延伸费可能使交付成本增加50%以上,在新的生产线投入运作之前,这将挤压净利率。 PFAS的使用将于2026年被禁用,这将迫使食品包装上的防油涂层进行再製造;而将于2028年生效的标籤规则将要求数千个SKU的图案进行更改。

细分市场分析

到2024年,塑胶将占欧洲软包装市场62.43%的份额,主要得益于聚乙烯在食品和电商领域的性价比优势。儘管石油基材仍保持主导,但由于品牌商积极寻求符合PPWR(聚丙烯薄膜回收利用)标准,对生物基和可堆肥薄膜的浓厚兴趣推动了欧洲软包装市场以5.84%的复合年增长率增长。纸张和纸板不受再生纸配额的限制,像科勒纸业这样的供应商在阻隔涂布等级产品方面取得了长足进步,其回收率达到了81.5%。金属化结构仍供应给製药公司和高端食品公司,这些公司主要依赖绝对阻隔性能,但由于其市场需求较小众,因此受销售波动的影响较小。 PET化学回收倡议,包括解聚合接近原生材料,旨在确保2027年实现食品级树脂的生产。

欧洲软包装公司正在试验混合复合材料,将传统的聚烯层与可生物降解涂层结合。双向拉伸聚丙烯(BOPP)仍然是透明零食薄膜的主要材料,而共聚聚丙烯(CPP)因其优异的蒸馏材料。虽然生质塑胶目前在总吨位中所占比例较小,但聚乳酸(PLA)、聚丁二烯丙基甲苯(PBAT)和淀粉的混合物正在向高阻隔结构转型,其应用范围不仅限于可堆肥购物袋。加工商预测,在原料规模扩大和相关政策刺激需求之前,生物塑胶的成本要到2028年才能与化石基材料持平。

到2024年,薄膜和包装膜将占据欧洲软包装市场44.53%的份额,因为它们主要面向烘焙食品、起司和工业零件等大批量消费品类。然而,到2030年,家常小菜的复合年增长率将达到6.76%,因为蒸馏的宠物食品包装和微波炉即食食品更符合消费者快节奏的生活方式。自立式包装能够提高货架利用率和品牌知名度,零售商也会给予其优先展示位置。雀巢的可回收高温杀菌杀菌袋展示了品牌如何在维持产品性能的同时,与传统包装相比减少60%的碳排放。

在农产品种子、肥料和DIY市场,袋装包装仍然占据主导地位,因为大包装重量限制了薄壁包装的吸引力。数位印刷技术的兴起使得加工商能够在5000件或更小的批量中提供SKU级别的客製化服务,而不会影响单件成本,这促使小众高端品牌在其产品生命週期的早期阶段就采用袋装包装。外包装和收缩膜套仍然是饮料和药品的重要防篡改解决方案,但其可回收性受到密切关注。欧洲PET保鲜率的两位数成长进一步推动了对杀菌袋和立式袋的需求,这些包装能够确保产品的保鲜度和香气。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟循环经济目标推动了对可回收单一材料薄膜的需求激增。

- 欧洲电子商务的快速成长推动了对柔性邮寄包装和保护性包装的需求。

- 消费者对便利性和份量控制产品的偏好推动了软包装袋的普及

- 高阻隔共挤压技术的进步延长了调理食品的保质期

- 数位印刷和混合印刷技术的普及使得小批量印刷和大规模个人化定製成为可能。

- 由于杀菌袋和立式袋的普及,欧洲宠物食品产业迅速扩张。

- 市场限制

- 欧盟塑胶和包装废弃物法规收紧,合规成本上升

- 多层薄膜回收基础设施不足阻碍了循环经济目标的实现

- 能源危机后聚烯和铝箔价格波动影响利润率

- 来自可回收替代品的竞争压力,对永续性的品牌构成挑战。

- 供应链分析

- 监理展望

- 技术展望

- 投资分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依材料类型

- 塑胶

- 聚乙烯(PE)

- 双轴延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚苯乙烯(PS)和发泡聚苯乙烯(EPS)

- 其他类型的塑料

- 纸和纸板

- 金属

- 可生物降解和可堆肥材料

- 塑胶

- 依产品类型

- 小袋

- 包包

- 薄膜包装

- 其他产品类型

- 按最终用户行业划分

- 食物

- 饮料

- 医疗保健和製药

- 化妆品和个人护理

- 工业的

- 其他终端用户产业

- 透过散布

- 直销

- 间接销售

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amcor PLC

- Mondi Group

- Huhtamaki Oyj

- Constantia Flexibles GmbH

- Sealed Air Corporation

- Coveris Management GmbH

- ProAmpac LLC

- Novolex Holdings Inc.

- Sonoco Products Company

- Bischof+Klein SE & Co. KG

- Wipak Oy

- Schur International A/S

- Gualapack SpA

- ePac Holdings LLC

- Danaflex Group

- Cellografica Gerosa SpA

- Di Mauro Officine Grafiche SpA

- Bak Ambalaj Sanayi ve Ticaret AS

- Flextrus AB

- Sipospack Kft.

- Clondalkin Flexible Packaging

- Innovia Films Ltd.

- AR Packaging Group AB

- RKW Group

- Plastopil Hazorea Co. Ltd.

- Schur Flexibles Group

- Glenroy Inc.

- Leefung ASG Europe

第七章 市场机会与未来展望

The Europe flexible packaging market size reached USD 81.62 billion in 2025 and is projected to climb to USD 94.96 billion by 2030, reflecting a steady 3.07% CAGR.

This trajectory follows tougher EU recycling mandates, expanding e-commerce parcel volumes, and accelerating demand for convenience foods that need extended shelf life. Mono-material film innovation is gathering pace as the Packaging and Packaging Waste Regulation (PPWR) pushes for 30% recycled plastic content by 2030, while biodegradable options are scaling from a small base. Brand owners continue to migrate toward lightweight pouches that cut logistics costs, yet films and wraps still dominate on volume thanks to their versatility in food and industrial lines. Moderate competitive intensity-as the seven largest suppliers together control only about one quarter of sales-creates room for regional specialists to capture niche opportunities in barrier technology and digital printing.

Europe Flexible Packaging Market Trends and Insights

Surge in Demand for Recyclable Mono-Material Films Driven by EU Circular Economy Targets

The PPWR obliges every package sold in Europe to be recyclable by 2030, prompting converters to redesign multilayer structures into mono-material formats that pass mechanical recycling streams. Nestle reports 60% carbon-footprint savings from polypropylene retort pouches for pet food, while Saica Flex plans a fully recyclable portfolio by 2025 that integrates post-consumer recyclate. Paper's exemption from recycled-content quotas gives a lift to paper-based alternatives such as Koehler Paper's NexPlus barrier line. To compensate for lost multilayer performance, suppliers are testing ORMOCER and other inorganic coatings that cut oxygen transmission rates by 95% on PP substrates. Extended Producer Responsibility fees now penalize non-recyclable materials, compressing timetables for adoption.

Accelerated Growth of E-Commerce Elevating Demand for Flexible Mailer & Protective Formats

Online retail continues to expand double-digit in many EU markets, spurring uptake of lightweight mailers and protective films that reduce freight cost per parcel. Digital presses such as HP Indigo 200K allow brands to personalize outer graphics for seasonal or regional promotions, while cutting set-up waste versus flexography. Uteco's SapphireAQUA hybrid platform prints 1,200 X 1,200 DPI at 150 mpm using low-migration, water-based inks that fulfil food-contact rules. Smaller e-commerce brands increasingly outsource fulfillment, channeling more volume through indirect distributors who favor flexible formats compatible with automated packing lines.

Stringent EU Plastics & Packaging-Waste Regulations Increasing Compliance Costs

Smaller converters face steep investments to certify recyclability, integrate recycled resin, and redesign graphics to meet harmonized labeling. Extended Producer Responsibility fees for non-compliant packs can add 50% or more to delivered cost, squeezing margins until new lines come on-stream. PFAS bans hitting in 2026 will force reformulation of grease-resistant coatings for food wraps, while labeling rules effective 2028 drive artwork changeovers across thousands of SKUs.

Other drivers and restraints analyzed in the detailed report include:

- Consumer Shift Toward Convenience & Portion-Control Products Boosting Flexible Pouch Adoption

- Technological Advances in High-Barrier Co-Extrusion Enhancing Shelf-Life for Ready Meals

- Limited Recycling Infrastructure for Multi-Layer Films Hampering Circularity Goals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics contributed 62.43% of Europe flexible packaging market share in 2024, powered by polyethylene's cost-to-performance edge in food and e-commerce lines. Petro-based substrates maintain leadership today, yet the Europe flexible packaging market is witnessing brisk interest in bio-based and compostable films expanding at a 5.84% CAGR as brand owners chase PPWR alignment. Paper and paperboard enjoy an exemption from recycled-content quotas, and suppliers such as Koehler Paper are making headway with barrier-coated grades that hit 81.5% recycling rates. Metalized structures still serve pharma and premium food where absolute barrier rules, but stand largely insulated from volume swings thanks to niche demand. Chemical recycling initiatives for PET, including depolymerization to virgin-like feedstock, aim to secure food-grade resin streams by 2027, a milestone that could stabilise PET's position amid rising recycled-content targets.

Europe flexible packaging market players are trialing hybrid laminates that pair traditional polyolefin layers with biodegradable coatings to accelerate soil decomposition while preserving seal integrity during shelf life. BOPP remains the workhorse for transparent snack films, whereas CPP is favoured for retortable lidding thanks to its sealability. Bioplastics, currently a sliver of overall tonnage, are moving beyond compostable shopping bags into high-barrier structures with blending of PLA, PBAT, and starch. Converters anticipate cost parity with fossil-based grades only after 2028, pending feedstock scale-up and mandates that spur demand.

Films and wraps carried 44.53% of Europe flexible packaging market share in 2024 because they serve high-volume categories such as bakery, cheese, and industrial components. Nonetheless, pouches are clocking a 6.76% CAGR through 2030, buoyed by retortable pet-food packs and microwaveable ready meals that fit on-the-go consumer lifestyles. Stand-up formats improve shelf utilisation and brand visibility, which retailers reward with premium placement. Nestle's recyclable retort pouch illustrates how brands can cut carbon footprints by 60% versus legacy structures while maintaining performance Packaging Digest.

Bag formats continue to dominate agricultural seeds, fertilizers, and DIY markets, where bulk weight limits the appeal of thin-wall alternatives. Digital printing's rise allows converters to offer SKU-level customisation in lot sizes below 5,000 units without compromising unit economics, encouraging niche gourmet brands to adopt pouch packaging earlier in their lifecycle. Overwraps and shrink sleeves remain relevant as tamper-evidence solutions in beverages and pharmaceuticals but face scrutiny over recyclability. Double-digit growth in European pet ownership further underpins demand for retort and stand-up pouches that guarantee product freshness and aroma protection.

The Europe Flexible Packaging Market Report is Segmented by Material Type (Plastics, Paper and Paperboard, and More), Product Type (Pouches, Bags, and More), End-User Industry (Food, Beverage, Healthcare and Pharmaceuticals, and More), Distribution (Direct Sales, Indirect Sales), and Country (Germany, United Kingdom, France, Italy, Spain, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor PLC

- Mondi Group

- Huhtamaki Oyj

- Constantia Flexibles GmbH

- Sealed Air Corporation

- Coveris Management GmbH

- ProAmpac LLC

- Novolex Holdings Inc.

- Sonoco Products Company

- Bischof + Klein SE & Co. KG

- Wipak Oy

- Schur International A/S

- Gualapack SpA

- ePac Holdings LLC

- Danaflex Group

- Cellografica Gerosa SpA

- Di Mauro Officine Grafiche SpA

- Bak Ambalaj Sanayi ve Ticaret AS

- Flextrus AB

- Sipospack Kft.

- Clondalkin Flexible Packaging

- Innovia Films Ltd.

- AR Packaging Group AB

- RKW Group

- Plastopil Hazorea Co. Ltd.

- Schur Flexibles Group

- Glenroy Inc.

- Leefung ASG Europe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Demand for Recyclable Mono-Material Films Driven by EU Circular Economy Targets

- 4.2.2 Accelerated Growth of E-Commerce Elevating Demand for Flexible Mailer & Protective Formats in Europe

- 4.2.3 Consumer Shift Toward Convenience & Portion-Control Products Boosting Flexible Pouch Adoption

- 4.2.4 Technological Advances in High-Barrier Co-Extrusion Enhancing Shelf-Life for Ready Meals

- 4.2.5 Rising Penetration of Digital & Hybrid Printing Enabling Short Runs and Mass Personalisation

- 4.2.6 Rapid Expansion of European Pet-Food Industry Using Retort & Stand-Up Pouches

- 4.3 Market Restraints

- 4.3.1 Stringent EU Plastics & Packaging-Waste Regulations Increasing Compliance Costs

- 4.3.2 Limited Recycling Infrastructure for Multi-Layer Films Hampering Circularity Goals

- 4.3.3 Volatile Polyolefin & Aluminium-Foil Prices Post-Energy Crisis Impacting Margins

- 4.3.4 Competitive Pressure from Rigid Recyclable Alternatives Among Sustainability-Minded Brands

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Investment Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Bi-orientated Polypropylene (BOPP)

- 5.1.1.3 Cast Polypropylene (CPP)

- 5.1.1.4 Polyethylene Terephthalate (PET)

- 5.1.1.5 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.6 Other Plastics Types

- 5.1.2 Paper and Paperboard

- 5.1.3 Metal

- 5.1.4 Biodegradable and Compostable Materials

- 5.1.1 Plastics

- 5.2 By Product Type

- 5.2.1 Pouches

- 5.2.2 Bags

- 5.2.3 Films and Wraps

- 5.2.4 Other Product Type

- 5.3 By End-User Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Healthcare and Pharmaceuticals

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Industrial

- 5.3.6 Other End-Use Industries

- 5.4 By Distribution

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Mondi Group

- 6.4.3 Huhtamaki Oyj

- 6.4.4 Constantia Flexibles GmbH

- 6.4.5 Sealed Air Corporation

- 6.4.6 Coveris Management GmbH

- 6.4.7 ProAmpac LLC

- 6.4.8 Novolex Holdings Inc.

- 6.4.9 Sonoco Products Company

- 6.4.10 Bischof + Klein SE & Co. KG

- 6.4.11 Wipak Oy

- 6.4.12 Schur International A/S

- 6.4.13 Gualapack SpA

- 6.4.14 ePac Holdings LLC

- 6.4.15 Danaflex Group

- 6.4.16 Cellografica Gerosa SpA

- 6.4.17 Di Mauro Officine Grafiche SpA

- 6.4.18 Bak Ambalaj Sanayi ve Ticaret AS

- 6.4.19 Flextrus AB

- 6.4.20 Sipospack Kft.

- 6.4.21 Clondalkin Flexible Packaging

- 6.4.22 Innovia Films Ltd.

- 6.4.23 AR Packaging Group AB

- 6.4.24 RKW Group

- 6.4.25 Plastopil Hazorea Co. Ltd.

- 6.4.26 Schur Flexibles Group

- 6.4.27 Glenroy Inc.

- 6.4.28 Leefung ASG Europe

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment